Submitted by Tyler Durden on 08/06/2015 - 23:06

Submitted by Tyler Durden on 08/06/2015 - 23:06

17 Entered... Despite the onslaught of attacks from the other 16 GOP Presidential nominee candidates, Donald Trump came out the 'winner' in his usual brash manner threatening to run as an independent and able to dominate the conversation, pitbull back at any jibes, and shrug off cozy Clintonite comments. Ted Cruz and Rand Paul appeared to have a strong showing but "had a tough night" in Trump's words. Rick Perry blew up again, calling the former President Ronald 'Raven' - which his team vehemently denied the entire FOX watching audience heard. Carly Fiorina easily won the undercard against a field of has-beens and wannabes and surely deserves some more top-billing in the next Republican death-match. In the immortal words of Kenny Rogers, we hope a few of the 17-strong gaggle now "know when to fold 'em," and can we suggest Rick Perry's corner "throws in the damn towel."

from Natural News:

After the mainstream media desperately tried to destroy Donald Trump by

defaming him with a barrage of made-up lies — that’s what the media

does best — suddenly all the journalists who tried to destroy Trump are

befuddled by his inexplicable rise in the polls.

After the mainstream media desperately tried to destroy Donald Trump by

defaming him with a barrage of made-up lies — that’s what the media

does best — suddenly all the journalists who tried to destroy Trump are

befuddled by his inexplicable rise in the polls.

But it isn’t inexplicable at all, it turns out. The American people are sick and tired of being constantly lied to by doublespeak politicians and Washington criminals like the Clintons and Bushes.

They’re sick and tired of the McCain RINOs, the Biden clowns and the same old useless ideas of hope and change which always end up being “tyranny and impoverishment” with a heavy dose of government propaganda.

Read More

After the mainstream media desperately tried to destroy Donald Trump by

defaming him with a barrage of made-up lies — that’s what the media

does best — suddenly all the journalists who tried to destroy Trump are

befuddled by his inexplicable rise in the polls.

After the mainstream media desperately tried to destroy Donald Trump by

defaming him with a barrage of made-up lies — that’s what the media

does best — suddenly all the journalists who tried to destroy Trump are

befuddled by his inexplicable rise in the polls.But it isn’t inexplicable at all, it turns out. The American people are sick and tired of being constantly lied to by doublespeak politicians and Washington criminals like the Clintons and Bushes.

They’re sick and tired of the McCain RINOs, the Biden clowns and the same old useless ideas of hope and change which always end up being “tyranny and impoverishment” with a heavy dose of government propaganda.

Read More

"Teflon Don" Holds Court - GOP Debates Begin

Submitted by Tyler Durden on 08/06/2015 - 20:42

The Rumblings of War

Dear CIGAs,

Shock of all shocks, the IMF announced the Chinese yuan will not be admitted into the SDR until at least Sept. 2016. http://www.bloomberg.com/news/articles/2015-08-04/imf-says-more-work-needed-before-yuan-reserve-currency-decision What exactly does this mean? I can tell you the gold community is so shell shocked and fearful at this point, it “must be bad for gold”, right? Going back a couple of weeks, China announced they had accumulated another 600 tons or so of gold to the near panic of precious metals investors. This announcement would be used as another shot at taking price down because the Chinese “don’t like gold as much as we thought”. This was the prevailing sentiment.

What I think happened was China played “good boy” with the West and lied about their gold holdings. They announced enough gold to allow them into “the club” but not so much as to “offend” or intimidate anyone in the West. Their announcement was clearly bogus as they are importing 600 tons every three months …and we are to believe it took them six years? China had requested both “publicly and officially” to be included in the SDR. They were publicly humiliated with this move by the IMF. The Chinese are a very proud people, public humiliation would be last on my list of aggressions toward them!

Make no mistake, they will retaliate. I believe just as the IMF did this while China is having market problems and during a period of weakness, China will return the favor to the U.S. …at a very inopportune time for us. When our markets are convulsing, probably this fall, you can expect one of two responses from the Chinese. They will either come public with a true and VERY LARGE number for their gold holdings, or they will threaten to and actually dump some Treasury securities/dollar holdings…or both! I believe their response will be timed to hit us just as in a boxing match, when we are tired, down or vulnerable …for maximum effect.

Whether you want to believe it or not, the U.S. is in a financial war with nearly the rest of the entire world. To not include a rising China into the SDR makes no sense and is an impossible feat in the long term unless China decides it is not their desire. I see no upside whatsoever to this action. Does it “buy time” and postpone the inevitable? Maybe not. The action of poking the hornets nest may actually accelerate the collapse!

There are other possibilities but looking at the two retaliatory options mentioned above, what could result? First, were China to come clean and “admit” they have 10,000 tons of gold (or MUCH MORE), the yuan would immediately strengthen and move into the dollar’s territory as a settlement currency. Markets would quickly do the math and understand if China has this much gold …where oh where did it come from? China could even do an audit publicly and count the bars out in the open surroundings of their Olympic stadium in a “we’ve shown you ours, now you show us yours” fashion!

The other possibility comes with an “option A or B” for the Fed. If the Chinese decided to sell some of their Treasury holdings, could the Fed sit idly by? Option A, the Fed could let the market absorb the dumped Treasuries and allow interest rates to rise and watch as bond prices crater. This is not much of an option, especially in a world where all prices are generated and created “officially”. On the other hand, option B would be FORCED MONETIZATION! The Fed could decide they had to buy any and all Treasuries offered by China. I believe this is exactly what the Fed will decide they MUST do.

Not coincidentally, the Chinese know this. They also understand by using this tactic, they will be forcing the Federal Reserve to create an “exit door” especially for …and because of them. This is the reverse of the old story, if you owe the bank $1 million they own you, if you owe $1 billion then you own the bank. You see, in this instance the Chinese have a direct lever on our credit markets. It would be bad enough if they could control our interest rates which they certainly can now influence. What makes this really bad is they can FORCE the Fed to either monetize or face the immediate collapse of credit markets and thus all markets. As I mentioned above, the Chinese will not do this until the time is right. The time will “be right” when our markets display weakness. They will smile while doing this and politely (publicly) restore honor and dignity.

Before finishing and as long as we are talking about financial “war”, let’s briefly look at Russia. The U.S. and NATO are now crossing some very red lines in the sand when it comes to both Ukraine and Syria. Trainings and war games are taking place in western Ukraine while the U.S. is and has authorized airstrikes (with Israeli assistance) against Syria. Mr. Putin has said in no uncertain terms he will not allow the slaughter of Russians in Ukraine. He has also stated numerous times he will not stand by idly should allies Syria or Iran be attacked http://www.zerohedge.com/news/2015-08-04/russia-ready-send-paratroopers-syria . These are all very real sparks in the dry tinder of current geopolitics.

The question you need to ask yourself is this, do you really believe the current fairy tale pricing of assets, ALL ASSETS will hold during a financial war with China? Or during a real war with Russia? This is not fear mongering, it is what’s on our dinner table!

Standing watch,

Bill Holter

Holter-Sinclair collaboration

Comments welcome! bholter@hotmail.com

America's Biggest Lie - Dictatorship Or Democracy?

Submitted by Tyler Durden on 08/06/2015 - 22:30

The real issue is whether the country is controlled by its

aristocracy (a dictatorship), or instead by its public (its residents). Let’s be frank and honest: an

aristocratically controlled government is a dictatorship, regardless

of whether that “aristocracy” is in fascist Italy, or in Nazi Germany,

or in Communist USSR, or in North Korea, or in the United States of

America.

A group of government researchers working for a National Institutes of

Health laboratory in Montana made “humanized mice” by implanting the

mice with tissues cut from human livers and thymuses taken from babies

at 17 to 22 weeks gestational age.

A group of government researchers working for a National Institutes of

Health laboratory in Montana made “humanized mice” by implanting the

mice with tissues cut from human livers and thymuses taken from babies

at 17 to 22 weeks gestational age.The researchers then published a paper describing how they constructed this particular type of “humanized” mouse, saying they hoped their description of the process would help other researchers seeking to make such mice in the future.

The same government researchers had collaborated on another journal article about the “humanized” mouse with an NIH-funded researcher at Massachusetts General Hospital–which has an ongoing federal grant that also involves humanizing mice using human fetal livers and thymuses. The NIH could not answer some basic questions about the fetal tissue used in these research projects that U.S. taxpayers funded.

Read More @ CNSnews.com

$60 Trillion Of World Debt In One Visualization

Submitted by Tyler Durden on 08/06/2015 - 21:31 Today’s visualization breaks down $59.7 trillion of world debt by country, as well as highlighting each country’s debt-to-GDP ratio using colour. The data comes from the IMF and only covers external government debt. Combining the debt of the United States, Japan, and Europe together accounts for 75% of total global debt.

Emerging Market Mayhem: Gross Warns Of "Debacle" As Currencies, Bonds Collapse

Submitted by Tyler Durden on 08/06/2015 - 15:01 Things are getting downright scary in emerging markets as a "triple unwind" in credit, Chinese leverage, and loose US monetary policy wreaks havoc across the space. Between a prolonged slump in commodity prices and a structural shift towards weaker global trade, the situation could worsen materially going forward.

What Kind Of Investor Are You? The Market Doesn't Care!

Submitted by Tyler Durden on 08/06/2015 - 21:15 The #1 question we get after we review correlations every month is “Why are they so high relative to long term historical norms?” Our answer is that Federal Reserve policy has been an unusually important factor in asset prices since 2009. The unusually easy monetary policy since that time (and its planning, implementation, and effect on the economy) has been a powerful unifying story in capital markets. Now, as the Federal Reserve moves to return the economy to a more “Normal” policy stance, correlations should drop. That they have not yet moved convincingly lower is a sign that equity markets may want to see the Fed actually pull the trigger.

One Third Of All Chinese 'Gamblers' Have Shut Their Equity Trading Accounts

Submitted by Tyler Durden on 08/06/2015 - 20:30 It turns out making money trading stocks is not "easier than farmwork" and, as China Daily reports, a stunning 24 million Chinese 'investors' have shuttered their trading accounts since the end of June. Unlike in the U.S., where institutions dominate stock trading, retail investors are king in China, owning around 80% of listed stocks’ tradable shares, according to investment bank CICC. With the number of small investors holding stocks in their accounts sliding to 51 million at the end of July from 75 million at the end of June, it appears some grandmas and farmers have learned their lesson (for now).from Peter Schiff:

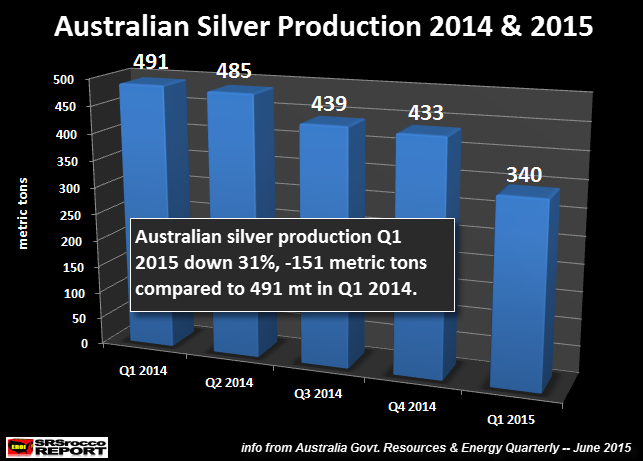

In a stunning development, the world’s largest silver producing

countries reported big declines in recent months. This was surprising

because the top two producers, Mexico and Peru, stated positive growth

in the first two months of the year. However, silver production from

these two countries reversed this trend by declining in April and May.

In a stunning development, the world’s largest silver producing

countries reported big declines in recent months. This was surprising

because the top two producers, Mexico and Peru, stated positive growth

in the first two months of the year. However, silver production from

these two countries reversed this trend by declining in April and May.While this was a significant drop in silver mine supply from the leading producers, what took place in Australia (world’s fourth largest silver producer), was quite a shocker. Not only did Australian silver production fall precipitously, it was down a stunning 31% during the first quarter of 2015 compared to the same period last year:

Read More…

Let The Kool Aid Flow: Bank Of America "Predicts" No Recession In The Next Decade

Submitted by Tyler Durden on 08/06/2015 - 19:05 One year ago, as part of its always entertaining long-run forecasting exercise, Bank of America predicted that GDP growth in 2015 and 2016 would be 3.3% and 3.4% respectively. Fast forward one year, when in its updated "long-run" forecast, Bank of America's crack economist Ethan Harris admits he was off by "only" 30% in his prediction of next year's GDP, and instead of 3.3%, he now "forecasts" 2015 GDP to be... 2.3%. But the punchline is this: "if history is our guide, at some point in the next decade the US will experience a recession, but predicting a recession far in advance is almost impossible. We plan to update this table on a regular basis."

Mapping The Rising Poverty Of The U.S.

Submitted by Tyler Durden on 08/06/2015 - 18:30 Concentrated poverty in the neighborhoods of the nation's largest urban cores has exploded since the 1970s. The number of high poverty neighborhoods has tripled and the number of poor people in those neighborhoods has doubled according to a report released by City Observatory...

The Sweet, Sickly Stench Of QE 'Success'

Submitted by Tyler Durden on 08/06/2015 - 18:00 Six years ago, hardly anybody outside financial circles had any idea what Quantitative Easing was – hell, many within financial circles had no idea what QE entailed. The success of the narrative created around QE; that it is the mythical ‘free lunch’ that we all intuitively know can’t exist but secretly hope does, has played perfectly to the public and now, having endured for two electoral cycles, the next wave of politicians also believe it will have no consequences and are actually using it when planning the message they feel will endear them to the electorate. What plays better than free money?

Oil Trading "God" Loses $500 Million In July On Commodity Rout

Submitted by Tyler Durden on 08/06/2015 - 17:30 It appears that after the great collapse of 2014, oil trading "god" Andy Hall refused to learn from his mistakes, and was convinced that oil would promptly rebound up to its historic levels. He was wrong, and as Reuters reports, after two consecutive months of 3% losses in May and June at which point he was up just 2% for the year, July was by far the cruelest month in history for the oil trader, a month in which he suffered a whopping 17% loss, one which lowered his aum by $500 million to $2.8 billion.

Is Trump The Democrat 'Wolf' In GOP Clothing?

Submitted by Tyler Durden on 08/06/2015 - 17:10 When we earlier noted the change of course for the GOP as RNC Chair Riebus showed Donald Trump much love, we wondered why the sudden shift of attitude and comment on being a Republican nominee? Well, perhaps, just perhaps, there is a reason why Republican leadership is vying for Trump's 'support'... As WaPo reports, former president Bill Clinton had a private telephone conversation in late spring with Donald Trump as he neared a decision to run for the White House, according to associates of both men. While there are no specifics about the call, we are reminded that Trump has also donated to Hillary Clinton’s Senate campaigns and to the Clinton Foundation. With Hillary facing plunging poll numbers and FBI probes, is The Donald the Democratic nominee in waiting?

Republican "Losers" Debate Pits Rick Perry Against Other "B List" GOP Hopefuls

Submitted by Tyler Durden on 08/06/2015 - 16:55 The "main event" GOP debate isn’t until 9 p.m. ET on Thursday, but for some, the anticipation surrounding Donald Trump’s debate debut will be too much to handle. For those folks, there’s the so-called "undercard", which kicks of four hours earlier and should suffice as an appetizer until the Trump-sized entree is served up piping hot on Fox later this evening. Here is your full undercard preview.

3 Warnings For Market Bulls

Submitted by Tyler Durden on 08/06/2015 - 16:30 "The question for 2015 is whether Fed actions are going to take away the liquidity punch bowl, and create a problem for the next rally's ability to achieve escape velocity... We saw this principle of diminished liquidity back in 1998-2000, and again in 2007-08..."Dow Dumps Almost 1000 Points From Highs To 6-Month Lows, Crude Carnage Continues

Submitted by Tyler Durden on 08/06/2015 - 16:04

TBTF Banks Lowering Down-Payments & Credit Standards To Keep High-End Housing Market Alive

Submitted by Tyler Durden on 08/06/2015 - 15:55 What do you do when even wealthy people begin to face an increasingly hard time purchasing a home in a vertical market completely disconnected from income trends? You reduce downpayments and lower credit standards, of course. Where have we seen this story before...

Analysts Give Up On "Man-Made" China Data: It's "A Fantasy" That "No One Believes"

Submitted by Tyler Durden on 08/06/2015 - 15:40 The veracity of China's economic data has long been the subject of debate and when FT called out the country’s National Bureau of Statistics for employing what we called "deficient deflator math" the NBS responded, saying the data reflected the "real situation." Now, virtually no one believes Beijing, with some analysts simply dismissing the "official" figures out of hand.filed under (unt

by Steve Watson, Infowars:

The Center for Medical Progress, responsible for producing the

undercover exposé videos on Planned Parenthood, has hours more footage

in the can, and is deliberately drip feeding it to the public to keep

the issue of organ harvesting from aborted fetuses in the headlines –

and Planned Parenthood head Cecile Richards HATES it. Richards took to

Twitter yesterday to complain about the method in which CMP is releasing

the videos:

The Center for Medical Progress, responsible for producing the

undercover exposé videos on Planned Parenthood, has hours more footage

in the can, and is deliberately drip feeding it to the public to keep

the issue of organ harvesting from aborted fetuses in the headlines –

and Planned Parenthood head Cecile Richards HATES it. Richards took to

Twitter yesterday to complain about the method in which CMP is releasing

the videos:

Cecile Richards @CecileRichards “If you’re concerned about what’s going on, you should release all at once. Leaking one at a time, that’s politics.” http://on.wsj.com/1INcVwH

Richards linked to a Wall Street Journal article in which medical “ethicist” Arthur Caplan denounced the “water torture” method of releasing the footage.

Read More @ Infowars.com

The Center for Medical Progress, responsible for producing the

undercover exposé videos on Planned Parenthood, has hours more footage

in the can, and is deliberately drip feeding it to the public to keep

the issue of organ harvesting from aborted fetuses in the headlines –

and Planned Parenthood head Cecile Richards HATES it. Richards took to

Twitter yesterday to complain about the method in which CMP is releasing

the videos:

The Center for Medical Progress, responsible for producing the

undercover exposé videos on Planned Parenthood, has hours more footage

in the can, and is deliberately drip feeding it to the public to keep

the issue of organ harvesting from aborted fetuses in the headlines –

and Planned Parenthood head Cecile Richards HATES it. Richards took to

Twitter yesterday to complain about the method in which CMP is releasing

the videos:Cecile Richards @CecileRichards “If you’re concerned about what’s going on, you should release all at once. Leaking one at a time, that’s politics.” http://on.wsj.com/1INcVwH

Richards linked to a Wall Street Journal article in which medical “ethicist” Arthur Caplan denounced the “water torture” method of releasing the footage.

Read More @ Infowars.com

from misesmedia:

by Dave Kranzler, Investment Research Dynamics:

Renowned gold expert James Turk says prolonged gold backwardation like

we are seeing now, where the spot price is higher than the future

price, has never happened before. Turk contends, “No, never, and I am a student of monetary history as well, and I have never seen it happen like this in monetary history. – James Turk on Greg Hunter’s USAWatchdog

Renowned gold expert James Turk says prolonged gold backwardation like

we are seeing now, where the spot price is higher than the future

price, has never happened before. Turk contends, “No, never, and I am a student of monetary history as well, and I have never seen it happen like this in monetary history. – James Turk on Greg Hunter’s USAWatchdog

The signs are everywhere. We are seeing extreme “backwardation” in gold on the LBMA. Backwardation occurs when the spot price is higher than the future price for LBMA forward contracts. It means that buyers of gold are willing to pay more for gold for immediate delivery than pay a lower price to receive delivery in the future (30-day, 60-day, etc). It means that physical gold buyers do not trust the ability of the market to delivery physical gold in the future.

Read More

Renowned gold expert James Turk says prolonged gold backwardation like

we are seeing now, where the spot price is higher than the future

price, has never happened before. Turk contends, “No, never, and I am a student of monetary history as well, and I have never seen it happen like this in monetary history. – James Turk on Greg Hunter’s USAWatchdog

Renowned gold expert James Turk says prolonged gold backwardation like

we are seeing now, where the spot price is higher than the future

price, has never happened before. Turk contends, “No, never, and I am a student of monetary history as well, and I have never seen it happen like this in monetary history. – James Turk on Greg Hunter’s USAWatchdogThe signs are everywhere. We are seeing extreme “backwardation” in gold on the LBMA. Backwardation occurs when the spot price is higher than the future price for LBMA forward contracts. It means that buyers of gold are willing to pay more for gold for immediate delivery than pay a lower price to receive delivery in the future (30-day, 60-day, etc). It means that physical gold buyers do not trust the ability of the market to delivery physical gold in the future.

Read More

filed under (unt

by Pam Martens and Russ Martens, Wall Street on Parade:

The Dodd-Frank financial reform legislation was signed into law five years ago to address the Wall Street abuses that led to the greatest financial crash since the Great Depression in 2008 and 2009. One of the requirements of that law was for the Securities and Exchange Commission to implement a rule making corporations publicly disclose the ratio of their CEO’s pay to the median worker’s pay.

Yesterday, after being publicly humiliated over not putting the law into force, the SEC finally adopted the rule. But it won’t go into effect until corporations complete their 2017 fiscal year, meaning it will be stalled for almost another three years.

Back on June 2, Senator Elizabeth Warren sent a scathing letter to SEC Chair Mary Jo White, berating her on a laundry list of broken promises. Warren told White: “You have now been SEC Chair for over two years, and to date, your leadership of the Commission has been extremely disappointing.” Among the long list of complaints was that the SEC Chair had failed to implement the CEO pay-ratio rule.

Read More @ WallStreetonParade.com

The Dodd-Frank financial reform legislation was signed into law five years ago to address the Wall Street abuses that led to the greatest financial crash since the Great Depression in 2008 and 2009. One of the requirements of that law was for the Securities and Exchange Commission to implement a rule making corporations publicly disclose the ratio of their CEO’s pay to the median worker’s pay.

Yesterday, after being publicly humiliated over not putting the law into force, the SEC finally adopted the rule. But it won’t go into effect until corporations complete their 2017 fiscal year, meaning it will be stalled for almost another three years.

Back on June 2, Senator Elizabeth Warren sent a scathing letter to SEC Chair Mary Jo White, berating her on a laundry list of broken promises. Warren told White: “You have now been SEC Chair for over two years, and to date, your leadership of the Commission has been extremely disappointing.” Among the long list of complaints was that the SEC Chair had failed to implement the CEO pay-ratio rule.

Read More @ WallStreetonParade.com

from corbettreport:

by Dan Steinhart, Activist Post:

On April 10, 2006, Mexican authorities searched through a DC-9 jet at

the airport in Ciudad del Carmen. They found more than five tons of

cocaine … valued at more than $100 million. If you’re like many

Americans, you’re not surprised by a story like this. Not a year goes by

without a few big media stories about Mexican drug cartels.

On April 10, 2006, Mexican authorities searched through a DC-9 jet at

the airport in Ciudad del Carmen. They found more than five tons of

cocaine … valued at more than $100 million. If you’re like many

Americans, you’re not surprised by a story like this. Not a year goes by

without a few big media stories about Mexican drug cartels.

However, you probably will be very surprised to learn who aided and abetted the drug operation: it was US banking giant Wachovia.

After an investigation that took years, Wells Fargo, which now owns Wachovia, paid a $160 million fine to settle the case. “Wachovia’s blatant disregard for our banking laws gave international cocaine cartels a virtual carte blanche to finance their operations,” said federal prosecutor Jeffrey Sloman.

Read More @ ActivistPost.com

On April 10, 2006, Mexican authorities searched through a DC-9 jet at

the airport in Ciudad del Carmen. They found more than five tons of

cocaine … valued at more than $100 million. If you’re like many

Americans, you’re not surprised by a story like this. Not a year goes by

without a few big media stories about Mexican drug cartels.

On April 10, 2006, Mexican authorities searched through a DC-9 jet at

the airport in Ciudad del Carmen. They found more than five tons of

cocaine … valued at more than $100 million. If you’re like many

Americans, you’re not surprised by a story like this. Not a year goes by

without a few big media stories about Mexican drug cartels.However, you probably will be very surprised to learn who aided and abetted the drug operation: it was US banking giant Wachovia.

After an investigation that took years, Wells Fargo, which now owns Wachovia, paid a $160 million fine to settle the case. “Wachovia’s blatant disregard for our banking laws gave international cocaine cartels a virtual carte blanche to finance their operations,” said federal prosecutor Jeffrey Sloman.

Read More @ ActivistPost.com

from The Sleuth Journal:

It seems a lot of people lately are having a gut feeling that

something “Big” is about to unfold, but no one knows exactly what it is.

Maybe people are feeling that way because of the events that are taking

place around them. From signs in the heavens, to military stockpiling,

to politically disturbing events. There seems to be a confluence of

activity both in the political and spiritual realm culminating in 2015

causing peoples alarms to go off. Could it be that people are feeling

this way because of the eerie events that are culminating in September??

I believe so…

It seems a lot of people lately are having a gut feeling that

something “Big” is about to unfold, but no one knows exactly what it is.

Maybe people are feeling that way because of the events that are taking

place around them. From signs in the heavens, to military stockpiling,

to politically disturbing events. There seems to be a confluence of

activity both in the political and spiritual realm culminating in 2015

causing peoples alarms to go off. Could it be that people are feeling

this way because of the eerie events that are culminating in September??

I believe so…

Read More

It seems a lot of people lately are having a gut feeling that

something “Big” is about to unfold, but no one knows exactly what it is.

Maybe people are feeling that way because of the events that are taking

place around them. From signs in the heavens, to military stockpiling,

to politically disturbing events. There seems to be a confluence of

activity both in the political and spiritual realm culminating in 2015

causing peoples alarms to go off. Could it be that people are feeling

this way because of the eerie events that are culminating in September??

I believe so…

It seems a lot of people lately are having a gut feeling that

something “Big” is about to unfold, but no one knows exactly what it is.

Maybe people are feeling that way because of the events that are taking

place around them. From signs in the heavens, to military stockpiling,

to politically disturbing events. There seems to be a confluence of

activity both in the political and spiritual realm culminating in 2015

causing peoples alarms to go off. Could it be that people are feeling

this way because of the eerie events that are culminating in September??

I believe so…Read More

from GoldSilver.com:

Predicting the future isn’t easy. For example, in 1977 it was predicted

by Ken Olsen, a well-known tech entrepreneur at the time, that “There

is no reason for any individual to have a computer in his home.”

Predicting the future isn’t easy. For example, in 1977 it was predicted

by Ken Olsen, a well-known tech entrepreneur at the time, that “There

is no reason for any individual to have a computer in his home.”

It was not only an inaccurate prediction, but decades later the exact opposite has happened. Billions of computers now fit in our homes and our pockets. Even refrigerators, thermostats, and alarm clocks are armed with computers that connect to us as the Internet Of Things grows exponentially.

As a result, we should take any forward-looking guesses with an open mind and a light heart.

Read More/InfoGraphic

Predicting the future isn’t easy. For example, in 1977 it was predicted

by Ken Olsen, a well-known tech entrepreneur at the time, that “There

is no reason for any individual to have a computer in his home.”

Predicting the future isn’t easy. For example, in 1977 it was predicted

by Ken Olsen, a well-known tech entrepreneur at the time, that “There

is no reason for any individual to have a computer in his home.” It was not only an inaccurate prediction, but decades later the exact opposite has happened. Billions of computers now fit in our homes and our pockets. Even refrigerators, thermostats, and alarm clocks are armed with computers that connect to us as the Internet Of Things grows exponentially.

As a result, we should take any forward-looking guesses with an open mind and a light heart.

Read More/InfoGraphic

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment