Submitted by Tyler Durden on 08/28/2015 - 13:36

Submitted by Tyler Durden on 08/28/2015 - 13:36

Damian McBride is the former head of communications at the British treasury and former special adviser to Gordon Brown, erstwhile Prime Minister of the U.K.

Yesterday he tweeted some surprising advice in response to the plunge in global equities markets....

by Dave Hodges, The Common Sense Show:

The above picture is eerie and it has been mostly associated with the

transport of civilian detainees presumably to a FEMA camp. Many have

questioned the authenticity of the photo and have subsequently made

allegations of photo shopping this picture in order to make it look like

a FEMA transport trait. I have known that this was authentic for

sometime and have had on eyewitness guests appear on my talk show which

have authenticated the existence of these “FEMA trains”.

The above picture is eerie and it has been mostly associated with the

transport of civilian detainees presumably to a FEMA camp. Many have

questioned the authenticity of the photo and have subsequently made

allegations of photo shopping this picture in order to make it look like

a FEMA transport trait. I have known that this was authentic for

sometime and have had on eyewitness guests appear on my talk show which

have authenticated the existence of these “FEMA trains”.

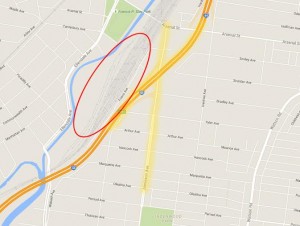

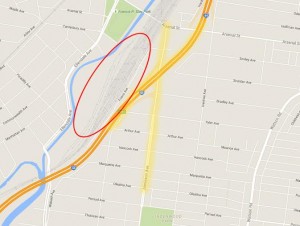

FEMA Prison Train Spotted in St. Louis

The following communication was sent to me, by email, in a which a picture of a FEMA train was taken and it is identical to other pictures of the same in which critics have maintained are a fraud. To the critics, feast your eyes on what follows:

Read More

The above picture is eerie and it has been mostly associated with the

transport of civilian detainees presumably to a FEMA camp. Many have

questioned the authenticity of the photo and have subsequently made

allegations of photo shopping this picture in order to make it look like

a FEMA transport trait. I have known that this was authentic for

sometime and have had on eyewitness guests appear on my talk show which

have authenticated the existence of these “FEMA trains”.

The above picture is eerie and it has been mostly associated with the

transport of civilian detainees presumably to a FEMA camp. Many have

questioned the authenticity of the photo and have subsequently made

allegations of photo shopping this picture in order to make it look like

a FEMA transport trait. I have known that this was authentic for

sometime and have had on eyewitness guests appear on my talk show which

have authenticated the existence of these “FEMA trains”.FEMA Prison Train Spotted in St. Louis

The following communication was sent to me, by email, in a which a picture of a FEMA train was taken and it is identical to other pictures of the same in which critics have maintained are a fraud. To the critics, feast your eyes on what follows:

Read More

from Washington’s Blog:

North Dakota has become

the first state to approve government use of drones equipped with “less

than lethal weapons”, including “rubber bullets, pepper spray, tear

gas, sound cannons, and Tasers”.

North Dakota has become

the first state to approve government use of drones equipped with “less

than lethal weapons”, including “rubber bullets, pepper spray, tear

gas, sound cannons, and Tasers”.

The bill passsed largely due to the inherent corruption of the US political system, as the wording was modified to allow for weaponized drones and approved “thanks to a last-minute push by a … lobbyist representing law enforcement—tight with a booming drone industry”.

Read More

North Dakota has become

the first state to approve government use of drones equipped with “less

than lethal weapons”, including “rubber bullets, pepper spray, tear

gas, sound cannons, and Tasers”.

North Dakota has become

the first state to approve government use of drones equipped with “less

than lethal weapons”, including “rubber bullets, pepper spray, tear

gas, sound cannons, and Tasers”.The bill passsed largely due to the inherent corruption of the US political system, as the wording was modified to allow for weaponized drones and approved “thanks to a last-minute push by a … lobbyist representing law enforcement—tight with a booming drone industry”.

Read More

by CCN, Mint Press News:

“It’s the first time in my life I’m ashamed to be an American.”

“It’s the first time in my life I’m ashamed to be an American.”

Officers from the Fayetteville, Georgia police department brutally arrested a retired four-star Army general, and now he says he’s ashamed to be an American” because of how out-of-control the police have gotten.

William J. Livsey, 84, along with his neighbors, have accused police of severe violent acts during an alleged dispute with a food delivery driver.

“It’s the first time in my life I’m ashamed to be an American,” Livsey said to the Atlanta Journal-Constitution.

Read More

“It’s the first time in my life I’m ashamed to be an American.”

“It’s the first time in my life I’m ashamed to be an American.”Officers from the Fayetteville, Georgia police department brutally arrested a retired four-star Army general, and now he says he’s ashamed to be an American” because of how out-of-control the police have gotten.

William J. Livsey, 84, along with his neighbors, have accused police of severe violent acts during an alleged dispute with a food delivery driver.

“It’s the first time in my life I’m ashamed to be an American,” Livsey said to the Atlanta Journal-Constitution.

Read More

When The Yen Was A Last Resort Safety Bid, You Know It Was Bad

Submitted by Tyler Durden on 08/28/2015 - 14:23 It goes until the “big one” shows up “out of nowhere” because everyone studiously ignores these events as if they can’t possibly be what they so obviously are: continued warnings. It is impossible to say what the final turn will be, as you can’t predict the level of “necessary” liquidations going too far because liquidity supply is totally hidden and derivative. The fact that one central bank after another continues to fall victim to the same connecting degeneration is cause for still deeper pause and reassessment, but that isn’t any fun for the bull bubble and the “easy money” mindset. In any case, when the yen functions as the last resort bid of safety, you can pretty well assess just how messed up everything got – and start to make some determination about just how close to the precipice.

Oil Surges To $45 After Saudi Troops Invade Yemen

Submitted by Tyler Durden on 08/28/2015 - 12:30 For the 3rd day in a row, crude oil prices are spiking as the short squeeze morphs into a war premium. Heberler reports that Saudi ground troops have entered Northern Yemen and seized control of two areas in the Saada province. WTI is now above $45...

The Reason China's Crash Will Unleash A Global Bond Shockwave

Submitted by Tyler Durden on 08/28/2015 - 13:51 "The PBoC’s actions are equivalent to an unwind of QE, or in other words Quantitative Tightening. The potential for more China outflows is huge [and] the bottom line is that QT has much more to go. It is hard to become very optimistic on global risk appetite until a solution is found to China’s evolving QT."

VIX ETF Short Squeezes For 6th Day In A Row, Long-Dated Vol Above Monday's Peak

Submitted by Tyler Durden on 08/28/2015 - 14:00 While all eyes are on the front-end of the VIX term structure, today's volatility term structure in the out-dates is now higher than they were at the close on Monday at "peak crisis." VXX - the VIX ETF - is still surging, as the massive short position continues to get squeezed amid the ongoing backwardation in VIX...

Joe Biden's Son Blames "Russian Agents" For Ashley Madison Profile

Submitted by Tyler Durden on 08/28/2015 - 13:26 Last night we heard the best 'excuse' yet if you are caught with an Ashley Madison account, from Dan Loeb - "due diligence." Today, not to be outdone by a married hedge fund manager, Vice-President Joe Biden's son "Hunter" has unleashed his own set of excuses for member ship of the extramarital affairs website, as Breitbart reports - Biden thinks international agents, possibly Russian, who objected to his board membership with a Ukrainian gas company set up a fake account to discredit him. However, IP mapping suggests otherwise...

Atlanta Fed Cuts Q3 GDP Forecast To A Paltry 1.2%

Submitted by Tyler Durden on 08/28/2015 - 13:08 Earlier today, following the disappointing July personal spending data and yesterday's record surge in inventories as part of the spike in Q2 GDP, we predicted that the Atlanta Fed would cut its already painfully low Q3 GDP forecast of 1.4%. Moments ago, it did just that, when the Atlanta Fed GDPNow "nowcast" was revised lower to just a 1.2% annualized growth rate, more than two-thirds below the BEA's first revision of Q2 GDP.

The Central Bankers’ Malodorous War On Savers

Submitted by Tyler Durden on 08/28/2015 - 12:49 The private economy and its millions of savers exist for the convenience of the apparatchiks who run the central bank. In their palpable fear and unrelieved arrogance, would they now throw millions of already ruined retirees and savers completely under the bus? Yes they would.

Pennsylvania Schools Start New Year Broke With "Minus $1 Billion" In Funding

Submitted by Tyler Durden on 08/28/2015 - 12:25 While the markets had a brief, if historic, limit-down hiccup earlier this week, even if Black Monday is now long forgotten and stocks are mostly in the green for the week following another epic round of central bank intervention, yesterday the Pennsylvania Association of School Business Officials announced something far more troubling: Pennsylvania schools are starting the year "minus $1 billion" in funds.

"Oil Cheap Or Gold Rich" Answered (For Now)

Submitted by Tyler Durden on 08/28/2015 - 12:05 A week ago we noticed something extreme in the price relationship between gold and oil. At the time we asked "is gold rich or oil cheap?" It appears we have our answer... perfectly tagging the January highs in the gold/oil ratio, the screaming rally in oil has pushed the ratio back into a less extreme region...

Dollar Spikes, Risk Slides After Fed's Fischer Seen As "Not Dovish Enough"

Submitted by Tyler Durden on 08/28/2015 - 11:50 It appears the economy is doing just well enough and the reflexive bounce in stocks showing that everything is awesome is all that Fed's vice chair Stan Fischer appeared to need to note that "we are heading [a September rate hike]direction." This has been judged as "not dovish enough" and sparked some turmoil...

Fed Fails - American Spending Growth Is Weakest Since March 2011

Submitted by Tyler Durden on 08/28/2015 - 11:37 Core personal consumption growth in July was just 1.2% - the weakest since March 2011. Whatever The Fed is doing to grow the middle class (yes, yes, we know: that's not in the mandate - only the "wealth effect" is) is not workingm and as the following chart suggests hasn't worked for the past 35 years.

Cocaine Production Plummets After DEA Kicked Out Of Bolivia

Submitted by Tyler Durden on 08/28/2015 - 11:13 After the U.S. Drug Enforcement Agency (DEA) was kicked out of Bolivia, the country was able to drastically reduce the amount of coca (cocaine) produced within its borders. According to data released by the United Nations, cocaine production in the country declined by 11% in the past year, marking the fourth year in a row of steady decrease.

Putin To Get $3 Billion From US Taxpayers After Ukraine Bond Debacle

Submitted by Tyler Durden on 08/28/2015 - 10:55 On Thursday, Ukraine struck a restructuring agreement on some $18 billion in Eurobonds with a group of creditors headed by Franklin Templeton. That's the good news. The bad news is that Ukraine also owes $3 billion to Vladimir Putin, and Vladimir Putin wants it back. All of it.

Ashley Madison CEO Quits

Submitted by Tyler Durden on 08/28/2015 - 10:40 A few months ago, Ashley Madison was the most anticipated upcoming adultery social network IPO. Then it was hacked, and all 34 million member accounts were exposed (with some amusing results and even more amusing explanations), leading to questions how long can the company exist in its current iteration, if at all. Moments ago we got the first answer, when the Daily Beast first reported that Avid Life Media, Noel Biderman, is stepping down.

The Troubling Decline Of Financial Independence In America

Submitted by Tyler Durden on 08/28/2015 - 10:23 If you can't work for yourself and afford health insurance, something is seriously messed up. I have no idea what his actual motivations are, nor would I presume to

guess. Having said that what you cannot dismiss is that this man has

single handedly changed the conversation in the USA from one of

obsequious groveling to any demand from the combined forces of

MSM/PC/SJW/he/she/whatevers to contemptuous, in your face dismissals.

That, to me, is huge.

I have no idea what his actual motivations are, nor would I presume to

guess. Having said that what you cannot dismiss is that this man has

single handedly changed the conversation in the USA from one of

obsequious groveling to any demand from the combined forces of

MSM/PC/SJW/he/she/whatevers to contemptuous, in your face dismissals.

That, to me, is huge.As I have written about in the past based on my own experience is that no one who stands up to the official party line in America can expect or even hope for serious consideration of any topic based on facts or data without first bowing down before the shibboleths of our current culture. Anything you say or write will be perpetually thrown in your face (unless you tweet your own acts of violence and then the record is scrubbed clean- funny how that works).

Read More

from Gold Core:

We continue to have a wonderful dialogue with and frequent editorial

submissions from readers and clients. Today, we have a thought provoking

and important article that should greatly contribute to the debate on

the merits of continuing to use artificial money. David Bryan draws on

the genius of Einstein and uses science as the basis for policies that

would end economic decay and rejuvenate local and national economies and

indeed the global economy.

We continue to have a wonderful dialogue with and frequent editorial

submissions from readers and clients. Today, we have a thought provoking

and important article that should greatly contribute to the debate on

the merits of continuing to use artificial money. David Bryan draws on

the genius of Einstein and uses science as the basis for policies that

would end economic decay and rejuvenate local and national economies and

indeed the global economy.

By backing their productivity with artificial money, people have been tricked into giving banks a counter party claim to their wealth. The assets used or owned by their forefathers are now incorporated within vast corporations or pledged as debt in exchange for central banker’s script.

Read More

We continue to have a wonderful dialogue with and frequent editorial

submissions from readers and clients. Today, we have a thought provoking

and important article that should greatly contribute to the debate on

the merits of continuing to use artificial money. David Bryan draws on

the genius of Einstein and uses science as the basis for policies that

would end economic decay and rejuvenate local and national economies and

indeed the global economy.

We continue to have a wonderful dialogue with and frequent editorial

submissions from readers and clients. Today, we have a thought provoking

and important article that should greatly contribute to the debate on

the merits of continuing to use artificial money. David Bryan draws on

the genius of Einstein and uses science as the basis for policies that

would end economic decay and rejuvenate local and national economies and

indeed the global economy.By backing their productivity with artificial money, people have been tricked into giving banks a counter party claim to their wealth. The assets used or owned by their forefathers are now incorporated within vast corporations or pledged as debt in exchange for central banker’s script.

Read More

from Boom Bust:

by James Corbett, The International Forecaster:

Good news, everybody! The markets are rebounding! Yes, we just a hit a minor bump in the road there, but don’t worry, everything is back to normal now. Let’s forget about the tail end of last week and this week’s Black Monday, shall we?

Pay no mind to the uncomfortable lowlights of the global stock rout:

The staggering $5 trillion wipeout of funny money paper promise “wealth” since the yuan deflation began ($2.7 trillion on Monday alone).

The all-time record spike on the volatility index (aka the “Fear Index”).

The 1000 point Dow plunge off the opening bell on Monday morning.

The halting of every major US index during the market mayhem.

The 4500 mini crash events that forced indices worldwide to halt and unhalt at a dizzying pace.

The amazing magic levitating act courtesy of our friends at the Plunge Protection Team that brought about the largest intraday point swing in Dow history.

Nope, nothing to see here. And now that this dead cat bounce is underway, surely there will be no more commodity deflation or global economic slowdown or worldwide currency war or historically unprecedented bond bubbles to worry about, right?

OK, enough sarcasm. Readers of this column will know by now that the phoney baloney stock markets, manipulated as they are from top to bottom and juiced as they are on the Fed’s QE heroin, are no longer reflective of economic reality. The only question is how far this particular dead cat market will bounce, and whether it will be helped along with more heroin from the Fed.

But there is already one vitally important take away from these events that the independent media must articulate now, before it’s too late. Namely: This crisis was engineered by the central banks. It is their fault.

Read More @ Theinternationalforecaster.com

Good news, everybody! The markets are rebounding! Yes, we just a hit a minor bump in the road there, but don’t worry, everything is back to normal now. Let’s forget about the tail end of last week and this week’s Black Monday, shall we?

Pay no mind to the uncomfortable lowlights of the global stock rout:

The staggering $5 trillion wipeout of funny money paper promise “wealth” since the yuan deflation began ($2.7 trillion on Monday alone).

The all-time record spike on the volatility index (aka the “Fear Index”).

The 1000 point Dow plunge off the opening bell on Monday morning.

The halting of every major US index during the market mayhem.

The 4500 mini crash events that forced indices worldwide to halt and unhalt at a dizzying pace.

The amazing magic levitating act courtesy of our friends at the Plunge Protection Team that brought about the largest intraday point swing in Dow history.

Nope, nothing to see here. And now that this dead cat bounce is underway, surely there will be no more commodity deflation or global economic slowdown or worldwide currency war or historically unprecedented bond bubbles to worry about, right?

OK, enough sarcasm. Readers of this column will know by now that the phoney baloney stock markets, manipulated as they are from top to bottom and juiced as they are on the Fed’s QE heroin, are no longer reflective of economic reality. The only question is how far this particular dead cat market will bounce, and whether it will be helped along with more heroin from the Fed.

But there is already one vitally important take away from these events that the independent media must articulate now, before it’s too late. Namely: This crisis was engineered by the central banks. It is their fault.

Read More @ Theinternationalforecaster.com

from corbettreport :

The “Chinese dragon” of the last two decades may be faltering but it is still hailed by many as an economic miracle. Far from a great advance for Chinese workers, however, it is the direct result of a consolidation of power in the hands of a small clique of powerful families, families that have actively collaborated with Western financial oligarchs.

The “Chinese dragon” of the last two decades may be faltering but it is still hailed by many as an economic miracle. Far from a great advance for Chinese workers, however, it is the direct result of a consolidation of power in the hands of a small clique of powerful families, families that have actively collaborated with Western financial oligarchs.

from Outsider Club:

This week, our Outsider Club

editors have been sure to share our views on the market crash in light

of Black Monday fears rising from all the dark depths of every corner of

the interwebs at the start of the week.

This week, our Outsider Club

editors have been sure to share our views on the market crash in light

of Black Monday fears rising from all the dark depths of every corner of

the interwebs at the start of the week.

Now that things are looking a little brighter (granted, it would have been nearly impossible for stocks not to rebound from Monday’s extreme lows), we’re hearing a lot of best-case/worst-case scenarios.

On the one hand, we’ve got CNNMoney reporting that “stocks aren’t headed for a crash”, touting an overall healthy economy… on the other hand, I read a Forbes article yesterday indicating that the world lost 66 billionaires in just eight days while Marc Faber’s telling his followers to expect markets to fall 20 to 40%.

Read More

This week, our Outsider Club

editors have been sure to share our views on the market crash in light

of Black Monday fears rising from all the dark depths of every corner of

the interwebs at the start of the week.

This week, our Outsider Club

editors have been sure to share our views on the market crash in light

of Black Monday fears rising from all the dark depths of every corner of

the interwebs at the start of the week.Now that things are looking a little brighter (granted, it would have been nearly impossible for stocks not to rebound from Monday’s extreme lows), we’re hearing a lot of best-case/worst-case scenarios.

On the one hand, we’ve got CNNMoney reporting that “stocks aren’t headed for a crash”, touting an overall healthy economy… on the other hand, I read a Forbes article yesterday indicating that the world lost 66 billionaires in just eight days while Marc Faber’s telling his followers to expect markets to fall 20 to 40%.

Read More

from KingWorldNews:

Today a legend in the business sent King World News a powerful piece

that warns amidst the global chaos, China is aggressively moving to

create a New World Order. John Ing, who has been in the business for 43

years, also discussed everything from the “Death Cross,” to flash

crashes and China’s plans for gold in their move to dominate the global

monetary architecture.

Today a legend in the business sent King World News a powerful piece

that warns amidst the global chaos, China is aggressively moving to

create a New World Order. John Ing, who has been in the business for 43

years, also discussed everything from the “Death Cross,” to flash

crashes and China’s plans for gold in their move to dominate the global

monetary architecture.

Is China’s surprise move to weaken its currency a step towards market reform or does it presage a widespread series of “race to the bottom” devaluations reminiscent of the Great Depression? China joins the Swiss National Bank (SNB) who earlier this year let the Swiss franc float freely to protect its exports….

Read More…

Today a legend in the business sent King World News a powerful piece

that warns amidst the global chaos, China is aggressively moving to

create a New World Order. John Ing, who has been in the business for 43

years, also discussed everything from the “Death Cross,” to flash

crashes and China’s plans for gold in their move to dominate the global

monetary architecture.

Today a legend in the business sent King World News a powerful piece

that warns amidst the global chaos, China is aggressively moving to

create a New World Order. John Ing, who has been in the business for 43

years, also discussed everything from the “Death Cross,” to flash

crashes and China’s plans for gold in their move to dominate the global

monetary architecture.Is China’s surprise move to weaken its currency a step towards market reform or does it presage a widespread series of “race to the bottom” devaluations reminiscent of the Great Depression? China joins the Swiss National Bank (SNB) who earlier this year let the Swiss franc float freely to protect its exports….

Read More…

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment