Submitted by Tyler Durden on 08/27/2015 - 07:27 As Bloomberg reports, "China has cut its holdings of U.S. Treasuries this month to raise dollars needed to support the yuan in the wake of a shock devaluation two weeks ago, according to people familiar with the matter. Channels for such transactions include China selling directly, as well as through agents in Belgium and Switzerland, said one of the people, who declined to be identified as the information isn’t public. China has communicated with U.S. authorities about the sales."

Morning Has Broken: A Deep Dive Into The Trading Patterns Of The American Retail Invetor

Submitted by Tyler Durden on 08/27/2015 - 09:02 Americans associate the morning with “Time to trade equities”. They hear news – in the case of the last few days, bad news from overseas – first thing in the morning. By the time the market opens, they have made their decisions and entered their orders. About half as many will check in around the close to see how things turned out, but for many the next piece of market news won’t hit their mental “Screen” until 20 hours or so later.

September Rate Hike Back On Table: Q2 GDP Soars In Revision From 2.3% To 3.7% Driven By Record Inventory Build

Submitted by Tyler Durden on 08/27/2015 - 08:43 Well, if the Fed is truly data-dependent, September is now squarely back on the table following the first revision of (double seasonally-adjusted) Q2 GDP data which soared from 2.3% to a whopping 3.7%, blowing out the Wall Street consensus estimate of 3.2%, and printing above the highest Wall Street forecast (the 3.6% from JPM). The reason for the surge was simple: from an inventory build of $124 in the first GDP estimate, the BEA now sees a total of $136.2 billion in inventory build in Q2. This is an all time record, and a number which suggests the upcoming inventory liquidation will be truly epic, not to mention recessionary.

Initial Jobless Claims Ends Losing Streak, Unchanged Since January

Submitted by Tyler Durden on 08/27/2015 - 08:38 After four weeks of rising - the longest streak since Feb 2009 - initial claims dropped very modestly to 271k this week. This means initial jobless claims has gone nowhere since January 23rd.

The Stock Market After The Mini Crash

Submitted by Tyler Durden on 08/27/2015 - 08:20 Crash waves are notoriously volatile – several of the biggest one day rallies in history have occurred before and during crash waves. This makes short term forecasting even more of a coin flip than it normally is. However, we believe it is important not to lose sight of the forest for the trees; stock markets around the world have been in bubbles driven by extremely loose monetary policy, which ipso facto allows us to identify them as an example of artificial price distortion. Such bubbles always collapse sooner or later – unless the monetary authority decides to simply destroy the currency it issues, as has happened in Zimbabwe and is currently happening in countries like Venezuela and to a slightly lesser extent Argentina. We don’t expect the central banks of the developed nations to follow suit, at least not yet.

Tiffany Stock Tumbles After Revenue And Profit Drops, EPS Slide 16%; Forecast Cut; Strong Dollar Blamed

Submitted by Tyler Durden on 08/27/2015 - 07:58 Even the rich are starting to feel the pinch, at least according to the favorite jeweler of the upwardly mobile middle-to-upper class (especially in China and Japan), Tiffany & Co., which earlier today reported Q2 EPS of $0.86, below the $0.91 expected, with GAAP EPS of $0.81 some 16% below the $0.96 record last year. Like other retailers, TIF was quick to blame the surging dollar (which isn't going anywhere if the Fed indeed proceeds with a rate hike), blaming it for lowering the value of the Tiffany’s sales overseas, where the company gets most of its revenue. Currency fluctuations also have kept tourists from making purchases at U.S. stores, dealing a second blow to revenue.

Aggressive Chinese Intervention Prevents Another Rout, Sends Stocks Soaring 5% In Last Trading Hour; US Futures Jump

Submitted by Tyler Durden on 08/27/2015 - 06:48 After a 5 day tumbling streak, which saw Chinese stock plunge well over 20% and 17% in just the first three days of this week, overnight the Shanghai Composite was hanging by a thread (and threat) until the last hour of trading. In fact, this is what the SHCOMP looked like until the very end: Up 2.6%, up 1.2%, up 2.8%, up 0.6%, up 2%... down 0.2%. And then the cavalry came in: "Heavyweight stocks like banks and insurance companies helped pull up the index, and it’s possibly China Securities Finance entering the market again to shore up stocks," Central China Sec. strategist Zhang Gang told Bloomberg by phone. Net result: the Composite, having been red just shortly before the close, soared higher by 156 points or 5.4%, showing the US stock market just how it's down.

Russia Refuses To Participate In Ukraine Debt Restructuring

Submitted by Tyler Durden on 08/27/2015 - 09:21 War-torn Ukraine has reportedly reached a restructuring deal with a group of creditors headed by Franklin Templeton, according to the country’s finance minister Natalie Jaresko. The terms of the agreement call for a 20% writedown and a reprofiling that includes a maturity extension of four years and an across-the-board 7.75% coupon. Vladimir Putin isn't interested.

by Michael Snyder, The Economic Collapse Blog:

On Wednesday we witnessed the third largest single day point gain for

the Dow Jones Industrial Average ever. That sounds like great news

until you realize that the two largest were in October 2008 – right in the middle of the last financial crisis. This is a perfect example of what I wrote about yesterday.

Every time the market crashes, there are huge up days, huge down days

and giant waves of market momentum. Even though the Dow was up 619

points on Wednesday, overall we are still down more than 2,000 points

from the peak of the market. During the weeks and months to come, we

are going to see many more wild market swings, but the overall direction

of the market will be down.

On Wednesday we witnessed the third largest single day point gain for

the Dow Jones Industrial Average ever. That sounds like great news

until you realize that the two largest were in October 2008 – right in the middle of the last financial crisis. This is a perfect example of what I wrote about yesterday.

Every time the market crashes, there are huge up days, huge down days

and giant waves of market momentum. Even though the Dow was up 619

points on Wednesday, overall we are still down more than 2,000 points

from the peak of the market. During the weeks and months to come, we

are going to see many more wild market swings, but the overall direction

of the market will be down.

Read More…

On Wednesday we witnessed the third largest single day point gain for

the Dow Jones Industrial Average ever. That sounds like great news

until you realize that the two largest were in October 2008 – right in the middle of the last financial crisis. This is a perfect example of what I wrote about yesterday.

Every time the market crashes, there are huge up days, huge down days

and giant waves of market momentum. Even though the Dow was up 619

points on Wednesday, overall we are still down more than 2,000 points

from the peak of the market. During the weeks and months to come, we

are going to see many more wild market swings, but the overall direction

of the market will be down.

On Wednesday we witnessed the third largest single day point gain for

the Dow Jones Industrial Average ever. That sounds like great news

until you realize that the two largest were in October 2008 – right in the middle of the last financial crisis. This is a perfect example of what I wrote about yesterday.

Every time the market crashes, there are huge up days, huge down days

and giant waves of market momentum. Even though the Dow was up 619

points on Wednesday, overall we are still down more than 2,000 points

from the peak of the market. During the weeks and months to come, we

are going to see many more wild market swings, but the overall direction

of the market will be down.Read More…

Rosy scenario gets tangled up in reality.

Rosy scenario gets tangled up in reality.The rout in Chinese stocks, the deteriorating Chinese economy, the subsequent rout in US stocks, and nagging questions about the US economy – they all got blamed for the unceremonious collapse of the confidence Americans have in our rosy scenario.

It’s sinking in. Even NPR has been talking about it. Whatever you do, “don’t sell,” was their admonition today. Those kind of shows first thing in the morning don’t fit into our rosy scenario.

That scenario looked a lot rosier in early January, when after a long hard climb the economic confidence of Americans reached the highest level in the Index since Gallup started collecting the data on a weekly basis in 2008. At the time, Gallup credited lower gas prices for the miracle.

Read More

Huge Gold and Silver SALE...

by Harvey Organ, HarveyOrganblog:

Good evening Ladies and Gentlemen:

Good evening Ladies and Gentlemen:

Here are the following closes for gold and silver today:

Gold: $1124.60 down $13.60 (comex closing time)

Silver $14.05 down 56 cents.

In the access market 5:15 pm

Gold $1125.30

Silver: $14.12

needless to say, the bankers will try and contain silver and gold until Sept 1.2015:

Read More

Good evening Ladies and Gentlemen:

Good evening Ladies and Gentlemen:Here are the following closes for gold and silver today:

Gold: $1124.60 down $13.60 (comex closing time)

Silver $14.05 down 56 cents.

In the access market 5:15 pm

Gold $1125.30

Silver: $14.12

needless to say, the bankers will try and contain silver and gold until Sept 1.2015:

Read More

from ZenGardner:

Aren’t you getting a kick out of this financial meltdown? What self

induced insanity, and all as if they didn’t know that all this was what

they were in for. What a sham. Intoxicated psycho-pathetic leeches

living off the manipulated matrix of the whirled system thinking they

can crank themselves into eternal material bliss with hardly a glitch.

Aren’t you getting a kick out of this financial meltdown? What self

induced insanity, and all as if they didn’t know that all this was what

they were in for. What a sham. Intoxicated psycho-pathetic leeches

living off the manipulated matrix of the whirled system thinking they

can crank themselves into eternal material bliss with hardly a glitch.

Nothing could be any more moronic. On this scale or any other measuring system. Yet they keep trying.

We all know money is arguably the most blatantly weaponized life force on planet earth. This entire structure of centrally controlled money is a life-sucking fear and scarcity mongering force installed simply for domination and human energy siphoning. It is so readily manipulated it would make any investor or pitiful stock broker crap their pants to realize it, never mind the ignorant consumer entrapped in this vortex of endless deceit and designed futility.

Read More

Aren’t you getting a kick out of this financial meltdown? What self

induced insanity, and all as if they didn’t know that all this was what

they were in for. What a sham. Intoxicated psycho-pathetic leeches

living off the manipulated matrix of the whirled system thinking they

can crank themselves into eternal material bliss with hardly a glitch.

Aren’t you getting a kick out of this financial meltdown? What self

induced insanity, and all as if they didn’t know that all this was what

they were in for. What a sham. Intoxicated psycho-pathetic leeches

living off the manipulated matrix of the whirled system thinking they

can crank themselves into eternal material bliss with hardly a glitch.Nothing could be any more moronic. On this scale or any other measuring system. Yet they keep trying.

We all know money is arguably the most blatantly weaponized life force on planet earth. This entire structure of centrally controlled money is a life-sucking fear and scarcity mongering force installed simply for domination and human energy siphoning. It is so readily manipulated it would make any investor or pitiful stock broker crap their pants to realize it, never mind the ignorant consumer entrapped in this vortex of endless deceit and designed futility.

Read More

from Lew Rockwell, via VisionLiberty:

Sibel Edmonds talks to the Lew Rockwell Show. The Truth About ISIS.

Sibel Edmonds talks to the Lew Rockwell Show. The Truth About ISIS.

from Silver Charts:

from Pete Santilli Show:

Hundreds of email addresses from the Obama White House and key federal agencies appear to have been uncovered in a leaked list of clients who use Ashley Madison, the website that encourages people to sign up for a chance to cheat on their spouse.

Hundreds of email addresses from the Obama White House and key federal agencies appear to have been uncovered in a leaked list of clients who use Ashley Madison, the website that encourages people to sign up for a chance to cheat on their spouse.

from WallStForMainSt:

Jason Burack of Wall St for Main St interviewed returning guest, precious metals expert David Jensen who owns a private mining company and also is a paid consultant in the precious metals mining industry.

Jason Burack of Wall St for Main St interviewed returning guest, precious metals expert David Jensen who owns a private mining company and also is a paid consultant in the precious metals mining industry.

by Kevin Scott King, Truth Shock:

Awakening is a traumatic experience, and those who are compelled to awaken others must approach it as such.

Awakening is a traumatic experience, and those who are compelled to awaken others must approach it as such.

When I created this blog I wanted to call it ‘The Forest’. Short for ‘one can’t see the forest for the trees’. An analogy that when one is in the ‘middle of it’ they cannot see what is really going on. One cannot see the whole because they are lost in the details. This confusion or blindness is deliberately created. But every bloody variation of this statement was taken on WordPress. Frankly, I’m not sure where ‘TruthShock’ came from. I did not have an alternative name when trying to create ‘The Forest’ on WP. I’m actually most skeptical of any entity that uses ‘truth’ in its identifier. The professional deceiver always wrapped themselves in truth. Which means you should be as skeptical of what I write as anyone else you expose yourself too.

Read More

Awakening is a traumatic experience, and those who are compelled to awaken others must approach it as such.

Awakening is a traumatic experience, and those who are compelled to awaken others must approach it as such.When I created this blog I wanted to call it ‘The Forest’. Short for ‘one can’t see the forest for the trees’. An analogy that when one is in the ‘middle of it’ they cannot see what is really going on. One cannot see the whole because they are lost in the details. This confusion or blindness is deliberately created. But every bloody variation of this statement was taken on WordPress. Frankly, I’m not sure where ‘TruthShock’ came from. I did not have an alternative name when trying to create ‘The Forest’ on WP. I’m actually most skeptical of any entity that uses ‘truth’ in its identifier. The professional deceiver always wrapped themselves in truth. Which means you should be as skeptical of what I write as anyone else you expose yourself too.

Read More

from The Money GPS:

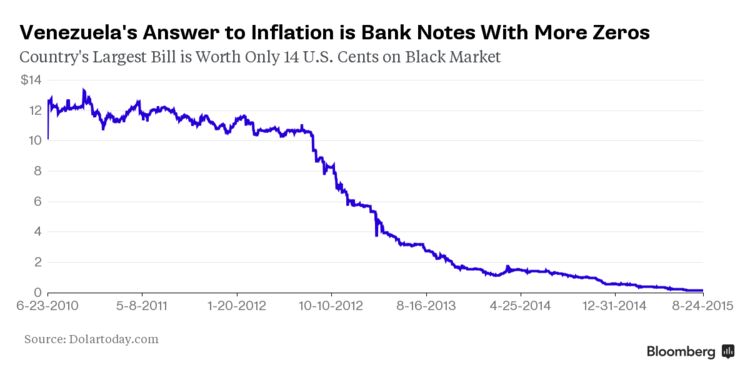

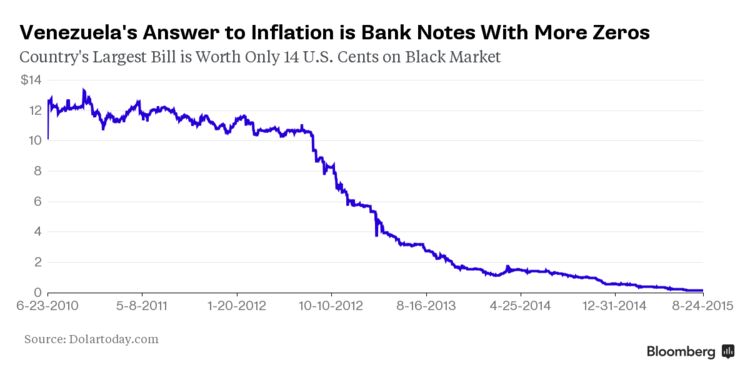

by Nathan Crooks, Bloomberg:

Venezuela is preparing to issue bank notes in higher denominations next

year as rampant inflation reduces the value of a 100-bolivar bill to

just 14 cents on the black market.

Venezuela is preparing to issue bank notes in higher denominations next

year as rampant inflation reduces the value of a 100-bolivar bill to

just 14 cents on the black market.

The new notes — of 500 and possibly 1,000 bolivars — are expected to be released sometime after congressional elections are held on Dec. 6, said a senior government official who isn’t authorized to talk about the plans publicly.

Many Venezuelans have to carry wads of cash in bags instead of wallets as soaring inflation and a declining currency increase the number of bills needed for everyday purchases. The situation is set to get worse. Inflation, already the fastest in the world, could end the year at 150 percent, said the official.

Read More

Venezuela is preparing to issue bank notes in higher denominations next

year as rampant inflation reduces the value of a 100-bolivar bill to

just 14 cents on the black market.

Venezuela is preparing to issue bank notes in higher denominations next

year as rampant inflation reduces the value of a 100-bolivar bill to

just 14 cents on the black market.The new notes — of 500 and possibly 1,000 bolivars — are expected to be released sometime after congressional elections are held on Dec. 6, said a senior government official who isn’t authorized to talk about the plans publicly.

Many Venezuelans have to carry wads of cash in bags instead of wallets as soaring inflation and a declining currency increase the number of bills needed for everyday purchases. The situation is set to get worse. Inflation, already the fastest in the world, could end the year at 150 percent, said the official.

Read More

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment