Submitted by Tyler Durden on 08/04/2015 - 11:20 "The Koran teaches persecution is worse than slaughter. Then it says, retaliation is prescribed in matters of the slain. Retaliation is a prescription from God to calm the breaths of those whose children have been slain. So if the federal government will not intercede in our affairs, then we must rise up and kill those who kill us. Stalk them and kill them and let them feel the pain of death that we are feeling."

Some Clear Thinking About The Price Of Gold

Submitted by Tyler Durden on 08/04/2015 - 15:30 Despite its history of gains, and 5,000 years of tradition behind it, gold is rapidly becoming one of the most widely despised assets. But before we pronounce it dead and write the final gold eulogy, however, let’s consider the following...

We The Sheeplez

Submitted by Tyler Durden on 08/04/2015 - 15:05 Presented with no comment...

by Dave Hodges, The Common Sense Show:

Following yesterday’s article dealing with how Obama is positioning to

control all food through nationalizing the resource, the trolls have

been out in force. And are they ever getting desperate! The globalist

minions, known in part as the Obama administration, do not want the

public reading about the NDAA, Executive Order 13603 (EO) and the CIA’s

funding of ISIS. As Snopes has wrongly stated, there is nothing to worry

about with regard to EO 13603 and it represents nothing new. Snopes?

Really? Why don’t the believers of the fiction known as Snopes just cite

The Wiggles instead? They would have more credibility when it comes to

reporting on the actions and stated intentions of globalists.

Following yesterday’s article dealing with how Obama is positioning to

control all food through nationalizing the resource, the trolls have

been out in force. And are they ever getting desperate! The globalist

minions, known in part as the Obama administration, do not want the

public reading about the NDAA, Executive Order 13603 (EO) and the CIA’s

funding of ISIS. As Snopes has wrongly stated, there is nothing to worry

about with regard to EO 13603 and it represents nothing new. Snopes?

Really? Why don’t the believers of the fiction known as Snopes just cite

The Wiggles instead? They would have more credibility when it comes to

reporting on the actions and stated intentions of globalists.

Read More

Following yesterday’s article dealing with how Obama is positioning to

control all food through nationalizing the resource, the trolls have

been out in force. And are they ever getting desperate! The globalist

minions, known in part as the Obama administration, do not want the

public reading about the NDAA, Executive Order 13603 (EO) and the CIA’s

funding of ISIS. As Snopes has wrongly stated, there is nothing to worry

about with regard to EO 13603 and it represents nothing new. Snopes?

Really? Why don’t the believers of the fiction known as Snopes just cite

The Wiggles instead? They would have more credibility when it comes to

reporting on the actions and stated intentions of globalists.

Following yesterday’s article dealing with how Obama is positioning to

control all food through nationalizing the resource, the trolls have

been out in force. And are they ever getting desperate! The globalist

minions, known in part as the Obama administration, do not want the

public reading about the NDAA, Executive Order 13603 (EO) and the CIA’s

funding of ISIS. As Snopes has wrongly stated, there is nothing to worry

about with regard to EO 13603 and it represents nothing new. Snopes?

Really? Why don’t the believers of the fiction known as Snopes just cite

The Wiggles instead? They would have more credibility when it comes to

reporting on the actions and stated intentions of globalists.Read More

Japan's Real Wages Just Plunged The Most In Six Years

Submitted by Tyler Durden on 08/04/2015 - 14:48 Japan's all important real wages, even those including bonuses and special payments, once again failed to keep up with inflation, and in June crashed by a whopping 2.9% reflecting a 0.5% yoy increase in the CPI excluding imputed rent. As the chart below shows, there has now been 24 consecutive months without a single Y/Y monthly increase in real wages. What's worse is that when one adjusts the inflationary surge from the consumption tax hike last April, which has now been fully anniversaried and is no longer part of the base effect, this was the largest decline in Japan's real wages since December 2009, or the biggest monthly plunge in 6 years!

Fed/Treasury Worried High-Frequency-Trading "Hurts Market Function"

Submitted by Tyler Durden on 08/04/2015 - 14:34 Just days after China bans Citadel (and its high frequency trading) from trading Chinese markets, US Treasury and Federal Reserve officials have been forced to admit they "need to consider whether the race for speed, at this already advanced stage, helps or hurts market functioning." As WSJ reports, Fed governor Jerome Powell and Antonio Weiss, a senior counselor to U.S. Treasury Secretary Jacob Lew, said Monday that the government should re-evaluate the structure of U.S. markets in light of recent events. They are growing more concerned about signs that financial markets have grown more volatile with the growth of fast trading. As Weiss concludes, "the constant pursuit to save one more millisecond not only consumes resources potentially better invested elsewhere, but increases the pressure on the plumbing of the system to handle ever-increasing speeds and messaging traffic." The pre-emptive blame-mongery is beginning...

US Shale: How Smoke And Mirrors Could Cost Investors Millions

Submitted by Tyler Durden on 08/04/2015 - 14:15 Overly myopic investors/creditors will continue to be confident in various drillers, based on the numbers of initial production (IP) data extrapolations and balance sheets, but will in the near future spend sleepless nights wondering why such good IPs and strong balance sheets produces poor or no profits and/or why they do not fully receive the money lent. Their worries will gradually morph from being focused on return on investment to return of investment. The mysteries created by Nature’s lack of cooperation with the balance sheets will surpass any other existential questions.

Fed's Lockhart Sends Stocks Reeling; Dollar, Bond Yields Soaring

Submitted by Tyler Durden on 08/04/2015 - 14:00 "Priced in?" Atlanta Fed's Lockhart is the un-Bullard as he proclaims that September would be "appropriate time" for rate hikes to begin... Stocks have roundtripped from initial excitement to lows of the day, short-end bonds are ugly as the curve flattens dramatically and the USD index is surging...Dramatic Footage Of Saudi Tanks Invading Yemen

Submitted by Tyler Durden on 08/04/2015 - 13:45

American Oligarchy: 400 Families Represent 50% Of Money Raised by 2016 Presidential Candidates So Far

Submitted by Tyler Durden on 08/04/2015 - 13:29 The American system of government is nothing like what we are told in school and via the oligarch-owned mainstream media.

The country has become so captured and corrupted by sociopathic

oligarchs, that a neo-feudal modern serfdom is emerging where the

opportunities to enjoy rising standards of living for the vast majority

of people was rapidly becoming a pipe dream. The Dark Ages almost look democratic by comparison.

The American system of government is nothing like what we are told in school and via the oligarch-owned mainstream media.

The country has become so captured and corrupted by sociopathic

oligarchs, that a neo-feudal modern serfdom is emerging where the

opportunities to enjoy rising standards of living for the vast majority

of people was rapidly becoming a pipe dream. The Dark Ages almost look democratic by comparison.

"Please Ignore Oil"

Submitted by Tyler Durden on 08/04/2015 - 13:06 How many times have we been told "excluding oil-related firms" everything is awesome? Well, we have one question, why did Factory orders ex-transportation just plunge a depression-like 7.5% YoY - the worst since the great recession in 2009...?

The Failure of Politics: Merkel's Euro Debacle?

Submitted by Tyler Durden on 08/04/2015 - 12:46 Now it is time for Merkel to face the unpleasant truth. Her aiming for a pain-free solution has failed. Now, she sits in the lower left box with unlimited costs for Germany, a tarnished reputation in Europe and a soon-to-come domestic backlash.

Laszlo Birinyi Projects S&P 3,200 Within 2 Years, Squeaks "It's All Noise, Don't Worry"

Submitted by Tyler Durden on 08/04/2015 - 12:24 "It's all noise," squeaks Laszlo Birinyi, deflecting concerns about revenues, earnings, Europe, China, commodities, and rates as he unleashes his latest extrapolation. "If we continue to grow at 11bps per day, the S&P will be at 3,200 within 2 years," he warbles as he hopes his ruler - which missed its 2013 projection by 1100 points - is forecasting better this time.

De Blasio's Keynesian Utopia: Giant Sinkhole Devours Brooklyn Intersection

Submitted by Tyler Durden on 08/04/2015 - 12:12 Forget the broke window fallacy, meet the broken Brooklyn utopia. We are sure Mayor De Blasio will be cock-a-hoop this morning that a giant sinkhole has appeared in one of his boroughs - swallowing an entire intersection - as what is better for the economy than filling in holes created by a total lack of infrastructure spend with other people's money...

Axel Merk Comes Out... As A Bear

Submitted by Tyler Durden on 08/04/2015 - 11:45 "Increasingly concerned about the markets, I’ve taken more aggressive action than in 2007, the last time I soured on the equity markets. Let me explain why and what I’m doing to try to profit from what may lie ahead."

AAPL Down 15% From Highs - Worst Drop In 30 Months

Submitted by Tyler Durden on 08/04/2015 - 11:07 Apple is now down 15% from record highs as "no brainer" investors begin to question their faith in its China prospects. This is the biggest drop since January 2013 and overall AAPL is now almost unchanged on the year...AAPL has lost $27bn market cap today.. a TWTR or a LNKD

Russia Ready To Send Paratroopers To Syria

Submitted by Tyler Durden on 08/04/2015 - 10:56 The Russian Airborne Troops are ready to assist Syria in countering terrorists, if such a task is set by Russia’s leaders, commander of the Airborne Troops Colonel-General Vladimir Shamanov told reporters on Tuesday.

One Furious Greek Sums It All Up: "My Country & Its People Are Falling Apart"

Submitted by Tyler Durden on 08/04/2015 - 10:31 "I am speechless. Not since yesterday or last week. I have been speechless since July 13th when the Greek left-wing coalition government agreed to burden the country and the people with a new loan, the third bailout for Greece since 2010 together with the strictest austerity program ever. I really don’t care if Varoufakis wears tasteless shirts and why he wanted to ‘hack’ taxpayers’ numbers while sitting with his team of skilled hackers and childhood friends... I just don’t care. It doesn’t affect my life, not even a tiny little bit. I give neither a a whole dam nor half of it for this so-called Greek political agenda after July 13th. What do I care about is watching my country and the people falling into pieces."

US Recession Imminent As Factory Orders Plunge For 8th Consecutive Month

Submitted by Tyler Durden on 08/04/2015 - 10:06 For the 8th month in a row, US factory orders fell YoY. Down 6.2% in June, this is the longest streak of declining factory orders outside of a recession in history. MoM, factory orders rose 1.8% - as expected - the most since May 2014 but historical orders and shipments were revised lower. Inventories contonue to rise leaving inventories-to-shipments ratios at cycle highs.

by Bill Holter SGT Report:

It is not often I write something as important as what follows. It was

said after the last crash that “no one could’ve seen it coming”. This

was not so back then and is not so today. If you were looking for the

truth in 2007, the average investor had ample warning from many sources

warning of what was to come. The warnings are now much louder, far

easier to hear and coming from some mainstream and even “official

sources”. Are you listening?

It is not often I write something as important as what follows. It was

said after the last crash that “no one could’ve seen it coming”. This

was not so back then and is not so today. If you were looking for the

truth in 2007, the average investor had ample warning from many sources

warning of what was to come. The warnings are now much louder, far

easier to hear and coming from some mainstream and even “official

sources”. Are you listening?

After the biggest financial and social crash in history occurs, “they” will say you were warned! Who are “they” and how exactly were we warned? For several years and in particular the last 12 months, the IMF (International Monetary Fund) and the BIS (Bank for International Settlements) have been issuing warning after warning. They have truly warned us as I will show you. Do I believe they did this out of the goodness of their hearts? No, I believe it has been in “c.y.a” fashion followed by their laughter because the sheep have and will sleep through it all until it’s too late.

Read More

It is not often I write something as important as what follows. It was

said after the last crash that “no one could’ve seen it coming”. This

was not so back then and is not so today. If you were looking for the

truth in 2007, the average investor had ample warning from many sources

warning of what was to come. The warnings are now much louder, far

easier to hear and coming from some mainstream and even “official

sources”. Are you listening?

It is not often I write something as important as what follows. It was

said after the last crash that “no one could’ve seen it coming”. This

was not so back then and is not so today. If you were looking for the

truth in 2007, the average investor had ample warning from many sources

warning of what was to come. The warnings are now much louder, far

easier to hear and coming from some mainstream and even “official

sources”. Are you listening?After the biggest financial and social crash in history occurs, “they” will say you were warned! Who are “they” and how exactly were we warned? For several years and in particular the last 12 months, the IMF (International Monetary Fund) and the BIS (Bank for International Settlements) have been issuing warning after warning. They have truly warned us as I will show you. Do I believe they did this out of the goodness of their hearts? No, I believe it has been in “c.y.a” fashion followed by their laughter because the sheep have and will sleep through it all until it’s too late.

Read More

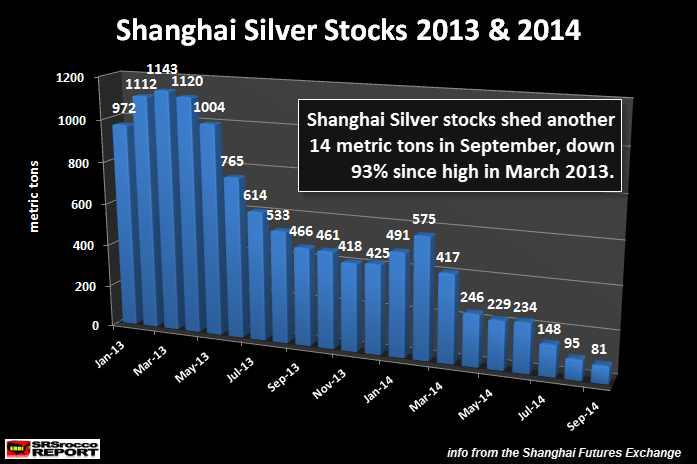

There seems to be more evidence indicating the beginning stages of a global run on silver. How so? Well, ever since the middle of June, something significantly changed in the silver market. Physical silver investment demand skyrocketed. Why June? This was at the time Greece was voting on whether or not to remain in the European Union.

Since the middle of June, investment demand for silver has increased considerably. Matter-a-fact, the U.S. Mint suspended sales of the Silver Eagle for two weeks starting on July 12th. When Silver Eagle sales resumed on July 27th, over 2.5 million were sold over the next two days.

Read More

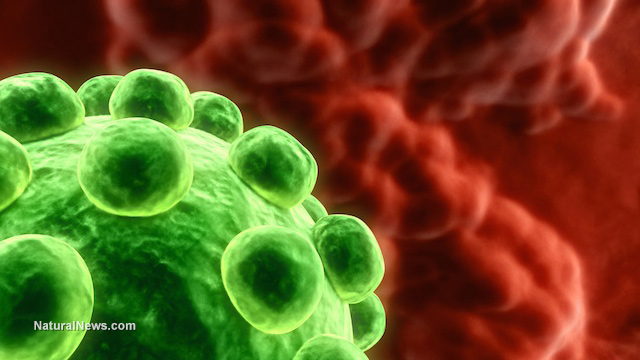

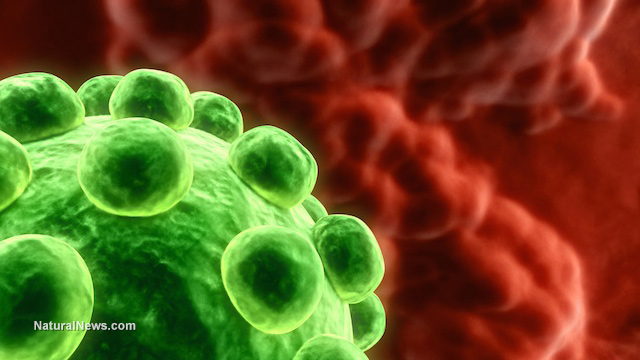

by Dr.Sofiya, Natural News:

Even with all the progress that has been made in cancer detection and

treatment in the last few decades, there is still a long way to go. Even

with all the money that gets poured into cancer research, this disease

remains the fourth leading cause of death in the United States – and

numbers are similar for many other countries around the world. And a big

part of the problem is that the majority of cancer therapies still

revolve around some combination of surgery, chemo or radiation therapy.

All of these treatments carry risks – and all have unwanted side

effects. That is why so many researchers are putting their time into

coming up with more natural ways to treat cancer. And one surprising

candidate that has emerged from all of this is vitamin E, which is more

popularly known for its ability to nourish the skin.

Even with all the progress that has been made in cancer detection and

treatment in the last few decades, there is still a long way to go. Even

with all the money that gets poured into cancer research, this disease

remains the fourth leading cause of death in the United States – and

numbers are similar for many other countries around the world. And a big

part of the problem is that the majority of cancer therapies still

revolve around some combination of surgery, chemo or radiation therapy.

All of these treatments carry risks – and all have unwanted side

effects. That is why so many researchers are putting their time into

coming up with more natural ways to treat cancer. And one surprising

candidate that has emerged from all of this is vitamin E, which is more

popularly known for its ability to nourish the skin.

Continue reading Vitamin E kills off cancer cells and prevents their reproduction, study finds

Even with all the progress that has been made in cancer detection and

treatment in the last few decades, there is still a long way to go. Even

with all the money that gets poured into cancer research, this disease

remains the fourth leading cause of death in the United States – and

numbers are similar for many other countries around the world. And a big

part of the problem is that the majority of cancer therapies still

revolve around some combination of surgery, chemo or radiation therapy.

All of these treatments carry risks – and all have unwanted side

effects. That is why so many researchers are putting their time into

coming up with more natural ways to treat cancer. And one surprising

candidate that has emerged from all of this is vitamin E, which is more

popularly known for its ability to nourish the skin.

Even with all the progress that has been made in cancer detection and

treatment in the last few decades, there is still a long way to go. Even

with all the money that gets poured into cancer research, this disease

remains the fourth leading cause of death in the United States – and

numbers are similar for many other countries around the world. And a big

part of the problem is that the majority of cancer therapies still

revolve around some combination of surgery, chemo or radiation therapy.

All of these treatments carry risks – and all have unwanted side

effects. That is why so many researchers are putting their time into

coming up with more natural ways to treat cancer. And one surprising

candidate that has emerged from all of this is vitamin E, which is more

popularly known for its ability to nourish the skin.Continue reading Vitamin E kills off cancer cells and prevents their reproduction, study finds

from MissingSky101:

from SilverSeek:

If there are words to characterize the precious metals markets for

July, it would be “divergences” and “shortages.” There was heavy selling

in the leveraged futures market and extraordinary buying demand and

shortages in physical coins, rounds, and bars.

If there are words to characterize the precious metals markets for

July, it would be “divergences” and “shortages.” There was heavy selling

in the leveraged futures market and extraordinary buying demand and

shortages in physical coins, rounds, and bars.

Despite turmoil surrounding Greece and a huge sell-off in Chinese equities, traders dumped wheelbarrow loads of paper gold and silver. The expected safe-haven buying was concentrated entirely in physical bullion. Spot prices fell relentlessly during the month.

We’ve reported on this divergence recently, and so did Frank Holmes of U.S. Global Investors during last Friday’s Money Metals podcast. But some surprising new data has come to light…

Read More

If there are words to characterize the precious metals markets for

July, it would be “divergences” and “shortages.” There was heavy selling

in the leveraged futures market and extraordinary buying demand and

shortages in physical coins, rounds, and bars.

If there are words to characterize the precious metals markets for

July, it would be “divergences” and “shortages.” There was heavy selling

in the leveraged futures market and extraordinary buying demand and

shortages in physical coins, rounds, and bars.Despite turmoil surrounding Greece and a huge sell-off in Chinese equities, traders dumped wheelbarrow loads of paper gold and silver. The expected safe-haven buying was concentrated entirely in physical bullion. Spot prices fell relentlessly during the month.

We’ve reported on this divergence recently, and so did Frank Holmes of U.S. Global Investors during last Friday’s Money Metals podcast. But some surprising new data has come to light…

Read More

from KingWorldNews:

On the heels of continued volatile trading in key global markets, the

Godfather of newsletter writers, 90-year-old Richard Russell, warned

about an event that will signal the start of a historic bear market that

will destroy the current economic system. The legend also discussed

gold, silver and a trapped Federal Reserve.

On the heels of continued volatile trading in key global markets, the

Godfather of newsletter writers, 90-year-old Richard Russell, warned

about an event that will signal the start of a historic bear market that

will destroy the current economic system. The legend also discussed

gold, silver and a trapped Federal Reserve.

Richard Russell: “Investor’s Business Daily headline, 7/31/15: ‘Fed Rate Hike Probability in September Increases to 50%.’ From every side, it appears that the Fed is more than anxious to raise the federal funds rate. This is based on the Fed’s perception that the economy is rosy and growing stronger.

Read More

On the heels of continued volatile trading in key global markets, the

Godfather of newsletter writers, 90-year-old Richard Russell, warned

about an event that will signal the start of a historic bear market that

will destroy the current economic system. The legend also discussed

gold, silver and a trapped Federal Reserve.

On the heels of continued volatile trading in key global markets, the

Godfather of newsletter writers, 90-year-old Richard Russell, warned

about an event that will signal the start of a historic bear market that

will destroy the current economic system. The legend also discussed

gold, silver and a trapped Federal Reserve.Richard Russell: “Investor’s Business Daily headline, 7/31/15: ‘Fed Rate Hike Probability in September Increases to 50%.’ From every side, it appears that the Fed is more than anxious to raise the federal funds rate. This is based on the Fed’s perception that the economy is rosy and growing stronger.

Read More

by Daisy Luther, The Organic Prepper:

People all over the globe are struggling right now to put food on the table and keep a roof over their heads. In the United States and Canada, we’re watching many more people than we’ve seen in nearly a decade plunge into poverty due to our failing economy. We’re losing jobs, paying higher expenses, and getting slapped with medical bills that we won’t make enough money to pay for in this lifetime.

For some folks, tips like the ones that follow would not be helpful because their situations have become so dire. For the rest of us, though, there are many places that we can cut the budget in order to survive in the new economic paradigm. Frugality is a viable alternative lifestyle.

Read More

People all over the globe are struggling right now to put food on the table and keep a roof over their heads. In the United States and Canada, we’re watching many more people than we’ve seen in nearly a decade plunge into poverty due to our failing economy. We’re losing jobs, paying higher expenses, and getting slapped with medical bills that we won’t make enough money to pay for in this lifetime.

For some folks, tips like the ones that follow would not be helpful because their situations have become so dire. For the rest of us, though, there are many places that we can cut the budget in order to survive in the new economic paradigm. Frugality is a viable alternative lifestyle.

Read More

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment