By The Gold Report, The Market Oracle:

John Williams, author of the ShadowStats.com newsletter, shines light

on his interpretations of the GDP, CPI, unemployment and other

government statistics in this exclusive Gold Report

interview from the recent Recovery Reality Check conference.

Highlights include what the money supply measures tell him and why QE3

will be a hard sell.

John Williams, author of the ShadowStats.com newsletter, shines light

on his interpretations of the GDP, CPI, unemployment and other

government statistics in this exclusive Gold Report

interview from the recent Recovery Reality Check conference.

Highlights include what the money supply measures tell him and why QE3

will be a hard sell.

John Williams, author of the ShadowStats.com newsletter, shines light

on his interpretations of the GDP, CPI, unemployment and other

government statistics in this exclusive Gold Report

interview from the recent Recovery Reality Check conference.

Highlights include what the money supply measures tell him and why QE3

will be a hard sell.

John Williams, author of the ShadowStats.com newsletter, shines light

on his interpretations of the GDP, CPI, unemployment and other

government statistics in this exclusive Gold Report

interview from the recent Recovery Reality Check conference.

Highlights include what the money supply measures tell him and why QE3

will be a hard sell.

The Gold Report:

John, at the recent Casey Research Recovery Reality Check conference

you described the economic recovery heralded by the Obama

administration as an illusion based largely on skewed inflation data.

Can you walk us through why, based on your calculations, a recovery is

impossible?

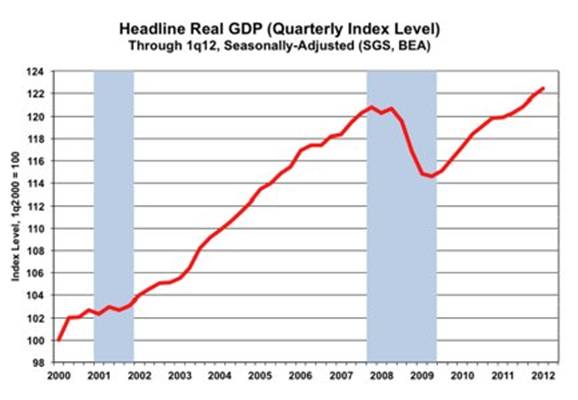

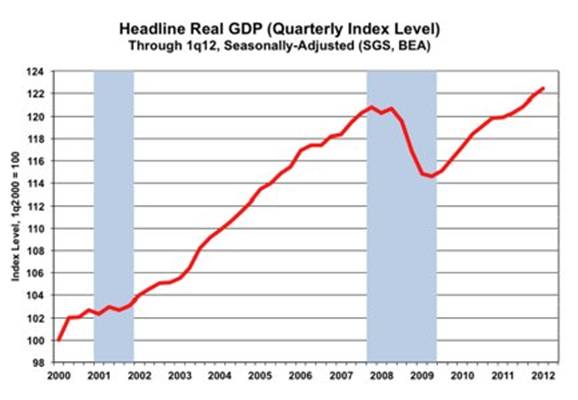

John Williams: We can start with the gross domestic product (GDP), which like most economic reports is adjusted for inflation. If you take inflation out of it, what is left should be changes in economic activity, as opposed to changes from prices going up or down.

John Williams: We can start with the gross domestic product (GDP), which like most economic reports is adjusted for inflation. If you take inflation out of it, what is left should be changes in economic activity, as opposed to changes from prices going up or down.

Reported

GDP activity for Q3/11, Q4/11 and Q1/12 was above where it had been

going into the recession. Formally, that is a recovery. The problem is

that no other major economic series shows that same pattern, which is a

physical impossibility if the GDP numbers are accurate.

Read More @ TheMarketOracle.co.ukIs This Why We Are Rallying Today?

As

we noted last week, the level that would represent the same size drop

as triggered globally coordinated central bank easing in November of

last year, is around 1285 and sure enough we got close (1287) in

futures before today's rally began...is it really this easy?

As

we noted last week, the level that would represent the same size drop

as triggered globally coordinated central bank easing in November of

last year, is around 1285 and sure enough we got close (1287) in

futures before today's rally began...is it really this easy?Four Reasons Why The Euro Is Not Crashing

Based on a swap-spread-based model, EURUSD should trade around 1.30, but based on GDP-weighted sovereign credit risk EURUSD should trade around 1.00;

so who is right and what are the factors that supporting the Euro at

higher levels than many would assume (given the rising probability of a

Euro-zone #fail and the 0.82 lows from 2000).

UBS addresses four key reasons for the apparent paradox based on the

difference between ECB and Fed 'monetization', the EZ's balanced current

account (independent of foreign capital flows), and the high-oil-price

induced petro-dollar circulation diversifying into Euros (or out of

USD). The final and most telling of factors though is bank

deleveraging as European financial entities, who remain under pressure

to shrink their balance sheets and re-build capital, have been selling

foreign assets. They remain EUR dismalists with a year-end

target of 1.15 but expect the slide to these levels to be cushioned

(absent an imminent break-up) by banks' 'shrinkage'.

Based on a swap-spread-based model, EURUSD should trade around 1.30, but based on GDP-weighted sovereign credit risk EURUSD should trade around 1.00;

so who is right and what are the factors that supporting the Euro at

higher levels than many would assume (given the rising probability of a

Euro-zone #fail and the 0.82 lows from 2000).

UBS addresses four key reasons for the apparent paradox based on the

difference between ECB and Fed 'monetization', the EZ's balanced current

account (independent of foreign capital flows), and the high-oil-price

induced petro-dollar circulation diversifying into Euros (or out of

USD). The final and most telling of factors though is bank

deleveraging as European financial entities, who remain under pressure

to shrink their balance sheets and re-build capital, have been selling

foreign assets. They remain EUR dismalists with a year-end

target of 1.15 but expect the slide to these levels to be cushioned

(absent an imminent break-up) by banks' 'shrinkage'.

by Alasdair Macleod, Gold Money:

The reason we accept paper money as a store of value is habit. This

habit has its origins in history, when banks took our gold as deposit

and issued paper receipts for it. The gold has gone, but the paper with

its habitual value remains, and we accept it without question. The only

backing is a vague government promise.

The reason we accept paper money as a store of value is habit. This

habit has its origins in history, when banks took our gold as deposit

and issued paper receipts for it. The gold has gone, but the paper with

its habitual value remains, and we accept it without question. The only

backing is a vague government promise.

There is no sound theoretical basis for why unbacked government-issued money should retain a store of value: it depends for its value on a market-based acceptance of financial credibility. So it follows that if a government loses all financial credibility in markets, its paper becomes worthless. This is confirmed by experience in all paper money collapses.

The fact it can and has happened elsewhere confirms that all faith can theoretically disappear from the dollar, pound, euro or yen. This is a very different understanding about currency values compared with what is commonly accepted. Instead, we assume that any change in purchasing power is tied firmly to price inflation, and we factor out any reliance upon faith. But this is a cop-out, a way of not addressing the basic assumptions that uplift the value of government-issued money from zero to what it will actually purchase.

Read More @ GoldMoney.com

The reason we accept paper money as a store of value is habit. This

habit has its origins in history, when banks took our gold as deposit

and issued paper receipts for it. The gold has gone, but the paper with

its habitual value remains, and we accept it without question. The only

backing is a vague government promise.

The reason we accept paper money as a store of value is habit. This

habit has its origins in history, when banks took our gold as deposit

and issued paper receipts for it. The gold has gone, but the paper with

its habitual value remains, and we accept it without question. The only

backing is a vague government promise.There is no sound theoretical basis for why unbacked government-issued money should retain a store of value: it depends for its value on a market-based acceptance of financial credibility. So it follows that if a government loses all financial credibility in markets, its paper becomes worthless. This is confirmed by experience in all paper money collapses.

The fact it can and has happened elsewhere confirms that all faith can theoretically disappear from the dollar, pound, euro or yen. This is a very different understanding about currency values compared with what is commonly accepted. Instead, we assume that any change in purchasing power is tied firmly to price inflation, and we factor out any reliance upon faith. But this is a cop-out, a way of not addressing the basic assumptions that uplift the value of government-issued money from zero to what it will actually purchase.

Read More @ GoldMoney.com

Forget 'GREXIT'; Meet 'GEURO'

The

catastrophe that is Greece that has spawned the term 'Grexit' for its

likely self-abdication (or dismissal) from the Euro remains a long way

from being solved. Should the next elections go the way the opinion

polls suggest, it seems highly likely that a government vehemently

opposed to its own bailout terms and further austerity will stretch the

patience of its 'core'-supporters to a breaking point - even though

they know the gun they hold is squarely pointed at their own forehead.

However, Deutsche Bank's economics team see the potential for a third

path - that of running a Greek parallel currency to the Euro

(which they dub "GEURO") to represent government issued IoUs to meet

current payment obligations. This would enable, in DB's view,

Greece to engineer an exchange rate devaluation without formally exiting

the EMU. With Greece unlikely to meet primary budget surplus targets

envisaged by the TROIKA, and political will inside Greece hardly making

an effort to do so - perhaps this is the 'compromise' that meets everyone's needs (in a strange way). Initially there would be a large depreciation (which Germany could use politically to claim - see 'they suffered' - and maintain circular support for the financial system implications of GREXIT)

but at the same time Greek authorities would reclaim some semblance of

control to stabilize or even strengthen (over time) their own GEURO

against the EURO - leaving the door open to a return to the Euro at

some point.

The

catastrophe that is Greece that has spawned the term 'Grexit' for its

likely self-abdication (or dismissal) from the Euro remains a long way

from being solved. Should the next elections go the way the opinion

polls suggest, it seems highly likely that a government vehemently

opposed to its own bailout terms and further austerity will stretch the

patience of its 'core'-supporters to a breaking point - even though

they know the gun they hold is squarely pointed at their own forehead.

However, Deutsche Bank's economics team see the potential for a third

path - that of running a Greek parallel currency to the Euro

(which they dub "GEURO") to represent government issued IoUs to meet

current payment obligations. This would enable, in DB's view,

Greece to engineer an exchange rate devaluation without formally exiting

the EMU. With Greece unlikely to meet primary budget surplus targets

envisaged by the TROIKA, and political will inside Greece hardly making

an effort to do so - perhaps this is the 'compromise' that meets everyone's needs (in a strange way). Initially there would be a large depreciation (which Germany could use politically to claim - see 'they suffered' - and maintain circular support for the financial system implications of GREXIT)

but at the same time Greek authorities would reclaim some semblance of

control to stabilize or even strengthen (over time) their own GEURO

against the EURO - leaving the door open to a return to the Euro at

some point.Cembalest On Germany: "You Can Ignore Economics, But It Will Not Ignore You"

Ten months ago, as the latest Grand Plan was being announced, we wrote in detail

on just how angry Zee German people might get once they realized what

was going on. With the weight of the world increasingly burdened on

their shoulders, Michael Cembalest of JPMorgan asks "will Germany spend

its accumulated national wealth to save the Eurozone (at least

temporarily), and how much might it cost them?" Notably, for the better

part of a century, the tendency for conflicts in Europe to coincide with Germany's relative economic might is astonishing,

but between backstopping the Periphery, a non-inflationary ECB

solution, and five years of support to finance the departure of foreign

capital - avoiding social collapse in Greece for example - Cembalest

estimates the cost to be around 1 trillion Euros. What

is more astounding is that he then goes on to compare this cost to

re-unification (over the past 20 years) and notes that even if Germany had to pick up half the trillion-euro tab, its debt-to-GDP ratio would rise above 100%

(well over the 90% 'This Time It's Different' tipping point). Just how

much does this mean to Germany and Europe? IMF Managing Director

Lagarde gave a speech last week in which she highlighted the historical

importance of Europe and how the concept of the Euro dates back to

Charlemagne in the 800s. True, perhaps; but that has not prevented

other European monetary unions from failing in the interim. You can ignore economics, but it will not ignore you.

Ten months ago, as the latest Grand Plan was being announced, we wrote in detail

on just how angry Zee German people might get once they realized what

was going on. With the weight of the world increasingly burdened on

their shoulders, Michael Cembalest of JPMorgan asks "will Germany spend

its accumulated national wealth to save the Eurozone (at least

temporarily), and how much might it cost them?" Notably, for the better

part of a century, the tendency for conflicts in Europe to coincide with Germany's relative economic might is astonishing,

but between backstopping the Periphery, a non-inflationary ECB

solution, and five years of support to finance the departure of foreign

capital - avoiding social collapse in Greece for example - Cembalest

estimates the cost to be around 1 trillion Euros. What

is more astounding is that he then goes on to compare this cost to

re-unification (over the past 20 years) and notes that even if Germany had to pick up half the trillion-euro tab, its debt-to-GDP ratio would rise above 100%

(well over the 90% 'This Time It's Different' tipping point). Just how

much does this mean to Germany and Europe? IMF Managing Director

Lagarde gave a speech last week in which she highlighted the historical

importance of Europe and how the concept of the Euro dates back to

Charlemagne in the 800s. True, perhaps; but that has not prevented

other European monetary unions from failing in the interim. You can ignore economics, but it will not ignore you.

Please support our efforts to keep you informed...

Thank You

I'm PayPal Verified

Blast From The Past: SNL Explains Wall Street

Just

because few have captured the essence of Wall Street quite like the

following "Straight talk with Global Century" SNL skit from the recent

past, which reminds us that the more things change, the more they stay

the same: a timely reminder in the aftermath of the FB bloodbath.

Just

because few have captured the essence of Wall Street quite like the

following "Straight talk with Global Century" SNL skit from the recent

past, which reminds us that the more things change, the more they stay

the same: a timely reminder in the aftermath of the FB bloodbath.Net Asset Value Premiums of Certain Precious Metal Trusts and Funds

Americans Want Smaller Government And Lower Taxes

The

reality is that — with the exception of Obama — Americans have again

and again opted for a candidate who has paid lip-service to small

government. Even Bill Clinton paid lip service to the idea that “the era

of big government is over” (yeah, right). And then once in office,

they have bucked their promises and massively increased the size and

scope of government. Reagan’s administration increased the debt by 190%

alone, and successive Presidents — especially George W. Bush and

Barack Obama — just went bigger and bigger, in total contradict to

voters’ expressed preferences. The choice between the Republicans and

Democrats has been one of rhetoric and not policy. Republicans may

consistently talk about reducing the size and scope of government, but

they don’t follow through.Today Ron Paul, the only Republican candidate

who is putting forth a seriously reduced notion of government, has

been marginalised and sidelined by the major media and Republican

establishment. The establishment candidate — Mitt Romney — as governor

of Massachusetts left that state with the biggest per-capita debt of any state. His track record in government and his choice of advisers

strongly suggest that he will follow in the George W. Bush school of

promising smaller government and delivering massive government and

massive debt.

The

reality is that — with the exception of Obama — Americans have again

and again opted for a candidate who has paid lip-service to small

government. Even Bill Clinton paid lip service to the idea that “the era

of big government is over” (yeah, right). And then once in office,

they have bucked their promises and massively increased the size and

scope of government. Reagan’s administration increased the debt by 190%

alone, and successive Presidents — especially George W. Bush and

Barack Obama — just went bigger and bigger, in total contradict to

voters’ expressed preferences. The choice between the Republicans and

Democrats has been one of rhetoric and not policy. Republicans may

consistently talk about reducing the size and scope of government, but

they don’t follow through.Today Ron Paul, the only Republican candidate

who is putting forth a seriously reduced notion of government, has

been marginalised and sidelined by the major media and Republican

establishment. The establishment candidate — Mitt Romney — as governor

of Massachusetts left that state with the biggest per-capita debt of any state. His track record in government and his choice of advisers

strongly suggest that he will follow in the George W. Bush school of

promising smaller government and delivering massive government and

massive debt.Feedback, Unintended Consequences And Global Markets

All models of non-linear complex systems are crude because

they attempt to model millions of interactions with a handful of

variables. When it comes to global weather or global markets,

our ability to predict non-linear complex systems with what amounts to

mathematical tricks (algorithms, etc.) is proscribed by the fundamental

limits of the tricks. Projecting current trends is also an erratic and inaccurate method of prediction.

The current trend may continue or it may weaken or reverse. "The Way

of the Tao is reversal," but gaming life's propensity for reversal with

contrarian thinking is not sure-fire, either. If it was that easy to

predict the future of markets, we'd all be millionaires. Part of the intrinsic uncertainty of the future is visible in unintended consequences.

The Federal Reserve, for example, predicted that lowering interest

rates to zero and paying banks interest on their deposits at the Federal

Reserve would rebuild bank reserves by slight-of-hand. Banks would

then start lending to qualified borrowers, and the economy would

recover strongly as a result.

They were wrong on every count.

"The Mourning After" - Argentina Is On The Greek Side, But Why Is The IMF Holding It Hostage?

The

latest gambit used by the Eurocrats is that should Greece dare to not

follow their sage advice, and leave the EMU, it will burn in hell for

perpetuity, where famine and pestilence will join in making Greeks

regret they ever dared to not listen to their Keynesian overlords. The

only problem is that despite what econo-pundits everywhere claim, the

Argentina case study (as well as the Iceland and the Southeast Asian) is

a rather optimistic one of what Greece can expect to occur after it

finally "just says no" to the biggest vanity experiment in European

history. And as JPM's Michael Cembalest shows without any doubt, "there is a morning after." The far bigger problem is that there will be a "mourning after" for all those who are threatening Greece will hell and damnation right about now. Which brings us to a very critical question: why is the IMF not doing what it should be doing, and promising to assist the Greek decision, even if it means exiting the Euro. As JPM's Cembalest says "If

the IMF did what it is supposed to do and lend into a devaluation/

structural adjustment (instead of financing a German and French bank

rescue), Greece just might have a shot. Within the Euro, they don’t."

Which begs the question: just how many pieces of silver did it take

for the IMF to join the bandwagon of sell out and rehypothecate its

soul, and charter, to the highest bidder?

The

latest gambit used by the Eurocrats is that should Greece dare to not

follow their sage advice, and leave the EMU, it will burn in hell for

perpetuity, where famine and pestilence will join in making Greeks

regret they ever dared to not listen to their Keynesian overlords. The

only problem is that despite what econo-pundits everywhere claim, the

Argentina case study (as well as the Iceland and the Southeast Asian) is

a rather optimistic one of what Greece can expect to occur after it

finally "just says no" to the biggest vanity experiment in European

history. And as JPM's Michael Cembalest shows without any doubt, "there is a morning after." The far bigger problem is that there will be a "mourning after" for all those who are threatening Greece will hell and damnation right about now. Which brings us to a very critical question: why is the IMF not doing what it should be doing, and promising to assist the Greek decision, even if it means exiting the Euro. As JPM's Cembalest says "If

the IMF did what it is supposed to do and lend into a devaluation/

structural adjustment (instead of financing a German and French bank

rescue), Greece just might have a shot. Within the Euro, they don’t."

Which begs the question: just how many pieces of silver did it take

for the IMF to join the bandwagon of sell out and rehypothecate its

soul, and charter, to the highest bidder?Bipartisan Congressional Bill Would Authorize the Use of Propaganda On Americans Living Inside America

05/21/2012 - 13:34

from Silver Vigilante:

When buying your first precious metals, it can be confusing as to

which coins and/or bars you should purchase. The following piece is

intended to function as a very general guideline for the silver

vigilante when it comes to buying silver, gold, platinum and palladium.

First of all, let’s distinguish between types of products. I will focus

on silver, but similar applies to the three other precious metals.

When buying your first precious metals, it can be confusing as to

which coins and/or bars you should purchase. The following piece is

intended to function as a very general guideline for the silver

vigilante when it comes to buying silver, gold, platinum and palladium.

First of all, let’s distinguish between types of products. I will focus

on silver, but similar applies to the three other precious metals.

There are generally two types of silver products the silver-investor can buy: privately minted and public.

The privately minted products range from 1 oz bars and rounds to 10 oz, 100 oz and 1000 ounce bars. The advantage of the private products is typically their low premium. This does not apply with Johnson Matthey and Engelhard products, for example, which come with higher premiums. But, these higher premiums are not such a big deal considering how well-recognized their products are.

Read More @ SilverVigilante.com

When buying your first precious metals, it can be confusing as to

which coins and/or bars you should purchase. The following piece is

intended to function as a very general guideline for the silver

vigilante when it comes to buying silver, gold, platinum and palladium.

First of all, let’s distinguish between types of products. I will focus

on silver, but similar applies to the three other precious metals.

When buying your first precious metals, it can be confusing as to

which coins and/or bars you should purchase. The following piece is

intended to function as a very general guideline for the silver

vigilante when it comes to buying silver, gold, platinum and palladium.

First of all, let’s distinguish between types of products. I will focus

on silver, but similar applies to the three other precious metals.There are generally two types of silver products the silver-investor can buy: privately minted and public.

The privately minted products range from 1 oz bars and rounds to 10 oz, 100 oz and 1000 ounce bars. The advantage of the private products is typically their low premium. This does not apply with Johnson Matthey and Engelhard products, for example, which come with higher premiums. But, these higher premiums are not such a big deal considering how well-recognized their products are.

Read More @ SilverVigilante.com

from Liberty Blitzkrieg

Ah the U.S. Postal Service. This shining example of American efficiency that just announced a $3.2 billion loss in the second quarter and employed six hundred thousand people in order to achieve this feat, has brilliantly decided we need to use SDRs when sending internationally insured parcels. Yep, glad to see our pride and joy is leading the charge to global fiat feudalism. I mean you’ve got to be kidding me…

The accepting clerk must do the following:

$100.00 (U.S.)

63.39 SDR

See it for yourself here.

Read More @ LibertyBlitzkrieg.com

Ah the U.S. Postal Service. This shining example of American efficiency that just announced a $3.2 billion loss in the second quarter and employed six hundred thousand people in order to achieve this feat, has brilliantly decided we need to use SDRs when sending internationally insured parcels. Yep, glad to see our pride and joy is leading the charge to global fiat feudalism. I mean you’ve got to be kidding me…

The accepting clerk must do the following:

- Indicate on PS Form 2976-A the amount for which the parcel is insured. Write the amount in U.S. dollars in ink in the “Insured Amount (U.S.) block.”

- Convert the U.S. dollar amount to the special drawing right (SDR) value and enter it in the SDR value block. For example:

$100.00 (U.S.)

63.39 SDR

See it for yourself here.

Read More @ LibertyBlitzkrieg.com

by Greg Hunter, USAWatchdog:

The meeting, this week, in Iraq to negotiate Iran’s nuclear program

will decide whether or not the world will go to war. The meeting is

between the East (Iran, China and Russia) and the West (U.S., UK, France

and Germany). If the meeting goes well, war will be avoided. If the

meeting goes badly, the world will be heading for war. If

yesterday’s CNN interview with Iran’s Finance Minister, Shamseddin

Hosseini, is any indication, the upcoming meeting will be a disaster.

When asked if Iran would allow inspectors to scrutinize all its nuclear

facilities, Hosseini said, “There are conversations and

dialogues taking place currently, but there cannot be a hegemony and a

double-standard in the treatment of member countries such as Iran. If

these principles can be understood and applied with mutual respect, I

think we will be in a much better place. If we don’t, we will witness an

increase in international oil markets.” (Click here to see the complete CNN story.) In other words, he sidestepped the question and gave no indication total access by inspectors would be a possibility.

The meeting, this week, in Iraq to negotiate Iran’s nuclear program

will decide whether or not the world will go to war. The meeting is

between the East (Iran, China and Russia) and the West (U.S., UK, France

and Germany). If the meeting goes well, war will be avoided. If the

meeting goes badly, the world will be heading for war. If

yesterday’s CNN interview with Iran’s Finance Minister, Shamseddin

Hosseini, is any indication, the upcoming meeting will be a disaster.

When asked if Iran would allow inspectors to scrutinize all its nuclear

facilities, Hosseini said, “There are conversations and

dialogues taking place currently, but there cannot be a hegemony and a

double-standard in the treatment of member countries such as Iran. If

these principles can be understood and applied with mutual respect, I

think we will be in a much better place. If we don’t, we will witness an

increase in international oil markets.” (Click here to see the complete CNN story.) In other words, he sidestepped the question and gave no indication total access by inspectors would be a possibility.

Read More @ USAWatchdog.com

The meeting, this week, in Iraq to negotiate Iran’s nuclear program

will decide whether or not the world will go to war. The meeting is

between the East (Iran, China and Russia) and the West (U.S., UK, France

and Germany). If the meeting goes well, war will be avoided. If the

meeting goes badly, the world will be heading for war. If

yesterday’s CNN interview with Iran’s Finance Minister, Shamseddin

Hosseini, is any indication, the upcoming meeting will be a disaster.

When asked if Iran would allow inspectors to scrutinize all its nuclear

facilities, Hosseini said, “There are conversations and

dialogues taking place currently, but there cannot be a hegemony and a

double-standard in the treatment of member countries such as Iran. If

these principles can be understood and applied with mutual respect, I

think we will be in a much better place. If we don’t, we will witness an

increase in international oil markets.” (Click here to see the complete CNN story.) In other words, he sidestepped the question and gave no indication total access by inspectors would be a possibility.

The meeting, this week, in Iraq to negotiate Iran’s nuclear program

will decide whether or not the world will go to war. The meeting is

between the East (Iran, China and Russia) and the West (U.S., UK, France

and Germany). If the meeting goes well, war will be avoided. If the

meeting goes badly, the world will be heading for war. If

yesterday’s CNN interview with Iran’s Finance Minister, Shamseddin

Hosseini, is any indication, the upcoming meeting will be a disaster.

When asked if Iran would allow inspectors to scrutinize all its nuclear

facilities, Hosseini said, “There are conversations and

dialogues taking place currently, but there cannot be a hegemony and a

double-standard in the treatment of member countries such as Iran. If

these principles can be understood and applied with mutual respect, I

think we will be in a much better place. If we don’t, we will witness an

increase in international oil markets.” (Click here to see the complete CNN story.) In other words, he sidestepped the question and gave no indication total access by inspectors would be a possibility.Read More @ USAWatchdog.com

by Lawrence Williams, Mineweb

LONDON (Mineweb) –

LONDON (Mineweb) –

In his keynote presentation to last week’s New York Hard Assets Investment Conference, Eric Sprott, as usual as a precious metals believer, gave an upbeat presentation on the long term prospects for gold and silver.

He opened his address by pointing to a big change in the markets since he presented at the same event a year earlier when, as he pointed out, the silver price was around $49.50 “until they bombed it” and gold was shortly to see $1900 plus. But overall he pointed to the huge sea change in the precious metals markets over the past 12 years and that the 12 month correction we are currently seeing is a temporary phenomenon and that he reckons the physical market in gold and silver is actually still in great shape.

Read More @ MineWeb.com

Please support our efforts to keep you informed...

I'm PayPal Verified

LONDON (Mineweb) –

LONDON (Mineweb) – In his keynote presentation to last week’s New York Hard Assets Investment Conference, Eric Sprott, as usual as a precious metals believer, gave an upbeat presentation on the long term prospects for gold and silver.

He opened his address by pointing to a big change in the markets since he presented at the same event a year earlier when, as he pointed out, the silver price was around $49.50 “until they bombed it” and gold was shortly to see $1900 plus. But overall he pointed to the huge sea change in the precious metals markets over the past 12 years and that the 12 month correction we are currently seeing is a temporary phenomenon and that he reckons the physical market in gold and silver is actually still in great shape.

Read More @ MineWeb.com

Please support our efforts to keep you informed...

Thank You

I'm PayPal Verified

There Has Been No Austerity

Admin at Marc Faber Blog - 2 hours ago

There has been no austerity in Europe, Dr. Marc Faber says to CNBC.

*Marc Faber is an international investor known for his uncanny predictions

of the stock market and futures markets around the world.*

Today Egon von Greyerz told King World News that a client went to move a

significant amount of “allocated” gold from a Swiss bank, but the bank

shocked the customer because they did not have the gold. Egon von

Greyerz is founder and managing partner at Matterhorn Asset Management

out of Switzerland. Von Greyerz also said, “the risk of having gold in

the banking system is major.” But first, here is what Greyerz had to

say about the bank runs in Europe: “This is just amazing, Eric,

you couldn’t write a better story than this. We have bank runs in

Greece and Spain, and now a French bank, one of the biggest mortgage

banks, is also having problems. Ireland, they thought they were all

right, but they need more money.”

Today Egon von Greyerz told King World News that a client went to move a

significant amount of “allocated” gold from a Swiss bank, but the bank

shocked the customer because they did not have the gold. Egon von

Greyerz is founder and managing partner at Matterhorn Asset Management

out of Switzerland. Von Greyerz also said, “the risk of having gold in

the banking system is major.” But first, here is what Greyerz had to

say about the bank runs in Europe: “This is just amazing, Eric,

you couldn’t write a better story than this. We have bank runs in

Greece and Spain, and now a French bank, one of the biggest mortgage

banks, is also having problems. Ireland, they thought they were all

right, but they need more money.” With the way that things are heading in this country, it is not surprising that there are

With the way that things are heading in this country, it is not surprising that there are  Europe’s leaders — that is to say German Chancellor Angela Merkel and

the bureaucrats running the various eurozone agencies from Brussels —

have looked into the abyss and don’t like what they see. Specifically, a

default and departure by even a relatively insignificant country like

Greece might start a contagion that cripples or destroys the whole

eurozone.

Europe’s leaders — that is to say German Chancellor Angela Merkel and

the bureaucrats running the various eurozone agencies from Brussels —

have looked into the abyss and don’t like what they see. Specifically, a

default and departure by even a relatively insignificant country like

Greece might start a contagion that cripples or destroys the whole

eurozone. Greece suffered in 2011. The economy tanked for the fourth year in a

row. Unemployment rose to above 20%. The government, up to the gills in

debt and cut off from the capital markets, had to go begging to the

infamous Troika of EU, ECB, and IMF bureaucrats and elected officials.

In return, it had to implement painful reforms—layoffs, wage cuts for

the lucky ones, liberalization of coddled markets and professions, deep

cuts to the state healthcare system, privatization of state-owned

enterprises, new taxes…. reforms it then didn’t implement, or couldn’t

implement, or refused to implement. And each time Troika inspectors came

to Athens to check on progress and audit the books, they left angry.

The Troika would threaten to cut off the bailout funds, and in fact did

cut them off for a while, to force Greece to make some progress in

getting its economy to be competitive on a global basis.

Greece suffered in 2011. The economy tanked for the fourth year in a

row. Unemployment rose to above 20%. The government, up to the gills in

debt and cut off from the capital markets, had to go begging to the

infamous Troika of EU, ECB, and IMF bureaucrats and elected officials.

In return, it had to implement painful reforms—layoffs, wage cuts for

the lucky ones, liberalization of coddled markets and professions, deep

cuts to the state healthcare system, privatization of state-owned

enterprises, new taxes…. reforms it then didn’t implement, or couldn’t

implement, or refused to implement. And each time Troika inspectors came

to Athens to check on progress and audit the books, they left angry.

The Troika would threaten to cut off the bailout funds, and in fact did

cut them off for a while, to force Greece to make some progress in

getting its economy to be competitive on a global basis.![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment