Euro zone officials agree to prepare for Greek exit scenario

Eric De Groot at Eric De Groot - 3 minutes ago

The markets and actions of Greek people discount reality better than any

political discussion. Headline: Euro zone officials agree to prepare for

Greek exit scenario May 23 (Reuters) - Euro zone officials have agreed that

each euro zone country must prepare an individual contingency plan in the

eventuality that Greece decides to leave the single currency area, two

eurozone officials said...

[[ This is a content summary only. Visit my website for full links, other

content, and more! ]]

By: Peter Cooper, Arabian Money:

The pessimism in the precious metals market just has to be at something of a high point.

And yet there is an obvious point of release on the horizon. Greece

runs out of cash in six weeks’ time and that will finally force the

eurozone to do the necessary and print money again.

The pessimism in the precious metals market just has to be at something of a high point.

And yet there is an obvious point of release on the horizon. Greece

runs out of cash in six weeks’ time and that will finally force the

eurozone to do the necessary and print money again.

At the same time the long-standing enemy of bullion prices, JP Morgan is in serious trouble with its derivative gambles on the eurozone. Estimates of losses were originally $2 billion but we now have $5 billion suggested by rival Morgan Stanley.

Read More @ arabianmoney.net

The pessimism in the precious metals market just has to be at something of a high point.

And yet there is an obvious point of release on the horizon. Greece

runs out of cash in six weeks’ time and that will finally force the

eurozone to do the necessary and print money again.

The pessimism in the precious metals market just has to be at something of a high point.

And yet there is an obvious point of release on the horizon. Greece

runs out of cash in six weeks’ time and that will finally force the

eurozone to do the necessary and print money again.At the same time the long-standing enemy of bullion prices, JP Morgan is in serious trouble with its derivative gambles on the eurozone. Estimates of losses were originally $2 billion but we now have $5 billion suggested by rival Morgan Stanley.

Read More @ arabianmoney.net

On The Predictability Of European Lies

Earlier today we were delighted to predict precisely what the script of the European headline flow would be now that the only thing that matters is instilling the fear of Chairsatan in the Greek people, who are so confused that 75% of them wish to keep the Euro, but 80% wish for austerity to end - two mutually exclusive events. We outlined the daily event flow for the next month as follows:- Europe releases definitive rumor that everyone is preparing for a Greek exit full of bombastic jargon and details of how Greece will be annihilated if it does exit the EMU;

- Immediate election polls are taken;

- If "anti-memorandum" Syriza support is not materially lower, rumor is promptly withdrawn for the day, only to be unleashed the next day with even more bombastic end of world adjectives describing the 9th circle of hell Greece will enter unless the Greek people vote "for" the pro-bailout parties, "for" the Euro, and "for" a perpetuation of the status quo;

- Rinse

- Repeat

Flowcharting The Eurocalypse

We

have laid out in great detail over the past few months the contagious

paths, game-theoretical endgames, and transmission channels that would

occur should a nation (Greece for example) leave the Euro. Yet the covered matter is not simple, which is why sometimes the best representation is the visual one. The Financial Times has outdone themselves with the best graphical (and audio walkthrough) representation of this process.

From the collapse of the domestic banking system (and its possible

social implications) to the creation of a new 'local' currency absent

foreign capital aid, to the obvious 'who's next?' question that leads

inevitably to exaggerated bank runs across other weak European nations

and ultimately more pressure on already weak economies to exit the Euro -

hastening a wholesale Euro-breakup. Eurocalypse now indeed.

We

have laid out in great detail over the past few months the contagious

paths, game-theoretical endgames, and transmission channels that would

occur should a nation (Greece for example) leave the Euro. Yet the covered matter is not simple, which is why sometimes the best representation is the visual one. The Financial Times has outdone themselves with the best graphical (and audio walkthrough) representation of this process.

From the collapse of the domestic banking system (and its possible

social implications) to the creation of a new 'local' currency absent

foreign capital aid, to the obvious 'who's next?' question that leads

inevitably to exaggerated bank runs across other weak European nations

and ultimately more pressure on already weak economies to exit the Euro -

hastening a wholesale Euro-breakup. Eurocalypse now indeed.

by Mac Slavo, SHTFPlan:

In the 1970′s he predicted gold’s meteoric rise and its 1980 top to the day. He published a full page advertisement in USA Today warning of the impending collapse of stock markets in the 1987 Savings & Loan crash – and nailed that one to the day. He saw the collapse of the Japanese real estate market and warned his clients that a depression was coming. In the late 1990′s he contacted Russian officials to advise them of an impending meltdown of their currency due to forces beyond their control – and he was right again.

He lives in New York today, but for the better part of the last decade he was held in federal prison. His charge? Officially, nothing. Unofficially, he was held in contempt of court for nearly ten years for refusing to hand over his cyclical economic models to Goldman Sachs and the US Government. According to the powers that be, Armstrong was manipulating the world economy, and because he refused to share his prescient models, they locked him away without charge or trial – indefinitely.

He may sound like a fictional character out of a Hollywood blockbuster, except Martin Armstrong is the real deal, and he’s been warning of a paradigm shift unlike any we have witnessed in history.

Read More @ SHTFPlan.com

In the 1970′s he predicted gold’s meteoric rise and its 1980 top to the day. He published a full page advertisement in USA Today warning of the impending collapse of stock markets in the 1987 Savings & Loan crash – and nailed that one to the day. He saw the collapse of the Japanese real estate market and warned his clients that a depression was coming. In the late 1990′s he contacted Russian officials to advise them of an impending meltdown of their currency due to forces beyond their control – and he was right again.

He lives in New York today, but for the better part of the last decade he was held in federal prison. His charge? Officially, nothing. Unofficially, he was held in contempt of court for nearly ten years for refusing to hand over his cyclical economic models to Goldman Sachs and the US Government. According to the powers that be, Armstrong was manipulating the world economy, and because he refused to share his prescient models, they locked him away without charge or trial – indefinitely.

He may sound like a fictional character out of a Hollywood blockbuster, except Martin Armstrong is the real deal, and he’s been warning of a paradigm shift unlike any we have witnessed in history.

Read More @ SHTFPlan.com

from KingWorldNews:

Today John Embry told King World News that customers holding

“allocated” gold inside certain banking institutions have had their gold

“loaned out.” Embry, who is Chief Investment Strategist of the $10

billion strong Sprott Asset Management, also told KWN, “Many of these

customers will wake up one day and realize they entrusted their gold to

the wrong people.” But first, here is what Embry had to say about what

is happening in Europe and how it is impacting gold: “The

pressure will be on the Germans today to fall off the austerity kick.

The only alternative will seem to be that Germany will have to leave the

euro and they are really not in a position to do that. The solution to

keep the thing together is going to be more and more money creation and

this is extraordinarily bullish for gold.”

Today John Embry told King World News that customers holding

“allocated” gold inside certain banking institutions have had their gold

“loaned out.” Embry, who is Chief Investment Strategist of the $10

billion strong Sprott Asset Management, also told KWN, “Many of these

customers will wake up one day and realize they entrusted their gold to

the wrong people.” But first, here is what Embry had to say about what

is happening in Europe and how it is impacting gold: “The

pressure will be on the Germans today to fall off the austerity kick.

The only alternative will seem to be that Germany will have to leave the

euro and they are really not in a position to do that. The solution to

keep the thing together is going to be more and more money creation and

this is extraordinarily bullish for gold.”

Embry continues @ KingWorldNews.com

Ron Paul Stands for Honor, Ron Paul Stands for Truth

JP Morgan is the custodian of the SLV ETF.

Ron Paul is the custodian of the Constitution.

JP Morgan is in bed with the Fed as a Federal Reserve primary dealer.

Ron Paul stands courageously against the Fed and has continuously pointed out the crimes of the Federal Reserve’s fiat, debt-based system for decades.

JP Morgan holds more than $70 Trillion in derivatives on its books, and according to the Silver Doctors, just dumped another half a million ounces of paper silver on the market today.

Ron Paul has asked how future generations will judge us for the $100+ Trillion in debt, including unfunded liabilities, that has been spent in their names.

JP Morgan is headed by Jamie Dimon who along with Federal Reserve Chairman Ben Bernanke work together through the Federal Reserve System to literally rob the people of their wealth.

Ron Paul has the mettle to publicly grill the Federal Reserve Chairman about the crimes of the Fed, while reminding Bernanke and the world that SILVER IS MONEY.

JP Morgan is dishonorable. Ron Paul is honorable.

I stand with Ron Paul. Buying physical silver is clearly the honorable thing to do. I just bought more physical silver moments ago with silver at $27.38 per ounce.

The end of this criminal system is nearly upon us. Who will you stand with?

Today John Embry told King World News that customers holding

“allocated” gold inside certain banking institutions have had their gold

“loaned out.” Embry, who is Chief Investment Strategist of the $10

billion strong Sprott Asset Management, also told KWN, “Many of these

customers will wake up one day and realize they entrusted their gold to

the wrong people.” But first, here is what Embry had to say about what

is happening in Europe and how it is impacting gold: “The

pressure will be on the Germans today to fall off the austerity kick.

The only alternative will seem to be that Germany will have to leave the

euro and they are really not in a position to do that. The solution to

keep the thing together is going to be more and more money creation and

this is extraordinarily bullish for gold.”

Today John Embry told King World News that customers holding

“allocated” gold inside certain banking institutions have had their gold

“loaned out.” Embry, who is Chief Investment Strategist of the $10

billion strong Sprott Asset Management, also told KWN, “Many of these

customers will wake up one day and realize they entrusted their gold to

the wrong people.” But first, here is what Embry had to say about what

is happening in Europe and how it is impacting gold: “The

pressure will be on the Germans today to fall off the austerity kick.

The only alternative will seem to be that Germany will have to leave the

euro and they are really not in a position to do that. The solution to

keep the thing together is going to be more and more money creation and

this is extraordinarily bullish for gold.”Embry continues @ KingWorldNews.com

JP Morgan is the custodian of the SLV ETF.

Ron Paul is the custodian of the Constitution.

JP Morgan is in bed with the Fed as a Federal Reserve primary dealer.

Ron Paul stands courageously against the Fed and has continuously pointed out the crimes of the Federal Reserve’s fiat, debt-based system for decades.

JP Morgan holds more than $70 Trillion in derivatives on its books, and according to the Silver Doctors, just dumped another half a million ounces of paper silver on the market today.

Ron Paul has asked how future generations will judge us for the $100+ Trillion in debt, including unfunded liabilities, that has been spent in their names.

JP Morgan is headed by Jamie Dimon who along with Federal Reserve Chairman Ben Bernanke work together through the Federal Reserve System to literally rob the people of their wealth.

Ron Paul has the mettle to publicly grill the Federal Reserve Chairman about the crimes of the Fed, while reminding Bernanke and the world that SILVER IS MONEY.

JP Morgan is dishonorable. Ron Paul is honorable.

I stand with Ron Paul. Buying physical silver is clearly the honorable thing to do. I just bought more physical silver moments ago with silver at $27.38 per ounce.

The end of this criminal system is nearly upon us. Who will you stand with?

BTFD...Keep Stacking...

Capitulation,

or the Apex of manipulation? NetDania’s 1 hour silver chart indicates

105,231silver contracts were dumped on the market this morning between

9am and 10am EST, as silver was smashed a dollar from $28 to $27.

Capitulation,

or the Apex of manipulation? NetDania’s 1 hour silver chart indicates

105,231silver contracts were dumped on the market this morning between

9am and 10am EST, as silver was smashed a dollar from $28 to $27.To put this number in perspective, 105,231 contracts is north of 500,000,000 ounces of silver, nearly 2/3rds of entire world annual silver production trading in a single hour!

This is either capitulation/panic selling in the face of the EUR/USD gapping down on Euro contagion fears, or more likely, the most blatant manipulative raid to date…even more than the infamous February 29th Leap Day Massacre!

Read More @ SilverDoctors.com

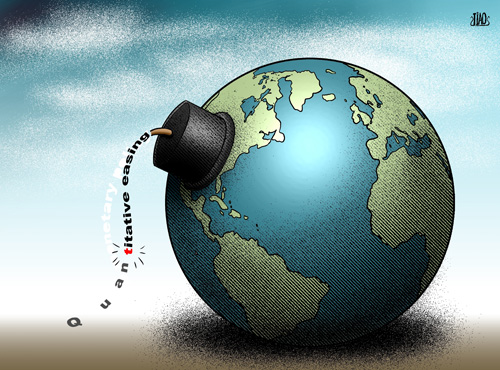

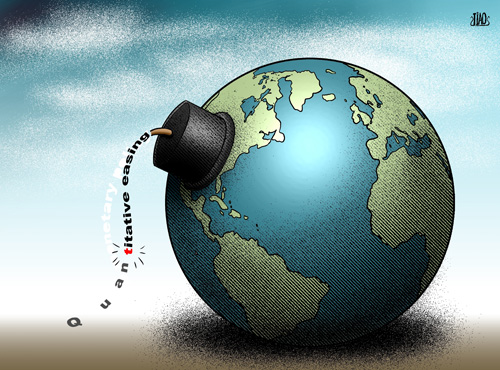

QE's Long Shadow Is Getting Shorter

With

Europe hitting the skids, EURUSD at multi-year lows, and the US equity

market down a whopping (and terrifying) 9% from its March highs, it

seems the market remains increasingly hopeful that this time will not

be different in that the Central Banks of the world will print and save

us once more. As a reminder we suspect the ECB can't (collateral is

non-existent for the most needy sovereigns/banks) and won't (Germany and

the AAA-Club vehemently opposed to losing this game of chicken), China

won't (inflationary concerns), and the BoJ won't (after checking to

the Fed post-downgrade last night as it appears they recognize the

limit). This means, the world has pretty much checked to The Fed - but with TIPS yields a good distance from his precognitive threshold

for deflation-avoidance and with the S&P 500 at 1300 still, we

suspect the hope is premature. And if performance anxiety is affecting

all those long-only managers who are are just now unwinding their P.A.

over-allotment to Facebook, we estimate (based on QE1 and QE2) that the S&P could trade down to 1100-1150 before we see Ben step in to save the world - which by the way is only early December 2011 lows. How quickly we lose perspective and anchoring bias takes over when a market rises magically for months without any looking back.

With

Europe hitting the skids, EURUSD at multi-year lows, and the US equity

market down a whopping (and terrifying) 9% from its March highs, it

seems the market remains increasingly hopeful that this time will not

be different in that the Central Banks of the world will print and save

us once more. As a reminder we suspect the ECB can't (collateral is

non-existent for the most needy sovereigns/banks) and won't (Germany and

the AAA-Club vehemently opposed to losing this game of chicken), China

won't (inflationary concerns), and the BoJ won't (after checking to

the Fed post-downgrade last night as it appears they recognize the

limit). This means, the world has pretty much checked to The Fed - but with TIPS yields a good distance from his precognitive threshold

for deflation-avoidance and with the S&P 500 at 1300 still, we

suspect the hope is premature. And if performance anxiety is affecting

all those long-only managers who are are just now unwinding their P.A.

over-allotment to Facebook, we estimate (based on QE1 and QE2) that the S&P could trade down to 1100-1150 before we see Ben step in to save the world - which by the way is only early December 2011 lows. How quickly we lose perspective and anchoring bias takes over when a market rises magically for months without any looking back.Pimco Vs Shilling: The Housing Bull Vs Bear Debate

PIMCO vs GARY SHILLING - ROUND 1

Beating The Grass To Startle The Snakes

Eric De Groot at Eric De Groot - 26 minutes ago

In the past I often wrote that the invisible hand beating the grass to

startle the snakes;The snakes are the weak handed holders of gold and

silver. The trading funds and retail money snakes are scattering in the

grass as I write. The surge in spreading activity (SA - red line) from 20%

in late March to 71% while the diffusion index climbs above 85% (DI - blue

line) reveals their growing...

[[ This is a content summary only. Visit my website for full links, other

content, and more! ]]

S&P 500 Technical Review

Eric De Groot at Eric De Groot - 1 hour ago

The red dots on the NYSE composite illustrate statistical spiks in the TRIN (chart 1). These readings almost always precede tradable bottoms in the S&P 500 by several days/weeks. The quality of these signals can be improved when combined with trend force and concentration readings. Chart 1: NYSE Composite and Trin 2011 The NYSE has yet to record a red dot (chart 2). This... [[ This is a content summary only. Visit my website for full links, other content, and more! ]]

More Than 30 Blocks Of Grey & Decay

Our

entire society is in a downward social and economic spiral. We

are just at different levels of decay (Dante’s circles of hell). At the

current pace it won’t be long before I’m writing about the 50 States of

Squalor. It is virtually impossible to reverse a decline that has been

underway for the last three decades. We sold our souls to Wall Street

and chose a debt financed illusion of wealth over

productive savings and investment which would have led to real wealth.

Our choices are reflected in the continued deterioration and decay

along West Chester Pike and the squalor that is West Philly. Grey and

decay will carry the day. The words on the Statue of Liberty should be

revised from, ”Give me your tired, your poor, Your huddled masses

yearning to breathe free”, to “we have become your indebted,

materialistic, obese, aging masses yearning for the government to

protect and sustain us as our once great nation decays.”

Our

entire society is in a downward social and economic spiral. We

are just at different levels of decay (Dante’s circles of hell). At the

current pace it won’t be long before I’m writing about the 50 States of

Squalor. It is virtually impossible to reverse a decline that has been

underway for the last three decades. We sold our souls to Wall Street

and chose a debt financed illusion of wealth over

productive savings and investment which would have led to real wealth.

Our choices are reflected in the continued deterioration and decay

along West Chester Pike and the squalor that is West Philly. Grey and

decay will carry the day. The words on the Statue of Liberty should be

revised from, ”Give me your tired, your poor, Your huddled masses

yearning to breathe free”, to “we have become your indebted,

materialistic, obese, aging masses yearning for the government to

protect and sustain us as our once great nation decays.” As a nation, we have chosen this path. We made the choices and now we will suffer the consequences.

by Geoff Candy, MineWeb.com

As the possibility of a Greek exit looms large and US debt remains unruly, why is gold behaving as it is?.

As newspaper front pages around the world start considering the possibility of a Greek exit from the euro zone, investors are beginning to do the maths as to what the financial fallout is likely to be. And, by most calculations, the numbers look fairly bleak.

But, while the outlook for Greece and, indeed, other parts of Europe is concerning, many gold investors are scratching their heads and trying to figure out why the metal is not acting as much like a safe haven as many were expecting it to.

Speaking to Mineweb.com’s Gold Weekly podcast, Vulpes Investment Management, Investment Advisor, Grant Williams, said, “where we are right now is far more bullish for gold than I think it really has been at any time in that 11-12 year run.”

Read More @ MineWeb.com

As the possibility of a Greek exit looms large and US debt remains unruly, why is gold behaving as it is?.

As newspaper front pages around the world start considering the possibility of a Greek exit from the euro zone, investors are beginning to do the maths as to what the financial fallout is likely to be. And, by most calculations, the numbers look fairly bleak.

But, while the outlook for Greece and, indeed, other parts of Europe is concerning, many gold investors are scratching their heads and trying to figure out why the metal is not acting as much like a safe haven as many were expecting it to.

Speaking to Mineweb.com’s Gold Weekly podcast, Vulpes Investment Management, Investment Advisor, Grant Williams, said, “where we are right now is far more bullish for gold than I think it really has been at any time in that 11-12 year run.”

Read More @ MineWeb.com

from MSN.com:

Facebook Inc and banks including Morgan Stanley were sued by the social networking leader’s shareholders, who claimed the defendants hid Facebook’s weakened growth forecasts ahead of its $16 billion initial public offering.

The defendants, who also include Facebook Chief Executive Officer Mark Zuckerberg, were accused of concealing from investors during the IPO marketing process “a severe and pronounced reduction” in revenue growth forecasts, resulting from increased use of its app or website through mobile devices. Facebook went public last week.

The lawsuit was filed in U.S. District Court in Manhattan on Wednesday, according to a law firm for the plaintiffs. A day earlier, a similar lawsuit by a different investor was filed in a California state court, according to a law firm involved in that case.

Read More @ MSN.com

Facebook Inc and banks including Morgan Stanley were sued by the social networking leader’s shareholders, who claimed the defendants hid Facebook’s weakened growth forecasts ahead of its $16 billion initial public offering.

The defendants, who also include Facebook Chief Executive Officer Mark Zuckerberg, were accused of concealing from investors during the IPO marketing process “a severe and pronounced reduction” in revenue growth forecasts, resulting from increased use of its app or website through mobile devices. Facebook went public last week.

The lawsuit was filed in U.S. District Court in Manhattan on Wednesday, according to a law firm for the plaintiffs. A day earlier, a similar lawsuit by a different investor was filed in a California state court, according to a law firm involved in that case.

Read More @ MSN.com

from RTAmerica:

Propaganda is the transfer of information,ideas or rumors to purposely help or harm a person, and governments use such tactics to manipulate people’sthoughts and opinions. The United States spends approximately $4 billion per yearfor propaganda efforts in countries such as Iraq and Afghanistan, but now a new defense bill is hoping to increase the budget to implement propaganda in America.

Propaganda is the transfer of information,ideas or rumors to purposely help or harm a person, and governments use such tactics to manipulate people’sthoughts and opinions. The United States spends approximately $4 billion per yearfor propaganda efforts in countries such as Iraq and Afghanistan, but now a new defense bill is hoping to increase the budget to implement propaganda in America.

by Ethan A. Huff, Natural News:

It has been more than a year now since the massive 9.0-plus magnitude

earthquake and corresponding tsunami devastated the Fukushima Daiichi

nuclear power plant on the eastern coast of Japan, sending untold

amounts of nuclear radiation into the environment. And to this day, the

threat of nuclear fallout is ever-present all around the world in what

some have described as a “nuclear war without a war.”

It has been more than a year now since the massive 9.0-plus magnitude

earthquake and corresponding tsunami devastated the Fukushima Daiichi

nuclear power plant on the eastern coast of Japan, sending untold

amounts of nuclear radiation into the environment. And to this day, the

threat of nuclear fallout is ever-present all around the world in what

some have described as a “nuclear war without a war.”

Though governments and many media outlets have downplayed the disaster, its aftermath continues to threaten the health and wellbeing of plants, animals and humans not only in Japan, but all around the world. Far worse than Chernobyl, the Fukushima catastrophe truly is a nuclear holocaust event with gradual, long-term consequences that we are only just now beginning to recognize and grasp.

Read More @ NaturalNews.com

It has been more than a year now since the massive 9.0-plus magnitude

earthquake and corresponding tsunami devastated the Fukushima Daiichi

nuclear power plant on the eastern coast of Japan, sending untold

amounts of nuclear radiation into the environment. And to this day, the

threat of nuclear fallout is ever-present all around the world in what

some have described as a “nuclear war without a war.”

It has been more than a year now since the massive 9.0-plus magnitude

earthquake and corresponding tsunami devastated the Fukushima Daiichi

nuclear power plant on the eastern coast of Japan, sending untold

amounts of nuclear radiation into the environment. And to this day, the

threat of nuclear fallout is ever-present all around the world in what

some have described as a “nuclear war without a war.”Though governments and many media outlets have downplayed the disaster, its aftermath continues to threaten the health and wellbeing of plants, animals and humans not only in Japan, but all around the world. Far worse than Chernobyl, the Fukushima catastrophe truly is a nuclear holocaust event with gradual, long-term consequences that we are only just now beginning to recognize and grasp.

Read More @ NaturalNews.com

by Daniel Taylor, Infowars:

Foundations have always enjoyed

a cozy relationship with government, but the Gates Foundation has taken

the game to a whole other level. In the past tax exempt foundation

influence was more subtle and hush hush; Now they are openly acting as

extensions of government.

Foundations have always enjoyed

a cozy relationship with government, but the Gates Foundation has taken

the game to a whole other level. In the past tax exempt foundation

influence was more subtle and hush hush; Now they are openly acting as

extensions of government.

The Gates Foundation has reached its tentacles into every significant venture it can find. Genetic engineering, vaccines, and education are just a few examples. Every aspect of our lives has been in some way impacted by Foundation influence. In a previous article, Old-Thinker News exposed the campaign of tax exempt foundations – specifically the Gates and Rockefeller philanthropies – to vaccinate the world.

The education system in the United States has been influenced since its very beginning by tax-exempt foundations. The Rockefeller Foundation’s influence in education was exposed by the Reece Committee in 1954. Today, the major operations in education policy are coming from the Bill & Melinda Gates Foundation. A hidden hand of control outside of elected representatives is setting the agenda for the education of the country.

Read More @ Infowars.com

Foundations have always enjoyed

a cozy relationship with government, but the Gates Foundation has taken

the game to a whole other level. In the past tax exempt foundation

influence was more subtle and hush hush; Now they are openly acting as

extensions of government.

Foundations have always enjoyed

a cozy relationship with government, but the Gates Foundation has taken

the game to a whole other level. In the past tax exempt foundation

influence was more subtle and hush hush; Now they are openly acting as

extensions of government.The Gates Foundation has reached its tentacles into every significant venture it can find. Genetic engineering, vaccines, and education are just a few examples. Every aspect of our lives has been in some way impacted by Foundation influence. In a previous article, Old-Thinker News exposed the campaign of tax exempt foundations – specifically the Gates and Rockefeller philanthropies – to vaccinate the world.

The education system in the United States has been influenced since its very beginning by tax-exempt foundations. The Rockefeller Foundation’s influence in education was exposed by the Reece Committee in 1954. Today, the major operations in education policy are coming from the Bill & Melinda Gates Foundation. A hidden hand of control outside of elected representatives is setting the agenda for the education of the country.

Read More @ Infowars.com

by William K Black Phd, Financial Sense:

JPMorgan’s flacks and apologists have, unintentionally, exposed the

fact that their cover story – hedging gone bad – is false. JPMorgan runs

the world’s largest gambling operation in financial derivatives. The New York Times reported the key facts, but not the analytics, in an article entitled “Discord at Key JPMorgan Unit is Faulted in Loss.”

The analytics suggest that the latest JPMorgan cover story – it was

JPMorgan’s “Achilles the heel” (based in the UK) who caused the loss –

is misleading.

JPMorgan’s flacks and apologists have, unintentionally, exposed the

fact that their cover story – hedging gone bad – is false. JPMorgan runs

the world’s largest gambling operation in financial derivatives. The New York Times reported the key facts, but not the analytics, in an article entitled “Discord at Key JPMorgan Unit is Faulted in Loss.”

The analytics suggest that the latest JPMorgan cover story – it was

JPMorgan’s “Achilles the heel” (based in the UK) who caused the loss –

is misleading.

The thrust of the story is that in the beginning JPMorgan’s Chief Investment Office (CIO) was run by a fair princess (Ina Drew) and all was fabulous. Sadly, Ms. Drew contracted Lyme’s Disease and was unable to ensure peace and prosperity in her land. The evil Achilles Macris, based in the UK, became disloyal and mean. He made massive, bad purchases of financial derivatives that caused major losses. CIO senior officers based in the U.S. (and women to boot) tried to warn Achilles but he screamed at them and refused to listen and learn. The just king, Jamie Dimon, did not act promptly to save his kingdom from loss because of his great confidence in Princess Drew.

The personal story of Achilles acting like a heel makes compelling journalism, but it obscures rather than clarifies the analysis as to why JPMorgan poses a clear and present danger to the global economy.

Read More @ Financial Sense.com

JPMorgan’s flacks and apologists have, unintentionally, exposed the

fact that their cover story – hedging gone bad – is false. JPMorgan runs

the world’s largest gambling operation in financial derivatives. The New York Times reported the key facts, but not the analytics, in an article entitled “Discord at Key JPMorgan Unit is Faulted in Loss.”

The analytics suggest that the latest JPMorgan cover story – it was

JPMorgan’s “Achilles the heel” (based in the UK) who caused the loss –

is misleading.

JPMorgan’s flacks and apologists have, unintentionally, exposed the

fact that their cover story – hedging gone bad – is false. JPMorgan runs

the world’s largest gambling operation in financial derivatives. The New York Times reported the key facts, but not the analytics, in an article entitled “Discord at Key JPMorgan Unit is Faulted in Loss.”

The analytics suggest that the latest JPMorgan cover story – it was

JPMorgan’s “Achilles the heel” (based in the UK) who caused the loss –

is misleading.The thrust of the story is that in the beginning JPMorgan’s Chief Investment Office (CIO) was run by a fair princess (Ina Drew) and all was fabulous. Sadly, Ms. Drew contracted Lyme’s Disease and was unable to ensure peace and prosperity in her land. The evil Achilles Macris, based in the UK, became disloyal and mean. He made massive, bad purchases of financial derivatives that caused major losses. CIO senior officers based in the U.S. (and women to boot) tried to warn Achilles but he screamed at them and refused to listen and learn. The just king, Jamie Dimon, did not act promptly to save his kingdom from loss because of his great confidence in Princess Drew.

The personal story of Achilles acting like a heel makes compelling journalism, but it obscures rather than clarifies the analysis as to why JPMorgan poses a clear and present danger to the global economy.

Read More @ Financial Sense.com

The Daily Bell:

There are several qualities that define our humanity. Today I want to talk about two of them: our capacity for conscious empathy and our ability to consciously redirect our emotional impulses. You have a choice of whether and how you will use these.

Empathy is the action of understanding, being aware of, being sensitive to, and vicariously experiencing the feelings, thoughts, and experience of another (Merriam-Webster’s Dictionary).

Empathy is what allows us to be anything but narcissistic; it is the quality that allows us to relate to other people, to have feelings for them, to understand them in an experiential/emotional sense, and not just as an intellectual study. Without the capacity for empathy, we could not see one another as human, with common feelings, thoughts, and experiences.

Read More @ TheDailyBell.com

There are several qualities that define our humanity. Today I want to talk about two of them: our capacity for conscious empathy and our ability to consciously redirect our emotional impulses. You have a choice of whether and how you will use these.

Empathy is the action of understanding, being aware of, being sensitive to, and vicariously experiencing the feelings, thoughts, and experience of another (Merriam-Webster’s Dictionary).

Empathy is what allows us to be anything but narcissistic; it is the quality that allows us to relate to other people, to have feelings for them, to understand them in an experiential/emotional sense, and not just as an intellectual study. Without the capacity for empathy, we could not see one another as human, with common feelings, thoughts, and experiences.

Read More @ TheDailyBell.com

by J. D. Heyes, Natural News:

In another sign of America’s increasing debtor status to China, the

Obama administration is allowing Beijing to bypass Wall Street entirely

when it comes to buy U.S. Treasury bonds, the first time a foreign

country has ever been afforded such special treatment.

In another sign of America’s increasing debtor status to China, the

Obama administration is allowing Beijing to bypass Wall Street entirely

when it comes to buy U.S. Treasury bonds, the first time a foreign

country has ever been afforded such special treatment.

In a recent exclusive, Reuters said that, according to documents examined by its reporters, the arrangement means China – since June 2011 – has been able to purchase U.S. debt directly, which is differently than any other country in the world. That’s significant because of the secrecy surrounding the deal.

Why weren’t Americans told China has a direct pipeline to their treasury? Is Beijing running U.S. fiscal policy too?

Read More @ NaturalNews.com

In another sign of America’s increasing debtor status to China, the

Obama administration is allowing Beijing to bypass Wall Street entirely

when it comes to buy U.S. Treasury bonds, the first time a foreign

country has ever been afforded such special treatment.

In another sign of America’s increasing debtor status to China, the

Obama administration is allowing Beijing to bypass Wall Street entirely

when it comes to buy U.S. Treasury bonds, the first time a foreign

country has ever been afforded such special treatment.In a recent exclusive, Reuters said that, according to documents examined by its reporters, the arrangement means China – since June 2011 – has been able to purchase U.S. debt directly, which is differently than any other country in the world. That’s significant because of the secrecy surrounding the deal.

Why weren’t Americans told China has a direct pipeline to their treasury? Is Beijing running U.S. fiscal policy too?

Read More @ NaturalNews.com

By Greg Hunter’s USAWatchdog.com

Dear CIGAs,

The $2 billion derivative trading loss JP Morgan announced, about two weeks ago, is growing in size. It is reportedly now more than triple the original loss. According to a CNN report, “One thing seems clear about JPMorgan Chase’s $2 billion loss. It’s no longer $2 billion. It’s likely much higher. The number being bandied about now is closer to a range of $6 billion to $7 billion, according to several people working on trading desks that specialize in the derivatives JPMorgan Chase (JPM, Fortune 500) used to make its trades and from two sources with knowledge of the bank’s positions.” (Click here for the complete report from CNN.)

The problem derivative losses seem to be growing for JP Morgan, and it’s affecting its share price in a negative way. Yesterday, The Independent (a British publication) reported, “In a further blow, chairman and chief executive Jamie Dimon has suspended plans to use the US bank’s own funds to buy back $15bn worth of shares. Buybacks are a popular way for firms to use up cash sitting on the balance sheet and prop up the share price.” (Click here for the complete Independent story.) A trading loss big enough to halt a $15 billion stock buyback sounds like trouble to me, but that’s not really the big problem.

The largest banks in the U.S. were bailed out by taxpayers, and ever since the financial meltdown in 2008, all get taxpayer backing in the form of FDIC insurance. The Federal Reserve is also providing near 0% interest rates to the banks while the banks provide savers with interest rates as measured in fractions. JP Morgan may be the world’s biggest bank and holder of the most derivative exposure ($70.1 trillion), but it is far from the only big bank making risky derivative trades. Too big to fail (TBTF) banks trading in derivatives are not like taking a risk on car loans, mortgage lending, startup companies or loaning money to help companies grow and add jobs. The enormous risk the (TBTF) banks make is simply taxpayer supported gambling and nothing else. Derivatives are mostly debt bets.

More…

Dear CIGAs,

The $2 billion derivative trading loss JP Morgan announced, about two weeks ago, is growing in size. It is reportedly now more than triple the original loss. According to a CNN report, “One thing seems clear about JPMorgan Chase’s $2 billion loss. It’s no longer $2 billion. It’s likely much higher. The number being bandied about now is closer to a range of $6 billion to $7 billion, according to several people working on trading desks that specialize in the derivatives JPMorgan Chase (JPM, Fortune 500) used to make its trades and from two sources with knowledge of the bank’s positions.” (Click here for the complete report from CNN.)

The problem derivative losses seem to be growing for JP Morgan, and it’s affecting its share price in a negative way. Yesterday, The Independent (a British publication) reported, “In a further blow, chairman and chief executive Jamie Dimon has suspended plans to use the US bank’s own funds to buy back $15bn worth of shares. Buybacks are a popular way for firms to use up cash sitting on the balance sheet and prop up the share price.” (Click here for the complete Independent story.) A trading loss big enough to halt a $15 billion stock buyback sounds like trouble to me, but that’s not really the big problem.

The largest banks in the U.S. were bailed out by taxpayers, and ever since the financial meltdown in 2008, all get taxpayer backing in the form of FDIC insurance. The Federal Reserve is also providing near 0% interest rates to the banks while the banks provide savers with interest rates as measured in fractions. JP Morgan may be the world’s biggest bank and holder of the most derivative exposure ($70.1 trillion), but it is far from the only big bank making risky derivative trades. Too big to fail (TBTF) banks trading in derivatives are not like taking a risk on car loans, mortgage lending, startup companies or loaning money to help companies grow and add jobs. The enormous risk the (TBTF) banks make is simply taxpayer supported gambling and nothing else. Derivatives are mostly debt bets.

More…

from Silver Vigilante:

Everything seems to be going awry for JPMorgan these days. After its

2011 stock price conflated with the US Dollar silver price – a sure sign

that the bank was in trouble – 2012 has proven to be a transformative

year for the bank.

Everything seems to be going awry for JPMorgan these days. After its

2011 stock price conflated with the US Dollar silver price – a sure sign

that the bank was in trouble – 2012 has proven to be a transformative

year for the bank.

In just the last couple of weeks, three huge blows – k.o. style – to confidence in and the balance-sheet of the bank have come-to-pass in full public view. And, what’s likely, is that this is merely the beginning. Here they are:

Everything seems to be going awry for JPMorgan these days. After its

2011 stock price conflated with the US Dollar silver price – a sure sign

that the bank was in trouble – 2012 has proven to be a transformative

year for the bank.

Everything seems to be going awry for JPMorgan these days. After its

2011 stock price conflated with the US Dollar silver price – a sure sign

that the bank was in trouble – 2012 has proven to be a transformative

year for the bank.In just the last couple of weeks, three huge blows – k.o. style – to confidence in and the balance-sheet of the bank have come-to-pass in full public view. And, what’s likely, is that this is merely the beginning. Here they are:

- Jamie Dimon oversees London whale whose risky hedging positions would wind up costing the bank billions. The mainstream portrayals of the JPMorgan Chase & Co billions in losses have touched on a number of common themes, such as too-big-to-fail and stricter regulations by the state over the economy. Jamie Dimon has had to defend himself, claiming that he is not a criminal.

- Facebook IPO goes awry, JP Morgan has to spend hundreds of millions to prop-up price. Read More @ SilverVigilante.com

Are we entering a deflationary era? Two charts suggest “yes”.

by Charles Hugh Smith, Of Two Minds:

Are we entering an era in which prices stagnate and the purchasing power of the U.S. dollar rises? Our Chartist Friend from Pittsburgh has kindly provided two charts which suggest we have entered such a deflationary period.

Are we entering an era in which prices stagnate and the purchasing power of the U.S. dollar rises? Our Chartist Friend from Pittsburgh has kindly provided two charts which suggest we have entered such a deflationary period.

Long-time readers know I have presented technical evidence for over a year that the

U.S. dollar appears to be in a long-term uptrend, at least relative to other currencies.

These charts suggest the uptrend is not just nominal but in purchasing power.

Read More @ OfTwoMinds.com

by Charles Hugh Smith, Of Two Minds:

Are we entering an era in which prices stagnate and the purchasing power of the U.S. dollar rises? Our Chartist Friend from Pittsburgh has kindly provided two charts which suggest we have entered such a deflationary period.

Are we entering an era in which prices stagnate and the purchasing power of the U.S. dollar rises? Our Chartist Friend from Pittsburgh has kindly provided two charts which suggest we have entered such a deflationary period.Long-time readers know I have presented technical evidence for over a year that the

U.S. dollar appears to be in a long-term uptrend, at least relative to other currencies.

These charts suggest the uptrend is not just nominal but in purchasing power.

Read More @ OfTwoMinds.com

from Gold Core:

Gold edged down again this morning despite fears that the European

Union’s umpteenth meeting later today will not take clear steps to solve

the area’s debt debacle. Even more worrisome is the showdown that

could ensue between Hollande and Merkel about mutualised European debt

which could create new obstacles and delay any means of a quick

solution.

Gold edged down again this morning despite fears that the European

Union’s umpteenth meeting later today will not take clear steps to solve

the area’s debt debacle. Even more worrisome is the showdown that

could ensue between Hollande and Merkel about mutualised European debt

which could create new obstacles and delay any means of a quick

solution.

Gold hit $1,555.03 early in the day, its lowest level in nearly a week but gold in euro terms remains robust well above strong support at €1,200/oz.

Greece’s exiting the EU financial bloc and monetary union could see further short term gold weakness but is gold bullish and should lead to higher prices in the long term.

Meanwhile the euro is at a 4 month low against the dollar, and the dollar index is at its highest level since September 2010. This dollar strength is not sustainable due to the appalling fiscal and monetary situation in the U.S.

Since the Greek elections on May 6, just about every asset class has fallen in value.

Read More @ GoldCore.com

Gold edged down again this morning despite fears that the European

Union’s umpteenth meeting later today will not take clear steps to solve

the area’s debt debacle. Even more worrisome is the showdown that

could ensue between Hollande and Merkel about mutualised European debt

which could create new obstacles and delay any means of a quick

solution.

Gold edged down again this morning despite fears that the European

Union’s umpteenth meeting later today will not take clear steps to solve

the area’s debt debacle. Even more worrisome is the showdown that

could ensue between Hollande and Merkel about mutualised European debt

which could create new obstacles and delay any means of a quick

solution.Gold hit $1,555.03 early in the day, its lowest level in nearly a week but gold in euro terms remains robust well above strong support at €1,200/oz.

Greece’s exiting the EU financial bloc and monetary union could see further short term gold weakness but is gold bullish and should lead to higher prices in the long term.

Meanwhile the euro is at a 4 month low against the dollar, and the dollar index is at its highest level since September 2010. This dollar strength is not sustainable due to the appalling fiscal and monetary situation in the U.S.

Since the Greek elections on May 6, just about every asset class has fallen in value.

Read More @ GoldCore.com

by Wolf Richter, Testosterone Pit.com:

Nuclear power is galvanizing Japan, stirring up public discussions and outright dissent with demonstrations and all, a rare occurrence in Japan. It has divided the country in two: those who want nuclear power generation to resume so that a stranglehold can be lifted from the economy, and those who want a “nuclear-free” Japan.

Japan’s power nightmare wasn’t triggered by the March 11 earthquake and tsunami that resulted in the meltdowns at Fukushima Number One; power companies could have worked around the vacuum left behind by the four defunct reactors. But it was triggered by the Japanese people who finally had had enough. Nuclear contamination in unexpected areas, scandals of collusion between regulators and the omnipotent nuclear power industry, mounting evidence of negligence and even malfeasance, and a history of cover-ups have turned many Japanese against the nuclear power industry and its regulators. Read…. A Revolt, the Quiet Japanese Way.

As a result, each time one of the remaining 50 reactors was taken off line for scheduled maintenance, local opposition prevented power companies from bringing it back on line. Until March 11, 2011, nuclear power produced 30% of Japan’s electricity. By the evening of May 5 this year, it was zero. “Nuclear-free” Japan had arrived.

Read More @ TestosteronePit.com

Please support our efforts to keep you informed...

I'm PayPal Verified

Nuclear power is galvanizing Japan, stirring up public discussions and outright dissent with demonstrations and all, a rare occurrence in Japan. It has divided the country in two: those who want nuclear power generation to resume so that a stranglehold can be lifted from the economy, and those who want a “nuclear-free” Japan.

Japan’s power nightmare wasn’t triggered by the March 11 earthquake and tsunami that resulted in the meltdowns at Fukushima Number One; power companies could have worked around the vacuum left behind by the four defunct reactors. But it was triggered by the Japanese people who finally had had enough. Nuclear contamination in unexpected areas, scandals of collusion between regulators and the omnipotent nuclear power industry, mounting evidence of negligence and even malfeasance, and a history of cover-ups have turned many Japanese against the nuclear power industry and its regulators. Read…. A Revolt, the Quiet Japanese Way.

As a result, each time one of the remaining 50 reactors was taken off line for scheduled maintenance, local opposition prevented power companies from bringing it back on line. Until March 11, 2011, nuclear power produced 30% of Japan’s electricity. By the evening of May 5 this year, it was zero. “Nuclear-free” Japan had arrived.

Read More @ TestosteronePit.com

Please support our efforts to keep you informed...

Thank You

I'm PayPal Verified

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment