from Rense.com

In response to a request by Germany's SPIEGEL,

the German government has, for the first time, released hundreds of

pages of documents from 1994 to 1998 on the introduction of the euro

and the inclusion of Italy in the euro zone. They include reports from

the German embassy in Rome, internal government memos and letters, and

hand-written minutes of the chancellor's meetings. The documents prove

what was only assumed until now: Italy should never have been accepted

into the common currency zone. The decision to invite Rome to

join was based almost exclusively on political considerations at the

expense of economic criteria. It also created a precedent for a much

bigger mistake two years later, namely Greece's acceptance into the

euro zone. Many of the euro's problems can be traced to its

birth defects. For political reasons, countries were included that

weren't ready at the time. Operation "self-deception" began in December

1991, and culminated with a plausibly deniable comment of 'not without

the Italians' by Kohl who needed them to bring the French along to the

Euro party to ensure his successful re-election. A few weeks before the

launch of the common European currency, Stenglin's assessment of the

situation took on a dramatic undertone, when he wrote: "The

question arises as to whether a country with an extremely high debt

ratio doesn't risk gambling away the success of its consolidation

efforts to date, thereby harming not only itself, but also the monetary

union." It was a prophetic remark. Of course, financial data

doesn't play much of a role when it comes to war and peace. Italy

became a perfect example of the steadfast belief of politicians that economic development would eventually conform to the visions of national leaders.

In response to a request by Germany's SPIEGEL,

the German government has, for the first time, released hundreds of

pages of documents from 1994 to 1998 on the introduction of the euro

and the inclusion of Italy in the euro zone. They include reports from

the German embassy in Rome, internal government memos and letters, and

hand-written minutes of the chancellor's meetings. The documents prove

what was only assumed until now: Italy should never have been accepted

into the common currency zone. The decision to invite Rome to

join was based almost exclusively on political considerations at the

expense of economic criteria. It also created a precedent for a much

bigger mistake two years later, namely Greece's acceptance into the

euro zone. Many of the euro's problems can be traced to its

birth defects. For political reasons, countries were included that

weren't ready at the time. Operation "self-deception" began in December

1991, and culminated with a plausibly deniable comment of 'not without

the Italians' by Kohl who needed them to bring the French along to the

Euro party to ensure his successful re-election. A few weeks before the

launch of the common European currency, Stenglin's assessment of the

situation took on a dramatic undertone, when he wrote: "The

question arises as to whether a country with an extremely high debt

ratio doesn't risk gambling away the success of its consolidation

efforts to date, thereby harming not only itself, but also the monetary

union." It was a prophetic remark. Of course, financial data

doesn't play much of a role when it comes to war and peace. Italy

became a perfect example of the steadfast belief of politicians that economic development would eventually conform to the visions of national leaders.

The beepers at the BIS crew are going off in unison as the "EURUSD under 1.3000" Code Red has just arrived, and this time it is early. And tomorrow there will be no surprising German economic activity "beats."

We

are in the last innings of a very bad ball game. We are coping with

the crash of a 30-year–long debt super-cycle and the aftermath of an

unsustainable bubble. Quantitative easing is making it worse by

facilitating more public-sector borrowing and preventing debt

liquidation in the private sector—both erroneous steps in my view. The

federal government is not getting its financial house in order. We are

on the edge of a crisis in the bond markets. It has already happened in

Europe and will be coming to our neighborhood soon. The Fed is

destroying the capital market by pegging and manipulating the price of

money and debt capital. Interest rates signal nothing anymore because

they are zero. Capital markets are at the heart of capitalism and they

are not working.

We

are in the last innings of a very bad ball game. We are coping with

the crash of a 30-year–long debt super-cycle and the aftermath of an

unsustainable bubble. Quantitative easing is making it worse by

facilitating more public-sector borrowing and preventing debt

liquidation in the private sector—both erroneous steps in my view. The

federal government is not getting its financial house in order. We are

on the edge of a crisis in the bond markets. It has already happened in

Europe and will be coming to our neighborhood soon. The Fed is

destroying the capital market by pegging and manipulating the price of

money and debt capital. Interest rates signal nothing anymore because

they are zero. Capital markets are at the heart of capitalism and they

are not working.

Spain's banking system bailout is quickly becoming farcical. According to the WSJ this evening,

Spain is to require its banks to set aside more provisions (between

EUR20 billion and EUR40 billion) in an effort to overhaul the country's

financial sector. This additional need for reserves (or provisioning)

puts yet more pressure on the banks' balance sheets as it comes on top

of the already EUR54 billion that has been set aside from February.

Interestingly the EUR20-40 billion still falls dramatically

short of Goldman Sachs' estimate of an additional EUR58 billion that is

needed to cover reasonable loss assumptions. We can only

assume that the game is to create as large a hole as is possible

without tipping the world over the brink and then fill it with the

state funds a la TARP (as Rajoy has indicated will be the case).

Spain's banking system bailout is quickly becoming farcical. According to the WSJ this evening,

Spain is to require its banks to set aside more provisions (between

EUR20 billion and EUR40 billion) in an effort to overhaul the country's

financial sector. This additional need for reserves (or provisioning)

puts yet more pressure on the banks' balance sheets as it comes on top

of the already EUR54 billion that has been set aside from February.

Interestingly the EUR20-40 billion still falls dramatically

short of Goldman Sachs' estimate of an additional EUR58 billion that is

needed to cover reasonable loss assumptions. We can only

assume that the game is to create as large a hole as is possible

without tipping the world over the brink and then fill it with the

state funds a la TARP (as Rajoy has indicated will be the case).

Today it was widely reported that the CIA thwarted a “plot by al Qaeda’s affiliate in Yemen to destroy a U.S.-bound airliner using a bomb.”

This bomb, which was to be concealed in a pair of underwear, was

designed as an improvement over what Umar Farouk Abdulmutallab attempted

to use to blow up an airliner over Detroit on Christmas Day of 2009.

This bomb was upgraded and designed to specifically avoid metal

detectors. At first glance it would appear to be a job well done by the

world’s leading domestic affairs meddlers. The truth was finally revealed as the would-be bomber was, in fact, a double agent of the CIA.

When considering the nature of the state, this new instance of

government supported terrorism is unsurprisingly comparable to previous

cases. The alleged Yemen “underwear” bomber was just another fabricated

spook in the long line of mounting justifications to keep the war on

terror and its profiteers going; no matter the cost. As long as the American people are still easily whipped into a frenzy over forged menaces from afar, their blood and treasure will go on to be squandered on military boondoggles and redundant intelligence agencies. War and fear end up becoming a way of life.

And so does the state’s command over what could be a life of peace and

tranquility for the nation it supposedly protects. This isn’t

conspiracy theory; just a recognition of the various hobgoblins, as

H.L. Mencken described them, invented to justify encroaching totalitarianism.

Today it was widely reported that the CIA thwarted a “plot by al Qaeda’s affiliate in Yemen to destroy a U.S.-bound airliner using a bomb.”

This bomb, which was to be concealed in a pair of underwear, was

designed as an improvement over what Umar Farouk Abdulmutallab attempted

to use to blow up an airliner over Detroit on Christmas Day of 2009.

This bomb was upgraded and designed to specifically avoid metal

detectors. At first glance it would appear to be a job well done by the

world’s leading domestic affairs meddlers. The truth was finally revealed as the would-be bomber was, in fact, a double agent of the CIA.

When considering the nature of the state, this new instance of

government supported terrorism is unsurprisingly comparable to previous

cases. The alleged Yemen “underwear” bomber was just another fabricated

spook in the long line of mounting justifications to keep the war on

terror and its profiteers going; no matter the cost. As long as the American people are still easily whipped into a frenzy over forged menaces from afar, their blood and treasure will go on to be squandered on military boondoggles and redundant intelligence agencies. War and fear end up becoming a way of life.

And so does the state’s command over what could be a life of peace and

tranquility for the nation it supposedly protects. This isn’t

conspiracy theory; just a recognition of the various hobgoblins, as

H.L. Mencken described them, invented to justify encroaching totalitarianism.

Just

as we warned at the end of today's nonsense, the afternoon ramp is

fading fast now as the sad but true reality of a sun that rises in

Europe awakening the maddening crowd. EURUSD is at 1.2970 (70 pips off the late-day swing highs already),

ES (S&P 500 e-mini futures) are down 10 pts from the closing swing

highs (which just happens to coincide with Sunday night's gap-down

opening level around 1354.25), Silver has slumped back to the day's lows

around $29, Gold back under $1600, and WTI is down

around 2% from the day-session close at around $96.50. Treasuries are

leaking lower in yield but FX markets seem very active as AUD drops to

near parity with USD and carry pairs are generally weak. There are still

a few more hours until Europe opens so anything can happen but for an

overnight session, markets are not happy.

Just

as we warned at the end of today's nonsense, the afternoon ramp is

fading fast now as the sad but true reality of a sun that rises in

Europe awakening the maddening crowd. EURUSD is at 1.2970 (70 pips off the late-day swing highs already),

ES (S&P 500 e-mini futures) are down 10 pts from the closing swing

highs (which just happens to coincide with Sunday night's gap-down

opening level around 1354.25), Silver has slumped back to the day's lows

around $29, Gold back under $1600, and WTI is down

around 2% from the day-session close at around $96.50. Treasuries are

leaking lower in yield but FX markets seem very active as AUD drops to

near parity with USD and carry pairs are generally weak. There are still

a few more hours until Europe opens so anything can happen but for an

overnight session, markets are not happy.

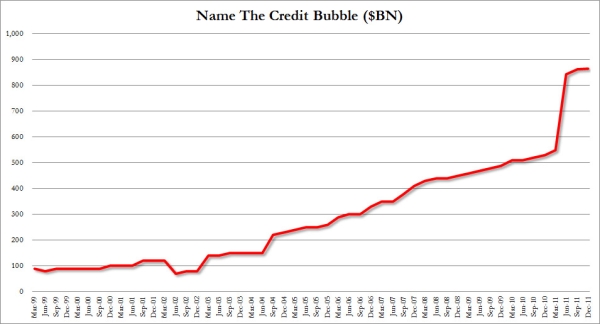

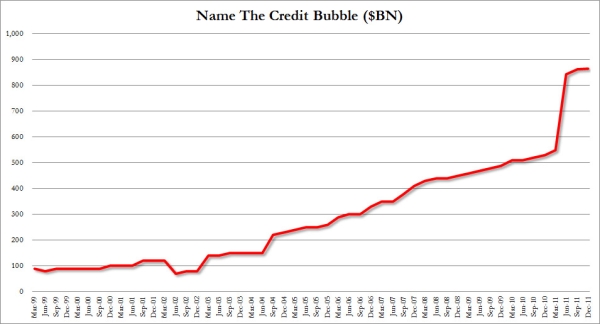

It really is this simple...

Whether

it was stocks, credit, gold, silver, oil, EURUSD, or conk shells, the

message we were to believe was clear - BTFD today. As if by clockwork,

Europe closed and US equity markets surged - seemingly forgetting that

Europe will re-open again tonight but should you need any reassurance

of what your pre-assigned Pavlovian role in this tragi-comedic

dance-with-the-devil is - we suggest the following clip as a reminder.

Whether

it was stocks, credit, gold, silver, oil, EURUSD, or conk shells, the

message we were to believe was clear - BTFD today. As if by clockwork,

Europe closed and US equity markets surged - seemingly forgetting that

Europe will re-open again tonight but should you need any reassurance

of what your pre-assigned Pavlovian role in this tragi-comedic

dance-with-the-devil is - we suggest the following clip as a reminder.

by Jim Willie, via Silver Doctors:

The propaganda against gold has intensified with Munger and Gates,

unqualified to be sure that jewelry demand is down actually confirms the

gold bull investment demand is much greater than jewelry demand to

claim that gold supply is insufficient to accommodate a gold standard is

rubbish the argument actually highlights the gargantuan

expansion of the monetary base which urges a gold price an order of

magnitude higher, like near $12,000/oz a 5% gold cover clause would be

perfect to set a new global trade currency in motion actually, several

new gold-backed currencies could simultaneously be launched that way,

the new currencies form the core and the US & UK would be outside

looking in the gold market is in a pitched battle still, with enormous

orders being filled the Eastern Coalition continues to drain Western

cartel member banks of their gold the cartel banks are insolvent and

lately, they are suffering from illiquidity they have wrecked sovereign

bond positions and off-side FOREX positions in the margin call, they are

being forced to sell out their gold reserves for the precious cash the

gold price will rise when the East is satisfied with their gold raids in

the current round.

The propaganda against gold has intensified with Munger and Gates,

unqualified to be sure that jewelry demand is down actually confirms the

gold bull investment demand is much greater than jewelry demand to

claim that gold supply is insufficient to accommodate a gold standard is

rubbish the argument actually highlights the gargantuan

expansion of the monetary base which urges a gold price an order of

magnitude higher, like near $12,000/oz a 5% gold cover clause would be

perfect to set a new global trade currency in motion actually, several

new gold-backed currencies could simultaneously be launched that way,

the new currencies form the core and the US & UK would be outside

looking in the gold market is in a pitched battle still, with enormous

orders being filled the Eastern Coalition continues to drain Western

cartel member banks of their gold the cartel banks are insolvent and

lately, they are suffering from illiquidity they have wrecked sovereign

bond positions and off-side FOREX positions in the margin call, they are

being forced to sell out their gold reserves for the precious cash the

gold price will rise when the East is satisfied with their gold raids in

the current round.

Read More @ SilverDoctors.com

By Scott Silva, Gold Seek:

It’s May Day again in Paris. Over the weekend, French voters elected Socialist Party leader François Hollande who promises to repeal all austerity measures in favor of a robust Keynesian spending program. This development is a setback for EU fiscal stability, and will likely undermine Franco-German cooperation and may spell the end of the Eurozone. What effect will the new socialist regime in France have on us here in the United States? Is socialism the answer to our economic problems? What affect will socialist Europe have on my portfolio?

May 1st is celebrated traditionally in most socialist, Marxist and communist countries as Labor Day and International Workers’ Solidarity Day.

Read More @ GoldSeek.com

.

"Once A Liar, Always A Liar": The Incredible (Un)Truth About Italy, Greece, And The Birth Of The Euro

In response to a request by Germany's SPIEGEL,

the German government has, for the first time, released hundreds of

pages of documents from 1994 to 1998 on the introduction of the euro

and the inclusion of Italy in the euro zone. They include reports from

the German embassy in Rome, internal government memos and letters, and

hand-written minutes of the chancellor's meetings. The documents prove

what was only assumed until now: Italy should never have been accepted

into the common currency zone. The decision to invite Rome to

join was based almost exclusively on political considerations at the

expense of economic criteria. It also created a precedent for a much

bigger mistake two years later, namely Greece's acceptance into the

euro zone. Many of the euro's problems can be traced to its

birth defects. For political reasons, countries were included that

weren't ready at the time. Operation "self-deception" began in December

1991, and culminated with a plausibly deniable comment of 'not without

the Italians' by Kohl who needed them to bring the French along to the

Euro party to ensure his successful re-election. A few weeks before the

launch of the common European currency, Stenglin's assessment of the

situation took on a dramatic undertone, when he wrote: "The

question arises as to whether a country with an extremely high debt

ratio doesn't risk gambling away the success of its consolidation

efforts to date, thereby harming not only itself, but also the monetary

union." It was a prophetic remark. Of course, financial data

doesn't play much of a role when it comes to war and peace. Italy

became a perfect example of the steadfast belief of politicians that economic development would eventually conform to the visions of national leaders.

In response to a request by Germany's SPIEGEL,

the German government has, for the first time, released hundreds of

pages of documents from 1994 to 1998 on the introduction of the euro

and the inclusion of Italy in the euro zone. They include reports from

the German embassy in Rome, internal government memos and letters, and

hand-written minutes of the chancellor's meetings. The documents prove

what was only assumed until now: Italy should never have been accepted

into the common currency zone. The decision to invite Rome to

join was based almost exclusively on political considerations at the

expense of economic criteria. It also created a precedent for a much

bigger mistake two years later, namely Greece's acceptance into the

euro zone. Many of the euro's problems can be traced to its

birth defects. For political reasons, countries were included that

weren't ready at the time. Operation "self-deception" began in December

1991, and culminated with a plausibly deniable comment of 'not without

the Italians' by Kohl who needed them to bring the French along to the

Euro party to ensure his successful re-election. A few weeks before the

launch of the common European currency, Stenglin's assessment of the

situation took on a dramatic undertone, when he wrote: "The

question arises as to whether a country with an extremely high debt

ratio doesn't risk gambling away the success of its consolidation

efforts to date, thereby harming not only itself, but also the monetary

union." It was a prophetic remark. Of course, financial data

doesn't play much of a role when it comes to war and peace. Italy

became a perfect example of the steadfast belief of politicians that economic development would eventually conform to the visions of national leaders.

from KingWorldNews:

With global stock markets plunging, along with gold and silver, today

King World News interviewed John Embry, Chief Investment Strategist of

the $10 billion strong Sprott Asset Management. Embry told KWN “There

is a war going on right now” because “the pure fiat currency system is

on its last legs.” Embry also said “Europe is in desperate shape” and

the implications are “horrific” if the US dollar loses its reserve

status. Bur first, here is what Embry had to say about gold: “Gold

is falling because the powers that be, with their paper shenanigans,

are knocking the hell out of it. We see tremendous physical demand.

Massive amounts of gold are going through Turkey, into the Middle-East.

Chinese imports are strong. To me that’s the ultimate antidote.”

With global stock markets plunging, along with gold and silver, today

King World News interviewed John Embry, Chief Investment Strategist of

the $10 billion strong Sprott Asset Management. Embry told KWN “There

is a war going on right now” because “the pure fiat currency system is

on its last legs.” Embry also said “Europe is in desperate shape” and

the implications are “horrific” if the US dollar loses its reserve

status. Bur first, here is what Embry had to say about gold: “Gold

is falling because the powers that be, with their paper shenanigans,

are knocking the hell out of it. We see tremendous physical demand.

Massive amounts of gold are going through Turkey, into the Middle-East.

Chinese imports are strong. To me that’s the ultimate antidote.”

John Embry Continues @ KingWorldNews.com

With global stock markets plunging, along with gold and silver, today

King World News interviewed John Embry, Chief Investment Strategist of

the $10 billion strong Sprott Asset Management. Embry told KWN “There

is a war going on right now” because “the pure fiat currency system is

on its last legs.” Embry also said “Europe is in desperate shape” and

the implications are “horrific” if the US dollar loses its reserve

status. Bur first, here is what Embry had to say about gold: “Gold

is falling because the powers that be, with their paper shenanigans,

are knocking the hell out of it. We see tremendous physical demand.

Massive amounts of gold are going through Turkey, into the Middle-East.

Chinese imports are strong. To me that’s the ultimate antidote.”

With global stock markets plunging, along with gold and silver, today

King World News interviewed John Embry, Chief Investment Strategist of

the $10 billion strong Sprott Asset Management. Embry told KWN “There

is a war going on right now” because “the pure fiat currency system is

on its last legs.” Embry also said “Europe is in desperate shape” and

the implications are “horrific” if the US dollar loses its reserve

status. Bur first, here is what Embry had to say about gold: “Gold

is falling because the powers that be, with their paper shenanigans,

are knocking the hell out of it. We see tremendous physical demand.

Massive amounts of gold are going through Turkey, into the Middle-East.

Chinese imports are strong. To me that’s the ultimate antidote.”John Embry Continues @ KingWorldNews.com

Europe Breaks Again As EURUSD Dips Under 1.3000

The beepers at the BIS crew are going off in unison as the "EURUSD under 1.3000" Code Red has just arrived, and this time it is early. And tomorrow there will be no surprising German economic activity "beats."

The Emperor Is Buck Naked

We

are in the last innings of a very bad ball game. We are coping with

the crash of a 30-year–long debt super-cycle and the aftermath of an

unsustainable bubble. Quantitative easing is making it worse by

facilitating more public-sector borrowing and preventing debt

liquidation in the private sector—both erroneous steps in my view. The

federal government is not getting its financial house in order. We are

on the edge of a crisis in the bond markets. It has already happened in

Europe and will be coming to our neighborhood soon. The Fed is

destroying the capital market by pegging and manipulating the price of

money and debt capital. Interest rates signal nothing anymore because

they are zero. Capital markets are at the heart of capitalism and they

are not working.

We

are in the last innings of a very bad ball game. We are coping with

the crash of a 30-year–long debt super-cycle and the aftermath of an

unsustainable bubble. Quantitative easing is making it worse by

facilitating more public-sector borrowing and preventing debt

liquidation in the private sector—both erroneous steps in my view. The

federal government is not getting its financial house in order. We are

on the edge of a crisis in the bond markets. It has already happened in

Europe and will be coming to our neighborhood soon. The Fed is

destroying the capital market by pegging and manipulating the price of

money and debt capital. Interest rates signal nothing anymore because

they are zero. Capital markets are at the heart of capitalism and they

are not working.Greek leader of anti bailout party states bailout in Greece null and void/Spanish banks increase lending from ECB/

Harvey Organ at Harvey Organ's - The Daily Gold and Silver Report - 8 hours ago

Good

evening Ladies and Gentlemen:

Gold closed down badly to the tune of $34.60 to close at $1604. Silver

fared slightly worse falling by 66 cents to $29.41. The day started bad

from Europe with reports that the leader of the anti-bailout party

Tsipras declared that the bailout agreement with Europe is null and

void. That sent all European bourses in the red and it immediately

caused a spike

Gold Down but Holds Support at $1600

Trader Dan at Trader Dan's Market Views - 9 hours ago

In spite of the strong wave of selling that has swept across the entirety

of the commodity complex in today's session, gold did rebound from its move

below the psychological round number support level at $1600. If you note on

the chart, the market continues to be essentially trapped within a very

broad range that with a brief exception made in late December of last year,

has held the metal for the last 7 months. That range is basically bounded

on the top by $1800 and on the bottom by $1600.

Within that $200 range, there has been a tighter range for the last two

months bounded on th... more »

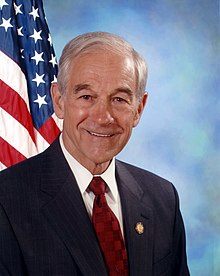

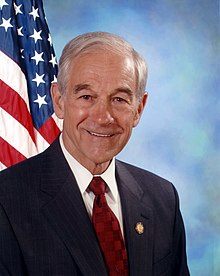

from The Daily Bell:

Ron Paul‘s Hearing to Ask: Mend or End the Fed?… Defenders of Ben Bernanke

may be hard to come by in at least one gathering Tuesday on Capitol

Hill. Ron Paul, the Republican congressman with libertarian positions

who is still running for president, will host the much-hyped hearing

titled, “The Federal Reserve System: Mend It or End It?” Mr. Paul, who heads the House panel that oversees America’s central bank,

has made a career for himself arguing the later and the central bank is

beyond fixing. (The congressman’s 2009 book is also titled “End the

Fed.) Witnesses include Rep. Kevin Brady (R., Texas), who has introduced

legislation to eliminate the Fed’s dual mandate of promoting maximum

employment and price stability. Mr. Brady opposed much of Mr. Bernanke’s

efforts to stimulate the economy by pumping money into it. He would

rather the Fed just focus on inflation. Rep. Barney Frank

(D., Mass.), who will also testify, has his own issues with the Fed. He

feels the central bank spends too much time worrying about inflation

and should be more proactive in curing the hangover from last decade’s

recession. – AP

Ron Paul‘s Hearing to Ask: Mend or End the Fed?… Defenders of Ben Bernanke

may be hard to come by in at least one gathering Tuesday on Capitol

Hill. Ron Paul, the Republican congressman with libertarian positions

who is still running for president, will host the much-hyped hearing

titled, “The Federal Reserve System: Mend It or End It?” Mr. Paul, who heads the House panel that oversees America’s central bank,

has made a career for himself arguing the later and the central bank is

beyond fixing. (The congressman’s 2009 book is also titled “End the

Fed.) Witnesses include Rep. Kevin Brady (R., Texas), who has introduced

legislation to eliminate the Fed’s dual mandate of promoting maximum

employment and price stability. Mr. Brady opposed much of Mr. Bernanke’s

efforts to stimulate the economy by pumping money into it. He would

rather the Fed just focus on inflation. Rep. Barney Frank

(D., Mass.), who will also testify, has his own issues with the Fed. He

feels the central bank spends too much time worrying about inflation

and should be more proactive in curing the hangover from last decade’s

recession. – AP

Dominant Social Theme: Ron Paul? Isn’t he a political non-factor … ?

Free-Market Analysis: Ron Paul, libertarian-conservative candidate for US president just won’t quit. In fact, he keeps grabbing delegates and is threatening to deprive putative GOP nominee Mitt Romney of a first-round nomination.

Read More @ TheDailyBell.com

Ron Paul‘s Hearing to Ask: Mend or End the Fed?… Defenders of Ben Bernanke

may be hard to come by in at least one gathering Tuesday on Capitol

Hill. Ron Paul, the Republican congressman with libertarian positions

who is still running for president, will host the much-hyped hearing

titled, “The Federal Reserve System: Mend It or End It?” Mr. Paul, who heads the House panel that oversees America’s central bank,

has made a career for himself arguing the later and the central bank is

beyond fixing. (The congressman’s 2009 book is also titled “End the

Fed.) Witnesses include Rep. Kevin Brady (R., Texas), who has introduced

legislation to eliminate the Fed’s dual mandate of promoting maximum

employment and price stability. Mr. Brady opposed much of Mr. Bernanke’s

efforts to stimulate the economy by pumping money into it. He would

rather the Fed just focus on inflation. Rep. Barney Frank

(D., Mass.), who will also testify, has his own issues with the Fed. He

feels the central bank spends too much time worrying about inflation

and should be more proactive in curing the hangover from last decade’s

recession. – AP

Ron Paul‘s Hearing to Ask: Mend or End the Fed?… Defenders of Ben Bernanke

may be hard to come by in at least one gathering Tuesday on Capitol

Hill. Ron Paul, the Republican congressman with libertarian positions

who is still running for president, will host the much-hyped hearing

titled, “The Federal Reserve System: Mend It or End It?” Mr. Paul, who heads the House panel that oversees America’s central bank,

has made a career for himself arguing the later and the central bank is

beyond fixing. (The congressman’s 2009 book is also titled “End the

Fed.) Witnesses include Rep. Kevin Brady (R., Texas), who has introduced

legislation to eliminate the Fed’s dual mandate of promoting maximum

employment and price stability. Mr. Brady opposed much of Mr. Bernanke’s

efforts to stimulate the economy by pumping money into it. He would

rather the Fed just focus on inflation. Rep. Barney Frank

(D., Mass.), who will also testify, has his own issues with the Fed. He

feels the central bank spends too much time worrying about inflation

and should be more proactive in curing the hangover from last decade’s

recession. – APDominant Social Theme: Ron Paul? Isn’t he a political non-factor … ?

Free-Market Analysis: Ron Paul, libertarian-conservative candidate for US president just won’t quit. In fact, he keeps grabbing delegates and is threatening to deprive putative GOP nominee Mitt Romney of a first-round nomination.

Read More @ TheDailyBell.com

Spain Appears Unsure What A "Bank Bailout" Means

Spain's banking system bailout is quickly becoming farcical. According to the WSJ this evening,

Spain is to require its banks to set aside more provisions (between

EUR20 billion and EUR40 billion) in an effort to overhaul the country's

financial sector. This additional need for reserves (or provisioning)

puts yet more pressure on the banks' balance sheets as it comes on top

of the already EUR54 billion that has been set aside from February.

Interestingly the EUR20-40 billion still falls dramatically

short of Goldman Sachs' estimate of an additional EUR58 billion that is

needed to cover reasonable loss assumptions. We can only

assume that the game is to create as large a hole as is possible

without tipping the world over the brink and then fill it with the

state funds a la TARP (as Rajoy has indicated will be the case).

Spain's banking system bailout is quickly becoming farcical. According to the WSJ this evening,

Spain is to require its banks to set aside more provisions (between

EUR20 billion and EUR40 billion) in an effort to overhaul the country's

financial sector. This additional need for reserves (or provisioning)

puts yet more pressure on the banks' balance sheets as it comes on top

of the already EUR54 billion that has been set aside from February.

Interestingly the EUR20-40 billion still falls dramatically

short of Goldman Sachs' estimate of an additional EUR58 billion that is

needed to cover reasonable loss assumptions. We can only

assume that the game is to create as large a hole as is possible

without tipping the world over the brink and then fill it with the

state funds a la TARP (as Rajoy has indicated will be the case).The Yemen Underwear Bomb and Other Hobgoblins

Today it was widely reported that the CIA thwarted a “plot by al Qaeda’s affiliate in Yemen to destroy a U.S.-bound airliner using a bomb.”

This bomb, which was to be concealed in a pair of underwear, was

designed as an improvement over what Umar Farouk Abdulmutallab attempted

to use to blow up an airliner over Detroit on Christmas Day of 2009.

This bomb was upgraded and designed to specifically avoid metal

detectors. At first glance it would appear to be a job well done by the

world’s leading domestic affairs meddlers. The truth was finally revealed as the would-be bomber was, in fact, a double agent of the CIA.

When considering the nature of the state, this new instance of

government supported terrorism is unsurprisingly comparable to previous

cases. The alleged Yemen “underwear” bomber was just another fabricated

spook in the long line of mounting justifications to keep the war on

terror and its profiteers going; no matter the cost. As long as the American people are still easily whipped into a frenzy over forged menaces from afar, their blood and treasure will go on to be squandered on military boondoggles and redundant intelligence agencies. War and fear end up becoming a way of life.

And so does the state’s command over what could be a life of peace and

tranquility for the nation it supposedly protects. This isn’t

conspiracy theory; just a recognition of the various hobgoblins, as

H.L. Mencken described them, invented to justify encroaching totalitarianism.

Today it was widely reported that the CIA thwarted a “plot by al Qaeda’s affiliate in Yemen to destroy a U.S.-bound airliner using a bomb.”

This bomb, which was to be concealed in a pair of underwear, was

designed as an improvement over what Umar Farouk Abdulmutallab attempted

to use to blow up an airliner over Detroit on Christmas Day of 2009.

This bomb was upgraded and designed to specifically avoid metal

detectors. At first glance it would appear to be a job well done by the

world’s leading domestic affairs meddlers. The truth was finally revealed as the would-be bomber was, in fact, a double agent of the CIA.

When considering the nature of the state, this new instance of

government supported terrorism is unsurprisingly comparable to previous

cases. The alleged Yemen “underwear” bomber was just another fabricated

spook in the long line of mounting justifications to keep the war on

terror and its profiteers going; no matter the cost. As long as the American people are still easily whipped into a frenzy over forged menaces from afar, their blood and treasure will go on to be squandered on military boondoggles and redundant intelligence agencies. War and fear end up becoming a way of life.

And so does the state’s command over what could be a life of peace and

tranquility for the nation it supposedly protects. This isn’t

conspiracy theory; just a recognition of the various hobgoblins, as

H.L. Mencken described them, invented to justify encroaching totalitarianism.Overnight Markets Plunging

Just

as we warned at the end of today's nonsense, the afternoon ramp is

fading fast now as the sad but true reality of a sun that rises in

Europe awakening the maddening crowd. EURUSD is at 1.2970 (70 pips off the late-day swing highs already),

ES (S&P 500 e-mini futures) are down 10 pts from the closing swing

highs (which just happens to coincide with Sunday night's gap-down

opening level around 1354.25), Silver has slumped back to the day's lows

around $29, Gold back under $1600, and WTI is down

around 2% from the day-session close at around $96.50. Treasuries are

leaking lower in yield but FX markets seem very active as AUD drops to

near parity with USD and carry pairs are generally weak. There are still

a few more hours until Europe opens so anything can happen but for an

overnight session, markets are not happy.

Just

as we warned at the end of today's nonsense, the afternoon ramp is

fading fast now as the sad but true reality of a sun that rises in

Europe awakening the maddening crowd. EURUSD is at 1.2970 (70 pips off the late-day swing highs already),

ES (S&P 500 e-mini futures) are down 10 pts from the closing swing

highs (which just happens to coincide with Sunday night's gap-down

opening level around 1354.25), Silver has slumped back to the day's lows

around $29, Gold back under $1600, and WTI is down

around 2% from the day-session close at around $96.50. Treasuries are

leaking lower in yield but FX markets seem very active as AUD drops to

near parity with USD and carry pairs are generally weak. There are still

a few more hours until Europe opens so anything can happen but for an

overnight session, markets are not happy.Complete Gundlach "Deficits Don't Matter" (sic) Presentation

You asked for it, you got it...

It really is this simple...

BTFD

Whether

it was stocks, credit, gold, silver, oil, EURUSD, or conk shells, the

message we were to believe was clear - BTFD today. As if by clockwork,

Europe closed and US equity markets surged - seemingly forgetting that

Europe will re-open again tonight but should you need any reassurance

of what your pre-assigned Pavlovian role in this tragi-comedic

dance-with-the-devil is - we suggest the following clip as a reminder.

Whether

it was stocks, credit, gold, silver, oil, EURUSD, or conk shells, the

message we were to believe was clear - BTFD today. As if by clockwork,

Europe closed and US equity markets surged - seemingly forgetting that

Europe will re-open again tonight but should you need any reassurance

of what your pre-assigned Pavlovian role in this tragi-comedic

dance-with-the-devil is - we suggest the following clip as a reminder. The propaganda against gold has intensified with Munger and Gates,

unqualified to be sure that jewelry demand is down actually confirms the

gold bull investment demand is much greater than jewelry demand to

claim that gold supply is insufficient to accommodate a gold standard is

rubbish the argument actually highlights the gargantuan

expansion of the monetary base which urges a gold price an order of

magnitude higher, like near $12,000/oz a 5% gold cover clause would be

perfect to set a new global trade currency in motion actually, several

new gold-backed currencies could simultaneously be launched that way,

the new currencies form the core and the US & UK would be outside

looking in the gold market is in a pitched battle still, with enormous

orders being filled the Eastern Coalition continues to drain Western

cartel member banks of their gold the cartel banks are insolvent and

lately, they are suffering from illiquidity they have wrecked sovereign

bond positions and off-side FOREX positions in the margin call, they are

being forced to sell out their gold reserves for the precious cash the

gold price will rise when the East is satisfied with their gold raids in

the current round.

The propaganda against gold has intensified with Munger and Gates,

unqualified to be sure that jewelry demand is down actually confirms the

gold bull investment demand is much greater than jewelry demand to

claim that gold supply is insufficient to accommodate a gold standard is

rubbish the argument actually highlights the gargantuan

expansion of the monetary base which urges a gold price an order of

magnitude higher, like near $12,000/oz a 5% gold cover clause would be

perfect to set a new global trade currency in motion actually, several

new gold-backed currencies could simultaneously be launched that way,

the new currencies form the core and the US & UK would be outside

looking in the gold market is in a pitched battle still, with enormous

orders being filled the Eastern Coalition continues to drain Western

cartel member banks of their gold the cartel banks are insolvent and

lately, they are suffering from illiquidity they have wrecked sovereign

bond positions and off-side FOREX positions in the margin call, they are

being forced to sell out their gold reserves for the precious cash the

gold price will rise when the East is satisfied with their gold raids in

the current round.Read More @ SilverDoctors.com

It’s May Day again in Paris. Over the weekend, French voters elected Socialist Party leader François Hollande who promises to repeal all austerity measures in favor of a robust Keynesian spending program. This development is a setback for EU fiscal stability, and will likely undermine Franco-German cooperation and may spell the end of the Eurozone. What effect will the new socialist regime in France have on us here in the United States? Is socialism the answer to our economic problems? What affect will socialist Europe have on my portfolio?

May 1st is celebrated traditionally in most socialist, Marxist and communist countries as Labor Day and International Workers’ Solidarity Day.

Read More @ GoldSeek.com

After The Media Has Gone: Fukushima, Suicide and the Legacy of 3.11

by Makiko Segawa, Japan Focus:

For the media, time is of the essence in a news story. The March 11,

2011 disaster attracted thousands of reporters and photographers from

around the world. There was a brief deluge of Japanese and

international media coverage on the first anniversary, this spring. Now

the journalists have packed up and gone and by accident or design

Japan’s government seems to be mobilizing its agenda, aware that it is

under less scrutiny.

For the media, time is of the essence in a news story. The March 11,

2011 disaster attracted thousands of reporters and photographers from

around the world. There was a brief deluge of Japanese and

international media coverage on the first anniversary, this spring. Now

the journalists have packed up and gone and by accident or design

Japan’s government seems to be mobilizing its agenda, aware that it is

under less scrutiny.

The press pack has disappeared like a ghost since this April. The influx of foreign media has suddenly stopped, as I can attest since I worked as a translator and aid to many foreign journalists in the year up to the 3.11 anniversary in 2012. Using the keywords ‘Fukushima’ and ‘nuclear plant’ in Japanese to scour the Nikkei TELECOM 21 search engine shows 9,981 domestic news items in April 2012, just over half the 17,272 stories the previous month.

As if to take advantage of the precise timing of the media evacuation, the municipal government of Minami-soma city, Fukushima Prefecture began implementing a blueprint planned some time earlier.

Watch Video @ Japan Focus.org

by Makiko Segawa, Japan Focus:

For the media, time is of the essence in a news story. The March 11,

2011 disaster attracted thousands of reporters and photographers from

around the world. There was a brief deluge of Japanese and

international media coverage on the first anniversary, this spring. Now

the journalists have packed up and gone and by accident or design

Japan’s government seems to be mobilizing its agenda, aware that it is

under less scrutiny.

For the media, time is of the essence in a news story. The March 11,

2011 disaster attracted thousands of reporters and photographers from

around the world. There was a brief deluge of Japanese and

international media coverage on the first anniversary, this spring. Now

the journalists have packed up and gone and by accident or design

Japan’s government seems to be mobilizing its agenda, aware that it is

under less scrutiny.The press pack has disappeared like a ghost since this April. The influx of foreign media has suddenly stopped, as I can attest since I worked as a translator and aid to many foreign journalists in the year up to the 3.11 anniversary in 2012. Using the keywords ‘Fukushima’ and ‘nuclear plant’ in Japanese to scour the Nikkei TELECOM 21 search engine shows 9,981 domestic news items in April 2012, just over half the 17,272 stories the previous month.

As if to take advantage of the precise timing of the media evacuation, the municipal government of Minami-soma city, Fukushima Prefecture began implementing a blueprint planned some time earlier.

Watch Video @ Japan Focus.org

Young Americans living at home surges by 50 percent from 2005

MyBudget360.com

The viable pathway for success for many young Americans

seems to have gotten very narrow in the last decade. The opportunities

for many young workers have become mired with an economy that is

largely in a deep recession with limited quality positions. Many are

saddled with debt and taking on employment positions that may not even

utilize the very expensive college education some have taken on. Education is important but doing it intelligently has become tougher since we are living in a student loan bubble.

Many young Americans have been forced to move back home to live with

mom and dad because of the shoddy economy even if they have a job. Each

point of data suggests that we will have a less affluent generation

coming forward yet this is the generation that is largely going to

shoulder the burden of unsupportable government debt? The bill is

largely coming due but many younger Americans are already starting with a

negative net worth.

The viable pathway for success for many young Americans

seems to have gotten very narrow in the last decade. The opportunities

for many young workers have become mired with an economy that is

largely in a deep recession with limited quality positions. Many are

saddled with debt and taking on employment positions that may not even

utilize the very expensive college education some have taken on. Education is important but doing it intelligently has become tougher since we are living in a student loan bubble.

Many young Americans have been forced to move back home to live with

mom and dad because of the shoddy economy even if they have a job. Each

point of data suggests that we will have a less affluent generation

coming forward yet this is the generation that is largely going to

shoulder the burden of unsupportable government debt? The bill is

largely coming due but many younger Americans are already starting with a

negative net worth.

Read More @ MyBudget360.com

from ronpaulusa2012:

MyBudget360.com

The viable pathway for success for many young Americans

seems to have gotten very narrow in the last decade. The opportunities

for many young workers have become mired with an economy that is

largely in a deep recession with limited quality positions. Many are

saddled with debt and taking on employment positions that may not even

utilize the very expensive college education some have taken on. Education is important but doing it intelligently has become tougher since we are living in a student loan bubble.

Many young Americans have been forced to move back home to live with

mom and dad because of the shoddy economy even if they have a job. Each

point of data suggests that we will have a less affluent generation

coming forward yet this is the generation that is largely going to

shoulder the burden of unsupportable government debt? The bill is

largely coming due but many younger Americans are already starting with a

negative net worth.

The viable pathway for success for many young Americans

seems to have gotten very narrow in the last decade. The opportunities

for many young workers have become mired with an economy that is

largely in a deep recession with limited quality positions. Many are

saddled with debt and taking on employment positions that may not even

utilize the very expensive college education some have taken on. Education is important but doing it intelligently has become tougher since we are living in a student loan bubble.

Many young Americans have been forced to move back home to live with

mom and dad because of the shoddy economy even if they have a job. Each

point of data suggests that we will have a less affluent generation

coming forward yet this is the generation that is largely going to

shoulder the burden of unsupportable government debt? The bill is

largely coming due but many younger Americans are already starting with a

negative net worth.Read More @ MyBudget360.com

from ronpaulusa2012:

.

.

by Michael Scheuer, Lew Rockwell.com:

Ron Paul’s treatment by mainstream media, other Republican hopefuls, and the punditry makes me think the W.B. Yeats lines “Things fall apart; the centre cannot hold; Mere anarchy is loosed upon the world”

also describe the year 2012 in the United States. Indeed, Paul’s

experience in the nomination campaign suggests U.S. politics lacks

reasoned substance, common sense, and an understanding of what America’s

Founding Fathers intended.

Ron Paul’s treatment by mainstream media, other Republican hopefuls, and the punditry makes me think the W.B. Yeats lines “Things fall apart; the centre cannot hold; Mere anarchy is loosed upon the world”

also describe the year 2012 in the United States. Indeed, Paul’s

experience in the nomination campaign suggests U.S. politics lacks

reasoned substance, common sense, and an understanding of what America’s

Founding Fathers intended.

Open up any newspaper to see the mess America has sunk itself into around the world: for example, facing off with China over a lone, non-American dissident whose safety has no relation to U.S. security. Yet today, Paul’s call for staying out of other people’s wars unless genuine U.S. national interests are at stake is deemed radical, immoral, even anti-American. Amazing…

Read More @ LewRockwell.com

Please support our efforts to keep you informed...

Thank You

I'm PayPal Verified

Ron Paul’s treatment by mainstream media, other Republican hopefuls, and the punditry makes me think the W.B. Yeats lines “Things fall apart; the centre cannot hold; Mere anarchy is loosed upon the world”

also describe the year 2012 in the United States. Indeed, Paul’s

experience in the nomination campaign suggests U.S. politics lacks

reasoned substance, common sense, and an understanding of what America’s

Founding Fathers intended.

Ron Paul’s treatment by mainstream media, other Republican hopefuls, and the punditry makes me think the W.B. Yeats lines “Things fall apart; the centre cannot hold; Mere anarchy is loosed upon the world”

also describe the year 2012 in the United States. Indeed, Paul’s

experience in the nomination campaign suggests U.S. politics lacks

reasoned substance, common sense, and an understanding of what America’s

Founding Fathers intended.Open up any newspaper to see the mess America has sunk itself into around the world: for example, facing off with China over a lone, non-American dissident whose safety has no relation to U.S. security. Yet today, Paul’s call for staying out of other people’s wars unless genuine U.S. national interests are at stake is deemed radical, immoral, even anti-American. Amazing…

Read More @ LewRockwell.com

Please support our efforts to keep you informed...

Thank You

I'm PayPal Verified

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment