from The Economic Collapse Blog:

When news broke of a 2 billion dollar trading loss by JP Morgan, much

of the financial world was absolutely stunned. But the truth is that

this is just the beginning. This is just a very small preview of what

is going to happen when we see the collapse of the worldwide derivatives

market. When most Americans think of Wall Street, they think of a

bunch of stuffy bankers trading stocks and bonds. But over the past

couple of decades it has evolved into much more than that. Today, Wall

Street is the biggest casino in the entire world. When the “too big to fail”

banks make good bets, they can make a lot of money. When they make bad

bets, they can lose a lot of money, and that is exactly what just

happened to JP Morgan. Their Chief Investment Office made a series of

trades which turned out horribly, and it resulted in a loss of over 2

billion dollars over the past 40 days. But 2 billion dollars is small

potatoes compared to the vast size of the global derivatives market. It

has been estimated that the the notional value of all the derivatives

in the world is somewhere between 600 trillion dollars and 1.5

quadrillion dollars. Nobody really knows the real amount, but when this

derivatives bubble finally bursts there is not going to be nearly

enough money on the entire planet to fix things.

When news broke of a 2 billion dollar trading loss by JP Morgan, much

of the financial world was absolutely stunned. But the truth is that

this is just the beginning. This is just a very small preview of what

is going to happen when we see the collapse of the worldwide derivatives

market. When most Americans think of Wall Street, they think of a

bunch of stuffy bankers trading stocks and bonds. But over the past

couple of decades it has evolved into much more than that. Today, Wall

Street is the biggest casino in the entire world. When the “too big to fail”

banks make good bets, they can make a lot of money. When they make bad

bets, they can lose a lot of money, and that is exactly what just

happened to JP Morgan. Their Chief Investment Office made a series of

trades which turned out horribly, and it resulted in a loss of over 2

billion dollars over the past 40 days. But 2 billion dollars is small

potatoes compared to the vast size of the global derivatives market. It

has been estimated that the the notional value of all the derivatives

in the world is somewhere between 600 trillion dollars and 1.5

quadrillion dollars. Nobody really knows the real amount, but when this

derivatives bubble finally bursts there is not going to be nearly

enough money on the entire planet to fix things.

Read More @ TheEconomicCollapseBlog.com

When news broke of a 2 billion dollar trading loss by JP Morgan, much

of the financial world was absolutely stunned. But the truth is that

this is just the beginning. This is just a very small preview of what

is going to happen when we see the collapse of the worldwide derivatives

market. When most Americans think of Wall Street, they think of a

bunch of stuffy bankers trading stocks and bonds. But over the past

couple of decades it has evolved into much more than that. Today, Wall

Street is the biggest casino in the entire world. When the “too big to fail”

banks make good bets, they can make a lot of money. When they make bad

bets, they can lose a lot of money, and that is exactly what just

happened to JP Morgan. Their Chief Investment Office made a series of

trades which turned out horribly, and it resulted in a loss of over 2

billion dollars over the past 40 days. But 2 billion dollars is small

potatoes compared to the vast size of the global derivatives market. It

has been estimated that the the notional value of all the derivatives

in the world is somewhere between 600 trillion dollars and 1.5

quadrillion dollars. Nobody really knows the real amount, but when this

derivatives bubble finally bursts there is not going to be nearly

enough money on the entire planet to fix things.

When news broke of a 2 billion dollar trading loss by JP Morgan, much

of the financial world was absolutely stunned. But the truth is that

this is just the beginning. This is just a very small preview of what

is going to happen when we see the collapse of the worldwide derivatives

market. When most Americans think of Wall Street, they think of a

bunch of stuffy bankers trading stocks and bonds. But over the past

couple of decades it has evolved into much more than that. Today, Wall

Street is the biggest casino in the entire world. When the “too big to fail”

banks make good bets, they can make a lot of money. When they make bad

bets, they can lose a lot of money, and that is exactly what just

happened to JP Morgan. Their Chief Investment Office made a series of

trades which turned out horribly, and it resulted in a loss of over 2

billion dollars over the past 40 days. But 2 billion dollars is small

potatoes compared to the vast size of the global derivatives market. It

has been estimated that the the notional value of all the derivatives

in the world is somewhere between 600 trillion dollars and 1.5

quadrillion dollars. Nobody really knows the real amount, but when this

derivatives bubble finally bursts there is not going to be nearly

enough money on the entire planet to fix things.Read More @ TheEconomicCollapseBlog.com

by Anthony Wile, The Daily Bell:

Here’s some interesting news along the lines of “man bites dog.” According to a recent Reuters article, US financial advisors are actually growing leery of US Treasury bonds.

Here’s some interesting news along the lines of “man bites dog.” According to a recent Reuters article, US financial advisors are actually growing leery of US Treasury bonds.

This is almost unheard of and one could certainly make a case that it is a sign of most unsettled times. Ordinarily, financial advisors, especially those in the US, are disposed to provide Treasuries for most every ill.

They are seen as repositories of value, security and liquidity – and this perspective has been preached relentlessly to the average US consumer. And yet now we now find a much different perspective, being reported by Reuters:

It’s the newest market riddle: where do you go for safety when the traditional option could be in a bubble?

With fiscal problems in Europe once again leading to sharp drops in global stock markets, many investors are seeking out stable assets that can both protect their principal and generate an income stream to keep up with inflation.

Read More @ TheDailyBell.com

Here’s some interesting news along the lines of “man bites dog.” According to a recent Reuters article, US financial advisors are actually growing leery of US Treasury bonds.

Here’s some interesting news along the lines of “man bites dog.” According to a recent Reuters article, US financial advisors are actually growing leery of US Treasury bonds.This is almost unheard of and one could certainly make a case that it is a sign of most unsettled times. Ordinarily, financial advisors, especially those in the US, are disposed to provide Treasuries for most every ill.

They are seen as repositories of value, security and liquidity – and this perspective has been preached relentlessly to the average US consumer. And yet now we now find a much different perspective, being reported by Reuters:

It’s the newest market riddle: where do you go for safety when the traditional option could be in a bubble?

With fiscal problems in Europe once again leading to sharp drops in global stock markets, many investors are seeking out stable assets that can both protect their principal and generate an income stream to keep up with inflation.

Read More @ TheDailyBell.com

Why Going "Naked To The Strip" Means More Pain For Nat Gas Companies

Hedged natural gas contracts have protected many producers from the full wrath of today's rock-bottom prices. They've been able to sell their production at relatively high prices... even while the spot price collapsed. But... for a lot of producers, these higher-priced hedges are about to expire. Encana, Canada's largest natural gas company, is a good example. The company had prudently hedged lots of the gas it sold over the last six months. This means it was still realizing $4 or $5 per MMBtu on its sales. Now, those hedges are expiring... and the new hedges are at much lower prices. Encana's cash flow and its economically recoverable reserves are going to plunge.Stock Market Outlook

I think the market will have difficulties to move up strongly unless we

have a massive QE3. - *in Bloomberg *

Related, SPDR S&P 500 Index ETF (SPY), iShares MSCI Emerging Markets Index

ETF (EEM)

*Marc Faber is an international investor known for his uncanny predictions

of the stock market and futures markets around the world.*

US Economy: The Main Problem Is The Staggering Debt

The main problem is the staggering debt. We are the largest debtor nation

in the history of the world. It’s amazing how high the debt is, and it’s

going up by leaps and bounds. It’s just mind boggling how fast it’s going

up. Nobody seems to understand or care what the significance and the

consequences will be. It’s not good. It’s not good news. - *in Forbes *

*Jim Rogers is an author, financial commentator and successful

international investor. He has been frequently featured in Time, The New

York Times, Barron’s, Forbes, Fortune, The Wall Street Journal, The

Financial Times and is ... more »

Video Interview, Forbes, May 2012

Latest video interview, Forbes. Topics: US Dollar, Farming, Agriculture, US Economy *Jim Rogers is an author, financial commentator and successful international investor. He has been frequently featured in Time, The New York Times, Barron’s, Forbes, Fortune, The Wall Street Journal, The Financial Times and is a regular guest on Bloomberg and CNBC. *

The

economic crisis across Europe has perhaps been most keenly felt in

Greece, where people have taken to the streets in violent and emotional

protests against the austerity measures imposed on the nation.

Daily Mail:

Once a month, usually on a Saturday, Kasiani Papadopoulou packs a bag

with children’s presents and takes the bus from her one-bedroom flat in a

dusty suburb of Athens up into the cool hills outside the Greek capital

that overlook the sea.

Once a month, usually on a Saturday, Kasiani Papadopoulou packs a bag

with children’s presents and takes the bus from her one-bedroom flat in a

dusty suburb of Athens up into the cool hills outside the Greek capital

that overlook the sea.

The 20-mile journey is an emotional one for her, but she would not stop making it for anything in the world.

A young widow of 30, she travels to see her two daughters and son — aged 14, 13 and 12. Kasiani was forced to give them away a year ago when her money ran out and she was unable to pay for their food, her rent or send them to school with shoes or books.

At the charity home where the three are now cared for, the children excitedly shout ‘Mama’ as they run down the steps to greet her. Her eldest daughter, Ianthe, hugs her tightly and gives her a kiss.

When, a few hours later, it is time to say goodbye, Kasiani is always close to tears. The youngest, Melissa and Markos, cling to her before she leaves to go home alone. ‘It is not easy for a mother to leave her kids,’ she says.

Read More @ DailyMail.co.uk

Daily Mail:

Once a month, usually on a Saturday, Kasiani Papadopoulou packs a bag

with children’s presents and takes the bus from her one-bedroom flat in a

dusty suburb of Athens up into the cool hills outside the Greek capital

that overlook the sea.

Once a month, usually on a Saturday, Kasiani Papadopoulou packs a bag

with children’s presents and takes the bus from her one-bedroom flat in a

dusty suburb of Athens up into the cool hills outside the Greek capital

that overlook the sea.The 20-mile journey is an emotional one for her, but she would not stop making it for anything in the world.

A young widow of 30, she travels to see her two daughters and son — aged 14, 13 and 12. Kasiani was forced to give them away a year ago when her money ran out and she was unable to pay for their food, her rent or send them to school with shoes or books.

At the charity home where the three are now cared for, the children excitedly shout ‘Mama’ as they run down the steps to greet her. Her eldest daughter, Ianthe, hugs her tightly and gives her a kiss.

When, a few hours later, it is time to say goodbye, Kasiani is always close to tears. The youngest, Melissa and Markos, cling to her before she leaves to go home alone. ‘It is not easy for a mother to leave her kids,’ she says.

Read More @ DailyMail.co.uk

from TF Metals Report:

Hey guys, SGT here with a quick note about this latest interview from Turd over at TF Metals Report.

I just listened to this one with Jim Willie and it’s a doozie. One could argue it’s even a “must listen”. I’ve transcribed one particularly good chunk for you here.

“What’s the END GAME on this? And it’s a shocking conclusion… In two years, give or take, the cartel banks will not own any gold. Now we’ve been looking for years, when are we going to see release of the gold price? How about when the cartel doesn’t have any more gold?! …They’re not going to have the tools with which to defend their short position which is physical gold. They’ll be defenseless. They’ll be like a ship at sea in a storm with zero ballast!” – Jim Willie

There’s also a surprisingly nutty rant within this interview in which Jim spews the view that “A lot of talk that I’ve heard recently that JFK spent his last vegetable years on a Greek island and that’s why Jackie Kennedy married Onassis!” (21:45). NOTE: For the record Jim, sadly JFK did not make it out of Dallas.

What can I tell you, Jim’s a wild man. Link below.

Listen NOW @ TF Metals Report

Hey guys, SGT here with a quick note about this latest interview from Turd over at TF Metals Report.

I just listened to this one with Jim Willie and it’s a doozie. One could argue it’s even a “must listen”. I’ve transcribed one particularly good chunk for you here.

“What’s the END GAME on this? And it’s a shocking conclusion… In two years, give or take, the cartel banks will not own any gold. Now we’ve been looking for years, when are we going to see release of the gold price? How about when the cartel doesn’t have any more gold?! …They’re not going to have the tools with which to defend their short position which is physical gold. They’ll be defenseless. They’ll be like a ship at sea in a storm with zero ballast!” – Jim Willie

There’s also a surprisingly nutty rant within this interview in which Jim spews the view that “A lot of talk that I’ve heard recently that JFK spent his last vegetable years on a Greek island and that’s why Jackie Kennedy married Onassis!” (21:45). NOTE: For the record Jim, sadly JFK did not make it out of Dallas.

What can I tell you, Jim’s a wild man. Link below.

Listen NOW @ TF Metals Report

by drhousingbubble, Zero Hedge:

The California housing market

sits in an odd stage of limbo. You can see that the public for the

most part is fully aware of the situation like an Alamo standoff in real

estate. People fully acknowledge now that banks are holding off a

tremendous amount of inventory.

There is little that is secretive about the shadow inventory at this

point. Yet with all the distressed properties, people are looking at

artificially low rates and are wondering if this is the time to buy

(assuming they are not one of the 20+ percent that are underemployed). Adjustable rate mortgage

use is at all-time lows and why would you not go with a fixed rate

given the insanely low rates? Yet the market and economy is not

healthy. Mortgage rates and low inventory would be signs of a healthy

market in other times but the opposite is the case. What does this mean

for housing going forward?

The California housing market

sits in an odd stage of limbo. You can see that the public for the

most part is fully aware of the situation like an Alamo standoff in real

estate. People fully acknowledge now that banks are holding off a

tremendous amount of inventory.

There is little that is secretive about the shadow inventory at this

point. Yet with all the distressed properties, people are looking at

artificially low rates and are wondering if this is the time to buy

(assuming they are not one of the 20+ percent that are underemployed). Adjustable rate mortgage

use is at all-time lows and why would you not go with a fixed rate

given the insanely low rates? Yet the market and economy is not

healthy. Mortgage rates and low inventory would be signs of a healthy

market in other times but the opposite is the case. What does this mean

for housing going forward?

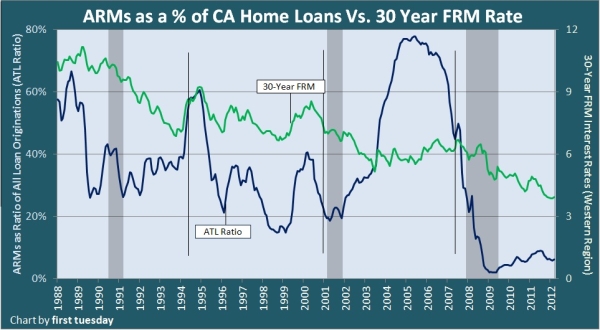

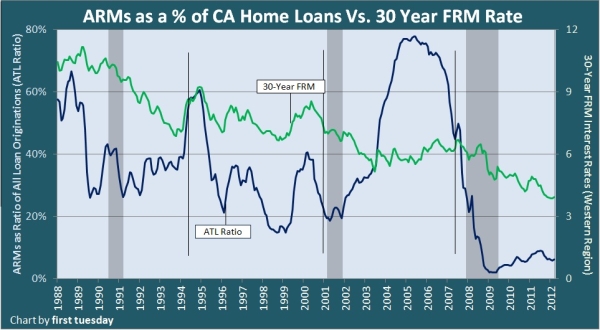

The use of adjustable rate mortgage is at all-time lows (see chart):

The use of ARMs is practically non-existent when at the peak it was nearly reaching 80 percent of all loan originations. This is the Alt-A and option ARM universe that we once inhabited. The low usage of ARMs might be obvious on the surface but I think it tells us more about the market.

Read More @ Zero Hedge.com

Please support our efforts to keep you informed...

Thank You

I'm PayPal Verified

The California housing market

sits in an odd stage of limbo. You can see that the public for the

most part is fully aware of the situation like an Alamo standoff in real

estate. People fully acknowledge now that banks are holding off a

tremendous amount of inventory.

There is little that is secretive about the shadow inventory at this

point. Yet with all the distressed properties, people are looking at

artificially low rates and are wondering if this is the time to buy

(assuming they are not one of the 20+ percent that are underemployed). Adjustable rate mortgage

use is at all-time lows and why would you not go with a fixed rate

given the insanely low rates? Yet the market and economy is not

healthy. Mortgage rates and low inventory would be signs of a healthy

market in other times but the opposite is the case. What does this mean

for housing going forward?

The California housing market

sits in an odd stage of limbo. You can see that the public for the

most part is fully aware of the situation like an Alamo standoff in real

estate. People fully acknowledge now that banks are holding off a

tremendous amount of inventory.

There is little that is secretive about the shadow inventory at this

point. Yet with all the distressed properties, people are looking at

artificially low rates and are wondering if this is the time to buy

(assuming they are not one of the 20+ percent that are underemployed). Adjustable rate mortgage

use is at all-time lows and why would you not go with a fixed rate

given the insanely low rates? Yet the market and economy is not

healthy. Mortgage rates and low inventory would be signs of a healthy

market in other times but the opposite is the case. What does this mean

for housing going forward?

The use of adjustable rate mortgage is at all-time lows (see chart):

The use of ARMs is practically non-existent when at the peak it was nearly reaching 80 percent of all loan originations. This is the Alt-A and option ARM universe that we once inhabited. The low usage of ARMs might be obvious on the surface but I think it tells us more about the market.

Read More @ Zero Hedge.com

Please support our efforts to keep you informed...

Thank You

I'm PayPal Verified

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment