by James Quinn, Financial Sense:

Jim welcomes back John Williams from Shadow Government Statistics.

John believes the real unemployment rate is 22%, not 8.1%, which is why

it still feels like a recession. He also calculates the CPI at 6%, not

2.8%, and explains how the government manipulates the rate of inflation.

Lastly, John believes the US is still on track for hyperinflation in

2014 as we near the coming fiscal cliff.

Jim welcomes back John Williams from Shadow Government Statistics.

John believes the real unemployment rate is 22%, not 8.1%, which is why

it still feels like a recession. He also calculates the CPI at 6%, not

2.8%, and explains how the government manipulates the rate of inflation.

Lastly, John believes the US is still on track for hyperinflation in

2014 as we near the coming fiscal cliff.

John received an A.B. in Economics, cum laude, from Dartmouth College in 1971, and was awarded a M.B.A. from Dartmouth’s Amos Tuck School of Business Administration in 1972, where he was named an Edward Tuck Scholar. During his career as a consulting economist, John has worked with individuals as well as Fortune 500 companies. Formally known as Walter J. Williams, his friends call him John. For nearly 30 years, John has been a private consulting economist and, out of necessity, had to become a specialist in government economic reporting.

Click Here to Listen to the Audio

Read More @ Financial Sense.com

Jim welcomes back John Williams from Shadow Government Statistics.

John believes the real unemployment rate is 22%, not 8.1%, which is why

it still feels like a recession. He also calculates the CPI at 6%, not

2.8%, and explains how the government manipulates the rate of inflation.

Lastly, John believes the US is still on track for hyperinflation in

2014 as we near the coming fiscal cliff.

Jim welcomes back John Williams from Shadow Government Statistics.

John believes the real unemployment rate is 22%, not 8.1%, which is why

it still feels like a recession. He also calculates the CPI at 6%, not

2.8%, and explains how the government manipulates the rate of inflation.

Lastly, John believes the US is still on track for hyperinflation in

2014 as we near the coming fiscal cliff.John received an A.B. in Economics, cum laude, from Dartmouth College in 1971, and was awarded a M.B.A. from Dartmouth’s Amos Tuck School of Business Administration in 1972, where he was named an Edward Tuck Scholar. During his career as a consulting economist, John has worked with individuals as well as Fortune 500 companies. Formally known as Walter J. Williams, his friends call him John. For nearly 30 years, John has been a private consulting economist and, out of necessity, had to become a specialist in government economic reporting.

Click Here to Listen to the Audio

Read More @ Financial Sense.com

from, SHTFPlan:

Government mouthpiece and well known Keynesian economist Paul Krugman

makes the case for monetary easing and Fed intervention by claiming

that the rising cost of food and gas has nothing to do with the Federal

Reserve and easy money dished out to banks, both foreign and domestic,

to the tunes of not billions, but tens of trillions of dollars.

Government mouthpiece and well known Keynesian economist Paul Krugman

makes the case for monetary easing and Fed intervention by claiming

that the rising cost of food and gas has nothing to do with the Federal

Reserve and easy money dished out to banks, both foreign and domestic,

to the tunes of not billions, but tens of trillions of dollars.

The latest economic theory from the Nobel Prize winning economist suggests that the Fed and government intervention couldn’t possibly have anything to do with US dollar depreciation – not for the last hundred years, and certainly not today:

Please support our efforts to keep you informed...

Thank You

I'm PayPal Verified

Government mouthpiece and well known Keynesian economist Paul Krugman

makes the case for monetary easing and Fed intervention by claiming

that the rising cost of food and gas has nothing to do with the Federal

Reserve and easy money dished out to banks, both foreign and domestic,

to the tunes of not billions, but tens of trillions of dollars.

Government mouthpiece and well known Keynesian economist Paul Krugman

makes the case for monetary easing and Fed intervention by claiming

that the rising cost of food and gas has nothing to do with the Federal

Reserve and easy money dished out to banks, both foreign and domestic,

to the tunes of not billions, but tens of trillions of dollars.The latest economic theory from the Nobel Prize winning economist suggests that the Fed and government intervention couldn’t possibly have anything to do with US dollar depreciation – not for the last hundred years, and certainly not today:

Food and gas is not something that’s being driven by Fed policy. Sorry, but Ben Bernanke doesn’t have that much power. That’s being driven by events in China. That’s being driven by events in a large world economy.Read More @ SHTFPlan.com

…

The dollar hasn’t gone down. That’s the amazing thing. If you actually look at the Dollar vs. the Euro, the Dollar vs. the Yen, it has not. In terms of the world’s other major currencies we have not had a big depreciation of the dollar.

Please support our efforts to keep you informed...

Thank You

I'm PayPal Verified

BTFD...

from Silver Doctors:

Gold and silver are getting hammered this morning, as gold is flirting

with new lows for the entire correction at $1610, and silver took out

critical support at $30, and is now nearing $29.25.

Gold and silver are getting hammered this morning, as gold is flirting

with new lows for the entire correction at $1610, and silver took out

critical support at $30, and is now nearing $29.25.

With silver’s support breached at $30, it is now likely that silver will see $28-$28.50 which is the next strong support level, and possibly even test the double bottom placed near $26.

The cartel can read a chart as well as you and I, and they are attempting to invalidate the massive 6-month inverse head and shoulders formation in silver.

Read More @ SilverDoctors.com

Gold and silver are getting hammered this morning, as gold is flirting

with new lows for the entire correction at $1610, and silver took out

critical support at $30, and is now nearing $29.25.

Gold and silver are getting hammered this morning, as gold is flirting

with new lows for the entire correction at $1610, and silver took out

critical support at $30, and is now nearing $29.25. With silver’s support breached at $30, it is now likely that silver will see $28-$28.50 which is the next strong support level, and possibly even test the double bottom placed near $26.

The cartel can read a chart as well as you and I, and they are attempting to invalidate the massive 6-month inverse head and shoulders formation in silver.

Read More @ SilverDoctors.com

from The Economic Collapse Blog:

The results of the elections in France and Greece have made it

abundantly clear that there is a tremendous backlash against the

austerity approach that Germany has been pushing. All over Europe,

prominent politicians and incumbent political parties are being voted

out. In fact, Nicolas Sarkozy has become the 11th leader of a European

nation to be defeated in an election since 2008. We have seen

governments fall in the Netherlands, the UK, Spain, Ireland, Italy,

Portugal and Greece. Whenever they get a chance, the citizens of Europe

are using the ballot box to send a message that they do not like what

is going on. It turns out that austerity is extremely unpopular. But

if newly elected politicians all over Europe begin rejecting austerity,

this puts Germany in a very difficult position. Should Germany be

expected to indefinitely bail out all of the members of the eurozone

that choose to live way beyond their means? If Germany pulled out of

the euro tomorrow, the euro would absolutely collapse, bond yields for

the rest of the eurozone would skyrocket to unprecedented heights, and

without German bailout money troubled nations such as Greece would be

headed directly for default. The rest of the eurozone is absolutely and

completely dependent on Germany at this point. But as we have seen,

much of the rest of the eurozone is sick and tired of taking orders from

Germany and is rejecting austerity.

The results of the elections in France and Greece have made it

abundantly clear that there is a tremendous backlash against the

austerity approach that Germany has been pushing. All over Europe,

prominent politicians and incumbent political parties are being voted

out. In fact, Nicolas Sarkozy has become the 11th leader of a European

nation to be defeated in an election since 2008. We have seen

governments fall in the Netherlands, the UK, Spain, Ireland, Italy,

Portugal and Greece. Whenever they get a chance, the citizens of Europe

are using the ballot box to send a message that they do not like what

is going on. It turns out that austerity is extremely unpopular. But

if newly elected politicians all over Europe begin rejecting austerity,

this puts Germany in a very difficult position. Should Germany be

expected to indefinitely bail out all of the members of the eurozone

that choose to live way beyond their means? If Germany pulled out of

the euro tomorrow, the euro would absolutely collapse, bond yields for

the rest of the eurozone would skyrocket to unprecedented heights, and

without German bailout money troubled nations such as Greece would be

headed directly for default. The rest of the eurozone is absolutely and

completely dependent on Germany at this point. But as we have seen,

much of the rest of the eurozone is sick and tired of taking orders from

Germany and is rejecting austerity.

Read More @ TheEconomicCollapseBlog.com

The results of the elections in France and Greece have made it

abundantly clear that there is a tremendous backlash against the

austerity approach that Germany has been pushing. All over Europe,

prominent politicians and incumbent political parties are being voted

out. In fact, Nicolas Sarkozy has become the 11th leader of a European

nation to be defeated in an election since 2008. We have seen

governments fall in the Netherlands, the UK, Spain, Ireland, Italy,

Portugal and Greece. Whenever they get a chance, the citizens of Europe

are using the ballot box to send a message that they do not like what

is going on. It turns out that austerity is extremely unpopular. But

if newly elected politicians all over Europe begin rejecting austerity,

this puts Germany in a very difficult position. Should Germany be

expected to indefinitely bail out all of the members of the eurozone

that choose to live way beyond their means? If Germany pulled out of

the euro tomorrow, the euro would absolutely collapse, bond yields for

the rest of the eurozone would skyrocket to unprecedented heights, and

without German bailout money troubled nations such as Greece would be

headed directly for default. The rest of the eurozone is absolutely and

completely dependent on Germany at this point. But as we have seen,

much of the rest of the eurozone is sick and tired of taking orders from

Germany and is rejecting austerity.

The results of the elections in France and Greece have made it

abundantly clear that there is a tremendous backlash against the

austerity approach that Germany has been pushing. All over Europe,

prominent politicians and incumbent political parties are being voted

out. In fact, Nicolas Sarkozy has become the 11th leader of a European

nation to be defeated in an election since 2008. We have seen

governments fall in the Netherlands, the UK, Spain, Ireland, Italy,

Portugal and Greece. Whenever they get a chance, the citizens of Europe

are using the ballot box to send a message that they do not like what

is going on. It turns out that austerity is extremely unpopular. But

if newly elected politicians all over Europe begin rejecting austerity,

this puts Germany in a very difficult position. Should Germany be

expected to indefinitely bail out all of the members of the eurozone

that choose to live way beyond their means? If Germany pulled out of

the euro tomorrow, the euro would absolutely collapse, bond yields for

the rest of the eurozone would skyrocket to unprecedented heights, and

without German bailout money troubled nations such as Greece would be

headed directly for default. The rest of the eurozone is absolutely and

completely dependent on Germany at this point. But as we have seen,

much of the rest of the eurozone is sick and tired of taking orders from

Germany and is rejecting austerity. Read More @ TheEconomicCollapseBlog.com

The European Union Is Destroying European Unity

So we know that the pro-bailout parties in Greece have failed to form a coalition, and that this will either mean an anti-bailout anti-austerity government, or new elections, and that this will probably mean that the Greek default is about to become extremely messy (because let’s face it the chances of the Greek people electing a pro-austerity, pro-bailout government is about as likely as Hillary Clinton quitting her job at the State Department and seeking a job shaking her booty at Spearmint Rhino). It was said that the E.U.’s existence was justified in the name of preventing the return of nationalism and fascism to European politics. Well, as a result of the austerity terms imposed upon Greece by their European cousins in Brussels and Frankfurt, Greeks just put a fully-blown fascist party into Parliament.

Dan Loeb Explains His (Brief) Infatuation With Portuguese Bonds

Last week, looking at Third Point's best performing positions we noticed something odd: a big win in Portuguese sovereign bonds in the month of April. We further suggested: "We suspect the plan went something like this: Loeb had one of his hedge-fund-huddles; the cartel all bought into Portuguese bonds (or more likely the basis trade - lower risk, higher leverage if a 'guaranteed winner'); bonds soared and the basis was crushed; now that same cartel - facing pressure on its AAPL position (noted as one of Loeb's largest positions at the end of April) - has to liquidate (reduce leverage thanks to AAPL's collateral-value dropping) and is forced to unwind the Portuguese positions. A quick glance at the chart below tells the story of a Portuguese bond market very much in a world of its own relative to the rest of Europe this last month - and perhaps now we know who was pulling those strings?" Since the end of April, both AAPL and Portuguese bonds have tumbled, and Portugal CDS is +45 bps today alone, proving that circumstantially we have been quite correct. Today, we have the full Long Portugal thesis as explained by Loeb (it was a simple Portuguese bond long, which explains the odd rip-fest seen in the cash product in April). There is nothing too surprising in the thesis, with the pros and cons of the trade neatly laid out, however the core premise is that the Troika will simply not allow Portugal to fail, and that downside on the bonds is limited... A thesis we have heard repeatedly before, most recently last week by Greylock and various other hedge funds, which said a long-Greek bond was the "trade of the year", and a "no brainer." Sure, that works, until it doesn't: such as after this past weekend, in which Greece left the world stunned with the aftermath of what happens when the people's voice is for once heard over that of the kleptocrats, and the entire house of cards is poised to collapse.

from KingWorldNews:

James

Turk: Founder & Chairman of Goldmoney.com – James has written “The

Freemarket Gold & Money Report,” an investment newsletter since

1987. James has specialized in international banking, finance and

investments since 1969. His business career began at The Chase Manhattan

Bank (now JP Morgan Chase Bank). He subsequently joined the investment

and trading company of a prominent precious metals trader based in

Greenwich, Connecticut then moved to the United Arab Emirates to be

appointed Manager of the Commodity Department of the Abu Dhabi

Investment Authority, until resigning in 1987.

James

Turk: Founder & Chairman of Goldmoney.com – James has written “The

Freemarket Gold & Money Report,” an investment newsletter since

1987. James has specialized in international banking, finance and

investments since 1969. His business career began at The Chase Manhattan

Bank (now JP Morgan Chase Bank). He subsequently joined the investment

and trading company of a prominent precious metals trader based in

Greenwich, Connecticut then moved to the United Arab Emirates to be

appointed Manager of the Commodity Department of the Abu Dhabi

Investment Authority, until resigning in 1987.

Listen Now @ KingWorldNews.com

James

Turk: Founder & Chairman of Goldmoney.com – James has written “The

Freemarket Gold & Money Report,” an investment newsletter since

1987. James has specialized in international banking, finance and

investments since 1969. His business career began at The Chase Manhattan

Bank (now JP Morgan Chase Bank). He subsequently joined the investment

and trading company of a prominent precious metals trader based in

Greenwich, Connecticut then moved to the United Arab Emirates to be

appointed Manager of the Commodity Department of the Abu Dhabi

Investment Authority, until resigning in 1987.

James

Turk: Founder & Chairman of Goldmoney.com – James has written “The

Freemarket Gold & Money Report,” an investment newsletter since

1987. James has specialized in international banking, finance and

investments since 1969. His business career began at The Chase Manhattan

Bank (now JP Morgan Chase Bank). He subsequently joined the investment

and trading company of a prominent precious metals trader based in

Greenwich, Connecticut then moved to the United Arab Emirates to be

appointed Manager of the Commodity Department of the Abu Dhabi

Investment Authority, until resigning in 1987.Listen Now @ KingWorldNews.com

Gasoline Prices continues Getting Knocked Lower

Trader Dan at Trader Dan's Market Views - 15 minutes ago

Count me in as one of those who firmly believes that the Bernanke-led Fed

has been doing everything in its power to rescue their boss's rear end from

the fire of higher gasoline prices which is sinking his poll numbers along

with the rest of the economy.

How so you might ask? Simple - they are absolutely close-mouthed on any

hints of further monetary stimulus to electrify the paddles on the

defibulator that is now needed to stave off the contagion effects from the

woes besetting the Euro Zone. As the entire commodity sector gets hit by

the risk off trades, we hear dead silence from ... more »

Silver Chart and Comments

Trader Dan at Trader Dan's Market Views - 30 minutes ago

Silver is being pummelled today, along with just about every other single

commodity on the planet, as the combination of the Socialist win in France

along with the results of the Greek elections, has traders running away

from growth assets and into the "safety" of US Treasuries ( I still have

trouble saying those words in the same sentence).

Many are fearing that Greece will not be able to hobble together a

governing coaltion in time ot meet the detail for their loan bailout

package.

Either way, the usual "sell everything in sight" mentality has taken over

the markets with the resu... more »

European Credit Risk Surges Near 4-Month Highs

Just

as we warned last night, the lack of an active European credit market

to look over the shoulders of their more exuberant equity colleagues

quickly came to bear today as London traders turned up for work in no

mood for bullish hope. Investment grade credit spreads in

Europe jumped their most in a month and pushed close to four-month

wides as the entire credit complex sold off aggressively. It

seemed Main (the European IG credit index) was instrument of choice for

hedgers (cheaper and more liquid with a smattering of financials) as

opposed to XOVER (the European HY credit index) but we suspect the

latter will rapidly catch up. Stocks fell further with Greece hitting

multi-decade lows but Italy and France underperforming (as reality bit

following yesterday's pump). Euro Stoxx 50 was down around 2% (now -3.5% YTD)

but Spain remains the YTD biggest loser -18.2% (as opposed to Germany's

DAX +9.25%). Sovereign credit was also not happy (just like yesterday)

but as US opened, Italy and Spain saw notable derisking pushing their

5Y spreads +7bps and +15bps respectively on the week now. Portugal is

+24bps on the week so far as the basis trade unwind begins. Europe's VIX surged above 31% for the first time since the beginning of the year

and while Treasuries were bid (with 30Y touching 3%), 10Y Bunds

outperformed on the safety rotation now 28.5bps inside of the 10Y TSY.

EURUSD slid back under 1.30 shortly after the US opened but some

miraculous gappiness (and comments from Greece) dragged its lumbering

body back over the 1.30 Maginot line for now.

Just

as we warned last night, the lack of an active European credit market

to look over the shoulders of their more exuberant equity colleagues

quickly came to bear today as London traders turned up for work in no

mood for bullish hope. Investment grade credit spreads in

Europe jumped their most in a month and pushed close to four-month

wides as the entire credit complex sold off aggressively. It

seemed Main (the European IG credit index) was instrument of choice for

hedgers (cheaper and more liquid with a smattering of financials) as

opposed to XOVER (the European HY credit index) but we suspect the

latter will rapidly catch up. Stocks fell further with Greece hitting

multi-decade lows but Italy and France underperforming (as reality bit

following yesterday's pump). Euro Stoxx 50 was down around 2% (now -3.5% YTD)

but Spain remains the YTD biggest loser -18.2% (as opposed to Germany's

DAX +9.25%). Sovereign credit was also not happy (just like yesterday)

but as US opened, Italy and Spain saw notable derisking pushing their

5Y spreads +7bps and +15bps respectively on the week now. Portugal is

+24bps on the week so far as the basis trade unwind begins. Europe's VIX surged above 31% for the first time since the beginning of the year

and while Treasuries were bid (with 30Y touching 3%), 10Y Bunds

outperformed on the safety rotation now 28.5bps inside of the 10Y TSY.

EURUSD slid back under 1.30 shortly after the US opened but some

miraculous gappiness (and comments from Greece) dragged its lumbering

body back over the 1.30 Maginot line for now.Santelli On The Encumbered Youth Of The US

"Sometime

the math just doesn't add up" is how CNBC's Rick Santelli begins what

should become must-watch viewing for the youth of America as he tries

to "Wake Up Young People" to the incredible realities of the level of debt encumbrance they are being born with.

The lessons we are learning from our European brothers is that no-one

is going to volunteer for austerity and fundamentally, to Rick, austerity is about 'past due bills'.

From birth (where the average soon-to-be-taxpayer is already

encumbered by $138k) to the future (looking for growth through capital

attainment and job creation), Santelli starkly looks into camera,

addressing the under-27-year-old demographic and tells them straight "you are paying for a meal that previous generations have eaten".

The worrying point is that in order for the youth not to revolt

against this 'unfairness' they need optimism and what appears to be

occurring now is a fading of that generational optimism (except for

CEOs whose last name begin with Z) as joblessness, and the costs of

college and healthcare anchor our traditionally upwardly mobile bias.

So how do 'we' hook the younger generations in? Student loan

forgiveness? But where's that money going to come from? ...and so the ponzi feeds on itself once again.

"Sometime

the math just doesn't add up" is how CNBC's Rick Santelli begins what

should become must-watch viewing for the youth of America as he tries

to "Wake Up Young People" to the incredible realities of the level of debt encumbrance they are being born with.

The lessons we are learning from our European brothers is that no-one

is going to volunteer for austerity and fundamentally, to Rick, austerity is about 'past due bills'.

From birth (where the average soon-to-be-taxpayer is already

encumbered by $138k) to the future (looking for growth through capital

attainment and job creation), Santelli starkly looks into camera,

addressing the under-27-year-old demographic and tells them straight "you are paying for a meal that previous generations have eaten".

The worrying point is that in order for the youth not to revolt

against this 'unfairness' they need optimism and what appears to be

occurring now is a fading of that generational optimism (except for

CEOs whose last name begin with Z) as joblessness, and the costs of

college and healthcare anchor our traditionally upwardly mobile bias.

So how do 'we' hook the younger generations in? Student loan

forgiveness? But where's that money going to come from? ...and so the ponzi feeds on itself once again. It was curious recently to meet with some old friends who recalled a

big argument we had four years ago about the merits of buying gold and

silver.

It was curious recently to meet with some old friends who recalled a

big argument we had four years ago about the merits of buying gold and

silver.They had to concede defeat. After all a portfolio equally split between those precious metals is up by around 80 per cent since then. In that time even Warren Buffett has underperformed the S&P that has basically gone nowhere despite huge volatility.

Late buyers? Yet these friends were still reluctant to buy gold and silver and had not done so. They now thought the price too high and that they had missed the boat. It is worth keeping an eye on them: when they do finally buy it will be time to think about selling!

Read More @ ArabianMoney.net

(Vicksburg,

MS) It’s a tragedy of the human condition that our “tribe” of peeps on

the rock is around – billion because it has reduced us all to numbers,

and this in turn has caused an infatuation with that which “counts.”

This morning there are several numbers to consider, such as 3,000 which

is the level in the French CAC40 index – a kind of French Dow – which is coming into view since their “let’s go back to free lunches” presidential election.

(Vicksburg,

MS) It’s a tragedy of the human condition that our “tribe” of peeps on

the rock is around – billion because it has reduced us all to numbers,

and this in turn has caused an infatuation with that which “counts.”

This morning there are several numbers to consider, such as 3,000 which

is the level in the French CAC40 index – a kind of French Dow – which is coming into view since their “let’s go back to free lunches” presidential election.

The same could be said for the S&P 500, which has its own load of troubles to deal with staying above 1,340. Sure, it closed Monday 30-points above that level,

but the futures were down another 7, or so, when I looked, and we’re in

no particular hurry to get to the edge of the cliff, since respectable

crashes trade sideways and down normally for either 35/37 days or 55

days from lower-high spots. So sometime this summer is an interesting

bet.

Dow 13,000 on the other hand could fall today, and if it does,

sometimes these who number spots (ending in a couple of zeros) can be

important psychological markers to keep in mind.

Read More @ UrbanSurvival.com

by Jack Hunter, RonPaul2012.com:

Most

journalists simply don’t get Ron Paul. A big part of it is journalists

not being able to understand anything other than what they’ve been

taught to understand, which in politics amounts to little more than the

horserace before them. Journalists understand how to cover a

conventional campaign. They really don’t know what to do with a

movement. Plus, they can be pretty lazy. Trust me.

Most

journalists simply don’t get Ron Paul. A big part of it is journalists

not being able to understand anything other than what they’ve been

taught to understand, which in politics amounts to little more than the

horserace before them. Journalists understand how to cover a

conventional campaign. They really don’t know what to do with a

movement. Plus, they can be pretty lazy. Trust me.

In his review of Reason’s Brian Doherty’s book on Dr. Paul, James Antle makes some keen observations concerning Ron Paul and media coverage at Real Clear Books:

Brian Doherty aside, most reporters don’t know what to make of Ron Paul. This observation isn’t simply a clichéd swipe at the “drive-by media” or the dinosaurs of the dreaded “MSM.” To the working press, from the Red Bull-addled gumshoes at Internet start-ups to grizzled veterans of the campaign trail, Paul’s two Republican presidential bids simply do not compute.

Read More @ RonPaul2012.com:

Most

journalists simply don’t get Ron Paul. A big part of it is journalists

not being able to understand anything other than what they’ve been

taught to understand, which in politics amounts to little more than the

horserace before them. Journalists understand how to cover a

conventional campaign. They really don’t know what to do with a

movement. Plus, they can be pretty lazy. Trust me.

Most

journalists simply don’t get Ron Paul. A big part of it is journalists

not being able to understand anything other than what they’ve been

taught to understand, which in politics amounts to little more than the

horserace before them. Journalists understand how to cover a

conventional campaign. They really don’t know what to do with a

movement. Plus, they can be pretty lazy. Trust me.In his review of Reason’s Brian Doherty’s book on Dr. Paul, James Antle makes some keen observations concerning Ron Paul and media coverage at Real Clear Books:

Brian Doherty aside, most reporters don’t know what to make of Ron Paul. This observation isn’t simply a clichéd swipe at the “drive-by media” or the dinosaurs of the dreaded “MSM.” To the working press, from the Red Bull-addled gumshoes at Internet start-ups to grizzled veterans of the campaign trail, Paul’s two Republican presidential bids simply do not compute.

Read More @ RonPaul2012.com:

by Ethan A. Huff, Natural News:

When it comes to freedom of food choice, the U.S. Food and Drug

Administration (FDA) considers Americans to be too stupid to make their

own dietary choices. But when pharmaceuticals are involved, the FDA

apparently thinks individuals should be able to completely self-medicate

themselves without a prescription, having recently proposed new

guidelines that would make it easier than ever for patients to access

high-risk prescription drugs without even having to see a doctor.

When it comes to freedom of food choice, the U.S. Food and Drug

Administration (FDA) considers Americans to be too stupid to make their

own dietary choices. But when pharmaceuticals are involved, the FDA

apparently thinks individuals should be able to completely self-medicate

themselves without a prescription, having recently proposed new

guidelines that would make it easier than ever for patients to access

high-risk prescription drugs without even having to see a doctor.

The Washington Times reports that a new four-page proposal made by the FDA suggests that cholesterol (statins), diabetes, and asthma drugs, among others, be made available over-the-counter (OTC) to patients without a prescription. And what is the reason for this? According to the agency, too many patients are not getting their prescriptions filled, and many would-be patients are not going in to receive the treatments that their medical overlords feel they should be receiving.

Read More @ NaturalNews.com

More "Change You Can Believe In"

When it comes to freedom of food choice, the U.S. Food and Drug

Administration (FDA) considers Americans to be too stupid to make their

own dietary choices. But when pharmaceuticals are involved, the FDA

apparently thinks individuals should be able to completely self-medicate

themselves without a prescription, having recently proposed new

guidelines that would make it easier than ever for patients to access

high-risk prescription drugs without even having to see a doctor.

When it comes to freedom of food choice, the U.S. Food and Drug

Administration (FDA) considers Americans to be too stupid to make their

own dietary choices. But when pharmaceuticals are involved, the FDA

apparently thinks individuals should be able to completely self-medicate

themselves without a prescription, having recently proposed new

guidelines that would make it easier than ever for patients to access

high-risk prescription drugs without even having to see a doctor.The Washington Times reports that a new four-page proposal made by the FDA suggests that cholesterol (statins), diabetes, and asthma drugs, among others, be made available over-the-counter (OTC) to patients without a prescription. And what is the reason for this? According to the agency, too many patients are not getting their prescriptions filled, and many would-be patients are not going in to receive the treatments that their medical overlords feel they should be receiving.

Read More @ NaturalNews.com

More "Change You Can Believe In"

by Alexander Higgins, Alexander Higgins:

The

US has been forced to reveal the location of 63 secret bases used to

conduct aerial drone flights for domestic spying operations.

The

US has been forced to reveal the location of 63 secret bases used to

conduct aerial drone flights for domestic spying operations.

A lawsuit has forced the FAA to reveal the location of 63 Secret Drone bases located inside the United States some of which will be the starting point for a massive deployment of airborne robots flying over the United States for spying on citizens which will eventually conduct targeted killings across the country.

While the information released shows an alarming number of bases being used for military and local law enforcement drones, perhaps the most startling revelation is that the United States is allowing Canadian Border Patrol Drones to operate across the Canadian border.

Odds are that the are many more drone bases inside the United States whose locations have been kept secret for various national security reasons and the lawsuit only forced the government to release the names and locations of permitted US drone operators.

That means that the type of drones – be they for targeted killing, guiding missiles, or general surveillance – and the number of drones at each location still remains a secret although the FAA says they plan on releasing such information at a later date.

Read More @ AlexanderHiggins.com

Read More @ GoldMoney.com

The

US has been forced to reveal the location of 63 secret bases used to

conduct aerial drone flights for domestic spying operations.

The

US has been forced to reveal the location of 63 secret bases used to

conduct aerial drone flights for domestic spying operations.A lawsuit has forced the FAA to reveal the location of 63 Secret Drone bases located inside the United States some of which will be the starting point for a massive deployment of airborne robots flying over the United States for spying on citizens which will eventually conduct targeted killings across the country.

While the information released shows an alarming number of bases being used for military and local law enforcement drones, perhaps the most startling revelation is that the United States is allowing Canadian Border Patrol Drones to operate across the Canadian border.

Odds are that the are many more drone bases inside the United States whose locations have been kept secret for various national security reasons and the lawsuit only forced the government to release the names and locations of permitted US drone operators.

That means that the type of drones – be they for targeted killing, guiding missiles, or general surveillance – and the number of drones at each location still remains a secret although the FAA says they plan on releasing such information at a later date.

Read More @ AlexanderHiggins.com

by Ron Paul, The Daily Bell:

Last week President Obama made a surprise pre-dawn trip to Afghanistan to mark the one year anniversary of the killing of Osama bin Laden

and to sign a document further extending the US presence in that

country. The president said, “We’re building an enduring partnership…As

you stand up, you will not stand alone.” What that means in practice is

that the US will continue its efforts to prop up the government in

Afghanistan for another ten years beyond the promised withdrawal date of

2014.

Last week President Obama made a surprise pre-dawn trip to Afghanistan to mark the one year anniversary of the killing of Osama bin Laden

and to sign a document further extending the US presence in that

country. The president said, “We’re building an enduring partnership…As

you stand up, you will not stand alone.” What that means in practice is

that the US will continue its efforts to prop up the government in

Afghanistan for another ten years beyond the promised withdrawal date of

2014.

To those of us who believe the US should leave Afghanistan immediately, the president retorted, “We must give Afghanistan the opportunity to stabilize.” But how long will that take, when we have already fought the longest war in our nation’s history at incredible human and economic cost to the nation and no end is in sight?

There is little evidence of any sustained increase in stability in Afghanistan and, in fact, April saw the loss of 34 more American troops and an escalation of violence and upheaval. Within 90 minutes of the president’s departure, seven more people were killed in Kabul by a suicide bomber. It is clear that our presence in that country is not creating any real stability. With Osama bin Laden dead and the al Qaeda presence in Afghanistan virtually non-existent, we are reduced to nation-building in a nation where there is no real nation to build.

Read More @ TheDailyBell.com

by Gabriel M. Mueller, Gold Money:

In this debate, Mr McEwen made an excellent case for gold as “the ultimate currency”. He argued that using gold as currency could help restore fiscal discipline in governments; and that, in essence, it already is the world’s reserve currency.

Conversely, Mr Crofton stated all the typical arguments against the gold standard: that there is not enough gold in the world for everyone; that it would prevent the authorities from controlling the monetary system; that it would hinder the government’s debt financing, etc.

Here are some of my responses to Mr Crofton’s points.

First, in regard to the “not-enough-gold-in-the-world” argument, the error in this thinking is that quantity equals quality.

Last week President Obama made a surprise pre-dawn trip to Afghanistan to mark the one year anniversary of the killing of Osama bin Laden

and to sign a document further extending the US presence in that

country. The president said, “We’re building an enduring partnership…As

you stand up, you will not stand alone.” What that means in practice is

that the US will continue its efforts to prop up the government in

Afghanistan for another ten years beyond the promised withdrawal date of

2014.

Last week President Obama made a surprise pre-dawn trip to Afghanistan to mark the one year anniversary of the killing of Osama bin Laden

and to sign a document further extending the US presence in that

country. The president said, “We’re building an enduring partnership…As

you stand up, you will not stand alone.” What that means in practice is

that the US will continue its efforts to prop up the government in

Afghanistan for another ten years beyond the promised withdrawal date of

2014.To those of us who believe the US should leave Afghanistan immediately, the president retorted, “We must give Afghanistan the opportunity to stabilize.” But how long will that take, when we have already fought the longest war in our nation’s history at incredible human and economic cost to the nation and no end is in sight?

There is little evidence of any sustained increase in stability in Afghanistan and, in fact, April saw the loss of 34 more American troops and an escalation of violence and upheaval. Within 90 minutes of the president’s departure, seven more people were killed in Kabul by a suicide bomber. It is clear that our presence in that country is not creating any real stability. With Osama bin Laden dead and the al Qaeda presence in Afghanistan virtually non-existent, we are reduced to nation-building in a nation where there is no real nation to build.

Read More @ TheDailyBell.com

by Gabriel M. Mueller, Gold Money:

In this debate, Mr McEwen made an excellent case for gold as “the ultimate currency”. He argued that using gold as currency could help restore fiscal discipline in governments; and that, in essence, it already is the world’s reserve currency.

Conversely, Mr Crofton stated all the typical arguments against the gold standard: that there is not enough gold in the world for everyone; that it would prevent the authorities from controlling the monetary system; that it would hinder the government’s debt financing, etc.

Here are some of my responses to Mr Crofton’s points.

First, in regard to the “not-enough-gold-in-the-world” argument, the error in this thinking is that quantity equals quality.

Read More @ GoldMoney.com

from, Bloomberg :

Demand has climbed in the world’s second-largest economy as rising incomes and curbs on property speculation boosted purchases. China may become the biggest user annually this year,

according to a forecast from the producer-funded World Gold Council. Last year, total Indian demand including for jewelry and investment was 933.4 tons to China’s 769.8 tons.

Read More @ Bloomberg.com

Mainland China’s gold imports from Hong Kong surged more

than sixfold in the first quarter, adding to signs that the country may

displace India as the world’s largest consumer of the precious metal on

an annual basis.

Imports from Hong Kong were 135,529 kilograms (135.53 metric tons)

between January and March, from 19,729 kilograms in the year-earlier

period, according to data from the Census and Statistics Department of

the Hong Kong government. Shipments in March rose 59 percent from

February, yesterday’s data showed. Demand has climbed in the world’s second-largest economy as rising incomes and curbs on property speculation boosted purchases. China may become the biggest user annually this year,

according to a forecast from the producer-funded World Gold Council. Last year, total Indian demand including for jewelry and investment was 933.4 tons to China’s 769.8 tons.

Read More @ Bloomberg.com

from KingWorldNews:

With continued uncertainty surrounding global markets, today King

World News interviewed Bill Fleckenstein, President of Fleckenstein

Capital, to get his take on the situation. Fleckenstein told KWN that

despite the volatility, “stocks are going down.” He also predicted

continued collapse in Europe and railed on Warren Buffett and Charlie

Munger. Here is what Fleckenstein had to say: “I mean, look,

they’ve figured out how to skin the paper money machine pretty well.

They’ve benefitted greatly by government bailouts. Buffett’s gotten

himself upside down and sideways in various different financial

entities, and they’ve worked out okay in the end.”

With continued uncertainty surrounding global markets, today King

World News interviewed Bill Fleckenstein, President of Fleckenstein

Capital, to get his take on the situation. Fleckenstein told KWN that

despite the volatility, “stocks are going down.” He also predicted

continued collapse in Europe and railed on Warren Buffett and Charlie

Munger. Here is what Fleckenstein had to say: “I mean, look,

they’ve figured out how to skin the paper money machine pretty well.

They’ve benefitted greatly by government bailouts. Buffett’s gotten

himself upside down and sideways in various different financial

entities, and they’ve worked out okay in the end.”

Bill Fleckenstein Continues @ KingWorldNews.com

With continued uncertainty surrounding global markets, today King

World News interviewed Bill Fleckenstein, President of Fleckenstein

Capital, to get his take on the situation. Fleckenstein told KWN that

despite the volatility, “stocks are going down.” He also predicted

continued collapse in Europe and railed on Warren Buffett and Charlie

Munger. Here is what Fleckenstein had to say: “I mean, look,

they’ve figured out how to skin the paper money machine pretty well.

They’ve benefitted greatly by government bailouts. Buffett’s gotten

himself upside down and sideways in various different financial

entities, and they’ve worked out okay in the end.”

With continued uncertainty surrounding global markets, today King

World News interviewed Bill Fleckenstein, President of Fleckenstein

Capital, to get his take on the situation. Fleckenstein told KWN that

despite the volatility, “stocks are going down.” He also predicted

continued collapse in Europe and railed on Warren Buffett and Charlie

Munger. Here is what Fleckenstein had to say: “I mean, look,

they’ve figured out how to skin the paper money machine pretty well.

They’ve benefitted greatly by government bailouts. Buffett’s gotten

himself upside down and sideways in various different financial

entities, and they’ve worked out okay in the end.”Bill Fleckenstein Continues @ KingWorldNews.com

by Jerome R. Corsi, WND

A private investigator has been unable to find the only eyewitness to

the sudden death of media innovator and conservative activist Andrew

Breitbart.

A private investigator has been unable to find the only eyewitness to

the sudden death of media innovator and conservative activist Andrew

Breitbart.

The apparent disappearance of Christopher Lasseter, who says he saw Breitbart drop to the sidewalk in front of a restaurant, adds to the mystery surrounding Breitbart’s March 1 death.

On the day the Los Angeles County coroner released Breitbart’s autopsy report, a photographic technician at the coroner’s office died suddenly of suspicious causes.

Read More @ WND.com

A private investigator has been unable to find the only eyewitness to

the sudden death of media innovator and conservative activist Andrew

Breitbart.

A private investigator has been unable to find the only eyewitness to

the sudden death of media innovator and conservative activist Andrew

Breitbart.The apparent disappearance of Christopher Lasseter, who says he saw Breitbart drop to the sidewalk in front of a restaurant, adds to the mystery surrounding Breitbart’s March 1 death.

On the day the Los Angeles County coroner released Breitbart’s autopsy report, a photographic technician at the coroner’s office died suddenly of suspicious causes.

Read More @ WND.com

from Gold Core:

While Turkey has assured the U.S. government it will cut purchases of

oil from Iran by 20% this year, its total trade with the Islamic

Republic increased 47% to $4.8 billion in the first quarter from a year

earlier. Sanctions aimed at isolating Iran because of its nuclear

program, combined with revolutions in the Middle East, have spurred a

tripling in the region’s purchases of Turkish precious metals and jewels

to $942 million in the first three months, from $282 million in the

same period last year. This 30% increase in demand is contributing to

gold remaining above $1,600/oz in what has all the hallmarks of another

period of consolidation prior to higher prices. “Turkey is exporting

massive quantities of gold to Iran and Arab Spring countries as citizens

in those countries switch to portable wealth,” Mert Yildiz, chief

economist for Turkey at Renaissance Capital, told Bloomberg on April 30.

The increase in trade with Iran comes as sanctions make it harder for

trading partners such as Turkey, India and China to pay in dollars and

euros. Iran said in February it would accept payment in any local currency or gold.

Reuters report today that Iran is accepting payments in yuan for some

of the crude oil it supplies to China, the Iranian ambassador to the

United Arab Emirates said on Tuesday. “Yes, that is correct,” Mohammed

Reza Fayyaz told Reuters when asked to comment on an earlier report in

The Financial Times.

While Turkey has assured the U.S. government it will cut purchases of

oil from Iran by 20% this year, its total trade with the Islamic

Republic increased 47% to $4.8 billion in the first quarter from a year

earlier. Sanctions aimed at isolating Iran because of its nuclear

program, combined with revolutions in the Middle East, have spurred a

tripling in the region’s purchases of Turkish precious metals and jewels

to $942 million in the first three months, from $282 million in the

same period last year. This 30% increase in demand is contributing to

gold remaining above $1,600/oz in what has all the hallmarks of another

period of consolidation prior to higher prices. “Turkey is exporting

massive quantities of gold to Iran and Arab Spring countries as citizens

in those countries switch to portable wealth,” Mert Yildiz, chief

economist for Turkey at Renaissance Capital, told Bloomberg on April 30.

The increase in trade with Iran comes as sanctions make it harder for

trading partners such as Turkey, India and China to pay in dollars and

euros. Iran said in February it would accept payment in any local currency or gold.

Reuters report today that Iran is accepting payments in yuan for some

of the crude oil it supplies to China, the Iranian ambassador to the

United Arab Emirates said on Tuesday. “Yes, that is correct,” Mohammed

Reza Fayyaz told Reuters when asked to comment on an earlier report in

The Financial Times.

Read More @ GoldCore.com

from RepresentativePress:

While Turkey has assured the U.S. government it will cut purchases of

oil from Iran by 20% this year, its total trade with the Islamic

Republic increased 47% to $4.8 billion in the first quarter from a year

earlier. Sanctions aimed at isolating Iran because of its nuclear

program, combined with revolutions in the Middle East, have spurred a

tripling in the region’s purchases of Turkish precious metals and jewels

to $942 million in the first three months, from $282 million in the

same period last year. This 30% increase in demand is contributing to

gold remaining above $1,600/oz in what has all the hallmarks of another

period of consolidation prior to higher prices. “Turkey is exporting

massive quantities of gold to Iran and Arab Spring countries as citizens

in those countries switch to portable wealth,” Mert Yildiz, chief

economist for Turkey at Renaissance Capital, told Bloomberg on April 30.

The increase in trade with Iran comes as sanctions make it harder for

trading partners such as Turkey, India and China to pay in dollars and

euros. Iran said in February it would accept payment in any local currency or gold.

Reuters report today that Iran is accepting payments in yuan for some

of the crude oil it supplies to China, the Iranian ambassador to the

United Arab Emirates said on Tuesday. “Yes, that is correct,” Mohammed

Reza Fayyaz told Reuters when asked to comment on an earlier report in

The Financial Times.

While Turkey has assured the U.S. government it will cut purchases of

oil from Iran by 20% this year, its total trade with the Islamic

Republic increased 47% to $4.8 billion in the first quarter from a year

earlier. Sanctions aimed at isolating Iran because of its nuclear

program, combined with revolutions in the Middle East, have spurred a

tripling in the region’s purchases of Turkish precious metals and jewels

to $942 million in the first three months, from $282 million in the

same period last year. This 30% increase in demand is contributing to

gold remaining above $1,600/oz in what has all the hallmarks of another

period of consolidation prior to higher prices. “Turkey is exporting

massive quantities of gold to Iran and Arab Spring countries as citizens

in those countries switch to portable wealth,” Mert Yildiz, chief

economist for Turkey at Renaissance Capital, told Bloomberg on April 30.

The increase in trade with Iran comes as sanctions make it harder for

trading partners such as Turkey, India and China to pay in dollars and

euros. Iran said in February it would accept payment in any local currency or gold.

Reuters report today that Iran is accepting payments in yuan for some

of the crude oil it supplies to China, the Iranian ambassador to the

United Arab Emirates said on Tuesday. “Yes, that is correct,” Mohammed

Reza Fayyaz told Reuters when asked to comment on an earlier report in

The Financial Times.Read More @ GoldCore.com

from RepresentativePress:

from Jesse’s Café Américain:

“Hi. I’ve got a tape I want to play.”

“Hi. I’ve got a tape I want to play.”

David Byrne, Talking Heads

I think today was a number 36.

Do you think they could just eliminate the traders and exchanges and run the whole US futures complex with CGI from J. P. Morgan’s servers?

Hi, this is Virtual Maria from the massively multiplayer NYSE…

Just take Charlie Munger’s advice and put your life savings into the equity markets slot machine. But no whining when they take all your money through the mispricing of risk and fraud.

Read More @ JessesCrossRoadsCafe.Blogspot.com

by Doc Medina, Activist Post

Tennessee

and Arizona are leading the way in a movement by several states to stop

the implementation of U.N. Agenda 21. Now that state governments are on

the case we can all relax and forget about the threat to our liberties

in the name of sustainable development, right? Not, at all.

Tennessee

and Arizona are leading the way in a movement by several states to stop

the implementation of U.N. Agenda 21. Now that state governments are on

the case we can all relax and forget about the threat to our liberties

in the name of sustainable development, right? Not, at all.

“Hi. I’ve got a tape I want to play.”

“Hi. I’ve got a tape I want to play.”David Byrne, Talking Heads

I think today was a number 36.

Do you think they could just eliminate the traders and exchanges and run the whole US futures complex with CGI from J. P. Morgan’s servers?

Hi, this is Virtual Maria from the massively multiplayer NYSE…

Just take Charlie Munger’s advice and put your life savings into the equity markets slot machine. But no whining when they take all your money through the mispricing of risk and fraud.

“Charles Munger, the billionaire vice chairman of Berkshire Hathaway Inc., defended the U.S. financial-company rescues of 2008 and told students that people in economic distress should ‘suck it in and cope.’”Unless of course you are a member of one of the mongrel races, and then you do something uncivilized and buy gold.

Bloomberg, Sept 20, 2010

Read More @ JessesCrossRoadsCafe.Blogspot.com

Biderman’s Daily Edge 5/7/2012: The Aftermath of Friday’s BLS “Findings”

Tennessee

and Arizona are leading the way in a movement by several states to stop

the implementation of U.N. Agenda 21. Now that state governments are on

the case we can all relax and forget about the threat to our liberties

in the name of sustainable development, right? Not, at all.

Tennessee

and Arizona are leading the way in a movement by several states to stop

the implementation of U.N. Agenda 21. Now that state governments are on

the case we can all relax and forget about the threat to our liberties

in the name of sustainable development, right? Not, at all.

The Arizona legislation would serve to stop state, county, and city

governments from “adopting or implementing the creed, doctrine,

principles or any tenet of the Declaration and the Statement of

Principles for Sustainable Development”(AZ. SB 1507).

However, the sustainable development matrix already has backups in place.

Some of the backup organizations will hide under

the cover of Economic Development. Who doesn’t want Economic

Development? Lets develop the economy and create jobs, yay! Foreign

Trade Zones advertise the benefits to some businesses while destroying

many others. Lastly, the Rural Council and the National Defense

Resources Preparedness executive order, will be able to tie all loose

ends in the move towards the Agenda 21 goal.

Read More @ Activist Post

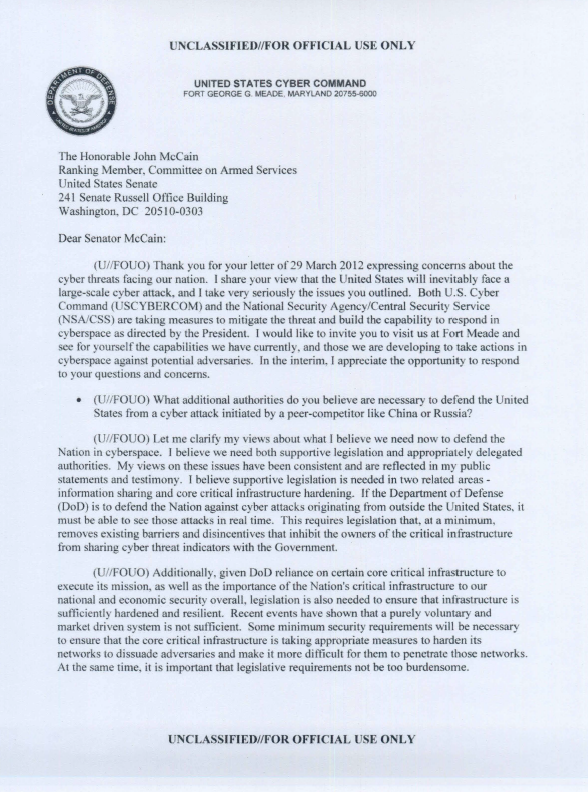

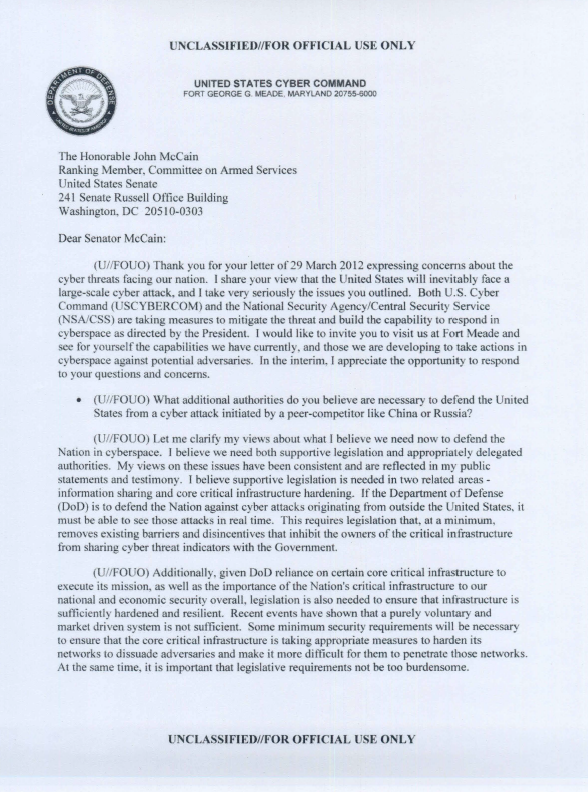

from Public Intelligence:

Thank you for your letter of 29 March 2012 expressing concerns about the cyber threats facing our nation. I share your view that the United States will inevitably face a large-scale cyber attack, and I take very seriously the issues you outlined. Both U.S. Cyber Command (USCYBERCOM) and the National Security Agency/Central Security Service (NSA/CSS) are taking measures to mitigate the threat and build the capability to respond in cyberspace as directed by the President. I would like to invite you to visit us at Fort Meade and see for yourself the capabilities we have currently and those we are developing to take actions in cyberspace against potential adversaries. In the interim, I appreciate the opportunity to respond to your questions and concerns.

Thank you for your letter of 29 March 2012 expressing concerns about the cyber threats facing our nation. I share your view that the United States will inevitably face a large-scale cyber attack, and I take very seriously the issues you outlined. Both U.S. Cyber Command (USCYBERCOM) and the National Security Agency/Central Security Service (NSA/CSS) are taking measures to mitigate the threat and build the capability to respond in cyberspace as directed by the President. I would like to invite you to visit us at Fort Meade and see for yourself the capabilities we have currently and those we are developing to take actions in cyberspace against potential adversaries. In the interim, I appreciate the opportunity to respond to your questions and concerns.

- (U//FOUO) What additional authorities do you believe are necessary to defend the United States from a cyber attack initiated by a peer-competitor like China or Russia? Read More @ PublicIntelligence.net

from Liberty Blitzkrieg

“Ah Brisbane, the east coast Australian city where my brother studied abroad in 2001. Looks like if it is a precious metal and it’s not in your hands well…it’s not really yours!”

“Ah Brisbane, the east coast Australian city where my brother studied abroad in 2001. Looks like if it is a precious metal and it’s not in your hands well…it’s not really yours!”

Key Quotes:

The claims appeared in court documents filed in the Supreme Court which describe a hunt for at least $150,000 worth of “missing” silver ingots amid a fight for control of the company running the high security vault, The Reserve Vault.

The vault, marketed as the most secure location in Queensland, is one of only a handful of such facilities in Australia.

One bullion trader told The Courier-Mail it was used by rich individuals, hedge funds, foreigners and others who “don’t trust banks” as well as dealers in precious metals.

Court documents claim that security cameras were not monitored, that the company appeared to be trading while insolvent and did not keep proper business records, and that Mr Sands had been closely involved in its operation.

Read More @ LibertyBlitzkrieg.com

“Ah Brisbane, the east coast Australian city where my brother studied abroad in 2001. Looks like if it is a precious metal and it’s not in your hands well…it’s not really yours!”

“Ah Brisbane, the east coast Australian city where my brother studied abroad in 2001. Looks like if it is a precious metal and it’s not in your hands well…it’s not really yours!”Key Quotes:

The claims appeared in court documents filed in the Supreme Court which describe a hunt for at least $150,000 worth of “missing” silver ingots amid a fight for control of the company running the high security vault, The Reserve Vault.

The vault, marketed as the most secure location in Queensland, is one of only a handful of such facilities in Australia.

One bullion trader told The Courier-Mail it was used by rich individuals, hedge funds, foreigners and others who “don’t trust banks” as well as dealers in precious metals.

Court documents claim that security cameras were not monitored, that the company appeared to be trading while insolvent and did not keep proper business records, and that Mr Sands had been closely involved in its operation.

Read More @ LibertyBlitzkrieg.com

from KingWorldNews:

With continued volatility in gold and silver,

today King World News interviewed 25 year veteran Caesar Bryan.

Gabelli & Company has over $31 billion under management and Caesar

Bryan has managed the gold fund since its inception in 1994. Caesar

told KWN Europe is moving away from austerity and the fundamentals for

gold are still solid. He also addressed the mining shares, but first,

here is what Caesar had to say about the situation in Europe “There

is a difference between the underlying fundamentals on gold and current

sentiment. The fundamentals for gold are still very solid. We are

going to move from an austerity program in Europe to more of a political

program in Europe.”

With continued volatility in gold and silver,

today King World News interviewed 25 year veteran Caesar Bryan.

Gabelli & Company has over $31 billion under management and Caesar

Bryan has managed the gold fund since its inception in 1994. Caesar

told KWN Europe is moving away from austerity and the fundamentals for

gold are still solid. He also addressed the mining shares, but first,

here is what Caesar had to say about the situation in Europe “There

is a difference between the underlying fundamentals on gold and current

sentiment. The fundamentals for gold are still very solid. We are

going to move from an austerity program in Europe to more of a political

program in Europe.”

Read More @ KingWorldNews.com

With continued volatility in gold and silver,

today King World News interviewed 25 year veteran Caesar Bryan.

Gabelli & Company has over $31 billion under management and Caesar

Bryan has managed the gold fund since its inception in 1994. Caesar

told KWN Europe is moving away from austerity and the fundamentals for

gold are still solid. He also addressed the mining shares, but first,

here is what Caesar had to say about the situation in Europe “There

is a difference between the underlying fundamentals on gold and current

sentiment. The fundamentals for gold are still very solid. We are

going to move from an austerity program in Europe to more of a political

program in Europe.”

With continued volatility in gold and silver,

today King World News interviewed 25 year veteran Caesar Bryan.

Gabelli & Company has over $31 billion under management and Caesar

Bryan has managed the gold fund since its inception in 1994. Caesar

told KWN Europe is moving away from austerity and the fundamentals for

gold are still solid. He also addressed the mining shares, but first,

here is what Caesar had to say about the situation in Europe “There

is a difference between the underlying fundamentals on gold and current

sentiment. The fundamentals for gold are still very solid. We are

going to move from an austerity program in Europe to more of a political

program in Europe.”Read More @ KingWorldNews.com

by Addison Wiggin, SilverBearCafe.com:

The shrinking dollar is a modern problem. The U.S. dollar has been

shrinking since the inception of the Federal Reserve — the very crew

assigned the task of maintaining its value. Of late, the decline is

accelerating at an alarming rate.

The shrinking dollar is a modern problem. The U.S. dollar has been

shrinking since the inception of the Federal Reserve — the very crew

assigned the task of maintaining its value. Of late, the decline is

accelerating at an alarming rate.

For many Americans, the suggestion that the dollar is losing value is unthinkable — even unpatriotic. The problem is not simply a lack of understanding about the nature of wealth and investment used to sustain it.

Our policy makers and economists make no distinction between wealth created through savings and investment in the real economy versus “wealth” created in the markets through asset bubbles brought about by credit policies.

When I tell people this, I feel like I’m addressing a meeting of folks who want to lose weight at the local burger joint. We as individuals — and as a nation — are addicted to cheap, easy credit.

Read More @ SilverBearCafe.com

The shrinking dollar is a modern problem. The U.S. dollar has been

shrinking since the inception of the Federal Reserve — the very crew

assigned the task of maintaining its value. Of late, the decline is

accelerating at an alarming rate.

The shrinking dollar is a modern problem. The U.S. dollar has been

shrinking since the inception of the Federal Reserve — the very crew

assigned the task of maintaining its value. Of late, the decline is

accelerating at an alarming rate.For many Americans, the suggestion that the dollar is losing value is unthinkable — even unpatriotic. The problem is not simply a lack of understanding about the nature of wealth and investment used to sustain it.

Our policy makers and economists make no distinction between wealth created through savings and investment in the real economy versus “wealth” created in the markets through asset bubbles brought about by credit policies.

When I tell people this, I feel like I’m addressing a meeting of folks who want to lose weight at the local burger joint. We as individuals — and as a nation — are addicted to cheap, easy credit.

Read More @ SilverBearCafe.com

by JC Parets, All Star Charts

Gold on the verge

Gold on the verge

…“We’re in an extremely broad trading range, but I think the next move for gold will be up,” Brandt said, forecasting a climb as high as $2,200 an ounce.

Why so bullish? Brandt said the technical chart pattern of the past year resembles a period in 2009 when gold prices drifted sideways for many exasperating months. That go-nowhere trading eventually “exhausted the participants,” Brandt said, setting the stage for a sharp rally. Moreover, he added, the current lackluster movement in the gold market has washed out a large swath of buyers.

Said Brandt: “Markets that have lulled people to sleep are typically ready to have a substantial move.”

Read More @ allstarcharts.com

…“We’re in an extremely broad trading range, but I think the next move for gold will be up,” Brandt said, forecasting a climb as high as $2,200 an ounce.

Why so bullish? Brandt said the technical chart pattern of the past year resembles a period in 2009 when gold prices drifted sideways for many exasperating months. That go-nowhere trading eventually “exhausted the participants,” Brandt said, setting the stage for a sharp rally. Moreover, he added, the current lackluster movement in the gold market has washed out a large swath of buyers.

Said Brandt: “Markets that have lulled people to sleep are typically ready to have a substantial move.”

Read More @ allstarcharts.com

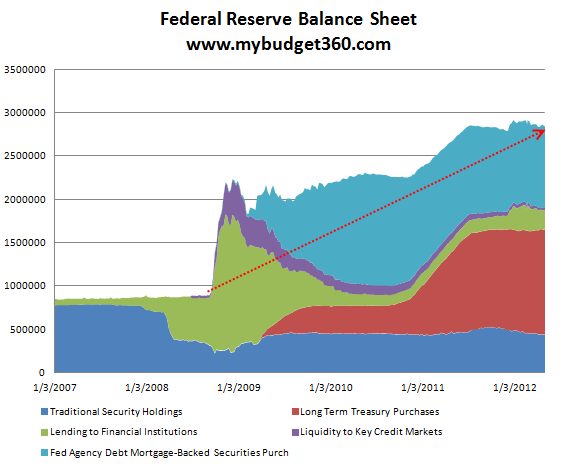

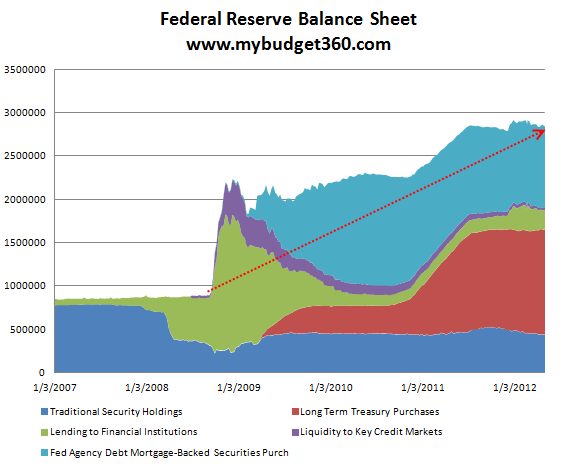

Fed and ECB balance sheet look like financial twins

MyBudget360.com

The Fed and ECB (European Central Bank) have taken notes from the exact playbook in dealing with the global financial crisis.

People tend to believe that these are somehow fully set government

agencies but in reality, they are designed to protect their number one

constituency group. The Fed and ECB have the primary mission of

protecting select financial institutions.

At their core they are where the bankers bank. I was examining the

balance sheets of both the Fed and ECB and from 2008 onward their

reactions to the financial crisis have been nearly mirror images.But ask

most Americans and Europeans if their trillion dollars of asset

maneuvers have worked out. To the contrary, many of the European

nations are back in recessions while in the US the unemployment rate

only falls because people are dropping out of the workforce or being

shadowed out in colleges with massive student debt. The central banks

have succeeded in allowing the financial system to essentially transfer

the waste onto the backs of the public.

The Fed and ECB (European Central Bank) have taken notes from the exact playbook in dealing with the global financial crisis.

People tend to believe that these are somehow fully set government

agencies but in reality, they are designed to protect their number one

constituency group. The Fed and ECB have the primary mission of

protecting select financial institutions.

At their core they are where the bankers bank. I was examining the

balance sheets of both the Fed and ECB and from 2008 onward their

reactions to the financial crisis have been nearly mirror images.But ask

most Americans and Europeans if their trillion dollars of asset

maneuvers have worked out. To the contrary, many of the European

nations are back in recessions while in the US the unemployment rate

only falls because people are dropping out of the workforce or being

shadowed out in colleges with massive student debt. The central banks

have succeeded in allowing the financial system to essentially transfer

the waste onto the backs of the public.

Read More @ MyBudget360.com

MyBudget360.com

The Fed and ECB (European Central Bank) have taken notes from the exact playbook in dealing with the global financial crisis.

People tend to believe that these are somehow fully set government

agencies but in reality, they are designed to protect their number one

constituency group. The Fed and ECB have the primary mission of

protecting select financial institutions.

At their core they are where the bankers bank. I was examining the

balance sheets of both the Fed and ECB and from 2008 onward their

reactions to the financial crisis have been nearly mirror images.But ask

most Americans and Europeans if their trillion dollars of asset

maneuvers have worked out. To the contrary, many of the European

nations are back in recessions while in the US the unemployment rate

only falls because people are dropping out of the workforce or being

shadowed out in colleges with massive student debt. The central banks

have succeeded in allowing the financial system to essentially transfer

the waste onto the backs of the public.

The Fed and ECB (European Central Bank) have taken notes from the exact playbook in dealing with the global financial crisis.

People tend to believe that these are somehow fully set government

agencies but in reality, they are designed to protect their number one

constituency group. The Fed and ECB have the primary mission of

protecting select financial institutions.

At their core they are where the bankers bank. I was examining the

balance sheets of both the Fed and ECB and from 2008 onward their

reactions to the financial crisis have been nearly mirror images.But ask

most Americans and Europeans if their trillion dollars of asset

maneuvers have worked out. To the contrary, many of the European

nations are back in recessions while in the US the unemployment rate

only falls because people are dropping out of the workforce or being

shadowed out in colleges with massive student debt. The central banks

have succeeded in allowing the financial system to essentially transfer

the waste onto the backs of the public.Read More @ MyBudget360.com

CNBC:

It’s not everyday you can find people to take the opposite side of a trade from Warren Buffett and Bill Gates, but then gold is not your average trade.

Gold bugs are known as some of the most passionate investors, so not even high-level slams from the Oracle of Omaha and the founder of Microsoft can cool their fire.

“Absolutely I would take the other side of that trade,” says Michael Pento, founder of Pento Portfolio Strategies in Holmdel, N.J. “The stock market has gone nowhere in nominal terms in 12 years. It makes sense as a default under the current conditions of negative real interest rates to own something that keeps you afloat, that preserves your purchasing power.”

Pento is the former senior economist at Euro Pacific Capital, the firm run by noted gold enthusiast Peter Schiff. Pento has nailed the trajectory of gold’s price for the past three years running.

Read More @ CNBC

It’s not everyday you can find people to take the opposite side of a trade from Warren Buffett and Bill Gates, but then gold is not your average trade.

Gold bugs are known as some of the most passionate investors, so not even high-level slams from the Oracle of Omaha and the founder of Microsoft can cool their fire.

“Absolutely I would take the other side of that trade,” says Michael Pento, founder of Pento Portfolio Strategies in Holmdel, N.J. “The stock market has gone nowhere in nominal terms in 12 years. It makes sense as a default under the current conditions of negative real interest rates to own something that keeps you afloat, that preserves your purchasing power.”

Pento is the former senior economist at Euro Pacific Capital, the firm run by noted gold enthusiast Peter Schiff. Pento has nailed the trajectory of gold’s price for the past three years running.

Read More @ CNBC

from Silver Doctors:

Reuters reports that Argentina purchased gold last September for the

1st time since 2005. No mention on whether the Argentinian Central bank

plans on making an investment in caves per Warren Buffett’s recommendation.

Reuters reports that Argentina purchased gold last September for the

1st time since 2005. No mention on whether the Argentinian Central bank

plans on making an investment in caves per Warren Buffett’s recommendation.

On a more serious note, if Argentina is finally increasing their gold reserves, the dollar is in serious jeopardy of fully losing its reserve currency status as even the most inept governments and central banks are now distancing themselves from the dollar.

Read More @ SilverDoctors.com

Please support our efforts to keep you informed...

Thank You

I'm PayPal Verified

Reuters reports that Argentina purchased gold last September for the

1st time since 2005. No mention on whether the Argentinian Central bank

plans on making an investment in caves per Warren Buffett’s recommendation.

Reuters reports that Argentina purchased gold last September for the

1st time since 2005. No mention on whether the Argentinian Central bank

plans on making an investment in caves per Warren Buffett’s recommendation.On a more serious note, if Argentina is finally increasing their gold reserves, the dollar is in serious jeopardy of fully losing its reserve currency status as even the most inept governments and central banks are now distancing themselves from the dollar.

Read More @ SilverDoctors.com

Please support our efforts to keep you informed...

Thank You

I'm PayPal Verified

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)