German Press: "The Greek Exit Is A Done Deal"

Did France, Italy and Greece think they are the only ones who can float strawmen in the media? No. Once again, Germany shows us how it is done. From Tomorrow's edition of Deutsche Wirtschafts Nachricthen: "The Greece-exit is a done deal: According to the German economic news from financial circles EU and the ECB have abandoned the motherland of democracy as a euro member. The reason is, interestingly, not in the upcoming elections - these are basically become irrelevant. The EU has finally realized that the Greeks have not met any agreements and will not continue not to meet them. A banker: "We helped with the Toika. The help of the troika was tied to conditions. Greece has fulfilled none of the conditions, and has been for months now." So more posturing? Or is Germany truly just so sick and tired of bailing out not just Greece (which pockets between 0% and 20% of any actual bailout cash), and indirectly French banks which as of this moment are the biggest pass thru beneficiaries, and of course the ECB with its tens of billions in old par GGB holdings, that this article is, gasp, founded in reality? Is Europe approaching its own Lehman moment when everyone says "just screw it", and let the dice fall where they may? Many said Lehman could never be allowed to fail. They were wrong. Just as many are saying that Europe will never let Greece leave as the costs to the continent are just too great. Well, judging by tonight's epic fiasco of a Euro-summit, the last thing we would attribute to Europe's leaders is clear and rational thought.Beware Of Proud Greeks And Ultimatums

The

ballot box and economics textbook are on a collision course around the

world, and we thought Nic Colas' (of ConvergEx) analysis of what

behavioral economists call The Ultimatum Game was worth a refresher. That’s where two strangers divide a fixed sum of money, with one person proposing a split and the other accepting or rejecting it.

It’s a one-shot deal, so the proposer tries to work out the minimum

amount required to get the other person to go along. Classical

economics says that a $1 proposal out of a $100 pot should work, but in

real life (and this study has been done everywhere from the

rainforests of South America to the bars of Pittsburgh) it takes 25-50%

offers to win the day. Nic found three recent updates to the

Ultimatum Game that each speak directly to the current political state

of play in Europe and the United States. One shows that proud

people (or those led by nationalist-minded politicians, perhaps) need

higher offers in order to accept a split. The second shows that the

Game works even for small amounts. The last – and the first such study

we've ever seen from a mainland Chinese university – shows that

worries over social status complicate the already difficult mental

calculus of "How much is enough?" Classical economics

would say – and you will hear a lot of policymakers echo – that the

Greeks should take whatever deal they can. Something is better than

nothing. However, all the lessons of the Ultimatum Game studies point

to an entirely different conclusion.

The

ballot box and economics textbook are on a collision course around the

world, and we thought Nic Colas' (of ConvergEx) analysis of what

behavioral economists call The Ultimatum Game was worth a refresher. That’s where two strangers divide a fixed sum of money, with one person proposing a split and the other accepting or rejecting it.

It’s a one-shot deal, so the proposer tries to work out the minimum

amount required to get the other person to go along. Classical

economics says that a $1 proposal out of a $100 pot should work, but in

real life (and this study has been done everywhere from the

rainforests of South America to the bars of Pittsburgh) it takes 25-50%

offers to win the day. Nic found three recent updates to the

Ultimatum Game that each speak directly to the current political state

of play in Europe and the United States. One shows that proud

people (or those led by nationalist-minded politicians, perhaps) need

higher offers in order to accept a split. The second shows that the

Game works even for small amounts. The last – and the first such study

we've ever seen from a mainland Chinese university – shows that

worries over social status complicate the already difficult mental

calculus of "How much is enough?" Classical economics

would say – and you will hear a lot of policymakers echo – that the

Greeks should take whatever deal they can. Something is better than

nothing. However, all the lessons of the Ultimatum Game studies point

to an entirely different conclusion. Spain 'Discovers' 28 Billion In Debt

Back in late March, we pointed out

- much to the chagrin of the LTRO-funded

Spanish-sovereign-debt-stuffing banks of the tapas-nation - that, in a

similarly misleading manner to Greece's 'leverage' the debt-to-GDP data for Spain was significantly higher than official estimates.

Once sovereign guarantees, contingent liabilities and their

responsibilities to the EU and the ECB were included things got a whole

lot uglier. Now, slowly but surely, as reported by Reuters this evening, some of these bilateral guarantees/loans are coming to light. Instead of the expected EUR8 billion of 'regional refinancing' expected for 2012, it turns out there is EUR36 billion

and as Reuters notes "the difference is due to bilateral loans from

Spanish banks to the regions worth 28 billion euros that were not made

public previously" adding that "It could unnerve further investors

concerned by the capacity of Spain to curb its public finances and

reform its banking sector." Critically this stunning 'discovery' should

be worrisome since the plan, given the regions are virtually blocked

from public market financing - due to the high cost of funds, was/is for

the sovereign to guarantee (there's that word again)

their issuance explicitly. Ironically, as de Guindos and Hollande are

chummy borrow-and-spendaholic growth-seekers versus Merkel's

safe-and-austere determination, so now the Spanish authorities must lend

exuberantly to their regions while at the same time demanding deficit

targets are met (or else?) - or as one Reuters' source objects: "You

can't tell them on one side that they have to be austere and on the

other side give them unlimited liquidity". Irony indeed.

Back in late March, we pointed out

- much to the chagrin of the LTRO-funded

Spanish-sovereign-debt-stuffing banks of the tapas-nation - that, in a

similarly misleading manner to Greece's 'leverage' the debt-to-GDP data for Spain was significantly higher than official estimates.

Once sovereign guarantees, contingent liabilities and their

responsibilities to the EU and the ECB were included things got a whole

lot uglier. Now, slowly but surely, as reported by Reuters this evening, some of these bilateral guarantees/loans are coming to light. Instead of the expected EUR8 billion of 'regional refinancing' expected for 2012, it turns out there is EUR36 billion

and as Reuters notes "the difference is due to bilateral loans from

Spanish banks to the regions worth 28 billion euros that were not made

public previously" adding that "It could unnerve further investors

concerned by the capacity of Spain to curb its public finances and

reform its banking sector." Critically this stunning 'discovery' should

be worrisome since the plan, given the regions are virtually blocked

from public market financing - due to the high cost of funds, was/is for

the sovereign to guarantee (there's that word again)

their issuance explicitly. Ironically, as de Guindos and Hollande are

chummy borrow-and-spendaholic growth-seekers versus Merkel's

safe-and-austere determination, so now the Spanish authorities must lend

exuberantly to their regions while at the same time demanding deficit

targets are met (or else?) - or as one Reuters' source objects: "You

can't tell them on one side that they have to be austere and on the

other side give them unlimited liquidity". Irony indeed.

from ArmstrongEconomics:

I have been warning that government is getting VERY aggressive all

because of the Sovereign Debt Crisis. I have warned that this problem

CANNOT be solved in the manner in which they are pursuing – taxing

everyone & everything. They are about to destroy the economy and we

are headed toward a major period of authoritarianism. There is a steady

flow of bills being introduced in Washington that are design to

eliminate the Constitution all to save the Bureaucracy. They are going

to make DWI a federal offense. Sure, drunk drivers are dangerous. The

question becomes what is drunk? When there is money involved and profit

for government, do not be foolish to really think they are doing

anything for society. The kill switch on the Internet is to cut off the

free press and to eliminate the right to assemble since they saw how the

Arab youth used social media to organize their revolutions.

I have been warning that government is getting VERY aggressive all

because of the Sovereign Debt Crisis. I have warned that this problem

CANNOT be solved in the manner in which they are pursuing – taxing

everyone & everything. They are about to destroy the economy and we

are headed toward a major period of authoritarianism. There is a steady

flow of bills being introduced in Washington that are design to

eliminate the Constitution all to save the Bureaucracy. They are going

to make DWI a federal offense. Sure, drunk drivers are dangerous. The

question becomes what is drunk? When there is money involved and profit

for government, do not be foolish to really think they are doing

anything for society. The kill switch on the Internet is to cut off the

free press and to eliminate the right to assemble since they saw how the

Arab youth used social media to organize their revolutions.Now on January 1st, 2013, the US government will be requiring everyone to have direct deposit for Social Security checks and pensions. Why? Well guess what.

Read More @ ArmstrongEconomics.org

GoldSeekRadiodotcom:

Is China Really Liquidating Treasuries?

Maybe the real reason that the Treasury offered China direct access (thus cutting out the middleman and offering China cheaper access than ever) was precisely because China was selling, and because the Treasury was concerned about the effect on rates, and wanted to give China some incentive to keep buying. As Jon Huntsman noted in a 2010 cable leaked by Wikileaks, the PBOC has felt pressured to keep buying, and as various PBOC officials have hinted in recent months, China is actively seeking to convert out of treasuries and into gold. And that makes sense — treasuries are yielding ever deeper negative real rates. People holding treasuries are losing their purchasing power. No wonder the treasury is willing to cut Wall Street out of the deal. And it isn’t like the Treasury would have taken this move lightly — cutting Wall Street out of the equation is a slap in the face to Wall StreetChina HSBC Flash PMI Declines, Economy Now In Contraction For 10 Of Past 11 Months

The

Chinese Schrodinger conundrum, in which two different distinct PMI

indicators continue to paint opposite pictures of the economy, as

explained first here,

continues. Moments ago, the HSBC Flash PMI posted a decline from 49.3

in April to 48.7. This is the 7th consecutive month in which the

economy is in a contraction according to HSBC, and 10th of the last 11.

Needless to say, this is only half of the story, and we expect that

the official Chinese PMI index will post another increase well into

expansionary territory as the random number generator known as

China_Economy.xls spews fresh gibberish every time F9 is hit. In the

meantime, the spin has already begun, worse is better, and futures are

higher simply because the expectation is that another perfectly futile

RRR hike (which does virtually nothing for real cash circulating in the

economy) will follow suit. Of course, if the number had come in over

50, the spin would be that China's economy has entered into a virtuous

loop as goalseeking the narrative to comply with the central planners'

market intervention continues.

The

Chinese Schrodinger conundrum, in which two different distinct PMI

indicators continue to paint opposite pictures of the economy, as

explained first here,

continues. Moments ago, the HSBC Flash PMI posted a decline from 49.3

in April to 48.7. This is the 7th consecutive month in which the

economy is in a contraction according to HSBC, and 10th of the last 11.

Needless to say, this is only half of the story, and we expect that

the official Chinese PMI index will post another increase well into

expansionary territory as the random number generator known as

China_Economy.xls spews fresh gibberish every time F9 is hit. In the

meantime, the spin has already begun, worse is better, and futures are

higher simply because the expectation is that another perfectly futile

RRR hike (which does virtually nothing for real cash circulating in the

economy) will follow suit. Of course, if the number had come in over

50, the spin would be that China's economy has entered into a virtuous

loop as goalseeking the narrative to comply with the central planners'

market intervention continues.Frontline On MF Global's Six Billion Dollar Bet

While

the sur-realities of just what Corzine and the rest of the MF Global

'traders' did has been extensively discussed here and elsewhere, PBS' Frontline provides

the most succinct (and relatively in-depth) documentary on just what

occurred from how the corrupt CEO lobbied regulators who had the power

to stop his risky bets to the endgame realization of the missing

customer money. A narrative, not just of "a bet that went bad", but "a Wall Street morality tale". Must watch!

While

the sur-realities of just what Corzine and the rest of the MF Global

'traders' did has been extensively discussed here and elsewhere, PBS' Frontline provides

the most succinct (and relatively in-depth) documentary on just what

occurred from how the corrupt CEO lobbied regulators who had the power

to stop his risky bets to the endgame realization of the missing

customer money. A narrative, not just of "a bet that went bad", but "a Wall Street morality tale". Must watch!Live Webcast Of European Council Press Conference

Update: Conference over. Mentions of Deposit Guarantees? Zero. Is the market run by idiot algos? Yes, next question.Wondering if Germany did indeed cede to demands for an international deposit guarantee system (of the Eurosystem's $11 trillion in deposits), or if it was all merely a bad dream concocted by several rumormongers who took advantage of stupid algo-matics to ramp stocks 1.5% on absolutely nothing? Then watch the below live press conference from the European Council, starring Gollum, which will make everything clear, and once again confirm why the Einhorn representation of Europe's only strategy is still alive and well.

CARTEL RAID UPDATE: Miles Franklin President Andy Schectman visits

with us to set the record straight about this latest Bankster cartel

raid. Guess what? NOTHING has changed. Andy says these slams are nothing

more than a SUBSIDY and a gift. Physical silver IS money. Physical

gold IS money. And if you don’t hold it, you don’t own it. Visit Miles

Franklin here, and call Andy for a screaming good price on PHYSICAL.

[Ed. Note:

On days like this, it's important to remember the words of those who

are trying to help us see the big picture. In this case, the recent

words of Jim Willie. Today, my pal B5 reminded me of this excerpt from

Willies' latest:]

MY GOLD TRADER SOURCE IS PRIVY TO SOME GOLD TRANSACTIONS AS WITNESS.

THE WALL STREET AND LONDON FIRMS PUSH THE GOLD PRICE DOWN WITH NAKED

SHORT PAPER FUTURES CONTRACTS. THE EASTERN COALITION PUSHES IT DOWN

FARTHER, IDENTIFIES THE ILLIQUID BIG BANKS WITH MARGIN CALLS, REFUSES

CASH TO SATISFY, AND FORCES GOLD SALES AT DISCOUNT PRICES. THE VICTIMS

ARE DRY OF CASH, HURTING MAINLY FROM EUROPEAN DEBT. THE CARTEL MEMBER

BANKS ARE TARGETED IN A MODEL EXECUTION. THE PHENOMENON IS NEW. THE SLOW

PROCESS IS EXPLAINED. HERE ARE SOME SKETCHY DETAILS.

MY GOLD TRADER SOURCE IS PRIVY TO SOME GOLD TRANSACTIONS AS WITNESS.

THE WALL STREET AND LONDON FIRMS PUSH THE GOLD PRICE DOWN WITH NAKED

SHORT PAPER FUTURES CONTRACTS. THE EASTERN COALITION PUSHES IT DOWN

FARTHER, IDENTIFIES THE ILLIQUID BIG BANKS WITH MARGIN CALLS, REFUSES

CASH TO SATISFY, AND FORCES GOLD SALES AT DISCOUNT PRICES. THE VICTIMS

ARE DRY OF CASH, HURTING MAINLY FROM EUROPEAN DEBT. THE CARTEL MEMBER

BANKS ARE TARGETED IN A MODEL EXECUTION. THE PHENOMENON IS NEW. THE SLOW

PROCESS IS EXPLAINED. HERE ARE SOME SKETCHY DETAILS.

The following note came in early May. The important part is that the transactions are conducted off-market. The reason can only be surmised as higher powers are at work, calling the shots, angry at the criminal banker roles, conducting redress, announcing a new Sheriff in town ready and willing to cause some pain in old-fashioned justice, with feet put to the fire. These are financial executions and kills from a repeated model. My suspicion is that the Eastern entities are large hidden creditors who have returned with vengeance in mind but justice in their hearts. He wrote, “There are much bigger things going on behind the curtain. This has very little to do with the usual suspects. Read More…

by Henry Blodget, Finance.Yahoo.com:

from TruthNeverTold :

MY GOLD TRADER SOURCE IS PRIVY TO SOME GOLD TRANSACTIONS AS WITNESS.

THE WALL STREET AND LONDON FIRMS PUSH THE GOLD PRICE DOWN WITH NAKED

SHORT PAPER FUTURES CONTRACTS. THE EASTERN COALITION PUSHES IT DOWN

FARTHER, IDENTIFIES THE ILLIQUID BIG BANKS WITH MARGIN CALLS, REFUSES

CASH TO SATISFY, AND FORCES GOLD SALES AT DISCOUNT PRICES. THE VICTIMS

ARE DRY OF CASH, HURTING MAINLY FROM EUROPEAN DEBT. THE CARTEL MEMBER

BANKS ARE TARGETED IN A MODEL EXECUTION. THE PHENOMENON IS NEW. THE SLOW

PROCESS IS EXPLAINED. HERE ARE SOME SKETCHY DETAILS.

MY GOLD TRADER SOURCE IS PRIVY TO SOME GOLD TRANSACTIONS AS WITNESS.

THE WALL STREET AND LONDON FIRMS PUSH THE GOLD PRICE DOWN WITH NAKED

SHORT PAPER FUTURES CONTRACTS. THE EASTERN COALITION PUSHES IT DOWN

FARTHER, IDENTIFIES THE ILLIQUID BIG BANKS WITH MARGIN CALLS, REFUSES

CASH TO SATISFY, AND FORCES GOLD SALES AT DISCOUNT PRICES. THE VICTIMS

ARE DRY OF CASH, HURTING MAINLY FROM EUROPEAN DEBT. THE CARTEL MEMBER

BANKS ARE TARGETED IN A MODEL EXECUTION. THE PHENOMENON IS NEW. THE SLOW

PROCESS IS EXPLAINED. HERE ARE SOME SKETCHY DETAILS.The following note came in early May. The important part is that the transactions are conducted off-market. The reason can only be surmised as higher powers are at work, calling the shots, angry at the criminal banker roles, conducting redress, announcing a new Sheriff in town ready and willing to cause some pain in old-fashioned justice, with feet put to the fire. These are financial executions and kills from a repeated model. My suspicion is that the Eastern entities are large hidden creditors who have returned with vengeance in mind but justice in their hearts. He wrote, “There are much bigger things going on behind the curtain. This has very little to do with the usual suspects. Read More…

by Henry Blodget, Finance.Yahoo.com:

from TruthNeverTold :

by Jeff Nielson, Bullion Bulls Canada:

Austerity has failed. You won’t see that in any of the headlines from

the media propaganda machine, and for a very good reason: our

intellectually bankrupt governments have no “Plan B”.

Austerity has failed. You won’t see that in any of the headlines from

the media propaganda machine, and for a very good reason: our

intellectually bankrupt governments have no “Plan B”.

The evidence of the colossal failure of Friedman Austerity is both abundant and unequivocal. Greece was an insolvent economy in steady decline when its own “austerity” was commenced. After two years of austerity it was totally bankrupt, and the economy had been so completely destroyed that even after defaulting on 75% of its debt further default already seems inevitable. Austerity transformed an economic decline into one of the most rapid economic collapses in modern history.

Then there is the UK. It began its austerity campaign shortly after Greece, but its own economic collapse is proceeding on schedule. Its monthly budget deficits continue to widen, with the UK government recently reporting i its largest one-month deficit ever for the month of February. Given that the entire raison d’etre of austerity is to shrink deficits, that statistic alone is proof of the complete and utter failure of UK austerity.

Read More @ BullionBullsCanada.com

Please support our efforts to keep you informed...

I'm PayPal Verified

Austerity has failed. You won’t see that in any of the headlines from

the media propaganda machine, and for a very good reason: our

intellectually bankrupt governments have no “Plan B”.

Austerity has failed. You won’t see that in any of the headlines from

the media propaganda machine, and for a very good reason: our

intellectually bankrupt governments have no “Plan B”.The evidence of the colossal failure of Friedman Austerity is both abundant and unequivocal. Greece was an insolvent economy in steady decline when its own “austerity” was commenced. After two years of austerity it was totally bankrupt, and the economy had been so completely destroyed that even after defaulting on 75% of its debt further default already seems inevitable. Austerity transformed an economic decline into one of the most rapid economic collapses in modern history.

Then there is the UK. It began its austerity campaign shortly after Greece, but its own economic collapse is proceeding on schedule. Its monthly budget deficits continue to widen, with the UK government recently reporting i its largest one-month deficit ever for the month of February. Given that the entire raison d’etre of austerity is to shrink deficits, that statistic alone is proof of the complete and utter failure of UK austerity.

Read More @ BullionBullsCanada.com

by Silver Shield, Dont-Tread-On.me :

A week or so ago I did and interview with Elijah Johnson

who is 16. Since that interview he has gone on to interview Bill

Murphy, G. Edward Griffin, and David Morgan. The thing I liked about

Elijah is his pursuit of his passion. I had so much of his fire when I

was a kid but nobody fanned that flame and mentored me or encouraged

me. It took many years of hard effort to shake off my indoctrination

and find my purpose. Even when I did step out there were very few blogs

that would publish my work, so I started DTOM. I hope this allows

people to find their voice and allow others to encourage and guide them

into a more refined message.

A week or so ago I did and interview with Elijah Johnson

who is 16. Since that interview he has gone on to interview Bill

Murphy, G. Edward Griffin, and David Morgan. The thing I liked about

Elijah is his pursuit of his passion. I had so much of his fire when I

was a kid but nobody fanned that flame and mentored me or encouraged

me. It took many years of hard effort to shake off my indoctrination

and find my purpose. Even when I did step out there were very few blogs

that would publish my work, so I started DTOM. I hope this allows

people to find their voice and allow others to encourage and guide them

into a more refined message.

Read More @ Dont-Tread-On.me

A week or so ago I did and interview with Elijah Johnson

who is 16. Since that interview he has gone on to interview Bill

Murphy, G. Edward Griffin, and David Morgan. The thing I liked about

Elijah is his pursuit of his passion. I had so much of his fire when I

was a kid but nobody fanned that flame and mentored me or encouraged

me. It took many years of hard effort to shake off my indoctrination

and find my purpose. Even when I did step out there were very few blogs

that would publish my work, so I started DTOM. I hope this allows

people to find their voice and allow others to encourage and guide them

into a more refined message.

A week or so ago I did and interview with Elijah Johnson

who is 16. Since that interview he has gone on to interview Bill

Murphy, G. Edward Griffin, and David Morgan. The thing I liked about

Elijah is his pursuit of his passion. I had so much of his fire when I

was a kid but nobody fanned that flame and mentored me or encouraged

me. It took many years of hard effort to shake off my indoctrination

and find my purpose. Even when I did step out there were very few blogs

that would publish my work, so I started DTOM. I hope this allows

people to find their voice and allow others to encourage and guide them

into a more refined message.Read More @ Dont-Tread-On.me

By Michelle Chihara, Bloomberg:

During the housing madness, tens of millions of Americans watched a sentimental reality show called “Extreme Makeover: Home Edition.”

Each episode featured a deserving family that was down on its luck —

facing illness, disaster or other hardship. An army of friendly and

local businesses would come to their aid by building a lavish,

all-American vision of home. The show’s peak popularity coincided almost

exactly with the peak of the real-estate bubble.

During the housing madness, tens of millions of Americans watched a sentimental reality show called “Extreme Makeover: Home Edition.”

Each episode featured a deserving family that was down on its luck —

facing illness, disaster or other hardship. An army of friendly and

local businesses would come to their aid by building a lavish,

all-American vision of home. The show’s peak popularity coincided almost

exactly with the peak of the real-estate bubble.

As housing prices ticked up beyond rational levels, “Extreme Makeover” reminded us how much home was worth emotionally. When the helpers finished, we got a tour of the house on our little screens: its seven perfectly appointed bedrooms, its granite counters, its private motocross track or carousel or spaceship room. We wanted those hardworking, innocent, injured people to have that

beautiful house. We wanted it so badly. Every week, we reassured ourselves: Home is priceless! These people deserve those mansions!

When the bubble burst, the show’s ratings declined. Suddenly, the seven bedrooms and the indoor spaceships started to seem … a little extreme. The Dutch stopped building dollhouses when the Golden Age ended. This year, five years into the housing crash, ABC cancelled “Extreme Makeover: Home Edition.” We might ask ourselves what else is coming to an end.

Read More @ Bloomberg

During the housing madness, tens of millions of Americans watched a sentimental reality show called “Extreme Makeover: Home Edition.”

Each episode featured a deserving family that was down on its luck —

facing illness, disaster or other hardship. An army of friendly and

local businesses would come to their aid by building a lavish,

all-American vision of home. The show’s peak popularity coincided almost

exactly with the peak of the real-estate bubble.

During the housing madness, tens of millions of Americans watched a sentimental reality show called “Extreme Makeover: Home Edition.”

Each episode featured a deserving family that was down on its luck —

facing illness, disaster or other hardship. An army of friendly and

local businesses would come to their aid by building a lavish,

all-American vision of home. The show’s peak popularity coincided almost

exactly with the peak of the real-estate bubble. As housing prices ticked up beyond rational levels, “Extreme Makeover” reminded us how much home was worth emotionally. When the helpers finished, we got a tour of the house on our little screens: its seven perfectly appointed bedrooms, its granite counters, its private motocross track or carousel or spaceship room. We wanted those hardworking, innocent, injured people to have that

beautiful house. We wanted it so badly. Every week, we reassured ourselves: Home is priceless! These people deserve those mansions!

When the bubble burst, the show’s ratings declined. Suddenly, the seven bedrooms and the indoor spaceships started to seem … a little extreme. The Dutch stopped building dollhouses when the Golden Age ended. This year, five years into the housing crash, ABC cancelled “Extreme Makeover: Home Edition.” We might ask ourselves what else is coming to an end.

Read More @ Bloomberg

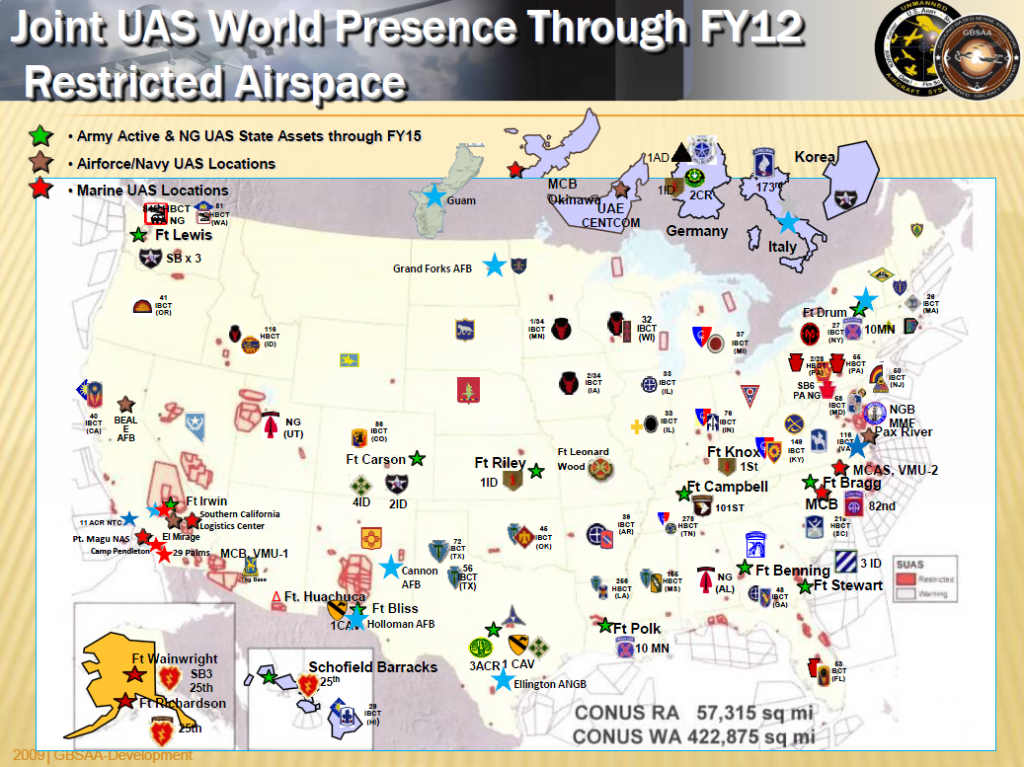

by J. D. Heyes, Natural News:

irst it was traffic cams, then surveillance cameras in business

parking lots. Next in line was Google Earth. Now, increasing domestic

use of drones by the military, police agencies and even universities are

making author George Orwell’s “fictional” novel 1984 – which envisions a

surveillance society and features thought police – look downright

prophetic.

irst it was traffic cams, then surveillance cameras in business

parking lots. Next in line was Google Earth. Now, increasing domestic

use of drones by the military, police agencies and even universities are

making author George Orwell’s “fictional” novel 1984 – which envisions a

surveillance society and features thought police – look downright

prophetic.

Following what has been described as a “landmark” Freedom of Information Act request, the federal government has been forced to reveal that unmanned spy drones are being launched from 63 sites in 20 states.

Further, some of the drones are of a make and model that has been used overseas to target insurgents and terrorists with missiles, the government’s information revealed.

Read More @ NaturalNews.com

irst it was traffic cams, then surveillance cameras in business

parking lots. Next in line was Google Earth. Now, increasing domestic

use of drones by the military, police agencies and even universities are

making author George Orwell’s “fictional” novel 1984 – which envisions a

surveillance society and features thought police – look downright

prophetic.

irst it was traffic cams, then surveillance cameras in business

parking lots. Next in line was Google Earth. Now, increasing domestic

use of drones by the military, police agencies and even universities are

making author George Orwell’s “fictional” novel 1984 – which envisions a

surveillance society and features thought police – look downright

prophetic.Following what has been described as a “landmark” Freedom of Information Act request, the federal government has been forced to reveal that unmanned spy drones are being launched from 63 sites in 20 states.

Further, some of the drones are of a make and model that has been used overseas to target insurgents and terrorists with missiles, the government’s information revealed.

Read More @ NaturalNews.com

from Public Intelligence:

U.S. and allied combat operations continue to highlight the value of

unmanned systems in the modern combat environment. Combatant Commanders

(CCDRs) and warfighters value the inherent features of unmanned systems,

especially their persistence, versatility, and reduced risk to human

life. The U.S. military Services are fielding these systems in rapidly

increasing numbers across all domains: air, ground, and maritime.

Unmanned systems provide diverse capabilities to the joint commander to

conduct operations across the range of military operations:

environmental sensing and battlespace awareness; chemical, biological,

radiological, and nuclear (CBRN) detection; counter-improvised explosive

device (C-IED) capabilities; port security; precision targeting; and

precision strike. Furthermore, the capabilities provided by these

unmanned systems continue to expand.

U.S. and allied combat operations continue to highlight the value of

unmanned systems in the modern combat environment. Combatant Commanders

(CCDRs) and warfighters value the inherent features of unmanned systems,

especially their persistence, versatility, and reduced risk to human

life. The U.S. military Services are fielding these systems in rapidly

increasing numbers across all domains: air, ground, and maritime.

Unmanned systems provide diverse capabilities to the joint commander to

conduct operations across the range of military operations:

environmental sensing and battlespace awareness; chemical, biological,

radiological, and nuclear (CBRN) detection; counter-improvised explosive

device (C-IED) capabilities; port security; precision targeting; and

precision strike. Furthermore, the capabilities provided by these

unmanned systems continue to expand.

Read More @ PublicIntelligence.net

U.S. and allied combat operations continue to highlight the value of

unmanned systems in the modern combat environment. Combatant Commanders

(CCDRs) and warfighters value the inherent features of unmanned systems,

especially their persistence, versatility, and reduced risk to human

life. The U.S. military Services are fielding these systems in rapidly

increasing numbers across all domains: air, ground, and maritime.

Unmanned systems provide diverse capabilities to the joint commander to

conduct operations across the range of military operations:

environmental sensing and battlespace awareness; chemical, biological,

radiological, and nuclear (CBRN) detection; counter-improvised explosive

device (C-IED) capabilities; port security; precision targeting; and

precision strike. Furthermore, the capabilities provided by these

unmanned systems continue to expand.

U.S. and allied combat operations continue to highlight the value of

unmanned systems in the modern combat environment. Combatant Commanders

(CCDRs) and warfighters value the inherent features of unmanned systems,

especially their persistence, versatility, and reduced risk to human

life. The U.S. military Services are fielding these systems in rapidly

increasing numbers across all domains: air, ground, and maritime.

Unmanned systems provide diverse capabilities to the joint commander to

conduct operations across the range of military operations:

environmental sensing and battlespace awareness; chemical, biological,

radiological, and nuclear (CBRN) detection; counter-improvised explosive

device (C-IED) capabilities; port security; precision targeting; and

precision strike. Furthermore, the capabilities provided by these

unmanned systems continue to expand.Read More @ PublicIntelligence.net

by Ethan A. Huff, Natural News:

Radioactive fallout from the Fukushima Daiichi nuclear disaster continues to show up at dangerously high levels in the city of Tokyo, which is located roughly 200 miles from the actual disaster site. According to an analysis of five random soil samples recently taken by nuclear expert Arnie Gundersen, the soil around Tokyo is so contaminated with Fukushima radiation that it would be considered nuclear waste here in the U.S.

If Reactor 4 fuel explodes, the world is done for

According to Gundersen’s estimate, the spent fuel rods in Fukushima’s Reactor 4, which are currently in the process of cooling and have been for over a year, should be fine if nothing further occurs at the site. But during a recent interview, he explained how a seismic event or other unexpected disaster would likely crack the cooling pool and expose these fuel rods, which number in the thousands, to open air.

Read More @ NaturalNews.com

Jim Sinclair’s Commentary

Accidentally Released – and Incredibly Embarrassing – Documents Show How Goldman et al Engaged in ‘Naked Short Selling’ POSTED: May 15, 5:39 PM ET

It doesn’t happen often, but sometimes God smiles on us. Last week, he smiled on investigative reporters everywhere, when the lawyers for Goldman, Sachs slipped on one whopper of a legal banana peel, inadvertently delivering some of the bank’s darker secrets into the hands of the public.

The lawyers for Goldman and Bank of America/Merrill Lynch have been involved in a legal battle for some time – primarily with the retail giant Overstock.com, but also with Rolling Stone, the Economist, Bloomberg, and the New York Times. The banks have been fighting us to keep sealed certain documents that surfaced in the discovery process of an ultimately unsuccessful lawsuit filed by Overstock against the banks.

Last week, in response to an Overstock.com motion to unseal certain documents, the banks’ lawyers, apparently accidentally, filed an unredacted version of Overstock’s motion as an exhibit in their declaration of opposition to that motion. In doing so, they inadvertently entered into the public record a sort of greatest-hits selection of the very material they’ve been fighting for years to keep sealed.

I contacted Morgan Lewis, the firm that represents Goldman in this matter, earlier today, but they haven’t commented as of yet. I wonder if the poor lawyer who FUBARred this thing has already had his organs harvested; his panic is almost palpable in the air. It is both terrible and hilarious to contemplate. The bank has spent a fortune in legal fees trying to keep this material out of the public eye, and here one of their own lawyers goes and dumps it out on the street.

The lawsuit between Overstock and the banks concerned a phenomenon called naked short-selling, a kind of high-finance counterfeiting that, especially prior to the introduction of new regulations in 2008, short-sellers could use to artificially depress the value of the stocks they’ve bet against. The subject of naked short-selling is a) highly technical, and b) very controversial on Wall Street, with many pundits in the financial press for years treating the phenomenon as the stuff of myths and conspiracy theories.

More…

Jim Sinclair’s Commentary

Buy Gold Today Wednesday, May 23, 2012

I don’t often make market calls or indicate when to buy or sell, but…if you have been waiting to buy gold, or have a dollar-cost averaging strategy in play, today served up a very compelling buy signal for gold.

For years, I tracked and traded the gold futures market very closely, and over time I discovered that charts alone were insufficient to provide a useful trading edge; I had to incorporate another set of market indicators, which I’ll get to below.

First a chart of gold:

By this view, gold has been tracing out a series of pennants, and each time, it busted out to make new highs. Where the prior pennants were relatively modest affairs, this most recent one is far larger and far longer lasting than any of the prior ones. Perhaps that’s because gold got ahead of itself back in 2011 and had to work off all of that exuberance, or perhaps someone drew a firmer line in the sand and said "no more."

The implication is that breaking up and out of a bigger flag implies a bigger run. Of course, gold could break down from here, but with everything going on in Europe and the likelihood of QE X, and maybe even a crash landing or two in Asia, the odds of that seem rather remote.

As a final point about the above chart, notice the intense support for gold that exists between 1500 and 1550. With gold currently trading right at 1550 (as of this writing), there’s quite a bit of price support not too far below.

Over time, I learned that charts such as these were helpful, but if I wanted to trade gold on a short or intermediate term basis, I had to be nimble. An indispensible tool in trading gold was tracking shares of gold mining stocks. I quickly learned that the price of gold shares would move up or down in advance of gold or silver moving in price.

We can speculate all we want about why that might be. Perhaps the big hedge funds that are capable of moving the prices of gold would make their first move in the gold shares, or perhaps there’s some other form of inside information about imminent gold sales/purchases that gets telegraphed to the major traders of mining stocks, but the signal of mining shares moving against the current of the price of gold was not to be ignored.

I would often have positions in gold and/or silver open, and then rapidly dump them if the gold mining shares suddenly moved against my positions, meaning if I was long gold and the mining shares suddenly started selling off, I would sell out my gold positions. I learned over time that it was much more profitable to sell first and ask questions later.

More…

Jim Sinclair’s Commentary

Swiss America’s Gold News Daily by DAVID BRADSHAW

Editor, Real Money Perspectives

5.23.12 – A Quadrillion Reasons to Own Gold– Listen

DERIVATIVES MARKET $1.2 QUADRILLION, 20 TIMES WORLD ECONOMY – DailyFinance

A quadrillion is a big number: 1,000 times a trillion. Yet according to one of the world’s leading derivatives experts, Paul Wilmott, who holds a doctorate in applied mathematics from Oxford University, $1.2 quadrillion is the so-called notional value of the worldwide derivatives market. To put that in perspective, the world’s annual gross domestic product is between $50 trillion and $60 trillion.

newsletter@SwissAmerica.com

Jim Sinclair’s Commentary

To quote Porter Stansberry:

Update: GDX

The Market Vectors Gold Miners Fund (GDX) is breaking out to the upside of its inverse "head and shoulders" pattern. Take a look…

![clip_image002[5] clip_image002[5]](http://www.jsmineset.com/wp-content/uploads/2012/05/clip_image0025_thumb1.jpg)

Jim Sinclair’s Commentary

“Goldman clearly knew there was a discrepancy between what it

was telling regulators, and what it was actually doing. “We have to be

careful not to link locates to fails [because] we have told the

regulators we can’t,” one executive is quoted as saying, in the

document.”

Link to full article…

Radioactive fallout from the Fukushima Daiichi nuclear disaster continues to show up at dangerously high levels in the city of Tokyo, which is located roughly 200 miles from the actual disaster site. According to an analysis of five random soil samples recently taken by nuclear expert Arnie Gundersen, the soil around Tokyo is so contaminated with Fukushima radiation that it would be considered nuclear waste here in the U.S.

If Reactor 4 fuel explodes, the world is done for

According to Gundersen’s estimate, the spent fuel rods in Fukushima’s Reactor 4, which are currently in the process of cooling and have been for over a year, should be fine if nothing further occurs at the site. But during a recent interview, he explained how a seismic event or other unexpected disaster would likely crack the cooling pool and expose these fuel rods, which number in the thousands, to open air.

Read More @ NaturalNews.com

Jim Sinclair’s Commentary

To quote the author, "Karma is a b*tch."

I would add "for some." It does not necessarily have to be.

Accidentally Released – and Incredibly Embarrassing – Documents Show How Goldman et al Engaged in ‘Naked Short Selling’ POSTED: May 15, 5:39 PM ET

It doesn’t happen often, but sometimes God smiles on us. Last week, he smiled on investigative reporters everywhere, when the lawyers for Goldman, Sachs slipped on one whopper of a legal banana peel, inadvertently delivering some of the bank’s darker secrets into the hands of the public.

The lawyers for Goldman and Bank of America/Merrill Lynch have been involved in a legal battle for some time – primarily with the retail giant Overstock.com, but also with Rolling Stone, the Economist, Bloomberg, and the New York Times. The banks have been fighting us to keep sealed certain documents that surfaced in the discovery process of an ultimately unsuccessful lawsuit filed by Overstock against the banks.

Last week, in response to an Overstock.com motion to unseal certain documents, the banks’ lawyers, apparently accidentally, filed an unredacted version of Overstock’s motion as an exhibit in their declaration of opposition to that motion. In doing so, they inadvertently entered into the public record a sort of greatest-hits selection of the very material they’ve been fighting for years to keep sealed.

I contacted Morgan Lewis, the firm that represents Goldman in this matter, earlier today, but they haven’t commented as of yet. I wonder if the poor lawyer who FUBARred this thing has already had his organs harvested; his panic is almost palpable in the air. It is both terrible and hilarious to contemplate. The bank has spent a fortune in legal fees trying to keep this material out of the public eye, and here one of their own lawyers goes and dumps it out on the street.

The lawsuit between Overstock and the banks concerned a phenomenon called naked short-selling, a kind of high-finance counterfeiting that, especially prior to the introduction of new regulations in 2008, short-sellers could use to artificially depress the value of the stocks they’ve bet against. The subject of naked short-selling is a) highly technical, and b) very controversial on Wall Street, with many pundits in the financial press for years treating the phenomenon as the stuff of myths and conspiracy theories.

More…

Jim Sinclair’s Commentary

I have a strong respect for Chris Martenson who today published the following:

Buy Gold Today Wednesday, May 23, 2012

I don’t often make market calls or indicate when to buy or sell, but…if you have been waiting to buy gold, or have a dollar-cost averaging strategy in play, today served up a very compelling buy signal for gold.

For years, I tracked and traded the gold futures market very closely, and over time I discovered that charts alone were insufficient to provide a useful trading edge; I had to incorporate another set of market indicators, which I’ll get to below.

First a chart of gold:

By this view, gold has been tracing out a series of pennants, and each time, it busted out to make new highs. Where the prior pennants were relatively modest affairs, this most recent one is far larger and far longer lasting than any of the prior ones. Perhaps that’s because gold got ahead of itself back in 2011 and had to work off all of that exuberance, or perhaps someone drew a firmer line in the sand and said "no more."

The implication is that breaking up and out of a bigger flag implies a bigger run. Of course, gold could break down from here, but with everything going on in Europe and the likelihood of QE X, and maybe even a crash landing or two in Asia, the odds of that seem rather remote.

As a final point about the above chart, notice the intense support for gold that exists between 1500 and 1550. With gold currently trading right at 1550 (as of this writing), there’s quite a bit of price support not too far below.

Over time, I learned that charts such as these were helpful, but if I wanted to trade gold on a short or intermediate term basis, I had to be nimble. An indispensible tool in trading gold was tracking shares of gold mining stocks. I quickly learned that the price of gold shares would move up or down in advance of gold or silver moving in price.

We can speculate all we want about why that might be. Perhaps the big hedge funds that are capable of moving the prices of gold would make their first move in the gold shares, or perhaps there’s some other form of inside information about imminent gold sales/purchases that gets telegraphed to the major traders of mining stocks, but the signal of mining shares moving against the current of the price of gold was not to be ignored.

I would often have positions in gold and/or silver open, and then rapidly dump them if the gold mining shares suddenly moved against my positions, meaning if I was long gold and the mining shares suddenly started selling off, I would sell out my gold positions. I learned over time that it was much more profitable to sell first and ask questions later.

More…

Jim Sinclair’s Commentary

It is nice to see that another source watched the Bank for

International Settlement reporting closely when they halved the notional

value of all the OTC derivatives outstanding by simply changing their

computer model. This unimaginable pile of unfunded crap circulates today

in the Western world financial system guaranteeing QE to infinity

without any doubt whatsoever. I have told you this for years, but let

the reality described herein percolate in your mind.

Swiss America’s Gold News Daily by DAVID BRADSHAW

Editor, Real Money Perspectives

5.23.12 – A Quadrillion Reasons to Own Gold– Listen

DERIVATIVES MARKET $1.2 QUADRILLION, 20 TIMES WORLD ECONOMY – DailyFinance

A quadrillion is a big number: 1,000 times a trillion. Yet according to one of the world’s leading derivatives experts, Paul Wilmott, who holds a doctorate in applied mathematics from Oxford University, $1.2 quadrillion is the so-called notional value of the worldwide derivatives market. To put that in perspective, the world’s annual gross domestic product is between $50 trillion and $60 trillion.

newsletter@SwissAmerica.com

Jim Sinclair’s Commentary

To quote Porter Stansberry:

Update: GDX

The Market Vectors Gold Miners Fund (GDX) is breaking out to the upside of its inverse "head and shoulders" pattern. Take a look…

![clip_image002[5] clip_image002[5]](http://www.jsmineset.com/wp-content/uploads/2012/05/clip_image0025_thumb1.jpg)

Jim Sinclair’s Commentary

Now that the cat is out of the bag don’t expect any remedial action.

Link to full article…

Please support our efforts to keep you informed...

Thank You

I'm PayPal Verified

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment