My Dear Extended Family,

Your greatest enemy now is your emotions. In fact it is the only tool that can be used against you.

If you have not taken margin your worst case scenario is the pain of quoting. I have suggested at various times since $248 gold that you dig a hole, jump in and pull a rock over your head. Each time I did I was derided thoroughly by the shorts. Each time I did the price of gold went significantly higher.

The price of gold is going much higher. The problems that give gold its reason to go higher are growing, not waning.

The entire thesis for gold is illustrated by the three Skiers posted on the weekend.

There is no political will for the results of an EU break up. There is no way the Fed is going austere as the austerity is exploding in the face of Europe politically.

There has been no decline in the amount of notional value of OTC derivatives outstanding. If you think Morgan is the only derivative problem out there you are quite wrong.

Stay the course, stop looking every few minutes, and quiet your emotions. Gold will trade at and above $2111 after this reaction is completed.

Respectfully,

Jim

Total Donations this year...$10.00 Thank You James

Please support our efforts to keep you informed...

Thank You

I'm PayPal Verified

Just because it is never boring after hours:

- MOODY'S DOWNGRADES ITALIAN BANKS; OUTLOOKS REMAIN NEGATIVE

Must Read: "Another Perspective"

Explaining why and how the global monetary system is failing, why it is too late to stop, what will come next, and why the crisis is only financial – not commercial.Still no word on whether Greece buys out Norwegian funds/Spanish 10 yr yields at 6.23%/Italian bonds at 5.75% Red ink in all bourses throughout the globe

Harvey Organ at Harvey Organ's - The Daily Gold and Silver Report - 7 minutes ago

Good

evening Ladies and Gentlemen:

Gold closed down 23.00 to $1560. 60. Silver fell by 53 cents to $28.52.

The markets have digested the news from JPMorgan and now conclude that

the 2 billion dollar loss is just a tip of the iceberg. Most of the

good guys have now concluded that JPMorgan has underwritten massive

quantities of corporate debt via credit default swaps. They then stated

that

While,

by definition, we can't 'know' or predict what the event is that

becomes a Black Swan, it is nevertheless useful to consider which large

risks are relatively underpriced by the market currently and perhaps

more so - what to keep an eye on to consider the odds of such an event. Biancerman (or should it be Bideranco) take on Europe (the pace of the disaster is accelerating and the hope for a Draghi-save is overdone), US Inflation (focus on 3% as a 'problem' and owners-equivalent-rent), The Debt Ceiling

(will Geithner get 'extraordinary' again or will it become the

political hot potato that proves the deficit will never be cut) , and

The Fiscal Cliff (the entire gain in income from the

2009 lows will be removed if this occurs - that doesn't seem like a

positive) in this thought-provoking clip. Reflecting on these realities,

Biderman so eloquently notes "means the smelly stuff is likely to hit

the fan" and Bianco reminds us that, just as in 2008, "hope [in equities] can be a very powerful drug".

While,

by definition, we can't 'know' or predict what the event is that

becomes a Black Swan, it is nevertheless useful to consider which large

risks are relatively underpriced by the market currently and perhaps

more so - what to keep an eye on to consider the odds of such an event. Biancerman (or should it be Bideranco) take on Europe (the pace of the disaster is accelerating and the hope for a Draghi-save is overdone), US Inflation (focus on 3% as a 'problem' and owners-equivalent-rent), The Debt Ceiling

(will Geithner get 'extraordinary' again or will it become the

political hot potato that proves the deficit will never be cut) , and

The Fiscal Cliff (the entire gain in income from the

2009 lows will be removed if this occurs - that doesn't seem like a

positive) in this thought-provoking clip. Reflecting on these realities,

Biderman so eloquently notes "means the smelly stuff is likely to hit

the fan" and Bianco reminds us that, just as in 2008, "hope [in equities] can be a very powerful drug".

by SRSrocco, Silver Doctors:

MY BALLPARK FORMULA FOR CALCULATING COMPLETE MINING COSTS FOR SILVER

MY BALLPARK FORMULA FOR CALCULATING COMPLETE MINING COSTS FOR SILVER

Last year, I wrote an article titled THE COMPLETE COST OF MINING SILVER. In it I used a quick formula to figure what a more true cost would be for an ounce of silver than the CASH COST.

This is an update of the complete cost for mining silver in 2011.

Miners use the CASH COST to compare just how cheap it is to mine silver.

They arrive at their CASH COST by adding all the by-product revenue against an ounce of silver. For example, if a miner has some Gold, Lead and Zinc in a ton of ore, they take the revenue received from those by-product credits and get an INSANELY LOW CASH COST. In 2011, HECLA had a CASH COST of only $1.15 an ounce for silver. To the layman they would think that they would have all this wonderful profit – but they don’t.

Read More @ SilverDoctors.com

Biderman And Bianco On The Black Swan Bonanza

While,

by definition, we can't 'know' or predict what the event is that

becomes a Black Swan, it is nevertheless useful to consider which large

risks are relatively underpriced by the market currently and perhaps

more so - what to keep an eye on to consider the odds of such an event. Biancerman (or should it be Bideranco) take on Europe (the pace of the disaster is accelerating and the hope for a Draghi-save is overdone), US Inflation (focus on 3% as a 'problem' and owners-equivalent-rent), The Debt Ceiling

(will Geithner get 'extraordinary' again or will it become the

political hot potato that proves the deficit will never be cut) , and

The Fiscal Cliff (the entire gain in income from the

2009 lows will be removed if this occurs - that doesn't seem like a

positive) in this thought-provoking clip. Reflecting on these realities,

Biderman so eloquently notes "means the smelly stuff is likely to hit

the fan" and Bianco reminds us that, just as in 2008, "hope [in equities] can be a very powerful drug".

While,

by definition, we can't 'know' or predict what the event is that

becomes a Black Swan, it is nevertheless useful to consider which large

risks are relatively underpriced by the market currently and perhaps

more so - what to keep an eye on to consider the odds of such an event. Biancerman (or should it be Bideranco) take on Europe (the pace of the disaster is accelerating and the hope for a Draghi-save is overdone), US Inflation (focus on 3% as a 'problem' and owners-equivalent-rent), The Debt Ceiling

(will Geithner get 'extraordinary' again or will it become the

political hot potato that proves the deficit will never be cut) , and

The Fiscal Cliff (the entire gain in income from the

2009 lows will be removed if this occurs - that doesn't seem like a

positive) in this thought-provoking clip. Reflecting on these realities,

Biderman so eloquently notes "means the smelly stuff is likely to hit

the fan" and Bianco reminds us that, just as in 2008, "hope [in equities] can be a very powerful drug".  MY BALLPARK FORMULA FOR CALCULATING COMPLETE MINING COSTS FOR SILVER

MY BALLPARK FORMULA FOR CALCULATING COMPLETE MINING COSTS FOR SILVERLast year, I wrote an article titled THE COMPLETE COST OF MINING SILVER. In it I used a quick formula to figure what a more true cost would be for an ounce of silver than the CASH COST.

This is an update of the complete cost for mining silver in 2011.

Miners use the CASH COST to compare just how cheap it is to mine silver.

They arrive at their CASH COST by adding all the by-product revenue against an ounce of silver. For example, if a miner has some Gold, Lead and Zinc in a ton of ore, they take the revenue received from those by-product credits and get an INSANELY LOW CASH COST. In 2011, HECLA had a CASH COST of only $1.15 an ounce for silver. To the layman they would think that they would have all this wonderful profit – but they don’t.

Read More @ SilverDoctors.com

Video: US Stocks Outlook

Admin at Jim Rogers Blog - 1 hour ago

Latest video interview - Business Insider.

Topics: US stocks, Europe, Gold, US dollar, Euro FX;

*Jim Rogers is an author, financial commentator and successful

international investor. He has been frequently featured in Time, The New

York Times, Barron’s, Forbes, Fortune, The Wall Street Journal, The

Financial Times and is a regular guest on Bloomberg and CNBC.*

SP 500 and NDX Futures Daily Charts

by Simon Black, Sovereign Man :

Imagine

you are one of two people playing Monopoly. While you follow the rules

religiously, the other player, who also happens to be the banker, does

not.

Imagine

you are one of two people playing Monopoly. While you follow the rules

religiously, the other player, who also happens to be the banker, does

not.

He routinely appropriates properties. If he doesn’t like the score on the dice, he simply changes them. He continually takes as much money from the bank as he likes. Whenever the rules don’t suit he arbitrarily alters them in his favour.

Oh, and he hates to lose. Rather than concede defeat, he is perfectly willing to set fire to the table.

Imagine no longer. This is the state of the financial markets. You are playing against the world’s central banks.

Read More @ SovereignMan.com

Imagine

you are one of two people playing Monopoly. While you follow the rules

religiously, the other player, who also happens to be the banker, does

not.

Imagine

you are one of two people playing Monopoly. While you follow the rules

religiously, the other player, who also happens to be the banker, does

not.He routinely appropriates properties. If he doesn’t like the score on the dice, he simply changes them. He continually takes as much money from the bank as he likes. Whenever the rules don’t suit he arbitrarily alters them in his favour.

Oh, and he hates to lose. Rather than concede defeat, he is perfectly willing to set fire to the table.

Imagine no longer. This is the state of the financial markets. You are playing against the world’s central banks.

Read More @ SovereignMan.com

from Public Intelligence:

The

Money As A Weapon System – Afghanistan Commander’s Emergency Response

Program Standard Operating Procedure supports the United States

Government Integrated Civilian-Military Campaign Plan and ISAF Theater

Campaign Plan (TCP). The Theater Campaign Plan lists objectives that

include improving governance and socio-economic development in order to

provide a secure environment for sustainable stability that is

observable to the population. CERP provides an enabling tool that

commanders can utilize to achieve these objectives. This is accomplished

through an assortment of projects planned with desired COIN effects

such as addressing urgent needs of the population, promoting GIRoA

legitimacy, countering Taliban influence, increasing needed capacity,

gaining access, building/expanding relationships, promoting economic

growth, and demonstrating positive intent or goodwill.

The

Money As A Weapon System – Afghanistan Commander’s Emergency Response

Program Standard Operating Procedure supports the United States

Government Integrated Civilian-Military Campaign Plan and ISAF Theater

Campaign Plan (TCP). The Theater Campaign Plan lists objectives that

include improving governance and socio-economic development in order to

provide a secure environment for sustainable stability that is

observable to the population. CERP provides an enabling tool that

commanders can utilize to achieve these objectives. This is accomplished

through an assortment of projects planned with desired COIN effects

such as addressing urgent needs of the population, promoting GIRoA

legitimacy, countering Taliban influence, increasing needed capacity,

gaining access, building/expanding relationships, promoting economic

growth, and demonstrating positive intent or goodwill.

Read More @ PublicIntelligence.net

The

Money As A Weapon System – Afghanistan Commander’s Emergency Response

Program Standard Operating Procedure supports the United States

Government Integrated Civilian-Military Campaign Plan and ISAF Theater

Campaign Plan (TCP). The Theater Campaign Plan lists objectives that

include improving governance and socio-economic development in order to

provide a secure environment for sustainable stability that is

observable to the population. CERP provides an enabling tool that

commanders can utilize to achieve these objectives. This is accomplished

through an assortment of projects planned with desired COIN effects

such as addressing urgent needs of the population, promoting GIRoA

legitimacy, countering Taliban influence, increasing needed capacity,

gaining access, building/expanding relationships, promoting economic

growth, and demonstrating positive intent or goodwill.

The

Money As A Weapon System – Afghanistan Commander’s Emergency Response

Program Standard Operating Procedure supports the United States

Government Integrated Civilian-Military Campaign Plan and ISAF Theater

Campaign Plan (TCP). The Theater Campaign Plan lists objectives that

include improving governance and socio-economic development in order to

provide a secure environment for sustainable stability that is

observable to the population. CERP provides an enabling tool that

commanders can utilize to achieve these objectives. This is accomplished

through an assortment of projects planned with desired COIN effects

such as addressing urgent needs of the population, promoting GIRoA

legitimacy, countering Taliban influence, increasing needed capacity,

gaining access, building/expanding relationships, promoting economic

growth, and demonstrating positive intent or goodwill.Read More @ PublicIntelligence.net

Ready Nutrition:

Collapse Investing: Money and Wealth Preservation During Times of Uncertainty and Instability

Collapse Investing: Money and Wealth Preservation During Times of Uncertainty and Instability

We could spend a significant portion of our time outlining the various reasons for why the world’s economic, financial and political systems sit on the brink of an unprecedented paradigm shift that promises to change the landscape of the entire system as it exists today.

I could try to convince you that it’s a good idea to prepare for what’s coming, but the fact that you are reading this article via Tess’ Ready Nutrition newsletter means that you’re already in action planning and execution mode. If you’ve been following the 52 Weeks to Preparedness from the beginning, then you’ve spent the last 44 weeks establishing an emergency and disaster response plan that would probably make FEMA jealous.

Read More @ readynutrition.com

Collapse Investing: Money and Wealth Preservation During Times of Uncertainty and Instability

Collapse Investing: Money and Wealth Preservation During Times of Uncertainty and InstabilityWe could spend a significant portion of our time outlining the various reasons for why the world’s economic, financial and political systems sit on the brink of an unprecedented paradigm shift that promises to change the landscape of the entire system as it exists today.

I could try to convince you that it’s a good idea to prepare for what’s coming, but the fact that you are reading this article via Tess’ Ready Nutrition newsletter means that you’re already in action planning and execution mode. If you’ve been following the 52 Weeks to Preparedness from the beginning, then you’ve spent the last 44 weeks establishing an emergency and disaster response plan that would probably make FEMA jealous.

Read More @ readynutrition.com

David Tepper Goes On Buying Spree, Top-Ticks Financials And Tech Stocks

Sometime around March 31 the market was soaring, and there were still those naive, clueless ones, who thought that 2012 would not be a carbon copy of 2011. Rumors of more QE were becoming quieter and quieter as the S&P was on a rampage, the economy was humming along (courtesy of the reacord warm winter as ZH predicted in January, but this would not be widely accepted for at least 2-3 more weeks), Europe was "fixed" and the world was a lovely place. It is right there that everyone's favorite "baller to the waller" David Tepper went all in and bought anything that moves, or doesn't, in financials and tech. As the chart below shows, after having a mere $764 million in equity AUM at the end of December 31, Appaloosa went on an epic liftathon, and increased its AUM to a whopping $4.1 billion in the span of 3 months.Biderman And Bianco Bury Bernanke's Bond Bull Market Backbone

Digging

into the details of the Fed's balance sheet can sometimes be a

thankless task but Charles Biderman and Jim Bianco have some

fascinating insights into where the real money is being hidden. The

stability of the Fed's balance sheet post-QE2, given we are

borrowing-and-spending over $100bn per month is all down to Operation

Twist and the Fed's creation of demand at the short-end (via

telling banks that rates will be low forever and 'guaranteeing' positive

carry returns on rolling overnight repo) and using this 'cash' to

almost entirely fund longer-term borrowing. In a simple primer

of the Fed's implicit risk-free carry trade, the two chaps note that

the only downside is too much growth or inflation which would cause a

massive unwind of these positions (leading only to further bailouts).

Critically though, they explain the fact that Operation Twist

(and its implicit off-balance-sheet funding of this risk-free carry

trade) is nothing more than the Fed's version of the ECB's LTRO

- as the banks are 'encouraged' to buy short-term government debt with

risk-free-carry expectations - implying the Fed's balance sheet could

in fact be considerably larger than it appears. Yet more ponzinomics

explained in a simple way - that surely eventually will trickle down to

the masses who will question the emperor's clothing.

Digging

into the details of the Fed's balance sheet can sometimes be a

thankless task but Charles Biderman and Jim Bianco have some

fascinating insights into where the real money is being hidden. The

stability of the Fed's balance sheet post-QE2, given we are

borrowing-and-spending over $100bn per month is all down to Operation

Twist and the Fed's creation of demand at the short-end (via

telling banks that rates will be low forever and 'guaranteeing' positive

carry returns on rolling overnight repo) and using this 'cash' to

almost entirely fund longer-term borrowing. In a simple primer

of the Fed's implicit risk-free carry trade, the two chaps note that

the only downside is too much growth or inflation which would cause a

massive unwind of these positions (leading only to further bailouts).

Critically though, they explain the fact that Operation Twist

(and its implicit off-balance-sheet funding of this risk-free carry

trade) is nothing more than the Fed's version of the ECB's LTRO

- as the banks are 'encouraged' to buy short-term government debt with

risk-free-carry expectations - implying the Fed's balance sheet could

in fact be considerably larger than it appears. Yet more ponzinomics

explained in a simple way - that surely eventually will trickle down to

the masses who will question the emperor's clothing.JPM Chase Chairman, Jamie Dimon, The Whale Man, And Glass-Steagall

It’s 1933 and the country has undergone

several years of painful Depression following the 1920s speculation

that crashed in the fall of 1929. Investigations into the bank related

causes began under Republican President, Herbert Hoover and continued

under Democratic President, FDR. Okay, that’s pretty common knowledge.

But, here’s something that isn’t: of all the giant banks operating their

trusts schemes and taking advantage of off-book deals, and

international bets in the late 1920s, it was an incoming head of Chase

(replacing Al Wiggins who shorted Chase stock in a network of fraud)

that advocated for Glass-Steagall. Indeed, despite all pedigree to the

opposite (his father was Senator Nelson Aldrich architect of the Federal

Reserve and brother-in-law, John D. Rockefeller), Chase Chair,

Winthrop Aldrich, took to the front pages of the New York Times

in March, 1933 to pitch decisive separation of commercial and

speculative activity arguments. Fellow bankers hated him. His motives

weren’t totally altruistic to be sure, but somewhere in his calculation

that Chase would survive a separation of activities and emerge

stronger than rival, Morgan Bank, was an awareness that something more –

permanent – had to be put in place if only to save the banking

industry from future confidence breaches and loss. It turned out he was

right. And wrong. (much more on that in my next book, research still ongoing.)

Financial history has a sense of irony. JPM Chase was the

post-Glass-Steagall repeal marriage, 66 years in the making, of Morgan

Bank and Chase. Today, it is the largest bank in America, possessing

greater control of the nation’s cash than any other bank. It also has

the largest derivatives exposure ($70 trillion) including nearly $6

trillion worth of credit derivatives.

Deja Deja Deja Etc. As S&P 500 Closes Below 50DMA First Time Since November

It

happened again. Just like the last five days in a row - post-Europe

close euphoria gives way to oops-Europe-will-open-tomorrow-reality

dysphoria. The S&P 500 e-mini futures (ES) closed below their 50DMA for the first since November today as it has dropped 7 of the last 9 days.

Financials were a disaster (-2%) as the reality of a levered bet on

the Bernanke Put and economic growth are unwound on a total and utter

lack of trust (back below 100DMA again) and as we noted BofA is

starting to converge back with its peers (and broadly financial stocks

with their CDS). With JPM back below $36 and its 200DMA and AAPL

testing its pre-earnings lows, markets are hotting up and Treasuries

were bid all the way to the close with the long-end down 6-7bps today

alone (10Y with a 1.77% handle). IG and HY credit

underperformed stocks on the day as the JPM overhang continues to

pressure the indices - though the skew is collapsing fast. VIX jumped

to its highest close in 4 months at 21.87%. IG9 10Y jumped over 8bps

more today to 147bps mid, now 30bps from its 5/1 swing low spead. The

USD rose further and EURUSD dropped back below 1.29 for the first time

in 4 months but perhaps AUD losing pairty with the USD was the bigger

news - back to 5 month lows.

It

happened again. Just like the last five days in a row - post-Europe

close euphoria gives way to oops-Europe-will-open-tomorrow-reality

dysphoria. The S&P 500 e-mini futures (ES) closed below their 50DMA for the first since November today as it has dropped 7 of the last 9 days.

Financials were a disaster (-2%) as the reality of a levered bet on

the Bernanke Put and economic growth are unwound on a total and utter

lack of trust (back below 100DMA again) and as we noted BofA is

starting to converge back with its peers (and broadly financial stocks

with their CDS). With JPM back below $36 and its 200DMA and AAPL

testing its pre-earnings lows, markets are hotting up and Treasuries

were bid all the way to the close with the long-end down 6-7bps today

alone (10Y with a 1.77% handle). IG and HY credit

underperformed stocks on the day as the JPM overhang continues to

pressure the indices - though the skew is collapsing fast. VIX jumped

to its highest close in 4 months at 21.87%. IG9 10Y jumped over 8bps

more today to 147bps mid, now 30bps from its 5/1 swing low spead. The

USD rose further and EURUSD dropped back below 1.29 for the first time

in 4 months but perhaps AUD losing pairty with the USD was the bigger

news - back to 5 month lows.Sex, Money and Largesse - The Hidden Depression

"Sex" and "Money"

are probably two of the most powerful words in the English language.

First, those two words got you to look at this article. They also sell

products, books and services from "How To Have Better Sex" to "How To Make More Money"

— ostensibly so you can have more of the former. Unfortunately, they

are also the two primary causes of divorce in the country today... The

problem for American families today, despite media commentary to the

contrary, is simply the inability to maintain their current standard of

living. When income remains stagnant or falls, due to job loss or

reduction in pay, the impact on the budget at home is significant when

there are already very low saving rates and the inability to access a

tight credit market. The recent surge in consumer debt, with little

relative increase in overall personal consumption expenditures, shows

this to be the case. For Main Street the economy remains mired at

sub-par growth rates three years into a post-recessionary environment.

These financial strains are pervasive and continue to weigh on families

and their relationships. While it is true that "money can't buy happiness" try asking a couple who are living on food stamps and working two part-time jobs just to "get by" about how "happy" they are. Even as the media trumpets that the Fed has saved the economy from a "depression," it might

just be a statistical victory at best. The government may say this is

not the 1930's where bread lines formed outside the corner soup

kitchen, however, for many American's the only difference is that they

are found at the mailbox and online instead.

"Sex" and "Money"

are probably two of the most powerful words in the English language.

First, those two words got you to look at this article. They also sell

products, books and services from "How To Have Better Sex" to "How To Make More Money"

— ostensibly so you can have more of the former. Unfortunately, they

are also the two primary causes of divorce in the country today... The

problem for American families today, despite media commentary to the

contrary, is simply the inability to maintain their current standard of

living. When income remains stagnant or falls, due to job loss or

reduction in pay, the impact on the budget at home is significant when

there are already very low saving rates and the inability to access a

tight credit market. The recent surge in consumer debt, with little

relative increase in overall personal consumption expenditures, shows

this to be the case. For Main Street the economy remains mired at

sub-par growth rates three years into a post-recessionary environment.

These financial strains are pervasive and continue to weigh on families

and their relationships. While it is true that "money can't buy happiness" try asking a couple who are living on food stamps and working two part-time jobs just to "get by" about how "happy" they are. Even as the media trumpets that the Fed has saved the economy from a "depression," it might

just be a statistical victory at best. The government may say this is

not the 1930's where bread lines formed outside the corner soup

kitchen, however, for many American's the only difference is that they

are found at the mailbox and online instead.

By Jordan Roy Byrne, The Market Oracle:

Normally

catching a bottom is not difficult. Bottoms tend to occur instantly

while market tops form during a process. Yet, I’ve found that bottoms of

long-term significance do not occur instantly. Like tops, they can take

time to develop. For example, think about late 2008 to early 2009.

Commodities hit their price low in December but the bottoming process

began in October and wasn’t complete until May. Emerging markets hit

their low in November but the process began in October and ended in

March. Returning to the present, we see that Gold and Silver look set to

retest their late December lows. Our work leads us to argue that the

metals will successfully retest their lows and soon emerge from what in

the future will be considered a major bottom in-line with 2008, 2005 and

2001.

Normally

catching a bottom is not difficult. Bottoms tend to occur instantly

while market tops form during a process. Yet, I’ve found that bottoms of

long-term significance do not occur instantly. Like tops, they can take

time to develop. For example, think about late 2008 to early 2009.

Commodities hit their price low in December but the bottoming process

began in October and wasn’t complete until May. Emerging markets hit

their low in November but the process began in October and ended in

March. Returning to the present, we see that Gold and Silver look set to

retest their late December lows. Our work leads us to argue that the

metals will successfully retest their lows and soon emerge from what in

the future will be considered a major bottom in-line with 2008, 2005 and

2001.

We begin with a daily chart of Gold which shows its daily closing prices and a volatility indicator. The percentage figure refers to the percent bullish reading from the daily sentiment index. As we noted recently, each bottom in Gold (except 2008) has come during a period of low and declining volatility. Volatility is currently at a 9-month low while only 7% of traders are bullish on Gold.

Read More @ TheMarketOracle.co.uk

Normally

catching a bottom is not difficult. Bottoms tend to occur instantly

while market tops form during a process. Yet, I’ve found that bottoms of

long-term significance do not occur instantly. Like tops, they can take

time to develop. For example, think about late 2008 to early 2009.

Commodities hit their price low in December but the bottoming process

began in October and wasn’t complete until May. Emerging markets hit

their low in November but the process began in October and ended in

March. Returning to the present, we see that Gold and Silver look set to

retest their late December lows. Our work leads us to argue that the

metals will successfully retest their lows and soon emerge from what in

the future will be considered a major bottom in-line with 2008, 2005 and

2001.

Normally

catching a bottom is not difficult. Bottoms tend to occur instantly

while market tops form during a process. Yet, I’ve found that bottoms of

long-term significance do not occur instantly. Like tops, they can take

time to develop. For example, think about late 2008 to early 2009.

Commodities hit their price low in December but the bottoming process

began in October and wasn’t complete until May. Emerging markets hit

their low in November but the process began in October and ended in

March. Returning to the present, we see that Gold and Silver look set to

retest their late December lows. Our work leads us to argue that the

metals will successfully retest their lows and soon emerge from what in

the future will be considered a major bottom in-line with 2008, 2005 and

2001.We begin with a daily chart of Gold which shows its daily closing prices and a volatility indicator. The percentage figure refers to the percent bullish reading from the daily sentiment index. As we noted recently, each bottom in Gold (except 2008) has come during a period of low and declining volatility. Volatility is currently at a 9-month low while only 7% of traders are bullish on Gold.

Read More @ TheMarketOracle.co.uk

It's An Interconnected World After All

"The

US recovery must overcome the European divorce and the China slowdown

in order for the US to grow more than 2%" is how JPMorgan's Michael

Cembalest describes the reality of an un-decoupled world. There is some

divergence as while the US economy if only growing at 2.0% and

regional manufacturing surveys have rolled over, other economic

indicators (JOLTS, railcar loadings, even select housing markets) are

picking up. His point being that these trends will need to coalesce into

more household spending (not just on cars) and capital spending in

order for the US growth to grow more than 2%. For that to happen, some

clarity may be needed on both the “2013 fiscal cliff’ and the “long

term entitlement bomb”, which unfortunately calls for opposing fiscal

measures to mitigate them. It will be hard for the world to grow

if China depends on Europe which depends on China which depends on the

US which depends on China and Europe. It’s an odd market: in the US, 98%

of the S&P 500’s cumulative 27% return since January 2010 occurred

either during corporate earnings season, or right after QE programs. The rest of the time, the S&P 500 is flat, since the economic news has not been that good.

"The

US recovery must overcome the European divorce and the China slowdown

in order for the US to grow more than 2%" is how JPMorgan's Michael

Cembalest describes the reality of an un-decoupled world. There is some

divergence as while the US economy if only growing at 2.0% and

regional manufacturing surveys have rolled over, other economic

indicators (JOLTS, railcar loadings, even select housing markets) are

picking up. His point being that these trends will need to coalesce into

more household spending (not just on cars) and capital spending in

order for the US growth to grow more than 2%. For that to happen, some

clarity may be needed on both the “2013 fiscal cliff’ and the “long

term entitlement bomb”, which unfortunately calls for opposing fiscal

measures to mitigate them. It will be hard for the world to grow

if China depends on Europe which depends on China which depends on the

US which depends on China and Europe. It’s an odd market: in the US, 98%

of the S&P 500’s cumulative 27% return since January 2010 occurred

either during corporate earnings season, or right after QE programs. The rest of the time, the S&P 500 is flat, since the economic news has not been that good.Full LightSquared Org Chart

Good

news: it is not the Enron (wall of pain) org chart. Bad news: it is

the SkyTerra, pardon, LightSquared one. Bad for Falcone that is and its

various unsecured creditors. Good for Milbank Tweed which has just

started billing hundreds of attorneys to the estate at about $500/hour

on average. Expect many, many more bankruptcy professionals to get

involved shortly in this fee bonanza in a desert of recent restructuring

assignments. Time for Centerview to shine.

Good

news: it is not the Enron (wall of pain) org chart. Bad news: it is

the SkyTerra, pardon, LightSquared one. Bad for Falcone that is and its

various unsecured creditors. Good for Milbank Tweed which has just

started billing hundreds of attorneys to the estate at about $500/hour

on average. Expect many, many more bankruptcy professionals to get

involved shortly in this fee bonanza in a desert of recent restructuring

assignments. Time for Centerview to shine.Phil Falcone's Downfall Is Complete: LightSquared Files For Bankruptcy

The fall of the man, whom everyone wanted to work for back in 2006, is now complete.- LIGHTSQUARED, FAILED WIRELESS VENTURE, FILES FOR BANKRUPTCY

- LIGHTSQUARED 74 PERCENT-OWNED BY FALCONE’S HARBINGER CAPITAL

- LIGHTSQUARED’S PLANNED HIGH-SPEED NETWORK INTERFERED WITH GPS

By UnpuncturedCycle via, The Market Oracle:

We now see signs of deflation everywhere except of course in the news where they still insist in talking about the possibility of inflation.

On Friday we saw that a drop in gasoline prices dragged producer prices

down in April by the most in six months, according to data released by

the government on Friday.

We now see signs of deflation everywhere except of course in the news where they still insist in talking about the possibility of inflation.

On Friday we saw that a drop in gasoline prices dragged producer prices

down in April by the most in six months, according to data released by

the government on Friday.

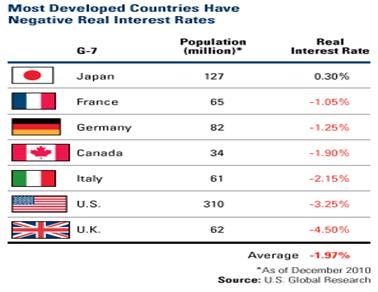

According to the news services it’s unlikely that officials at the Federal Reserve will be worried by April’s PPI report, as they continue to see interest rates at ultra-low levels through the end of 2014. Then again rates are at historically low levels nominally and they’re already negative in real terms so what else can they do? Of course they could decide to live within their means but that would drive the world economy into a deep dark depression, so they’ll opt for more printing. Quantitative easing is a euphemism for printing and we’ve already had several rounds of easing here in the US and now it is being tried in Europe and Japan. Even the IMF is getting into the act.

Read More @ TheMarketOracle.co.uk

We now see signs of deflation everywhere except of course in the news where they still insist in talking about the possibility of inflation.

On Friday we saw that a drop in gasoline prices dragged producer prices

down in April by the most in six months, according to data released by

the government on Friday.

We now see signs of deflation everywhere except of course in the news where they still insist in talking about the possibility of inflation.

On Friday we saw that a drop in gasoline prices dragged producer prices

down in April by the most in six months, according to data released by

the government on Friday.According to the news services it’s unlikely that officials at the Federal Reserve will be worried by April’s PPI report, as they continue to see interest rates at ultra-low levels through the end of 2014. Then again rates are at historically low levels nominally and they’re already negative in real terms so what else can they do? Of course they could decide to live within their means but that would drive the world economy into a deep dark depression, so they’ll opt for more printing. Quantitative easing is a euphemism for printing and we’ve already had several rounds of easing here in the US and now it is being tried in Europe and Japan. Even the IMF is getting into the act.

Read More @ TheMarketOracle.co.uk

from CapitalAccount:

from TrimTabs:

Mint Director’s Conference participants look to future

by Jeff Starck, Coin World:

The future of currency, physical and digital, consumed much of the discussion time during the 27th Mint Director’s Conference conducted May 7 and 8 in Austria.

The future of currency, physical and digital, consumed much of the discussion time during the 27th Mint Director’s Conference conducted May 7 and 8 in Austria.

The conference, hosted by the Austrian Mint in Vienna, was an industry gathering for officials from the mints that strike coins, the central banks that issue them, and the equipment manufacturers and material providers employed in the process. Also participating were affiliated parties including some of the dealers and distributors that channel the coins to customers.

The theme of the conference was “Tradition meets innovation,” but it may well have been “remaining relevant in a digital age,” based on the presentations and discussions that resulted.

Read More @ CoinWorld.com

by Aaron Task, Finance.Yahoo.com:

Gold, oil, copper and a host of other commodities were heading lower Monday morning, continuing a recent pattern that has some wondering if the commodity “super-cycle” has come to an end.

After falling 13% in 2011, the Dow Jones-UBS Commodity Index entered this week at its lowest level since September 2010 amid concern about slowing global growth hurting demand. In addition, the dollar has benefited from Europe’s ongoing debt crisis, resulting in lower prices for hard assets, notably gold and silver.

by Jeff Starck, Coin World:

The future of currency, physical and digital, consumed much of the discussion time during the 27th Mint Director’s Conference conducted May 7 and 8 in Austria.

The future of currency, physical and digital, consumed much of the discussion time during the 27th Mint Director’s Conference conducted May 7 and 8 in Austria.The conference, hosted by the Austrian Mint in Vienna, was an industry gathering for officials from the mints that strike coins, the central banks that issue them, and the equipment manufacturers and material providers employed in the process. Also participating were affiliated parties including some of the dealers and distributors that channel the coins to customers.

The theme of the conference was “Tradition meets innovation,” but it may well have been “remaining relevant in a digital age,” based on the presentations and discussions that resulted.

Read More @ CoinWorld.com

by Aaron Task, Finance.Yahoo.com:

Gold, oil, copper and a host of other commodities were heading lower Monday morning, continuing a recent pattern that has some wondering if the commodity “super-cycle” has come to an end.

After falling 13% in 2011, the Dow Jones-UBS Commodity Index entered this week at its lowest level since September 2010 amid concern about slowing global growth hurting demand. In addition, the dollar has benefited from Europe’s ongoing debt crisis, resulting in lower prices for hard assets, notably gold and silver.

from KingWorldNews:

With

a sea of red across virtually all markets, today King World News

interviewed acclaimed money manager Stephen Leeb, Chairman & Chief

Investment Officer of Leeb Capital Management. Leeb told KWN that

global financial markets are in an extraordinarily unstable situation.

Leeb also said investors should expect to see more “tumutuous events”

ahead. But first, here is what Leeb had to say about the derivatives

crisis the world faces today: “When you start talking about

quadrillions (of dollars), you are talking about numbers that are 1,000

times larger than $1 trillion. GDP is measured in trillions, and when

you start talking quadrillions, you are talking about numbers that dwarf

worldwide GDP.”

With

a sea of red across virtually all markets, today King World News

interviewed acclaimed money manager Stephen Leeb, Chairman & Chief

Investment Officer of Leeb Capital Management. Leeb told KWN that

global financial markets are in an extraordinarily unstable situation.

Leeb also said investors should expect to see more “tumutuous events”

ahead. But first, here is what Leeb had to say about the derivatives

crisis the world faces today: “When you start talking about

quadrillions (of dollars), you are talking about numbers that are 1,000

times larger than $1 trillion. GDP is measured in trillions, and when

you start talking quadrillions, you are talking about numbers that dwarf

worldwide GDP.”

Stephen Leeb continues @ KingWorldNews.com

With

a sea of red across virtually all markets, today King World News

interviewed acclaimed money manager Stephen Leeb, Chairman & Chief

Investment Officer of Leeb Capital Management. Leeb told KWN that

global financial markets are in an extraordinarily unstable situation.

Leeb also said investors should expect to see more “tumutuous events”

ahead. But first, here is what Leeb had to say about the derivatives

crisis the world faces today: “When you start talking about

quadrillions (of dollars), you are talking about numbers that are 1,000

times larger than $1 trillion. GDP is measured in trillions, and when

you start talking quadrillions, you are talking about numbers that dwarf

worldwide GDP.”

With

a sea of red across virtually all markets, today King World News

interviewed acclaimed money manager Stephen Leeb, Chairman & Chief

Investment Officer of Leeb Capital Management. Leeb told KWN that

global financial markets are in an extraordinarily unstable situation.

Leeb also said investors should expect to see more “tumutuous events”

ahead. But first, here is what Leeb had to say about the derivatives

crisis the world faces today: “When you start talking about

quadrillions (of dollars), you are talking about numbers that are 1,000

times larger than $1 trillion. GDP is measured in trillions, and when

you start talking quadrillions, you are talking about numbers that dwarf

worldwide GDP.”Stephen Leeb continues @ KingWorldNews.com

by Bill Bonner, DailyReckoning.com.au:

The new Japan is China. It’s an export economy with too much capacity…like Japan in ’89.

The new Japan is China. It’s an export economy with too much capacity…like Japan in ’89.

The new Greece is Spain. It’s got mortgage debt up the kazoo…

The new Ireland is the old Ireland. Yes, Ireland is now exporting people again…at the fastest rate since the 19th century.

Our old friend Jim Davidson says the new America is Brazil. But what happened to the old America? It’s the new Argentina. Whoa! What a topsy-turvy world! The US is going broke…and going rogue. Just like Argentina in the ’80s…

Read More @ DailyReckoning.com.au

The new Japan is China. It’s an export economy with too much capacity…like Japan in ’89.

The new Japan is China. It’s an export economy with too much capacity…like Japan in ’89.The new Greece is Spain. It’s got mortgage debt up the kazoo…

The new Ireland is the old Ireland. Yes, Ireland is now exporting people again…at the fastest rate since the 19th century.

Our old friend Jim Davidson says the new America is Brazil. But what happened to the old America? It’s the new Argentina. Whoa! What a topsy-turvy world! The US is going broke…and going rogue. Just like Argentina in the ’80s…

Read More @ DailyReckoning.com.au

from TheAlexJonesChannel:

“Our time has come, and it won’t be stopped,” the Congressman noted during a 50-minute long speech. “In the short range, there will be bumps. In the long range, if we are dedicated, we will change this country and we will change the world.”

“Our time has come, and it won’t be stopped,” the Congressman noted during a 50-minute long speech. “In the short range, there will be bumps. In the long range, if we are dedicated, we will change this country and we will change the world.”

Goldman Market Summary: Dumb Money Joins The Dumpfest

Last week the hedgies were dumping, as the "momo whale" dumb money was chasing things higher on low volume intraday levitation. Today, idiot money (which is known thus for a reason) joins the dump fest. And according to Goldman, "the selling pressure is still muted." And unless the Politburo of the Developed World comes up with a Deus ex Printerium fast, muted may soon go to Max Volume.

by Richard William Posner, Activist Post

Humanity Has Been Herded Into A Cul-De-Sac Of Slavery And Extinction

Humanity Has Been Herded Into A Cul-De-Sac Of Slavery And Extinction

state [steɪt] (noun)

6. (Government, Politics & Diplomacy) a sovereign political power or community

7. (Government, Politics & Diplomacy) the territory occupied by such a community

A State Of Terror; Of The Few, By The Few And For The Few

The United States of America, at this time, is the primary conduit, instrument and catalyst, employed by an age-old line of supremacists, in the finalisation of an ancient quest for global totalitarianism.

The last remaining superpower, now an unmitigated rogue state, is being used as both the sharp end of the stick, to back everyone into a corner, and a blunt instrument to beat them into submission.

The New World Order has been under construction for a very long time.

But how long?

Humanity Has Been Herded Into A Cul-De-Sac Of Slavery And Extinction

Humanity Has Been Herded Into A Cul-De-Sac Of Slavery And Extinctionstate [steɪt] (noun)

6. (Government, Politics & Diplomacy) a sovereign political power or community

7. (Government, Politics & Diplomacy) the territory occupied by such a community

A State Of Terror; Of The Few, By The Few And For The Few

The United States of America, at this time, is the primary conduit, instrument and catalyst, employed by an age-old line of supremacists, in the finalisation of an ancient quest for global totalitarianism.

The last remaining superpower, now an unmitigated rogue state, is being used as both the sharp end of the stick, to back everyone into a corner, and a blunt instrument to beat them into submission.

The New World Order has been under construction for a very long time.

But how long?

Some 60 families—names like Rockefeller, Morgan, Dodge, Mellon, Pratt, Harkness, Whitney, Duke, Harriman, Carnegie, Vanderbilt, DuPont, Guggenheim, Astor, Lehman, Warburg, Taft, Huntington, Baruch and Rosenwald— formed a close network of plutocratic wealth that manipulated, bribed, and bullied its way to control the destiny of the United States.Read More @ Activist Post

by Geoff Candy, Mineweb

A look at the trends seen in the PGM market in 2011 and what Johnson Matthey expects in 2012.

A look at the trends seen in the PGM market in 2011 and what Johnson Matthey expects in 2012.

GEOFF CANDY: I am joined now by Dr. Jonathan Butler, he is the publications manager at Johnson Matthey and they have just released their Platinum Survey 2012. In 2011,total demand for platinum rose 2% while supply rose to a four-year high, up 7% in total. What were there drivers behind those two moves?

JON BUTLER: The main reason that supply rose last year was a combination of higher output in SA and also a ramp up to full production at operations in Zimbabwe and also North America. And, its interesting, if we look at South Africa, because underlying production actually fell but, because of a drawdown of stock, that is refined and pipeline material toward the end of last year we actually saw output in total grow in South Africa. Which helped to move the market into a surplus last year.

Read More @ MineWeb.com

A look at the trends seen in the PGM market in 2011 and what Johnson Matthey expects in 2012.

A look at the trends seen in the PGM market in 2011 and what Johnson Matthey expects in 2012.GEOFF CANDY: I am joined now by Dr. Jonathan Butler, he is the publications manager at Johnson Matthey and they have just released their Platinum Survey 2012. In 2011,total demand for platinum rose 2% while supply rose to a four-year high, up 7% in total. What were there drivers behind those two moves?

JON BUTLER: The main reason that supply rose last year was a combination of higher output in SA and also a ramp up to full production at operations in Zimbabwe and also North America. And, its interesting, if we look at South Africa, because underlying production actually fell but, because of a drawdown of stock, that is refined and pipeline material toward the end of last year we actually saw output in total grow in South Africa. Which helped to move the market into a surplus last year.

Read More @ MineWeb.com

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment