If Greece Exits, Here Is What Happens

Now that the Greek exit is back to being topic #1

of discussion, just as it was back in the fall of 2011, and the media

has been flooded by groundless speculation posited by journalists who

have never used excel in their lives and are merely paid mouthpieces of

bigger bank interests (long live access journalism and the book sales

it facilitates), it is time to rewind to a step by step analysis of

precisely what will happen in the moment before Greece announces the

EMU exit, how the transition from pre to post occurs, and the aftermath

of what said transition would entail, courtesy of one of the smarter

minds out there, Citi's Willem Buiter, who pontificated precisely on

this topic last year, and whose thoughts he has graciously provided for

all to read on his own website.

Of course, take all of this with a huge grain of salt - these are

observations by the chief economist of a bank which will likely be swept

aside the second the EMU starts to post-Greece rumble.

Now that the Greek exit is back to being topic #1

of discussion, just as it was back in the fall of 2011, and the media

has been flooded by groundless speculation posited by journalists who

have never used excel in their lives and are merely paid mouthpieces of

bigger bank interests (long live access journalism and the book sales

it facilitates), it is time to rewind to a step by step analysis of

precisely what will happen in the moment before Greece announces the

EMU exit, how the transition from pre to post occurs, and the aftermath

of what said transition would entail, courtesy of one of the smarter

minds out there, Citi's Willem Buiter, who pontificated precisely on

this topic last year, and whose thoughts he has graciously provided for

all to read on his own website.

Of course, take all of this with a huge grain of salt - these are

observations by the chief economist of a bank which will likely be swept

aside the second the EMU starts to post-Greece rumble.Merkel's CDU Trounced In Most Populous State Elections Over Austerity; Pirates Strong

Another weekend, another stunner in local European elections, this time as Merkel's CDU gets a record low vote in the state elections of Germany's most populous state North Rhein-Westphalia. According to a preliminary projections by ARD, the breakdown is as follows:- SPD:39%

- CDU: 26%

- Greens:12%

- Pirates: 7.5%

- FDP: 8.5%

- Left:2.5%

When Is A Prop Trade A Prop Trade, And When Is It A Hedge: A KPMG Case Study

- How do you define market risk?

- Do you take fixed price positions?

- Are you exclusively a hedger or do you “optimize” your assets?

- Do you have a risk policy?

- How do you monitor trading/hedging limits?.

from Silver Vigilante:

“Scenes

are now to take place as will open the eyes of credulity and of

insanity itself, to the dangers of a paper medium abandoned to the

discretion of avarice and of swindlers.” –Thomas Jefferson 1814

“Scenes

are now to take place as will open the eyes of credulity and of

insanity itself, to the dangers of a paper medium abandoned to the

discretion of avarice and of swindlers.” –Thomas Jefferson 1814

The history of civilization is comprised in significant regard of the rise and fall of empires, a story of the victors and the vanquished. There are innumerable observations to heed when examining the similarities, differences, causes and effects in the timeline of these many empires. For millennia, these empires have played a game of musical chairs that has decided who the victor was and who the vanquished in any given time and place. Oftentimes the winners and in this game of musical chairs has been predetermined. Over the centuries, victims have become vanquished and vice versa, and an abundant body of work bearing witness and analyzing this has been born.

All of these empires, however, were not the largest embodying structure giving rise to man’s society and culture. An overarching civilization, first and foremost, lent its caste serfdom to the way things are and have always been. This has decreased the options available to all countries – empire or not, victor or vanquished – when dealing with the conflicts and disasters of civilization’s gait.

Read More @ SilverVigilante.com

“Scenes

are now to take place as will open the eyes of credulity and of

insanity itself, to the dangers of a paper medium abandoned to the

discretion of avarice and of swindlers.” –Thomas Jefferson 1814

“Scenes

are now to take place as will open the eyes of credulity and of

insanity itself, to the dangers of a paper medium abandoned to the

discretion of avarice and of swindlers.” –Thomas Jefferson 1814The history of civilization is comprised in significant regard of the rise and fall of empires, a story of the victors and the vanquished. There are innumerable observations to heed when examining the similarities, differences, causes and effects in the timeline of these many empires. For millennia, these empires have played a game of musical chairs that has decided who the victor was and who the vanquished in any given time and place. Oftentimes the winners and in this game of musical chairs has been predetermined. Over the centuries, victims have become vanquished and vice versa, and an abundant body of work bearing witness and analyzing this has been born.

All of these empires, however, were not the largest embodying structure giving rise to man’s society and culture. An overarching civilization, first and foremost, lent its caste serfdom to the way things are and have always been. This has decreased the options available to all countries – empire or not, victor or vanquished – when dealing with the conflicts and disasters of civilization’s gait.

Read More @ SilverVigilante.com

by Alexander Higgins, The Intel Hub:

An Army Job Ad For Concentration Camps Officers: Military confinement/correctional facility or detention/internment facility, similar to civilian Corrections Officers.

For a complete background see: Leaked Army Manual Reveals US Based War On Terror Concentration Camps

Read More @ The Intel Hub

An Army Job Ad For Concentration Camps Officers: Military confinement/correctional facility or detention/internment facility, similar to civilian Corrections Officers.

For a complete background see: Leaked Army Manual Reveals US Based War On Terror Concentration Camps

Read More @ The Intel Hub

Waving the White Flag

By John Mauldin, Gold Seek:

A common mistake that people make when trying to design something completely foolproof is to underestimate the ingenuity of complete fools.

- Douglas Adams, The Hitchhiker’s Guide to the Galaxy

For

quite some time in this letter I have been making the case that for the

eurozone to survive, the European Central Bank would have to print more

money than any of us can now imagine. That the sentiment among European

leaders was that they were prepared for such a move was clear – except

for Germany, which is haunted by fears of a return to the days of the

Weimar Republic and hyperinflation.

For

quite some time in this letter I have been making the case that for the

eurozone to survive, the European Central Bank would have to print more

money than any of us can now imagine. That the sentiment among European

leaders was that they were prepared for such a move was clear – except

for Germany, which is haunted by fears of a return to the days of the

Weimar Republic and hyperinflation.

When Germany agreed to a fixed monetary union and a European Central Bank, it was with the clear understanding that it would be run along the lines of the German central bank, the Bundesbank. The members of the Bundesbank and the German members of the ECB were most outspoken about the need for a conservative monetary policy that would keep a clamp on inflation.

However, as I have previously noted, the Bundesbank was a toothless tiger. Germany has two votes out of 23 on the ECB, and the loud drumbeat from most of Europe, which is experiencing the difficulty of austerity accompanied by too much debt, is for a far more accommodating ECB.

Read More @ GoldSeek.com

A common mistake that people make when trying to design something completely foolproof is to underestimate the ingenuity of complete fools.

- Douglas Adams, The Hitchhiker’s Guide to the Galaxy

For

quite some time in this letter I have been making the case that for the

eurozone to survive, the European Central Bank would have to print more

money than any of us can now imagine. That the sentiment among European

leaders was that they were prepared for such a move was clear – except

for Germany, which is haunted by fears of a return to the days of the

Weimar Republic and hyperinflation.

For

quite some time in this letter I have been making the case that for the

eurozone to survive, the European Central Bank would have to print more

money than any of us can now imagine. That the sentiment among European

leaders was that they were prepared for such a move was clear – except

for Germany, which is haunted by fears of a return to the days of the

Weimar Republic and hyperinflation.When Germany agreed to a fixed monetary union and a European Central Bank, it was with the clear understanding that it would be run along the lines of the German central bank, the Bundesbank. The members of the Bundesbank and the German members of the ECB were most outspoken about the need for a conservative monetary policy that would keep a clamp on inflation.

However, as I have previously noted, the Bundesbank was a toothless tiger. Germany has two votes out of 23 on the ECB, and the loud drumbeat from most of Europe, which is experiencing the difficulty of austerity accompanied by too much debt, is for a far more accommodating ECB.

Read More @ GoldSeek.com

Monster Sunspot Aimed Directly at Earth; Could Produce an X-flare, the Most Powerful Kind of Solar Flare

by Deborah Byrd, The Daily Sheeple:

Space weather forecasters at NOAA estimate a 75% chance of M-class solar flares and a 20% chance of X-flares during the next 24 hours from the large sunspot AR 1476. This sunspot is directly facing our planet, so if a flare does occur its effects on the space weather environment are likely to pass our way. NOAA’s Space Weather Prediction Center said today (May 11, 2012):

NOAA Region 1476, now right in the middle of the solar disk, continues to dissipate its energy in relatively small bursts of modest flares and weak CMEs. That output belies its appearance — large sunspots and entangled magnetic fields. Forecasters are vigilant. Watch here should things break loose.

What are the effects of a solar flare on Earth? These flares have been happening throughout human evolution. They’ve been happening for billions of years of Earth history. So there is no danger to our Earth or our human bodies. Our technology can take a hit, however, when a major flare occurs.

Read More @ TheDailySheeple.com

Space weather forecasters at NOAA estimate a 75% chance of M-class solar flares and a 20% chance of X-flares during the next 24 hours from the large sunspot AR 1476. This sunspot is directly facing our planet, so if a flare does occur its effects on the space weather environment are likely to pass our way. NOAA’s Space Weather Prediction Center said today (May 11, 2012):

NOAA Region 1476, now right in the middle of the solar disk, continues to dissipate its energy in relatively small bursts of modest flares and weak CMEs. That output belies its appearance — large sunspots and entangled magnetic fields. Forecasters are vigilant. Watch here should things break loose.

What are the effects of a solar flare on Earth? These flares have been happening throughout human evolution. They’ve been happening for billions of years of Earth history. So there is no danger to our Earth or our human bodies. Our technology can take a hit, however, when a major flare occurs.

Read More @ TheDailySheeple.com

Greece To Get European Aid Even After It Exits, Speculates Spiegel

As suspected, yesterday's report that the Troika may be caving on Greece appears more and more as a red-herring trial balloon, leaked by the Greek press without substantiation, and which sought to lighten the tension ahead of a trading week which is already looking rather askew. Because not even a full 24 hours later, Germany fires right back with an article in the Spiegel which not only anticipates the Grexit, but what happens the day after: namely that Greece would receive further aid from the EFSF if it exited the euro. It also notes that the EFSF aid to service bonds would continue. Greece would continue to get aid as EU member as every other member state. While it is unclear if this article is in response to the WiWo piece we noted yesterday which tried to quantify the costs of a Greek impact, and which has now ominously been picked up by Die Welt, in which Germany was finally starting to get worried about the hundreds of billions in sunk costs should Greece exit, the punchline here, needless to say, is not only the contemplation of a Greek exit but that Greece would be "all taken care of" even as the newly reintroduced Drachma lost a few hundred percent in value every day as Greece stormed its way back to FX competitiveness. Spiegel's punchline: "This is to the consequences of a possible €-egress will be mitigated." Hopefully the market agrees.Europe Has Bet The Farm

Europe is heading for a showdown and in a number of places; that much can be acknowledged with certainty. The first, and perhaps the most important, is the stand-off between France and the European Commission. The EU budgetary office is demanding that France reduce its deficit to 3.00% for 2012 while the projection is for 4.50% so that the Commission is threatening France with large fines. Mr. Hollande ran his campaign upon a reduction in the retirement age, more generous pensions, shorter work hours and more governmental spending so that the budgetary miss is likely to be larger than forecast; somewhere around 5.2% in my estimation. France then finds itself, one way or another, with a larger budgetary deficit and if the EU then imposes fines and sanctions Paris may thumb its nose at Berlin/Brussels in what could be a rather nasty affair with unknown consequences. Mrs. Merkel in one corner and Mr. Hollande in another slugging it out will not make for harmonious relations. Then there are the issues of Greece and Spain and the Socialist reaction is bound to be very different than the Austerity imposition as demanded by Germany. Jawohl!

By Nadeem Walayat, The Market Oracle:

This analysis continues on from my last article

in light of the recent French and Greek elections where voters rejected

economic austerity in favour of money printing Inflation stealth debt

default as politically an smoke and mirrors Inflationary depression is

being seen as far more palatable for populations than a deflationary

depression slow motion economic collapse. However to be able to print

money inline with the true state of the respective competitiveness of

euro-zone economies, then these countries governments have no choice but

to exit the euro-zone, or be forced out as they one by one fail to

follow through on agreed austerity measures.

This analysis continues on from my last article

in light of the recent French and Greek elections where voters rejected

economic austerity in favour of money printing Inflation stealth debt

default as politically an smoke and mirrors Inflationary depression is

being seen as far more palatable for populations than a deflationary

depression slow motion economic collapse. However to be able to print

money inline with the true state of the respective competitiveness of

euro-zone economies, then these countries governments have no choice but

to exit the euro-zone, or be forced out as they one by one fail to

follow through on agreed austerity measures.

Read More @ TheMarketOracle.co.uk

This analysis continues on from my last article

in light of the recent French and Greek elections where voters rejected

economic austerity in favour of money printing Inflation stealth debt

default as politically an smoke and mirrors Inflationary depression is

being seen as far more palatable for populations than a deflationary

depression slow motion economic collapse. However to be able to print

money inline with the true state of the respective competitiveness of

euro-zone economies, then these countries governments have no choice but

to exit the euro-zone, or be forced out as they one by one fail to

follow through on agreed austerity measures.

This analysis continues on from my last article

in light of the recent French and Greek elections where voters rejected

economic austerity in favour of money printing Inflation stealth debt

default as politically an smoke and mirrors Inflationary depression is

being seen as far more palatable for populations than a deflationary

depression slow motion economic collapse. However to be able to print

money inline with the true state of the respective competitiveness of

euro-zone economies, then these countries governments have no choice but

to exit the euro-zone, or be forced out as they one by one fail to

follow through on agreed austerity measures.Read More @ TheMarketOracle.co.uk

The Invisible Hand Manages Gold & Silver

Eric De Groot at Eric De Groot - 2 hours ago

The public is sprinting away from gold faster than shoppers vying for the

day after Thanksgiving door buster deals moments after the front doors are

opened. This paints a picture of frenzy-fast (bordering on complete

lunacy) for most Americans. While the public sprints from gold in fear,

they most likely miss the invisible hand calmly collecting its things and

walking in the opposite...

[[ This is a content summary only. Visit my website for full links, other

content, and more! ]]

Gold's High Body Count Event Stretching From New York To Beijini

Eric De Groot at Eric De Groot - 3 hours ago

I suspect gold traders have been salivating over gold's recent earthquake activity. The nuisance of timing, however, demands more patience that a simple flick of a seismic switch. While a diffusion index readings above 85 are extremely rare (fourth highest reading since 2001) and bullish, it could conceivably continue generating higher readings in coming weeks (see chart 1); 86 is... [[ This is a content summary only. Visit my website for full links, other content, and more! ]]

by Tony Cartalucci, Activist Post

Editor’s Note: For more information, please read “Farmers group wants Ireland to follow Iceland and burn the bondholders.”

Editor’s Note: For more information, please read “Farmers group wants Ireland to follow Iceland and burn the bondholders.”

Across the dominion of the corporate-financiers on Wall Street and in the city of London, the reckless Ponzi schemes destroying the West’s economy and plunging it into an economic depression have left politicians, the bought-and-paid-for servants of corporate-financier hegemony, wringing the public dry to cover losses. In reality, when an enterprise fails because of criminality, incompetence or both, citizens should not be forced to pass the hat around to “bail them out.”

They are declared bankrupt, their assets (if they have any) are stripped, often if fraud is involved, executives and board members go to jail, and society attempts to fill the void with sounder enterprises run by more reputable people.

Read More @ Activist Post

Editor’s Note: For more information, please read “Farmers group wants Ireland to follow Iceland and burn the bondholders.”

Editor’s Note: For more information, please read “Farmers group wants Ireland to follow Iceland and burn the bondholders.” Across the dominion of the corporate-financiers on Wall Street and in the city of London, the reckless Ponzi schemes destroying the West’s economy and plunging it into an economic depression have left politicians, the bought-and-paid-for servants of corporate-financier hegemony, wringing the public dry to cover losses. In reality, when an enterprise fails because of criminality, incompetence or both, citizens should not be forced to pass the hat around to “bail them out.”

They are declared bankrupt, their assets (if they have any) are stripped, often if fraud is involved, executives and board members go to jail, and society attempts to fill the void with sounder enterprises run by more reputable people.

Read More @ Activist Post

by Alasdair Macleod, Gold Money:

In

recent weeks, while the eurozone has suffered escalating levels of

systemic stress in government bond markets and its banking system, the

gold price has fallen under $1,600. One would have thought that – but

for the occasional fat-finger trade

– gold would rise in all this instability, not fall. Putting aside

short-term considerations, the simple reason has to be that the

investment establishment, which has bought into the bond market bubble,

does not believe that gold is any longer an alternative to paper money.

In

recent weeks, while the eurozone has suffered escalating levels of

systemic stress in government bond markets and its banking system, the

gold price has fallen under $1,600. One would have thought that – but

for the occasional fat-finger trade

– gold would rise in all this instability, not fall. Putting aside

short-term considerations, the simple reason has to be that the

investment establishment, which has bought into the bond market bubble,

does not believe that gold is any longer an alternative to paper money.

We can understand why they think this. Though the Keynesian vs Austrian economic debate is attracting increasing attention, financial services companies recruit economists who have been trained in the traditions of Keynes and Friedman. They are thus immersed in economic disciplines that assume gold is old-fashioned and has no meaningful place in a modern economy. While they might accept that gold has an historical attraction for some investors, they see it as a “risk-on” investment. This is jargon for something you buy when you want to take risks, the opposite of gold’s traditional role.

Read More @ GoldMoney.com

In

recent weeks, while the eurozone has suffered escalating levels of

systemic stress in government bond markets and its banking system, the

gold price has fallen under $1,600. One would have thought that – but

for the occasional fat-finger trade

– gold would rise in all this instability, not fall. Putting aside

short-term considerations, the simple reason has to be that the

investment establishment, which has bought into the bond market bubble,

does not believe that gold is any longer an alternative to paper money.

In

recent weeks, while the eurozone has suffered escalating levels of

systemic stress in government bond markets and its banking system, the

gold price has fallen under $1,600. One would have thought that – but

for the occasional fat-finger trade

– gold would rise in all this instability, not fall. Putting aside

short-term considerations, the simple reason has to be that the

investment establishment, which has bought into the bond market bubble,

does not believe that gold is any longer an alternative to paper money.We can understand why they think this. Though the Keynesian vs Austrian economic debate is attracting increasing attention, financial services companies recruit economists who have been trained in the traditions of Keynes and Friedman. They are thus immersed in economic disciplines that assume gold is old-fashioned and has no meaningful place in a modern economy. While they might accept that gold has an historical attraction for some investors, they see it as a “risk-on” investment. This is jargon for something you buy when you want to take risks, the opposite of gold’s traditional role.

Read More @ GoldMoney.com

from Jesse’s Café Américain:

I

think the next financial crisis is less than two years away, and it

will strike the global real economy as badly as the banking crisis with

the collapse of Lehman Brothers.

I

think the next financial crisis is less than two years away, and it

will strike the global real economy as badly as the banking crisis with

the collapse of Lehman Brothers.

I

think the next financial crisis is less than two years away, and it

will strike the global real economy as badly as the banking crisis with

the collapse of Lehman Brothers.

I

think the next financial crisis is less than two years away, and it

will strike the global real economy as badly as the banking crisis with

the collapse of Lehman Brothers.Jamie Dimon’s SNAFU: JPMorgan’s Other Derivatives’ Losses

By Janet Tavakoli

In an August 2010 commentary about JPMorgan’s losses in coal trades I wrote: “The commodities division isn’t the only area in which JPMorgan is vulnerable. Credit derivatives, interest rate derivatives, and currency trading are vulnerable to leveraged hidden bets. Ambitious managers strive to pump speculative earnings from zero to hero.”

At issue is corporate governance at JPMorgan and the ability of its CEO, Jamie Dimon, to manage its risk. It’s reasonable to ask whether any CEO can manage the risks of a bank this size, but the questions surrounding Jamie Dimon’s management are more targeted than that. The problem Jamie Dimon has is that JPMorgan lost control in multiple areas. Each time a new problem becomes public, it is revealed that management controls weren’t adequate in the first place.

Read More @ Jesse’s Café Américain:

by Harvey Organ, HarveyOrgan.Blogspot.ca:

Good morning Ladies and Gentlemen:

Good morning Ladies and Gentlemen:

Gold closed down by $11.50 to $1583.60. Silver fell 29 cents to $28.85 in the aftermath of the JPMorgan revelation of a 2 billion USA derivative loss. I will spend most of the time highlighting various concerns on this story as this no doubt will be a game changer. The only other real development on Friday was the Pasok party failing to form a coalition government setting the stage for another election. In Asian news, the Chinese PMI number was weak, which followed a big miss in Chinese industrial production. The banking system of there reported plunging loans to the tune of 32%. We will cover all of those events but first let us now head over to the comex and asses the damage today.

The total gold comex OI lowered by a wide 5219 contracts falling from 422,470 to 417,252. Gold rose modestly yesterday so this large loss in OI is kind of a surprise to me. Maybe some of our newbie longs left the arena late in the day when gold and silver equities faltered and they believed that another raid was forthcoming which by chance did happen on Friday. The front non official delivery month of May for gold saw its OI fall from 146 to 36 for a loss of 110 contracts. We had 109 deliveries yesterday so we lost one poor soul contract due to the raid.

Read More @ HarveyOrgan.Blogspot.ca

Good morning Ladies and Gentlemen:

Good morning Ladies and Gentlemen:Gold closed down by $11.50 to $1583.60. Silver fell 29 cents to $28.85 in the aftermath of the JPMorgan revelation of a 2 billion USA derivative loss. I will spend most of the time highlighting various concerns on this story as this no doubt will be a game changer. The only other real development on Friday was the Pasok party failing to form a coalition government setting the stage for another election. In Asian news, the Chinese PMI number was weak, which followed a big miss in Chinese industrial production. The banking system of there reported plunging loans to the tune of 32%. We will cover all of those events but first let us now head over to the comex and asses the damage today.

The total gold comex OI lowered by a wide 5219 contracts falling from 422,470 to 417,252. Gold rose modestly yesterday so this large loss in OI is kind of a surprise to me. Maybe some of our newbie longs left the arena late in the day when gold and silver equities faltered and they believed that another raid was forthcoming which by chance did happen on Friday. The front non official delivery month of May for gold saw its OI fall from 146 to 36 for a loss of 110 contracts. We had 109 deliveries yesterday so we lost one poor soul contract due to the raid.

Read More @ HarveyOrgan.Blogspot.ca

from Silver Doctors:

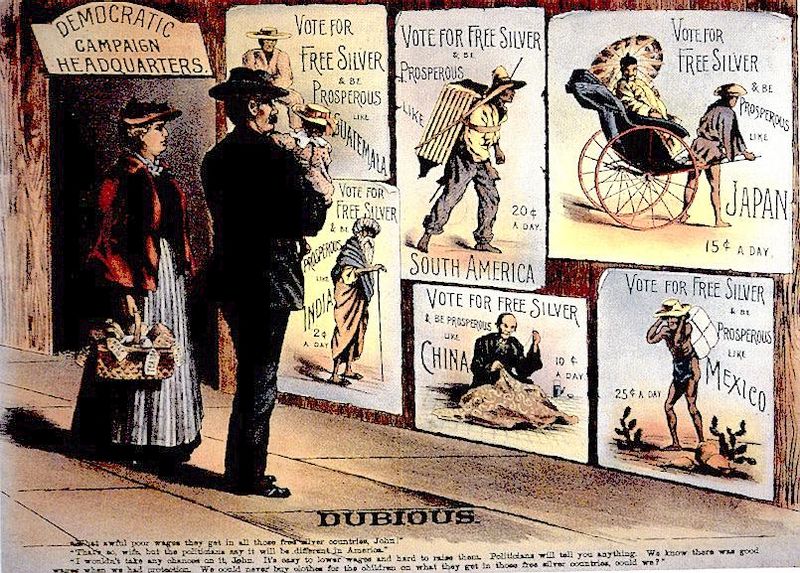

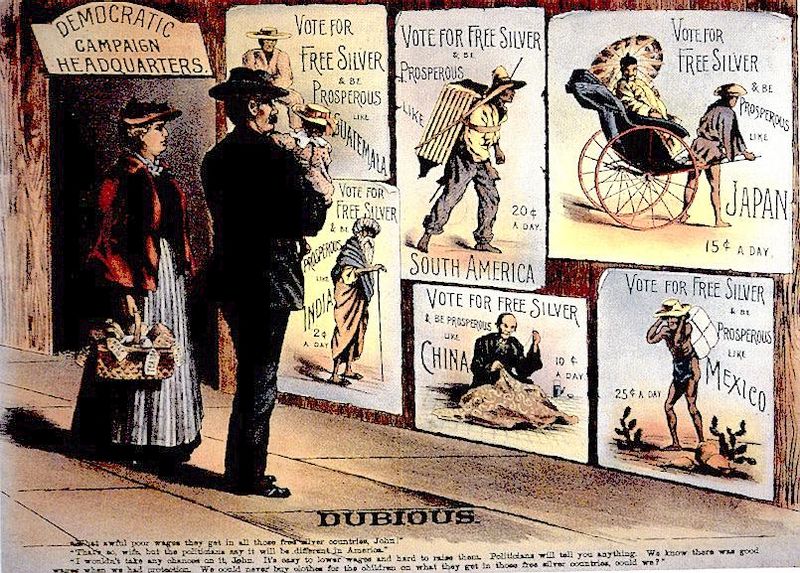

Bankster Campaign posters from the 1800′s attacking ‘Free Silver’ demonstrate that the cartel’s ostracization of silver is nothing new.

Bankster Campaign posters from the 1800′s attacking ‘Free Silver’ demonstrate that the cartel’s ostracization of silver is nothing new.

by Jeff Berwick, Dollar Vigilante:

Hello again to all my friends around the world,

Hello again to all my friends around the world,

I’m still in Acapulco. I’m starting to feel like a boring person… although it’s not all that boring… for me anyways. Every morning I get to witness a battle royale between my chihuahuas and an iguana. It always starts and ends the same way but for some reason I absolutely love watching.

And, today, at my evening office, Mangos, I thought for sure I was about to witness a serious event. There are lots of police here in Acapulco… all funded by the US Government to fight their War on People (drugs). I saw a group of heavily armed cops like the ones below surround a woman. Here we go, I thought.

Read More @ DollarVigilante.com

BTFD...

Hello again to all my friends around the world,

Hello again to all my friends around the world,I’m still in Acapulco. I’m starting to feel like a boring person… although it’s not all that boring… for me anyways. Every morning I get to witness a battle royale between my chihuahuas and an iguana. It always starts and ends the same way but for some reason I absolutely love watching.

And, today, at my evening office, Mangos, I thought for sure I was about to witness a serious event. There are lots of police here in Acapulco… all funded by the US Government to fight their War on People (drugs). I saw a group of heavily armed cops like the ones below surround a woman. Here we go, I thought.

Read More @ DollarVigilante.com

BTFD...

by Egon von Greyerz Gold Switzerland:

The

precious metals markets have now been going sideways for around 7

months. No investors like corrections but in all bull markets there will

always be periods when the price corrects.

The

precious metals markets have now been going sideways for around 7

months. No investors like corrections but in all bull markets there will

always be periods when the price corrects.

Some of these moves are bigger like in 2008 when gold in dollar terms corrected by 34% from $1,032 to $681. Silver which is always more volatile corrected by 60% in 2008. The correction, in dollar terms, is so far 17% in gold and in silver 42% . In Euros gold is down only 10%.

The physical precious metals market is still very strong with Swiss refiners working around the clock and central banks around the world continuing to buy. Chinese imports this year so far are up 6 times on last year. The selling that we are currently seeing is primarily in the gold paper market. This is short term speculators in precious metals that are getting out of their positions. We saw the same in the 2008 correction when gold came down as many investors liquidated positions in all investment classes. So the real gold market continues to be very strong and at some point the paper gold market will be exposed for what it is; worthless paper with no gold backing.

Read More @ GoldSwitzerland.com

The

precious metals markets have now been going sideways for around 7

months. No investors like corrections but in all bull markets there will

always be periods when the price corrects.

The

precious metals markets have now been going sideways for around 7

months. No investors like corrections but in all bull markets there will

always be periods when the price corrects.Some of these moves are bigger like in 2008 when gold in dollar terms corrected by 34% from $1,032 to $681. Silver which is always more volatile corrected by 60% in 2008. The correction, in dollar terms, is so far 17% in gold and in silver 42% . In Euros gold is down only 10%.

The physical precious metals market is still very strong with Swiss refiners working around the clock and central banks around the world continuing to buy. Chinese imports this year so far are up 6 times on last year. The selling that we are currently seeing is primarily in the gold paper market. This is short term speculators in precious metals that are getting out of their positions. We saw the same in the 2008 correction when gold came down as many investors liquidated positions in all investment classes. So the real gold market continues to be very strong and at some point the paper gold market will be exposed for what it is; worthless paper with no gold backing.

Read More @ GoldSwitzerland.com

by Reggie Middleton, BoomBustBlog.com:

S&P and Fitch finally downgrade JP Morgan, 3 years after my initial multimedia warnings (see Listen Carefully… for

the details). Unfortunately, despite threats and ruminations, these

rating agencies again act in retrospect, failing to do anything but

remind stakeholders of the losses they have already taken rather than

assisting them in avoiding losses.

S&P and Fitch finally downgrade JP Morgan, 3 years after my initial multimedia warnings (see Listen Carefully… for

the details). Unfortunately, despite threats and ruminations, these

rating agencies again act in retrospect, failing to do anything but

remind stakeholders of the losses they have already taken rather than

assisting them in avoiding losses.

So, what are the rating agencies missing? They’re missing the fact that nearly all of the big money center banks are doing exactly what JPM was doing and they have no one to rely upon but themselves when things go awry from a counterparty perspective. Bennie Bernanke has instituted perpetual ZIRP, and as such has basically broken the banking business in his attempt to save it. Through ZIRP, banks simply cannot make money doing things that traditional banks do, ex. profit from lending. As such, they reach for yield, and that’s just the conservative ones. The big boys take baseball bats swinging for home runs, either consciously or subconsciously sanguine in the protection of the Bernanke flavored taxpayer put under their respective businesses. With such protection, already historically proven, bank managers are getting progressively more aggressive and increasingly less aware of the term “RISK adjusted reward” as they simply seek rewards. Alas, I’m getting ahead of myself, let me explain…

Read More @ BoomBustBlog.com

S&P and Fitch finally downgrade JP Morgan, 3 years after my initial multimedia warnings (see Listen Carefully… for

the details). Unfortunately, despite threats and ruminations, these

rating agencies again act in retrospect, failing to do anything but

remind stakeholders of the losses they have already taken rather than

assisting them in avoiding losses.

S&P and Fitch finally downgrade JP Morgan, 3 years after my initial multimedia warnings (see Listen Carefully… for

the details). Unfortunately, despite threats and ruminations, these

rating agencies again act in retrospect, failing to do anything but

remind stakeholders of the losses they have already taken rather than

assisting them in avoiding losses.So, what are the rating agencies missing? They’re missing the fact that nearly all of the big money center banks are doing exactly what JPM was doing and they have no one to rely upon but themselves when things go awry from a counterparty perspective. Bennie Bernanke has instituted perpetual ZIRP, and as such has basically broken the banking business in his attempt to save it. Through ZIRP, banks simply cannot make money doing things that traditional banks do, ex. profit from lending. As such, they reach for yield, and that’s just the conservative ones. The big boys take baseball bats swinging for home runs, either consciously or subconsciously sanguine in the protection of the Bernanke flavored taxpayer put under their respective businesses. With such protection, already historically proven, bank managers are getting progressively more aggressive and increasingly less aware of the term “RISK adjusted reward” as they simply seek rewards. Alas, I’m getting ahead of myself, let me explain…

Read More @ BoomBustBlog.com

by Anthony Wile, The Daily Bell:

The Daily Bell is pleased to present this exclusive interview with Thomas H. Naylor (left).

Introduction: Thomas H. Naylor, Professor Emeritus of Economics at Duke University, is a writer and a political activist who has taught at Middlebury College and the University of Vermont. For 30 years he taught economics, management science and computer science at Duke. As an international management consultant specializing in strategic management, Dr. Naylor has advised major corporations and governments in over 30 countries. During the 1970s he was President of SIMPLAN Systems, a 50-person computer software firm whose clients were Fortune 500 companies in the US and abroad. Recognizing that the United States had become more like its former nemesis the Soviet Union than most Americans care to admit, in 2003 he founded the Second Vermont Republic, a nonviolent citizens network and think tank opposed to the tyranny of corporate America and the US government and committed to the return of Vermont to its status as an independent republic. Ode Magazine editor Jay Walljasper dubbed him, “Tom Paine for the 21st century.” The New York Times, International Herald Tribune, Los Angeles Times, Adbusters, Christian Science Monitor, The Nation and Business Week have published his articles. For additional information, visit www.vermontrepublic.org.

Read More @ TheDailyBell.com

The Daily Bell is pleased to present this exclusive interview with Thomas H. Naylor (left).

Introduction: Thomas H. Naylor, Professor Emeritus of Economics at Duke University, is a writer and a political activist who has taught at Middlebury College and the University of Vermont. For 30 years he taught economics, management science and computer science at Duke. As an international management consultant specializing in strategic management, Dr. Naylor has advised major corporations and governments in over 30 countries. During the 1970s he was President of SIMPLAN Systems, a 50-person computer software firm whose clients were Fortune 500 companies in the US and abroad. Recognizing that the United States had become more like its former nemesis the Soviet Union than most Americans care to admit, in 2003 he founded the Second Vermont Republic, a nonviolent citizens network and think tank opposed to the tyranny of corporate America and the US government and committed to the return of Vermont to its status as an independent republic. Ode Magazine editor Jay Walljasper dubbed him, “Tom Paine for the 21st century.” The New York Times, International Herald Tribune, Los Angeles Times, Adbusters, Christian Science Monitor, The Nation and Business Week have published his articles. For additional information, visit www.vermontrepublic.org.

Read More @ TheDailyBell.com

by Jeffrey Tucker, DailyReckoning.com.au:

“Economics puts parameters on people’s utopias.”

Yes. That’s exactly it. That’s why the politicians hate economics. That’s why the media are so… selective in which economists they call on to talk about policy.

That’s why the economics departments in colleges are put down by the sociologists, philosophers, literature professors and just about everyone else who has romantic longings for a coerced utopia.

“The teachings of the principles of economics should inform as much on what not to do, perhaps even more than providing a guide to public action.”

That’s it again. Don’t control prices. Don’t socialize medicine. Don’t raise taxes. Don’t inflate the money supply. Don’t put up trade barriers. Don’t go to war. Economists just keep bursting people’s bubbles. And it’s because economists say these things that the ruling class wants them to shut up about.

Read More @ DailyReckoning.com.au

“Economics puts parameters on people’s utopias.”

Yes. That’s exactly it. That’s why the politicians hate economics. That’s why the media are so… selective in which economists they call on to talk about policy.

That’s why the economics departments in colleges are put down by the sociologists, philosophers, literature professors and just about everyone else who has romantic longings for a coerced utopia.

“The teachings of the principles of economics should inform as much on what not to do, perhaps even more than providing a guide to public action.”

That’s it again. Don’t control prices. Don’t socialize medicine. Don’t raise taxes. Don’t inflate the money supply. Don’t put up trade barriers. Don’t go to war. Economists just keep bursting people’s bubbles. And it’s because economists say these things that the ruling class wants them to shut up about.

Read More @ DailyReckoning.com.au

by Jonathan Benson, Natural News:

It

is no longer a secret that drug-resistant bacteria are rapidly emerging

and spreading all around the world as a result of the continued overuse

and abuse of antibiotic drugs in both conventional medicine and

industrial agriculture. But now it appears that the genes responsible

for spawning these so-called “superbugs” are also spreading, and turning

otherwise mild conditions such as throat infections into deadly

killers.

It

is no longer a secret that drug-resistant bacteria are rapidly emerging

and spreading all around the world as a result of the continued overuse

and abuse of antibiotic drugs in both conventional medicine and

industrial agriculture. But now it appears that the genes responsible

for spawning these so-called “superbugs” are also spreading, and turning

otherwise mild conditions such as throat infections into deadly

killers.

Known as NDM-1, or New Delhi metallo-beta-lactamase-1, these genes basically hitch a ride on mobile DNA loops known as plasmids, and latch themselves onto various bacteria whenever and wherever they find an opportunity. The end result of this parasite-like invasion into bacteria is that even largely innocuous microbes can become extremely virulent and fully able to outsmart even the strongest antibiotic drugs available.

Read More @ NaturalNews.com

It

is no longer a secret that drug-resistant bacteria are rapidly emerging

and spreading all around the world as a result of the continued overuse

and abuse of antibiotic drugs in both conventional medicine and

industrial agriculture. But now it appears that the genes responsible

for spawning these so-called “superbugs” are also spreading, and turning

otherwise mild conditions such as throat infections into deadly

killers.

It

is no longer a secret that drug-resistant bacteria are rapidly emerging

and spreading all around the world as a result of the continued overuse

and abuse of antibiotic drugs in both conventional medicine and

industrial agriculture. But now it appears that the genes responsible

for spawning these so-called “superbugs” are also spreading, and turning

otherwise mild conditions such as throat infections into deadly

killers.Known as NDM-1, or New Delhi metallo-beta-lactamase-1, these genes basically hitch a ride on mobile DNA loops known as plasmids, and latch themselves onto various bacteria whenever and wherever they find an opportunity. The end result of this parasite-like invasion into bacteria is that even largely innocuous microbes can become extremely virulent and fully able to outsmart even the strongest antibiotic drugs available.

Read More @ NaturalNews.com

by Heath Stillwell, Political Pie Hole:

The U.S. military wants to plant nanosensors in soldiers to monitor health on future battlefields and immediately respond to needs, but a privacy expert warns the step is just one more down the road to computer chips for all.

“It’s never going to happen that the government at gunpoint says, ‘You’re going to have a tracking chip,’” said Katherine Albrecht, who with Liz McIntyre authored “Spychips,” a book that warns of the threat to privacy posed by Radio Frequency Identification.

“It’s always in incremental steps. If you can put a microchip in someone that doesn’t track them … everybody looks and says, ‘Come on,’” she said. “It’ll be interesting seeing where we go.”

According to a report at Mobiledia, the U.S. military’s Defense Advanced Research Projects Agency has confirmed plans to create nanosensors to monitor the health of soldiers on battlefields.

The devices also would report data to doctors. But privacy analysts have expressed concern that the implants could be used not just to monitor health but to keep track of and possibly control people.

Read More @ PoliticalPieHole.com

The U.S. military wants to plant nanosensors in soldiers to monitor health on future battlefields and immediately respond to needs, but a privacy expert warns the step is just one more down the road to computer chips for all.

“It’s never going to happen that the government at gunpoint says, ‘You’re going to have a tracking chip,’” said Katherine Albrecht, who with Liz McIntyre authored “Spychips,” a book that warns of the threat to privacy posed by Radio Frequency Identification.

“It’s always in incremental steps. If you can put a microchip in someone that doesn’t track them … everybody looks and says, ‘Come on,’” she said. “It’ll be interesting seeing where we go.”

According to a report at Mobiledia, the U.S. military’s Defense Advanced Research Projects Agency has confirmed plans to create nanosensors to monitor the health of soldiers on battlefields.

The devices also would report data to doctors. But privacy analysts have expressed concern that the implants could be used not just to monitor health but to keep track of and possibly control people.

Read More @ PoliticalPieHole.com

by Charles Hugh Smith, Of Two Minds:

After

considering her many other wins, Ross concluded GreenDollGal would bid

just over a round number—something 89 cents more. You have to draw the

line in the sand somewhere, he told himself unhappily; he simply didn’t

have enough cash in his account to go higher than about the equivalent

of two months’ rent.

After

considering her many other wins, Ross concluded GreenDollGal would bid

just over a round number—something 89 cents more. You have to draw the

line in the sand somewhere, he told himself unhappily; he simply didn’t

have enough cash in his account to go higher than about the equivalent

of two months’ rent.

A sharp staccato knock sounded on his door and he recognized his neighbor Kylie’s signature signal. “Come in,” he boomed, and Kylie entered, looking very pretty in a white tennis skirt and blouse, and immediately shushed him.

“Not so loud,” she hissed. “Or Vonda will hear us.”

Nodding in chagrined agreement, Ross motioned to Kylie to close his door. Vonda lived upstairs and was always home; elderly and wrenchingly bored, she left her door ajar to monitor all the residents’ comings and goings. Even though she kept her television or opera recordings on all day, she retained an uncanny ability to detect Kylie’s presence; hearing her young neighbor’s voice or door squeak open, she would scurry downstairs with an alarmingly spiderlike rapidity.

For unlike the boarding house’s other residents, Kylie tolerated her questions and curiosity and oft-repeated stories; and as a result, she had to be careful lest Vonda sense her and clamber down to regale her with questions about boyfriends and stale tales of her own distant youth.

Read More @ OfTwoMinds.com

Please support our efforts to keep you informed...

Thank You

I'm PayPal Verified

After

considering her many other wins, Ross concluded GreenDollGal would bid

just over a round number—something 89 cents more. You have to draw the

line in the sand somewhere, he told himself unhappily; he simply didn’t

have enough cash in his account to go higher than about the equivalent

of two months’ rent.

After

considering her many other wins, Ross concluded GreenDollGal would bid

just over a round number—something 89 cents more. You have to draw the

line in the sand somewhere, he told himself unhappily; he simply didn’t

have enough cash in his account to go higher than about the equivalent

of two months’ rent.A sharp staccato knock sounded on his door and he recognized his neighbor Kylie’s signature signal. “Come in,” he boomed, and Kylie entered, looking very pretty in a white tennis skirt and blouse, and immediately shushed him.

“Not so loud,” she hissed. “Or Vonda will hear us.”

Nodding in chagrined agreement, Ross motioned to Kylie to close his door. Vonda lived upstairs and was always home; elderly and wrenchingly bored, she left her door ajar to monitor all the residents’ comings and goings. Even though she kept her television or opera recordings on all day, she retained an uncanny ability to detect Kylie’s presence; hearing her young neighbor’s voice or door squeak open, she would scurry downstairs with an alarmingly spiderlike rapidity.

For unlike the boarding house’s other residents, Kylie tolerated her questions and curiosity and oft-repeated stories; and as a result, she had to be careful lest Vonda sense her and clamber down to regale her with questions about boyfriends and stale tales of her own distant youth.

Read More @ OfTwoMinds.com

by James P. Tucker, Jr., American Free Press

• Bilderberg group will meet in Chantilly, Va. in late May

• Bilderberg group will meet in Chantilly, Va. in late May

• Tucker heads to Memphis to attend two patriot rallies

Must Read...

• Bilderberg group will meet in Chantilly, Va. in late May

• Bilderberg group will meet in Chantilly, Va. in late May• Tucker heads to Memphis to attend two patriot rallies

By James P. Tucker Jr.

MEMPHIS—Hundreds of patriots were on

hand for two consecutive rallies held in Memphis on April 27, one at

noon and one in the evening. Many pledged to bring busloads of other

like-minded advocates for American sovereignty to Chantilly, Va. on the

weekend of May 31 – June 3 to protest the annual meeting of the

secretive Bilderberg group being held there.

Bilderberg will meet in Chantilly at the Westfields Marriott,

a short distance from Dulles International Airport, some 30 miles

outside Washington, D.C. Bilderberg previously met there in 2002 and

then again in 2008.

Read More @ AmericanFreePress.netMust Read...

by Be Informed, SHTFPlan:

I have become personally so disenchanted with the way people fail to prep. People still don’t understand how important it is to put away. I have gotten into arguments over this and had cretins call me a fool because I put away food, water, and supplies. I thought about this and the frustration that other preppers have with this laid back idiotic attitude that there is no need for preparation. There are good people that just can’t/won’t start preparing. They have the money to do so, but just don’t want to. Many have only seen what happens to non-preppers on TV, but it still doesn’t make an impact. Read More @ SHTFPlan.com

Editor’s

Note: You have no doubt had your own set of issues dealing with friends

and family members that simply don’t see the writing on the wall. The

following article may serve to assist you in convincing those who simply

don’t know, don’t want to know, don’t care, or have never even thought

to contemplate. Some of the scenarios outlined below may be frightening,

as they should be, because when it hits the fan millions of people will

be thrown into desperation with no hope of a solution. Be Informed

provides a variety of point-by-point details that may (and hopefully

will) convince the non-prepared individual to at least insulate

themselves with the basic necessities. The consequences for not doing

so, as you’ll see, are severe and often deadly.

I have become personally so disenchanted with the way people fail to prep. People still don’t understand how important it is to put away. I have gotten into arguments over this and had cretins call me a fool because I put away food, water, and supplies. I thought about this and the frustration that other preppers have with this laid back idiotic attitude that there is no need for preparation. There are good people that just can’t/won’t start preparing. They have the money to do so, but just don’t want to. Many have only seen what happens to non-preppers on TV, but it still doesn’t make an impact. Read More @ SHTFPlan.com

Please support our efforts to keep you informed...

Thank You

I'm PayPal Verified

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment