JPM To Be Subpoenaed Over Defunct PFG's Missing Segregated Money

The blunt trauma that JPMorgan was implicated in the missing millions from segregated accounts in Jon Corzine's bankrupt MF Global may have passed but the memory lingers, especially for all those whose cash is still locked up somewhere in vapor space. Yet one event that may tear the scab that patiently was healing, courtesy of a Copperfield market full of distractions such as JPM's CIO fiasco, Lieborgate, oh and, Europe, right off is the recent bankruptcy of Peregrine Financial, aka PFG, whose story we first broke, and which just as we suspected, has promptly become the second coming of MF Global, as at least $200 million has "evaporated." It is thus with little surprise that we find that the first party of interest is none other than JPMorgan, which together with various other banks, will be the target of a subpoena by the PFG trustee. How shocking will it be to find that Dimon's company is once again implicated in this particular episode of monetary vaporization.

by David Schectman, MilesFranklin.com:

I sense we are very close to breaking out from the nine-month

correction in gold and silver. The verdict will be in when gold tops

$1630 and then $1650. Some analysts are waiting around for gold to

cross over $1700 before they tell you to buy, but that’s waiting way too

long, in my view.

I sense we are very close to breaking out from the nine-month

correction in gold and silver. The verdict will be in when gold tops

$1630 and then $1650. Some analysts are waiting around for gold to

cross over $1700 before they tell you to buy, but that’s waiting way too

long, in my view.

The world is awash with debt – and with money too. Even more money needs to be “created” (QE) in order to service the debt. By its very nature, money does not like to just sit around; it needs to grow, to make a profit. Whether the money is controlled by a bank or fund manager with huge amounts to invest, or by a regular guy or gal like you with a little to invest, the challenge is the same. Where do I park my money? Where can it go and both be SAFE and earn at least enough to beat inflation? It used to be that if you had lots of extra money you would buy bonds and “clip coupons.” The first time I heard that saying was in the early 1970s. Susan and I were having lunch at the Lincoln Del in St. Louis Park and we were talking with a man sitting at the table next to us.

At some point in our conversation, I asked him, “What do you do for a living?”

He replied, “I clip coupons.” In 1972 you could do that with your money. At that point in my life, I had no idea what a Zero Coupon Bond was, but his statement piqued my interest. Frankly, today, only a fool would be sitting around clipping coupons from 30-year bonds! But you could do it 40 years ago. Times have changed.

Read more @ MilesFranklin.com

I sense we are very close to breaking out from the nine-month

correction in gold and silver. The verdict will be in when gold tops

$1630 and then $1650. Some analysts are waiting around for gold to

cross over $1700 before they tell you to buy, but that’s waiting way too

long, in my view.

I sense we are very close to breaking out from the nine-month

correction in gold and silver. The verdict will be in when gold tops

$1630 and then $1650. Some analysts are waiting around for gold to

cross over $1700 before they tell you to buy, but that’s waiting way too

long, in my view.The world is awash with debt – and with money too. Even more money needs to be “created” (QE) in order to service the debt. By its very nature, money does not like to just sit around; it needs to grow, to make a profit. Whether the money is controlled by a bank or fund manager with huge amounts to invest, or by a regular guy or gal like you with a little to invest, the challenge is the same. Where do I park my money? Where can it go and both be SAFE and earn at least enough to beat inflation? It used to be that if you had lots of extra money you would buy bonds and “clip coupons.” The first time I heard that saying was in the early 1970s. Susan and I were having lunch at the Lincoln Del in St. Louis Park and we were talking with a man sitting at the table next to us.

At some point in our conversation, I asked him, “What do you do for a living?”

He replied, “I clip coupons.” In 1972 you could do that with your money. At that point in my life, I had no idea what a Zero Coupon Bond was, but his statement piqued my interest. Frankly, today, only a fool would be sitting around clipping coupons from 30-year bonds! But you could do it 40 years ago. Times have changed.

Read more @ MilesFranklin.com

Why Another Major China Stimulus Package Is Not Coming

Some

market participants seem to be eagerly anticipating or hoping for

another stimulus in China, and each day that has passed without a big

policy announcement seems to have depressed the Chinese market further.

While the Chinese government has been very concerned about the economic

slowdown and has taken policies to support growth, UBS' Tao Wang suggests investors not be holding their breath for another big stimulus. The previous stimulus in 2008-09 did lift growth much higher than otherwise would have been, but

the excessive credit expansion also worsened the imbalance in the

economy and left serious negative consequences which are still been

dealt with today. The Chinese government has clearly recognized

this and is keen to avoid making a similar mistake this time. This is

not to say that the government has done little or will do little to

support growth; but the ride, of course, may not be pretty.

Some

market participants seem to be eagerly anticipating or hoping for

another stimulus in China, and each day that has passed without a big

policy announcement seems to have depressed the Chinese market further.

While the Chinese government has been very concerned about the economic

slowdown and has taken policies to support growth, UBS' Tao Wang suggests investors not be holding their breath for another big stimulus. The previous stimulus in 2008-09 did lift growth much higher than otherwise would have been, but

the excessive credit expansion also worsened the imbalance in the

economy and left serious negative consequences which are still been

dealt with today. The Chinese government has clearly recognized

this and is keen to avoid making a similar mistake this time. This is

not to say that the government has done little or will do little to

support growth; but the ride, of course, may not be pretty.The Most Often Forgotten Survival Preparations

I

think it’s safe to say with some conviction that in the year of 2012

the concept of survival prepping is NOT an alien one to most Americans.

When National Geographic decides there is a viable market for a

prepper TV show (no matter how misrepresentative of true preppers it

may be), when Walmart starts stocking shelves with long term emergency

food storage kits, when survivalism in general becomes one of the few

growing business markets in the midst of an otherwise disintegrating

economy; you know that the methodology has gone “mainstream”. There is

a noticeable and expanding concern amongst Americans that we are,

indeed, on the verge of something new and unfortunate. Is it the big

bad hoodoo of the soon to expire Mayan Calendar? For a few, maybe, but

for the majority of us, no. That jazz is a carnival sideshow designed

to make the prepping culture appear ridiculous. We don’t need to

believe in magical prophecies to know that there is a catastrophic road

ahead; all we have to do is look at the stark realities of our current

circumstances. It does not take much awareness anymore to notice

looming fiscal volatility, social unrest, the potential for unrestrained

war, and the totalitarian boldness of our government. I’ll take the

wrath of Quetzalcoatl any day over the manure storm that is approaching

us currently.

I

think it’s safe to say with some conviction that in the year of 2012

the concept of survival prepping is NOT an alien one to most Americans.

When National Geographic decides there is a viable market for a

prepper TV show (no matter how misrepresentative of true preppers it

may be), when Walmart starts stocking shelves with long term emergency

food storage kits, when survivalism in general becomes one of the few

growing business markets in the midst of an otherwise disintegrating

economy; you know that the methodology has gone “mainstream”. There is

a noticeable and expanding concern amongst Americans that we are,

indeed, on the verge of something new and unfortunate. Is it the big

bad hoodoo of the soon to expire Mayan Calendar? For a few, maybe, but

for the majority of us, no. That jazz is a carnival sideshow designed

to make the prepping culture appear ridiculous. We don’t need to

believe in magical prophecies to know that there is a catastrophic road

ahead; all we have to do is look at the stark realities of our current

circumstances. It does not take much awareness anymore to notice

looming fiscal volatility, social unrest, the potential for unrestrained

war, and the totalitarian boldness of our government. I’ll take the

wrath of Quetzalcoatl any day over the manure storm that is approaching

us currently.China PMI Misses And Prints Lowest In 8 Months With 10 Of 11 Sub-Indices Contracting

UPDATE: China's HSBC PMI came at 49.3 (slightly below the Flash print) but up from last month

The seemingly exuberant levels of the China Manufacturing PMI data when compared to HSBC's Manufacturing PMI have largely disappeared now as the two are the closest together in 9 months. As China's PMI drops to its lowest print in 8 months at 50.1 (less than the expected 50.5), we note that 10 of the 11 sub-indices (including employment and new orders) are all lower and now in contraction mode. Only the Output sub-index remains above 50 (in the if-we-build-it-they-will-come period). New Export Orders also fell notably. Of course having learned their lesson with the unintended consequences of their last major stimulus effort, we suspect the PBoC will be a little more careful with the method to resuscitate this time.

Jeremy Grantham: "I, For One, Wish That The World Would Get On With Whatever Is Coming Next"

"The economic environment seems to be stuck in a rather unpleasant perpetual loop. Greece is always about to default; the latest bailout is always about to save the day and yet never seems to; China is always about to collapse but instead teases us by inching down; and I swear the Financial Times is beginning to recycle its reports! In the U.S., the fiscal cliff looms along with debt limits and the usual election uncertainties. The dysfunctional U.S. Congress continues for the time being in its intractable ways. The stock market rises and falls and rises and falls again. It is getting difficult to find anything new to say at client meetings. I, for one, wish that the world would get on with whatever is coming next."The European Tinder Box

We wonder if harsh economic realities could transcend generally accepted logic.

The common perception of unravelling events relies, by and large, on

politicians remaining in close control of events and in particular in

tight control of their societies. There are more than 18 million people

unemployed in Europe today and, for as long Europe’s political class

stays on its current course, that unemployed rate will climb and

climb. That’s a really bad state of affairs; indeed, it’s

life-threatening. Eventually, we judge that the smouldering European tinder box will burst forth in to flame and thence on to conflagration.

It's this 'direct action' by angry citizens that would scupper the

controlled, totalitarian formation of a European superstate. Europe is on the verge of being raped and our own politicians don’t know where to look, still less what to do.

We wonder if harsh economic realities could transcend generally accepted logic.

The common perception of unravelling events relies, by and large, on

politicians remaining in close control of events and in particular in

tight control of their societies. There are more than 18 million people

unemployed in Europe today and, for as long Europe’s political class

stays on its current course, that unemployed rate will climb and

climb. That’s a really bad state of affairs; indeed, it’s

life-threatening. Eventually, we judge that the smouldering European tinder box will burst forth in to flame and thence on to conflagration.

It's this 'direct action' by angry citizens that would scupper the

controlled, totalitarian formation of a European superstate. Europe is on the verge of being raped and our own politicians don’t know where to look, still less what to do.Take Our Guns? Over our Dead Bodies!

07/31/2012 - 18:21

by Marc Chandler, Also Sprach Analyst:

The ECB’s Draghi expressed an appreciation for the urgency facing the euro area,

but he seems more isolated than he did last week when Merkel and

Hollande reiterated their willingness to do what was necessary.

The ECB’s Draghi expressed an appreciation for the urgency facing the euro area,

but he seems more isolated than he did last week when Merkel and

Hollande reiterated their willingness to do what was necessary.

Even though the euro fell more than a 1.5 cents from its pre-weekend high just below $1.24, Spanish bond yields have continued to retreat. The 10-year benchmark is now about 100 bp below the level seen early last week and the 2-year yield is off about 200 bp.

The market is pricing in a resumption of the ECB sovereign bond purchases (SMP). Yet in the past purchases by the ECB did not seem to have much lasting impact as yields and spreads continued to widen after some short-term and mostly limited reaction. The decline in Spanish yields will be tested Thursday just before the ECB meeting when Spain will raise 2.4-3.7 bln euros of 2, 4, and 10 year bonds.

Read More @ AlsoSprachAnalyst.com

The ECB’s Draghi expressed an appreciation for the urgency facing the euro area,

but he seems more isolated than he did last week when Merkel and

Hollande reiterated their willingness to do what was necessary.

The ECB’s Draghi expressed an appreciation for the urgency facing the euro area,

but he seems more isolated than he did last week when Merkel and

Hollande reiterated their willingness to do what was necessary.Even though the euro fell more than a 1.5 cents from its pre-weekend high just below $1.24, Spanish bond yields have continued to retreat. The 10-year benchmark is now about 100 bp below the level seen early last week and the 2-year yield is off about 200 bp.

The market is pricing in a resumption of the ECB sovereign bond purchases (SMP). Yet in the past purchases by the ECB did not seem to have much lasting impact as yields and spreads continued to widen after some short-term and mostly limited reaction. The decline in Spanish yields will be tested Thursday just before the ECB meeting when Spain will raise 2.4-3.7 bln euros of 2, 4, and 10 year bonds.

Read More @ AlsoSprachAnalyst.com

by Patrick A. Heller, Numismaster.com:

There are some indicators that August could bring a sudden demand for physical gold and silver coins and bars. This shift in demand could be strong enough that it would quickly deplete wholesale and retail supplies of bullion-priced products. To the extent that this occurs, that would almost certainly increase demand for the lower-premium pre-1934 U.S. gold coins as happened during the bullion coin buying frenzy in late 2008.

What could spark such a surge in demand that people would even consider purchasing older U.S. gold coins and Morgan and Peace dollars?

My friend Bill Murphy, the chairman of the Gold Anti-Trust Action Committee (www.gata.org) passed along news that in the past three weeks he has received the same information from three independent and usually reliable sources. The news is that the LIBOR scandal investigations that have mostly focused on Barclays bank thus far are expanding.

Read More @ Numismaster.com

There are some indicators that August could bring a sudden demand for physical gold and silver coins and bars. This shift in demand could be strong enough that it would quickly deplete wholesale and retail supplies of bullion-priced products. To the extent that this occurs, that would almost certainly increase demand for the lower-premium pre-1934 U.S. gold coins as happened during the bullion coin buying frenzy in late 2008.

What could spark such a surge in demand that people would even consider purchasing older U.S. gold coins and Morgan and Peace dollars?

My friend Bill Murphy, the chairman of the Gold Anti-Trust Action Committee (www.gata.org) passed along news that in the past three weeks he has received the same information from three independent and usually reliable sources. The news is that the LIBOR scandal investigations that have mostly focused on Barclays bank thus far are expanding.

Read More @ Numismaster.com

from Current:

Neil Barofsky, author of Bailout and former TARP overseer says that as a Bush appointee and lifelong Democrat, he hoped the Obama administration would stop the power financial institutions wielded in D.C., but instead there was more of the same. “There was almost no noticeable change when it came to the administration when it came to that deference to Wall Street,” Barofsky says.

I'm PayPal Verified

Neil Barofsky, author of Bailout and former TARP overseer says that as a Bush appointee and lifelong Democrat, he hoped the Obama administration would stop the power financial institutions wielded in D.C., but instead there was more of the same. “There was almost no noticeable change when it came to the administration when it came to that deference to Wall Street,” Barofsky says.

We The Sheeplez... is intended to reflect

excellence in effort and content. Donations will help maintain this goal

and defray the operational costs. Paypal, a leading provider of secure

online money transfers, will handle the donations. Thank you for your

contribution.

I'm PayPal Verified

by Patrick J. Buchanan, Lew Rockwell:

Has Mitt Romney given Israel a blank check for war?

So it seemed from the declaration in Jerusalem by his adviser Dan Senor, who all but flashed Israel a green light for war, signaling the Israelis that, if you go, Mitt’s got your back:

“If Israel has to take action on its own in order to stop Iran from developing that capability, the governor would respect that decision.”

“No option would be excluded. Gov. Romney recognizes Israel’s right to defend itself and that it is right for America to stand with it.”

What does “stand with” Israel, if she launches a surprise attack on Iran, mean? Does it mean the United States will guide Israeli planes to their targets and provide bases on their return? Does it mean U.S. air cover while Israeli planes strike Iran?

Read More @ LewRockwell.com

from Matlarson10:

from Brandon Turbeville, Activist Post

In a rare instance of real journalism, ABC news aired a report

on the increasing number of foreign workers being contracted and

imported into the United States for the purpose of rebuilding U.S.

infrastructure.

In a rare instance of real journalism, ABC news aired a report

on the increasing number of foreign workers being contracted and

imported into the United States for the purpose of rebuilding U.S.

infrastructure.

Has Mitt Romney given Israel a blank check for war?

So it seemed from the declaration in Jerusalem by his adviser Dan Senor, who all but flashed Israel a green light for war, signaling the Israelis that, if you go, Mitt’s got your back:

“If Israel has to take action on its own in order to stop Iran from developing that capability, the governor would respect that decision.”

“No option would be excluded. Gov. Romney recognizes Israel’s right to defend itself and that it is right for America to stand with it.”

What does “stand with” Israel, if she launches a surprise attack on Iran, mean? Does it mean the United States will guide Israeli planes to their targets and provide bases on their return? Does it mean U.S. air cover while Israeli planes strike Iran?

Read More @ LewRockwell.com

from Matlarson10:

from Brandon Turbeville, Activist Post

In a rare instance of real journalism, ABC news aired a report

on the increasing number of foreign workers being contracted and

imported into the United States for the purpose of rebuilding U.S.

infrastructure.

In a rare instance of real journalism, ABC news aired a report

on the increasing number of foreign workers being contracted and

imported into the United States for the purpose of rebuilding U.S.

infrastructure.

It is part of a trend in globalization that sees an increasing Chinese presence in the United States, including everything from banking to outright purchase of U.S. cities to planting Chinese flags on U.S. soil to GM effectively becoming China Motors to buying up U.S. oil and gas deposits.

Indeed, ABC journalist Chris Cuomo of the Bringing America Back

division of ABC News has reported that, out of the various different

infrastructure repair projects being undertaken in the United States, a

sizeable portion of those projects have been outsourced to foreign

companies, particularly Chinese firms, who have then imported their own

workers for the projects.

Read More @ Activist Post

Read More @ Activist Post

by Jeff Nielson, SilverGoldBull:

While this news item out of Iran is technically not a “bullion story”, bank-fraud most definitely is related to why we own bullion, with the latest and most notable example of bank-fraud being the unimaginably huge $350 trillion LIBOR-rigging fraud by the Western banking cabal. With that in mind, let’s note a few facts – and (shall we say) “inconsistencies”?

While this news item out of Iran is technically not a “bullion story”, bank-fraud most definitely is related to why we own bullion, with the latest and most notable example of bank-fraud being the unimaginably huge $350 trillion LIBOR-rigging fraud by the Western banking cabal. With that in mind, let’s note a few facts – and (shall we say) “inconsistencies”?

1) The death sentences in Iran concerned bank-fraud which totaled $2.6 billion in size, or less than 1/100,000th the total size of the LIBOR-fraud.

2) Western governments and their pretend-regulators have demonstrated total unwillingness to do anything to even slow down Western bank fraud – let alone put a halt to it. Indeed the banksters are now proclaiming their fraud to be “too big to fail.”

3) The United States alone among (supposedly) civilized nations continues to engage in “capital punishment”; and has no qualms about executing poor, non-white males in large numbers.

With the addition of those facts, I offer the following open question to readers: how many “death sentences” would the U.S. government need to hand-out for Wall Street fraud, before these banksters decided that crime was no longer a way of life…?

Read More @ SilverGoldBull

While this news item out of Iran is technically not a “bullion story”, bank-fraud most definitely is related to why we own bullion, with the latest and most notable example of bank-fraud being the unimaginably huge $350 trillion LIBOR-rigging fraud by the Western banking cabal. With that in mind, let’s note a few facts – and (shall we say) “inconsistencies”?

While this news item out of Iran is technically not a “bullion story”, bank-fraud most definitely is related to why we own bullion, with the latest and most notable example of bank-fraud being the unimaginably huge $350 trillion LIBOR-rigging fraud by the Western banking cabal. With that in mind, let’s note a few facts – and (shall we say) “inconsistencies”?1) The death sentences in Iran concerned bank-fraud which totaled $2.6 billion in size, or less than 1/100,000th the total size of the LIBOR-fraud.

2) Western governments and their pretend-regulators have demonstrated total unwillingness to do anything to even slow down Western bank fraud – let alone put a halt to it. Indeed the banksters are now proclaiming their fraud to be “too big to fail.”

3) The United States alone among (supposedly) civilized nations continues to engage in “capital punishment”; and has no qualms about executing poor, non-white males in large numbers.

With the addition of those facts, I offer the following open question to readers: how many “death sentences” would the U.S. government need to hand-out for Wall Street fraud, before these banksters decided that crime was no longer a way of life…?

Read More @ SilverGoldBull

from Silver Doctors:

After yesterday’s 9 silver inventory movements and 2.5 million ounce withdrawal from Brink’s vaults, inventory volatility continued in COMEX vaults Monday, as another 320,000 ounces were withdrawn from Brink’s, and HSBC adjusted nearly 5,000 ounces out of registered vaults.

While the CME is now reporting inventory levels to 3 decimal places, strangely enough- once again, NO MENTION FROM THE CME OF THE MISSING 1.4 MILLION OUNCES OF REGISTERED SILVER THAT SIMPLY DISAPPEARED IN THE AFTERMATH OF THE MF GLOBAL BANKRUPTCY!

As a strangely coincidental supply turned up in JPMorgan vaults almost simultaneously as the MFGlobal clients phyzz went missing, until the CME provides an update of what happened to this stolen inventory, The Doc will continue to provide the latest available info on this from the CME:

Read More @ Silver Doctors

After yesterday’s 9 silver inventory movements and 2.5 million ounce withdrawal from Brink’s vaults, inventory volatility continued in COMEX vaults Monday, as another 320,000 ounces were withdrawn from Brink’s, and HSBC adjusted nearly 5,000 ounces out of registered vaults.

While the CME is now reporting inventory levels to 3 decimal places, strangely enough- once again, NO MENTION FROM THE CME OF THE MISSING 1.4 MILLION OUNCES OF REGISTERED SILVER THAT SIMPLY DISAPPEARED IN THE AFTERMATH OF THE MF GLOBAL BANKRUPTCY!

As a strangely coincidental supply turned up in JPMorgan vaults almost simultaneously as the MFGlobal clients phyzz went missing, until the CME provides an update of what happened to this stolen inventory, The Doc will continue to provide the latest available info on this from the CME:

Read More @ Silver Doctors

by Richard Leiby, The Washington Post:

Pakistan will allow NATO supply convoys

to cross its territory into Afghanistan until the end of 2015, one year

beyond the deadline for withdrawal of U.S. combat forces there, under

an agreement signed Tuesday by U.S. and Pakistani officials.

Pakistan will allow NATO supply convoys

to cross its territory into Afghanistan until the end of 2015, one year

beyond the deadline for withdrawal of U.S. combat forces there, under

an agreement signed Tuesday by U.S. and Pakistani officials.

The pact seems to close, for now, one of the most contentious chapters in the turbulent relationship between Washington and Islamabad, cementing cooperation by Pakistan in winding down the war in Afghanistan, at least in terms of logistical assistance. Washington also has urged Islamabad to step up its participation in the peace process by bringing to the negotiating table militant groups that shelter in Pakistani’s tribal belt and regularly cross the border to attack NATO troops.

The memorandum of understanding signed Tuesday provides the option for both sides to extend the deal in one-year increments beyond Dec. 31, 2015. It would apply to other NATO nations if they sign separate pacts with Pakistan.

Although Pakistan ended its seven-month blockade of NATO supplies in early July, the pact formalizes some key details, including a ban on transporting lethal equipment unless it is meant for Afghan security forces. It also says that Pakistan will provide security for the thousands of container trucks and oil tankers whose routes originate at the port of Karachi.

Read More @ The Washington Post.com

Pakistan will allow NATO supply convoys

to cross its territory into Afghanistan until the end of 2015, one year

beyond the deadline for withdrawal of U.S. combat forces there, under

an agreement signed Tuesday by U.S. and Pakistani officials.

Pakistan will allow NATO supply convoys

to cross its territory into Afghanistan until the end of 2015, one year

beyond the deadline for withdrawal of U.S. combat forces there, under

an agreement signed Tuesday by U.S. and Pakistani officials.The pact seems to close, for now, one of the most contentious chapters in the turbulent relationship between Washington and Islamabad, cementing cooperation by Pakistan in winding down the war in Afghanistan, at least in terms of logistical assistance. Washington also has urged Islamabad to step up its participation in the peace process by bringing to the negotiating table militant groups that shelter in Pakistani’s tribal belt and regularly cross the border to attack NATO troops.

The memorandum of understanding signed Tuesday provides the option for both sides to extend the deal in one-year increments beyond Dec. 31, 2015. It would apply to other NATO nations if they sign separate pacts with Pakistan.

Although Pakistan ended its seven-month blockade of NATO supplies in early July, the pact formalizes some key details, including a ban on transporting lethal equipment unless it is meant for Afghan security forces. It also says that Pakistan will provide security for the thousands of container trucks and oil tankers whose routes originate at the port of Karachi.

Read More @ The Washington Post.com

from KingWorldNews:

With market participants eagerly awaiting decisions by both the Fed

and the ECB, today King World News interviewed 25 year veteran Caesar

Bryan over at Gabelli & Company, which has over $31 billion under

management. Here is what Ceasar had to say regarding the upcoming

central bank meetings and their impact on key markets: “Clearly

it’s the week for central banks. The market is waiting to see what the

Fed does tomorrow. There is also anticipation as to what action the

ECB is going take this week as well. The market will certainly test the

European’s resolve. Draghi came out and claimed that they would do

whatever it took to save the euro.”

With market participants eagerly awaiting decisions by both the Fed

and the ECB, today King World News interviewed 25 year veteran Caesar

Bryan over at Gabelli & Company, which has over $31 billion under

management. Here is what Ceasar had to say regarding the upcoming

central bank meetings and their impact on key markets: “Clearly

it’s the week for central banks. The market is waiting to see what the

Fed does tomorrow. There is also anticipation as to what action the

ECB is going take this week as well. The market will certainly test the

European’s resolve. Draghi came out and claimed that they would do

whatever it took to save the euro.”

Caesar Bryan continues @ KingWorldNews.com

With market participants eagerly awaiting decisions by both the Fed

and the ECB, today King World News interviewed 25 year veteran Caesar

Bryan over at Gabelli & Company, which has over $31 billion under

management. Here is what Ceasar had to say regarding the upcoming

central bank meetings and their impact on key markets: “Clearly

it’s the week for central banks. The market is waiting to see what the

Fed does tomorrow. There is also anticipation as to what action the

ECB is going take this week as well. The market will certainly test the

European’s resolve. Draghi came out and claimed that they would do

whatever it took to save the euro.”

With market participants eagerly awaiting decisions by both the Fed

and the ECB, today King World News interviewed 25 year veteran Caesar

Bryan over at Gabelli & Company, which has over $31 billion under

management. Here is what Ceasar had to say regarding the upcoming

central bank meetings and their impact on key markets: “Clearly

it’s the week for central banks. The market is waiting to see what the

Fed does tomorrow. There is also anticipation as to what action the

ECB is going take this week as well. The market will certainly test the

European’s resolve. Draghi came out and claimed that they would do

whatever it took to save the euro.”Caesar Bryan continues @ KingWorldNews.com

by Mike Shedlock, Global Economic Analysis:

So far it’s been nothing but hot air and no action from ECB president

Mario Draghi after he pledged to do whatever it takes to save the euro.

So far it’s been nothing but hot air and no action from ECB president

Mario Draghi after he pledged to do whatever it takes to save the euro.

One of the highly-touted ideas as of late has been a ESM banking license. However, the idea is not really new, and has been shot down repeatedly already. Nonetheless eurocrats like Jean-Claude Juncker, chairman of the eurogroup, keep bringing the idea up as if the answer will change.

It won’t. Bloomberg reports Merkel Allies Harden Opposition to Granting ESM Bank License

So far it’s been nothing but hot air and no action from ECB president

Mario Draghi after he pledged to do whatever it takes to save the euro.

So far it’s been nothing but hot air and no action from ECB president

Mario Draghi after he pledged to do whatever it takes to save the euro.One of the highly-touted ideas as of late has been a ESM banking license. However, the idea is not really new, and has been shot down repeatedly already. Nonetheless eurocrats like Jean-Claude Juncker, chairman of the eurogroup, keep bringing the idea up as if the answer will change.

It won’t. Bloomberg reports Merkel Allies Harden Opposition to Granting ESM Bank License

German Chancellor Angela Merkel’s coalition rejected granting the permanent euro rescue fund access to European Central Bank liquidity via a banking license, as the Finance Ministry said it saw no need for any such move.

The rules of the European Stability Mechanism don’t provide for refinancing through the ECB, the ministry in Berlin said today in an e-mailed response to questions. The ministry isn’t holding talks on the topic nor are secret meetings taking place on such proposals, it said.

Read More @ GlobalEconomicAnalysis.blogspot.com

by Brandon Smith, SHTFPlan:

I think it’s safe to say with some conviction that in the year of 2012 the concept of survival prepping is NOT an alien one to most Americans. When National Geographic decides there is a viable market for a prepper TV show (no matter how misrepresentative of true preppers it may be), when Walmart starts stocking shelves with long term emergency food storage kits, when survivalism in general becomes one of the few growing business markets in the midst of an otherwise disintegrating economy; you know that the methodology has gone “mainstream”. There is a noticeable and expanding concern amongst Americans that we are, indeed, on the verge of something new and unfortunate.

Is it the big bad hoodoo of the soon to expire Mayan Calendar? For a few, maybe, but for the majority of us, no. That jazz is a carnival sideshow designed to make the prepping culture appear ridiculous. We don’t need to believe in magical prophecies to know that there is a catastrophic road ahead; all we have to do is look at the stark realities of our current circumstances. It does not take much awareness anymore to notice looming fiscal volatility, social unrest, the potential for unrestrained war, and the totalitarian boldness of our government. I’ll take the wrath of Quetzalcoatl any day over the manure storm that is approaching us currently.

With some estimating a count of 3 million prepper families and growing in the U.S., the motto of “beans, bullets, and band-aids” is finding a home amongst legions. However, being closely involved in the survivalist movement during the past six years and speaking with literally thousands of preppers, it has become clear to me that we still have a long journey ahead of us before we can claim true efficiency and mastery.

Read More @ SHTFPlan.com

I think it’s safe to say with some conviction that in the year of 2012 the concept of survival prepping is NOT an alien one to most Americans. When National Geographic decides there is a viable market for a prepper TV show (no matter how misrepresentative of true preppers it may be), when Walmart starts stocking shelves with long term emergency food storage kits, when survivalism in general becomes one of the few growing business markets in the midst of an otherwise disintegrating economy; you know that the methodology has gone “mainstream”. There is a noticeable and expanding concern amongst Americans that we are, indeed, on the verge of something new and unfortunate.

Is it the big bad hoodoo of the soon to expire Mayan Calendar? For a few, maybe, but for the majority of us, no. That jazz is a carnival sideshow designed to make the prepping culture appear ridiculous. We don’t need to believe in magical prophecies to know that there is a catastrophic road ahead; all we have to do is look at the stark realities of our current circumstances. It does not take much awareness anymore to notice looming fiscal volatility, social unrest, the potential for unrestrained war, and the totalitarian boldness of our government. I’ll take the wrath of Quetzalcoatl any day over the manure storm that is approaching us currently.

With some estimating a count of 3 million prepper families and growing in the U.S., the motto of “beans, bullets, and band-aids” is finding a home amongst legions. However, being closely involved in the survivalist movement during the past six years and speaking with literally thousands of preppers, it has become clear to me that we still have a long journey ahead of us before we can claim true efficiency and mastery.

Read More @ SHTFPlan.com

from CapitalAccount:

Welcome to Capital Account. The FOMC’s two day meeting starts today and the ECB will meet later this week, amid the heightened expectations that the central banks are moving toward new actions. But, according to the Wall Street Journal, doubts linger as to whether central banks even have the tools to fix the economic problems they face. A lot of the money the Fed has tried to pump into the economy has wound up right back at the Fed. We will talk to Mike Maloney about what the Fed’s actions mean for the lives of average people.

And Bill Gross, co-founder of PIMCO, wrote that the cult of equity may be dying. However, the cult of inflation may have only just begun. We will talk to Mike Maloney, founder of GoldSilver.com, about the occult.

Also, US home prices rose in May for the fourth month in a row, according to the S&P Case Shiller data out today. We will talk to Mike Maloney, author of “Guide to Investing in Gold and Silver,” and see how this fits in with the other data pointing to a slowdown in the US economy.

Welcome to Capital Account. The FOMC’s two day meeting starts today and the ECB will meet later this week, amid the heightened expectations that the central banks are moving toward new actions. But, according to the Wall Street Journal, doubts linger as to whether central banks even have the tools to fix the economic problems they face. A lot of the money the Fed has tried to pump into the economy has wound up right back at the Fed. We will talk to Mike Maloney about what the Fed’s actions mean for the lives of average people.

And Bill Gross, co-founder of PIMCO, wrote that the cult of equity may be dying. However, the cult of inflation may have only just begun. We will talk to Mike Maloney, founder of GoldSilver.com, about the occult.

Also, US home prices rose in May for the fourth month in a row, according to the S&P Case Shiller data out today. We will talk to Mike Maloney, author of “Guide to Investing in Gold and Silver,” and see how this fits in with the other data pointing to a slowdown in the US economy.

by J. D. Heyes, Natural News:

One of the elements of Obamacare critics have been most vocal about is

the so-called government-sponsored “insurance pools” the law creates.

Now that it’s largely been upheld by the U.S. Supreme Court, these pools

will soon become a reality.

One of the elements of Obamacare critics have been most vocal about is

the so-called government-sponsored “insurance pools” the law creates.

Now that it’s largely been upheld by the U.S. Supreme Court, these pools

will soon become a reality.

So what? That’s the basis of the law, to provide insurance for everyone, correct?

Yes, but not necessarily the type of insurance you want. Or that you have now, say, through your employer.

One of the law’s selling points uttered by everyone in the administration paid to defend it, especially the president himself, promised Americans they could keep their current health insurance.

In his Weekly Address on August 15, 2009, Obama said of his health care proposal, “First, no matter what you’ve heard, if you like your doctor or healthcare plan, you can keep it.”

That was then. By July 2012, the administration was singing a different tune, admitting that, “as a practical matter, a majority of group health plans will lose their grandfather status by 2013.”

Read More @ NaturalNews.com

I'm PayPal Verified

One of the elements of Obamacare critics have been most vocal about is

the so-called government-sponsored “insurance pools” the law creates.

Now that it’s largely been upheld by the U.S. Supreme Court, these pools

will soon become a reality.

One of the elements of Obamacare critics have been most vocal about is

the so-called government-sponsored “insurance pools” the law creates.

Now that it’s largely been upheld by the U.S. Supreme Court, these pools

will soon become a reality.So what? That’s the basis of the law, to provide insurance for everyone, correct?

Yes, but not necessarily the type of insurance you want. Or that you have now, say, through your employer.

One of the law’s selling points uttered by everyone in the administration paid to defend it, especially the president himself, promised Americans they could keep their current health insurance.

In his Weekly Address on August 15, 2009, Obama said of his health care proposal, “First, no matter what you’ve heard, if you like your doctor or healthcare plan, you can keep it.”

That was then. By July 2012, the administration was singing a different tune, admitting that, “as a practical matter, a majority of group health plans will lose their grandfather status by 2013.”

Read More @ NaturalNews.com

With the United Nations poised to sign an international arms treaty that would

With the United Nations poised to sign an international arms treaty that would  Of course this time is different, right?

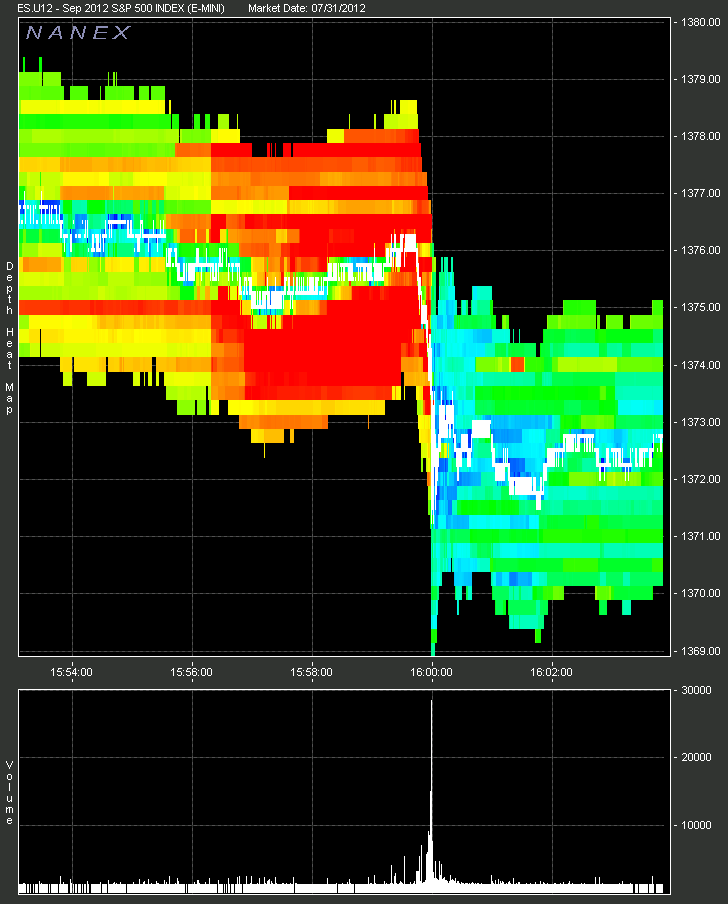

Of course this time is different, right? Do

you believe in miracles? Well, all those managers who were long the

QE-sensitive darlings of Financials, Materials, and Consumer

Discretionary into the month can breath a collective unchanged sigh of

relief - thanks to last week's Draghi drag higher. The Energy sector

managed a stupendous 4.9% gain on the month. The S&P 500, Dow, and Nasdaq all finished about 1-1.4% higher on the month (while Dow Transports ended -2.3%)

as we came close to some Hindenberg Omens in the last few days. Today's

market felt like the start of a sell-the-news day as we leaked back to

the edge of the Friday cliff in S&P 500 e-mini futures (ES) - with

an after-day-session-close snap down to catch-down to where

risk-assets had broadly been biased all day - amid huge volume (leaving

ES below its recent swing highs and Fibonacci levels). Commodities generally slid lower but WTI led the way ending down over 3% from Friday's close.

Gold, Silver, and Copper all slid even as USD slid lower too. Treasury

yields fell back retracing about half of the post-Draghi sell-off. VIX ended testing 19% into the close, up almost 1vol as the term-structure flattened ahead of the events of the next couple of days. The massive rip in volume at the close

(and 5pt drop in ES) suggest plenty of short-term exits ahead of the

fun-and-games of the next two days and certainly Treasuries were sending

similar derisking signals.

Do

you believe in miracles? Well, all those managers who were long the

QE-sensitive darlings of Financials, Materials, and Consumer

Discretionary into the month can breath a collective unchanged sigh of

relief - thanks to last week's Draghi drag higher. The Energy sector

managed a stupendous 4.9% gain on the month. The S&P 500, Dow, and Nasdaq all finished about 1-1.4% higher on the month (while Dow Transports ended -2.3%)

as we came close to some Hindenberg Omens in the last few days. Today's

market felt like the start of a sell-the-news day as we leaked back to

the edge of the Friday cliff in S&P 500 e-mini futures (ES) - with

an after-day-session-close snap down to catch-down to where

risk-assets had broadly been biased all day - amid huge volume (leaving

ES below its recent swing highs and Fibonacci levels). Commodities generally slid lower but WTI led the way ending down over 3% from Friday's close.

Gold, Silver, and Copper all slid even as USD slid lower too. Treasury

yields fell back retracing about half of the post-Draghi sell-off. VIX ended testing 19% into the close, up almost 1vol as the term-structure flattened ahead of the events of the next couple of days. The massive rip in volume at the close

(and 5pt drop in ES) suggest plenty of short-term exits ahead of the

fun-and-games of the next two days and certainly Treasuries were sending

similar derisking signals.

The

The  Despite

record low coupon issuance and a net negative issuance that is

enabling technical flow to dominate any sense of releveraging risk in

favor of the 'safety' of corporate bonds, the credit cycle is deteriorating rather rapidly in both the US and Europe.

As these charts of the upgrade/downgrade cycle from Barclays show,

things are as bad as they have been since the crisis began in terms of

ratings changes among investment grade and high-yield credit. Combine

that with the historically dismal seasonals for credit in the next three months and we urge caution.

Despite

record low coupon issuance and a net negative issuance that is

enabling technical flow to dominate any sense of releveraging risk in

favor of the 'safety' of corporate bonds, the credit cycle is deteriorating rather rapidly in both the US and Europe.

As these charts of the upgrade/downgrade cycle from Barclays show,

things are as bad as they have been since the crisis began in terms of

ratings changes among investment grade and high-yield credit. Combine

that with the historically dismal seasonals for credit in the next three months and we urge caution. The

catalyst for the major turnaround in markets last week was comments

from ECB President Draghi that he was prepared to do whatever it takes

to preserve the Euro and ensure monetary policy transmission. While this

is nothing more than stating his mandate (and that water is wet), the

focus on 'transmission' caught the attention of many and Barclays

provides a succinct flowchart of just where those transmission channels are broken. However, with

SMP empirically a losing proposition for sovereign spreads, LTROs

having had no impact on loans to non-financial corporates, and rate cuts

not reaching the peripheral economies (and in fact signaling further

divergence); it seems that short of full-scale LSAP (which JPM

thinks will need to be a minimum EUR600bn to be in any way effective),

whatever Draghi says will be a disappointment and perhaps that explains the weakness in European sovereigns this week as exuberance fades (or is the game to implicitly weaken the EUR to regain competitiveness).

The

catalyst for the major turnaround in markets last week was comments

from ECB President Draghi that he was prepared to do whatever it takes

to preserve the Euro and ensure monetary policy transmission. While this

is nothing more than stating his mandate (and that water is wet), the

focus on 'transmission' caught the attention of many and Barclays

provides a succinct flowchart of just where those transmission channels are broken. However, with

SMP empirically a losing proposition for sovereign spreads, LTROs

having had no impact on loans to non-financial corporates, and rate cuts

not reaching the peripheral economies (and in fact signaling further

divergence); it seems that short of full-scale LSAP (which JPM

thinks will need to be a minimum EUR600bn to be in any way effective),

whatever Draghi says will be a disappointment and perhaps that explains the weakness in European sovereigns this week as exuberance fades (or is the game to implicitly weaken the EUR to regain competitiveness).

On Thursday the European Central Bank’s Mario Draghi was moved to

defend the euro, after Spain’s government bond yields rose dramatically

through the 7% level. And when Valencia asked the central government for

a bailout, followed by indications that other cities and regions have

similar problems, it became clear that Spain is in deep trouble. We have

got used to the concept of too-big-to-fail; now we have

too-big-to-rescue.

On Thursday the European Central Bank’s Mario Draghi was moved to

defend the euro, after Spain’s government bond yields rose dramatically

through the 7% level. And when Valencia asked the central government for

a bailout, followed by indications that other cities and regions have

similar problems, it became clear that Spain is in deep trouble. We have

got used to the concept of too-big-to-fail; now we have

too-big-to-rescue.

Mr del Missier, the bank’s former chief operating officer who

resigned three weeks ago, is understood to have negotiated the deal with

Barclays’ outgoing chairman Marcus Agius in the days before he quit.

The pay-out looks certain to trigger another political storm over

bankers’ pay.

Mr del Missier, the bank’s former chief operating officer who

resigned three weeks ago, is understood to have negotiated the deal with

Barclays’ outgoing chairman Marcus Agius in the days before he quit.

The pay-out looks certain to trigger another political storm over

bankers’ pay.

We have long argued that

We have long argued that  Making a case for higher silver prices can involve two ways of looking at its supply:

Making a case for higher silver prices can involve two ways of looking at its supply:

It was an exciting and educational week. I was in Vancouver at the

Agora Financial Investment Symposium speaking to hundreds of investors

who are eager to learn how to grow and protect their wealth. This year’s

theme, “Innovate or Die,” fit well with my presentation, as the

conference challenged attendees to adapt their investment strategies

just as empires and enterprises adjust to changing circumstances.

It was an exciting and educational week. I was in Vancouver at the

Agora Financial Investment Symposium speaking to hundreds of investors

who are eager to learn how to grow and protect their wealth. This year’s

theme, “Innovate or Die,” fit well with my presentation, as the

conference challenged attendees to adapt their investment strategies

just as empires and enterprises adjust to changing circumstances. While expectations of a Draghi rescuing us all from our bad selves

remain extreme – well he did promise! – it seems the market that one

would expect to be the most likely to benefit from his ‘Aid’ is

increasingly not Kool. The last two days have seen Italian and

Spanish sovereign bond spreads turn back down – even as stocks in those

countries keep up the good wealth-building work (with the front-end wider by around 30bps today alone). At the same time,

While expectations of a Draghi rescuing us all from our bad selves

remain extreme – well he did promise! – it seems the market that one

would expect to be the most likely to benefit from his ‘Aid’ is

increasingly not Kool. The last two days have seen Italian and

Spanish sovereign bond spreads turn back down – even as stocks in those

countries keep up the good wealth-building work (with the front-end wider by around 30bps today alone). At the same time,  Michael Foreman, 48, fell from a fifth-floor balcony in the members’

bar area of the gallery on the South Bank last Tuesday evening.

Michael Foreman, 48, fell from a fifth-floor balcony in the members’

bar area of the gallery on the South Bank last Tuesday evening. The dominoes seem to be falling into place for Mario Draghi and the

ECB to show what they’re made of. With the apparent blessing of Angela

Merkel and her French, Italian, and Spanish counterparts, Draghi is

preparing to announce a set of measures designed to push down stubbornly

high peripheral bond yields that are threatening to destroy the

monetary union.

The dominoes seem to be falling into place for Mario Draghi and the

ECB to show what they’re made of. With the apparent blessing of Angela

Merkel and her French, Italian, and Spanish counterparts, Draghi is

preparing to announce a set of measures designed to push down stubbornly

high peripheral bond yields that are threatening to destroy the

monetary union. California will borrow an estimated $10 billion from

California will borrow an estimated $10 billion from  You know a crisis is about to burst open when U.S. Treasury Secretary

Timothy Geithner flies in unexpectedly to meet German Finance Minister

Wolfgang Schaeuble and European Central Bank President Mario Draghi.

You know a crisis is about to burst open when U.S. Treasury Secretary

Timothy Geithner flies in unexpectedly to meet German Finance Minister

Wolfgang Schaeuble and European Central Bank President Mario Draghi. Marcello Bartolotta, a surgeon from the Sicilian town of Messina, has

hit the jackpot. He has just been granted a seat in the regional

parliament as a replacement for a parliamentarian from his party who

recently died. The assembly will be dissolved in October ahead of

regional elections. That, though, is hardly a problem for Bartoletta.

After all, for the three or four remaining sessions he will attend until

then, he will get some €40,000 ($49,000), in addition to expenses.

Marcello Bartolotta, a surgeon from the Sicilian town of Messina, has

hit the jackpot. He has just been granted a seat in the regional

parliament as a replacement for a parliamentarian from his party who

recently died. The assembly will be dissolved in October ahead of

regional elections. That, though, is hardly a problem for Bartoletta.

After all, for the three or four remaining sessions he will attend until

then, he will get some €40,000 ($49,000), in addition to expenses. A

case of the government seeking money and bondage from rural residents

by purposely misconstruing an old law & bending definitions.

A

case of the government seeking money and bondage from rural residents

by purposely misconstruing an old law & bending definitions.

President Obama has signed an executive order. He has set up a new

bureaucracy. This bureaucracy plans to make inner-city education so good

that whites will move back.

President Obama has signed an executive order. He has set up a new

bureaucracy. This bureaucracy plans to make inner-city education so good

that whites will move back. Today Michael Pento warned, “It is now becoming blatantly apparent

that the central banks of the developed world are becoming desperate in

their pursuit to fight deflation.” Pento also clarified, “… a central

bank can always create inflation when they so choose. All they need is a

firm commitment to destroy the value of the currency, and a government

that is compliant towards that goal.”

Today Michael Pento warned, “It is now becoming blatantly apparent

that the central banks of the developed world are becoming desperate in

their pursuit to fight deflation.” Pento also clarified, “… a central

bank can always create inflation when they so choose. All they need is a

firm commitment to destroy the value of the currency, and a government

that is compliant towards that goal.”  Hot on the heels of our comments yesterday about the high cost of

doing just about anything and everything in Australia, today’s Australian tells us $200 billion worth of resource projects are at risk because of…high costs!

Hot on the heels of our comments yesterday about the high cost of

doing just about anything and everything in Australia, today’s Australian tells us $200 billion worth of resource projects are at risk because of…high costs!![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)