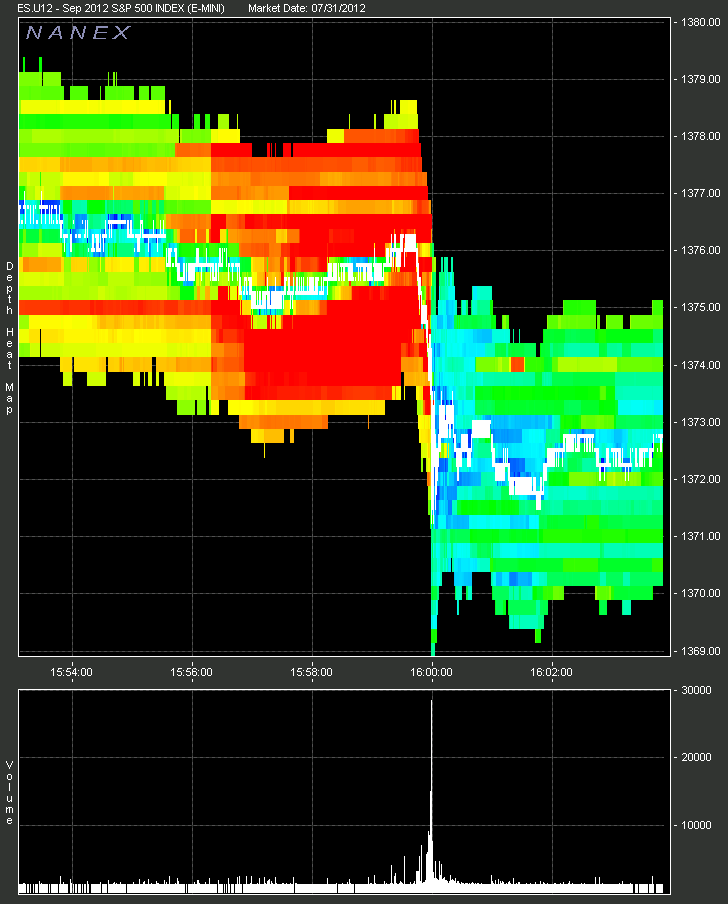

Visualizing Today's Deja Vu Last Second 60,000 E-Mini Contract Wipe Out

Today,

three seconds before the close, someone was in a desperate hurry to

dump 60,000 E-Mini contracts - the equivalent of $4.1 billion in

underlying notional (ignoring the reflexive impact on various correlated

assets and downstream synthetic instruments like ETFs and options).

What happened next was a trade that was just shy of the size of the

Waddell and Reed trade that the SEC said caused the flash crash. Luckily

this time there was just 3 seconds of potential waterfall

after-effects before the market closed. Had this happened at the May 6

blue light special time of 2:30 pm, the month end marks of US hedge

funds and prop desks would have looked very different one day before

the all too critical FOMC statement. The question remains: who waited

to perform a reverse E-bay (inverse bid all in, in the last second of

trading), and just what do/did they know? Below we present the complete

60,000 dump in its full visual glory courtesy of Nanex.

Today,

three seconds before the close, someone was in a desperate hurry to

dump 60,000 E-Mini contracts - the equivalent of $4.1 billion in

underlying notional (ignoring the reflexive impact on various correlated

assets and downstream synthetic instruments like ETFs and options).

What happened next was a trade that was just shy of the size of the

Waddell and Reed trade that the SEC said caused the flash crash. Luckily

this time there was just 3 seconds of potential waterfall

after-effects before the market closed. Had this happened at the May 6

blue light special time of 2:30 pm, the month end marks of US hedge

funds and prop desks would have looked very different one day before

the all too critical FOMC statement. The question remains: who waited

to perform a reverse E-bay (inverse bid all in, in the last second of

trading), and just what do/did they know? Below we present the complete

60,000 dump in its full visual glory courtesy of Nanex.

by Mac Slavo, SHTFPlan:

With the United Nations poised to sign an international arms treaty that would regulate global arms sales and ownership, and Congressional members just days ago attempting to sneak a nationwide restriction on “high capacity magazines” into a cyber security bill, the attack on firearm ownership in America is now in full swing.

With the United Nations poised to sign an international arms treaty that would regulate global arms sales and ownership, and Congressional members just days ago attempting to sneak a nationwide restriction on “high capacity magazines” into a cyber security bill, the attack on firearm ownership in America is now in full swing.This afternoon democrat Senators Frank Lautenberg and Carolyn McCarthy unveiled what may possibly be the most sweeping anti-second amendment legislative action in recent memory. Coming on the heels of the tragic events that left a dozen people dead and scores injured in Colorado, it’s becoming painfully obvious to proponents of the Second Amendment and individual liberty that politicians on the State and Federal level are doing everything in their power to ensure this crisis does not go to waste.

Two Democratic lawmakers on Monday will announce new legislation to regulate the online and mail-order sale of ammunition.

Sen. Frank Lautenberg (N.J.) and Rep. Carolyn McCarthy (N.Y.) said the new law would make the sale of ammunition “safer for law-abiding Americans who are sick and tired of the ease with which criminals can now anonymously stockpile for mass murder,” in a statement released Saturday.

The lawmakers cite the recent movie massacre in Aurora, Colo. for spurring their bill.

Read More @ SHTFPlan.com

Is Third Time The Charm For Central Bank Intervention Prayers?

Of course this time is different, right?

Of course this time is different, right?

We The Sheeplez... is intended to reflect

excellence in effort and content. Donations will help maintain this goal

and defray the operational costs. Paypal, a leading provider of secure

online money transfers, will handle the donations. Thank you for your

contribution.

I'm PayPal Verified Spanish and Italian yields back up again/Germany again says no to Draghi and the boys/Greece out of money

Harvey Organ at Harvey Organ's - The Daily Gold and Silver Report - 1 hour ago

Good

evening Ladies and Gentlemen:

Gold closed down today with most of the drop occurring after London was

put to bed. The closing price of gold at 1;30 pm today was $1610.40 down

$9.30. The price of silver held up pretty good down only 12 cents to

$27.90 The demand for physical metal is fierce especially when you see

how many gold ounces will stand in August. Today, Greece announced for

the

Equities Close Weak On Heavy Volume As Month Ends Up 1%

Do

you believe in miracles? Well, all those managers who were long the

QE-sensitive darlings of Financials, Materials, and Consumer

Discretionary into the month can breath a collective unchanged sigh of

relief - thanks to last week's Draghi drag higher. The Energy sector

managed a stupendous 4.9% gain on the month. The S&P 500, Dow, and Nasdaq all finished about 1-1.4% higher on the month (while Dow Transports ended -2.3%)

as we came close to some Hindenberg Omens in the last few days. Today's

market felt like the start of a sell-the-news day as we leaked back to

the edge of the Friday cliff in S&P 500 e-mini futures (ES) - with

an after-day-session-close snap down to catch-down to where

risk-assets had broadly been biased all day - amid huge volume (leaving

ES below its recent swing highs and Fibonacci levels). Commodities generally slid lower but WTI led the way ending down over 3% from Friday's close.

Gold, Silver, and Copper all slid even as USD slid lower too. Treasury

yields fell back retracing about half of the post-Draghi sell-off. VIX ended testing 19% into the close, up almost 1vol as the term-structure flattened ahead of the events of the next couple of days. The massive rip in volume at the close

(and 5pt drop in ES) suggest plenty of short-term exits ahead of the

fun-and-games of the next two days and certainly Treasuries were sending

similar derisking signals.

Do

you believe in miracles? Well, all those managers who were long the

QE-sensitive darlings of Financials, Materials, and Consumer

Discretionary into the month can breath a collective unchanged sigh of

relief - thanks to last week's Draghi drag higher. The Energy sector

managed a stupendous 4.9% gain on the month. The S&P 500, Dow, and Nasdaq all finished about 1-1.4% higher on the month (while Dow Transports ended -2.3%)

as we came close to some Hindenberg Omens in the last few days. Today's

market felt like the start of a sell-the-news day as we leaked back to

the edge of the Friday cliff in S&P 500 e-mini futures (ES) - with

an after-day-session-close snap down to catch-down to where

risk-assets had broadly been biased all day - amid huge volume (leaving

ES below its recent swing highs and Fibonacci levels). Commodities generally slid lower but WTI led the way ending down over 3% from Friday's close.

Gold, Silver, and Copper all slid even as USD slid lower too. Treasury

yields fell back retracing about half of the post-Draghi sell-off. VIX ended testing 19% into the close, up almost 1vol as the term-structure flattened ahead of the events of the next couple of days. The massive rip in volume at the close

(and 5pt drop in ES) suggest plenty of short-term exits ahead of the

fun-and-games of the next two days and certainly Treasuries were sending

similar derisking signals. Big Mogambo Plans (BMP)

Richard Daughty, a.k.a., 'The Mogambo Guru' at Mogambo Guru Report! - 1 hour ago

July 31, 2012 Mogambo Guru

As a loving, thoughtful, devoted father and husband, I occasionally have a

thought for my loving family. Not entirely free of selfish intention, I

hope that the wife and kids would see what a terrific dad and husband I am,

decide that they have been wrong about me all this time, and that out of

sheer gratitude, if nothing else, they would stop being such big pains in

my Huge Mogambo Ass (HMA).

I know that my fantasy world of "Leave me alone and get out of my way!" is

impossible to actually achieve, in that almost everything you can name

(exc... more »

Here's What the Fed May Do Instead of More QE

Eric De Groot at Eric De Groot - 2 hours ago

Who cares if it’s called QE3 or an indirect, fancy-pants liquidity

injection? Liquidity still devalues someone’s currency and general

standard of living. Headlines like a manure spreaders in Midwestern

fields throw sh*t in all directions and call it newsworthy. If the Fed

fails to hint at substantial liquidity by September tomorrow, the stock

market will...

[[ This is a content summary only. Visit my website for full links, other

content, and more! ]]

The Obama Welfare State

Dave in Denver at The Golden Truth - 5 hours ago

*If voting made any difference they wouldn't let us do it* *- *Mark Twain

Facebook stock hit a new low today. It's currently trading at $21.68, 43%

below its IPO price, in less than 2 1/2 months since going public. I know

there must be an example of a worse performing new IPO, but I can't think

of one in the 33 years in which I've been following/studying/trading the

markets. What blows my mind even more is that the Obama Justice Department

AND SEC are not investigating Morgan Stanley for this. It just goes to

show you the degree to which Wall Street controls Obama. If anyone... more »

Have $2,000 In Cash In Your Fidelity Account? Then You Too Can Qualify To Lose Money On The Manchester United IPO

Have $100,000 in "certain assets at Fidelity" and at least $2,000 in cash for close margin call encounters (you will need it)? Then you too are eligible to participate in the next IPO collapse, coming on August 9th in the form of the Manchester United public offering, which is going to be such an epic disaster it not only has middle market junk bond specialist Jefferies as lead left, that it has already opened itself up to retail participation by all the sub-underwriters, and as of this morning such reputable brokers as Fidelity are seeking indications of interest. Which simply means there is absolutely no interest at the institutional level. The last time this happened? FaceBerg, which went from $43 to $21 in about a month.FOMC Preview - Rate Extension But No NEW QE

The Hilsenrath-Haggle

Federal Open Market Committee (FOMC) is likely to ease monetary policy

at the July 31-August 1 meeting in response to the continued weakness

of the economic data and the persistent downside risks from the crisis

in Europe. While we expect nothing more exciting than an extension of the current “late 2014” interest rate guidance to "mid-2015",

Goldman adds in their preview of the decision that although a new Fed

asset purchase program is a possibility in the near term if the data

continue to disappoint, their central expectation is for a return to QE in December or early 2013.

The Hilsenrath-Haggle

Federal Open Market Committee (FOMC) is likely to ease monetary policy

at the July 31-August 1 meeting in response to the continued weakness

of the economic data and the persistent downside risks from the crisis

in Europe. While we expect nothing more exciting than an extension of the current “late 2014” interest rate guidance to "mid-2015",

Goldman adds in their preview of the decision that although a new Fed

asset purchase program is a possibility in the near term if the data

continue to disappoint, their central expectation is for a return to QE in December or early 2013.Your Taxpayer Dollars At Work

Not like anyone would expect anything more, technically, less, but it is always gratifying to know there is someone, somewhere willing to fight for the little guy. And lose.- SEC LOSES LAWSUIT AGAINST EX-CITIGROUP OFFICIAL STOKER - BBG

- SEC SUED CITIGROUP'S BRIAN STOKER OVER CDO REPRESENTATIONS - BBG

Picturing The Turn In The Credit Cycle

Despite

record low coupon issuance and a net negative issuance that is

enabling technical flow to dominate any sense of releveraging risk in

favor of the 'safety' of corporate bonds, the credit cycle is deteriorating rather rapidly in both the US and Europe.

As these charts of the upgrade/downgrade cycle from Barclays show,

things are as bad as they have been since the crisis began in terms of

ratings changes among investment grade and high-yield credit. Combine

that with the historically dismal seasonals for credit in the next three months and we urge caution.

Despite

record low coupon issuance and a net negative issuance that is

enabling technical flow to dominate any sense of releveraging risk in

favor of the 'safety' of corporate bonds, the credit cycle is deteriorating rather rapidly in both the US and Europe.

As these charts of the upgrade/downgrade cycle from Barclays show,

things are as bad as they have been since the crisis began in terms of

ratings changes among investment grade and high-yield credit. Combine

that with the historically dismal seasonals for credit in the next three months and we urge caution.Tax Cheat Timmy Geithner To DeMarco: "I Do Not Believe [Un-Socialism] Is The Best Decision For The Country"

In an administration that has completely lost its mind, and in which the solution to every problem is the forgiveness of debt to those who lived beyond their means, FHFA's Ed DeMarco is a lone voice of sanity. In a letter to Tim Geithner, the FHFA has the temerity to tell the truth and say that "after extensive analysis of the revised [Principal Reduction Act]...FHFA has concluded that the anticipated benefits do not outweigh the costs and risks... FHFA concluded that HAMP PRA did not clearly improve foreclosure avoidance while reducing costs to taxpayers relative to the approaches in place today."Via Bloomberg:- *FANNIE MAE, FREDDIE MAC WON'T WRITE DOWN LOANS, DEMARCO SAYS

- *FHFA'S DEMARCO SAYS PRINCIPAL REDUCTION WON'T BENEFIT TAXPAYERS

Charting Europe's Broken Transmission Channels

The

catalyst for the major turnaround in markets last week was comments

from ECB President Draghi that he was prepared to do whatever it takes

to preserve the Euro and ensure monetary policy transmission. While this

is nothing more than stating his mandate (and that water is wet), the

focus on 'transmission' caught the attention of many and Barclays

provides a succinct flowchart of just where those transmission channels are broken. However, with

SMP empirically a losing proposition for sovereign spreads, LTROs

having had no impact on loans to non-financial corporates, and rate cuts

not reaching the peripheral economies (and in fact signaling further

divergence); it seems that short of full-scale LSAP (which JPM

thinks will need to be a minimum EUR600bn to be in any way effective),

whatever Draghi says will be a disappointment and perhaps that explains the weakness in European sovereigns this week as exuberance fades (or is the game to implicitly weaken the EUR to regain competitiveness).

The

catalyst for the major turnaround in markets last week was comments

from ECB President Draghi that he was prepared to do whatever it takes

to preserve the Euro and ensure monetary policy transmission. While this

is nothing more than stating his mandate (and that water is wet), the

focus on 'transmission' caught the attention of many and Barclays

provides a succinct flowchart of just where those transmission channels are broken. However, with

SMP empirically a losing proposition for sovereign spreads, LTROs

having had no impact on loans to non-financial corporates, and rate cuts

not reaching the peripheral economies (and in fact signaling further

divergence); it seems that short of full-scale LSAP (which JPM

thinks will need to be a minimum EUR600bn to be in any way effective),

whatever Draghi says will be a disappointment and perhaps that explains the weakness in European sovereigns this week as exuberance fades (or is the game to implicitly weaken the EUR to regain competitiveness).My Dear Extended Family,

I have known Alf Fields for what seems like forever. I have long held

that the best technicians simply know the market of their interest and

use TA as a point of focus.

The prices of $3500 – $4000 and $4500 are now in the market’s focus.

Stay the course.

Regards,

Jim

Jim

Dear CIGAs,

There are no certainties in the investment universe. Investors are forced to weigh up the various risks and assess the probabilities involved before committing themselves to a course of action. Current Elliott Wave and technical studies suggest that the probabilities now favor a strong rise in the gold price.

It may be helpful to consider my personal assessment of the various probabilities at different points in the recent gold market correction. On 23 August 2011 when gold pushed above $1910 my guess was that there was a 90% probability of a severe correction. The target for the decline, as given in my keynote speech at the Sydney Gold Symposium in November, was circa $1480, the point at which the explosive extension in the gold price had started.

Extensions have a good record of retracing to the approximate point from which the extension began, in this case $1480. Market action during the decline is used to fine tune a more accurate end of the correction. Gold never got down to target of $1480, stopping not very far away at $1523 in late December 2011. At $1523 all the minor subdivisions suggested that there was a 75% probability that this was the low and that the market would move into a strong upward move, probably the most vigorous of the bull market. A lesser alternative considered was that $1523 might only be the A wave of a larger A-B-C correction.

Subsequent events proved that the lesser alternative – that $1523 was only the low point of the A wave – proved to be the correct diagnosis. The A-B-C correction is shown in the above chart.

The upward move from $1523 through January and February 2012 to $1792, a gain of $270 in just 2 months, looked exactly like the vigorous upward move that had been anticipated. From $1792 a correction in the 6%-8% range was expected. That meant a maximum retracement to $1650 could be tolerated. A decline below $1650 would indicate that something was wrong with the analysis and would necessitate examining alternative possibilities.

Gold did drop below $1650, throwing a spanner in the works of the expectation that the market was in the early stages of the massive third of a third wave with a target of $4500. Once the 61.8% retracement level at $1626 was also broken, the strongest probability was that the rise to $1792 was the B wave and that the market was declining in the C wave. At this stage it began to look as if gold might still achieve the original downside objective of $1480.

The decline halted at $1528 and then started rising in a desultory fashion. The above chart was produced at that time showing that the A wave decline had lasted 88 trading days while the C wave decline had lasted 55 days. In addition the C wave decline of $264 was 66.5% of the A wave decline of $397, as depicted on the chart. The 2/3 relationship between the A and C wave declines plus the ratio of 88 days to 55 days absorbed by the respective waves, a neat 8:5 Fibonacci ratio, improved the odds that $1528 was the end of wave C. It would thus also mark the final end of the correction that had lasted since late August 2011.

The above positive assessment was not published at the time. Additional confirmation from further market action was required to be sure of the call. The required evidence of a rapid and large upward surge in the gold price plus the break of the prominent downtrend did not emerge. Gold simply churned within a relatively narrow range below the declining trend line.

A number of readers have urged me to pay more attention to time. In the past I had found that the magnitude of the waves was a much more important factor than the time involved. I had never been able to make an accurate call using only time elements and cycles. Every time I made a forecast based on time, I got it wrong. Nevertheless, I resolved to examine the time elapsed by the different moves more closely.

That gave rise to recognizing that the 88 and 55 days absorbed by the A and C wave declines respectively was the interesting Fibonacci ratio of 8:5. With the gold market churning and going nowhere, I developed an alternative theory that $1528 was not the final low point of wave C but only the low point of wave a of an a-b-c move making up the C wave.

That would explain the desultory sideways trading in the gold price and implied that the final low was still somewhere in the future. An extension of this theory was that the decline in the smaller and final wave c to the low would last 33 trading days. This would extend the previous 88:55 ratio to 88:55:33, and would mean that the time absorbed by the two small c wave declines would total 88 days (55 +33), identical to the 88 days absorbed by the wave A decline.

This was pure hypothesis. There was no real basis for this theory, but it seemed worth testing it. If it was possible to predict the day of the final low ahead of time, that would be a significant achievement. Gold had rallied to $1640 on 6 June 2012 and then started churning sideways with a downward trend.

Projecting ahead 33 trading days from 6 June 2012 produced a date for the forthcoming low of 23 July 2012. I didn’t have any idea of what the low price would be. The chart below depicts what happened on 23 July 2012.

The low gold price on 23 July 2012 was $1564, certainly not a new low. Yet the gold price started rising almost immediately. Within a couple of days the gold price had broken upwards through the downtrend line that had been in place since the end of February 2012. This is a very positive development which will be greatly enhanced if the gold price continues to move strongly upwards over the coming days and weeks.

The bottom line is that we now have a really strong probability that the correction which started at $1913 on 23 August 2011 has been completed both in terms of Elliott waves and also in terms of time elapsed. If this is correct, the gold price should soon be expressing itself in violent upside action as it moves into the third of third wave which is still targeted to reach $4500.

Alf Field

31 July 2012 Comment to: alffield7@gmail.com

Disclosure and Disclaimer Statement: The author has personal investments in gold and silver bullion, as well as in gold, silver, uranium and other mining shares. The author’s objective in writing this article is to interest potential investors in this subject to the point where they are encouraged to conduct their own further diligent research. Neither the information nor the opinions expressed should be construed as a solicitation to buy or sell any stock, currency or commodity. Investors are recommended to obtain the advice of a qualified investment advisor before entering into any transactions. The author has neither been paid nor received any other inducement to write this article.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment