PFG's Chairman Was Forging Bank Documents For Years Even As The CFTC Gave An "All Clear"

If there is an event that should cost Gary Gensler his job as head regulator at the CFTC, it is this. According to a just released Reuters report, the head of MFG(lobal) part 2, PFG, whose story we broke yesterday, Russell Wasendorf Sr. "intercepted and forged bank documents for more than two years to cover up hundreds of millions of dollars in missing money, a person close to the situation." Once Wasendorf realized he was caught, and knew the implications of his actions would be exposed for the whole world to see, he tried to commit suicide, and failed. "Wasendorf, 64, is reported to be in a coma after a suicide attempt Monday morning, according to a complaint filed by the Commodity Futures Trading Commission on Tuesday that accuses Wasendorf and Peregrine of fraud." And while crime happens all the time, what is truly stunning is that as we reported previously, the CFTC gave the firm a clean bill of health in its January inspection of Peregrine Financial Group. That's 6 months ago. The CFTC, as a reminder, was it regulator. The entity whose sole charge is to make sure that firms at least have real, not rehypothecated, cash in their segregated client bank accounts. PFG never did for the past two years. And somehow the CFTC missed this. MF Global was a warning shot, and the CFTC missed it entirely. And not only that but 2 months later ir pronounced PFG clean. For this Gensler has to be fired immediately, and with prejudice.PGF Files Chapter 7

The natural and sad end to every fraud: liquidation (and even sadder for the10-25K creditors of the company who will get nothing as a result of this liquidation proceedings).BTFD... Keep Stacking...

“Inflationary

contagion is a fear on the minds of citizens the world over, and they

will continue taking physical precious metals off of the market until

the crisis ends.”

from Liberty CPM:

After the consolidation period of, really, the last nine months is

transcended, the end of 2011 and most of 2012 will be looked back upon

in a manner similar as the early 2000s and during the 2008 collapse, as

gold and silver reached price points much lower than they are today.

After the consolidation period of, really, the last nine months is

transcended, the end of 2011 and most of 2012 will be looked back upon

in a manner similar as the early 2000s and during the 2008 collapse, as

gold and silver reached price points much lower than they are today.

Having an idea of the scope of the gold and silver bull market, individuals on the sidelines will regret not having gotten in at these prices, both of which are well below their highs – silver rests 45% down about and gold at about 17.5% down. To be sure, however, from the perspective of medium-term -say, five years – both metals have proven resilient.

For now, daily noise and discussion are peppered by intermittent paper selloffs and the continued frustration of individuals who have bought at higher prices. On into the middle of the end of 2012, job reports will soften, not reaching the optimism of late fall 2011. The physical market has not been inundated with fearful selloffs at the retail level, by which such dips are usually defined, as can be seen by the recent dry-up in junk silver that was broadcast across the internet a few weeks ago.

Read More @ LibertyCPM.com

from Liberty CPM:

After the consolidation period of, really, the last nine months is

transcended, the end of 2011 and most of 2012 will be looked back upon

in a manner similar as the early 2000s and during the 2008 collapse, as

gold and silver reached price points much lower than they are today.

After the consolidation period of, really, the last nine months is

transcended, the end of 2011 and most of 2012 will be looked back upon

in a manner similar as the early 2000s and during the 2008 collapse, as

gold and silver reached price points much lower than they are today.Having an idea of the scope of the gold and silver bull market, individuals on the sidelines will regret not having gotten in at these prices, both of which are well below their highs – silver rests 45% down about and gold at about 17.5% down. To be sure, however, from the perspective of medium-term -say, five years – both metals have proven resilient.

For now, daily noise and discussion are peppered by intermittent paper selloffs and the continued frustration of individuals who have bought at higher prices. On into the middle of the end of 2012, job reports will soften, not reaching the optimism of late fall 2011. The physical market has not been inundated with fearful selloffs at the retail level, by which such dips are usually defined, as can be seen by the recent dry-up in junk silver that was broadcast across the internet a few weeks ago.

Read More @ LibertyCPM.com

from Silver Doctors:

After nearly 9 months of delays (and as Bart Chilton informed SD readers at the end of May), the CFTC has finally defined the word Swaps, meaning the first portions of the commodities positions limits rule will go into effect 60 days from today.

After nearly 9 months of delays (and as Bart Chilton informed SD readers at the end of May), the CFTC has finally defined the word Swaps, meaning the first portions of the commodities positions limits rule will go into effect 60 days from today.

The CFTC voted 4-1 for the definition of SWAPS, with BART CHILTON the lone vote against the rule. Chilton voted against the definition out of concern certain firms (ie JP Morgan) will side step the position limits by using forward contracts or swaps.

For those who missed it live, the full webcast of today’s meeting can be found at the link below:

http://onlinevideoservice.com/clients/cftc/archive.htm

Definition of “Swap” and “Security-Based Swap”

The Commissions believe that the definitions of “swap” and “security-based swap” in Title VII are detailed and comprehensive. However, as the Commissions did in the Proposing Release, the Commissions are clarifying in the final rules and interpretations that certain insurance products, consumer and commercial agreements, and loan participations are not swaps or security-based swaps.

Transactions that are Not Swaps or Security-Based Swaps

Insurance

The Commissions are issuing final rules and interpretations that would clarify that certain contracts, provided by certain entities, each meeting specified requirements would be considered insurance and not swaps or security-based swaps.

Final Rules

The final rules provide that certain transactions are swaps:

Read More @ SilverDoctors.com

After nearly 9 months of delays (and as Bart Chilton informed SD readers at the end of May), the CFTC has finally defined the word Swaps, meaning the first portions of the commodities positions limits rule will go into effect 60 days from today.

After nearly 9 months of delays (and as Bart Chilton informed SD readers at the end of May), the CFTC has finally defined the word Swaps, meaning the first portions of the commodities positions limits rule will go into effect 60 days from today.

The CFTC voted 4-1 for the definition of SWAPS, with BART CHILTON the lone vote against the rule. Chilton voted against the definition out of concern certain firms (ie JP Morgan) will side step the position limits by using forward contracts or swaps.

For those who missed it live, the full webcast of today’s meeting can be found at the link below:

http://onlinevideoservice.com/clients/cftc/archive.htm

Definition of “Swap” and “Security-Based Swap”

The Commissions believe that the definitions of “swap” and “security-based swap” in Title VII are detailed and comprehensive. However, as the Commissions did in the Proposing Release, the Commissions are clarifying in the final rules and interpretations that certain insurance products, consumer and commercial agreements, and loan participations are not swaps or security-based swaps.

Transactions that are Not Swaps or Security-Based Swaps

Insurance

The Commissions are issuing final rules and interpretations that would clarify that certain contracts, provided by certain entities, each meeting specified requirements would be considered insurance and not swaps or security-based swaps.

Final Rules

The final rules provide that certain transactions are swaps:

Read More @ SilverDoctors.com

from Silver Doctors:

Silver inventory movements in COMEX warehouses were quiet Monday, outside of a single massive one million ounce withdrawal from Scotia Mocatta.

While the CME is now reporting inventory levels to 3 decimal places, strangely enough- once again, NO MENTION FROM THE CME OF THE MISSING 1.4 MILLION OUNCES OF REGISTERED SILVER THAT SIMPLY DISAPPEARED IN THE AFTERMATH OF THE MF GLOBAL BANKRUPTCY!

A strangely coincidental supply turned up in JPMorgan vaults almost simultaneously as the MFGlobal clients phyzz went missing.

Read More @ SilverDoctors.com

Silver inventory movements in COMEX warehouses were quiet Monday, outside of a single massive one million ounce withdrawal from Scotia Mocatta.

While the CME is now reporting inventory levels to 3 decimal places, strangely enough- once again, NO MENTION FROM THE CME OF THE MISSING 1.4 MILLION OUNCES OF REGISTERED SILVER THAT SIMPLY DISAPPEARED IN THE AFTERMATH OF THE MF GLOBAL BANKRUPTCY!

A strangely coincidental supply turned up in JPMorgan vaults almost simultaneously as the MFGlobal clients phyzz went missing.

Read More @ SilverDoctors.com

More "Change You Can Believe In"...

by Bruce Krasting Bruce Krasting Blog:

Yesterday the Prez put his proposal on the table about what to do with the Fiscal Cliff the country faces at the end of the year. What Obama said is important. What he didn’t say is critical.

It should come as no surprise that Obama has proposed an extension of

the Bush tax cuts for those workers earning $250,000 or less and a tax

increase for those making above $250,000.

It should come as no surprise that Obama has proposed an extension of

the Bush tax cuts for those workers earning $250,000 or less and a tax

increase for those making above $250,000.

The extension of the tax cut for those earning under $250k will have a cost of $150B according to the White House:

The President’s proposal appears to be “tax progressive” in that it benefits workers on the middle to lower end of incomes. The plan is clearly designed to get some votes in the key political states of Ohio and Pennsylvania. Who knows? Maybe some suckers will actually cast a vote for Obama as they think he’s standing up for those on the lower rungs of the income profile. Baloney!

What the President didn’t say in his speech yesterday is far more important than what he did say. He did not say word one about the 2% Social Security tax break that has been on the books the past few years. What this means is that the FICA tax break is going to expire. When it does, every worker’s paycheck is going to get hit by 2%.

Read More @ BruceKrasting.blogspot.com

Yesterday the Prez put his proposal on the table about what to do with the Fiscal Cliff the country faces at the end of the year. What Obama said is important. What he didn’t say is critical.

It should come as no surprise that Obama has proposed an extension of

the Bush tax cuts for those workers earning $250,000 or less and a tax

increase for those making above $250,000.

It should come as no surprise that Obama has proposed an extension of

the Bush tax cuts for those workers earning $250,000 or less and a tax

increase for those making above $250,000.The extension of the tax cut for those earning under $250k will have a cost of $150B according to the White House:

The President’s proposal appears to be “tax progressive” in that it benefits workers on the middle to lower end of incomes. The plan is clearly designed to get some votes in the key political states of Ohio and Pennsylvania. Who knows? Maybe some suckers will actually cast a vote for Obama as they think he’s standing up for those on the lower rungs of the income profile. Baloney!

What the President didn’t say in his speech yesterday is far more important than what he did say. He did not say word one about the 2% Social Security tax break that has been on the books the past few years. What this means is that the FICA tax break is going to expire. When it does, every worker’s paycheck is going to get hit by 2%.

Read More @ BruceKrasting.blogspot.com

By gpc1981, Gains Pains & Capital:

The

emerging markets, especially China, are showing signs of a major

slowdown. Indeed, recent revelations have made it clear that China’s

slowdown is in fact much worse than expected:

The

emerging markets, especially China, are showing signs of a major

slowdown. Indeed, recent revelations have made it clear that China’s

slowdown is in fact much worse than expected:

Chinese Data Mask Depth of Slowdown, Executives Say

Record-setting mountains of excess coal have accumulated at the country’s biggest storage areas because power plants are burning less coal in the face of tumbling electricity demand. But local and provincial government officials have forced plant managers not to report to Beijing the full extent of the slowdown, power sector executives said.

Read More @ GainsPainsCapital.com

The

emerging markets, especially China, are showing signs of a major

slowdown. Indeed, recent revelations have made it clear that China’s

slowdown is in fact much worse than expected:

The

emerging markets, especially China, are showing signs of a major

slowdown. Indeed, recent revelations have made it clear that China’s

slowdown is in fact much worse than expected:Chinese Data Mask Depth of Slowdown, Executives Say

Record-setting mountains of excess coal have accumulated at the country’s biggest storage areas because power plants are burning less coal in the face of tumbling electricity demand. But local and provincial government officials have forced plant managers not to report to Beijing the full extent of the slowdown, power sector executives said.

Read More @ GainsPainsCapital.com

The Dark (Pool) Truth About What Really Goes On In The Stock Market: Part 4

The Island-Renaissance fusion was a vision of the future in which high-speed AI-guided robots would operate on lightning-fast electronic pools, controlling the daily ebb and flow of the market. The AI Bots poured their valuable liquidity into Island, which, in turn, made it possible for the Bots to operate at high frequencies. They fed off one another, creating a virtuous cycle that would become un- stoppable. Little-known outfits such as Timber Hill, Tradebot, RGM, and Getco would soon start trading on Island, forming the emergent ganglia of a new space-age trading organism driven by machines. Tricked-out artificial intelligence systems designed to scope out hid- den pockets in the market where they could ply their trades powered many of these systems. In the process, the very structure of how the U.S. stock market worked would shift to meet the endless needs of the Bots. The human middlemen, though they didn’t know it, were being phased out, doomed as dinosaurs. And the machines were breeding more machines in an endless cycle of innovation, as programmers pushed the boundaries of speed more ruthlessly than Olympic sprinters. Trading algorithms would mutate, grow, and evolve, feeding off one another like evolving species in a vast and growing digital pool.Because Once You Drop By Bankruptcy Court, You Don't Stop: San Bernardino On Chapter 9 Deck

Meredith Whitney made her doomsday prediction. The nothing. Nothing. Then lots of glib muni expert pundits gloating because the Fed, the ECB, the BOJ, the BOE, the SNB, and of course, the central bank of Kenya, had managed to delay the inevitable by a year. Then some more nothing. Then suddenly Stockton, Mammoth Lakes, and now San Bernardino all file in the span of 2 weeks.- SAN BERNARDINO, CALIFORNIA, WEIGHING CHAPTER 9 BANKRUPTCY

- SAN BERNARDINO COUNCIL TO DISCUSS ACTION, SPOKESWOMAN SAYS

- SAN BERNARDINO SPOKESWOMAN GWENDOLYN WATERS SPOKE IN INTERVIEW

JPMorgan To Clawback Bonuses, Will Announce CIO Loss Just Over $5 Billion

Many were stunned when Ina Drew left JPM with millions in bonuses a few short days after Jamie Dimon told Senate and Congress those responsible for the multi-billions CIO loss would see compensation clawbacks. They can be unstunned now, following a report from the WSJ that in a few days JPM will announces millions in clawbacks from disgraced CIO executives. As for the final loss on the CIO? Recall what Zero Hedge calculated (not speculated, not surmised, not made up) in the hours literally after the JPM announcement of a $2 billion loss? We said: "Is JPM Staring At Another $3 Billion Loss?" and elaborated that "this is where we find ourselves now - the net notionals remain huge (and implicitly on JPM's shoulders), his lack of selling has left the credit index maybe 20bps rich to where it might trade given its rough correlation with the S&P 500 and this would imply at least $3bn of losses already in addition at fair-value." We were again spot on: from the WSJ: "J.P. Morgan is expected to announce Friday that the trading blunders will cost the company just over $5 billion in the second quarter, in which the bank is expected to show a profit, according to people familiar with the situation." Math: it's fundamental (Ph.D. economists - take note).Gold and silver bombed/More fallout from PGF disaster/Fed away of the Libor lie/

Harvey Organ at Harvey Organ's - The Daily Gold and Silver Report - 6 hours ago

Good

evening Ladies and Gentlemen:

Gold closed down today to the tune of $9.30 to $1579.30. Silver also

joined in the raid falling by 57 cents to $26.85. I was asked yesterday

night about the sudden negative lease rates. I told the reader that

this was a sure sign that a raid would be orchestrated. The second clue

was the lackluster performance of the gold/silver equity shares

yesterday.

Silver Chart - by Request

Trader Dan at Trader Dan's Market Views - 6 hours ago

Taking a look at silver on the weekly chart it is not too difficult to see

that it has been in a well-defined downtrend since peaking in the spring of

last year. Rallies are being sold but dips into the region near $27.00 -

$26.00 have been bought. The result has been to form a perfect triangle

pattern on the chart. This latter or bottom level of support has thus

become CRITICAL to the future prospects of the metal.

It is getting very close to this downside line again this week. Bears are

going to continue to try to press it to see if they can push enough longs

out of the market to... more »

So Freaking Obvious (SFO)

Richard Daughty, a.k.a., 'The Mogambo Guru' at Mogambo Guru Report! - 8 hours ago

July 9 2012

I have long argued, until my throat is raspy and raw from rudely calling

people "imbeciles", "halfwits" and "low-life morons", that facts and

figures don't lie, and from them one learns, to one's paralyzing horror,

that We're Freaking Doomed (WFD).

Of course, being brought up on a steady diet of television and movies, I

always thought that the world would end with an invasion from outer space,

maybe with aliens sucking our blood for the hemoglobin or invading our

brains so that we become slaves, and the best we can hope for is to be

ruled by beautiful... more »

On Attacking Austrian Economics

Josh Barro of Bloomberg has an interesting theory. According to him,

conservatives in modern day America have become so infatuated with the

school of Austrian economics that they no longer listen to reason. It

is because of this diehard obsession that they reject all empirical

evidence and refuse to change their favorable views of laissez faire

capitalism following the financial crisis. Basically, because the

conservative movement is so smitten with the works of Ludwig von Mises

and F.A. Hayek, they see no need to pose any intellectual challenge to

the idea that the economy desperately needs to be guided along by an

“always knows best” government; much like a parent to a child. CNN and Newsweek contributor David Frum has jumped on board

with Barro and levels the same critique of conservatives while

complaining that not enough of them follow Milton Friedman anymore.

Josh Barro of Bloomberg has an interesting theory. According to him,

conservatives in modern day America have become so infatuated with the

school of Austrian economics that they no longer listen to reason. It

is because of this diehard obsession that they reject all empirical

evidence and refuse to change their favorable views of laissez faire

capitalism following the financial crisis. Basically, because the

conservative movement is so smitten with the works of Ludwig von Mises

and F.A. Hayek, they see no need to pose any intellectual challenge to

the idea that the economy desperately needs to be guided along by an

“always knows best” government; much like a parent to a child. CNN and Newsweek contributor David Frum has jumped on board

with Barro and levels the same critique of conservatives while

complaining that not enough of them follow Milton Friedman anymore.To put this as nicely as possible, Barro and Frum aren’t just incorrect; they have put their embarrassingly ignorant understandings of Austrian economics on full display for all to see.

Propping Up The Gold Price?

Ultimately, the surge in demand for gold reflects one thing alone: distrust of the increasingly messy, interconnected, over-leveraged and fraudulent financial system. Whether it is China — fearful of dollar debasement — loading up on bullion, or retail investors in the United States or Europe — fearful of another MF Global (or PFG, or Lehman Brothers) — stacking Krugerrands in their basement, demand for gold reflects distrust in finance, distrust in the financial establishment, distrust in banks, distrust in regulators, distrust in government and distrust in the financial media. And it is that distrust — not (by any stretch of the imagination) central bank interventionism — that is the force moving demand for gold. There will be no bear market for physical gold until trust in the financial system and regulators is fixed, until markets trade fundamentals instead of the possibility of the NEW QE, until governments represent the interests of their people instead of the interests of tiny financial elites.Spanish Financial Sector M.O.U. - Analysis

The devil is in the details and we finally have the Spanish Bank rescue details. The cost is not mentioned. We do not know the cost of the borrowing or how long it will last for. That ultimately will be key. Short dated, high coupon loans will not help much. Long dated, low coupon loans will help. The seniority issue doesn’t seem too bad but reading the documentation it looks like it must have been extremely contentious as it can’t help but say it is going to Spain time and again where it was unnecessary. The other reason the seniority doesn’t look too bad is because it doesn’t look like much money will get doled out. The timing seems far too long. This is a political fix and one where they live in some bankers world rather than a traders world. We are VERY concerned about the long timeframe for implementation. The immediate availability of €30 billion is good, but as TF Market Advisors' Peter Tchir confirms, we have our doubts that it will be distributed. However, as we noted earlier, even if fully implemented there would be well under EUR200 billion by year-end anyway and now with the German Court stalling implementation further, the devil in the details may just be overwhelmed by the god of reality.Bearish Enough To Buy? The Real Fear Index Says Not So Fast

All

day long we are bombarded with surveys of sentiment. When positive;

all is well. When negative they are used by any and every long-only

manager as yet another money-on-the-sideline-like as justification to be

the contrarian and buy-the-dip. There are however many times when the survey of people's 'views' is quite different from their positioning

(cognitive dissonance aside) and we prefer to look at real market

sentiment indications for our signals. Case in point is CSFB's Fear

Index - which, unlike VIX, measures the sentiment skew in options prices

(how much more bearish or bullish put options are relative to call

options). In general, it shows a slight leading indication for

larger-trend equity movements but most critically - it can signal when

real market positions have become too bullish (or overly confident) or

too bearish (overly conservative). The fact is that the options markets are NOT currently overly bearish here

- as they were in Q4 (green oval) - providing the short-squeeze-levered

ammo for a rally here; just as options markets were overly bullish

(red oval) as the end of LTRO2 began - which provided the initial

levered-long-squeeze ammo for the current sell-off. So the next

time you hear someone saying how negative sentiment is - and that's a

reason to buy - show them this chart (of real positions - not a survey!)

and tell them to move along.

All

day long we are bombarded with surveys of sentiment. When positive;

all is well. When negative they are used by any and every long-only

manager as yet another money-on-the-sideline-like as justification to be

the contrarian and buy-the-dip. There are however many times when the survey of people's 'views' is quite different from their positioning

(cognitive dissonance aside) and we prefer to look at real market

sentiment indications for our signals. Case in point is CSFB's Fear

Index - which, unlike VIX, measures the sentiment skew in options prices

(how much more bearish or bullish put options are relative to call

options). In general, it shows a slight leading indication for

larger-trend equity movements but most critically - it can signal when

real market positions have become too bullish (or overly confident) or

too bearish (overly conservative). The fact is that the options markets are NOT currently overly bearish here

- as they were in Q4 (green oval) - providing the short-squeeze-levered

ammo for a rally here; just as options markets were overly bullish

(red oval) as the end of LTRO2 began - which provided the initial

levered-long-squeeze ammo for the current sell-off. So the next

time you hear someone saying how negative sentiment is - and that's a

reason to buy - show them this chart (of real positions - not a survey!)

and tell them to move along.

We The Sheeplez... is intended to reflect

excellence in effort and content. Donations will help maintain this goal

and defray the operational costs. Paypal, a leading provider of secure

online money transfers, will handle the donations. Thank you for your

contribution.

I'm PayPal Verified

We The Sheeplez... is intended to reflect

excellence in effort and content. Donations will help maintain this goal

and defray the operational costs. Paypal, a leading provider of secure

online money transfers, will handle the donations. Thank you for your

contribution.

Labor Unions: The New, Old SuperPACs?

Much has been said about the evil crony capitalism inflicted upon America as a result of PAC, SuperPACs, corporate donations, and just general bribery on behalf of America's corporations in broad terms, and Wall Street in narrow (and Private Equity firms in uber-narrow) terms. But is there an even bigger destabilizing force of "cronyness" in America? According to the WSJ, there well may be: labor unions. Yes: those same entities that are so critical for Obama's reelection campaign that the president abrogated property rights and overturned the entire bankruptcy process in the case of GM and Chrysler, to benefit various forms of organized labor at the expense of evil, evil bondholders (represented on occasion by such even more evil entities as little old grandmas whose retirement money had been invested in GM bonds), appear to have a far greater impact in bribe-facilitated decision-making than previously thought.

Equities Smash Back To Risk-Asset Reality

After

surging away from risk-assets into Friday's close (only to revert

yesterday) and once again surging into yesterday's close, broad

derisking among most risk-assets finally saw US equities catching-down

to that reality in the short-term today - as they broke the

EU-Summit/Spain-Bailout/Greek-Election shoulder and ended comfortably

below the 50DMA. Short-end Treasury yields made new record lows

as belly to long-end all fell notably close to those record lows (with

10Y back under 1.50% and 30Y under 2.60%). The USD rallied back from a

0.3% loss on the week to a 0.1% gain - thanks mostly to EUR's new 2Y low at 1.2235 intraday and AUD weakness (as JPY remains better on the week - more carry unwinds). Commodities plunged

- far exceeding the USD-implied moves - with WTI down over 3% from

yesterday's highs and Gold and Silver in sync down around 1% on the

week. Staples and Utilities were the only sectors holding green today

(marginally) as Industrials, Materials, and Energy (all the high beta

QE-sensitive sectors) took a dive. It seems the message that no NEW QE

without a market plunge is getting through and the reality of a global

slowdown looms large. Credit outperformed (though was very quiet

flow-wise) but HYG underperformed - cracking into the close

- as it just seems like the most yield-chasing 'technicals-driven'

market there is currently. Slightly below average volume and above

average trade size offers little insight here but a pop back

above 19% in VIX (and a 2-month flat in term structure), a rise in

implied correlation, a rise in systemic cross-asset class correlation,

and the leaking negatives of broad risk assets suggest there is more to

come here (especially given the BUBA's comments this morning

and a lack of real progress in Europe). The ubiquitous late-day ramp saw

aggressive trade size and volume (with a delta bias to selling) as it

remained far below VWAP.

After

surging away from risk-assets into Friday's close (only to revert

yesterday) and once again surging into yesterday's close, broad

derisking among most risk-assets finally saw US equities catching-down

to that reality in the short-term today - as they broke the

EU-Summit/Spain-Bailout/Greek-Election shoulder and ended comfortably

below the 50DMA. Short-end Treasury yields made new record lows

as belly to long-end all fell notably close to those record lows (with

10Y back under 1.50% and 30Y under 2.60%). The USD rallied back from a

0.3% loss on the week to a 0.1% gain - thanks mostly to EUR's new 2Y low at 1.2235 intraday and AUD weakness (as JPY remains better on the week - more carry unwinds). Commodities plunged

- far exceeding the USD-implied moves - with WTI down over 3% from

yesterday's highs and Gold and Silver in sync down around 1% on the

week. Staples and Utilities were the only sectors holding green today

(marginally) as Industrials, Materials, and Energy (all the high beta

QE-sensitive sectors) took a dive. It seems the message that no NEW QE

without a market plunge is getting through and the reality of a global

slowdown looms large. Credit outperformed (though was very quiet

flow-wise) but HYG underperformed - cracking into the close

- as it just seems like the most yield-chasing 'technicals-driven'

market there is currently. Slightly below average volume and above

average trade size offers little insight here but a pop back

above 19% in VIX (and a 2-month flat in term structure), a rise in

implied correlation, a rise in systemic cross-asset class correlation,

and the leaking negatives of broad risk assets suggest there is more to

come here (especially given the BUBA's comments this morning

and a lack of real progress in Europe). The ubiquitous late-day ramp saw

aggressive trade size and volume (with a delta bias to selling) as it

remained far below VWAP.Peak Employment

Peak

employment is the theory that due to factors such as efficiency,

driven by technological innovation, and demand, developed economies may

have already passed beyond the highest point of employment and

that from this point onwards employment will continue to fall

and unemployment inexorably rise causing increased social tension.

Employment is falling, unemployment is rising but hidden behind those

headlines is the fact that part time Employment is rising. Less people

have full time jobs, more people have part time jobs, which means that

the hours of work are being spread increasingly more thinly across the population.

Some might argue that it is only because of the economic slump that

all of these things are happening and that it is only temporary. But

there is enough evidence to suggest that this is a long term trend that

has just been disguised by the boom of the last ten years and is only

now really becoming apparent. The fear is that we have

already passed Peak Employment and the downward trend will continue,

perhaps disguised by increasingly more part time employment.

Peak

employment is the theory that due to factors such as efficiency,

driven by technological innovation, and demand, developed economies may

have already passed beyond the highest point of employment and

that from this point onwards employment will continue to fall

and unemployment inexorably rise causing increased social tension.

Employment is falling, unemployment is rising but hidden behind those

headlines is the fact that part time Employment is rising. Less people

have full time jobs, more people have part time jobs, which means that

the hours of work are being spread increasingly more thinly across the population.

Some might argue that it is only because of the economic slump that

all of these things are happening and that it is only temporary. But

there is enough evidence to suggest that this is a long term trend that

has just been disguised by the boom of the last ten years and is only

now really becoming apparent. The fear is that we have

already passed Peak Employment and the downward trend will continue,

perhaps disguised by increasingly more part time employment.How Many Checkpoints in One Morning?! Welcome to the Police State!

[Ed. Note: If EVERY American ACTED like a real AMERICAN sovereign citizen, like THIS GUY DOES - this police state nightmare would crumble overnight.]

from sanderson1611:

by Marin Katusa, Casey Research:

Stories of doubles, five-baggers, or even tenfold returns abound in

the resource sector. These successes are exactly why we play the game:

The discovery and development of a new oilfield or gas basin can create

immense value, and being part of a story like that is extremely

satisfying, not to mention financially rewarding.

Stories of doubles, five-baggers, or even tenfold returns abound in

the resource sector. These successes are exactly why we play the game:

The discovery and development of a new oilfield or gas basin can create

immense value, and being part of a story like that is extremely

satisfying, not to mention financially rewarding.However, the potential for big resource returns can all too easily make investors forget just how risky the sector really is. Investors are not the only ones who get caught up in the hype – an exciting discovery can turn normally conservative CEOs and geologists into starry-eyed daydreamers waxing poetic about grand possibilities and great riches. As a story out of Brazil recently reminded us, even the world’s most successful investors can get carried away by dreams of resource riches.

Read More @ CaseyResearch.com

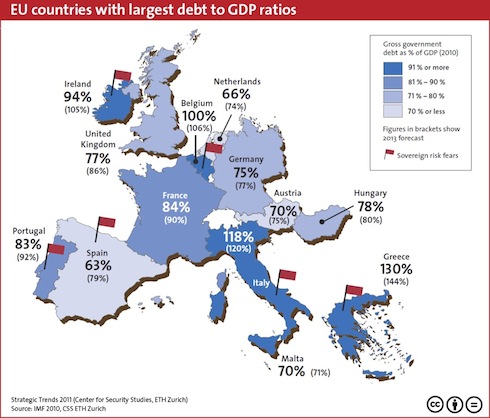

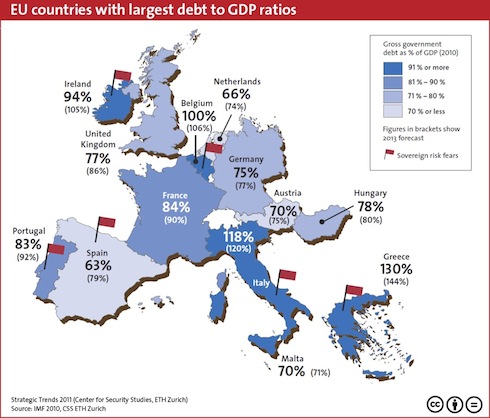

from KingWorldNews:

With continued volatility in global markets, today King World News

interviewed Jeffrey Saut, Chief Investment Strategist for Raymond James,

which has $360 billion assets under management. Saut spoke with KWN

about Europe and warned, “As I’ve always said, the systemic problem, I’m

not sure can be fixed.” He also warned about possible conflict with

Iran and class warfare, but first, here is what Saut had to say about

the crisis in Europe: “I think Europe took a step in the right

direction a couple of weeks ago. It was consistent with what I’ve been

saying year, that when push came to shove that politicians, bureaucrats

and bankers are the same over there as they are over here, and when you

get to the ‘nth’ hour they are going to paper over ‘Euroquake’ and try

to buy more time.”

With continued volatility in global markets, today King World News

interviewed Jeffrey Saut, Chief Investment Strategist for Raymond James,

which has $360 billion assets under management. Saut spoke with KWN

about Europe and warned, “As I’ve always said, the systemic problem, I’m

not sure can be fixed.” He also warned about possible conflict with

Iran and class warfare, but first, here is what Saut had to say about

the crisis in Europe: “I think Europe took a step in the right

direction a couple of weeks ago. It was consistent with what I’ve been

saying year, that when push came to shove that politicians, bureaucrats

and bankers are the same over there as they are over here, and when you

get to the ‘nth’ hour they are going to paper over ‘Euroquake’ and try

to buy more time.”“In this particular instance I think the papering over was significant in some of the measures they took. It actually looked like the first step in the right direction, ever. Every three months I think they are going to have to come back and do some more QE-whatever it is over there, and try to continue to buy more time.

As I’ve always said, the systemic problem, I’m not sure can be fixed….

Jeffrey Saut continues @ KingWorldNews.com

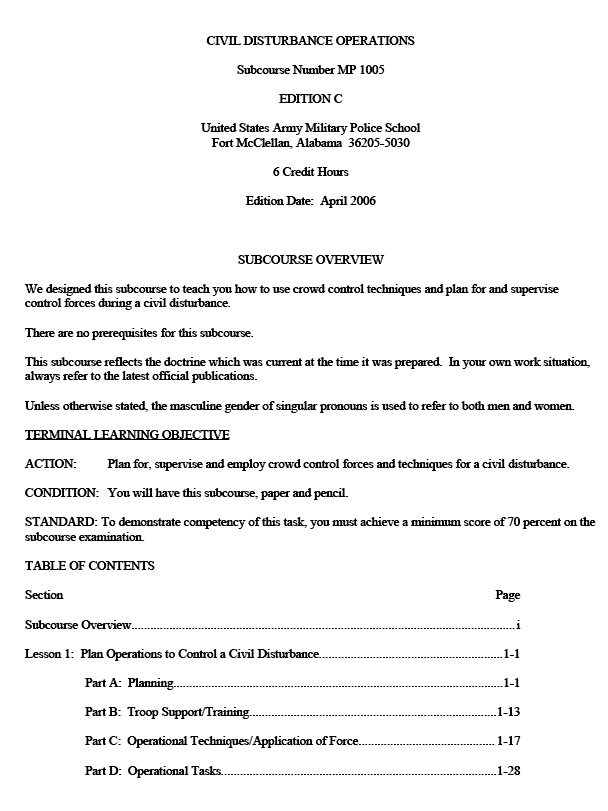

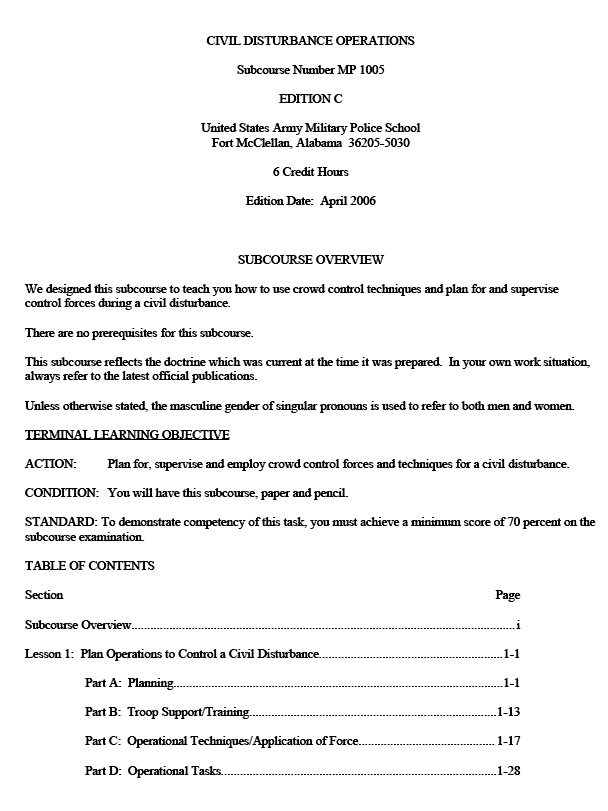

from Public Intelligence:

The following self-learning course from the U.S. Army Military Police

School at Fort McClellan describes procedures for military police

involvement in civil disturbance operations. The course makes it clear

that temporary detention facilities in the event of a civil disturbance

overloading local resources would be operated under existing military

doctrine for internment facilities. The course cites U.S. Army FM 3-19.40 Internment/Resettlement Operations, which is now numbered FM 3-39.40 since its most recent revision in 2010, as the primary reference for the operation of these facilities.

The following self-learning course from the U.S. Army Military Police

School at Fort McClellan describes procedures for military police

involvement in civil disturbance operations. The course makes it clear

that temporary detention facilities in the event of a civil disturbance

overloading local resources would be operated under existing military

doctrine for internment facilities. The course cites U.S. Army FM 3-19.40 Internment/Resettlement Operations, which is now numbered FM 3-39.40 since its most recent revision in 2010, as the primary reference for the operation of these facilities.

This lesson is designed to describe the nature and causes of disaffection and social unrest; define the potential for social unrest in the United States; identify the types of confrontations; define crowd behavioral and psychological influences; identify patterns of disorder.

…

2. Application of Force.

a. General.

(1) Civil disturbance operations by federal forces will not be authorized until the President is advised by the highest officials of the state that the situation cannot be controlled with nonfederal resources available. The mission of the control force is to help restore law and order and to help maintain it until such time as state and local forces can control the situation without federal help. In performing this mission, the control force may have to actively participate, not only in subduing the disturbance, but also in helping to detain those responsible for it. Control force commanders are authorized and directed to provide such active participation, subject to restraints on the use of force.

Read More @ PublicIntelligence.net

The following self-learning course from the U.S. Army Military Police

School at Fort McClellan describes procedures for military police

involvement in civil disturbance operations. The course makes it clear

that temporary detention facilities in the event of a civil disturbance

overloading local resources would be operated under existing military

doctrine for internment facilities. The course cites U.S. Army FM 3-19.40 Internment/Resettlement Operations, which is now numbered FM 3-39.40 since its most recent revision in 2010, as the primary reference for the operation of these facilities.

The following self-learning course from the U.S. Army Military Police

School at Fort McClellan describes procedures for military police

involvement in civil disturbance operations. The course makes it clear

that temporary detention facilities in the event of a civil disturbance

overloading local resources would be operated under existing military

doctrine for internment facilities. The course cites U.S. Army FM 3-19.40 Internment/Resettlement Operations, which is now numbered FM 3-39.40 since its most recent revision in 2010, as the primary reference for the operation of these facilities.This lesson is designed to describe the nature and causes of disaffection and social unrest; define the potential for social unrest in the United States; identify the types of confrontations; define crowd behavioral and psychological influences; identify patterns of disorder.

…

2. Application of Force.

a. General.

(1) Civil disturbance operations by federal forces will not be authorized until the President is advised by the highest officials of the state that the situation cannot be controlled with nonfederal resources available. The mission of the control force is to help restore law and order and to help maintain it until such time as state and local forces can control the situation without federal help. In performing this mission, the control force may have to actively participate, not only in subduing the disturbance, but also in helping to detain those responsible for it. Control force commanders are authorized and directed to provide such active participation, subject to restraints on the use of force.

Read More @ PublicIntelligence.net

by Justin Elliott, Pro Publica:

The NYPD is regularly held up as one of the most sophisticated and

significant counterterrorism operations in the country. As evidence of

the NYPD’s excellence, the department, its allies and the media have

repeatedly said the department has thwarted or helped thwart 14

terrorist plots against New York since Sept 11.

The NYPD is regularly held up as one of the most sophisticated and

significant counterterrorism operations in the country. As evidence of

the NYPD’s excellence, the department, its allies and the media have

repeatedly said the department has thwarted or helped thwart 14

terrorist plots against New York since Sept 11.

In a glowing profile of Commissioner Ray Kelly published in Newsweek last month, for example, journalist Christopher Dickey wrote of the commissioner’s tenure since taking office in 2002: The record “is hard to argue with: at least 14 full-blown terrorist attacks have been prevented or failed on Kelly’s watch.”

The figure has been cited repeatedly in the media, by New York congressmen, and by Kelly himself. The NYPD itself has published the full list, saying terrorists have “attempted to kill New Yorkers in 14 different plots.”

As Mayor Michael Bloomberg said in March: “We have the best police department in the world and I think they show that every single day and we have stopped 14 attacks since 9/11 fortunately without anybody dying.”

Is it true?

Read More @ ProPublica.org

The NYPD is regularly held up as one of the most sophisticated and

significant counterterrorism operations in the country. As evidence of

the NYPD’s excellence, the department, its allies and the media have

repeatedly said the department has thwarted or helped thwart 14

terrorist plots against New York since Sept 11.

The NYPD is regularly held up as one of the most sophisticated and

significant counterterrorism operations in the country. As evidence of

the NYPD’s excellence, the department, its allies and the media have

repeatedly said the department has thwarted or helped thwart 14

terrorist plots against New York since Sept 11.In a glowing profile of Commissioner Ray Kelly published in Newsweek last month, for example, journalist Christopher Dickey wrote of the commissioner’s tenure since taking office in 2002: The record “is hard to argue with: at least 14 full-blown terrorist attacks have been prevented or failed on Kelly’s watch.”

The figure has been cited repeatedly in the media, by New York congressmen, and by Kelly himself. The NYPD itself has published the full list, saying terrorists have “attempted to kill New Yorkers in 14 different plots.”

As Mayor Michael Bloomberg said in March: “We have the best police department in the world and I think they show that every single day and we have stopped 14 attacks since 9/11 fortunately without anybody dying.”

Is it true?

Read More @ ProPublica.org

By Dan Denning, Daily Reckoning.com.au:

Yesterday’s Daily Reckoning finished off by asking what the correct investment strategy

is when the world’s central banks flood markets with even more money.

We omitted the Bank of England adding £50 billion to its quantitative

easing (QE) program.

Yesterday’s Daily Reckoning finished off by asking what the correct investment strategy

is when the world’s central banks flood markets with even more money.

We omitted the Bank of England adding £50 billion to its quantitative

easing (QE) program.

Could the LIBOR scandal be the event that sideswipes the financial system and sends markets down? Hmm. We confess to ignoring the story for the first few days. Few things in life are as boring and depressing as examining the London Interbank Offered Rate. What the banks have to pay to borrow overnight and unsecured is, in a normal world, not news.

In an abnormal world, rising LIBOR is an indicator of rising mistrust in the credit markets. When LIBOR rises, banks get defensive and reluctant to lend to one another. When it’s not being manipulated, therefore, LIBOR is a kind of alarm in the credit markets that tells you when a bomb is about to go off.

If you think of it that way — as an early warning system that borrowers may face rising short-term borrowing costs — then it’s a lot easier to understand why someone would want to disable the early warning system. You just have to figure out who has the most to gain by preventing the communication of this information via LIBOR.

Read More @ DailyReckoning.com.au

Yesterday’s Daily Reckoning finished off by asking what the correct investment strategy

is when the world’s central banks flood markets with even more money.

We omitted the Bank of England adding £50 billion to its quantitative

easing (QE) program.

Yesterday’s Daily Reckoning finished off by asking what the correct investment strategy

is when the world’s central banks flood markets with even more money.

We omitted the Bank of England adding £50 billion to its quantitative

easing (QE) program.Could the LIBOR scandal be the event that sideswipes the financial system and sends markets down? Hmm. We confess to ignoring the story for the first few days. Few things in life are as boring and depressing as examining the London Interbank Offered Rate. What the banks have to pay to borrow overnight and unsecured is, in a normal world, not news.

In an abnormal world, rising LIBOR is an indicator of rising mistrust in the credit markets. When LIBOR rises, banks get defensive and reluctant to lend to one another. When it’s not being manipulated, therefore, LIBOR is a kind of alarm in the credit markets that tells you when a bomb is about to go off.

If you think of it that way — as an early warning system that borrowers may face rising short-term borrowing costs — then it’s a lot easier to understand why someone would want to disable the early warning system. You just have to figure out who has the most to gain by preventing the communication of this information via LIBOR.

Read More @ DailyReckoning.com.au

By Humay Guliyeva and Pan Kwan Yuk Financial Times, via GATA:

What’s Iran doing with Turkish gold?

What’s Iran doing with Turkish gold?

That is the question [the] Beyondbrics [column] found itself asking after it had a look at Turkey’s latest trade figures.

According to data released by the Turkish Statistical Institute (TurkStat), Turkey’s trade with Iran in May rose a whopping 513.2 per cent to hit $1.7 billion. Of this, gold exports to its eastern neighbour accounted for the bulk of the increase. Nearly $1.4 billion worth of gold was exported to Iran, accounting for 84 per cent of Turkey’s trade with the country.

So what’s going on? In a nutshell — sanctions and oil.

In recent months, Western powers, notably the US and the European Union, have tightened financial sanctions on the Islamic regime in an attempt to force Iran to scale back or halt its efforts to enrich uranium.

Read More @ GATA.org

What’s Iran doing with Turkish gold?

What’s Iran doing with Turkish gold?That is the question [the] Beyondbrics [column] found itself asking after it had a look at Turkey’s latest trade figures.

According to data released by the Turkish Statistical Institute (TurkStat), Turkey’s trade with Iran in May rose a whopping 513.2 per cent to hit $1.7 billion. Of this, gold exports to its eastern neighbour accounted for the bulk of the increase. Nearly $1.4 billion worth of gold was exported to Iran, accounting for 84 per cent of Turkey’s trade with the country.

So what’s going on? In a nutshell — sanctions and oil.

In recent months, Western powers, notably the US and the European Union, have tightened financial sanctions on the Islamic regime in an attempt to force Iran to scale back or halt its efforts to enrich uranium.

Read More @ GATA.org

from Azizonomics:

Izabella Kaminska makes the point that central banks have turned net gold buyers:

Izabella Kaminska makes the point that central banks have turned net gold buyers:

Kaminska seems to believe that gold’s price is not just central-bank supported, but its trajectory is downward:

If not for the gold bar/coin frenzy and ETF demand (now substituted by official buying), one might speculate that the collapse in conventional demand (i.e. for industrial and jewelery purposes) may have led to a very different price path for gold post 2008.

Now that ETF demand is waning, however, marginal support for the gold price is actually being provided by the official sector more than ever.

Though, given the gold price reaction of late, clearly even this is not so effective so, either gold and coin buying has started to wane as well – and there is evidencethat this is the case – or it’s taking ever more buying (by official sources) to keep prices supported at the current level.

The recent plateauing of the gold price thus either suggest that today’s spot supply is increasingly catering to tomorrow’s demand expectations, or in the context of more gold being produced all the time, it is taking ever more buying by the official sector to keep prices from falling.

In other words, sans the intervention of central banks on a major level: case bearish.

The obvious thing, though — even if we take central bank buying out of the equation altogether — is that total demand for gold is still increasing. And the price of gold has increased faster than sales, illustrating that the market has struggled and continues to struggle to keep pace with underlying demand.

And it’s not just demand for gold-denominated paper (i.e. ETFs or other such as-risky-as-anything-you’ll-get-from-MF Global assets) — it’s recently manifested as demand for hard physical gold:

Read More @ Azizonomics.com

Izabella Kaminska makes the point that central banks have turned net gold buyers:

Izabella Kaminska makes the point that central banks have turned net gold buyers:Kaminska seems to believe that gold’s price is not just central-bank supported, but its trajectory is downward:

If not for the gold bar/coin frenzy and ETF demand (now substituted by official buying), one might speculate that the collapse in conventional demand (i.e. for industrial and jewelery purposes) may have led to a very different price path for gold post 2008.

Now that ETF demand is waning, however, marginal support for the gold price is actually being provided by the official sector more than ever.

Though, given the gold price reaction of late, clearly even this is not so effective so, either gold and coin buying has started to wane as well – and there is evidencethat this is the case – or it’s taking ever more buying (by official sources) to keep prices supported at the current level.

The recent plateauing of the gold price thus either suggest that today’s spot supply is increasingly catering to tomorrow’s demand expectations, or in the context of more gold being produced all the time, it is taking ever more buying by the official sector to keep prices from falling.

In other words, sans the intervention of central banks on a major level: case bearish.

The obvious thing, though — even if we take central bank buying out of the equation altogether — is that total demand for gold is still increasing. And the price of gold has increased faster than sales, illustrating that the market has struggled and continues to struggle to keep pace with underlying demand.

And it’s not just demand for gold-denominated paper (i.e. ETFs or other such as-risky-as-anything-you’ll-get-from-MF Global assets) — it’s recently manifested as demand for hard physical gold:

Read More @ Azizonomics.com

by Bill Holter, MilesFranklin.com:

The latest fraud to be exposed is that of PFGBest. This looks like an

instant replay of MF Global except that the CFTC is actually suing them

this time (unlike MF Global) and not letting “the money get away”. This

will be discussed in detail over time and again end up with a bunch of

ignorant (there’s that word again) Congressmen asking dumb questions and

trying for soundbites in their 5 min. allotted time. So far this looks

like a ham sandwich deal being a little over $200 million, but that’s

not the point. The CFTC was in PFG’s offices just a couple of months

ago and what did they find? Apparently nothing…or if they did maybe

they wanted to keep it quiet like the

The latest fraud to be exposed is that of PFGBest. This looks like an

instant replay of MF Global except that the CFTC is actually suing them

this time (unlike MF Global) and not letting “the money get away”. This

will be discussed in detail over time and again end up with a bunch of

ignorant (there’s that word again) Congressmen asking dumb questions and

trying for soundbites in their 5 min. allotted time. So far this looks

like a ham sandwich deal being a little over $200 million, but that’s

not the point. The CFTC was in PFG’s offices just a couple of months

ago and what did they find? Apparently nothing…or if they did maybe

they wanted to keep it quiet like the

Li(e)bor fixing where “everyone knew but nobody told”. Which brings me to the point.

“Who do you trust”? What is the point of “trading” and winning if…you end up losing it to your custodian going bankrupt? This is just one more example fraud and one more example of the “confidence” being knocked out from under the Ponzified system. I might mention that this “real world” shortfall and “use of funds” is the same thing that WOULD be going on in the off market derivatives market but isn’t public. It isn’t “public” because John and Jane Doe are not participants who will scream when they lose money, no, these derivatives are done between “big boys” who know that if their counterparty is in default it is in their own best interest to…say NOTHING!

Read more @ MilesFranklin.com

The latest fraud to be exposed is that of PFGBest. This looks like an

instant replay of MF Global except that the CFTC is actually suing them

this time (unlike MF Global) and not letting “the money get away”. This

will be discussed in detail over time and again end up with a bunch of

ignorant (there’s that word again) Congressmen asking dumb questions and

trying for soundbites in their 5 min. allotted time. So far this looks

like a ham sandwich deal being a little over $200 million, but that’s

not the point. The CFTC was in PFG’s offices just a couple of months

ago and what did they find? Apparently nothing…or if they did maybe

they wanted to keep it quiet like the

The latest fraud to be exposed is that of PFGBest. This looks like an

instant replay of MF Global except that the CFTC is actually suing them

this time (unlike MF Global) and not letting “the money get away”. This

will be discussed in detail over time and again end up with a bunch of

ignorant (there’s that word again) Congressmen asking dumb questions and

trying for soundbites in their 5 min. allotted time. So far this looks

like a ham sandwich deal being a little over $200 million, but that’s

not the point. The CFTC was in PFG’s offices just a couple of months

ago and what did they find? Apparently nothing…or if they did maybe

they wanted to keep it quiet like theLi(e)bor fixing where “everyone knew but nobody told”. Which brings me to the point.

“Who do you trust”? What is the point of “trading” and winning if…you end up losing it to your custodian going bankrupt? This is just one more example fraud and one more example of the “confidence” being knocked out from under the Ponzified system. I might mention that this “real world” shortfall and “use of funds” is the same thing that WOULD be going on in the off market derivatives market but isn’t public. It isn’t “public” because John and Jane Doe are not participants who will scream when they lose money, no, these derivatives are done between “big boys” who know that if their counterparty is in default it is in their own best interest to…say NOTHING!

Read more @ MilesFranklin.com

from TrimTabs:

from TruthNeverTold :

from KingWorldNews:

Today legendary value investor, Jean Marie Eveillard, told KWN that elites throughout the world are discredited. Eveillard, who oversees $50 billion at First Eagle Funds, also said, “The implications (if the trend continues) would be a chaotic or semi-chaotic period. If the economy does not recover, in what would appear to be a sustainable manner, then the politicians will be under pressure to take very unusual steps.”

He also discussed the gold market, but first, here is what Eveillard had to say about the danger elites and bankers are facing: “Elites are discredited, not just in the US but throughout the world, including possibly in China if the economy there continues to do poorly. And it’s not just government elites, it’s also business elites, particularly financial elites in many countries, including the US, the bankers and the like. They will end up hanging a few. I suppose I’ll be spared because I’m too old.”

Jean Marie Eveillard continues @ KingWorldNews.com

Today legendary value investor, Jean Marie Eveillard, told KWN that elites throughout the world are discredited. Eveillard, who oversees $50 billion at First Eagle Funds, also said, “The implications (if the trend continues) would be a chaotic or semi-chaotic period. If the economy does not recover, in what would appear to be a sustainable manner, then the politicians will be under pressure to take very unusual steps.”

He also discussed the gold market, but first, here is what Eveillard had to say about the danger elites and bankers are facing: “Elites are discredited, not just in the US but throughout the world, including possibly in China if the economy there continues to do poorly. And it’s not just government elites, it’s also business elites, particularly financial elites in many countries, including the US, the bankers and the like. They will end up hanging a few. I suppose I’ll be spared because I’m too old.”

Jean Marie Eveillard continues @ KingWorldNews.com

by Bill Holter, MilesFranklin.com:

I spent 23 years in the brokerage business and saw everything from

soup to nuts as far as stupidity is concerned. Here are a few

instances. I saw corporate stupidity and hubris as a branch manager for

A G Edwards as I watched our research dept. get caught up in the dotcom

craze where “valuations” didn’t matter anymore. Like everyone else, it

was buy the dips all the way down and best to run with the pack. There

were times when I saw idiocy by local employees. One instance, an

employee who was going through a divorce signed and turned in a forged

distribution form for her spouses IRA account. Another time after doing

a meeting on why all portfolios needed to have at least some Gold

related assets in them, one of my bond guys came in a couple weeks later

and said “I bought some Gold yesterday”. Here I was thinking “WOW,

maybe part of the meeting got through his thick skull”. Lo and behold,

he then told me that he paid $9.95 a piece for 5 plated “Gold coins”!

His logic was that they were just as “pretty” as the real ones and cost

so much less. His remark of “what’s the difference?” still makes me

laugh out loud today!

I spent 23 years in the brokerage business and saw everything from

soup to nuts as far as stupidity is concerned. Here are a few

instances. I saw corporate stupidity and hubris as a branch manager for

A G Edwards as I watched our research dept. get caught up in the dotcom

craze where “valuations” didn’t matter anymore. Like everyone else, it

was buy the dips all the way down and best to run with the pack. There

were times when I saw idiocy by local employees. One instance, an

employee who was going through a divorce signed and turned in a forged

distribution form for her spouses IRA account. Another time after doing

a meeting on why all portfolios needed to have at least some Gold

related assets in them, one of my bond guys came in a couple weeks later

and said “I bought some Gold yesterday”. Here I was thinking “WOW,

maybe part of the meeting got through his thick skull”. Lo and behold,

he then told me that he paid $9.95 a piece for 5 plated “Gold coins”!

His logic was that they were just as “pretty” as the real ones and cost

so much less. His remark of “what’s the difference?” still makes me

laugh out loud today!

I decided to write this piece about “ignorance” after I met a retired neighbor of ours this past week at our local fireworks display. I had met him only once before and found out that he is retired and “trades” every day to make a little extra “cash”. I did very little talking and mostly listened to how he had EVERYTHING figured out. He went on to tell me that he owns a bunch of ETF’s primarily and trades sectors. I mentioned that the entire global financial system looked to me like it could meltdown at any time and asked him what’s the point of making “more Dollars” if their value is going to evaporate anyway?

Read more @ MilesFranklin.com

I spent 23 years in the brokerage business and saw everything from

soup to nuts as far as stupidity is concerned. Here are a few

instances. I saw corporate stupidity and hubris as a branch manager for

A G Edwards as I watched our research dept. get caught up in the dotcom

craze where “valuations” didn’t matter anymore. Like everyone else, it

was buy the dips all the way down and best to run with the pack. There

were times when I saw idiocy by local employees. One instance, an

employee who was going through a divorce signed and turned in a forged

distribution form for her spouses IRA account. Another time after doing

a meeting on why all portfolios needed to have at least some Gold

related assets in them, one of my bond guys came in a couple weeks later

and said “I bought some Gold yesterday”. Here I was thinking “WOW,

maybe part of the meeting got through his thick skull”. Lo and behold,

he then told me that he paid $9.95 a piece for 5 plated “Gold coins”!

His logic was that they were just as “pretty” as the real ones and cost

so much less. His remark of “what’s the difference?” still makes me

laugh out loud today!

I spent 23 years in the brokerage business and saw everything from

soup to nuts as far as stupidity is concerned. Here are a few

instances. I saw corporate stupidity and hubris as a branch manager for

A G Edwards as I watched our research dept. get caught up in the dotcom

craze where “valuations” didn’t matter anymore. Like everyone else, it

was buy the dips all the way down and best to run with the pack. There

were times when I saw idiocy by local employees. One instance, an

employee who was going through a divorce signed and turned in a forged

distribution form for her spouses IRA account. Another time after doing

a meeting on why all portfolios needed to have at least some Gold

related assets in them, one of my bond guys came in a couple weeks later

and said “I bought some Gold yesterday”. Here I was thinking “WOW,

maybe part of the meeting got through his thick skull”. Lo and behold,

he then told me that he paid $9.95 a piece for 5 plated “Gold coins”!

His logic was that they were just as “pretty” as the real ones and cost

so much less. His remark of “what’s the difference?” still makes me

laugh out loud today!I decided to write this piece about “ignorance” after I met a retired neighbor of ours this past week at our local fireworks display. I had met him only once before and found out that he is retired and “trades” every day to make a little extra “cash”. I did very little talking and mostly listened to how he had EVERYTHING figured out. He went on to tell me that he owns a bunch of ETF’s primarily and trades sectors. I mentioned that the entire global financial system looked to me like it could meltdown at any time and asked him what’s the point of making “more Dollars” if their value is going to evaporate anyway?

Read more @ MilesFranklin.com

We The Sheeplez... is intended to reflect

excellence in effort and content. Donations will help maintain this goal

and defray the operational costs. Paypal, a leading provider of secure

online money transfers, will handle the donations. Thank you for your

contribution.

I'm PayPal Verified

We The Sheeplez... is intended to reflect

excellence in effort and content. Donations will help maintain this goal

and defray the operational costs. Paypal, a leading provider of secure

online money transfers, will handle the donations. Thank you for your

contribution.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment