Schauble Just Says Nein Again: German FinMin Denies Rumors Of ECB Bond Buying

When

day after day, for three days in a row last week, the ECB spread

rumors that it would commence buying Spanish debt in what was in

retrospect nothing but a massive bluff (just as we suggested yesterday), what passes for a market postulated that since there was no official German denial, and

with Merkel on vacation that would mean a statement from her finance

minister sidekick Wolfgang Schauble, that Germany was ok with the

reactivation of Spanish bond buying and as a result ramped risk by over

4% in 3 days. All of that is about to wiped out as Schauble has finally

spoken. Quote Spiegel: "For days, it is rumored that the ECB will buy

Spanish government bonds in a big way. Now Finance Minister Wolfgang Schaeuble has rejected such reports - there was "no truth".

And scene. Luckily all the momo chasers who bought stocks last week on

hopes their prayer-based strategy will finally play out, will be able

to sell ahead of all those other momo chasers who bought stocks last week on hope their prayer-based strategy will finally play out. Or maybe not.

When

day after day, for three days in a row last week, the ECB spread

rumors that it would commence buying Spanish debt in what was in

retrospect nothing but a massive bluff (just as we suggested yesterday), what passes for a market postulated that since there was no official German denial, and

with Merkel on vacation that would mean a statement from her finance

minister sidekick Wolfgang Schauble, that Germany was ok with the

reactivation of Spanish bond buying and as a result ramped risk by over

4% in 3 days. All of that is about to wiped out as Schauble has finally

spoken. Quote Spiegel: "For days, it is rumored that the ECB will buy

Spanish government bonds in a big way. Now Finance Minister Wolfgang Schaeuble has rejected such reports - there was "no truth".

And scene. Luckily all the momo chasers who bought stocks last week on

hopes their prayer-based strategy will finally play out, will be able

to sell ahead of all those other momo chasers who bought stocks last week on hope their prayer-based strategy will finally play out. Or maybe not.The State As A Fantasy...

The unconscionable behavior of the political class should be thought of as a contagious disease that infiltrates any industry that comes within influence of the state. Government contractors, lobbying associations, favored corporations, and even the press all seek to use the monopolized power of government to further their own interests. Instead of attempting to roll back stifling regulations, many of these firms simply wish to get in on the spoils of the great extortionary scheme. The results are always the same. Politicians pretend to be saving the people from cold-natured capitalism while politically-connected businessmen and bankers act as if their commercial success is completely of their own doing. The hidden truth is both act in tandem to fleece the average taxpayer.

CDU's Michael Fuchs "Greece Cannot Be Saved, That Is Simple Mathematics"

Since it has now become the norm to spread myth, fairy tales and magic during the week, only to collapse the wave function of an insolvent "developed world" with a double dose of reality during the weekend when markets are conveniently closed (recall the Draghi in a Box phenomenon) only to repeat it all again the coming week, here is some more truth which may force Citi to hike its estimate of Greece leaving the Eurozone from 90% to 110% (or about how much of QE3 is now priced into the market): "Greece cannot be saved, that is simple mathematics," Michael Fuchs, deputy leader of the parliamentary group of Merkel's Christian Democrats and their Bavarian sister party told weekly business magazine Wirtschaftswoche." Indeed, truth hurts, especially when accompanied by math. Which sadly is the problem these days in a world where math and surreality can no longer coexist. Sadly, in the absence of money growing trees, where one can create wealth out of thin air, not fiat dilution, disappointments such as these will only propagate until the game theoretical equilibrium we discussed yesterday has no choice but to finally make its appearance.

from KingWorldNews:

Today 50 year veteran Art Cashin stunned King World News when he said,

“… the amount of liquidity that’s around the globe should be

hyperinflationary.” Cashin, who is Director of Floor Operations for

UBS, which has $612 billion under management, also warned, “… the fall

of Syria can destabilize the entire Middle-East.”

Today 50 year veteran Art Cashin stunned King World News when he said,

“… the amount of liquidity that’s around the globe should be

hyperinflationary.” Cashin, who is Director of Floor Operations for

UBS, which has $612 billion under management, also warned, “… the fall

of Syria can destabilize the entire Middle-East.”

Cashin also discussed gold, but first, when asked if we were getting close a tipping point in reference to the Fed and other central banks trying to encourage lending and spending, Cashin responded, “You are. They talk about a lot of things they may do, including stop paying on reserves. None of that matters, Eric. There is plenty of money around but it’s not finding its way into the system.”

“By standards, the amount of liquidity that’s around the globe should be hyperinflationary. It is not. It is because when Bernanke flies over your house and drops millions of dollars in fresh cash on your lawn, you are so terrified you pick it up and store it in the garage. They’ve got to find a way to unlock all of that liquidity in the garages around the globe.

LISTEN NOW @ KingWorldNews.com

Today 50 year veteran Art Cashin stunned King World News when he said,

“… the amount of liquidity that’s around the globe should be

hyperinflationary.” Cashin, who is Director of Floor Operations for

UBS, which has $612 billion under management, also warned, “… the fall

of Syria can destabilize the entire Middle-East.”

Today 50 year veteran Art Cashin stunned King World News when he said,

“… the amount of liquidity that’s around the globe should be

hyperinflationary.” Cashin, who is Director of Floor Operations for

UBS, which has $612 billion under management, also warned, “… the fall

of Syria can destabilize the entire Middle-East.”Cashin also discussed gold, but first, when asked if we were getting close a tipping point in reference to the Fed and other central banks trying to encourage lending and spending, Cashin responded, “You are. They talk about a lot of things they may do, including stop paying on reserves. None of that matters, Eric. There is plenty of money around but it’s not finding its way into the system.”

“By standards, the amount of liquidity that’s around the globe should be hyperinflationary. It is not. It is because when Bernanke flies over your house and drops millions of dollars in fresh cash on your lawn, you are so terrified you pick it up and store it in the garage. They’ve got to find a way to unlock all of that liquidity in the garages around the globe.

LISTEN NOW @ KingWorldNews.com

Some Stock Markets Are More Equal Than Others: Global Performance Since 2009

Since the 2009 stock market lows, Europe has demonstrated what happens to capital markets when there is no central planner willing and able to

accept the risk of runaway inflation in the future (not to mention

soaring deficits and deferred austerity) in exchange for instant stock

market gratification right here, right now. End result: the

French, Italian and Spanish stocks markets have barely budged since

their 2009 lows (and Spain is well below). How does this look in the

context of all global stock markets on a Price to Book ratio? The answer

is below.

Since the 2009 stock market lows, Europe has demonstrated what happens to capital markets when there is no central planner willing and able to

accept the risk of runaway inflation in the future (not to mention

soaring deficits and deferred austerity) in exchange for instant stock

market gratification right here, right now. End result: the

French, Italian and Spanish stocks markets have barely budged since

their 2009 lows (and Spain is well below). How does this look in the

context of all global stock markets on a Price to Book ratio? The answer

is below.The Rally's Dark Side: 68% Of Growth Funds Are Now Underperforming, A 30% Increase In Three Weeks

Prayer, courtesy of central banks, may still be a "valid" investing strategy, but "growth" no longer is: for all the euphoria over the stock market outperformance in the last few days on the heels of one after another rumor of ECB intervention in the peripheral bond market (now largely denied by Germany's finance minister) one would think that managers of all funds would be delighted at the sudden reprieve they have gotten courtesy of the European central bank. One would be wrong: as GS' David Kostin calculates, at the end of June, 52% large-cap growth funds had underperformed the Russell 1000 growth fund, aka their benchmark index. Three weeks later, this number has soared to 68%, a 30% increase in underperformers, which means that despite the headline S&P print, the bulk of active stock pickers once again face that most dreaded of Wall Street possibilities: career risk. Said otherwise, while those positioned to outperform in an environment of global slowdown are celebrating, everyone else is again polishing their resume, as the following chart confirms.

Draghi's put and the German Response/Wild trading day on Friday/Commercials cover like mad on their gold shorts/

Harvey Organ at Harvey Organ's - The Daily Gold and Silver Report - 3 hours ago

Good

morning Ladies and Gentlemen:

Gold and silver were on a roller coaster Friday. At the end of the day,

gold finished at $1617.90 up $2.90 with silver up 5 cents to $27.48.

All events yesterday are geared to two headline reports:

i) at 5:47 am est: the first report from Le Monde where the ECB is

preparing to purchase Italian/Spanish debt

ii at 1:30 pm est: reports that the EU is

07/28/2012 - 08:18

The Channel-Stuffed GDP Report

There was not much in the GDP report that was unexpected, except durable goods.

The decline in durable goods was comparable to Q2 2011, right down to

the primary driver of that weakness - motor vehicles. However, there

was no earthquake in Japan this year to disrupt supply chains,

production schedules and brand availability. Just like last year, marginal economic growth overall seems to be backfilled with a tide of inventory.

The trouble with inventory at the margins of growth is that it is

essentially a build-up of forward demand, and therefore susceptible to

reversal should overdone production move out of alignment with final

demand. Both monetary and fiscal policies actively seek to

pull forward demand, meaning this inventory-driven activity conforms to

policy goals. It's almost like the 1960's and 70's, with motor

vehicles and government spending driving the marginal economy again.

All that’s missing is for Ralph Nader to show up and write about how

cars are dangerous.

There was not much in the GDP report that was unexpected, except durable goods.

The decline in durable goods was comparable to Q2 2011, right down to

the primary driver of that weakness - motor vehicles. However, there

was no earthquake in Japan this year to disrupt supply chains,

production schedules and brand availability. Just like last year, marginal economic growth overall seems to be backfilled with a tide of inventory.

The trouble with inventory at the margins of growth is that it is

essentially a build-up of forward demand, and therefore susceptible to

reversal should overdone production move out of alignment with final

demand. Both monetary and fiscal policies actively seek to

pull forward demand, meaning this inventory-driven activity conforms to

policy goals. It's almost like the 1960's and 70's, with motor

vehicles and government spending driving the marginal economy again.

All that’s missing is for Ralph Nader to show up and write about how

cars are dangerous. Drought taking heavy toll on fishing industry

Eric De Groot at Eric De Groot - 4 hours ago

Both direct (foodstuffs) and indirect (damage to the food chain) cost of

the drought are beginning to mount. Headline: Drought taking heavy toll on

fishing industry (Reuters) - The drought and extreme heat wreaking havoc

across the U.S. farm belt is killing fish by the thousands in lakes and

rivers and could pose a problem to migrating ducks and other waterfowl if

it...

[[ This is a content summary only. Visit my website for full links, other

content, and more! ]]

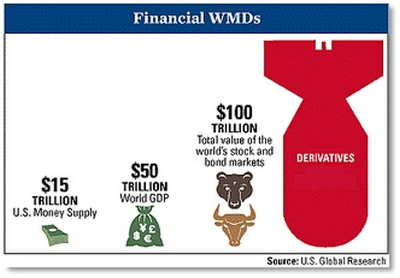

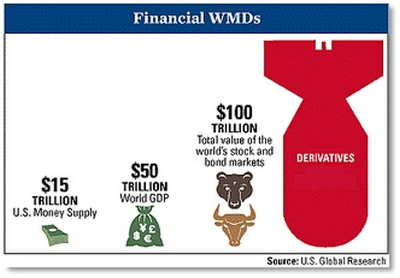

by: Money Morning, The Market Oracle:

Many experts claim we’re not in a bubble economy because they can’t see the “bubble.”

Many experts claim we’re not in a bubble economy because they can’t see the “bubble.”

Why is beyond me.

The bubble is so enormous right now that any serious bailout attempt would have to encompass the entire shootin’ match or roughly $600 trillion to $1.5 quadrillion ($1,500,000,000,000,000) in order for it to work.

That’s the total estimated amount of outstanding derivatives, credit default swaps and exotics outstanding at the moment according to various industry sources.

I say estimated because nobody actually knows for sure. Nearly five years into this crisis, the derivatives markets still remain almost entirely unregulated.

And, that’s why the well-intentioned but completely misguided onesey-twosey’s bailouts we’ve seen so far won’t cut it despite the fact that they’re already into the trillions of dollars.

I say this because, despite what most politicians and central bankers think, we are not staring at a series of independent bubbles blown into the wind, but a single, massive all-encompassing monster bubble that surrounds us all.

Read More @ TheMarketOracle.co.uk

Many experts claim we’re not in a bubble economy because they can’t see the “bubble.”

Many experts claim we’re not in a bubble economy because they can’t see the “bubble.”Why is beyond me.

The bubble is so enormous right now that any serious bailout attempt would have to encompass the entire shootin’ match or roughly $600 trillion to $1.5 quadrillion ($1,500,000,000,000,000) in order for it to work.

That’s the total estimated amount of outstanding derivatives, credit default swaps and exotics outstanding at the moment according to various industry sources.

I say estimated because nobody actually knows for sure. Nearly five years into this crisis, the derivatives markets still remain almost entirely unregulated.

And, that’s why the well-intentioned but completely misguided onesey-twosey’s bailouts we’ve seen so far won’t cut it despite the fact that they’re already into the trillions of dollars.

I say this because, despite what most politicians and central bankers think, we are not staring at a series of independent bubbles blown into the wind, but a single, massive all-encompassing monster bubble that surrounds us all.

Read More @ TheMarketOracle.co.uk

Trader Dan on King World News Markets and Metals Wrap

Trader Dan at Trader Dan's Market Views - 10 hours ago

Please click on the following link to listen in to my regular weekly radio

interview with Eric King on the KWN Markets and Metals Wrap.

*http://tinyurl.com/czua7fl*

**

By The Daily Reckoning, Daily Reckoning.com.au:

In The Dark Knight Rises,

a cruel strongman rallies the people of Gotham against the corruption

of the elites, instituting a violent dictatorship in the name of a

people’s liberation. What’s troubling for the viewer is that the

strongman is right about the corruption. In this case, and as usual, the

fix is worse than the problem.

In The Dark Knight Rises,

a cruel strongman rallies the people of Gotham against the corruption

of the elites, instituting a violent dictatorship in the name of a

people’s liberation. What’s troubling for the viewer is that the

strongman is right about the corruption. In this case, and as usual, the

fix is worse than the problem.

In a similar way today, the “Occupy” protesters and populists of the left and right scream about the corruption in the system today. The ongoing LIBOR scandal is but the beginning. Let’s try to understand this whole thing and see the way the corruption played itself out.

In olden days, people managing monetary and financial scams toyed with weights and measures. They would mix dross into silver to fool the traders. Governments were especially good at it, but they often relied on the cooperation of the bankers and money merchants. Everyone won but the public.

These days, these schemes take a very different form. There is no more metal in the money, so weights don’t apply. Measures are still around, but the system has become so incredibly complicated that only a tiny elite can begin to understand it. This is one reason that the LIBOR scandal probably won’t stay in the headlines that long.

Read More @ DailyReckoning.com.au

In The Dark Knight Rises,

a cruel strongman rallies the people of Gotham against the corruption

of the elites, instituting a violent dictatorship in the name of a

people’s liberation. What’s troubling for the viewer is that the

strongman is right about the corruption. In this case, and as usual, the

fix is worse than the problem.

In The Dark Knight Rises,

a cruel strongman rallies the people of Gotham against the corruption

of the elites, instituting a violent dictatorship in the name of a

people’s liberation. What’s troubling for the viewer is that the

strongman is right about the corruption. In this case, and as usual, the

fix is worse than the problem. In a similar way today, the “Occupy” protesters and populists of the left and right scream about the corruption in the system today. The ongoing LIBOR scandal is but the beginning. Let’s try to understand this whole thing and see the way the corruption played itself out.

In olden days, people managing monetary and financial scams toyed with weights and measures. They would mix dross into silver to fool the traders. Governments were especially good at it, but they often relied on the cooperation of the bankers and money merchants. Everyone won but the public.

These days, these schemes take a very different form. There is no more metal in the money, so weights don’t apply. Measures are still around, but the system has become so incredibly complicated that only a tiny elite can begin to understand it. This is one reason that the LIBOR scandal probably won’t stay in the headlines that long.

Read More @ DailyReckoning.com.au

Pressure and Energy Building As Investors Give Up On Gold

Eric De Groot at Eric De Groot - 18 hours ago

Net long as a percentage of open interest has risen to -19.06% (chart 1).

The invisible hand has been aggressively covering its shorts position in

2012. The last time it did that was 2008 before the huge rally of

2009-2011. Chart 1: London P.M Fixed and the Commercial Traders COT

Futures and Options Net Long As A % of Open Interest The gold market

continues to vent gas...

[[ This is a content summary only. Visit my website for full links, other

content, and more! ]] The control freaks are winning, and they are absolutely killing

America. Our founding fathers intended to establish a nation where

Americans would be free to pursue “life, liberty and the pursuit of

happiness” in an environment where freedom was maximized and government

interference was minimized. Unfortunately, our nation has turned away

from those principles and is now running 180 degrees in the other

direction. For some reason, our political system tends to attract

psychotic control freaks that want to micromanage our lives and make

most of our decisions for us. These control freaks are actually

convinced that freedom and liberty are “dangerous” and that there should

be a rule or a regulation for just about everything. This is not just

happening on the federal level either. The truth is that the control

freaks are often the worst on the local level. When you add up the red

tape on all levels of government, we literally have millions of laws,

rules and regulations in America today. All of this red tape is

suffocating our businesses, destroying our liberties and our freedoms,

and slowly sucking the life out of all of us. If we ever want to have

any hope of restoring America to what it once was, then we have to start

doing something about this horrific mountain of red tape.

The control freaks are winning, and they are absolutely killing

America. Our founding fathers intended to establish a nation where

Americans would be free to pursue “life, liberty and the pursuit of

happiness” in an environment where freedom was maximized and government

interference was minimized. Unfortunately, our nation has turned away

from those principles and is now running 180 degrees in the other

direction. For some reason, our political system tends to attract

psychotic control freaks that want to micromanage our lives and make

most of our decisions for us. These control freaks are actually

convinced that freedom and liberty are “dangerous” and that there should

be a rule or a regulation for just about everything. This is not just

happening on the federal level either. The truth is that the control

freaks are often the worst on the local level. When you add up the red

tape on all levels of government, we literally have millions of laws,

rules and regulations in America today. All of this red tape is

suffocating our businesses, destroying our liberties and our freedoms,

and slowly sucking the life out of all of us. If we ever want to have

any hope of restoring America to what it once was, then we have to start

doing something about this horrific mountain of red tape.Read More @ EndoftheAmericanDream.com

by Chris Francescani & Keith Coffman, The Inependent:

The former University of Colorado graduate student accused of killing

12 people and wounding 58 others in a shooting rampage at a cinema last

week had been under the care of a psychiatrist who was part of a campus

threat-assessment team.

The former University of Colorado graduate student accused of killing

12 people and wounding 58 others in a shooting rampage at a cinema last

week had been under the care of a psychiatrist who was part of a campus

threat-assessment team.

The disclosure came in court documents filed yesterday by lawyers for James Holmes, 24, who is accused of opening fire last Friday on a packed showing of the latest Batman movie, “The Dark Knight Rises,” in the Denver suburb of Aurora.

The defence attorneys, in their request to an Arapahoe County district judge, are seeking a court order requiring prosecutors to turn over the contents of a package that Holmes sent to Dr. Lynne Fenton and was later seized by investigators.

“Mr. Holmes was a psychiatric patient of Dr. Fenton, and his communications with her are protected,” the filing said.

Fenton, medical director for student mental health services at the University of Colorado-Denver Anschutz Medical Campus, provides medication and psychotherapy for grad students in addition to her teaching duties, according to a school website.

Read More @ Independent.co.uk

I'm PayPal Verified

The former University of Colorado graduate student accused of killing

12 people and wounding 58 others in a shooting rampage at a cinema last

week had been under the care of a psychiatrist who was part of a campus

threat-assessment team.

The former University of Colorado graduate student accused of killing

12 people and wounding 58 others in a shooting rampage at a cinema last

week had been under the care of a psychiatrist who was part of a campus

threat-assessment team.The disclosure came in court documents filed yesterday by lawyers for James Holmes, 24, who is accused of opening fire last Friday on a packed showing of the latest Batman movie, “The Dark Knight Rises,” in the Denver suburb of Aurora.

The defence attorneys, in their request to an Arapahoe County district judge, are seeking a court order requiring prosecutors to turn over the contents of a package that Holmes sent to Dr. Lynne Fenton and was later seized by investigators.

“Mr. Holmes was a psychiatric patient of Dr. Fenton, and his communications with her are protected,” the filing said.

Fenton, medical director for student mental health services at the University of Colorado-Denver Anschutz Medical Campus, provides medication and psychotherapy for grad students in addition to her teaching duties, according to a school website.

Read More @ Independent.co.uk

We The Sheeplez... is intended to reflect

excellence in effort and content. Donations will help maintain this goal

and defray the operational costs. Paypal, a leading provider of secure

online money transfers, will handle the donations. Thank you for your

contribution.

I'm PayPal Verified

by James Petras and Robin Eastman Abaya Global Research:

One of the most significant political developments in recent US history

has been the virtually unchallenged rise of the police state. Despite

the vast expansion of the police powers of the Executive Branch of

government, the extraordinary growth of an entire panoply of repressive

agencies, with hundreds of thousands of personnel, and enormous public

and secret budgets and the vast scope of police state surveillance,

including the acknowledged monitoring of over 40 million US citizens and

residents, no mass pro-democracy movement has emerged to confront the

powers and prerogatives or even protest the investigations of the police

state.

One of the most significant political developments in recent US history

has been the virtually unchallenged rise of the police state. Despite

the vast expansion of the police powers of the Executive Branch of

government, the extraordinary growth of an entire panoply of repressive

agencies, with hundreds of thousands of personnel, and enormous public

and secret budgets and the vast scope of police state surveillance,

including the acknowledged monitoring of over 40 million US citizens and

residents, no mass pro-democracy movement has emerged to confront the

powers and prerogatives or even protest the investigations of the police

state. In the early fifties, when the McCarthyite purges were accompanied by restrictions on free speech, compulsory loyalty oaths and congressional ‘witch hunt’ investigations of public officials, cultural figures , intellectuals, academics and trade unionists, such police state measures provoked widespread public debate and protests and even institutional resistance. By the end of the 1950’s mass demonstrations were held at the sites of the public hearings of the House Un-American Activities Committee (HUAC) in San Francisco (1960) and elsewhere and major civil rights movements arose to challenge the racially segregated South, the compliant Federal government and the terrorist racist death squads of the Ku Klux Klan (KKK). The Free Speech Movement in Berkeley (1964) ignited nationwide mass demonstrations against the authoritarian-style university governance.

The police state incubated during the first years of the Cold War was challenged by mass movements pledged to retain or regain democratic freedoms and civil rights.

Read More @ GlobalResearch.ca

from RussiaToday:

In this episode, Max Keiser presents a double header with co-host, Stacy Herbert, to discuss crime and punishment in the financial sector. In London, JP Morgan banker, Tony Blair, has responded to the Keiser Report with his claim that hanging 20 bankers will not help and that, in fact, he asserts, public anger with the financial crisis is wrong. They also discuss the ‘blazer over cuffs look’ being the new black this season as Sean Fitzpatrick is arrested in Dublin, while over in Pennsylvania, Joe Paterno’s statue is draped in blue tarpaulin and hauled away as bond investors punish the university with higher rates and Moody’s threatens a downgrade. Finally, in Los Angeles, victims of vandalism are shocked to discover that it was a senior UBS banker who was smashing windows with a slingshot.

Opinion

Finally, please prepare now for the escalating economic and social unrest. Good Day!

I'm PayPal Verified

In this episode, Max Keiser presents a double header with co-host, Stacy Herbert, to discuss crime and punishment in the financial sector. In London, JP Morgan banker, Tony Blair, has responded to the Keiser Report with his claim that hanging 20 bankers will not help and that, in fact, he asserts, public anger with the financial crisis is wrong. They also discuss the ‘blazer over cuffs look’ being the new black this season as Sean Fitzpatrick is arrested in Dublin, while over in Pennsylvania, Joe Paterno’s statue is draped in blue tarpaulin and hauled away as bond investors punish the university with higher rates and Moody’s threatens a downgrade. Finally, in Los Angeles, victims of vandalism are shocked to discover that it was a senior UBS banker who was smashing windows with a slingshot.

by Chris Puplava, Financial Sense:

At any given point in time there are several variables that affect the

price of gold. There are times when gold’s price is driven by its

perceived association with inflation and other times it’s seen as a

“safety asset” or even a global currency. One variable in particular

that was a constant driver of gold’s bull market in the 1970s was the

presence of negative real interest rates—where inflation rates are

higher than nominal interest rates—which means savers who park their

cash at the bank are seeing their purchasing power eroded. The power of

negative real interest rates as a major catalyst for gold has also been

dominant in gold’s secular bull market this time around and currently

argues for new highs. However, the USD’s strength at present has been

keeping gold in check. That may soon change if the Euro begins to

stabilize and money flows back out of the USD.

At any given point in time there are several variables that affect the

price of gold. There are times when gold’s price is driven by its

perceived association with inflation and other times it’s seen as a

“safety asset” or even a global currency. One variable in particular

that was a constant driver of gold’s bull market in the 1970s was the

presence of negative real interest rates—where inflation rates are

higher than nominal interest rates—which means savers who park their

cash at the bank are seeing their purchasing power eroded. The power of

negative real interest rates as a major catalyst for gold has also been

dominant in gold’s secular bull market this time around and currently

argues for new highs. However, the USD’s strength at present has been

keeping gold in check. That may soon change if the Euro begins to

stabilize and money flows back out of the USD.

Gold Variables

As mentioned above, one of the strongest correlations to the price of gold is not the USD but actually real interest rates. This can been seen below in which the top panel shows the open interest for gold futures contracts, the middle panel shows gold along with real interest rates (inverted in red), and the bottom panel shows the USD Index along with gold (USD Index shown inverted for directional similarity).

Read More @ Financial Sense.com

At any given point in time there are several variables that affect the

price of gold. There are times when gold’s price is driven by its

perceived association with inflation and other times it’s seen as a

“safety asset” or even a global currency. One variable in particular

that was a constant driver of gold’s bull market in the 1970s was the

presence of negative real interest rates—where inflation rates are

higher than nominal interest rates—which means savers who park their

cash at the bank are seeing their purchasing power eroded. The power of

negative real interest rates as a major catalyst for gold has also been

dominant in gold’s secular bull market this time around and currently

argues for new highs. However, the USD’s strength at present has been

keeping gold in check. That may soon change if the Euro begins to

stabilize and money flows back out of the USD.

At any given point in time there are several variables that affect the

price of gold. There are times when gold’s price is driven by its

perceived association with inflation and other times it’s seen as a

“safety asset” or even a global currency. One variable in particular

that was a constant driver of gold’s bull market in the 1970s was the

presence of negative real interest rates—where inflation rates are

higher than nominal interest rates—which means savers who park their

cash at the bank are seeing their purchasing power eroded. The power of

negative real interest rates as a major catalyst for gold has also been

dominant in gold’s secular bull market this time around and currently

argues for new highs. However, the USD’s strength at present has been

keeping gold in check. That may soon change if the Euro begins to

stabilize and money flows back out of the USD.Gold Variables

As mentioned above, one of the strongest correlations to the price of gold is not the USD but actually real interest rates. This can been seen below in which the top panel shows the open interest for gold futures contracts, the middle panel shows gold along with real interest rates (inverted in red), and the bottom panel shows the USD Index along with gold (USD Index shown inverted for directional similarity).

Read More @ Financial Sense.com

by Detlev Schlichter, Whiskey and Gunpowder:

On August 15, 1971, President Richard Nixon declared that the United

States would no longer honour its promise to exchange US dollars held by

foreign central banks for gold at a fixed price of $35 an ounce. The

innocuous term ‘Nixon closed the gold window’ that is now widely used to

describe this act does not quite convey its significance. (Was

something to be stopped from going out or from coming in through the

window? Can the window be reopened again?)

On August 15, 1971, President Richard Nixon declared that the United

States would no longer honour its promise to exchange US dollars held by

foreign central banks for gold at a fixed price of $35 an ounce. The

innocuous term ‘Nixon closed the gold window’ that is now widely used to

describe this act does not quite convey its significance. (Was

something to be stopped from going out or from coming in through the

window? Can the window be reopened again?)

What Nixon did was cut the last remaining official link between the world’s leading reserve currency and gold and thus remove the last constraint on fiat money creation.

Was this a big deal? – It was very big deal. In fact, we are only now beginning to realize the full consequences of it. In fact, the present crisis is nothing but the endgame of this system, or non-system, of this, mankind’s latest and so far most ambitious, experiment with unrestricted fiat money. The first truly global paper standard.

Nixon knew that it was big. On TV that day he felt compelled to reassure the American public that this was only temporary and that the purchasing power of the dollar was secure. Forty-one years later we are still on the same system (or non-system), and the dollar has lost 80% of its purchasing power.

Read More @ WhiskeyAndGunpowder.com

On August 15, 1971, President Richard Nixon declared that the United

States would no longer honour its promise to exchange US dollars held by

foreign central banks for gold at a fixed price of $35 an ounce. The

innocuous term ‘Nixon closed the gold window’ that is now widely used to

describe this act does not quite convey its significance. (Was

something to be stopped from going out or from coming in through the

window? Can the window be reopened again?)

On August 15, 1971, President Richard Nixon declared that the United

States would no longer honour its promise to exchange US dollars held by

foreign central banks for gold at a fixed price of $35 an ounce. The

innocuous term ‘Nixon closed the gold window’ that is now widely used to

describe this act does not quite convey its significance. (Was

something to be stopped from going out or from coming in through the

window? Can the window be reopened again?)What Nixon did was cut the last remaining official link between the world’s leading reserve currency and gold and thus remove the last constraint on fiat money creation.

Was this a big deal? – It was very big deal. In fact, we are only now beginning to realize the full consequences of it. In fact, the present crisis is nothing but the endgame of this system, or non-system, of this, mankind’s latest and so far most ambitious, experiment with unrestricted fiat money. The first truly global paper standard.

Nixon knew that it was big. On TV that day he felt compelled to reassure the American public that this was only temporary and that the purchasing power of the dollar was secure. Forty-one years later we are still on the same system (or non-system), and the dollar has lost 80% of its purchasing power.

Read More @ WhiskeyAndGunpowder.com

from Testosterone Pit.com:

The coordinated confidence-inspiring words from the Eurozone’s

fearless leaders yesterday and today about doing whatever it would take

to save the euro wasn’t about Greece anymore. Its life support may get

unplugged in September. Politicians have apparently given up. The tab

isn’t that dramatic: default and return to the drachma would cost

Germany €82 billion and France €62 billion (Ifo Institute PDF). Survivable.

The coordinated confidence-inspiring words from the Eurozone’s

fearless leaders yesterday and today about doing whatever it would take

to save the euro wasn’t about Greece anymore. Its life support may get

unplugged in September. Politicians have apparently given up. The tab

isn’t that dramatic: default and return to the drachma would cost

Germany €82 billion and France €62 billion (Ifo Institute PDF). Survivable.

The fearless leaders were afraid of Spain, whose vital signs were deteriorating. Unemployment hit 24.6%, worse than Greece’s 22.5%. In the southern region of Andalusia, it rose to a mind-boggling 33%. Youth unemployment (16-24) set a sobering record of 53.3%. Even more worryingly, in a country where family solidarity and multi-generational households are the norm, the number of households where no one worked climbed to 1,737,000. So, in the first half of 2012, over 40,000 Spaniards emigrated—up 44% from last year. Instead of consuming and producing in Spain, they took their education that society had invested in and sought their fortunes elsewhere.

Read More @ TestosteronePit.com

The coordinated confidence-inspiring words from the Eurozone’s

fearless leaders yesterday and today about doing whatever it would take

to save the euro wasn’t about Greece anymore. Its life support may get

unplugged in September. Politicians have apparently given up. The tab

isn’t that dramatic: default and return to the drachma would cost

Germany €82 billion and France €62 billion (Ifo Institute PDF). Survivable.

The coordinated confidence-inspiring words from the Eurozone’s

fearless leaders yesterday and today about doing whatever it would take

to save the euro wasn’t about Greece anymore. Its life support may get

unplugged in September. Politicians have apparently given up. The tab

isn’t that dramatic: default and return to the drachma would cost

Germany €82 billion and France €62 billion (Ifo Institute PDF). Survivable.The fearless leaders were afraid of Spain, whose vital signs were deteriorating. Unemployment hit 24.6%, worse than Greece’s 22.5%. In the southern region of Andalusia, it rose to a mind-boggling 33%. Youth unemployment (16-24) set a sobering record of 53.3%. Even more worryingly, in a country where family solidarity and multi-generational households are the norm, the number of households where no one worked climbed to 1,737,000. So, in the first half of 2012, over 40,000 Spaniards emigrated—up 44% from last year. Instead of consuming and producing in Spain, they took their education that society had invested in and sought their fortunes elsewhere.

Read More @ TestosteronePit.com

Opinion

I want to talk to you about clothing when things get really bad. No, I do not mean the latest trends.

First, let’s talk about shoes. You are

going to need shoes that will require very little maintenance and will

be able to last, not months, but years of harsh conditions. This means

those shoes you bought at the second-hand store are just not going to

cut it. My idea, and I am certainly open to constructive suggestions

on this, are to get a good set of steel-tipped work boats and wear them

in now. Perhaps, a set of non-flashy cowboy boots, or military boots,

could work very well.

Next, lets talk about your attire. Sorry,

tuxedos and dresses will not due for this special occasion. A good

idea, on top of jeans and lots of t-shirts, I believe, is to have at

least two pair of quality working coveralls that will last years.

Coveralls are versatile for staying warm when it is cold outside and

vice-verse. Try to get a size that will allow a little extra room for

any additional clothing, if necessary.

You will need to have plenty of underwear

unless you decide to use the 4 day rule for underwear. You know, wear

the underwear the first day, then wear it inside out on the second day,

then for the third – exchange with a friend. Thankfully, friends like

these are hopefully few and far between.

Anyway you really do not want to be

walking around with holy underwear, or holy socks for that matter;

therefore, stock up on those. Also, do not forget thermal underwear,

gloves, and socks to help keep you warm when things get really cold.

Now, lets address those Vacuum bags to

store a large amount of clothing in a small space. This is a great

idea for those articles that are not fluffed up with air for

insulation. The vacuum will suck out that air and could easily render

items, like sleeping bags and padded jackets, useless. Hopefully, you

are addressing your wardrobe needs.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment