obama: "If You've Got A Business - You Didn't Build That. Somebody Else Made That Happen"

"There are a lot of wealthy, successful Americans who agree with me -- because they want to give something back. They know they didn’t -- look, if you’ve been successful, you didn’t get there on your own. You didn’t get there on your own. I’m always struck by people who think, well, it must be because I was just so smart. There are a lot of smart people out there. It must be because I worked harder than everybody else. Let me tell you something -- there are a whole bunch of hardworking people out there. (Applause.)... If you were successful, somebody along the line gave you some help. There was a great teacher somewhere in your life. Somebody helped to create this unbelievable American system that we have that allowed you to thrive. Somebody invested in roads and bridges. If you’ve got a business -- you didn’t build that. Somebody else made that happen. The Internet didn’t get invented on its own. Government research created the Internet so that all the companies could make money off the Internet."Some Thoughts On Government And "Wealth Creation"

“What I was looking at was a tussle between two groups of mass-men, one large and poor, the other small and rich. As judged by the standards of a civilised society, neither of them any more meritorious or promising than the other. The object of the tussle was the material gains accruing from control of the State’s machinery. It is easier to seize wealth than to produce it; and as long as the State makes the seizure of wealth a matter of legalised privilege, so long will the squabble for that privilege go on.”

Alfred Jay Nock - Memoirs Of A Superfluous Man - 1943

In Shocking Development, ECB Demands Impairment For Senior Spanish Bondholders; Eurocrats Resist

In a landmark shift in its bank "impairment" stance, the WSJ reports that "in a sharp turnaround" the ECB has advocated the imposition of losses on senior bondholders at the most "damaged" Spanish savings banks, "though finance ministers have for now rejected the approach, according to people familiar with discussions." The WSJ continues: "The ECB's new position was made clear by its president, Mario Draghi, to a meeting of euro-zone finance ministers discussing a euro-zone rescue for Spain's struggling local lenders in Brussels the evening of July 9. It marks a contrast from the position the central bank adopted during the 2010 bailout of Irish banks--which, like Spain's, were victims of a property meltdown--when it prevailed in its insistence that senior bondholders in bailed-out banks shouldn't suffer losses." Needless to say, if indeed the fulcrum impairment security is no longer the Sub debt, but Senior debt, as the ECB suggests, it is only a matter of time before wholesale European bank liquidations commence as the ECB would only encourage this shift if it knew the level of asset impairment is far too great to be papered over by mere pooling of liabilities (think shared deposits, the creation of TBTF banks, and all those other gimmicks tried in 2010 when as a result of Caja failure we got such sterling example of financial viability as Bankia, which lasted all of 18 months). It also means the European crisis is likely about to take a big turn for the worse as suddenly bank failures become all too real. Why? Senior debt impairment means deposits are now at full risk of loss as even the main European bank admits there is no way banks will have enough assets to grow into their balance sheet.Deutsche Bank Turns Sides, Becomes Rat For The Liebor Prosecution

Escalation.

The inevitable collapse of the Prisoner's Dilemma that kept the LIBOR

contributors together is occurring rapidly. After Barclays' forced

admission and initial fine, the 'he-who-defects-first-wins'

strategy has been trumped by Deutsche Bank as they turn all 'Donnie

Brasco' on their oligopolistic peers. As Reuters reports

this morning "The bank last year obtained the status of being a

witness for the prosecution in the EU and in Switzerland," and "as a

result of that, the bank could get a lighter penalty if a punishment is

imposed," though of course this does not mean they are admitting guilt

(sigh). Under the leniency programs of the EU, companies may get total immunity from fines

or a reduction of fines which the anti-trust authorities would have

otherwise imposed on them if they hand over evidence on anti-competitive

agreements or those involved in a concerted practice. How quickly the

worm turns when trust leaves the system - the warning the rest of the

Liebor contributors - be afraid, be very afraid.

Escalation.

The inevitable collapse of the Prisoner's Dilemma that kept the LIBOR

contributors together is occurring rapidly. After Barclays' forced

admission and initial fine, the 'he-who-defects-first-wins'

strategy has been trumped by Deutsche Bank as they turn all 'Donnie

Brasco' on their oligopolistic peers. As Reuters reports

this morning "The bank last year obtained the status of being a

witness for the prosecution in the EU and in Switzerland," and "as a

result of that, the bank could get a lighter penalty if a punishment is

imposed," though of course this does not mean they are admitting guilt

(sigh). Under the leniency programs of the EU, companies may get total immunity from fines

or a reduction of fines which the anti-trust authorities would have

otherwise imposed on them if they hand over evidence on anti-competitive

agreements or those involved in a concerted practice. How quickly the

worm turns when trust leaves the system - the warning the rest of the

Liebor contributors - be afraid, be very afraid.After Creating Dollar Exclusion Zones In Asia And South America, China Set To Corner Africa Next

By now it really, really should be obvious. While the insolvent "developed world" is furiously fighting over who gets to pay the bill for 30 years of unsustainable debt accumulation and how to pretend that the modern 'crony capitalist for some and communist for others' system isn't one flap of a butterfly's wings away from full on collapse mode, China is slowly taking over the world's real assets. As a reminder: here is a smattering of our headlines on the topic from the last year: ""World's Second (China) And Third Largest (Japan) Economies To Bypass Dollar, Engage In Direct Currency Trade", "China, Russia Drop Dollar In Bilateral Trade", "China And Iran To Bypass Dollar, Plan Oil Barter System", "India and Japan sign new $15bn currency swap agreement", "Iran, Russia Replace Dollar With Rial, Ruble in Trade, Fars Says", "India Joins Asian Dollar Exclusion Zone, Will Transact With Iran In Rupees", 'The USD Trap Is Closing: Dollar Exclusion Zone Crosses The Pacific As Brazil Signs China Currency Swap", and finally, "Chile Is Latest Country To Launch Renminbi Swaps And Settlement", we now get the inevitable: "Central bank pledges financial push in Africa." To summarize: first Asia, next Latin America, and now Africa.Weekend Viewing: Terror, Robespierre, and the French Revolution

Markel Majority Fades As Internal Revolt May Signal 'Referendum'

Despite assurances that "we always get the majority we need" by Frau Merkel, the FT reports that

the Bundestag's vote this Thursday (expected to come down in favor of

the bailout) will not gain the so-called 'Chancellor's majority'. While

she retains an overall majority of 19 (from the ranks of her own

Christian Democratic Union, its Bavarian sister party, the Christian

Social Union, and the liberal Free Democratic party in her coalition),

the recent ESM vote saw 26 of her supporters rebel (voting 'Nein' or

abstaining) - though ended up being passed thanks to support from SPD

and The Greens. While a 'Chancellor's majority' is not required to

approve the EUR100 billion Spanish bailout, "Anything other than a chancellor’s majority is a defeat, and a sign of the erosion of the power of the chancellor," which leads us down the path we have noted previously of the inevitability of a referendum-like

vote next year (which may just be the

leave-the-Euro-coz-that's-what-the-people-want 'out' Germany has been

looking for). Certainly, the vote is no panacea (politically or

economically) as Jens Weidmann notes that the bailout would be more

effective 'conditions' were applied across Spain, adding that "It would

have a positive effect on the bond market if investors saw that the conditions... went beyond the banking sector".

Despite assurances that "we always get the majority we need" by Frau Merkel, the FT reports that

the Bundestag's vote this Thursday (expected to come down in favor of

the bailout) will not gain the so-called 'Chancellor's majority'. While

she retains an overall majority of 19 (from the ranks of her own

Christian Democratic Union, its Bavarian sister party, the Christian

Social Union, and the liberal Free Democratic party in her coalition),

the recent ESM vote saw 26 of her supporters rebel (voting 'Nein' or

abstaining) - though ended up being passed thanks to support from SPD

and The Greens. While a 'Chancellor's majority' is not required to

approve the EUR100 billion Spanish bailout, "Anything other than a chancellor’s majority is a defeat, and a sign of the erosion of the power of the chancellor," which leads us down the path we have noted previously of the inevitability of a referendum-like

vote next year (which may just be the

leave-the-Euro-coz-that's-what-the-people-want 'out' Germany has been

looking for). Certainly, the vote is no panacea (politically or

economically) as Jens Weidmann notes that the bailout would be more

effective 'conditions' were applied across Spain, adding that "It would

have a positive effect on the bond market if investors saw that the conditions... went beyond the banking sector".

James Howard Kunstler: It's Too Late for Solutions

The wishful thinking dominant today is that "with a little more growth, a little more energy, a little more technology -- a little more magic -- we'll somehow sail past our current tribulations without having to change our behavior."

Such self-delusion is particularly dangerous because it is preventing

us from taking intelligent, constructive action at the national level

when the clock is fast ticking out of our favor. In fact, we are past the state where solutions are possible -

instead, we need a response plan to help us best brace for the impact

of the coming consequences. And we need it fast. One of the lessons

that used to be at the center of a liberal education, and no longer is,

is that life is tragic. And by that we do not mean that happy endings

are impossible or that bad outcomes are guaranteed. What we mean is

that there are consequences to the things that you do and that everything has a beginning and a middle and an end. And we have to get real with those. We are discovering more and more is that the world is comprehensively broke

in every sphere, and in every dimension and in every way. The

governments in every level are all broke, the households are going

broke, the banks are insolvent, the money really is not there. And the

pretense that the money is there has been kept going simply with

accounting fraud.

The wishful thinking dominant today is that "with a little more growth, a little more energy, a little more technology -- a little more magic -- we'll somehow sail past our current tribulations without having to change our behavior."

Such self-delusion is particularly dangerous because it is preventing

us from taking intelligent, constructive action at the national level

when the clock is fast ticking out of our favor. In fact, we are past the state where solutions are possible -

instead, we need a response plan to help us best brace for the impact

of the coming consequences. And we need it fast. One of the lessons

that used to be at the center of a liberal education, and no longer is,

is that life is tragic. And by that we do not mean that happy endings

are impossible or that bad outcomes are guaranteed. What we mean is

that there are consequences to the things that you do and that everything has a beginning and a middle and an end. And we have to get real with those. We are discovering more and more is that the world is comprehensively broke

in every sphere, and in every dimension and in every way. The

governments in every level are all broke, the households are going

broke, the banks are insolvent, the money really is not there. And the

pretense that the money is there has been kept going simply with

accounting fraud.

Is Keynesianism Running Dry?

Even

though the policy mix is extraordinarily stimulating, developed-world

economies just cannot embark on a virtuous circle of recovery. Worse

still, as Pictet points out in this excellent brief, governments, whose

finances have been bled dry, are powerless to boost demand. This all

suggests, they note, that Keynesian policies have failed. With no credit to dispense, State-administered Keynesianism is, in effect, bankrupt as government spending levers can no longer be activated. The

implications are plain for all to see: once governments apply a brake

to public spending, growth slows considerably. Economies of the

developed world have become addicts, ‘hooked’ on government spending. A fresh approach to economic policy is needed. But policymakers will need to be both bold and brave as excess

lending will always and inevitably lead to artificially-driven

economic growth as it breaks the link between the cycles of innovation

and economic growth. At a time when capitalism is being accused

of the most reprehensible wrongdoings, policymakers will need to

display great courage to promote the virtues of entrepreneurship and

business.

Even

though the policy mix is extraordinarily stimulating, developed-world

economies just cannot embark on a virtuous circle of recovery. Worse

still, as Pictet points out in this excellent brief, governments, whose

finances have been bled dry, are powerless to boost demand. This all

suggests, they note, that Keynesian policies have failed. With no credit to dispense, State-administered Keynesianism is, in effect, bankrupt as government spending levers can no longer be activated. The

implications are plain for all to see: once governments apply a brake

to public spending, growth slows considerably. Economies of the

developed world have become addicts, ‘hooked’ on government spending. A fresh approach to economic policy is needed. But policymakers will need to be both bold and brave as excess

lending will always and inevitably lead to artificially-driven

economic growth as it breaks the link between the cycles of innovation

and economic growth. At a time when capitalism is being accused

of the most reprehensible wrongdoings, policymakers will need to

display great courage to promote the virtues of entrepreneurship and

business.

Despite assurances that "we always get the majority we need" by Frau Merkel, the FT reports that

the Bundestag's vote this Thursday (expected to come down in favor of

the bailout) will not gain the so-called 'Chancellor's majority'. While

she retains an overall majority of 19 (from the ranks of her own

Christian Democratic Union, its Bavarian sister party, the Christian

Social Union, and the liberal Free Democratic party in her coalition),

the recent ESM vote saw 26 of her supporters rebel (voting 'Nein' or

abstaining) - though ended up being passed thanks to support from SPD

and The Greens. While a 'Chancellor's majority' is not required to

approve the EUR100 billion Spanish bailout, "Anything other than a chancellor’s majority is a defeat, and a sign of the erosion of the power of the chancellor," which leads us down the path we have noted previously of the inevitability of a referendum-like

vote next year (which may just be the

leave-the-Euro-coz-that's-what-the-people-want 'out' Germany has been

looking for). Certainly, the vote is no panacea (politically or

economically) as Jens Weidmann notes that the bailout would be more

effective 'conditions' were applied across Spain, adding that "It would

have a positive effect on the bond market if investors saw that the conditions... went beyond the banking sector".

Despite assurances that "we always get the majority we need" by Frau Merkel, the FT reports that

the Bundestag's vote this Thursday (expected to come down in favor of

the bailout) will not gain the so-called 'Chancellor's majority'. While

she retains an overall majority of 19 (from the ranks of her own

Christian Democratic Union, its Bavarian sister party, the Christian

Social Union, and the liberal Free Democratic party in her coalition),

the recent ESM vote saw 26 of her supporters rebel (voting 'Nein' or

abstaining) - though ended up being passed thanks to support from SPD

and The Greens. While a 'Chancellor's majority' is not required to

approve the EUR100 billion Spanish bailout, "Anything other than a chancellor’s majority is a defeat, and a sign of the erosion of the power of the chancellor," which leads us down the path we have noted previously of the inevitability of a referendum-like

vote next year (which may just be the

leave-the-Euro-coz-that's-what-the-people-want 'out' Germany has been

looking for). Certainly, the vote is no panacea (politically or

economically) as Jens Weidmann notes that the bailout would be more

effective 'conditions' were applied across Spain, adding that "It would

have a positive effect on the bond market if investors saw that the conditions... went beyond the banking sector".

We The Sheeplez... is intended to reflect

excellence in effort and content. Donations will help maintain this goal

and defray the operational costs. Paypal, a leading provider of secure

online money transfers, will handle the donations. Thank you for your

contribution.

I'm PayPal Verified

We The Sheeplez... is intended to reflect

excellence in effort and content. Donations will help maintain this goal

and defray the operational costs. Paypal, a leading provider of secure

online money transfers, will handle the donations. Thank you for your

contribution.

by Harley Schlanger, LaRouche Pac:

As the LIBOR “Crime of the Century” is unfolding internationally, it

will mean the end of the career, and possibly prison time, for Timothy

Geithner, currently U.S. Treasury Secretary, and formerly President of

the New York Federal Reserve branch. Lyndon LaRouche’s characterization

of Geithner as “dead meat,” is not extreme, considering that former New

York Governor Eliot Spitzer, in an interview, compared Geithner’s role

in covering up LIBOR’s rigging of interest rates to the cover-up of the

crimes of former football coach, and convicted serial child molester,

Jerry Sandusky, by his employers at Pennsylvania State University!

As the LIBOR “Crime of the Century” is unfolding internationally, it

will mean the end of the career, and possibly prison time, for Timothy

Geithner, currently U.S. Treasury Secretary, and formerly President of

the New York Federal Reserve branch. Lyndon LaRouche’s characterization

of Geithner as “dead meat,” is not extreme, considering that former New

York Governor Eliot Spitzer, in an interview, compared Geithner’s role

in covering up LIBOR’s rigging of interest rates to the cover-up of the

crimes of former football coach, and convicted serial child molester,

Jerry Sandusky, by his employers at Pennsylvania State University!Geithner’s role emerged during testimony by Barclay’s former CEO, Robert Diamond, before a British Parliamentary inquiry. Diamond revealed that Barclay’s had been in contact with the New York Federal Reserve branch, about the rigging of interest rates, when Geithner was its President. The NY Fed, which oversees Wall Street, has a special regulatory role, as a watchdog agency. Yet, a series of emails released, following Diamond’s testimony, shows that Fed officials – including Geithner – were not only aware that the LIBOR banks were rigging interest rates, and did nothing to stop it, but later rewarded those same banks, with trillions of dollars in bailout funds and credits.

Barclays alone received $868 billion in bailout loans, at no interest! Read More…

from RussiaToday:

A slew of new cuts have led to a fresh eruption of public anger and protest in Spain. But rallies quickly turned violent – when police charged and beat demonstrators while firing rubber bullets. More than 70 people were injured in the clashes. The austerity cuts driving the trouble include tax hikes, and the promise of painful pension changes. But the protesters say they’re being made to pay for the mistakes of politicians and bankers. The measures were demanded by Spain’s EU creditors – who’ve pledged Madrid a vital bailout for crippled Spanish banks.

from KingWorldNews:

King World News is continuing to receive extraordinary levels of

interest in what has turned into a series of Michael Pento pieces.

Today Pento reports more stunning news, “Last week the ECB reported that

overnight deposits parked at the central bank plunged by the most on

record, or €484 billion in just one session. It now seems my theory

that banks would deploy their reserves was proven correct in a matter of

days.”

King World News is continuing to receive extraordinary levels of

interest in what has turned into a series of Michael Pento pieces.

Today Pento reports more stunning news, “Last week the ECB reported that

overnight deposits parked at the central bank plunged by the most on

record, or €484 billion in just one session. It now seems my theory

that banks would deploy their reserves was proven correct in a matter of

days.”

Pento also predicted, “I believe the cyclical period of deflation that I warned about several months ago is now close to an end.” Pento is now calling for another significant move, and he noted, “If the Fed does indeed go down that road, I would expect to see U.S money supply growth increase significantly. This will cause gold and commodity prices to soar.”

Today Michael Pento, of Pento Portfolio Strategies, writes exclusively for King World News to put global readers ahead of the curve, once again, on what is unfolding as a result of the major unprecedented moves by central banks. Here is Pento’s piece: “Could it be that world governments and central banks are now taking drastic measures to re-inflate their economies because they don’t believe their own economic statistics? For example, China reported that GDP growth came in at 7.6% last quarter. That’s slower growth, but still not so bad.”

Egon von Greyerz continues @ KingWorldNews.com

King World News is continuing to receive extraordinary levels of

interest in what has turned into a series of Michael Pento pieces.

Today Pento reports more stunning news, “Last week the ECB reported that

overnight deposits parked at the central bank plunged by the most on

record, or €484 billion in just one session. It now seems my theory

that banks would deploy their reserves was proven correct in a matter of

days.”

King World News is continuing to receive extraordinary levels of

interest in what has turned into a series of Michael Pento pieces.

Today Pento reports more stunning news, “Last week the ECB reported that

overnight deposits parked at the central bank plunged by the most on

record, or €484 billion in just one session. It now seems my theory

that banks would deploy their reserves was proven correct in a matter of

days.” Pento also predicted, “I believe the cyclical period of deflation that I warned about several months ago is now close to an end.” Pento is now calling for another significant move, and he noted, “If the Fed does indeed go down that road, I would expect to see U.S money supply growth increase significantly. This will cause gold and commodity prices to soar.”

Today Michael Pento, of Pento Portfolio Strategies, writes exclusively for King World News to put global readers ahead of the curve, once again, on what is unfolding as a result of the major unprecedented moves by central banks. Here is Pento’s piece: “Could it be that world governments and central banks are now taking drastic measures to re-inflate their economies because they don’t believe their own economic statistics? For example, China reported that GDP growth came in at 7.6% last quarter. That’s slower growth, but still not so bad.”

Egon von Greyerz continues @ KingWorldNews.com

by Mike Shedlock, Global Economic Analysis:

Italy’s new economic minister expects 2012 GDP fall “little less” than 2 percent.

Italy’s new economic minister expects 2012 GDP fall “little less” than 2 percent.

Italy’s GDP is expected to shrink “a little less” than 2 percent, the country’s new economy minister Vittorio Grilli said in a newspaper interview published on Sunday.

Grilli, who took over the economy portfolio from Prime Minister Mario Monti on Wednesday, made his comments in a long interview with the Corriere della Sera newspaper.

The Bank of Italy governor has forecast that the economy will shrink by 2.0 percent and employers’ lobby Confindustria has forecast a contraction of more than 2.4 percent.

Italy Loan Moratorium for Small and Medium-Sized Businesses

Given that politicians are always optimistic in such forecasts, look for a collapse in GDP closer to 3% than 2%. Meanwhile, please note that things are so bad that Italian Loan Moratorium Approved.

Read More @ GlobalEconomicAnalysis.blogspot.com

Italy’s new economic minister expects 2012 GDP fall “little less” than 2 percent.

Italy’s new economic minister expects 2012 GDP fall “little less” than 2 percent.

Italy’s GDP is expected to shrink “a little less” than 2 percent, the country’s new economy minister Vittorio Grilli said in a newspaper interview published on Sunday.

Grilli, who took over the economy portfolio from Prime Minister Mario Monti on Wednesday, made his comments in a long interview with the Corriere della Sera newspaper.

The Bank of Italy governor has forecast that the economy will shrink by 2.0 percent and employers’ lobby Confindustria has forecast a contraction of more than 2.4 percent.

Italy Loan Moratorium for Small and Medium-Sized Businesses

Given that politicians are always optimistic in such forecasts, look for a collapse in GDP closer to 3% than 2%. Meanwhile, please note that things are so bad that Italian Loan Moratorium Approved.

Read More @ GlobalEconomicAnalysis.blogspot.com

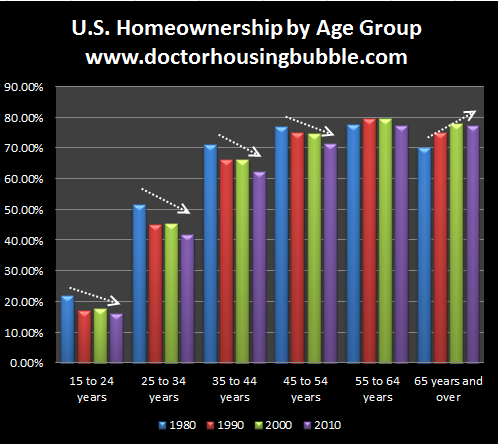

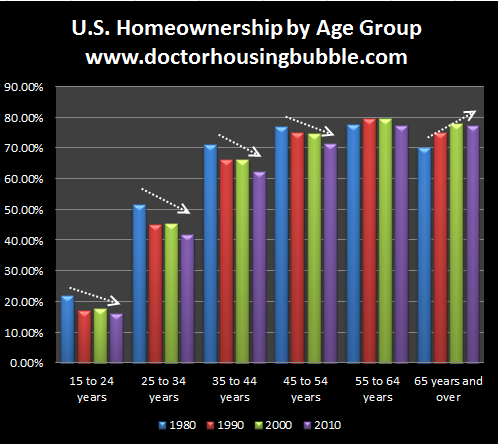

by Brittany Stepniak, Dr Housing Bubble:

10,000 baby boomers are retiring per day. This two decade trend has

only started but will certainly have an impact on the housing situation

moving forward. In most economic reports the boom and bust of the

housing market was not factored into the equation. Many boomers will

downsize or sell as they age. This is just a matter of demographics.

While trends are harder to predict,

we know that 10,000 baby boomers will be retiring on a daily basis for

well over a decade. What does this do to housing? The challenge we

will face is that the younger home buying generation is less affluent

and more in debt prior to purchasing a home. Instead of growing

households, we saw over 2 million young adults move back home to live

with their parents. So much for household formation taking up all that

excess demand. The recipe for the moment has been to constrain inventory and artificially push rates lower but this has done very little to increase actual financial security. What happens when millions of baby boomers retire?

10,000 baby boomers are retiring per day. This two decade trend has

only started but will certainly have an impact on the housing situation

moving forward. In most economic reports the boom and bust of the

housing market was not factored into the equation. Many boomers will

downsize or sell as they age. This is just a matter of demographics.

While trends are harder to predict,

we know that 10,000 baby boomers will be retiring on a daily basis for

well over a decade. What does this do to housing? The challenge we

will face is that the younger home buying generation is less affluent

and more in debt prior to purchasing a home. Instead of growing

households, we saw over 2 million young adults move back home to live

with their parents. So much for household formation taking up all that

excess demand. The recipe for the moment has been to constrain inventory and artificially push rates lower but this has done very little to increase actual financial security. What happens when millions of baby boomers retire?

Read More @ DoctorHousingBubble.com

10,000 baby boomers are retiring per day. This two decade trend has

only started but will certainly have an impact on the housing situation

moving forward. In most economic reports the boom and bust of the

housing market was not factored into the equation. Many boomers will

downsize or sell as they age. This is just a matter of demographics.

While trends are harder to predict,

we know that 10,000 baby boomers will be retiring on a daily basis for

well over a decade. What does this do to housing? The challenge we

will face is that the younger home buying generation is less affluent

and more in debt prior to purchasing a home. Instead of growing

households, we saw over 2 million young adults move back home to live

with their parents. So much for household formation taking up all that

excess demand. The recipe for the moment has been to constrain inventory and artificially push rates lower but this has done very little to increase actual financial security. What happens when millions of baby boomers retire?

10,000 baby boomers are retiring per day. This two decade trend has

only started but will certainly have an impact on the housing situation

moving forward. In most economic reports the boom and bust of the

housing market was not factored into the equation. Many boomers will

downsize or sell as they age. This is just a matter of demographics.

While trends are harder to predict,

we know that 10,000 baby boomers will be retiring on a daily basis for

well over a decade. What does this do to housing? The challenge we

will face is that the younger home buying generation is less affluent

and more in debt prior to purchasing a home. Instead of growing

households, we saw over 2 million young adults move back home to live

with their parents. So much for household formation taking up all that

excess demand. The recipe for the moment has been to constrain inventory and artificially push rates lower but this has done very little to increase actual financial security. What happens when millions of baby boomers retire?Read More @ DoctorHousingBubble.com

by Louise Armitstead, The Telegraph:

Barclays’

chairman and deputy chairman will travel to shareholders and investors

groups to explain their strategy for stemming the crisis that has ripped

through the bank and its boardroom. The pair are expected to use the

meetings to sound out investors on the plan to elevate Sir Mike to

chairman so he can swiftly start looking for a new chief executive and

fill the management vacuum at the top of the bank.

Barclays’

chairman and deputy chairman will travel to shareholders and investors

groups to explain their strategy for stemming the crisis that has ripped

through the bank and its boardroom. The pair are expected to use the

meetings to sound out investors on the plan to elevate Sir Mike to

chairman so he can swiftly start looking for a new chief executive and

fill the management vacuum at the top of the bank.

But it comes as Mr Del Missier, Barclays former chief operating officer – accused of ordering his subordinates to rig the bank’s Libor submission in 2008 – goes before the Treasury Select Committee.

Bob Diamond, the bank’s former chief executive, told the committee that, although he had received some advice from the Bank of England on Barclays’ borrowing levels, it was Mr Del Missier who misinterpreted it as an instruction to low-ball Libor.

Read More @ Telegraph.co.uk

Barclays’

chairman and deputy chairman will travel to shareholders and investors

groups to explain their strategy for stemming the crisis that has ripped

through the bank and its boardroom. The pair are expected to use the

meetings to sound out investors on the plan to elevate Sir Mike to

chairman so he can swiftly start looking for a new chief executive and

fill the management vacuum at the top of the bank.

Barclays’

chairman and deputy chairman will travel to shareholders and investors

groups to explain their strategy for stemming the crisis that has ripped

through the bank and its boardroom. The pair are expected to use the

meetings to sound out investors on the plan to elevate Sir Mike to

chairman so he can swiftly start looking for a new chief executive and

fill the management vacuum at the top of the bank.

But it comes as Mr Del Missier, Barclays former chief operating officer – accused of ordering his subordinates to rig the bank’s Libor submission in 2008 – goes before the Treasury Select Committee.

Bob Diamond, the bank’s former chief executive, told the committee that, although he had received some advice from the Bank of England on Barclays’ borrowing levels, it was Mr Del Missier who misinterpreted it as an instruction to low-ball Libor.

Read More @ Telegraph.co.uk

by Jonathan Benson, Natural News:

While millions of Americans were busy celebrating freedom from tyranny

during the recent Independence Day festivities, Monsanto was actively

trying to thwart that freedom with new attacks on health freedom. It

turns out that the most evil corporation in the world has quietly

attached riders to both the 2012 Farm Bill and the 2013 Agriculture Appropriations Bill that would essentially force the federal government to approve GMOs at the request of biotechnology companies, and prohibit all safety reviews of GMOs from having any real impact on the GMO approval process.

While millions of Americans were busy celebrating freedom from tyranny

during the recent Independence Day festivities, Monsanto was actively

trying to thwart that freedom with new attacks on health freedom. It

turns out that the most evil corporation in the world has quietly

attached riders to both the 2012 Farm Bill and the 2013 Agriculture Appropriations Bill that would essentially force the federal government to approve GMOs at the request of biotechnology companies, and prohibit all safety reviews of GMOs from having any real impact on the GMO approval process.

The Alliance for Natural Health – USA (ANH-USA), the Organic Consumers Association (OCA), and several other health freedom advocacy groups have been actively drawing attention to these stealth attacks in recent days, and urging Americans to rise up and oppose them now before it is too late. If we fail to act now as a single, unified community devoted to health freedom, in other words, America’s agricultural future could literally end up being controlled entirely by the biotech industry, which will have full immunity from the law.

Read More @ Natural News

While millions of Americans were busy celebrating freedom from tyranny

during the recent Independence Day festivities, Monsanto was actively

trying to thwart that freedom with new attacks on health freedom. It

turns out that the most evil corporation in the world has quietly

attached riders to both the 2012 Farm Bill and the 2013 Agriculture Appropriations Bill that would essentially force the federal government to approve GMOs at the request of biotechnology companies, and prohibit all safety reviews of GMOs from having any real impact on the GMO approval process.

While millions of Americans were busy celebrating freedom from tyranny

during the recent Independence Day festivities, Monsanto was actively

trying to thwart that freedom with new attacks on health freedom. It

turns out that the most evil corporation in the world has quietly

attached riders to both the 2012 Farm Bill and the 2013 Agriculture Appropriations Bill that would essentially force the federal government to approve GMOs at the request of biotechnology companies, and prohibit all safety reviews of GMOs from having any real impact on the GMO approval process.The Alliance for Natural Health – USA (ANH-USA), the Organic Consumers Association (OCA), and several other health freedom advocacy groups have been actively drawing attention to these stealth attacks in recent days, and urging Americans to rise up and oppose them now before it is too late. If we fail to act now as a single, unified community devoted to health freedom, in other words, America’s agricultural future could literally end up being controlled entirely by the biotech industry, which will have full immunity from the law.

Read More @ Natural News

from MOXNEWSd0tC0M:

“Democracy is hard. We have been at this for more than 236 years…” – Hillary Clinton

[Ed. Note: Someone may want to remind Ms. Clinton that as much as she might like it to be, the United Sates is not a "Democracy", it is (or at least it was at one point) a Republic.]

“Democracy is hard. We have been at this for more than 236 years…” – Hillary Clinton

[Ed. Note: Someone may want to remind Ms. Clinton that as much as she might like it to be, the United Sates is not a "Democracy", it is (or at least it was at one point) a Republic.]

Residents of the mainly black South Side want stop-and-search tactics brought back as gang murders plague President Barack Obama’s home city.

by Philip Sherwell, The Telegraph:

It just gets worse. If Sir Mervyn King was up to his waist in Libor before, now he’s drowning in it.

The cluster of young men hanging out on the porch of the run-down

brick home cast menacing stares at the unknown car as a “spotter”, a

teen on a bicycle, talked into a mobile phone.

The cluster of young men hanging out on the porch of the run-down

brick home cast menacing stares at the unknown car as a “spotter”, a

teen on a bicycle, talked into a mobile phone.

Beneath a tree across the street, burned red candle wax was the last remnant of an impromptu shrine for a 13-year-old boy, Tyquan Tyler, shot dead two weeks earlier by a killer just a few years older than him.

The assailant had run through an alleyway past a boarded-up home, mown down his victim and then disappeared back down the same route into a neighbouring street before the “ATM boys” could respond with their Glock pistols.

In the killing zones of Chicago’s predominantly black and poor South Side, turf warfare is no longer waged for control of districts but street to street.

A splintering of traditional gangs into smaller factions – known as crews or cliques – with ever-younger members desperate to prove their tough-guy credentials is fuelling a murder rate that makes swathes of Chicago more lethal than Afghanistan.

Read More @ Telegraph.co.uk

by Philip Sherwell, The Telegraph:

It just gets worse. If Sir Mervyn King was up to his waist in Libor before, now he’s drowning in it.

The cluster of young men hanging out on the porch of the run-down

brick home cast menacing stares at the unknown car as a “spotter”, a

teen on a bicycle, talked into a mobile phone.

The cluster of young men hanging out on the porch of the run-down

brick home cast menacing stares at the unknown car as a “spotter”, a

teen on a bicycle, talked into a mobile phone.Beneath a tree across the street, burned red candle wax was the last remnant of an impromptu shrine for a 13-year-old boy, Tyquan Tyler, shot dead two weeks earlier by a killer just a few years older than him.

The assailant had run through an alleyway past a boarded-up home, mown down his victim and then disappeared back down the same route into a neighbouring street before the “ATM boys” could respond with their Glock pistols.

In the killing zones of Chicago’s predominantly black and poor South Side, turf warfare is no longer waged for control of districts but street to street.

A splintering of traditional gangs into smaller factions – known as crews or cliques – with ever-younger members desperate to prove their tough-guy credentials is fuelling a murder rate that makes swathes of Chicago more lethal than Afghanistan.

Read More @ Telegraph.co.uk

by Jim Sinclair, JS Mineset:

My Dear Friends,

My Dear Friends,

I will expand on this over the summer, but as an introduction:

1. Economics are not weekly and monthly statistics. It is comprised of motion and change that determines the trend.

2. The effect of economic actions is not a static amount, for example0 QE in some determined period of time, but rather an inescapable cumulative impact due to the rate of change. Each event of stimulation requires greater effort than the previous.

3. Economic activity is either increasing at an increasing rate or it is decelerating and an increasing rate. There are no Plateaus of Prosperity or Goldilocks Economics other than in the minds of spin doctors.

Read More @ JSMineset.com

My Dear Friends,

My Dear Friends,I will expand on this over the summer, but as an introduction:

1. Economics are not weekly and monthly statistics. It is comprised of motion and change that determines the trend.

2. The effect of economic actions is not a static amount, for example0 QE in some determined period of time, but rather an inescapable cumulative impact due to the rate of change. Each event of stimulation requires greater effort than the previous.

3. Economic activity is either increasing at an increasing rate or it is decelerating and an increasing rate. There are no Plateaus of Prosperity or Goldilocks Economics other than in the minds of spin doctors.

Read More @ JSMineset.com

We The Sheeplez... is intended to reflect

excellence in effort and content. Donations will help maintain this goal

and defray the operational costs. Paypal, a leading provider of secure

online money transfers, will handle the donations. Thank you for your

contribution.

I'm PayPal Verified

We The Sheeplez... is intended to reflect

excellence in effort and content. Donations will help maintain this goal

and defray the operational costs. Paypal, a leading provider of secure

online money transfers, will handle the donations. Thank you for your

contribution.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment