by Andy Hoffman, Miles Franklin:

Last year, “ADMIRAL SPROTT” deemed silver the “investment of the decade” –with good reason…

Like all PM experts, he is well aware of the chronic supply deficits that caused the U.S. Geological Service (USGS) to recently declare silver likely to be the first “extinct” element on the periodic table – aside from private investor stashes, of course…

Silver will be the first element in the periodic table to become extinct

Not only has silver been in a supply deficit for at least 15 years – and that, using chronically understated demand estimates from Cartel apologist Jeff Christian’s CPM Group…

Major Silver Production / Usage Deficit Alert…

…but given its short supply – roughly one billion investable ounces exist, worth a measly $27 billion at today’s PAPER prices – and dual usage as a monetary AND industrial metal, it is quite conceivable that silver prices approach gold prices in the coming years. In other words, that the historical gold:silver ratio of 16:1 is significantly overshot on the downside. Readers know my long-term forecast for the gold:silver ratio is 5:1 to 15:1, compared to the current ratio of 58:1…

Read More @ Miles Franklin

Last year, “ADMIRAL SPROTT” deemed silver the “investment of the decade” –with good reason…

Like all PM experts, he is well aware of the chronic supply deficits that caused the U.S. Geological Service (USGS) to recently declare silver likely to be the first “extinct” element on the periodic table – aside from private investor stashes, of course…

Silver will be the first element in the periodic table to become extinct

Not only has silver been in a supply deficit for at least 15 years – and that, using chronically understated demand estimates from Cartel apologist Jeff Christian’s CPM Group…

Major Silver Production / Usage Deficit Alert…

…but given its short supply – roughly one billion investable ounces exist, worth a measly $27 billion at today’s PAPER prices – and dual usage as a monetary AND industrial metal, it is quite conceivable that silver prices approach gold prices in the coming years. In other words, that the historical gold:silver ratio of 16:1 is significantly overshot on the downside. Readers know my long-term forecast for the gold:silver ratio is 5:1 to 15:1, compared to the current ratio of 58:1…

Read More @ Miles Franklin

By Byron King, Daily Reckoning.com.au:

Money, although most people don’t view it as such, is technology.

Think about it. Money is not a “natural” thing.

Money is a human abstraction. Money is an idea that’s harnessed to certain standards. For example, archaeologists tell us that primitive societies used colored stones, seashells or pieces of bone as money.

Then for much of human history (including now, depending where you are) mankind used gold, silver and copper as money. In the 13th century, Kublai Khan introduced what some consider the first paper currency (the “chao”) throughout China – an idea that Marco Polo brought back to Europe.

The point is that across the ages, money is a construct – an invented tool – whether it’s seashells, gold, paper currency or even digital ones and zeros on a mobile device app.

Another way of viewing it is that money is an agreed-upon standard. Money is like time zones, where it’s the same time to the east, west, north and south. Money is like a standard unit of measurement, where a pound of steel weighs the same as a pound of feathers. Or money is like the width of railway gauge, so that rail cars from one railroad can run on the tracks of another railroad.

Read More @ DailyReckoning.com.au

Money, although most people don’t view it as such, is technology.

Think about it. Money is not a “natural” thing.

Money is a human abstraction. Money is an idea that’s harnessed to certain standards. For example, archaeologists tell us that primitive societies used colored stones, seashells or pieces of bone as money.

Then for much of human history (including now, depending where you are) mankind used gold, silver and copper as money. In the 13th century, Kublai Khan introduced what some consider the first paper currency (the “chao”) throughout China – an idea that Marco Polo brought back to Europe.

The point is that across the ages, money is a construct – an invented tool – whether it’s seashells, gold, paper currency or even digital ones and zeros on a mobile device app.

Another way of viewing it is that money is an agreed-upon standard. Money is like time zones, where it’s the same time to the east, west, north and south. Money is like a standard unit of measurement, where a pound of steel weighs the same as a pound of feathers. Or money is like the width of railway gauge, so that rail cars from one railroad can run on the tracks of another railroad.

Read More @ DailyReckoning.com.au

by Smith Mckenna, Bullion Street:

The next few years will likely prove to be exceptionally rewarding for those who invest in silver and other precious metals like gold.

History repeats itself in the precious metals market, said Stephen Smith, the managing member at Smith McKenna LLC.

History repeats itself in the precious metals market, said Stephen Smith, the managing member at Smith McKenna LLC.

According to Smith, With major investing assets like stocks and bonds expected to decline with eventual rising interest rates; gold and especially silver are going to increase in value dramatically in what investors like to call a ‘boom.’.

The next few years will likely prove to be exceptionally rewarding for those who invest in silver and other precious metals like gold.

The price of gold and silver would be much higher under current market conditions if it weren’t for some strength in the stock and bond sector. Is this bad? No it’s not, especially for first time and long term investors, because right now it is allowing for exceptionally cheap prices for buying and investing in silver.

As traditional investment forms reach their bubble and subsequently fall, including interest rates rebounding and global economic recovery, silver is expected to emerge as the leader – reaching never before seen highs.

Read More @ BullionStreet.com

The next few years will likely prove to be exceptionally rewarding for those who invest in silver and other precious metals like gold.

History repeats itself in the precious metals market, said Stephen Smith, the managing member at Smith McKenna LLC.

History repeats itself in the precious metals market, said Stephen Smith, the managing member at Smith McKenna LLC.According to Smith, With major investing assets like stocks and bonds expected to decline with eventual rising interest rates; gold and especially silver are going to increase in value dramatically in what investors like to call a ‘boom.’.

The next few years will likely prove to be exceptionally rewarding for those who invest in silver and other precious metals like gold.

The price of gold and silver would be much higher under current market conditions if it weren’t for some strength in the stock and bond sector. Is this bad? No it’s not, especially for first time and long term investors, because right now it is allowing for exceptionally cheap prices for buying and investing in silver.

As traditional investment forms reach their bubble and subsequently fall, including interest rates rebounding and global economic recovery, silver is expected to emerge as the leader – reaching never before seen highs.

Read More @ BullionStreet.com

by Lisa Oake, CNBC:

As the investment world eagerly awaits more stimulus, a debate on a

previously unthinkable topic has started to emerge – can fiat currencies

survive round after round of debasement?

As the investment world eagerly awaits more stimulus, a debate on a

previously unthinkable topic has started to emerge – can fiat currencies

survive round after round of debasement?

Some heavy hitters say the answer is no.

A fiat currency derives its worth from the issuing government – it is not fixed in value to any objective standard. That means central banks can print as much money as they want. If an economy is struggling, injecting more notes into the system juices activity but lowers the value of the currency in question.

With major central banks all desperate to stimulate their economies, some say currencies have entered a dangerous new phase often described as a race to the bottom.

Mark Mobius, Executive Chairman of Templeton Emerging Markets Group, says investors will soon start to demand fiat currencies be backed by gold or other hard assets.

“It’s already happening, you’re beginning to see that trend with central banks stocking up on gold. The estimate is that at least half of the buying is central bank buying. They are looking to the day when they can say okay, our currency is backed by gold and therefore we’re a strong country,” Mobius told CNBC Asia.

Read More @ CNBC.com

As the investment world eagerly awaits more stimulus, a debate on a

previously unthinkable topic has started to emerge – can fiat currencies

survive round after round of debasement?

As the investment world eagerly awaits more stimulus, a debate on a

previously unthinkable topic has started to emerge – can fiat currencies

survive round after round of debasement?Some heavy hitters say the answer is no.

A fiat currency derives its worth from the issuing government – it is not fixed in value to any objective standard. That means central banks can print as much money as they want. If an economy is struggling, injecting more notes into the system juices activity but lowers the value of the currency in question.

With major central banks all desperate to stimulate their economies, some say currencies have entered a dangerous new phase often described as a race to the bottom.

Mark Mobius, Executive Chairman of Templeton Emerging Markets Group, says investors will soon start to demand fiat currencies be backed by gold or other hard assets.

“It’s already happening, you’re beginning to see that trend with central banks stocking up on gold. The estimate is that at least half of the buying is central bank buying. They are looking to the day when they can say okay, our currency is backed by gold and therefore we’re a strong country,” Mobius told CNBC Asia.

Read More @ CNBC.com

by Gary North, The Market Oracle:

What the Federal Reserve System can do and what it will do are two different things.

What the Federal Reserve System can do and what it will do are two different things.

The Federal Reserve System can monetize anything. It can create digital money and buy any asset it chooses to buy. There are no legal restrictions on what it is allowed to monetize.

If it were to do this, and it continued to do this, the dollar would fall to zero value. This would produce hyperinflation. The result would be the destruction of all dollar-based creditors. Debtors could pay off their loans with the sale of an egg or a pack of cigarettes. This is what farmers did in 1923 in Germany and Austria.

The economists who advise the Federal Reserve System know this. The bankers who run the banks that own the shares of the 12 regional FED banks know this. Bernanke knows this.

The day will come when the decision-makers on the Federal Open Market Committee will have to fish or cut bait. They will have to decide: mass inflation (20%) or hyperinflation (QEx). They will have to decide: recession or hyperinflation.

Read More @ TheMarketOracle.co.uk

What the Federal Reserve System can do and what it will do are two different things.

What the Federal Reserve System can do and what it will do are two different things.The Federal Reserve System can monetize anything. It can create digital money and buy any asset it chooses to buy. There are no legal restrictions on what it is allowed to monetize.

If it were to do this, and it continued to do this, the dollar would fall to zero value. This would produce hyperinflation. The result would be the destruction of all dollar-based creditors. Debtors could pay off their loans with the sale of an egg or a pack of cigarettes. This is what farmers did in 1923 in Germany and Austria.

The economists who advise the Federal Reserve System know this. The bankers who run the banks that own the shares of the 12 regional FED banks know this. Bernanke knows this.

The day will come when the decision-makers on the Federal Open Market Committee will have to fish or cut bait. They will have to decide: mass inflation (20%) or hyperinflation (QEx). They will have to decide: recession or hyperinflation.

Read More @ TheMarketOracle.co.uk

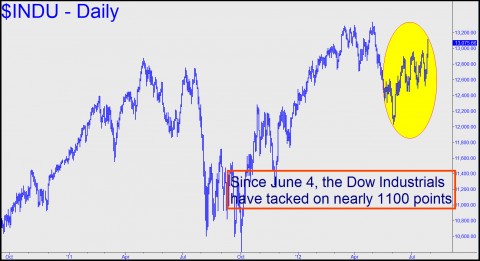

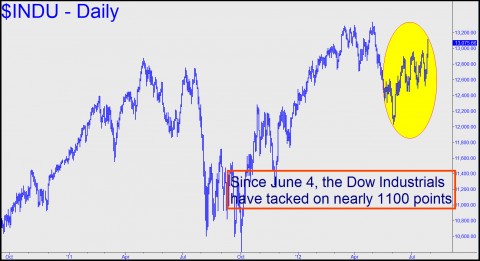

by Rick Ackerman, Rick Ackerman.com:

As usual, the stock market was vexatiously out of step with reality

last week, soaring on word that the ECB plans to do “whatever it takes”

to preserve the euro and the political union that it binds. For U.S.

investors, especially those who believe in hope and change (and,

presumably, the Easter Bunny), there was also the invaluable news that

the U.S. economy is once again verging on recession – a development

which is widely believed to portend yet more Fed easing. Completing the

delusional vision that good times are soon to return nonetheless, crude

oil finished the week with a gain of about $4 per barrel. Of course, no

one actually believes that so strong a recovery impends as to squeeze

current supplies of crude that are more than adequate. Even so, the news

media, feigning ignorance of forces that have been pushing the global

economy toward an abyss, and abetted by the stock market’s

steroid-addled lunge, were only too happy to report events in a way that

did not challenge officialdom’s cynically crafted, positive spin. The

Establishment’s most useful memes were dutifully trumpeted by The Wall

Street Journal in two headlines that ran above the fold on Friday: Weak

Economy Heads Lower, said the topmost, in a heavy font; and,

immediately below it, in italics, the implicitly good news: Markets Jump as European Leaders Vow to Protect Euro; Flagging U.S. Recovery Could Spur Fed.

As usual, the stock market was vexatiously out of step with reality

last week, soaring on word that the ECB plans to do “whatever it takes”

to preserve the euro and the political union that it binds. For U.S.

investors, especially those who believe in hope and change (and,

presumably, the Easter Bunny), there was also the invaluable news that

the U.S. economy is once again verging on recession – a development

which is widely believed to portend yet more Fed easing. Completing the

delusional vision that good times are soon to return nonetheless, crude

oil finished the week with a gain of about $4 per barrel. Of course, no

one actually believes that so strong a recovery impends as to squeeze

current supplies of crude that are more than adequate. Even so, the news

media, feigning ignorance of forces that have been pushing the global

economy toward an abyss, and abetted by the stock market’s

steroid-addled lunge, were only too happy to report events in a way that

did not challenge officialdom’s cynically crafted, positive spin. The

Establishment’s most useful memes were dutifully trumpeted by The Wall

Street Journal in two headlines that ran above the fold on Friday: Weak

Economy Heads Lower, said the topmost, in a heavy font; and,

immediately below it, in italics, the implicitly good news: Markets Jump as European Leaders Vow to Protect Euro; Flagging U.S. Recovery Could Spur Fed.

Read More @ RickAckerman.com

As usual, the stock market was vexatiously out of step with reality

last week, soaring on word that the ECB plans to do “whatever it takes”

to preserve the euro and the political union that it binds. For U.S.

investors, especially those who believe in hope and change (and,

presumably, the Easter Bunny), there was also the invaluable news that

the U.S. economy is once again verging on recession – a development

which is widely believed to portend yet more Fed easing. Completing the

delusional vision that good times are soon to return nonetheless, crude

oil finished the week with a gain of about $4 per barrel. Of course, no

one actually believes that so strong a recovery impends as to squeeze

current supplies of crude that are more than adequate. Even so, the news

media, feigning ignorance of forces that have been pushing the global

economy toward an abyss, and abetted by the stock market’s

steroid-addled lunge, were only too happy to report events in a way that

did not challenge officialdom’s cynically crafted, positive spin. The

Establishment’s most useful memes were dutifully trumpeted by The Wall

Street Journal in two headlines that ran above the fold on Friday: Weak

Economy Heads Lower, said the topmost, in a heavy font; and,

immediately below it, in italics, the implicitly good news: Markets Jump as European Leaders Vow to Protect Euro; Flagging U.S. Recovery Could Spur Fed.

As usual, the stock market was vexatiously out of step with reality

last week, soaring on word that the ECB plans to do “whatever it takes”

to preserve the euro and the political union that it binds. For U.S.

investors, especially those who believe in hope and change (and,

presumably, the Easter Bunny), there was also the invaluable news that

the U.S. economy is once again verging on recession – a development

which is widely believed to portend yet more Fed easing. Completing the

delusional vision that good times are soon to return nonetheless, crude

oil finished the week with a gain of about $4 per barrel. Of course, no

one actually believes that so strong a recovery impends as to squeeze

current supplies of crude that are more than adequate. Even so, the news

media, feigning ignorance of forces that have been pushing the global

economy toward an abyss, and abetted by the stock market’s

steroid-addled lunge, were only too happy to report events in a way that

did not challenge officialdom’s cynically crafted, positive spin. The

Establishment’s most useful memes were dutifully trumpeted by The Wall

Street Journal in two headlines that ran above the fold on Friday: Weak

Economy Heads Lower, said the topmost, in a heavy font; and,

immediately below it, in italics, the implicitly good news: Markets Jump as European Leaders Vow to Protect Euro; Flagging U.S. Recovery Could Spur Fed.Read More @ RickAckerman.com

by Peter Cooper, Arabian Money via, Gold Seek:

It was very interesting to hear a full presentation of the bearish case

for gold by Paul Van Eeden, President of Cranberry Capital at the

closing session of the Agora FInancial Investment Symposium in

Vancouver.

It was very interesting to hear a full presentation of the bearish case

for gold by Paul Van Eeden, President of Cranberry Capital at the

closing session of the Agora FInancial Investment Symposium in

Vancouver.

For his part it was both brave to face such a gold positive audience and tell them what they did not want to hear and also to stand up and say so in the same forum where he predicted the same thing three years ago only to be proven completely wrong (click here).

Different this time? But Mr Van Eeden does have some credibility because his timing on the gold junior stocks was excellent and he closed his newsletter recommending them and sold everything before this market collapsed. So will he be right on gold this time?

His argument in a nutshell is that the fear of inflation has been wildly overdone. Yes the money supply has doubled in the past four years since the global financial crisis but this does not automatically cause retail price inflation. Indeed, where is it?

Read More @ GoldSeek.com

It was very interesting to hear a full presentation of the bearish case

for gold by Paul Van Eeden, President of Cranberry Capital at the

closing session of the Agora FInancial Investment Symposium in

Vancouver.

It was very interesting to hear a full presentation of the bearish case

for gold by Paul Van Eeden, President of Cranberry Capital at the

closing session of the Agora FInancial Investment Symposium in

Vancouver.For his part it was both brave to face such a gold positive audience and tell them what they did not want to hear and also to stand up and say so in the same forum where he predicted the same thing three years ago only to be proven completely wrong (click here).

Different this time? But Mr Van Eeden does have some credibility because his timing on the gold junior stocks was excellent and he closed his newsletter recommending them and sold everything before this market collapsed. So will he be right on gold this time?

His argument in a nutshell is that the fear of inflation has been wildly overdone. Yes the money supply has doubled in the past four years since the global financial crisis but this does not automatically cause retail price inflation. Indeed, where is it?

Read More @ GoldSeek.com

Geithner And Schauble Release Joint Non-Statement

Timothy Geithner and Wolfgang Schäuble today met on the island of Sylt to use the informal atmosphere for an open exchange of views on global, U.S. and European economies. They emphasized the need for ongoing international cooperation and coordination to achieve sustainable public finances, reduce global macroeconomic imbalances, and restore growth.The Unbearable 'Factual' Lightness Of The Chinese Economy

Factual

data point after factual data point is indicating more than a little

stress in the Chinese economy (and the Asian engine of growth in

general). Whether it is bank loan losses escalating, shadow-banking

stress, real-estate corruption, dismal retail spending, the shrinking

textile industry, the artificial production in the crushingly slow

metals industry, the construction industry's contraction, or the

massive '50%-above-demand' channel-stuffing now occurring in the Chinese

auto market, Diapason Commodity's Sean Corrigan succinctly notes: "China

bulls will not heed any of this, of course, for they are prisoners of

the nested illusion that all increases in outlay represent genuine

growth (cf, Occidental property bubbles) and that higher growth must

imply greater profitability. They will also argue, on any uptick in the

macro numbers, that the worst is not only behind us, but that it has

been more than fully priced in." Given a picture paints a

thousand words; Asian trade volumes have ended their rebound and are now

exhausted, just as Chinese authorities are still giving off signals

that they will not repeat the indiscriminate orgy of spending of 2009-10.

Factual

data point after factual data point is indicating more than a little

stress in the Chinese economy (and the Asian engine of growth in

general). Whether it is bank loan losses escalating, shadow-banking

stress, real-estate corruption, dismal retail spending, the shrinking

textile industry, the artificial production in the crushingly slow

metals industry, the construction industry's contraction, or the

massive '50%-above-demand' channel-stuffing now occurring in the Chinese

auto market, Diapason Commodity's Sean Corrigan succinctly notes: "China

bulls will not heed any of this, of course, for they are prisoners of

the nested illusion that all increases in outlay represent genuine

growth (cf, Occidental property bubbles) and that higher growth must

imply greater profitability. They will also argue, on any uptick in the

macro numbers, that the worst is not only behind us, but that it has

been more than fully priced in." Given a picture paints a

thousand words; Asian trade volumes have ended their rebound and are now

exhausted, just as Chinese authorities are still giving off signals

that they will not repeat the indiscriminate orgy of spending of 2009-10.History, Borders & Change

Admin at Jim Rogers Blog - 43 minutes ago

“Not one country in existence today has had the same borders and government

for as long as two hundred years. The world will continue changing.”

- Jim Rogers, A Gift to My Children: A Father's Lessons for Life and

Investing

*Jim Rogers is an author, financial commentator and successful

international investor. He has been frequently featured in Time, The New

York Times, Barron’s, Forbes, Fortune, The Wall Street Journal, The

Financial Times and is a regular guest on Bloomberg and CNBC.*

Video: Market Outlook

Admin at Marc Faber Blog - 1 hour ago

Latest video interview, in Vancouver.

*

*

*Marc Faber is an international investor known for his uncanny predictions

of the stock market and futures markets around the world.*

Election Year Stock Market Rally?

Eric De Groot at Eric De Groot - 1 hour ago

If managing markets were possible and I wanted to generate a stock market

rally ahead of an important election, I would concentrate short positions

in the bond market (DI reading below -60%) to trigger a reallocation trade

from bonds to stock market. Of course, the random walk hypothesis, so

readily taught to nubile financial minds, tell us that despite numerous

real world examples of...

[[ This is a content summary only. Visit my website for full links, other

content, and more! ]]

Taibbi and Spitzer on Sandy Weill, Romney, LIBOR and Geithner

"Who Is Jamie Dimon?"...

Who is Jamie Dimon?

- New York Banker: 14%

- Texas Congressman: 9%

- X-Games Skateboarder: 7%

- Daredevil Motorcyclist: 4%

- Don't Know: 66%

Forget It Draghi, Spain is Finished... Here's Why.

07/30/2012 - 11:04

We are on the downslope side of the Grand Cycle Top in Everything.

We are on the downslope side of the Grand Cycle Top in Everything.

As the Republican National Convention approaches, the shouts of victory

resounding in the tents will easily conceal the broader political

forces at work in the party beyond this fall’s hopeful decisive victory.

As the Republican National Convention approaches, the shouts of victory

resounding in the tents will easily conceal the broader political

forces at work in the party beyond this fall’s hopeful decisive victory. Rupee

futures and gold trading helped drive trading at the gold exchange in

Dubai, to a new trading record in June at $32.92 billion.

Rupee

futures and gold trading helped drive trading at the gold exchange in

Dubai, to a new trading record in June at $32.92 billion. European Central Bank President

European Central Bank President  Gold and silver had solid finishes to the end of last week, with the

yellow metal posting another positive weekly run – settling at $1,621,

at the top end of the channel in which it has been trading for close to

three months now. Silver had a wild session, starting around $27.50

before gaining around 30 cents, then losing 40 cents in one crazy hour

of selling early afternoon, before recouping some of these losses on

rumours of fresh liquidity injections from the European Central Bank, to

close the week just shy of $27.70.

Gold and silver had solid finishes to the end of last week, with the

yellow metal posting another positive weekly run – settling at $1,621,

at the top end of the channel in which it has been trading for close to

three months now. Silver had a wild session, starting around $27.50

before gaining around 30 cents, then losing 40 cents in one crazy hour

of selling early afternoon, before recouping some of these losses on

rumours of fresh liquidity injections from the European Central Bank, to

close the week just shy of $27.70. We are beyond the point where a quarter point rate cut will achieve

anything. Nor will it help to launch a fresh round of “temporary and

limited” bond purchases – to use the self-defeating language that Mr

Draghi is forced to utter.

We are beyond the point where a quarter point rate cut will achieve

anything. Nor will it help to launch a fresh round of “temporary and

limited” bond purchases – to use the self-defeating language that Mr

Draghi is forced to utter. The focus of the markets and the alternative media is firmly placed on

the continued disintegration of the world financial system. Many

believe that the collapse of the fiat monetary system along with the

global banking cartel is the worst possible outcome. However, this may

actually turn out to be the good news in a sea of bad news that is

lurking around the corner.

The focus of the markets and the alternative media is firmly placed on

the continued disintegration of the world financial system. Many

believe that the collapse of the fiat monetary system along with the

global banking cartel is the worst possible outcome. However, this may

actually turn out to be the good news in a sea of bad news that is

lurking around the corner.

For the first time in history, the rebel alliance can compile a

diversified portfolio that reflects his or her inter-essences, that is

interests. While not only can investments be made under the dominant

financial system which undermine that system, such as physically

delivered precious metals, mediums of exchange can nowadays also be

taken outside that paradigm. German alternative analog world paper

currencies have gained attention and velocity more-so than the digital,

universal bitcoin, but it is the latter which is the first publicly

traded, globally accepted currency, predisposing it to longer-term

popularity.

For the first time in history, the rebel alliance can compile a

diversified portfolio that reflects his or her inter-essences, that is

interests. While not only can investments be made under the dominant

financial system which undermine that system, such as physically

delivered precious metals, mediums of exchange can nowadays also be

taken outside that paradigm. German alternative analog world paper

currencies have gained attention and velocity more-so than the digital,

universal bitcoin, but it is the latter which is the first publicly

traded, globally accepted currency, predisposing it to longer-term

popularity. Trigger-happy, over-aggressive cops are – unfortunately – a reality.

Which is why it’s probably a good idea to get your concealed handgun

permit (CHP) if you carry a gun with you in a car.

Trigger-happy, over-aggressive cops are – unfortunately – a reality.

Which is why it’s probably a good idea to get your concealed handgun

permit (CHP) if you carry a gun with you in a car. Northern India’s power grid crashed Monday, halting hundreds of trains,

forcing hospitals and airports to use backup generators and leaving 370

million people – more than the population of the United States and

Canada combined – sweltering in the summer heat.

Northern India’s power grid crashed Monday, halting hundreds of trains,

forcing hospitals and airports to use backup generators and leaving 370

million people – more than the population of the United States and

Canada combined – sweltering in the summer heat. Could it actually be possible that Mitt Romney is considering

selecting Florida Attorney General Pam Bondi as his running mate? Most

Americans have never even heard of her, but there are now indications

that she has made the short list of VP contenders. Over the weekend she

traveled

Could it actually be possible that Mitt Romney is considering

selecting Florida Attorney General Pam Bondi as his running mate? Most

Americans have never even heard of her, but there are now indications

that she has made the short list of VP contenders. Over the weekend she

traveled  Nations don’t wage permanent wars and survive. Imagine one calling itself a democracy trying.

Nations don’t wage permanent wars and survive. Imagine one calling itself a democracy trying.![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment