The Perfect Storm - Santelli Meets Farage

The

undisputed champion of European political ranting (UKIP's Nigel

Farage) discussed the sad reality of Europe's inevitable demise with the

reigning US chief of non-hype Rick Santelli in a no-holds-barred

cage-match of like-minded skeptics. From Rajoy's incompetence to the

'genius of mutual indebtedness', Farage explains the problem is

'bedeviled with complexity' as, for example, the last summit left "the

Finnish and Dutch finance ministers leaving with a very different

perspective on what happened than the rest" and now even Merkel is

arguing domestically what she has and has not agreed to. From the simple

self-referential idiocy of Spain's EUR100 billion bailout - that

creates vicious circles on all the peripheral 'bailing' nations; to "the same bundle of money going round and round in circles" leaving Nigel tempted to describe it as "a giant ponzi scheme"; Santelli, not to be outdone, explains how the US is just such a money-circulating ponzi scheme as "one part of the government issues debt as another part is buying".

The ECB, of course, is becoming plagued with more and more of the

ponzi-like peripheral paper and as Farage notes "the day Greece leaves

the Euro - and it will - the ECB is left with a massive paper loss"

leaving the ECB under-capitalized - which in all its wonderful craziness

means "it has to go and get fresh capital from the other countries

that themselves have been bailed out and are in fact in trouble". A

farcical perfect storm as the "medicine is killing the patient", and he fears if the nettle is not grasped (Euro break-up) now then the markets will overwhelm the whole thing this summer.

The

undisputed champion of European political ranting (UKIP's Nigel

Farage) discussed the sad reality of Europe's inevitable demise with the

reigning US chief of non-hype Rick Santelli in a no-holds-barred

cage-match of like-minded skeptics. From Rajoy's incompetence to the

'genius of mutual indebtedness', Farage explains the problem is

'bedeviled with complexity' as, for example, the last summit left "the

Finnish and Dutch finance ministers leaving with a very different

perspective on what happened than the rest" and now even Merkel is

arguing domestically what she has and has not agreed to. From the simple

self-referential idiocy of Spain's EUR100 billion bailout - that

creates vicious circles on all the peripheral 'bailing' nations; to "the same bundle of money going round and round in circles" leaving Nigel tempted to describe it as "a giant ponzi scheme"; Santelli, not to be outdone, explains how the US is just such a money-circulating ponzi scheme as "one part of the government issues debt as another part is buying".

The ECB, of course, is becoming plagued with more and more of the

ponzi-like peripheral paper and as Farage notes "the day Greece leaves

the Euro - and it will - the ECB is left with a massive paper loss"

leaving the ECB under-capitalized - which in all its wonderful craziness

means "it has to go and get fresh capital from the other countries

that themselves have been bailed out and are in fact in trouble". A

farcical perfect storm as the "medicine is killing the patient", and he fears if the nettle is not grasped (Euro break-up) now then the markets will overwhelm the whole thing this summer.On LIBOR - Sue Them All Or Go Home

Despite

BoE's Tucker telling us this morning that there is no need to look at

any other market but LIBOR, it appears the world has moved on from this

debacle of indication of anything. As we pointed out here,

the 'stability' of LIBOR given everything going on around it is

incredulous (whether due to the ECB's crappy-collateral standards-based

MROs or the Fed's FX swap lines - since unsecured interbank financing is

now a relic of the pre-crisis 'trust' era). Furthermore, as we discussed yesterday, the machinations of the LIBOR market and calculations (which Peter Tchir delves deeply into below) suggest that this

not the act of a lone assassin suggesting quite simply that complaining

or suing Barclays is redundant - any Libor-related suits (from the

public or the government/regulators) must sue all the submitters or it misses the critical facts of the manipulation.

Despite

BoE's Tucker telling us this morning that there is no need to look at

any other market but LIBOR, it appears the world has moved on from this

debacle of indication of anything. As we pointed out here,

the 'stability' of LIBOR given everything going on around it is

incredulous (whether due to the ECB's crappy-collateral standards-based

MROs or the Fed's FX swap lines - since unsecured interbank financing is

now a relic of the pre-crisis 'trust' era). Furthermore, as we discussed yesterday, the machinations of the LIBOR market and calculations (which Peter Tchir delves deeply into below) suggest that this

not the act of a lone assassin suggesting quite simply that complaining

or suing Barclays is redundant - any Libor-related suits (from the

public or the government/regulators) must sue all the submitters or it misses the critical facts of the manipulation.The Effects Of Increasing Global Money Supply On Gold

WGC stresses that when looking at the effects of variables like money supply and inflation on the gold price, it is important to look at the global economy, and not concentrate only on what is happening in the US. After the start of the financial crisis in 2007, many governments and central banks in the world implemented monetary and fiscal policies to help their economies, but these policies have led to a large increase in the global money supply.

The Real Fiscal Cliff

More and more Asian nations — led by China and Russia — have ditched the dollar for bilateral trade (out of fear of dollar instability).

Tension rises between the United States and Asia over Syria and Iran.

The Asian nations throw more and more abrasive rhetoric around — including war rhetoric. And on the other hand, both Obama and Romney — as well as Hillary Clinton — seem dead-set on ramping up the tense rhetoric. Romney seems extremely keen to brand China a currency manipulator.

In truth, both sides have a mutual interest in sitting down and

engaging in a frank discussion, and then coming out with a serious

long-term plan of co-operation on trade and fiscal issues where both

sides accept compromises — perhaps Asia could agree to reinvest some of

its dollar hoard in the United States to create American jobs and

rebuild American infrastructure in exchange for a long-term American

deficit-reduction and technology-sharing agreement? So the future, I

think, will more likely involve both sides jumping off the cliff into

the uncertain seas of trade war, currency war, default-by-debasement,

tariffs, proxy war and regional and global political and economic

instability.

More and more Asian nations — led by China and Russia — have ditched the dollar for bilateral trade (out of fear of dollar instability).

Tension rises between the United States and Asia over Syria and Iran.

The Asian nations throw more and more abrasive rhetoric around — including war rhetoric. And on the other hand, both Obama and Romney — as well as Hillary Clinton — seem dead-set on ramping up the tense rhetoric. Romney seems extremely keen to brand China a currency manipulator.

In truth, both sides have a mutual interest in sitting down and

engaging in a frank discussion, and then coming out with a serious

long-term plan of co-operation on trade and fiscal issues where both

sides accept compromises — perhaps Asia could agree to reinvest some of

its dollar hoard in the United States to create American jobs and

rebuild American infrastructure in exchange for a long-term American

deficit-reduction and technology-sharing agreement? So the future, I

think, will more likely involve both sides jumping off the cliff into

the uncertain seas of trade war, currency war, default-by-debasement,

tariffs, proxy war and regional and global political and economic

instability.Value In Distressed Eurozone

Admin at Marc Faber Blog - 37 minutes ago

I see value in equities, regardless of whether the euro zone stays or is

abandoned. - *in Irish Times*

*Marc Faber is an international investor known for his uncanny predictions

of the stock market and futures markets around the world.*

Central Banks Actions Are Adding To Inflationary Pressures

Admin at Jim Rogers Blog - 42 minutes ago

I find it absurd. It’s the wrong thing to do. They are just adding to the

inflationary pressures that are here, and we’re all going to have more

problems down the road. - *in Index Universe*

*Jim Rogers is an author, financial commentator and successful

international investor. He has been frequently featured in Time, The New

York Times, Barron’s, Forbes, Fortune, The Wall Street Journal, The

Financial Times and is a regular guest on Bloomberg and CNBC.*

US Government Current Expenditures - Corporatism

The Hope-To-Reality Gap

"Europe

looks as bad as we thought it would, but our US economic outlook was

too optimistic" is how JPMorgan's Michael Cembalest describes the

recent environment (adding that US equities have stayed relatively

stable thanks to resilient corporate profits and a ton of liquidity).

However, with negative pre-announcements mounting (and corporate cash

piles startiong to burn a little), we suspect the unusual disconnect

between profits and economics will end soon enough. As the following two

charts show, when US economic data has been generally sub-par (as

exemplified by the plunge in Citigroup's economic surprise indicator),

US equities have deteriorated notably in the past. For now, it

appears there is a 15-20% disconnect in the S&P' 500's performance

relative to the real economy's performance - and the current 'hope' gap

looks extremely similar to last summer's before reality set in.

"Europe

looks as bad as we thought it would, but our US economic outlook was

too optimistic" is how JPMorgan's Michael Cembalest describes the

recent environment (adding that US equities have stayed relatively

stable thanks to resilient corporate profits and a ton of liquidity).

However, with negative pre-announcements mounting (and corporate cash

piles startiong to burn a little), we suspect the unusual disconnect

between profits and economics will end soon enough. As the following two

charts show, when US economic data has been generally sub-par (as

exemplified by the plunge in Citigroup's economic surprise indicator),

US equities have deteriorated notably in the past. For now, it

appears there is a 15-20% disconnect in the S&P' 500's performance

relative to the real economy's performance - and the current 'hope' gap

looks extremely similar to last summer's before reality set in.Live Webcast Of BOE's Paul Tucker Testifying On LIBOR Before Parliament

Last

week the biggest point of contention in the testimony of Bob Diamond

before the House of Commons Treasury Committee was who told him what,

and when, with a special circle in hell saved for the BOE's Paul

Tucker, who was alleged to have explicitly ordered Barclays to lower its

fixing (which as was shown last week had

a pretty dramatic impact on the bank's self-reported LIBOR rate). In a

few short moments, Tucker himself will be in the hot chair, where an

emphasis will be on the emails he sent to Bob Diamond which we presented previously,

and whether he acted alone in "nudging" the bank to represent itself

as strong than it otherwise would. Watch the full webcast of Tucker's

testimony after the jump.

Last

week the biggest point of contention in the testimony of Bob Diamond

before the House of Commons Treasury Committee was who told him what,

and when, with a special circle in hell saved for the BOE's Paul

Tucker, who was alleged to have explicitly ordered Barclays to lower its

fixing (which as was shown last week had

a pretty dramatic impact on the bank's self-reported LIBOR rate). In a

few short moments, Tucker himself will be in the hot chair, where an

emphasis will be on the emails he sent to Bob Diamond which we presented previously,

and whether he acted alone in "nudging" the bank to represent itself

as strong than it otherwise would. Watch the full webcast of Tucker's

testimony after the jump.Mapping The EU Summit Political Maneuvers

The

politics of the EU summit appear quite tense, and as JPMorgan's CIO

Michael Cembalest notes, you have to wonder if this is how monetary

unions are made or broken: by strong-arming the Chancellor of the

country primarily expected to fund the Euro’s survival. In order to

better comprehend the shenanigans, Michael provides an aerial view of

the summit and how these maneuvers played out. The next move is Germany’s.

The

politics of the EU summit appear quite tense, and as JPMorgan's CIO

Michael Cembalest notes, you have to wonder if this is how monetary

unions are made or broken: by strong-arming the Chancellor of the

country primarily expected to fund the Euro’s survival. In order to

better comprehend the shenanigans, Michael provides an aerial view of

the summit and how these maneuvers played out. The next move is Germany’s.

from Times of Israel:

We Jews are a funny breed. We love to brag about every Jewish actor.

Sometimes we even pretend an actor is Jewish just because we like him

enough that we think he deserves to be on our team. We brag about Jewish

authors, Jewish politicians, Jewish directors. Every time someone

mentions any movie or book or piece of art, we inevitably say something

like, “Did you know that he was Jewish?” That’s just how we roll.

We Jews are a funny breed. We love to brag about every Jewish actor.

Sometimes we even pretend an actor is Jewish just because we like him

enough that we think he deserves to be on our team. We brag about Jewish

authors, Jewish politicians, Jewish directors. Every time someone

mentions any movie or book or piece of art, we inevitably say something

like, “Did you know that he was Jewish?” That’s just how we roll.

We Jews are a funny breed. We love to brag about every Jewish actor.

Sometimes we even pretend an actor is Jewish just because we like him

enough that we think he deserves to be on our team. We brag about Jewish

authors, Jewish politicians, Jewish directors. Every time someone

mentions any movie or book or piece of art, we inevitably say something

like, “Did you know that he was Jewish?” That’s just how we roll.

We Jews are a funny breed. We love to brag about every Jewish actor.

Sometimes we even pretend an actor is Jewish just because we like him

enough that we think he deserves to be on our team. We brag about Jewish

authors, Jewish politicians, Jewish directors. Every time someone

mentions any movie or book or piece of art, we inevitably say something

like, “Did you know that he was Jewish?” That’s just how we roll.

We’re a driven group, and not just in regards

to the art world. We have, for example, AIPAC, which was essentially

constructed just to drive agenda in Washington DC. And it succeeds

admirably. And we brag about it. Again, it’s just what we do.

But the funny part is when any anti-Semite or

anti-Israel person starts to spout stuff like, “The Jews control the

media!” and “The Jews control Washington!”

Suddenly we’re up in arms. We create huge

campaigns to take these people down. We do what we can to put them out

of work. We publish articles. We’ve created entire organizations

that exist just to tell everyone that the Jews don’t control nothin’.

No, we don’t control the media, we don’t have any more sway in DC than

anyone else. No, no, no, we swear: We’re just like everybody else!

Does anyone else (who’s not a bigot) see the irony of this?

Read More @ TimesofIsrael.com It

has begun – the unofficial collapse of the Euro that I have announced

back in late June has started to run into the massive canyon like

fissures of the financial world. As web site after web site and

expert after expert talk endlessly about the failing frame work of the

whole western financial system; they over look one main point. That

point is this; when a patient is brain dead, you may debate that there

is still blood coursing through their veins, that their heart still

beats, that there is still a modicum of respiration still occurring. The

fact remains though the vestigial systems of the organism works, it’s

main source of control that dictates every one of its voluntary

mechanical operation IS DEAD. So it is with Western Banking. There are

still “signs” of life, the ATMs work (for most anyway) online

transactions are for the most part operational (again for most) but the

arguments of liquidity and solvency rage because of the simple lack of

omission that the very needed rudiments of the financial system, it’s

modus operandi, it’s organized brain of safeguards and cognition has

ceased functioning.

It

has begun – the unofficial collapse of the Euro that I have announced

back in late June has started to run into the massive canyon like

fissures of the financial world. As web site after web site and

expert after expert talk endlessly about the failing frame work of the

whole western financial system; they over look one main point. That

point is this; when a patient is brain dead, you may debate that there

is still blood coursing through their veins, that their heart still

beats, that there is still a modicum of respiration still occurring. The

fact remains though the vestigial systems of the organism works, it’s

main source of control that dictates every one of its voluntary

mechanical operation IS DEAD. So it is with Western Banking. There are

still “signs” of life, the ATMs work (for most anyway) online

transactions are for the most part operational (again for most) but the

arguments of liquidity and solvency rage because of the simple lack of

omission that the very needed rudiments of the financial system, it’s

modus operandi, it’s organized brain of safeguards and cognition has

ceased functioning.The Unofficial Euro collapse has hastened the hemorrahging of various sectors around the financial world. Lets start with a few shall we.

Derivatives: I have documented that the real loss of JPM’s previous London trade debacle is not the purported intial $2billion or the now admitted $9 billion but $150 billion total loss. This coming from a Zombie Bank that recieves 77% of its profits from the government trough. The IR Swaps that are played in this field is astronomical and is accounting for more than 85% of all derivative trades. So what does this mean? I stated many times, when people have asked me, “what is THE SIGN of a financial collapse?” I have always said that it will begin in the derivative market first. After all we have an unsustainable world wide derivative debt that is in the Quadrillions. $1.4 Quadrillion by most estimates. What does this mean and how will it play out? Read More…

from KingWorldNews:

Today John Embry told King World News, “…the chaos will accelerate,”

and “…before this ends, it will be cataclysmic.”. Embry, who is Chief

Investment Strategist of the $10 billion strong Sprott Asset Management,

also discussed market manipulation. Here is what Embry had to say: “The

fact that this LIBOR scandal has come to the surface is interesting.

It’s an indication of the depth of the corruption in the system. The

LIBOR scandal is just one of the many manipulations going on in the

world at this point.”

Today John Embry told King World News, “…the chaos will accelerate,”

and “…before this ends, it will be cataclysmic.”. Embry, who is Chief

Investment Strategist of the $10 billion strong Sprott Asset Management,

also discussed market manipulation. Here is what Embry had to say: “The

fact that this LIBOR scandal has come to the surface is interesting.

It’s an indication of the depth of the corruption in the system. The

LIBOR scandal is just one of the many manipulations going on in the

world at this point.”Embry continues @ KingWorldNews.com

If this doesn't piss you off...then there is absolutely no hope for America...

The war on home Bible studies and house churches is heating up again.

Down in Phoenix, Arizona a man has been sentenced to 60 days in prison

and has been fined $12,180 for hosting a Bible study in his home. Since

2005, Michael Salman and his wife have been hosting gatherings of about

15 or 20 people

where they share food, fellowship and discuss the Bible.

Unfortunately, that kind of thing is against the law in Phoenix, Arizona

apparently. At one point, nearly a dozen armed police officers raided their home

and “evidence” of their “crimes” was gathered. Michael Salman was

found guilty of 67 “code violations”, and now he is going to be ripped

away from his family and put in prison for two months. In addition, the

assistant city prosecutor is asking the court

to “revoke his probation and convert it into a 2 1/2 year jail sentence

since he continues to hold worship gatherings on his property despite

court orders.” This kind of case has the potential to have a huge

“chilling effect” on home gatherings of all kinds all over the United

States.

The war on home Bible studies and house churches is heating up again.

Down in Phoenix, Arizona a man has been sentenced to 60 days in prison

and has been fined $12,180 for hosting a Bible study in his home. Since

2005, Michael Salman and his wife have been hosting gatherings of about

15 or 20 people

where they share food, fellowship and discuss the Bible.

Unfortunately, that kind of thing is against the law in Phoenix, Arizona

apparently. At one point, nearly a dozen armed police officers raided their home

and “evidence” of their “crimes” was gathered. Michael Salman was

found guilty of 67 “code violations”, and now he is going to be ripped

away from his family and put in prison for two months. In addition, the

assistant city prosecutor is asking the court

to “revoke his probation and convert it into a 2 1/2 year jail sentence

since he continues to hold worship gatherings on his property despite

court orders.” This kind of case has the potential to have a huge

“chilling effect” on home gatherings of all kinds all over the United

States.You may be thinking that you are glad that this man is being put in prison because you aren’t a Christian and you don’t have any sympathy for Christians.

Well, what if you wanted to hold small gatherings in your home to discuss the U.S. Constitution?

Read More @ EndoftheAmericanDream.com

by Mike Adams, Natural News:

Those of us who have long been describing the pharmaceutical industry as a “criminal racket” over the last few years have been wholly vindicated by recent news. Drug and vaccine manufacturer Merck was caught red-handed by two of its own scientists faking vaccine efficacy data by spiking blood samples with animal antibodies. GlaxoSmithKline has just been fined a whopping $3 billion

for bribing doctors, lying to the FDA, hiding clinical trial data and

fraudulent marketing. Pfizer, meanwhile has been sued by the nation’s

pharmacy retailers for what is alleged as an “overarching

anticompetitive scheme” to keep generic cholesterol drugs off the market

and thereby boost its own profits.

Those of us who have long been describing the pharmaceutical industry as a “criminal racket” over the last few years have been wholly vindicated by recent news. Drug and vaccine manufacturer Merck was caught red-handed by two of its own scientists faking vaccine efficacy data by spiking blood samples with animal antibodies. GlaxoSmithKline has just been fined a whopping $3 billion

for bribing doctors, lying to the FDA, hiding clinical trial data and

fraudulent marketing. Pfizer, meanwhile has been sued by the nation’s

pharmacy retailers for what is alleged as an “overarching

anticompetitive scheme” to keep generic cholesterol drugs off the market

and thereby boost its own profits.

The picture that’s emerging is one of a criminal drug industry that has turned to mafia tactics in the absence of any real science that would prove their products to be safe or effective. The emergence of this extraordinary evidence of bribery, scientific fraud, lying to regulators and monopolistic practices that harm consumers is also making all those doctors and “skeptics” who defended Big Pharma and vaccines eat their words.

To defend Big Pharma today is to defend a cabal of criminal corporations that have proven they will do anything — absolutely anything — to keep their profits rolling in. It makes no difference who they have to bribe, what studies they have to falsify, or who has to be threatened into silence. They will

Read More @ NaturalNews.com

Those of us who have long been describing the pharmaceutical industry as a “criminal racket” over the last few years have been wholly vindicated by recent news. Drug and vaccine manufacturer Merck was caught red-handed by two of its own scientists faking vaccine efficacy data by spiking blood samples with animal antibodies. GlaxoSmithKline has just been fined a whopping $3 billion

for bribing doctors, lying to the FDA, hiding clinical trial data and

fraudulent marketing. Pfizer, meanwhile has been sued by the nation’s

pharmacy retailers for what is alleged as an “overarching

anticompetitive scheme” to keep generic cholesterol drugs off the market

and thereby boost its own profits.

Those of us who have long been describing the pharmaceutical industry as a “criminal racket” over the last few years have been wholly vindicated by recent news. Drug and vaccine manufacturer Merck was caught red-handed by two of its own scientists faking vaccine efficacy data by spiking blood samples with animal antibodies. GlaxoSmithKline has just been fined a whopping $3 billion

for bribing doctors, lying to the FDA, hiding clinical trial data and

fraudulent marketing. Pfizer, meanwhile has been sued by the nation’s

pharmacy retailers for what is alleged as an “overarching

anticompetitive scheme” to keep generic cholesterol drugs off the market

and thereby boost its own profits.The picture that’s emerging is one of a criminal drug industry that has turned to mafia tactics in the absence of any real science that would prove their products to be safe or effective. The emergence of this extraordinary evidence of bribery, scientific fraud, lying to regulators and monopolistic practices that harm consumers is also making all those doctors and “skeptics” who defended Big Pharma and vaccines eat their words.

To defend Big Pharma today is to defend a cabal of criminal corporations that have proven they will do anything — absolutely anything — to keep their profits rolling in. It makes no difference who they have to bribe, what studies they have to falsify, or who has to be threatened into silence. They will

Read More @ NaturalNews.com

An excerpt from ‘The Drone Zone’

by Mark Mazzetti, NY Times:

Holloman Air Force Base, at the eastern edge of New Mexico’s White

Sands Missile Range, 200 miles south of Albuquerque, was once famous for

the daredevil maneuvers of those who trained there …

Holloman Air Force Base, at the eastern edge of New Mexico’s White

Sands Missile Range, 200 miles south of Albuquerque, was once famous for

the daredevil maneuvers of those who trained there …

… Today many of the pilots at Holloman never get off the ground. The base has been converted into the U.S. Air Force’s primary training center for drone operators, where pilots spend their days in sand-colored trailers near a runway from which their planes take off without them. Inside each trailer, a pilot flies his plane from a padded chair, using a joystick and throttle, as his partner, the “sensor operator,” focuses on the grainy images moving across a video screen, directing missiles to their targets with a laser.

Holloman sits on almost 60,000 acres of desert badlands, near jagged hills that are frosted with snow for several months of the year — a perfect training ground for pilots who will fly Predators and Reapers over the similarly hostile terrain of Afghanistan. When I visited the base earlier this year with a small group of reporters, we were taken into a command post where a large flat-screen television was broadcasting a video feed from a drone flying overhead. It took a few seconds to figure out exactly what we were looking at. A white S.U.V. traveling along a highway adjacent to the base came into the cross hairs in the center of the screen and was tracked as it headed south along the desert road. When the S.U.V. drove out of the picture, the drone began following another car.

“Wait, you guys practice tracking enemies by using civilian cars?” a reporter asked. One Air Force officer responded that this was only a training mission, and then the group was quickly hustled out of the room.

Read More @ NewYorkTimes.com

by Mark Mazzetti, NY Times:

Holloman Air Force Base, at the eastern edge of New Mexico’s White

Sands Missile Range, 200 miles south of Albuquerque, was once famous for

the daredevil maneuvers of those who trained there …

Holloman Air Force Base, at the eastern edge of New Mexico’s White

Sands Missile Range, 200 miles south of Albuquerque, was once famous for

the daredevil maneuvers of those who trained there …… Today many of the pilots at Holloman never get off the ground. The base has been converted into the U.S. Air Force’s primary training center for drone operators, where pilots spend their days in sand-colored trailers near a runway from which their planes take off without them. Inside each trailer, a pilot flies his plane from a padded chair, using a joystick and throttle, as his partner, the “sensor operator,” focuses on the grainy images moving across a video screen, directing missiles to their targets with a laser.

Holloman sits on almost 60,000 acres of desert badlands, near jagged hills that are frosted with snow for several months of the year — a perfect training ground for pilots who will fly Predators and Reapers over the similarly hostile terrain of Afghanistan. When I visited the base earlier this year with a small group of reporters, we were taken into a command post where a large flat-screen television was broadcasting a video feed from a drone flying overhead. It took a few seconds to figure out exactly what we were looking at. A white S.U.V. traveling along a highway adjacent to the base came into the cross hairs in the center of the screen and was tracked as it headed south along the desert road. When the S.U.V. drove out of the picture, the drone began following another car.

“Wait, you guys practice tracking enemies by using civilian cars?” a reporter asked. One Air Force officer responded that this was only a training mission, and then the group was quickly hustled out of the room.

Read More @ NewYorkTimes.com

from Silver Doctors:

Argentina’s Central Bank has banned citizens from buying dollars to

protect their savings. Perhaps the Central Bank has unintentionally

help protect Argentines from the coming dollar devaluation.

Argentina’s Central Bank has banned citizens from buying dollars to

protect their savings. Perhaps the Central Bank has unintentionally

help protect Argentines from the coming dollar devaluation.

For those concerned that the Fed or Congress could ban saving in gold or silver here in the US (likely labeled ‘hoarding’), note that the black market rate for dollars in Argentina soared over the weekend after the announcement.

Central Bank banning of physical metals would be the best thing that could ever happen (value wise) to PHYSICAL precious metals holders.

BUENOS AIRES, July 5 (Reuters) – Argentina’s central bank on Thursday formally banned people from buying dollars for the purpose of saving them, confirming the government’s de facto policy aimed at safeguarding foreign reserves.

Read More @ SilverDoctors.com

Argentina’s Central Bank has banned citizens from buying dollars to

protect their savings. Perhaps the Central Bank has unintentionally

help protect Argentines from the coming dollar devaluation.

Argentina’s Central Bank has banned citizens from buying dollars to

protect their savings. Perhaps the Central Bank has unintentionally

help protect Argentines from the coming dollar devaluation.For those concerned that the Fed or Congress could ban saving in gold or silver here in the US (likely labeled ‘hoarding’), note that the black market rate for dollars in Argentina soared over the weekend after the announcement.

Central Bank banning of physical metals would be the best thing that could ever happen (value wise) to PHYSICAL precious metals holders.

BUENOS AIRES, July 5 (Reuters) – Argentina’s central bank on Thursday formally banned people from buying dollars for the purpose of saving them, confirming the government’s de facto policy aimed at safeguarding foreign reserves.

Read More @ SilverDoctors.com

The governor uses his radio address to attack President Obama’s Affordable Care Act.

by Steve Mistler, Online Sentinel:

Gov. Paul LePage used his weekly radio address to blast President

Obama’s health care law and described the Internal Revenue Service as

the “new Gestapo.”

Gov. Paul LePage used his weekly radio address to blast President

Obama’s health care law and described the Internal Revenue Service as

the “new Gestapo.”

The IRS description was a reference to a provision in the Affordable Care Act that requires Americans not insured by their employers or Medicaid to buy health insurance or pay an annual penalty when filing their tax returns. The provision, known more broadly as the individual mandate, was the subject of a multi-state lawsuit, but was recently upheld by the U.S. Supreme Court.

LePage said the court decision has “made America less free.”

“We the people have been told there is no choice,” he said. “You must buy health insurance or pay the new Gestapo — the IRS.”

Read More @ OnlineSentinel.com

by Steve Mistler, Online Sentinel:

Gov. Paul LePage used his weekly radio address to blast President

Obama’s health care law and described the Internal Revenue Service as

the “new Gestapo.”

Gov. Paul LePage used his weekly radio address to blast President

Obama’s health care law and described the Internal Revenue Service as

the “new Gestapo.”The IRS description was a reference to a provision in the Affordable Care Act that requires Americans not insured by their employers or Medicaid to buy health insurance or pay an annual penalty when filing their tax returns. The provision, known more broadly as the individual mandate, was the subject of a multi-state lawsuit, but was recently upheld by the U.S. Supreme Court.

LePage said the court decision has “made America less free.”

“We the people have been told there is no choice,” he said. “You must buy health insurance or pay the new Gestapo — the IRS.”

Read More @ OnlineSentinel.com

by Susanne Posel, Occupy Corporatism:

President Obama has usurped all available forms of communication for use and discretion of the US government. Under executive order (EO) ,

Assignment of National Security and Emergency Preparedness

Communications Functions, Obama has enabled the executive branch to

control communications under all “possible under all circumstances to

ensure national security, effectively manage emergencies, and improve

national resilience.”

President Obama has usurped all available forms of communication for use and discretion of the US government. Under executive order (EO) ,

Assignment of National Security and Emergency Preparedness

Communications Functions, Obama has enabled the executive branch to

control communications under all “possible under all circumstances to

ensure national security, effectively manage emergencies, and improve

national resilience.”

Radio and wired communications systems “of all levels of government, the private and nonprofit sectors, and the public must inform the development of national security and emergency preparedness (NS/EP) communications policies, programs, and capabilities.”

Cellular phone corporations like Sprint owned Boost Mobile have released messages to their customers concerning the US government’s allocation of their phone communications at the whim of the President. In a text message to customers, Boost Mobile said that: “. . . you can receive national and local emergency alerts directly on your phone.”

Read More @ OccupyCorporatism.com

President Obama has usurped all available forms of communication for use and discretion of the US government. Under executive order (EO) ,

Assignment of National Security and Emergency Preparedness

Communications Functions, Obama has enabled the executive branch to

control communications under all “possible under all circumstances to

ensure national security, effectively manage emergencies, and improve

national resilience.”

President Obama has usurped all available forms of communication for use and discretion of the US government. Under executive order (EO) ,

Assignment of National Security and Emergency Preparedness

Communications Functions, Obama has enabled the executive branch to

control communications under all “possible under all circumstances to

ensure national security, effectively manage emergencies, and improve

national resilience.”Radio and wired communications systems “of all levels of government, the private and nonprofit sectors, and the public must inform the development of national security and emergency preparedness (NS/EP) communications policies, programs, and capabilities.”

Cellular phone corporations like Sprint owned Boost Mobile have released messages to their customers concerning the US government’s allocation of their phone communications at the whim of the President. In a text message to customers, Boost Mobile said that: “. . . you can receive national and local emergency alerts directly on your phone.”

Read More @ OccupyCorporatism.com

by Lawrence Williams, MineWeb.com

Paul

Mylchreest’s latest prognostications on the global economic situation

make for worrying reading. While gold could be a part of the ultimate

answer it is currently in lockdown while dollar devaluation looms.

Paul

Mylchreest’s latest prognostications on the global economic situation

make for worrying reading. While gold could be a part of the ultimate

answer it is currently in lockdown while dollar devaluation looms.

For some scary nighttime reading I would recommend Paul Mylchreest’s latest Thunder Road report – Part 1. Once one gets by some of the popular music and U.K. football references which may be obscure to non-Brit readers (and even to many Brits) and into the nitty-gritty of Mylchreest’ s latest irregular report, everything makes a huge amount of sense – and in the words of Hollywood hype -‘be afraid – be very afraid’. Or perhaps even more apposite might be one of the recurring catch phrases from excellent British TV comedy Dad’s Army (about the Home Guard during World War 2) – ‘We’re doomed, we’re all doomed!’

One cannot dismiss Mylchreest’s views as just scaremongering. As an analyst he has nearly always been correct in his views on what is going on in the world’s economic system, not that that is too difficult to define, and in its potential consequences. Some may not have actually come about yet but we do seem to be inexorably heading in the direction he propounds. And this, as a number of other commentators have also suggested, is effectively total collapse of the economic system as we know it brought on by huge unsustainable sovereign and bank debt and the huge bubble in MONEY through it being printed by the central banks in a seemingly vain attempt to drag the global economy out of the quagmire the debt situation has left us in. Solving the debt problem by the creation of ever more debt does not seem to be the most sensible solution.

Read More @ MineWeb.com

Paul

Mylchreest’s latest prognostications on the global economic situation

make for worrying reading. While gold could be a part of the ultimate

answer it is currently in lockdown while dollar devaluation looms.

Paul

Mylchreest’s latest prognostications on the global economic situation

make for worrying reading. While gold could be a part of the ultimate

answer it is currently in lockdown while dollar devaluation looms.For some scary nighttime reading I would recommend Paul Mylchreest’s latest Thunder Road report – Part 1. Once one gets by some of the popular music and U.K. football references which may be obscure to non-Brit readers (and even to many Brits) and into the nitty-gritty of Mylchreest’ s latest irregular report, everything makes a huge amount of sense – and in the words of Hollywood hype -‘be afraid – be very afraid’. Or perhaps even more apposite might be one of the recurring catch phrases from excellent British TV comedy Dad’s Army (about the Home Guard during World War 2) – ‘We’re doomed, we’re all doomed!’

One cannot dismiss Mylchreest’s views as just scaremongering. As an analyst he has nearly always been correct in his views on what is going on in the world’s economic system, not that that is too difficult to define, and in its potential consequences. Some may not have actually come about yet but we do seem to be inexorably heading in the direction he propounds. And this, as a number of other commentators have also suggested, is effectively total collapse of the economic system as we know it brought on by huge unsustainable sovereign and bank debt and the huge bubble in MONEY through it being printed by the central banks in a seemingly vain attempt to drag the global economy out of the quagmire the debt situation has left us in. Solving the debt problem by the creation of ever more debt does not seem to be the most sensible solution.

Read More @ MineWeb.com

by Charles Hugh Smith, Of Two Minds:

If

the economy continues declining into late October, there may be two

landslides in the making: the stock market and the presidential

election.

If

the economy continues declining into late October, there may be two

landslides in the making: the stock market and the presidential

election.

The stock market is precariously close to slipping into a landslide. If the economy and stock market both continue declining into late October, the presidential election could also turn into a landslide–against the incumbent.

There is nothing particularly partisan about this possibility; people who vote tend to vote their pocketbooks, and a re-election campaign that boils down to “hey, it’s not as bad as The Great Depression” is unlikely to inspire great loyalty in voters who are already culturally predisposed to tire quickly of presidents, wars and a tanking economy.

If the economy and stock markets are both slip-sliding away, the opponent need only be “not the incumbent” to win.

Read More @ OfTwoMinds.com

If

the economy continues declining into late October, there may be two

landslides in the making: the stock market and the presidential

election.

If

the economy continues declining into late October, there may be two

landslides in the making: the stock market and the presidential

election.The stock market is precariously close to slipping into a landslide. If the economy and stock market both continue declining into late October, the presidential election could also turn into a landslide–against the incumbent.

There is nothing particularly partisan about this possibility; people who vote tend to vote their pocketbooks, and a re-election campaign that boils down to “hey, it’s not as bad as The Great Depression” is unlikely to inspire great loyalty in voters who are already culturally predisposed to tire quickly of presidents, wars and a tanking economy.

If the economy and stock markets are both slip-sliding away, the opponent need only be “not the incumbent” to win.

Read More @ OfTwoMinds.com

by Louis James and Andrey Dashkov, Testosterone Pit.com:

Copper is sometimes referred to as “Dr. Copper,” because the metal is

used in so many industrial applications and is essential for many

different sectors of the economy, from infrastructure to housing to

consumer electronics. That usually makes its price action a good

indicator of the state of the global economy.

Copper is sometimes referred to as “Dr. Copper,” because the metal is

used in so many industrial applications and is essential for many

different sectors of the economy, from infrastructure to housing to

consumer electronics. That usually makes its price action a good

indicator of the state of the global economy.

The chart below illustrates the degree to which copper follows economic health – as opposed to gold, which is a traditionally a contra-cyclical commodity.

This illustration paints a convincing picture: over the past five years, copper (and the economy) stagnated, while gold was on a steady uptrend. No surprises here: gold has always been a reliable hedge against economic and financial turmoil.

In 2012, copper demand started out quite strong. The International Copper Study Group (ICSG) published Q112 numbers that showed a healthy uptrend in demand: year-on-year, apparent usage grew by 9%, while refined production increased by 4%. (This is defined by ICSG as refined production + refined imports – refined exports + refined beginning stocks – ending stocks.)

Read More @ TestosteronePit.com

Copper is sometimes referred to as “Dr. Copper,” because the metal is

used in so many industrial applications and is essential for many

different sectors of the economy, from infrastructure to housing to

consumer electronics. That usually makes its price action a good

indicator of the state of the global economy.

Copper is sometimes referred to as “Dr. Copper,” because the metal is

used in so many industrial applications and is essential for many

different sectors of the economy, from infrastructure to housing to

consumer electronics. That usually makes its price action a good

indicator of the state of the global economy.The chart below illustrates the degree to which copper follows economic health – as opposed to gold, which is a traditionally a contra-cyclical commodity.

This illustration paints a convincing picture: over the past five years, copper (and the economy) stagnated, while gold was on a steady uptrend. No surprises here: gold has always been a reliable hedge against economic and financial turmoil.

In 2012, copper demand started out quite strong. The International Copper Study Group (ICSG) published Q112 numbers that showed a healthy uptrend in demand: year-on-year, apparent usage grew by 9%, while refined production increased by 4%. (This is defined by ICSG as refined production + refined imports – refined exports + refined beginning stocks – ending stocks.)

Read More @ TestosteronePit.com

We The Sheeplez... is intended to reflect

excellence in effort and content. Donations will help maintain this goal

and defray the operational costs. Paypal, a leading provider of secure

online money transfers, will handle the donations. Thank you for your

contribution.

I'm PayPal Verified

We The Sheeplez... is intended to reflect

excellence in effort and content. Donations will help maintain this goal

and defray the operational costs. Paypal, a leading provider of secure

online money transfers, will handle the donations. Thank you for your

contribution.

from MyBudget360.com

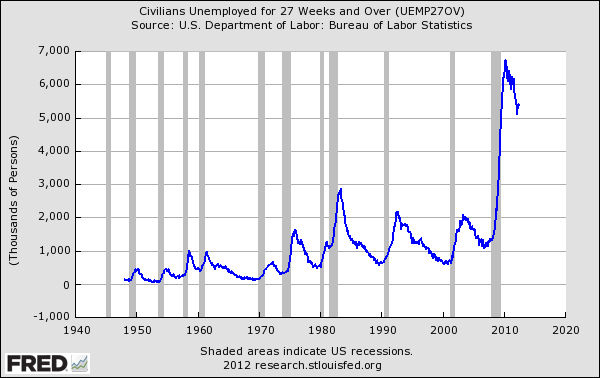

The US economy is facing tremendous financial hurdles in the years to

come. The current market is being held together by a flood of debt that

is masking underlying issues. Total credit market debt is many times

larger than our annual GDP. Student loan debt continues to expand

unabated even though the return-on-investment for many college degrees

is not worth it. We also have an interesting dynamic where we still do

produce manufactured goods but require fewer and fewer workers to

conduct these jobs. These challenges will not go away when the last

ballot is cast this November. We also have big challenges of taking

care of an older generation with a much less affluent and deeply in debt

younger generation.

The US economy is facing tremendous financial hurdles in the years to

come. The current market is being held together by a flood of debt that

is masking underlying issues. Total credit market debt is many times

larger than our annual GDP. Student loan debt continues to expand

unabated even though the return-on-investment for many college degrees

is not worth it. We also have an interesting dynamic where we still do

produce manufactured goods but require fewer and fewer workers to

conduct these jobs. These challenges will not go away when the last

ballot is cast this November. We also have big challenges of taking

care of an older generation with a much less affluent and deeply in debt

younger generation.

The total credit market in the US is over $55 trillion while GDP is roughly $15 trillion. This ratio was not always the case. It is interesting that once the US went off the gold standard in the 1970s did we enter a phase where deficit spending seemed to become the norm. This ballooned in the 1980s and we have yet to look back. Of course this can only continue so long as GDP growth continues to expand at a healthy pace. US GDP growth has slowed dramatically and actually contracted severely during the recession.

Read More @ MyBudget360.com

The US economy is facing tremendous financial hurdles in the years to

come. The current market is being held together by a flood of debt that

is masking underlying issues. Total credit market debt is many times

larger than our annual GDP. Student loan debt continues to expand

unabated even though the return-on-investment for many college degrees

is not worth it. We also have an interesting dynamic where we still do

produce manufactured goods but require fewer and fewer workers to

conduct these jobs. These challenges will not go away when the last

ballot is cast this November. We also have big challenges of taking

care of an older generation with a much less affluent and deeply in debt

younger generation.

The US economy is facing tremendous financial hurdles in the years to

come. The current market is being held together by a flood of debt that

is masking underlying issues. Total credit market debt is many times

larger than our annual GDP. Student loan debt continues to expand

unabated even though the return-on-investment for many college degrees

is not worth it. We also have an interesting dynamic where we still do

produce manufactured goods but require fewer and fewer workers to

conduct these jobs. These challenges will not go away when the last

ballot is cast this November. We also have big challenges of taking

care of an older generation with a much less affluent and deeply in debt

younger generation.The total credit market in the US is over $55 trillion while GDP is roughly $15 trillion. This ratio was not always the case. It is interesting that once the US went off the gold standard in the 1970s did we enter a phase where deficit spending seemed to become the norm. This ballooned in the 1980s and we have yet to look back. Of course this can only continue so long as GDP growth continues to expand at a healthy pace. US GDP growth has slowed dramatically and actually contracted severely during the recession.

Read More @ MyBudget360.com

from, Merco Press:

The Argentine Central Bank announced on Thursday it will officially ban the purchase of dollars for savings, the latest in a series of measures to discourage the buying of greenbacks.

The details of the decision which will be released in a communiqué from the monetary authority is a step further in the so called “dollar clamp” which the administration of President Cristina Fernandez has been implementing since last year to compensate for the scarcity of dollars and her pledge to repay all bonds maturing this year in “US dollars”.

Central bank sources however pointed out that the measure is not extensive to long term deposits or current accounts in foreign currency. The latest move banning the purchase of dollars for savings is an “indefinite suspension”.

The Argentine tax revenue office or AFIP will continue with the current system of allowing dollar purchases by importers and for other purposes following on specific requests. In reality since last June 14, it was impossible to legally purchase US dollars for savings since no authorizations were granted.

Read More @ MercoPress.com

The Argentine Central Bank announced on Thursday it will officially ban the purchase of dollars for savings, the latest in a series of measures to discourage the buying of greenbacks.

The details of the decision which will be released in a communiqué from the monetary authority is a step further in the so called “dollar clamp” which the administration of President Cristina Fernandez has been implementing since last year to compensate for the scarcity of dollars and her pledge to repay all bonds maturing this year in “US dollars”.

Central bank sources however pointed out that the measure is not extensive to long term deposits or current accounts in foreign currency. The latest move banning the purchase of dollars for savings is an “indefinite suspension”.

The Argentine tax revenue office or AFIP will continue with the current system of allowing dollar purchases by importers and for other purposes following on specific requests. In reality since last June 14, it was impossible to legally purchase US dollars for savings since no authorizations were granted.

Read More @ MercoPress.com

by Tony Cartalucci, Activist Post

Ideally the West would like to install “liberal” pro-globalist candidates into power in each of the nations it has destabilized and destroyed during its premeditated, engineered “Arab Spring.” In the case of Egypt where Mohammed ElBaradei was sufficiently exposed and his presidential aspirations effectively derailed, the West’s Muslim Brotherhood proxies made for a viable second option.

In Libya, a similar scenario has unfolded with two tiers of Western proxies poised to take power – pro-globalist technocrats like US-educated Mahmoud Jibril (Gibril) Elwarfally’s National Forces Alliance, and of course NATO’s terrorist proxies within the Muslim Brotherhood along with Al Qaeda-linked Libyan Islamic Fighting Group (LIFG) warlords like Abdul Hakim Belhaj.

In Egypt where relative economic and social stability returned after the brief chaos and violence of the early 2011 protests, the alternative media was able to sufficiently expose and disrupt “liberal” candidate ElBaradei. In Libya, the nation has been plunged into nationwide lawlessness, violence, and sweeping genocide by sectarian extremists, tribal confrontations, and militant opportunists. The people of Libya have been too busy defending themselves and desperately fighting for their own immediate survival to function as a nation-state, let alone scrutinize candidates politically before the farcical Western-hyped elections.

Read More @ Activist Post

Ideally the West would like to install “liberal” pro-globalist candidates into power in each of the nations it has destabilized and destroyed during its premeditated, engineered “Arab Spring.” In the case of Egypt where Mohammed ElBaradei was sufficiently exposed and his presidential aspirations effectively derailed, the West’s Muslim Brotherhood proxies made for a viable second option.

In Libya, a similar scenario has unfolded with two tiers of Western proxies poised to take power – pro-globalist technocrats like US-educated Mahmoud Jibril (Gibril) Elwarfally’s National Forces Alliance, and of course NATO’s terrorist proxies within the Muslim Brotherhood along with Al Qaeda-linked Libyan Islamic Fighting Group (LIFG) warlords like Abdul Hakim Belhaj.

In Egypt where relative economic and social stability returned after the brief chaos and violence of the early 2011 protests, the alternative media was able to sufficiently expose and disrupt “liberal” candidate ElBaradei. In Libya, the nation has been plunged into nationwide lawlessness, violence, and sweeping genocide by sectarian extremists, tribal confrontations, and militant opportunists. The people of Libya have been too busy defending themselves and desperately fighting for their own immediate survival to function as a nation-state, let alone scrutinize candidates politically before the farcical Western-hyped elections.

Read More @ Activist Post

by James Turk, Gold Money:

Sometimes bailouts do not achieve what is intended, which is one

reason they should be avoided. The people of Iceland apparently have

some discerning insight into this basic financial reality.

Sometimes bailouts do not achieve what is intended, which is one

reason they should be avoided. The people of Iceland apparently have

some discerning insight into this basic financial reality.

When a financial collapse over three years ago sent their economy into a tailspin, Icelanders were given a chance to vote on whether they should impose more debt on themselves in order to bail out insolvent banks. The Icelanders decided to reject the proposed debt burden and the accompanying draconian austerity that would be required. As it turns out, they chose wisely. Happily, Iceland’s economy is back on its feet. As the BBC reported a few months ago: “Iceland is safe to invest in again, according to Fitch, which has upgraded its credit rating three years after its economy spectacularly collapsed.”

In contrast to what happened in Iceland, people in the eurozone were not given a chance to vote on the serial bailouts or the oppressive austerity measures that were intended to solve Europe’s long simmering bank and sovereign debt crises, but have failed to do so. Consequently, following the Spanish election that resulted in a leadership change, the recent election results in Greece and France that dealt incumbents with stunning losses should not be a surprise. They should be seen as an inevitable reaction by citizens in those countries rejecting the economic choices made by their governments.

As the Greek election shows in particular, impatience against incumbents, whether socialist or conservative, has reached an unprecedented level. Ideology no longer matters when an economy is in tatters and unemployment is at record levels.

Read More @ GoldMoney.com

Sometimes bailouts do not achieve what is intended, which is one

reason they should be avoided. The people of Iceland apparently have

some discerning insight into this basic financial reality.

Sometimes bailouts do not achieve what is intended, which is one

reason they should be avoided. The people of Iceland apparently have

some discerning insight into this basic financial reality.When a financial collapse over three years ago sent their economy into a tailspin, Icelanders were given a chance to vote on whether they should impose more debt on themselves in order to bail out insolvent banks. The Icelanders decided to reject the proposed debt burden and the accompanying draconian austerity that would be required. As it turns out, they chose wisely. Happily, Iceland’s economy is back on its feet. As the BBC reported a few months ago: “Iceland is safe to invest in again, according to Fitch, which has upgraded its credit rating three years after its economy spectacularly collapsed.”

In contrast to what happened in Iceland, people in the eurozone were not given a chance to vote on the serial bailouts or the oppressive austerity measures that were intended to solve Europe’s long simmering bank and sovereign debt crises, but have failed to do so. Consequently, following the Spanish election that resulted in a leadership change, the recent election results in Greece and France that dealt incumbents with stunning losses should not be a surprise. They should be seen as an inevitable reaction by citizens in those countries rejecting the economic choices made by their governments.

As the Greek election shows in particular, impatience against incumbents, whether socialist or conservative, has reached an unprecedented level. Ideology no longer matters when an economy is in tatters and unemployment is at record levels.

Read More @ GoldMoney.com

by Greg Hunter, USAWatchdog:

Chris Duane was a 30 year old millionaire working at his family’s East coast car dealerships when he walked away from it all to become a citizen journalist. He sold his house in 2005 and started renting just before the real estate crash. He began warning anyone who would listen about the collapse and paradigm change coming to America. His YouTube channel, TheGreatestTruthNeverTold.com, has gotten 3.5 million views-in less than a year! He says, “The collapse is going to unwind all social and financial contracts worldwide.”

He tells people to, “Get out of every single paper asset you own because it’s all going to be worth nothing. . . . If you’re not ahead of the curve, you’re going to be historical road kill.” He also thinks sometime in the next three years, “the dollar will be completely worthless.” When that happens, Duane predicts, “mass hysteria, power grabs and food riots.” His number one investment is physical silver because it is in short supply and extremely undervalued. Greg Hunter goes One-on-One with Chris Duane.

Chris Duane was a 30 year old millionaire working at his family’s East coast car dealerships when he walked away from it all to become a citizen journalist. He sold his house in 2005 and started renting just before the real estate crash. He began warning anyone who would listen about the collapse and paradigm change coming to America. His YouTube channel, TheGreatestTruthNeverTold.com, has gotten 3.5 million views-in less than a year! He says, “The collapse is going to unwind all social and financial contracts worldwide.”

He tells people to, “Get out of every single paper asset you own because it’s all going to be worth nothing. . . . If you’re not ahead of the curve, you’re going to be historical road kill.” He also thinks sometime in the next three years, “the dollar will be completely worthless.” When that happens, Duane predicts, “mass hysteria, power grabs and food riots.” His number one investment is physical silver because it is in short supply and extremely undervalued. Greg Hunter goes One-on-One with Chris Duane.

by Steve St. Angelo (aka SRSrocco), Financial Sense:

Something very interesting took place in the first three months of 2012. Last year, the United States was a net importer of gold during the first quarter. However this year, the U.S. became a huge net exporter of gold during the same time period. This information was acquired from the latest USGS Gold Mineral Industry Surveys.

Below, we can see the actual data:

I have focused on the first three categories as these are the predominant sources used in the gold bullion trade. This first chart lists the amount of gold imported during the first quarter of 2012. If we look at the bottom highlighted figure we will see that 75.1 metric tonnes of gold were imported into the U.S. between January and March (These figures are listed in kilograms). The top highlighted figure (507 metric tonnes) shows the total amount of gold imported in 2011.

The chart below displays the amount of U.S. gold exported during Jan-Mar:

Read More @ Financial Sense.com

Savers and retirees aren’t the only ones getting screwed by interest

rates that have been artificially suppressed by central banks around the

world. These days, banks themselves are finding it increasingly

difficult to earn even a nominal return on instruments they consider

safe. Just last week, Denmark’s Nationalbanken set its deposit rate

below zero for the first time, effectively charging commercial banks and

others a fee for parking their surpluses in krones. There are numerous

reasons why the krone would be a magnet for idle money. For one,

Denmark’s economy is among the strongest in Europe. Also, because Danes

rejected euro-zone membership in 2000, they enjoy a degree of political

and economic autonomy that their neighbors do not have. This will

presumably make Denmark less susceptible to the shock waves that follow

the inevitable implosion of Greece, Spain, Italy et al. Small wonder,

then, that the global stewards of OPM would consider the krone a safe

haven even though it now guarantees them at least a small loss on their

money. From Denmark’s standpoint, the decision to follow the European

Central Bank’s latest rate cut was unavoidable. The alternative would

have been to sit idly by as the krone appreciated, hobbling the

country’s exports and destabilizing its balance sheet.

Savers and retirees aren’t the only ones getting screwed by interest

rates that have been artificially suppressed by central banks around the

world. These days, banks themselves are finding it increasingly

difficult to earn even a nominal return on instruments they consider

safe. Just last week, Denmark’s Nationalbanken set its deposit rate

below zero for the first time, effectively charging commercial banks and

others a fee for parking their surpluses in krones. There are numerous

reasons why the krone would be a magnet for idle money. For one,

Denmark’s economy is among the strongest in Europe. Also, because Danes

rejected euro-zone membership in 2000, they enjoy a degree of political

and economic autonomy that their neighbors do not have. This will

presumably make Denmark less susceptible to the shock waves that follow

the inevitable implosion of Greece, Spain, Italy et al. Small wonder,

then, that the global stewards of OPM would consider the krone a safe

haven even though it now guarantees them at least a small loss on their

money. From Denmark’s standpoint, the decision to follow the European

Central Bank’s latest rate cut was unavoidable. The alternative would

have been to sit idly by as the krone appreciated, hobbling the

country’s exports and destabilizing its balance sheet.

Read More @ RickAckerman.com

Something very interesting took place in the first three months of 2012. Last year, the United States was a net importer of gold during the first quarter. However this year, the U.S. became a huge net exporter of gold during the same time period. This information was acquired from the latest USGS Gold Mineral Industry Surveys.

Below, we can see the actual data:

I have focused on the first three categories as these are the predominant sources used in the gold bullion trade. This first chart lists the amount of gold imported during the first quarter of 2012. If we look at the bottom highlighted figure we will see that 75.1 metric tonnes of gold were imported into the U.S. between January and March (These figures are listed in kilograms). The top highlighted figure (507 metric tonnes) shows the total amount of gold imported in 2011.

The chart below displays the amount of U.S. gold exported during Jan-Mar:

Read More @ Financial Sense.com

by Rick Ackerman, Rick Ackerman.com:

Savers and retirees aren’t the only ones getting screwed by interest

rates that have been artificially suppressed by central banks around the

world. These days, banks themselves are finding it increasingly

difficult to earn even a nominal return on instruments they consider

safe. Just last week, Denmark’s Nationalbanken set its deposit rate

below zero for the first time, effectively charging commercial banks and

others a fee for parking their surpluses in krones. There are numerous

reasons why the krone would be a magnet for idle money. For one,

Denmark’s economy is among the strongest in Europe. Also, because Danes

rejected euro-zone membership in 2000, they enjoy a degree of political

and economic autonomy that their neighbors do not have. This will

presumably make Denmark less susceptible to the shock waves that follow

the inevitable implosion of Greece, Spain, Italy et al. Small wonder,

then, that the global stewards of OPM would consider the krone a safe

haven even though it now guarantees them at least a small loss on their

money. From Denmark’s standpoint, the decision to follow the European

Central Bank’s latest rate cut was unavoidable. The alternative would

have been to sit idly by as the krone appreciated, hobbling the

country’s exports and destabilizing its balance sheet.

Savers and retirees aren’t the only ones getting screwed by interest

rates that have been artificially suppressed by central banks around the

world. These days, banks themselves are finding it increasingly

difficult to earn even a nominal return on instruments they consider

safe. Just last week, Denmark’s Nationalbanken set its deposit rate

below zero for the first time, effectively charging commercial banks and

others a fee for parking their surpluses in krones. There are numerous

reasons why the krone would be a magnet for idle money. For one,

Denmark’s economy is among the strongest in Europe. Also, because Danes

rejected euro-zone membership in 2000, they enjoy a degree of political

and economic autonomy that their neighbors do not have. This will

presumably make Denmark less susceptible to the shock waves that follow

the inevitable implosion of Greece, Spain, Italy et al. Small wonder,

then, that the global stewards of OPM would consider the krone a safe

haven even though it now guarantees them at least a small loss on their

money. From Denmark’s standpoint, the decision to follow the European

Central Bank’s latest rate cut was unavoidable. The alternative would

have been to sit idly by as the krone appreciated, hobbling the

country’s exports and destabilizing its balance sheet.Read More @ RickAckerman.com

from Silver Doctors:

Grant Williams in his latest discusses Barclay’s manipulation of LIBOR

and how the massive media attention of perhaps the largest case of fraud

in world history will induce a fundamental change in how the mainstream

media treats financial conspiracy theories.

Grant Williams in his latest discusses Barclay’s manipulation of LIBOR

and how the massive media attention of perhaps the largest case of fraud

in world history will induce a fundamental change in how the mainstream

media treats financial conspiracy theories.

As we have pointed out (and discussed last week with Turd Ferguson), the LIBOR fixing scandal likely may end up being the black swan event that publicly exposes the cartel’s manipulation of gold and silver.

Attempts to manipulate free markets invariably end badly – after all, they are, supposedly, by their very nature, free. Over the past few weeks, the exposure of the Libor-rigging scandal has monopolized the headlines of the financial press. The rather obvious implication being that given almost half the reported inputs that help establish the Libor rate are discarded immediately, Barclays simply CANNOT have manipulated the Libor rate alone. Period. At best this is a cartel, at worst it’s outright fraud on a scale that is completely unprecedented. In Grant Williams’ humble opinion, the Libor scandal will mark a fundamental change in the treatment of financial conspiracy theories in the media.

Read More @ SilverDoctors.com

Grant Williams in his latest discusses Barclay’s manipulation of LIBOR

and how the massive media attention of perhaps the largest case of fraud

in world history will induce a fundamental change in how the mainstream

media treats financial conspiracy theories.

Grant Williams in his latest discusses Barclay’s manipulation of LIBOR

and how the massive media attention of perhaps the largest case of fraud

in world history will induce a fundamental change in how the mainstream

media treats financial conspiracy theories.As we have pointed out (and discussed last week with Turd Ferguson), the LIBOR fixing scandal likely may end up being the black swan event that publicly exposes the cartel’s manipulation of gold and silver.

Attempts to manipulate free markets invariably end badly – after all, they are, supposedly, by their very nature, free. Over the past few weeks, the exposure of the Libor-rigging scandal has monopolized the headlines of the financial press. The rather obvious implication being that given almost half the reported inputs that help establish the Libor rate are discarded immediately, Barclays simply CANNOT have manipulated the Libor rate alone. Period. At best this is a cartel, at worst it’s outright fraud on a scale that is completely unprecedented. In Grant Williams’ humble opinion, the Libor scandal will mark a fundamental change in the treatment of financial conspiracy theories in the media.

Read More @ SilverDoctors.com

from The Economic Collapse Blog:

The problems that America is experiencing right now are not just

confined to the field of economics. The truth is that there are signs

of deep decay wherever we look, and without question the United States

is rotting from the inside out in thousands of different ways. For a

long time our debt-fueled prosperity has masked much of the social decay

that has been festering underneath the surface, but now it is becoming

increasingly apparent that the thin veneer of civilization that we all

take for granted is beginning to disappear. For many Americans, it is

easy to point a finger at a particular group or political party and

blame them for all of our problems, but the reality of the matter is

that our societal decay cuts across all income levels, all political

affiliations and all regions of the country. We are being destroyed

from within, and this decay can be seen on the streets of the most

dilapidated sections of major U.S. cities and it can also be seen in the

halls of power in Washington D.C. and on Wall Street. It is undeniable

that something has fundamentally changed. The American people do not

seem to possess the same level of character that they once had. So

where do we go from here?

The problems that America is experiencing right now are not just

confined to the field of economics. The truth is that there are signs

of deep decay wherever we look, and without question the United States

is rotting from the inside out in thousands of different ways. For a

long time our debt-fueled prosperity has masked much of the social decay

that has been festering underneath the surface, but now it is becoming

increasingly apparent that the thin veneer of civilization that we all

take for granted is beginning to disappear. For many Americans, it is

easy to point a finger at a particular group or political party and

blame them for all of our problems, but the reality of the matter is

that our societal decay cuts across all income levels, all political

affiliations and all regions of the country. We are being destroyed

from within, and this decay can be seen on the streets of the most

dilapidated sections of major U.S. cities and it can also be seen in the

halls of power in Washington D.C. and on Wall Street. It is undeniable

that something has fundamentally changed. The American people do not

seem to possess the same level of character that they once had. So

where do we go from here?

Read More @ TheEconomicCollapseBlog.com

The problems that America is experiencing right now are not just

confined to the field of economics. The truth is that there are signs

of deep decay wherever we look, and without question the United States

is rotting from the inside out in thousands of different ways. For a

long time our debt-fueled prosperity has masked much of the social decay

that has been festering underneath the surface, but now it is becoming

increasingly apparent that the thin veneer of civilization that we all

take for granted is beginning to disappear. For many Americans, it is

easy to point a finger at a particular group or political party and

blame them for all of our problems, but the reality of the matter is

that our societal decay cuts across all income levels, all political

affiliations and all regions of the country. We are being destroyed