For Italy, It Is Game Theory Over

We discussed the use of Game Theory as a useful tool for analyzing Europe's predicament in February and noted that it was far from optimal for any (peripheral or core) sovereign to pre-emptively 'agree' to austerity or Eurobonds respectively (even though that would make both better off).

This Prisoner's Dilemma left the ugly Nash-Equilibrium game swinging

from a catastrophic break-up to a long, painful (and volatile)

continuation of the crisis. Recent work by BofAML's FX team takes this a

step further and in assigning incentives and from a 'do-not-cooperate' Nash-equilibrium between Greece and Germany

(no Greek austerity and no Eurobonds) they extend the single-period

game across the entire group of European nations - with an ugly outcome.

Analyzing the costs and benefits of a voluntary exit from the

euro-area for the core and periphery countries, the admittedly

over-simplified results are worrying. Italy and Ireland (not Greece) are expected to exit first

(with Italy having a decent chance of an orderly exit) and while

Germany is the most likely to achieve an orderly exit, it has the lowest

incentive to exit the euro-zone - since growth, borrowing costs, and a

weakening balance sheet would cause more pain. Ultimately, they play

the game out and find while Germany could 'bribe' Italy to stay, they will not accept and Italy will optimally exit first - suggesting a very dark future ahead for the Eurozone and with EUR tail-risk so cheap, it seems an optimal trade - as only a weaker EUR can save the Euro.

We discussed the use of Game Theory as a useful tool for analyzing Europe's predicament in February and noted that it was far from optimal for any (peripheral or core) sovereign to pre-emptively 'agree' to austerity or Eurobonds respectively (even though that would make both better off).

This Prisoner's Dilemma left the ugly Nash-Equilibrium game swinging

from a catastrophic break-up to a long, painful (and volatile)

continuation of the crisis. Recent work by BofAML's FX team takes this a

step further and in assigning incentives and from a 'do-not-cooperate' Nash-equilibrium between Greece and Germany

(no Greek austerity and no Eurobonds) they extend the single-period

game across the entire group of European nations - with an ugly outcome.

Analyzing the costs and benefits of a voluntary exit from the

euro-area for the core and periphery countries, the admittedly

over-simplified results are worrying. Italy and Ireland (not Greece) are expected to exit first

(with Italy having a decent chance of an orderly exit) and while

Germany is the most likely to achieve an orderly exit, it has the lowest

incentive to exit the euro-zone - since growth, borrowing costs, and a

weakening balance sheet would cause more pain. Ultimately, they play

the game out and find while Germany could 'bribe' Italy to stay, they will not accept and Italy will optimally exit first - suggesting a very dark future ahead for the Eurozone and with EUR tail-risk so cheap, it seems an optimal trade - as only a weaker EUR can save the Euro.

We discussed the use of Game Theory as a useful tool for analyzing Europe's predicament in February and noted that it was far from optimal for any (peripheral or core) sovereign to pre-emptively 'agree' to austerity or Eurobonds respectively (even though that would make both better off).

This Prisoner's Dilemma left the ugly Nash-Equilibrium game swinging

from a catastrophic break-up to a long, painful (and volatile)

continuation of the crisis. Recent work by BofAML's FX team takes this a

step further and in assigning incentives and from a 'do-not-cooperate' Nash-equilibrium between Greece and Germany

(no Greek austerity and no Eurobonds) they extend the single-period

game across the entire group of European nations - with an ugly outcome.

Analyzing the costs and benefits of a voluntary exit from the

euro-area for the core and periphery countries, the admittedly

over-simplified results are worrying. Italy and Ireland (not Greece) are expected to exit first

(with Italy having a decent chance of an orderly exit) and while

Germany is the most likely to achieve an orderly exit, it has the lowest

incentive to exit the euro-zone - since growth, borrowing costs, and a

weakening balance sheet would cause more pain. Ultimately, they play

the game out and find while Germany could 'bribe' Italy to stay, they will not accept and Italy will optimally exit first - suggesting a very dark future ahead for the Eurozone and with EUR tail-risk so cheap, it seems an optimal trade - as only a weaker EUR can save the Euro.

We discussed the use of Game Theory as a useful tool for analyzing Europe's predicament in February and noted that it was far from optimal for any (peripheral or core) sovereign to pre-emptively 'agree' to austerity or Eurobonds respectively (even though that would make both better off).

This Prisoner's Dilemma left the ugly Nash-Equilibrium game swinging

from a catastrophic break-up to a long, painful (and volatile)

continuation of the crisis. Recent work by BofAML's FX team takes this a

step further and in assigning incentives and from a 'do-not-cooperate' Nash-equilibrium between Greece and Germany

(no Greek austerity and no Eurobonds) they extend the single-period

game across the entire group of European nations - with an ugly outcome.

Analyzing the costs and benefits of a voluntary exit from the

euro-area for the core and periphery countries, the admittedly

over-simplified results are worrying. Italy and Ireland (not Greece) are expected to exit first

(with Italy having a decent chance of an orderly exit) and while

Germany is the most likely to achieve an orderly exit, it has the lowest

incentive to exit the euro-zone - since growth, borrowing costs, and a

weakening balance sheet would cause more pain. Ultimately, they play

the game out and find while Germany could 'bribe' Italy to stay, they will not accept and Italy will optimally exit first - suggesting a very dark future ahead for the Eurozone and with EUR tail-risk so cheap, it seems an optimal trade - as only a weaker EUR can save the Euro."It’s Been A Fun Ride, But Prepare For A Global Slowdown"

While in principle central banks around the world can talk up the market to infinity or until the last short has covered without ever committing to any action (obviously at some point long before that reality will take over and the fact that revenues and earnings are collapsing as stock prices are soaring will finally be grasped by every marginal buyer, but that is irrelevant for this thought experiment) the reality is that absent more unsterilized reserves entering the cash starved banking system, whose earnings absent such accounting gimmicks as loan loss reserve release and DVA, are the worst they have been in years, the banks will wither and die. Recall that the $1.6 trillion or so in excess reserves are currently used by banks mostly as window dressing to cover up capital deficiencies masked in the form of asset purchases, subsequently repoed out. Which is why central banks would certainly prefer to just talk the talk (ref: Draghi et al), private banks demand that they actually walk the walk, and the sooner the better. One such bank, which has the largest legacy liabilities and non-performing loans courtesy of its idiotic purchase of that epic housing scam factory Countrywide, is Bank of America. Which is why it is not at all surprising that just that bank has come out with a report titled "Shipwrecked" in which it says that not only will (or maybe should is the right word) launch QE3 immediately, but the QE will be bigger than expected, but as warned elsewhere, will be "much less effective than QE1/QE2, both in terms of boosting risky assets and stimulating the economy."

by Pater Tenebrarum, Financial Sense:

In recent days, numerous central bank bureaucrats have given us hints

that another round of pump priming is more or less imminent. It started

with John Williams, president of the San Francisco Fed who mused about

‘QE without a limit’. The FT reported:

In recent days, numerous central bank bureaucrats have given us hints

that another round of pump priming is more or less imminent. It started

with John Williams, president of the San Francisco Fed who mused about

‘QE without a limit’. The FT reported:

“The US will make little progress tackling high unemployment before 2014 unless the Federal Reserve eases policy further, one of the central bank’s leading officials has warned in the run-up to a meeting next week where the option of “QE3” will be on the table.The comments by John Williams, president of the Federal Reserve Bank of San Francisco, show how the weak economy is pushing the central bank towards action to support growth.If the Fed launched another round of quantitative easing, Mr Williams suggested that buying mortgage-backed securities rather than Treasuries would have a stronger effect on financial conditions. “There’s a lot more you can buy without interfering with market function and you maybe get a little more bang for the buck,” he said.

Read More @ Financial Sense.com

In recent days, numerous central bank bureaucrats have given us hints

that another round of pump priming is more or less imminent. It started

with John Williams, president of the San Francisco Fed who mused about

‘QE without a limit’. The FT reported:

In recent days, numerous central bank bureaucrats have given us hints

that another round of pump priming is more or less imminent. It started

with John Williams, president of the San Francisco Fed who mused about

‘QE without a limit’. The FT reported:“The US will make little progress tackling high unemployment before 2014 unless the Federal Reserve eases policy further, one of the central bank’s leading officials has warned in the run-up to a meeting next week where the option of “QE3” will be on the table.The comments by John Williams, president of the Federal Reserve Bank of San Francisco, show how the weak economy is pushing the central bank towards action to support growth.If the Fed launched another round of quantitative easing, Mr Williams suggested that buying mortgage-backed securities rather than Treasuries would have a stronger effect on financial conditions. “There’s a lot more you can buy without interfering with market function and you maybe get a little more bang for the buck,” he said.

Read More @ Financial Sense.com

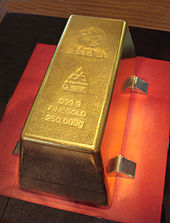

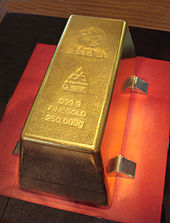

from GoldCore:

Gold edged up Friday, near the 3 week high, on the promise of the ECB

President Mario Draghi’s words to do “whatever it takes” to prevent a

collapse of the euro zone signalled more serious efforts to tackle the

debt crisis. The weakened dollar increased gold’s safe haven appeal.

Gold edged up Friday, near the 3 week high, on the promise of the ECB

President Mario Draghi’s words to do “whatever it takes” to prevent a

collapse of the euro zone signalled more serious efforts to tackle the

debt crisis. The weakened dollar increased gold’s safe haven appeal.

Today US 2nd qtr GDP figures are released and many feel these numbers will be the catalyst for the US Fed to decide next week on QE3.

US GDP is expected to grow at 1.5% for Q2 according to a Reuters poll, which is the slowest pace since 2Q 2011.

Spot gold prices were headed for over a 2% gain this week, the biggest weekly rise since the last week of May.

US gold futures contract for August delivery edged up 0.1% to $1,616.90.

Read More @ GoldCore.com

Gold edged up Friday, near the 3 week high, on the promise of the ECB

President Mario Draghi’s words to do “whatever it takes” to prevent a

collapse of the euro zone signalled more serious efforts to tackle the

debt crisis. The weakened dollar increased gold’s safe haven appeal.

Gold edged up Friday, near the 3 week high, on the promise of the ECB

President Mario Draghi’s words to do “whatever it takes” to prevent a

collapse of the euro zone signalled more serious efforts to tackle the

debt crisis. The weakened dollar increased gold’s safe haven appeal. Today US 2nd qtr GDP figures are released and many feel these numbers will be the catalyst for the US Fed to decide next week on QE3.

US GDP is expected to grow at 1.5% for Q2 according to a Reuters poll, which is the slowest pace since 2Q 2011.

Spot gold prices were headed for over a 2% gain this week, the biggest weekly rise since the last week of May.

US gold futures contract for August delivery edged up 0.1% to $1,616.90.

Read More @ GoldCore.com

The Bernanke And Draghi Are Dangerous...

“Within our mandate, the ECB is ready to do whatever it takes to preserve the euro. And believe me, it will be enough.” Nice, Mr. Draghi, but at what cost? And who will ultimately bear this cost? It is already far beyond the measure of mere money; democracy, truth and sovereignty have all been destroyed to prop up the central bankers' Status Quo. We can presume Mr. Bernanke and the Federal Reserve are in on the propaganda campaign, and so we need to examine the words and promises of these two central bankers, as well as what they have not said. Is talking about printing money as good as actually printing money? It would seem so. Is promising to "do whatever it takes" as good as actually doing whatever it takes? Once again, it seems so; global markets leaped at the "news" that the financial Status Quo was going to be "saved" yet again.What if it is beyond saving?

2nd Quarter GDP - Weaker In All The Wrong Places

The

first estimate of the 2nd Quarter GDP was released at a 1.5%

annualized growth rate which was just a smidgen better than the 1.4%

general consensus. There has been a rising chorus of calls as of late that the economy is already in a recession.

For all intents and purposes that may well be the case but the GDP

numbers do not currently reveal that. What we are fairly confident of

is that with the weakness that we have seen in the recent swath of

economic reports is that the 2nd quarter GDP will likely be weaker than reported in the first estimate.

It is this environment, combined with the continued Euro Zone crisis

and weaker stock markets, as the recent rumor induced bump fades, that

will give the Federal Reserve the latitude to launch a third round of

bond buying later this year. While the impact of such a program is likely to be muted - it will likely push off an outright recession into next year.

The

first estimate of the 2nd Quarter GDP was released at a 1.5%

annualized growth rate which was just a smidgen better than the 1.4%

general consensus. There has been a rising chorus of calls as of late that the economy is already in a recession.

For all intents and purposes that may well be the case but the GDP

numbers do not currently reveal that. What we are fairly confident of

is that with the weakness that we have seen in the recent swath of

economic reports is that the 2nd quarter GDP will likely be weaker than reported in the first estimate.

It is this environment, combined with the continued Euro Zone crisis

and weaker stock markets, as the recent rumor induced bump fades, that

will give the Federal Reserve the latitude to launch a third round of

bond buying later this year. While the impact of such a program is likely to be muted - it will likely push off an outright recession into next year.Mutiny At The ECB?

A lot of desk chatter about this move in risk-assets - and the entire reversion to red on the day in EURUSD - as a WSJ report now circulating suggests that ECB members are not backing reported proposals by President Draghi. Specifically, the statement referenced is the following: "Many ECB Members Surprised By Draghi's Comments Suggesting New Bond Buys, Source Tells WSJ". The bottom line here is that Draghi most likely pulled a Mario Monti (and his hanger on Mariano Rajoy), and spoke up before pre-clearing with Buba's Weidmann. Draghi thinks that, like Monti with Merkel at the June 29 summit, he can bluff the Bundesbank into submission, and Germany will agree to monetization, especially if markets have risen enough where nothing out of the ECB next week leads to a market plunge (as the WSJ explains below). The problem is that as we patiently explained, Monti got absolutely no concessions our of Merkel, as was seen in the bond yields of Spain after the June 29 summit, which hit record wides a few weeks later. Expect the same this time around too: i.e., Germany will hardly cave in to the European beggars.The EU Jerk-And-Smirk

Update: it just gets stranger and stranger. With a 40 minutes delay, now the WSJ gets in on the action, with their spin: "Many ECB Members Surprised By Draghi's Comments Suggesting New Bond Buys, Source Tells WSJ"

Normal' - USD has now reverted higher, TSY yields back lower, and Gold off but stocks refuse to give up hopePerfectly Idiotic Market

Sadly, the chart below says it all. It also means the summer of 2011 is now upon us.

Europe Releases Another Unsourced Rumor To Talk Markets To Weekly Highs

Update: "ECB spokeswoman said in an e-mailed statement that it is usual practice and nothing special that Draghi meets or talks with the members of the Governing Council. She declined to comment on the content of any talks."And so for the third day in a row, we get Europe continuing to talk itself up ever higher. From Bloomberg, with everything unsourced of course.

- DRAGHI SAID TO SPEAK TO WEIDMANN BEFORE AUG. 2 COUNCIL MEETING

- DRAGHI SAID TO FAVOR GIVING ESM BANKING LICENSE IN LONGER TERM

- DRAGHI'S PROPOSAL SAID TO INCLUDE BOND BUYS, RATE CUT, NEW LTRO

Mapping The Mounting Muni Meltdown

Many

local governments across the US face steep budget deficits as they

struggle to pay off debts accumulated over years. Increasingly, as a

last resort, some have filed for bankruptcy. There have been 26

municipal bankruptcy filings since 2010 and the pace is clustering, as Governing.com is keeping track. As Citi's George Friedlander noted (and we discussed here), technicals (net flows) are still dominant and dragging yields lower and spreads tighter; in spite of contagion fears

from cities with clear economic problems (specifically those in CA

with severe housing price collapses) and also general fund debt that is

not secured by a G.O. pledge. However, with the August 'cliff' in redemptions

clearly not priced in yet - as fear has driven momentum into bonds

recently - we fear more than a few will be wrong-footed when the net

flow shifts.

Many

local governments across the US face steep budget deficits as they

struggle to pay off debts accumulated over years. Increasingly, as a

last resort, some have filed for bankruptcy. There have been 26

municipal bankruptcy filings since 2010 and the pace is clustering, as Governing.com is keeping track. As Citi's George Friedlander noted (and we discussed here), technicals (net flows) are still dominant and dragging yields lower and spreads tighter; in spite of contagion fears

from cities with clear economic problems (specifically those in CA

with severe housing price collapses) and also general fund debt that is

not secured by a G.O. pledge. However, with the August 'cliff' in redemptions

clearly not priced in yet - as fear has driven momentum into bonds

recently - we fear more than a few will be wrong-footed when the net

flow shifts.Gold Chart and Comments

Trader Dan at Trader Dan's Market Views - 13 minutes ago

ECB President Draghi apparently has developed a severe case of loose lips

as he cannot seemingly keep his mouth from issuing words into the

atmosphere fast enough of late. The man has decided to initiate a round of

verbal intervention directed at his stinking currency and as a collateral

note, the global equity markets.

Yesterday it was: "we will save the Euro at all costs". Today it is "let's

propose another round of bond buying and lower interest rates".

Just like that, it was music to the ears of the hedge fund community which

wasted no time dutifully responding like the obedient... more »

I'm PayPal Verified

We The Sheeplez... is intended to reflect

excellence in effort and content. Donations will help maintain this goal

and defray the operational costs. Paypal, a leading provider of secure

online money transfers, will handle the donations. Thank you for your

contribution.

I'm PayPal Verified The Great American Swindle

Dave in Denver at The Golden Truth - 4 hours ago

*Facebook is turning out to be the poster child for everything that is

corrupt on Wall Street. From fraudulent representation of financials to

the fleecing of widows and orphans. *- Dave in Denver, May 22, 2012

After posting its first earnings report as a full-blown public company,

Facebook stock is down over 14% from last night's close as I write this.

It hit a new low of $22.28 earlier. From IPO ($38) to low, Facebook stock

has lost 41.3% of its value in just 51 days of trading as a public

company. That represents a $33 billion dollar loss in wealth. Given that

the report... more »

First - Smithfield - Now - Pilgrims' Pride

Trader Dan at Trader Dan's Market Views - 4 hours ago

With the grain markets the center of the commodity universe this year on

account of the fierce drought that has gripped the midWest for what now

seems like an eternity, commodity firms have been reaping a bonanza pushing

the "buy those grains" theme for new speculators.

What has happened however is that corn prices have reached a point where

the market is doing what it is supposed to be doing, namely shutting off

demand.

First we learned that Smithfield, the nations' largest pork producer, began

importing corn from Brazil. Even with the shipping costs to the EAst Coast,

South Ameri... more »

US economic growth slowed to 1.5 pct. rate in Q2

Eric De Groot at Eric De Groot - 4 hours ago

Same old song and dance of consumption at the expense of savings. Chart 1:

Personal Consumption Expenditures (PCE) As A %GDP and Personal Consumption

Expenditures As A %GDP Average from 1947 Chart 2: Savings (SAV) As A %GDP

Average from 1947 Headline: US economic growth slowed to 1.5 pct. rate in

Q2 WASHINGTON (AP) -- The U.S. economy grew at an annual rate of...

[[ This is a content summary only. Visit my website for full links, other

content, and more! ]]

by J G Vibes, Activist Post

Since the market crashes and bailouts that took place in 2008 it has

been no secret that the world economy is on shaky ground. For years,

those of us who were concerned about the future have been wondering and

speculating as to what mediums of exchange would replace the sinking

debt based currencies that now stretch across the globe.

Since the market crashes and bailouts that took place in 2008 it has

been no secret that the world economy is on shaky ground. For years,

those of us who were concerned about the future have been wondering and

speculating as to what mediums of exchange would replace the sinking

debt based currencies that now stretch across the globe.

The central bankers that got us into this mess will no doubt be using the media to propagandize the world into accepting a worldwide monopolized currency. This is already being hinted at by politicians and finance tycoons in mainstream interviews on an almost daily basis now. Their excuse for this move is that it would stabilize the economy, but this is provably false.

Read More @ Activist Post

from visionvictory

Since the market crashes and bailouts that took place in 2008 it has

been no secret that the world economy is on shaky ground. For years,

those of us who were concerned about the future have been wondering and

speculating as to what mediums of exchange would replace the sinking

debt based currencies that now stretch across the globe.

Since the market crashes and bailouts that took place in 2008 it has

been no secret that the world economy is on shaky ground. For years,

those of us who were concerned about the future have been wondering and

speculating as to what mediums of exchange would replace the sinking

debt based currencies that now stretch across the globe.The central bankers that got us into this mess will no doubt be using the media to propagandize the world into accepting a worldwide monopolized currency. This is already being hinted at by politicians and finance tycoons in mainstream interviews on an almost daily basis now. Their excuse for this move is that it would stabilize the economy, but this is provably false.

Read More @ Activist Post

from visionvictory

from KingWorldNews:

With the wild action in gold and silver this week, top Citi analyst

Tom Fitzpatrick put together a ‘Gold & Silver Chartapalooza’ where

he laid out the roadmap for gold and silver to hit new all-time highs.

Below is his interview and the KWN Special Friday Gold & Silver

‘Chart Mania’:

With the wild action in gold and silver this week, top Citi analyst

Tom Fitzpatrick put together a ‘Gold & Silver Chartapalooza’ where

he laid out the roadmap for gold and silver to hit new all-time highs.

Below is his interview and the KWN Special Friday Gold & Silver

‘Chart Mania’:

“We are still of the view that this has been a base building process for gold, and I would the same is true for silver. This has been similar to the 2006/2007 base before we went higher (See chart below). It’s really just a question of timing more than anything else because we are increasingly convinced we are going to get the up move.

In terms of gold, it has bottomed out a couple of times around this $1,500 to $1,520 area (See chart below). If gold can close Friday at $1,600, we’re going to get another bullish outside week for the second time in the last nine weeks off of this base.

Tom Fitzpatrick continues @ KingWorldNews.com

With the wild action in gold and silver this week, top Citi analyst

Tom Fitzpatrick put together a ‘Gold & Silver Chartapalooza’ where

he laid out the roadmap for gold and silver to hit new all-time highs.

Below is his interview and the KWN Special Friday Gold & Silver

‘Chart Mania’:

With the wild action in gold and silver this week, top Citi analyst

Tom Fitzpatrick put together a ‘Gold & Silver Chartapalooza’ where

he laid out the roadmap for gold and silver to hit new all-time highs.

Below is his interview and the KWN Special Friday Gold & Silver

‘Chart Mania’: “We are still of the view that this has been a base building process for gold, and I would the same is true for silver. This has been similar to the 2006/2007 base before we went higher (See chart below). It’s really just a question of timing more than anything else because we are increasingly convinced we are going to get the up move.

In terms of gold, it has bottomed out a couple of times around this $1,500 to $1,520 area (See chart below). If gold can close Friday at $1,600, we’re going to get another bullish outside week for the second time in the last nine weeks off of this base.

Tom Fitzpatrick continues @ KingWorldNews.com

from RTAmerica:

The issue of whether it is legit to film police at work or not has been causing a lot of discussion lately, before DC police chief put it blunt in a statement RT obtained from the Police Department, that it was allowed to do so in public places.

The issue of whether it is legit to film police at work or not has been causing a lot of discussion lately, before DC police chief put it blunt in a statement RT obtained from the Police Department, that it was allowed to do so in public places.

By Jeff Berwick, Dollar Vigilante:

Ron Paul’s Federal Reserve Transparency Act (H.R. 459), or “Audit the

Fed,” passed Wednesday July 25, 2012 in the U.S. House of

Representatives by a wide margin of 327-98, exceeding the two-thirds

majority needed. It had 274 cosponsors. But, by the evening of the same

day, mainstream press around the country was already preparing the

people for the bill’s fate in the Democrat-controlled Senate. As the

Chicago Tribune and others reported, it had little chance of passing in

the Senate, let alone being signed into law by the President. In fact,

Senate Majority Leader Harry Reid has already said that the Senate will

not even consider the bill, because, as Ron Paul told CSPAN, he didn’t

have the “guts.” With this in mind, as well as their own reputations,

Romney, Boehner and Cantor backed it. Even Harry Reid backed it… in 1987 and 2010, but now he has changed his mind on a Fed audit for some reason.

Ron Paul’s Federal Reserve Transparency Act (H.R. 459), or “Audit the

Fed,” passed Wednesday July 25, 2012 in the U.S. House of

Representatives by a wide margin of 327-98, exceeding the two-thirds

majority needed. It had 274 cosponsors. But, by the evening of the same

day, mainstream press around the country was already preparing the

people for the bill’s fate in the Democrat-controlled Senate. As the

Chicago Tribune and others reported, it had little chance of passing in

the Senate, let alone being signed into law by the President. In fact,

Senate Majority Leader Harry Reid has already said that the Senate will

not even consider the bill, because, as Ron Paul told CSPAN, he didn’t

have the “guts.” With this in mind, as well as their own reputations,

Romney, Boehner and Cantor backed it. Even Harry Reid backed it… in 1987 and 2010, but now he has changed his mind on a Fed audit for some reason.

But, here is the plain fact of the matter. We already know what the Federal Reserve is doing. Sure we may not know exactly which banks get exactly which graft, which may be of some interest. But for the most part we know exactly what they are doing. They are artificially price-fixing/manipulating interest rates at 0% through to 2014… which will be six years of ZIRP.

Read More @ DollarVigilante.com

Ron Paul’s Federal Reserve Transparency Act (H.R. 459), or “Audit the

Fed,” passed Wednesday July 25, 2012 in the U.S. House of

Representatives by a wide margin of 327-98, exceeding the two-thirds

majority needed. It had 274 cosponsors. But, by the evening of the same

day, mainstream press around the country was already preparing the

people for the bill’s fate in the Democrat-controlled Senate. As the

Chicago Tribune and others reported, it had little chance of passing in

the Senate, let alone being signed into law by the President. In fact,

Senate Majority Leader Harry Reid has already said that the Senate will

not even consider the bill, because, as Ron Paul told CSPAN, he didn’t

have the “guts.” With this in mind, as well as their own reputations,

Romney, Boehner and Cantor backed it. Even Harry Reid backed it… in 1987 and 2010, but now he has changed his mind on a Fed audit for some reason.

Ron Paul’s Federal Reserve Transparency Act (H.R. 459), or “Audit the

Fed,” passed Wednesday July 25, 2012 in the U.S. House of

Representatives by a wide margin of 327-98, exceeding the two-thirds

majority needed. It had 274 cosponsors. But, by the evening of the same

day, mainstream press around the country was already preparing the

people for the bill’s fate in the Democrat-controlled Senate. As the

Chicago Tribune and others reported, it had little chance of passing in

the Senate, let alone being signed into law by the President. In fact,

Senate Majority Leader Harry Reid has already said that the Senate will

not even consider the bill, because, as Ron Paul told CSPAN, he didn’t

have the “guts.” With this in mind, as well as their own reputations,

Romney, Boehner and Cantor backed it. Even Harry Reid backed it… in 1987 and 2010, but now he has changed his mind on a Fed audit for some reason.But, here is the plain fact of the matter. We already know what the Federal Reserve is doing. Sure we may not know exactly which banks get exactly which graft, which may be of some interest. But for the most part we know exactly what they are doing. They are artificially price-fixing/manipulating interest rates at 0% through to 2014… which will be six years of ZIRP.

Read More @ DollarVigilante.com

by The Daily Bell:

Before

the United States House of Representatives, Committee on Financial

Services, Hearing on the Annual Report of the Financial Stability

Oversight Council, July 25, 2012

Before

the United States House of Representatives, Committee on Financial

Services, Hearing on the Annual Report of the Financial Stability

Oversight Council, July 25, 2012

Mr. Chairman, I welcome this hearing to receive the report of the Financial Stability Oversight Council (FSOC). The creation of FSOC underscores perfectly the complete intellectual bankruptcy underpinning the government’s behavior towards financial markets. In the opinion of government leaders, the financial crisis was not caused by misguided regulation, interest rate manipulation, or government-caused distortions to the structure of production, but by a financial sector that was completely deregulated and laissez-faire. The response of legislators, therefore, was to create a new super-regulator with vast new powers to control the financial system.

Those who truly believe that the financial sector is deregulated might want to test their hypothesis by starting their own bank without the government’s imprimatur, assuming that they are prepared to spend some time in a federal penitentiary. To say that the financial sector is deregulated could not be further from

Read More @ TheDailyBell.com

Before

the United States House of Representatives, Committee on Financial

Services, Hearing on the Annual Report of the Financial Stability

Oversight Council, July 25, 2012

Before

the United States House of Representatives, Committee on Financial

Services, Hearing on the Annual Report of the Financial Stability

Oversight Council, July 25, 2012Mr. Chairman, I welcome this hearing to receive the report of the Financial Stability Oversight Council (FSOC). The creation of FSOC underscores perfectly the complete intellectual bankruptcy underpinning the government’s behavior towards financial markets. In the opinion of government leaders, the financial crisis was not caused by misguided regulation, interest rate manipulation, or government-caused distortions to the structure of production, but by a financial sector that was completely deregulated and laissez-faire. The response of legislators, therefore, was to create a new super-regulator with vast new powers to control the financial system.

Those who truly believe that the financial sector is deregulated might want to test their hypothesis by starting their own bank without the government’s imprimatur, assuming that they are prepared to spend some time in a federal penitentiary. To say that the financial sector is deregulated could not be further from

Read More @ TheDailyBell.com

By Bill Bonner, Daily Reckoning.com.au:

What’s going on…? What’s going on?

That was a song by Marvin Gaye. It was also the question the interviewer asked. Followed by, what’s going to happen next?

But those are questions no one can answer. All we can do is guess…speculate…and wonder.

“Deflation now. Inflation later” is what we’ve been saying for the last 4 years.

The interviewer seemed happy with the answer. And the elaboration: “Japan now…but don’t be surprised when we end up in Argentina.”

What do Japan…Argentina…and the US economies all have in common? They can print money. And when their backs are to the wall, that is what they will do.

But that’s later, remember. Right now, investors are lending money to governments at the lowest rates in history. They do not ask anything more than to get the money back. Eventually. And since the US and Japan can print, they are confident that they’ll get paid.

But what about Argentina? Turns out, Argentina borrowed in dollars too…and pledges to repay, in dollars.

Read More @ DailyReckoning.com.au

What’s going on…? What’s going on?

That was a song by Marvin Gaye. It was also the question the interviewer asked. Followed by, what’s going to happen next?

But those are questions no one can answer. All we can do is guess…speculate…and wonder.

“Deflation now. Inflation later” is what we’ve been saying for the last 4 years.

The interviewer seemed happy with the answer. And the elaboration: “Japan now…but don’t be surprised when we end up in Argentina.”

What do Japan…Argentina…and the US economies all have in common? They can print money. And when their backs are to the wall, that is what they will do.

But that’s later, remember. Right now, investors are lending money to governments at the lowest rates in history. They do not ask anything more than to get the money back. Eventually. And since the US and Japan can print, they are confident that they’ll get paid.

But what about Argentina? Turns out, Argentina borrowed in dollars too…and pledges to repay, in dollars.

Read More @ DailyReckoning.com.au

by Vin Maru, MineWeb.com

Should Ron Paul’s Audit the Fed Bill, now passed by Congress get ratified by the U.S. Senate (perhaps unlikely), would such a move have any direct effect, positive or negative, on the gold price?

July 25, 2012 should go down in history as the date the Federal Reserve

may become fully accountable to the US government. A motion to pass the

bill as amended was unanimously approved by the house to require a full

audit of the boards of governors of the Federal Reserve System and

banks. This will be done by the Comptroller General of the US before the

end of 2012 and they are required to issue their report within 12

months of enactment. The votes in the House in the bill’s passing this

was 326 yea votes to 99 nay votes with 7 non votes. Interestingly

enough it was the Republicans that strongly supported this bill with 239

yea and 1 nay vote, while the Democrats voted 88 yea and 98 nay.

July 25, 2012 should go down in history as the date the Federal Reserve

may become fully accountable to the US government. A motion to pass the

bill as amended was unanimously approved by the house to require a full

audit of the boards of governors of the Federal Reserve System and

banks. This will be done by the Comptroller General of the US before the

end of 2012 and they are required to issue their report within 12

months of enactment. The votes in the House in the bill’s passing this

was 326 yea votes to 99 nay votes with 7 non votes. Interestingly

enough it was the Republicans that strongly supported this bill with 239

yea and 1 nay vote, while the Democrats voted 88 yea and 98 nay.

There are many hurdles ahead of this bill before it takes effect; it still has to be ratified by the Senate and the President. However, finally getting approved in the House is a step in the right direction. Even if it does pass how much effect will the audit have in reality? Probably not much since the banking institution known as the Federal Reserve operates outside of any law. Even if they are found guilty of any wrong doing in managing the value of the US dollar or being involved in rigging the Libor rate, who will be there to prosecute them? Remember they operate outside the law, so even if they are found guilty, it will be the US citizens and holders of paper/digital US dollars that will somehow pay for it.

Read More @ MineWeb.com

Should Ron Paul’s Audit the Fed Bill, now passed by Congress get ratified by the U.S. Senate (perhaps unlikely), would such a move have any direct effect, positive or negative, on the gold price?

July 25, 2012 should go down in history as the date the Federal Reserve

may become fully accountable to the US government. A motion to pass the

bill as amended was unanimously approved by the house to require a full

audit of the boards of governors of the Federal Reserve System and

banks. This will be done by the Comptroller General of the US before the

end of 2012 and they are required to issue their report within 12

months of enactment. The votes in the House in the bill’s passing this

was 326 yea votes to 99 nay votes with 7 non votes. Interestingly

enough it was the Republicans that strongly supported this bill with 239

yea and 1 nay vote, while the Democrats voted 88 yea and 98 nay.

July 25, 2012 should go down in history as the date the Federal Reserve

may become fully accountable to the US government. A motion to pass the

bill as amended was unanimously approved by the house to require a full

audit of the boards of governors of the Federal Reserve System and

banks. This will be done by the Comptroller General of the US before the

end of 2012 and they are required to issue their report within 12

months of enactment. The votes in the House in the bill’s passing this

was 326 yea votes to 99 nay votes with 7 non votes. Interestingly

enough it was the Republicans that strongly supported this bill with 239

yea and 1 nay vote, while the Democrats voted 88 yea and 98 nay. There are many hurdles ahead of this bill before it takes effect; it still has to be ratified by the Senate and the President. However, finally getting approved in the House is a step in the right direction. Even if it does pass how much effect will the audit have in reality? Probably not much since the banking institution known as the Federal Reserve operates outside of any law. Even if they are found guilty of any wrong doing in managing the value of the US dollar or being involved in rigging the Libor rate, who will be there to prosecute them? Remember they operate outside the law, so even if they are found guilty, it will be the US citizens and holders of paper/digital US dollars that will somehow pay for it.

Read More @ MineWeb.com

by Mike Adams, Natural News:

In the aftermath of the Aurora, Colorado Batman movie theater

shooting, President Obama chimed in on the gun control debate yesterday,

saying, “Every day, the number of young people we lose to violence is

about the same as the number of people we lost in that movie theater.

For every Columbine or Virginia Tech, there are dozens gunned down on

the streets of Chicago or Atlanta…” (http://www.washingtontimes.com/news/2012/jul/25/obama-calls-measures-…)

In the aftermath of the Aurora, Colorado Batman movie theater

shooting, President Obama chimed in on the gun control debate yesterday,

saying, “Every day, the number of young people we lose to violence is

about the same as the number of people we lost in that movie theater.

For every Columbine or Virginia Tech, there are dozens gunned down on

the streets of Chicago or Atlanta…” (http://www.washingtontimes.com/news/2012/jul/25/obama-calls-measures-…)

What he didn’t say, however, is that every day 290 people are killed by FDA-approved prescription drugs, and that’s the conservative number published by the Journal of the American Medical Association.

As no one seems to believe these numbers are real, I’ll quote the source: The Journal of the American Medical Association (JAMA) Vol 284, No 4, July 26th 2000, authored by Dr Barbara Starfield, MD, MPH, of the Johns Hopkins School of Hygiene and Public Health.

Read More @ NaturalNews.com

In the aftermath of the Aurora, Colorado Batman movie theater

shooting, President Obama chimed in on the gun control debate yesterday,

saying, “Every day, the number of young people we lose to violence is

about the same as the number of people we lost in that movie theater.

For every Columbine or Virginia Tech, there are dozens gunned down on

the streets of Chicago or Atlanta…” (http://www.washingtontimes.com/news/2012/jul/25/obama-calls-measures-…)

In the aftermath of the Aurora, Colorado Batman movie theater

shooting, President Obama chimed in on the gun control debate yesterday,

saying, “Every day, the number of young people we lose to violence is

about the same as the number of people we lost in that movie theater.

For every Columbine or Virginia Tech, there are dozens gunned down on

the streets of Chicago or Atlanta…” (http://www.washingtontimes.com/news/2012/jul/25/obama-calls-measures-…)What he didn’t say, however, is that every day 290 people are killed by FDA-approved prescription drugs, and that’s the conservative number published by the Journal of the American Medical Association.

As no one seems to believe these numbers are real, I’ll quote the source: The Journal of the American Medical Association (JAMA) Vol 284, No 4, July 26th 2000, authored by Dr Barbara Starfield, MD, MPH, of the Johns Hopkins School of Hygiene and Public Health.

Read More @ NaturalNews.com

by Susanne Posel, Occupy Corporatism:

The US military is being used

to protect civilian events, like the 2012 Democratic and Republican

Party National Conventions in Tampa, Florida and Charlotte, North

Carolina.

The US military is being used

to protect civilian events, like the 2012 Democratic and Republican

Party National Conventions in Tampa, Florida and Charlotte, North

Carolina.

USNORTHCOM and Leon Panetta, US Secretary of Defense, has readily admitted that US armed forces will collaborate with local law enforcement “if called upon”.

In fact, more than 20,000 troops were brought home and readied for deployment within the US to assist in “civil unrest and crowd control”.

The US military will prop up the US Secret Service “for operational security reasons we do not discuss the numbers of military personnel and resources that are involved. Additionally, we do not share our operational plans,” said U.S. Navy Lt. Cdr. William G. Lewis.

The extent of use of military forces on civilian matters, as reported by mainstream media (MSM) have included the reallocation of hundreds of military police officers being trained to “assist local authorities” in investigation, crime scene and case building.

Read More @ OccupyCorporatism.com

Today acclaimed commodity trader Dan Norcini told King World News, “Once you had the 50 day moving average in gold violated to the upside, then you had a much larger wave of short covering which began to occur.” Norcini also said, “The momentum crowd, that was waiting for $1,600 to be breached, then took over and the move has continued to feed on itself.”

Norcini also discussed a key level which “… is where you will really see the shorts panic.” But first, here is what he had to say about the recent action in gold: “The move in gold we have been seeing was precipitated by an article which indicated the Fed was going to move in August, instead of September. Some of the shorts began to cover yesterday, and as they began driving the prices higher they tripped some key technical levels.”

Dan Norcini continues @ KingWorldNews.com

There is no means of avoiding the final collapse of a boom brought about by credit (debt) expansion. The alternative is only whether the crisis should come sooner as the result of a voluntary abandonment of further credit (debt) expansion, or later as a final and total catastrophe of the currency system involved. – Ludwig von Mises

Jim Sinclair’s Commentary

Nationwide hit by account meltdown: 700,000 customers have payments taken twice By Ruth Lythe and Dan Hyde

PUBLISHED: 13:23 EST, 26 July 2012 | UPDATED: 06:52 EST, 27 July 2012

Britain’s biggest building society left more than 700,000 customers out of pocket yesterday after a basic computer error took payments from their accounts twice.

An estimated 704,000 Nationwide account holders saw cash – in some cases thousands of pounds – wrongly snatched out of their current account.

Every debit card payment was deducted as normal on Tuesday – but then taken again on Wednesday.

In another blow to the UK’s beleaguered banks and building societies, NatWest’s online service froze yesterday, leaving up to 11.5million customers locked out and unable to access their cash.

The Nationwide error hit 50,000 people so badly that they were forced into unauthorised overdrafts which stung them with penalties of up to £100, had card purchases turned down or saw cash requests at ATMs rejected.

Others relying on a minimum sum in their account risked missing mortgage payments.

Nationwide blamed ‘human error’ and said the money would be refunded this morning.

More…

Jim Sinclair’s Commentary

EU may criminalise commodities price distortion Thu Jul 26, 2012 11:28am EDT

By Barbara Lewis

BRUSSELS, July 26 (Reuters) – Manipulating international commodity benchmarks such as Brent crude oil would be a criminal offence, punishable by jail, under a set of reforms the EU Commission has proposed in response to the rigging of a major interest reference rate.

The Commission, the EU’s executive arm, announced on Wednesday plans to tighten supervision of financial benchmarks after a scandal involving interbank lending rate Libor, used to set prices for trillions of dollars of financial products.

The benchmarks the Commission wants to make more "reliable, transparent and credible" also include commodities such as gold, cocoa, and Brent crude.

It would become an offence to transmit false or misleading information, provide "false or misleading inputs, or any action which manipulated the calculation of a benchmark", if the European Parliament and 27 EU member states endorse the proposals.

Although not cited specifically, that could include false reporting to oil price reporting agencies like Platts, the leading assessor of benchmark prices for physical Brent and other cash oil markets.

More…

Jim Sinclair’s Commentary

U.S. Economy Slowed to a Tepid 1.5% Rate of Growth By SHAILA DEWAN

Published: July 27, 2012

The United States economy grew by a tepid 1.5 percent annual rate in the second quarter, losing the momentum it had appeared to be gaining earlier this year, the government reported Friday.

Growth was curbed as consumers limited new spending and as business investment slowed in the face of a global slowdown and a stronger dollar. Several bright spots in the first quarter, including auto production, computer sales, housing and large purchases like appliances and televisions, dimmed or faded away altogether in the second quarter.

The sluggishness of the recovery makes the United States more vulnerable to trouble in Europe and increases the likelihood of more stimulus from the Federal Reserve, which has lowered its forecasts in recent weeks.

It also illustrates the election-season challenge to President Obama, who must sell his economic record to voters as the recovery slows.

The lackluster showing of the gross domestic product immediately gave Mr. Obama’s opponents the opportunity to question the federal government’s response to the financial crisis, though the vast majority of economists agree that the stimulus and the bank bailouts saved jobs. The G.D.P. report, released Friday by the Commerce Department, also spurred calls from liberals for the government to do more.

More…

Jim Sinclair’s Commentary

Weimar solution beckons as manufacturing crashes in US Fifth District? By Ambrose Evans-Pritchard Economics Last updated: July 25th, 2012

As Britain tanks by 0.7pc in the second quarter (much worse than Spain at 0.4pc), it is worth keeping a close eye on the very ominous turn of events in the US.

The Richmond Fed’s twin indices of manufacturing and services – a very good indicator at the onset of the Great Recession – collapsed this month.

They are now falling at a steeper pace than in early 2008. Current activity in manufacturing fell 16 points from -1 to -17. That is a major shock.

My apologies to those (mostly American) readers who have already seen this, but I was bogged down in Europe all of yesterday.

So here are the charts for British and Continental readers. They cover the Fifth District of the US.

More…

Jim Sinclair’s Commentary

US economic arsenal is empty: Volcker PUBLISHED: 26 Jul 2012 00:01:00 | UPDATED: 26 Jul 2012 06:14:35

American policymakers have exhausted fiscal and monetary policy remedies in their bid to cure the US economy’s growth blues, legendary inflation tamer Paul Volcker said.

The US was stuck in a “technical recovery”, growing at about 2 per cent a year, said Mr Volcker, who established his reputation when he killed off inflation in the early 1980s as chairman of the Federal Reserve Board.

“There is no magic bullet in fiscal or monetary policy. We have pretty much shot all the bullets we have,” Mr Volcker said. His downbeat remarks come as the Fed is under intense pressure to lower interest rates further by buying more bonds and extending their “near zero” guidance for the Fed’s overnight cash rate to 2015.

The Fed’s Open Market Committee meets next Tuesday. Its members are split about whether they should launch more bond buying in the face of evidence the US economy slowed to a crawl in the June quarter.

More…

Jim,

This sums up what you’re trying to say very clearly in the fewest words I have seen it expressed in.

KISTAC is true (Keep It Simple To Assure Clarity):

"As fundamentally useless as QE to infinity is, it allows the Fed and Treasury to direct huge flows of funds into the bankrupt. There is no limitation what bonds they can buy or loans they can make. The history of 2009 underscores that and nothing has changed since that. Since politicians always kick the can this is the only tool. The pinhead academics that point to other tools might consider what use Operation Twist was. The answer is zero. Therefore QE to infinity hidden in new clothes begins soon."

CIGA Sam

Durable goods orders ex-transportation fall in June CIGA Eric

The overwhelming need to maintain the illusion of an economic recovery will force the Fed to act sooner rather than later.

Chart: Real Business Core Capital Spending: Real or CPI-Adjusted New Orders of Durable Goods ex. defense and aircraft (RBCCS) and YOY Change

Headline: Durable goods orders ex-transportation fall in June

WASHINGTON (Reuters)- – New orders for a range of long-lasting manufactured goods fell in June and a gauge of planned business spending plans dropped, pointing to a slowdown in factory activity.

The Commerce Department said on Thursday durable goods orders excluding transportation dropped 1.1 percent, the biggest decline since January, after rising 0.8 percent in May. Economists had forecast this category being flat last month.

Overall orders increased 1.6 percent as demand for aircraft surged, after an upwardly revised 1.6 percent increase the prior month.

Economists polled by Reuters had forecast orders for durable goods, items from toasters to aircraft that are meant to last at least three years, rising 0.4 percent after a previously reported 1.3 percent increase in May.

"The manufacturing sector is going through a weak patch with orders excluding transportation falling over the last three months. This is also the message of the sub-50 readings on the ISM manufacturing composite and new orders indexes for June," said John Ryding, chief economist at RDQ Economics in New York.

Source: finance.yahoo.com

More…

I'm PayPal Verified

The US military is being used

to protect civilian events, like the 2012 Democratic and Republican

Party National Conventions in Tampa, Florida and Charlotte, North

Carolina.

The US military is being used

to protect civilian events, like the 2012 Democratic and Republican

Party National Conventions in Tampa, Florida and Charlotte, North

Carolina.USNORTHCOM and Leon Panetta, US Secretary of Defense, has readily admitted that US armed forces will collaborate with local law enforcement “if called upon”.

In fact, more than 20,000 troops were brought home and readied for deployment within the US to assist in “civil unrest and crowd control”.

The US military will prop up the US Secret Service “for operational security reasons we do not discuss the numbers of military personnel and resources that are involved. Additionally, we do not share our operational plans,” said U.S. Navy Lt. Cdr. William G. Lewis.

The extent of use of military forces on civilian matters, as reported by mainstream media (MSM) have included the reallocation of hundreds of military police officers being trained to “assist local authorities” in investigation, crime scene and case building.

Read More @ OccupyCorporatism.com

from KingWorldNews:

Today acclaimed commodity trader Dan Norcini told King World News, “Once you had the 50 day moving average in gold violated to the upside, then you had a much larger wave of short covering which began to occur.” Norcini also said, “The momentum crowd, that was waiting for $1,600 to be breached, then took over and the move has continued to feed on itself.”

Norcini also discussed a key level which “… is where you will really see the shorts panic.” But first, here is what he had to say about the recent action in gold: “The move in gold we have been seeing was precipitated by an article which indicated the Fed was going to move in August, instead of September. Some of the shorts began to cover yesterday, and as they began driving the prices higher they tripped some key technical levels.”

Dan Norcini continues @ KingWorldNews.com

by Dr. Paul Craig Roberts, PaulCraigRoberts.org:

One wonders what Syrians are thinking as “rebels” vowing to “free Syria” take the country down the same road to destruction as “rebels” in Libya. Libya, under Gaddafi a well run country whose oil revenues were shared with the Libyan people instead of monopolized by a princely class as in Saudi Arabia, now has no government and is in disarray with contending factions vying for power.

Just as no one knew who the Libyan “rebels” were, with elements of al Qaeda reportedly among them, no one knows who the Syrian “rebels” are, or indeed if they are even rebels (Antiwar.com). Some “rebels” appear to be bandit groups who seize the opportunity to loot and to rape and set themselves up as the governments of villages and towns. Others appear to be al Qaeda. (Antiwar.com)

The fact that the “rebels” are armed is an indication of interference from outside. There have been reports that Washington has ordered its Saudi and Bahrain puppet governments to supply the “rebels” with military weaponry.

Read More @ PaulCraigRoberts.org

One wonders what Syrians are thinking as “rebels” vowing to “free Syria” take the country down the same road to destruction as “rebels” in Libya. Libya, under Gaddafi a well run country whose oil revenues were shared with the Libyan people instead of monopolized by a princely class as in Saudi Arabia, now has no government and is in disarray with contending factions vying for power.

Just as no one knew who the Libyan “rebels” were, with elements of al Qaeda reportedly among them, no one knows who the Syrian “rebels” are, or indeed if they are even rebels (Antiwar.com). Some “rebels” appear to be bandit groups who seize the opportunity to loot and to rape and set themselves up as the governments of villages and towns. Others appear to be al Qaeda. (Antiwar.com)

The fact that the “rebels” are armed is an indication of interference from outside. There have been reports that Washington has ordered its Saudi and Bahrain puppet governments to supply the “rebels” with military weaponry.

Read More @ PaulCraigRoberts.org

There is no means of avoiding the final collapse of a boom brought about by credit (debt) expansion. The alternative is only whether the crisis should come sooner as the result of a voluntary abandonment of further credit (debt) expansion, or later as a final and total catastrophe of the currency system involved. – Ludwig von Mises

Jim Sinclair’s Commentary

Usually something like this happens when the institution needs liquidity on a certain day.

Nationwide hit by account meltdown: 700,000 customers have payments taken twice By Ruth Lythe and Dan Hyde

PUBLISHED: 13:23 EST, 26 July 2012 | UPDATED: 06:52 EST, 27 July 2012

Britain’s biggest building society left more than 700,000 customers out of pocket yesterday after a basic computer error took payments from their accounts twice.

An estimated 704,000 Nationwide account holders saw cash – in some cases thousands of pounds – wrongly snatched out of their current account.

Every debit card payment was deducted as normal on Tuesday – but then taken again on Wednesday.

In another blow to the UK’s beleaguered banks and building societies, NatWest’s online service froze yesterday, leaving up to 11.5million customers locked out and unable to access their cash.

The Nationwide error hit 50,000 people so badly that they were forced into unauthorised overdrafts which stung them with penalties of up to £100, had card purchases turned down or saw cash requests at ATMs rejected.

Others relying on a minimum sum in their account risked missing mortgage payments.

Nationwide blamed ‘human error’ and said the money would be refunded this morning.

More…

Jim Sinclair’s Commentary

Every passing day has to make the Greenwich gang that thinks they can

always hide behind their computer a little less comfortable.

For the purpose of understanding, manipulation of any public market

is and has always been illegal. It is called commercial fraud. The most

egregious being the professional dirty tricksters.

Now there is hope relief does not only exist in litigation for

violation of common commercial code, but maybe, just maybe, someone will

regulate the financial demons.

EU may criminalise commodities price distortion Thu Jul 26, 2012 11:28am EDT

By Barbara Lewis

BRUSSELS, July 26 (Reuters) – Manipulating international commodity benchmarks such as Brent crude oil would be a criminal offence, punishable by jail, under a set of reforms the EU Commission has proposed in response to the rigging of a major interest reference rate.

The Commission, the EU’s executive arm, announced on Wednesday plans to tighten supervision of financial benchmarks after a scandal involving interbank lending rate Libor, used to set prices for trillions of dollars of financial products.

The benchmarks the Commission wants to make more "reliable, transparent and credible" also include commodities such as gold, cocoa, and Brent crude.

It would become an offence to transmit false or misleading information, provide "false or misleading inputs, or any action which manipulated the calculation of a benchmark", if the European Parliament and 27 EU member states endorse the proposals.

Although not cited specifically, that could include false reporting to oil price reporting agencies like Platts, the leading assessor of benchmark prices for physical Brent and other cash oil markets.

More…

Jim Sinclair’s Commentary

This can’t get more static thinking that 1.5% is not weak enough for stimulation. It the motion gang, not the level!

U.S. Economy Slowed to a Tepid 1.5% Rate of Growth By SHAILA DEWAN

Published: July 27, 2012

The United States economy grew by a tepid 1.5 percent annual rate in the second quarter, losing the momentum it had appeared to be gaining earlier this year, the government reported Friday.

Growth was curbed as consumers limited new spending and as business investment slowed in the face of a global slowdown and a stronger dollar. Several bright spots in the first quarter, including auto production, computer sales, housing and large purchases like appliances and televisions, dimmed or faded away altogether in the second quarter.

The sluggishness of the recovery makes the United States more vulnerable to trouble in Europe and increases the likelihood of more stimulus from the Federal Reserve, which has lowered its forecasts in recent weeks.

It also illustrates the election-season challenge to President Obama, who must sell his economic record to voters as the recovery slows.

The lackluster showing of the gross domestic product immediately gave Mr. Obama’s opponents the opportunity to question the federal government’s response to the financial crisis, though the vast majority of economists agree that the stimulus and the bank bailouts saved jobs. The G.D.P. report, released Friday by the Commerce Department, also spurred calls from liberals for the government to do more.

More…

Jim Sinclair’s Commentary

In business, the upcoming downer will be remembered as a collapse. QE to infinity is certain, both here and there.

Weimar solution beckons as manufacturing crashes in US Fifth District? By Ambrose Evans-Pritchard Economics Last updated: July 25th, 2012

As Britain tanks by 0.7pc in the second quarter (much worse than Spain at 0.4pc), it is worth keeping a close eye on the very ominous turn of events in the US.

The Richmond Fed’s twin indices of manufacturing and services – a very good indicator at the onset of the Great Recession – collapsed this month.

They are now falling at a steeper pace than in early 2008. Current activity in manufacturing fell 16 points from -1 to -17. That is a major shock.

My apologies to those (mostly American) readers who have already seen this, but I was bogged down in Europe all of yesterday.

So here are the charts for British and Continental readers. They cover the Fifth District of the US.

More…

Jim Sinclair’s Commentary

I think you have heard this before. QE is the only tool that puts

tons of cash into the hands of the Fed and Treasury to do almost

anything they want with.

QE is not going to cure a thing.

US economic arsenal is empty: Volcker PUBLISHED: 26 Jul 2012 00:01:00 | UPDATED: 26 Jul 2012 06:14:35

American policymakers have exhausted fiscal and monetary policy remedies in their bid to cure the US economy’s growth blues, legendary inflation tamer Paul Volcker said.

The US was stuck in a “technical recovery”, growing at about 2 per cent a year, said Mr Volcker, who established his reputation when he killed off inflation in the early 1980s as chairman of the Federal Reserve Board.

“There is no magic bullet in fiscal or monetary policy. We have pretty much shot all the bullets we have,” Mr Volcker said. His downbeat remarks come as the Fed is under intense pressure to lower interest rates further by buying more bonds and extending their “near zero” guidance for the Fed’s overnight cash rate to 2015.

The Fed’s Open Market Committee meets next Tuesday. Its members are split about whether they should launch more bond buying in the face of evidence the US economy slowed to a crawl in the June quarter.

More…

Jim,

This sums up what you’re trying to say very clearly in the fewest words I have seen it expressed in.

KISTAC is true (Keep It Simple To Assure Clarity):

"As fundamentally useless as QE to infinity is, it allows the Fed and Treasury to direct huge flows of funds into the bankrupt. There is no limitation what bonds they can buy or loans they can make. The history of 2009 underscores that and nothing has changed since that. Since politicians always kick the can this is the only tool. The pinhead academics that point to other tools might consider what use Operation Twist was. The answer is zero. Therefore QE to infinity hidden in new clothes begins soon."

CIGA Sam

Durable goods orders ex-transportation fall in June CIGA Eric

The overwhelming need to maintain the illusion of an economic recovery will force the Fed to act sooner rather than later.

Chart: Real Business Core Capital Spending: Real or CPI-Adjusted New Orders of Durable Goods ex. defense and aircraft (RBCCS) and YOY Change

Headline: Durable goods orders ex-transportation fall in June

WASHINGTON (Reuters)- – New orders for a range of long-lasting manufactured goods fell in June and a gauge of planned business spending plans dropped, pointing to a slowdown in factory activity.

The Commerce Department said on Thursday durable goods orders excluding transportation dropped 1.1 percent, the biggest decline since January, after rising 0.8 percent in May. Economists had forecast this category being flat last month.

Overall orders increased 1.6 percent as demand for aircraft surged, after an upwardly revised 1.6 percent increase the prior month.

Economists polled by Reuters had forecast orders for durable goods, items from toasters to aircraft that are meant to last at least three years, rising 0.4 percent after a previously reported 1.3 percent increase in May.

"The manufacturing sector is going through a weak patch with orders excluding transportation falling over the last three months. This is also the message of the sub-50 readings on the ISM manufacturing composite and new orders indexes for June," said John Ryding, chief economist at RDQ Economics in New York.

Source: finance.yahoo.com

More…

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment