Europe Is Still In A Death Spiral

Replacing old impaired debt with new impaired debt does not generate growth. Borrowing more money will not reverse financial death spirals. Sorry, Bucko--Europe is still in a financial death spiral. Friday's "fix" changed nothing except the names of entities holding impaired debt. We can lay out the death spiral dynamics thusly:from, The Victory Report:

Dr. Doom Marc Faber Suggests The Markets will crash within 12 months.

Faber On Europe: Think GERxit Not GRExit

In line with our views on Europe's endgame, Marc Faber opined on Bloomberg TV this morning that if he "was running Germany, [he] would have abandoned the eurozone last week".

We suspect that given the lack of real steps forward and no additional

exposure (as yet) for Germany that they can hang on a little longer

before they reach the final phase of the game-theoretically optimal exit

(that Credit Suisse and us share) of a mercantilist GERxit occurring sooner than many think

(benefiting from deposit inflows and low-EUR-based high profitability

from exports for as long as possible and not a moment longer). The "cosmetic fix" of this latest summit, as Faber calls it, simply does not solve the fundamental problem

of over-investment in the euro-zone. He is bottom-fishing in some

European equities (though avoiding banks) and is not long the Euro here

as he sees the modest rally in risk assets in Europe as merely a

reflection of illiquidity and a grossly oversold market reverting on

'not a total disaster' though he reminds us early on that "pooling 100

sick banks does not make them healthy."

In line with our views on Europe's endgame, Marc Faber opined on Bloomberg TV this morning that if he "was running Germany, [he] would have abandoned the eurozone last week".

We suspect that given the lack of real steps forward and no additional

exposure (as yet) for Germany that they can hang on a little longer

before they reach the final phase of the game-theoretically optimal exit

(that Credit Suisse and us share) of a mercantilist GERxit occurring sooner than many think

(benefiting from deposit inflows and low-EUR-based high profitability

from exports for as long as possible and not a moment longer). The "cosmetic fix" of this latest summit, as Faber calls it, simply does not solve the fundamental problem

of over-investment in the euro-zone. He is bottom-fishing in some

European equities (though avoiding banks) and is not long the Euro here

as he sees the modest rally in risk assets in Europe as merely a

reflection of illiquidity and a grossly oversold market reverting on

'not a total disaster' though he reminds us early on that "pooling 100

sick banks does not make them healthy."Crude Spikes On News Iran Lawmakers Propose Straits Of Hormuz Blockade For Sanctions Countries

What goes down, must come up. In this case crude, which is soaring on news out of FARS that Iranian lawmakers have drafted a bill proposing a

blockade of the Straits of Hormuz for oil tankers heading to sanctions

supporters, i.e., embargo countries. Naturally, if implemented, this

would mean an almost inevitable military retaliation on behalf of the

"western world." Then again, this is not the first time Iran has

postured with a blockade. If indeed willing to follow through, it surely

mean Iran has at least implicit whisper support of Russian and Chinese

support when the situation inevitably escalates.

What goes down, must come up. In this case crude, which is soaring on news out of FARS that Iranian lawmakers have drafted a bill proposing a

blockade of the Straits of Hormuz for oil tankers heading to sanctions

supporters, i.e., embargo countries. Naturally, if implemented, this

would mean an almost inevitable military retaliation on behalf of the

"western world." Then again, this is not the first time Iran has

postured with a blockade. If indeed willing to follow through, it surely

mean Iran has at least implicit whisper support of Russian and Chinese

support when the situation inevitably escalates.Charting The Exponential Function Of Financial Complexity

There is a perverse macro-level outcome from over-zealous central-planning.

We have talked in the past about the greater risk of huge tail events

in a controlled/normalized/planned/smoothed world, but as SocGen's

Dylan Grice in an analogy to driving: "traffic lights and road signs

are well intentioned, but by subtly encouraging us to lower our guard

they subtly alter the fundamental algorithm dictating micro-level

driving behavior." In other words, we drop our guard. With the plethora

of financial market traffic light and road signs (Basel III, Solvency

II, Bernanke Put) the fear is that this illusion of capital or safety

has made markets more lethal (think AAA-rated bonds for a simple

example). "We should be

able to understand that the world isn’t risk free, can never be made

risk free and that regulations which trick people into thinking it is

risk free serve only to make it more dangerous." But instead, following the rule-of-Iksil (baffling with bullshit), regulators have gone the traditional route - but this time to an exponential place of craziness with Dodd-Frank - layering complexity upon complexity to give an out to those who abuse it most.

Perhaps, as Grice notes, instead of focusing on 'fixing' the "crisis

of capitalism", it would be more pragmatic to focus on the "crisis of dumb counterproductive intervention"?

There is a perverse macro-level outcome from over-zealous central-planning.

We have talked in the past about the greater risk of huge tail events

in a controlled/normalized/planned/smoothed world, but as SocGen's

Dylan Grice in an analogy to driving: "traffic lights and road signs

are well intentioned, but by subtly encouraging us to lower our guard

they subtly alter the fundamental algorithm dictating micro-level

driving behavior." In other words, we drop our guard. With the plethora

of financial market traffic light and road signs (Basel III, Solvency

II, Bernanke Put) the fear is that this illusion of capital or safety

has made markets more lethal (think AAA-rated bonds for a simple

example). "We should be

able to understand that the world isn’t risk free, can never be made

risk free and that regulations which trick people into thinking it is

risk free serve only to make it more dangerous." But instead, following the rule-of-Iksil (baffling with bullshit), regulators have gone the traditional route - but this time to an exponential place of craziness with Dodd-Frank - layering complexity upon complexity to give an out to those who abuse it most.

Perhaps, as Grice notes, instead of focusing on 'fixing' the "crisis

of capitalism", it would be more pragmatic to focus on the "crisis of dumb counterproductive intervention"?Eurozone: It`s Another Cosmetic Fix

Admin at Marc Faber Blog - 4 minutes ago

If you put one or 100 sick banks in a union, it does not change the fact

that they're sick. In my view the markets are rallying because they were

grossly oversold. When markets are grossly oversold, especially markets of

Portugal, Spain, Italy, France, then any news that is not disastrous news

propels stocks higher. I think that combined with seasonal strength in

July, the rally has carried on somewhat.

But it is another cosmetic fix, a quick fix that does not solve the

long-term fundamental problem of over investment in the euro zone. And what

it does, basically, it forces Germans ... more »

Manufacturing activity shrinks in June, ISM says

Eric De Groot at Eric De Groot - 29 minutes ago

The prices paid (PP) to National Purchasing Manager's Index (PMI) ratio

violated its power up trend in July 2011 (chart). It's been generally

downhill since then. Investors and traders a just beginning to realize

something Insight readers have known for some time that the economy has

been decelerating for months. Can you hear Jim saying, "QE to infinity

baby" behind his trading desk...

[[ This is a content summary only. Visit my website for full links, other

content, and more! ]]

Retailers see Fourth of July spending fizzle

Eric De Groot at Eric De Groot - 1 hour ago

Normal 0 MicrosoftInternetExplorer4 /* Style Definitions */

table.MsoNormalTable {mso-style-name:"Table Normal";

mso-tstyle-rowband-size:0; mso-tstyle-colband-size:0; mso-style-noshow:yes;

mso-style-parent:""; mso-padding-alt:0in 5.4pt 0in 5.4pt;

mso-para-margin:0in; mso-para-margin-bottom:.0001pt;

mso-pagination:widow-orphan; font-size:10.0pt; ...

[[ This is a content summary only. Visit my website for full links, other

content, and more! ]]

I Am Bearish About US Treasuries

Admin at Marc Faber Blog - 2 hours ago

I am bearish basically about US treasuries and government bonds in general.

I think that equities will outperform bonds. - *in ET*

Related: ProShares UltraShort 20+ Year Treasuries ETF (TBT), iShares

Barclays 20+ Yr Treasury Bond ETF (TLT), iShares Lehman 7-10 Year Treasury

Bond ETF (IEF)

*Marc Faber is an international investor known for his uncanny predictions

of the stock market and futures markets around the world.*Chart Of The Day: Fed Interventions Since 2008

The chart below, via Stone McCarthy, shows the months with Fed intervention since December 2008. That in the past 42 or so months, less than one third have been intervention-free, should close any open

questions about whether the stock "market" is anything but a policy

vehicle used by the Fed to perpetuate a broke(n) status quo now entirely

dependent on every market up (and down) tick. We dread to think what

would happen to those record low US bond yields if the market

were to be left on its own without the backstop of guaranteed Fed

intervention in the interest rate market... ironically something which

Barclays is in boiling hot water for right about now.

The chart below, via Stone McCarthy, shows the months with Fed intervention since December 2008. That in the past 42 or so months, less than one third have been intervention-free, should close any open

questions about whether the stock "market" is anything but a policy

vehicle used by the Fed to perpetuate a broke(n) status quo now entirely

dependent on every market up (and down) tick. We dread to think what

would happen to those record low US bond yields if the market

were to be left on its own without the backstop of guaranteed Fed

intervention in the interest rate market... ironically something which

Barclays is in boiling hot water for right about now.Euro Bailout Fatigue

Judging by the market's response to the latest European bailout, the one associated with Germany supposedly 'folding' on austerity and being beaten down by her broke neighbors, and which according to the chart below had a half-life of one full day; the market has already priced in all the news and is now praying for more monetary morphine from the ECB and BOE this week. It will almost certainly get those. Then what: a half life of 12 hours? 6 hours? Or zero (and will Torres come on with 45 minutes to the close to save the day?)

What Do Treasuries Know That Stocks Don't?

With

the end of Operation Twist and a dismal multi-year low print in ISM, it

seems Treasuries are a little less sanguine at the hope for a

week-/month-/quarter-start bid for risk than equities. 10Y rates are

back near Friday's lows while S&P 500 e-mini futures are 40-45

points higher. Does Operation Twist+ have that much impact? Is 'bad' good once again for QE hopes?

With

the end of Operation Twist and a dismal multi-year low print in ISM, it

seems Treasuries are a little less sanguine at the hope for a

week-/month-/quarter-start bid for risk than equities. 10Y rates are

back near Friday's lows while S&P 500 e-mini futures are 40-45

points higher. Does Operation Twist+ have that much impact? Is 'bad' good once again for QE hopes?Houston, We Have Contraction

And so we have recoupling, with the ISM printing below 50 (i.e. contraction) at 49.7 for the first time since July 2009.

Expectations of a 52.5 print were obviously blown away, as the final

number came well below the lowest Wall Street forecast of 50.5. Prices

plunge to 37 on expectation of 57 and there go your corporate margins;

Employment down from 56.9 to 56.6, and New Orders implode from 60.1 to

47.8. Epic disaster which proves that no, decoupling, does not exist and

now puts the Fed back in play, which however, with the S&P just

shy of 2012 highs, can do didley squat.

And so we have recoupling, with the ISM printing below 50 (i.e. contraction) at 49.7 for the first time since July 2009.

Expectations of a 52.5 print were obviously blown away, as the final

number came well below the lowest Wall Street forecast of 50.5. Prices

plunge to 37 on expectation of 57 and there go your corporate margins;

Employment down from 56.9 to 56.6, and New Orders implode from 60.1 to

47.8. Epic disaster which proves that no, decoupling, does not exist and

now puts the Fed back in play, which however, with the S&P just

shy of 2012 highs, can do didley squat.Is The Swiss National Bank Faking It?

Some time ago we said that

in a world in which virtually every risk and liquidity benchmark is

manipulated by either private banks (thank your Liebor) or central

banks, if one needs to know the true state of events in Europe, the only

real remaining, unmanipulated benchmark remain Swiss nominal bond

yields. And at -23.5 bps for the 2 Year it is telling us that nothing is

fixed. As usual. Also judging by the SNB's new head Jordan statements

which just hit the tape, in which he says that he would not rule out

capital controls or negative rates if the crisis worsens, the SNB gets

it. Or does it? Jordan also said that the SNB is ready to defend the

FX market with unlimited market purchases if necessary. However, as

the note below from JPM shows, the SNB may simply be faking it, hoping

it too can get away with simple jawboning, instead of actually

putting its money where its mouth is. As it turns out the SNB has

indeed been intervening in huge size in the month of May to keep the

EURCHF peg. The previously undisclosed news is that it has also been

sterilizing its purchases. As JPM further notes: "This is

highly significant and undermines the credibility of the SNB’s claim

that it is willing to do whatever it takes to hold EUR/CHF 1.20. For

the floor to be credible the SNB needs to surrender control over the

Swiss monetary based, i.e. it has to be willing to deliver both

unlimited and unsterilised FX intervention. The intervention in May was

certainly unlimited; it most definitely was not unsterilised." How

long until the FX vigilantes decide to test just how far the SNB is

truly willing to go in defending the peg? And what happens when Swiss

nominal yields hit record negative numbers once again?

Some time ago we said that

in a world in which virtually every risk and liquidity benchmark is

manipulated by either private banks (thank your Liebor) or central

banks, if one needs to know the true state of events in Europe, the only

real remaining, unmanipulated benchmark remain Swiss nominal bond

yields. And at -23.5 bps for the 2 Year it is telling us that nothing is

fixed. As usual. Also judging by the SNB's new head Jordan statements

which just hit the tape, in which he says that he would not rule out

capital controls or negative rates if the crisis worsens, the SNB gets

it. Or does it? Jordan also said that the SNB is ready to defend the

FX market with unlimited market purchases if necessary. However, as

the note below from JPM shows, the SNB may simply be faking it, hoping

it too can get away with simple jawboning, instead of actually

putting its money where its mouth is. As it turns out the SNB has

indeed been intervening in huge size in the month of May to keep the

EURCHF peg. The previously undisclosed news is that it has also been

sterilizing its purchases. As JPM further notes: "This is

highly significant and undermines the credibility of the SNB’s claim

that it is willing to do whatever it takes to hold EUR/CHF 1.20. For

the floor to be credible the SNB needs to surrender control over the

Swiss monetary based, i.e. it has to be willing to deliver both

unlimited and unsterilised FX intervention. The intervention in May was

certainly unlimited; it most definitely was not unsterilised." How

long until the FX vigilantes decide to test just how far the SNB is

truly willing to go in defending the peg? And what happens when Swiss

nominal yields hit record negative numbers once again?China's Landing Getting Harder As Stimulus Fails To Prime Pump

The

spread between HSBC's and China's version of Manufacturing PMI

increased a little over the weekend when the headline of China's data

point managed to cling perilously above the 50-line of expansion over

contraction (while HSBC's drifts lower and lower under 50). The headline

print - still its lowest since Nov 11 - however, hides a much less

sanguine truth in the sub-indices with the new orders index fell once

again staying in the contractionary territory under 50. What is

more worrisome for China (and implicitly the rest of the world) is

that while transport equipment and electrical machinery improved

(explicitly thanks to government funded infrastructure projects) there

has been no multiplier effect of a broad-based investment rebound. As

Credit Suisse notes: "The stimuli launched in middle of May

seems to have failed to jump-start the overall economy, yet the

moderation in PMI is not severe enough to justify a much more

aggressive rescue package."

The

spread between HSBC's and China's version of Manufacturing PMI

increased a little over the weekend when the headline of China's data

point managed to cling perilously above the 50-line of expansion over

contraction (while HSBC's drifts lower and lower under 50). The headline

print - still its lowest since Nov 11 - however, hides a much less

sanguine truth in the sub-indices with the new orders index fell once

again staying in the contractionary territory under 50. What is

more worrisome for China (and implicitly the rest of the world) is

that while transport equipment and electrical machinery improved

(explicitly thanks to government funded infrastructure projects) there

has been no multiplier effect of a broad-based investment rebound. As

Credit Suisse notes: "The stimuli launched in middle of May

seems to have failed to jump-start the overall economy, yet the

moderation in PMI is not severe enough to justify a much more

aggressive rescue package."

by The Daily Bell:

Barclays

Chairman Marcus Agius resigns over rate rigging … Marcus Agius, the

chairman of Barclays, has resigned over the interest rate rigging

scandal at the bank. He is stepping down in the wake of fierce

shareholder and political pressure over the bank’s “misconduct”.

Barclays was fined a record £290m last week for attempting to manipulate

the interbank lending rate, Libor, between 2005 and 2009. – UK

Telegraph

Barclays

Chairman Marcus Agius resigns over rate rigging … Marcus Agius, the

chairman of Barclays, has resigned over the interest rate rigging

scandal at the bank. He is stepping down in the wake of fierce

shareholder and political pressure over the bank’s “misconduct”.

Barclays was fined a record £290m last week for attempting to manipulate

the interbank lending rate, Libor, between 2005 and 2009. – UK

TelegraphDominant Social Theme: These banks cannot be trusted.

Free-Market Analysis: The Barclays scandal grows worse and worse. So here’s a question: If you asked the average man on the street what the fuss was about, what answer would you get?

And if you told him the LIBOR rate was subjective anyway, what would be the response? And that Barclays seems to have set the rate LOWER than might have been warranted? .

Read More @ TheDailyBell.com

We The Sheeplez... is intended to reflect

excellence in effort and content. Donations will help maintain this goal

and defray the operational costs. Paypal, a leading provider of secure

online money transfers, will handle the donations. Thank you for your

contribution.

I'm PayPal Verified

by Dr. Paul Craig Roberts, PaulCraigRoberts.org:

Information has been leaked about the Trans Pacific Partnership (TPP),

which is being negotiated in secret by US Trade Representative Ron

Kirk. Six hundred corporate “advisors” are in on the know, but not

Congress or the media. Ron Wyden, chairman of the Senate trade

subcommittee that has jurisdiction over the TPP, has not been permitted

to see the text or to know the content.

Information has been leaked about the Trans Pacific Partnership (TPP),

which is being negotiated in secret by US Trade Representative Ron

Kirk. Six hundred corporate “advisors” are in on the know, but not

Congress or the media. Ron Wyden, chairman of the Senate trade

subcommittee that has jurisdiction over the TPP, has not been permitted

to see the text or to know the content.The TPP has been called a “one-percenter” power tool. The agreement essentially abolishes the accountability of foreign corporations to governments of countries with which they trade. Indeed, the agreement makes governments accountable to corporations for costs imposed by regulations, including health, safety and environmental regulations. The agreement gives corporations the right to make governments pay them for the cost of complying with the regulations of government. One wonders how long environmental, labor, and financial regulation can survive when the costs of compliance are imposed on the taxpayers of countries and not on the economic activity that results in spillover effects such as pollution.

Many will interpret the TPP as another big step toward the establishment of global government in the New World Order. However, what the TPP actually does is to remove corporations or the spillover effects of their activities from the reach of government. As the TPP does not transfer to corporations the power to govern countries, it is difficult to see how it leads to global government. The real result is global privilege of the corporate class as a class immune to government regulation.

Read More @ PaulCraigRoberts.org

BTFD...

by Lawrence Williams, MineWeb.com

Bulls will be bulls and bears will be bears. Contrasting viewpoints

on the likely path of the gold price abound – no wonder the investor who

relies on advice from recognised ‘experts’ in the field just doesn’t

know which way to turn – and why the huge majority have continued to

ignore gold as an investment or wealth protector all the way through the

yellow metal’s bull run.

Bulls will be bulls and bears will be bears. Contrasting viewpoints

on the likely path of the gold price abound – no wonder the investor who

relies on advice from recognised ‘experts’ in the field just doesn’t

know which way to turn – and why the huge majority have continued to

ignore gold as an investment or wealth protector all the way through the

yellow metal’s bull run.

The latest ‘expert’ to see his airs viewed on no less a website than that of U.S. based CNBC – the self styled ‘recognized world leader in business news’ – is Yoni Jacobs of Chart Prophet Capital who is most definitely in the bear camp as far as gold is concerned.

“Technical levels show us when the trouble is coming. Gold struggled at $1,700 and then at $1,600. If it breaks through the next key level of $1,500, which could be approaching soon, investors would start panicking and selling hard,” said Jacobs. “It appears that the market has decided on gold’s fate. And it’s not looking pretty. It looks like gold is about to see prices collapse and is on its way to $700″

Read More @ MineWeb.com

Bulls will be bulls and bears will be bears. Contrasting viewpoints

on the likely path of the gold price abound – no wonder the investor who

relies on advice from recognised ‘experts’ in the field just doesn’t

know which way to turn – and why the huge majority have continued to

ignore gold as an investment or wealth protector all the way through the

yellow metal’s bull run.

Bulls will be bulls and bears will be bears. Contrasting viewpoints

on the likely path of the gold price abound – no wonder the investor who

relies on advice from recognised ‘experts’ in the field just doesn’t

know which way to turn – and why the huge majority have continued to

ignore gold as an investment or wealth protector all the way through the

yellow metal’s bull run.The latest ‘expert’ to see his airs viewed on no less a website than that of U.S. based CNBC – the self styled ‘recognized world leader in business news’ – is Yoni Jacobs of Chart Prophet Capital who is most definitely in the bear camp as far as gold is concerned.

“Technical levels show us when the trouble is coming. Gold struggled at $1,700 and then at $1,600. If it breaks through the next key level of $1,500, which could be approaching soon, investors would start panicking and selling hard,” said Jacobs. “It appears that the market has decided on gold’s fate. And it’s not looking pretty. It looks like gold is about to see prices collapse and is on its way to $700″

Read More @ MineWeb.com

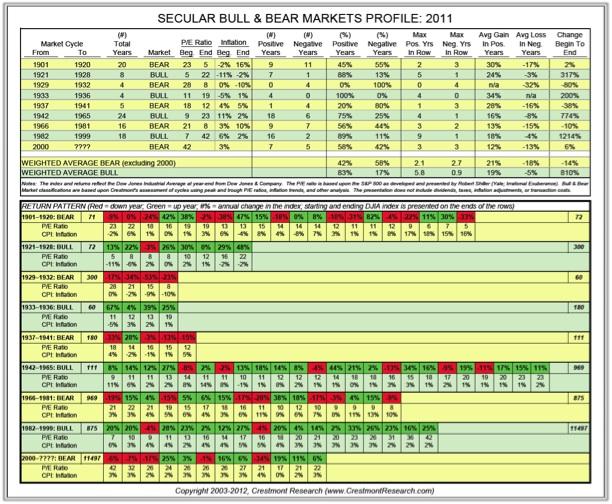

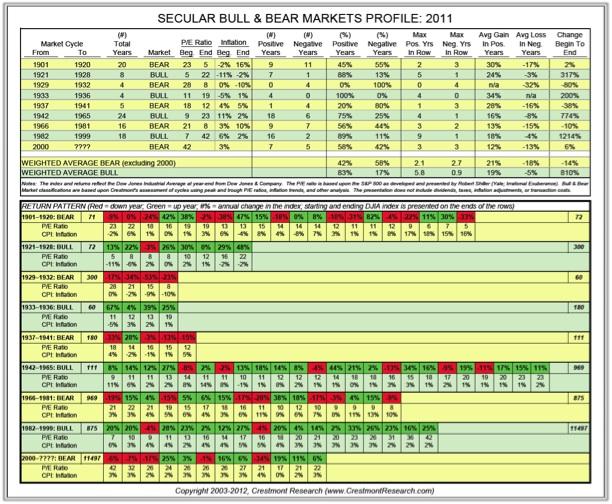

By John Mauldin, The Market Oracle:

It’s been almost a decade since I co-authored with Ed Easterling of

Crestmont Research some research in this letter that later became

chapters five and six of Bull’s Eye Investing. Although the ten-year

anniversary of the book is actually 2013, the current vulnerabilities in

the markets encouraged us to revisit the material a bit early, to

prepare you for what lies ahead. Reflecting back to yesteryear gives us

the opportunity to assess the accuracy of our insights.

It’s been almost a decade since I co-authored with Ed Easterling of

Crestmont Research some research in this letter that later became

chapters five and six of Bull’s Eye Investing. Although the ten-year

anniversary of the book is actually 2013, the current vulnerabilities in

the markets encouraged us to revisit the material a bit early, to

prepare you for what lies ahead. Reflecting back to yesteryear gives us

the opportunity to assess the accuracy of our insights.

I am in Tuscany at the moment, watching the sun set over the Tuscan hills; so I will thank Ed for doing the heavy lifting in this letter while I get to relax, although there is so much going on and I am such a junkie that I am forced to get my current-events fix every day. I must say, the news certainly provides some very pure adrenaline rushes. But more on that at the end. For now we take the longer view of the stock market that I first wrote about at the end of the last century, and to which Ed added some real meat in early 2003.

Read More @ TheMarketOracle.co.uk

It’s been almost a decade since I co-authored with Ed Easterling of

Crestmont Research some research in this letter that later became

chapters five and six of Bull’s Eye Investing. Although the ten-year

anniversary of the book is actually 2013, the current vulnerabilities in

the markets encouraged us to revisit the material a bit early, to

prepare you for what lies ahead. Reflecting back to yesteryear gives us

the opportunity to assess the accuracy of our insights.

It’s been almost a decade since I co-authored with Ed Easterling of

Crestmont Research some research in this letter that later became

chapters five and six of Bull’s Eye Investing. Although the ten-year

anniversary of the book is actually 2013, the current vulnerabilities in

the markets encouraged us to revisit the material a bit early, to

prepare you for what lies ahead. Reflecting back to yesteryear gives us

the opportunity to assess the accuracy of our insights. I am in Tuscany at the moment, watching the sun set over the Tuscan hills; so I will thank Ed for doing the heavy lifting in this letter while I get to relax, although there is so much going on and I am such a junkie that I am forced to get my current-events fix every day. I must say, the news certainly provides some very pure adrenaline rushes. But more on that at the end. For now we take the longer view of the stock market that I first wrote about at the end of the last century, and to which Ed added some real meat in early 2003.

Read More @ TheMarketOracle.co.uk

from TF Metals Report:

It’s going to be a weird one. A big up day last Friday. CoT Tuesday is

ahead of a market-closed Wednesday and then Friday is the next BLSBS

report. All in all, it’s very hard to predict what will happen. You know

what that means don’t you? Another hat contest!

It’s going to be a weird one. A big up day last Friday. CoT Tuesday is

ahead of a market-closed Wednesday and then Friday is the next BLSBS

report. All in all, it’s very hard to predict what will happen. You know

what that means don’t you? Another hat contest!

First of all, today will likely be flat-to-down. As Ranting Andy likes to point out, The Cartel rarely/never allows a second UP day after a big move. So far, that’s about how things are playing out. Gold is down $5 and silver is unch, both on light volume.

Tomorrow is CoT Tuesday and the last trading day until Thursday (American Independence Day is Wednesday). You’ll recall that Friday, June 1 was a $58 UP day. Monday, the 4th was down $8 and CoT Tuesday, the 5th was up $3. Does this gives us any clues following last Friday’s $54 UP day? Yes and no. Yes for today, tomorrow not so much because of the Wednesday holiday.

I would expect a bit of an UPward bias on Thursday ahead of the BLSBS. Why? To me, there’s a pretty strong likelihood that the BLSBS on Friday is going to be a stinker. Last month was +69,000 and this was only because of a 200,000+ birth/death adjustment. Given the economic data since and the uncertainty surrounding the Obamacare SCOTUS decision, the odds to seem to favor a very light number. Something less than 50,000? I can almost hear Hampton Pearson now: “UP 27,000. Non-farm payrolls for June were up just 27,000″. We’ll see.

Read More @ TF Metals Report.com

It’s going to be a weird one. A big up day last Friday. CoT Tuesday is

ahead of a market-closed Wednesday and then Friday is the next BLSBS

report. All in all, it’s very hard to predict what will happen. You know

what that means don’t you? Another hat contest!

It’s going to be a weird one. A big up day last Friday. CoT Tuesday is

ahead of a market-closed Wednesday and then Friday is the next BLSBS

report. All in all, it’s very hard to predict what will happen. You know

what that means don’t you? Another hat contest!First of all, today will likely be flat-to-down. As Ranting Andy likes to point out, The Cartel rarely/never allows a second UP day after a big move. So far, that’s about how things are playing out. Gold is down $5 and silver is unch, both on light volume.

Tomorrow is CoT Tuesday and the last trading day until Thursday (American Independence Day is Wednesday). You’ll recall that Friday, June 1 was a $58 UP day. Monday, the 4th was down $8 and CoT Tuesday, the 5th was up $3. Does this gives us any clues following last Friday’s $54 UP day? Yes and no. Yes for today, tomorrow not so much because of the Wednesday holiday.

I would expect a bit of an UPward bias on Thursday ahead of the BLSBS. Why? To me, there’s a pretty strong likelihood that the BLSBS on Friday is going to be a stinker. Last month was +69,000 and this was only because of a 200,000+ birth/death adjustment. Given the economic data since and the uncertainty surrounding the Obamacare SCOTUS decision, the odds to seem to favor a very light number. Something less than 50,000? I can almost hear Hampton Pearson now: “UP 27,000. Non-farm payrolls for June were up just 27,000″. We’ll see.

Read More @ TF Metals Report.com

by Clive Maund, Gold Seek:

The European Union is a creation of global elitists, the Bilderberg et

al, in pursuit of their long-term goal of a world government. Whether

this is a good thing or not depends in large part on whether politicians

in positions of great power can be trusted to behave fairly and

responsibly. In deciding if this is the case you have plenty of

empirical evidence to assist you in making up your mind, based on their

activities and antics of the past several years and their consequences

for the global populace.

The European Union is a creation of global elitists, the Bilderberg et

al, in pursuit of their long-term goal of a world government. Whether

this is a good thing or not depends in large part on whether politicians

in positions of great power can be trusted to behave fairly and

responsibly. In deciding if this is the case you have plenty of

empirical evidence to assist you in making up your mind, based on their

activities and antics of the past several years and their consequences

for the global populace.

The core problem of the European Union, that has led to the major crisis that it now faces is that it is, or has been up to now structurally dysfunctional. When the European Union was created the levels of integration and cooperation necessary to make it run smoothly were simply not possible because the citizens and electorates of the individual states within it refused to cede sufficient sovereignty to achieve this, and many politicians were similarly inclined – it would take a “back to the wall” steadily intensifying crisis such as we have seen over the past several years to make them yield. Here we should note that many politicians in Europe are as much in the dark as those they rule with regard to the master plan of the elites, and they have dug their heels in defending what they view as their national interest, a prime example being Mrs Merkel of Germany – but the situation had become so extreme that she and others like her have finally been forced to give significant ground.

Read More @ GoldSeek.com

The European Union is a creation of global elitists, the Bilderberg et

al, in pursuit of their long-term goal of a world government. Whether

this is a good thing or not depends in large part on whether politicians

in positions of great power can be trusted to behave fairly and

responsibly. In deciding if this is the case you have plenty of

empirical evidence to assist you in making up your mind, based on their

activities and antics of the past several years and their consequences

for the global populace.

The European Union is a creation of global elitists, the Bilderberg et

al, in pursuit of their long-term goal of a world government. Whether

this is a good thing or not depends in large part on whether politicians

in positions of great power can be trusted to behave fairly and

responsibly. In deciding if this is the case you have plenty of

empirical evidence to assist you in making up your mind, based on their

activities and antics of the past several years and their consequences

for the global populace.The core problem of the European Union, that has led to the major crisis that it now faces is that it is, or has been up to now structurally dysfunctional. When the European Union was created the levels of integration and cooperation necessary to make it run smoothly were simply not possible because the citizens and electorates of the individual states within it refused to cede sufficient sovereignty to achieve this, and many politicians were similarly inclined – it would take a “back to the wall” steadily intensifying crisis such as we have seen over the past several years to make them yield. Here we should note that many politicians in Europe are as much in the dark as those they rule with regard to the master plan of the elites, and they have dug their heels in defending what they view as their national interest, a prime example being Mrs Merkel of Germany – but the situation had become so extreme that she and others like her have finally been forced to give significant ground.

Read More @ GoldSeek.com

By Bill Bonner, Daily Reckoning.com.au:

“The US seems to have gotten the worst of it,” said a French friend this morning. We were taken aback. Everyone knows Europe is in a state of permanent crisis. The US seems solid by comparison, no?

“The US seems to have gotten the worst of it,” said a French friend this morning. We were taken aback. Everyone knows Europe is in a state of permanent crisis. The US seems solid by comparison, no?

“Now that the Supreme Court has approved Obamacare, you have the same problems we have in Europe, social welfare spending with no limits…plus you have your colossal military spending. You have both ‘bread and circuses,’ just like the ancient Romans. You are doomed.”

Yes, dear reader, we came to the fork in the road after the 9/11 attack. And the government took it!

And now the feds can fork over whoever and whatever they want. No kidding. They just have to think of it as a tax. Here’s AP’s report:

Health care law survives with Roberts’ help

WASHINGTON (AP) — America’s historic health care overhaul, certain now to touch virtually every citizen’s life, narrowly survived an election-year battle at the Supreme Court Thursday with the improbable help of conservative Chief Justice John Roberts.

Read More @ DailyReckoning.com.au

“The US seems to have gotten the worst of it,” said a French friend this morning. We were taken aback. Everyone knows Europe is in a state of permanent crisis. The US seems solid by comparison, no?

“The US seems to have gotten the worst of it,” said a French friend this morning. We were taken aback. Everyone knows Europe is in a state of permanent crisis. The US seems solid by comparison, no?“Now that the Supreme Court has approved Obamacare, you have the same problems we have in Europe, social welfare spending with no limits…plus you have your colossal military spending. You have both ‘bread and circuses,’ just like the ancient Romans. You are doomed.”

Yes, dear reader, we came to the fork in the road after the 9/11 attack. And the government took it!

And now the feds can fork over whoever and whatever they want. No kidding. They just have to think of it as a tax. Here’s AP’s report:

Health care law survives with Roberts’ help

WASHINGTON (AP) — America’s historic health care overhaul, certain now to touch virtually every citizen’s life, narrowly survived an election-year battle at the Supreme Court Thursday with the improbable help of conservative Chief Justice John Roberts.

Read More @ DailyReckoning.com.au

by Firearms Blog, Prison Planet:

Google sent out an email to Google Adwords customers saying that they are going to pull all Google Shopping results for guns, ammunition, gun optics and gun accessories (Shopping results, not general search results).

Google sent out an email to Google Adwords customers saying that they are going to pull all Google Shopping results for guns, ammunition, gun optics and gun accessories (Shopping results, not general search results).

HamLund Tactical received this email and posted it on 68forums.com (emphasis added) …

Google sent out an email to Google Adwords customers saying that they are going to pull all Google Shopping results for guns, ammunition, gun optics and gun accessories (Shopping results, not general search results).

Google sent out an email to Google Adwords customers saying that they are going to pull all Google Shopping results for guns, ammunition, gun optics and gun accessories (Shopping results, not general search results).HamLund Tactical received this email and posted it on 68forums.com (emphasis added) …

Dear Merchant,

We’re writing to let you know about some upcoming changes to the product listings you submit to Google. As we recently announced, we are starting to transition our shopping experience to a commercial model that builds on Product Listing Ads. This new shopping experience is called Google Shopping. As part of this transition, we’ll begin to enforce a set of new policies for Google Shopping in the coming weeks. A new list of the allowed, restricted, and prohibited products on Google Shopping is available on our new policy page – http://www.google.com/appserve/mkt/ApI7UWRj6OCZpd.

Based on a review of the products you’re currently submitting, it appears that some of the content in your Merchant Center account, HamLund Tactical, will be affected by these policy changes. In particular we found that your products may violate the following policies:

Weapons

When we make this change, Google will disapprove all of the products identified as being in violation of policies. We ask that you make any necessary changes to your feeds and/or site to comply, so that your products can continue to appear on Google Shopping.

Read More @ PrisonPlanet.com

by Bruce Krasting Bruce Krasting Blog:

Holy smokes!

The EU technocrats have finally pulled out the big guns! The agreement

on Friday was to take the incredibly bold step of avoiding subordination

in the Spanish bond market. The money needed for the busted Spanish

banks will now be made available directly from Brussels with few strings

attached. Wow! What a breakthrough!

Holy smokes!

The EU technocrats have finally pulled out the big guns! The agreement

on Friday was to take the incredibly bold step of avoiding subordination

in the Spanish bond market. The money needed for the busted Spanish

banks will now be made available directly from Brussels with few strings

attached. Wow! What a breakthrough!

Global markets have taken a quick look at what has been offered up by the deep thinkers in Euroland and said, “WE LOVE IT!”

Me? I think it’s a spit in the bucket. The half-life of this bailout will be measured in weeks.

We have seen this play out time and again the past four years. The capital markets are forcing policy decisions.

“Wise” people like Paul Krugman have said for years that “Bond Vigilantes” don’t exist. There is no doubt any longer that they exist and are alive, well and hungry. The vigilantes are also armed with highly sophisticated robots that can execute attacks on multiple fronts and across markets in milliseconds. The war going on in the bond markets is not over by a long shot.

Read More @ BruceKrasting.blogspot.com

Holy smokes!

The EU technocrats have finally pulled out the big guns! The agreement

on Friday was to take the incredibly bold step of avoiding subordination

in the Spanish bond market. The money needed for the busted Spanish

banks will now be made available directly from Brussels with few strings

attached. Wow! What a breakthrough!

Holy smokes!

The EU technocrats have finally pulled out the big guns! The agreement

on Friday was to take the incredibly bold step of avoiding subordination

in the Spanish bond market. The money needed for the busted Spanish

banks will now be made available directly from Brussels with few strings

attached. Wow! What a breakthrough!Global markets have taken a quick look at what has been offered up by the deep thinkers in Euroland and said, “WE LOVE IT!”

Me? I think it’s a spit in the bucket. The half-life of this bailout will be measured in weeks.

We have seen this play out time and again the past four years. The capital markets are forcing policy decisions.

“Wise” people like Paul Krugman have said for years that “Bond Vigilantes” don’t exist. There is no doubt any longer that they exist and are alive, well and hungry. The vigilantes are also armed with highly sophisticated robots that can execute attacks on multiple fronts and across markets in milliseconds. The war going on in the bond markets is not over by a long shot.

Read More @ BruceKrasting.blogspot.com

from GoldCore:

Today’s AM fix was USD 1,596.25, EUR 1,263.26, and GBP 1,018.34 per

ounce. Friday’s AM fix was USD 1,569.50, EUR 1,248.01, and GBP 1,006.09

per ounce.

Today’s AM fix was USD 1,596.25, EUR 1,263.26, and GBP 1,018.34 per

ounce. Friday’s AM fix was USD 1,569.50, EUR 1,248.01, and GBP 1,006.09

per ounce.

Gold ticked lower in Asia prior to a brief bounce in Europe prior to further losses which have seen gold fall to 1,590.40 USD/oz. Gold is marginally lower in pounds at 1,015.80 GBP/oz and marginally higher in euros and Swiss francs at 1,263.30 EUR/oz and 1,517.70 CHF/oz.

Gold climbed $50.09 to as high as $1607.09 in early afternoon New York trade Friday and ended with a gain of 2.68% for a gain of 1.65% for the week. Gold made similar gains in other fiat currencies.

Silver surged to as high as $27.918 in early New York trade before it pared its gains a bit, but it still ended with a gain of 3.93% to close 2.1% higher for the week.

NEWSWIRE

(Bloomberg) — U.S. Mint American Gold Coin Sales Climb to Highest Since March

The U.S. Mint sold 54,500 ounces of American Eagle gold coins last month, the most since March. Silver coin sales dropped 9.8 percent.

Sales of the gold coins rose 2.8 percent from 53,000 ounces in May, bringing the total for the year to 338,000 ounces, the Mint’s website shows. That compares with 576,000 ounces in the same six months last year. American Eagle silver coin sales fell to 2.59 million ounces last month, bringing the total for the first six months to 17.13 million ounces. The total was 22.3 million ounces in the same six months last year.

Read More @ GoldCore.com

Today’s AM fix was USD 1,596.25, EUR 1,263.26, and GBP 1,018.34 per

ounce. Friday’s AM fix was USD 1,569.50, EUR 1,248.01, and GBP 1,006.09

per ounce.

Today’s AM fix was USD 1,596.25, EUR 1,263.26, and GBP 1,018.34 per

ounce. Friday’s AM fix was USD 1,569.50, EUR 1,248.01, and GBP 1,006.09

per ounce.Gold ticked lower in Asia prior to a brief bounce in Europe prior to further losses which have seen gold fall to 1,590.40 USD/oz. Gold is marginally lower in pounds at 1,015.80 GBP/oz and marginally higher in euros and Swiss francs at 1,263.30 EUR/oz and 1,517.70 CHF/oz.

Gold climbed $50.09 to as high as $1607.09 in early afternoon New York trade Friday and ended with a gain of 2.68% for a gain of 1.65% for the week. Gold made similar gains in other fiat currencies.

Silver surged to as high as $27.918 in early New York trade before it pared its gains a bit, but it still ended with a gain of 3.93% to close 2.1% higher for the week.

NEWSWIRE

(Bloomberg) — U.S. Mint American Gold Coin Sales Climb to Highest Since March

The U.S. Mint sold 54,500 ounces of American Eagle gold coins last month, the most since March. Silver coin sales dropped 9.8 percent.

Sales of the gold coins rose 2.8 percent from 53,000 ounces in May, bringing the total for the year to 338,000 ounces, the Mint’s website shows. That compares with 576,000 ounces in the same six months last year. American Eagle silver coin sales fell to 2.59 million ounces last month, bringing the total for the first six months to 17.13 million ounces. The total was 22.3 million ounces in the same six months last year.

Read More @ GoldCore.com

by Mike Adams, the Health Ranger, Natural News:

In the wake of violent storms, the power remains out today for millions

of Americans across several U.S. states. Governors of Virginia, West

Virginia and Ohio have declared a state of emergency. Over a dozen

people are now confirmed dead, and millions are sweltering in blistering

temperatures while having no air conditioning or refrigeration. As

their frozen foods melt into processed goo, they’re waking up to a few

lessons that we would all be wise to remember.

In the wake of violent storms, the power remains out today for millions

of Americans across several U.S. states. Governors of Virginia, West

Virginia and Ohio have declared a state of emergency. Over a dozen

people are now confirmed dead, and millions are sweltering in blistering

temperatures while having no air conditioning or refrigeration. As

their frozen foods melt into processed goo, they’re waking up to a few

lessons that we would all be wise to remember.

See some shocking photos of recent weather events, including a trampoline strung over power lines at:

http://www.accuweather.com/en/weather-news/shocking-images-follow-sup…

Here are 10 hard lessons we’re all learning (or re-learning, as the case may be) as we watch this situation unfold:

#1) The power grid is ridiculously vulnerable to disruptions and failure

All it takes is Mother Nature unleashing a little wind storm, and entire human cities are cut off from their power grid. Wind and trees, in other words, can destroy in seconds what takes humans years to construct.

Read More @ NaturalNews.com

In the wake of violent storms, the power remains out today for millions

of Americans across several U.S. states. Governors of Virginia, West

Virginia and Ohio have declared a state of emergency. Over a dozen

people are now confirmed dead, and millions are sweltering in blistering

temperatures while having no air conditioning or refrigeration. As

their frozen foods melt into processed goo, they’re waking up to a few

lessons that we would all be wise to remember.

In the wake of violent storms, the power remains out today for millions

of Americans across several U.S. states. Governors of Virginia, West

Virginia and Ohio have declared a state of emergency. Over a dozen

people are now confirmed dead, and millions are sweltering in blistering

temperatures while having no air conditioning or refrigeration. As

their frozen foods melt into processed goo, they’re waking up to a few

lessons that we would all be wise to remember.See some shocking photos of recent weather events, including a trampoline strung over power lines at:

http://www.accuweather.com/en/weather-news/shocking-images-follow-sup…

Here are 10 hard lessons we’re all learning (or re-learning, as the case may be) as we watch this situation unfold:

#1) The power grid is ridiculously vulnerable to disruptions and failure

All it takes is Mother Nature unleashing a little wind storm, and entire human cities are cut off from their power grid. Wind and trees, in other words, can destroy in seconds what takes humans years to construct.

Read More @ NaturalNews.com

from KingWorldNews:

After a wild week of trading in global markets, today 40 year veteran,

Robert Fitzwilson, wrote the following piece exclusively for King World

News. Fitzwilson is founder of The Portola Group, one of the premier

boutique firms in the United States. Here are Fitzwilson’s observations

on the ongoing crisis: “On a recent excursion, the car in

which we were driving experienced a flat tire. Fortunately, we had not

gotten onto the freeway and a gas station was nearby. We also were

fortunate to have a pressurized product that you can use to seal the

inside of the tire and the puncture. The label on the can said that we

had up to 20 miles of driving to find a tire store.”

After a wild week of trading in global markets, today 40 year veteran,

Robert Fitzwilson, wrote the following piece exclusively for King World

News. Fitzwilson is founder of The Portola Group, one of the premier

boutique firms in the United States. Here are Fitzwilson’s observations

on the ongoing crisis: “On a recent excursion, the car in

which we were driving experienced a flat tire. Fortunately, we had not

gotten onto the freeway and a gas station was nearby. We also were

fortunate to have a pressurized product that you can use to seal the

inside of the tire and the puncture. The label on the can said that we

had up to 20 miles of driving to find a tire store.”

Robert Fitzwilson continues @ KingWorldNews.com

After a wild week of trading in global markets, today 40 year veteran,

Robert Fitzwilson, wrote the following piece exclusively for King World

News. Fitzwilson is founder of The Portola Group, one of the premier

boutique firms in the United States. Here are Fitzwilson’s observations

on the ongoing crisis: “On a recent excursion, the car in

which we were driving experienced a flat tire. Fortunately, we had not

gotten onto the freeway and a gas station was nearby. We also were

fortunate to have a pressurized product that you can use to seal the

inside of the tire and the puncture. The label on the can said that we

had up to 20 miles of driving to find a tire store.”

After a wild week of trading in global markets, today 40 year veteran,

Robert Fitzwilson, wrote the following piece exclusively for King World

News. Fitzwilson is founder of The Portola Group, one of the premier

boutique firms in the United States. Here are Fitzwilson’s observations

on the ongoing crisis: “On a recent excursion, the car in

which we were driving experienced a flat tire. Fortunately, we had not

gotten onto the freeway and a gas station was nearby. We also were

fortunate to have a pressurized product that you can use to seal the

inside of the tire and the puncture. The label on the can said that we

had up to 20 miles of driving to find a tire store.”Robert Fitzwilson continues @ KingWorldNews.com

by Greg Hunter, USAWatchdog:

The big headlines, last week, would lead you to believe the European debt crisis is on its way to being fixed. Reggie Middleton of BoomBustblog.com says, “Europe is insolvent,” and nothing is fixed. Middleton contends, “Collapse in Europe is absolutely unavoidable. It’s a foregone conclusion.” Why should you listen to this entrepreneurial investor?

He has made many stunning calls. He said Bear Stearns was insolvent when its stock was trading for well over $100 per share. He warned about Lehman Brothers and predicted the financial crisis of 2008 long before they happened. Now, he says, “Europe is coming to the end of the road very soon,” and a “system crash is the only way to fix the problem.” Greg Hunter goes “One-on-One” with Reggie Middleton.

I'm PayPal Verified

The big headlines, last week, would lead you to believe the European debt crisis is on its way to being fixed. Reggie Middleton of BoomBustblog.com says, “Europe is insolvent,” and nothing is fixed. Middleton contends, “Collapse in Europe is absolutely unavoidable. It’s a foregone conclusion.” Why should you listen to this entrepreneurial investor?

He has made many stunning calls. He said Bear Stearns was insolvent when its stock was trading for well over $100 per share. He warned about Lehman Brothers and predicted the financial crisis of 2008 long before they happened. Now, he says, “Europe is coming to the end of the road very soon,” and a “system crash is the only way to fix the problem.” Greg Hunter goes “One-on-One” with Reggie Middleton.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment