With

just 5 days needed for the Texas secession petition to surpass 100,000

signatories, all is not well with the Union. Actually, not only are

things not well with the Union, things are getting worse by the minute,

as American society splinters into diametrical opposites to a degree

not seen in decades, a process which in itself virtually assures there

will be no cliff compromise before the opportunity cost of ending the

stand off becomes far too great. And with the option of the Mr.

Chairman "getting to work" to fix things, one wonders - is even the

market a motivating enough factor given a 20, 30 or even 50% drop in

the rearview mirror: after all as the Fed has demonstrated, there is no

need for a fiscal compromise to get the S&P to just shy of all

time highs. Certainly, even America's politicians are very much aware

of this by now (of course, this assumes that Bernanke is still in

charge of the market: something we have claimed for two months is very

much in question). Regardless, with the topic of secession on

everybody's lips, here is what none other than Ron Paul has said about

this suddenly very volatile issue.

With

just 5 days needed for the Texas secession petition to surpass 100,000

signatories, all is not well with the Union. Actually, not only are

things not well with the Union, things are getting worse by the minute,

as American society splinters into diametrical opposites to a degree

not seen in decades, a process which in itself virtually assures there

will be no cliff compromise before the opportunity cost of ending the

stand off becomes far too great. And with the option of the Mr.

Chairman "getting to work" to fix things, one wonders - is even the

market a motivating enough factor given a 20, 30 or even 50% drop in

the rearview mirror: after all as the Fed has demonstrated, there is no

need for a fiscal compromise to get the S&P to just shy of all

time highs. Certainly, even America's politicians are very much aware

of this by now (of course, this assumes that Bernanke is still in

charge of the market: something we have claimed for two months is very

much in question). Regardless, with the topic of secession on

everybody's lips, here is what none other than Ron Paul has said about

this suddenly very volatile issue.The Unabridged Ron Paul Guide To Being A Libertarian

Presented with little comment since whatever we say would likely be superfluous to this all-encompassing speech. The full Ron Paul 'Farewell to Congress' speech and transcript.If nothing else, read the five greatest dangers that the American people face today that impede the goal of a free society....To achieve liberty and peace, two powerful human emotions have to be overcome. Number one is 'envy' which leads to hate and class warfare. Number two is 'intolerance' which leads to bigoted and judgmental policies. These emotions must be replaced with a much better understanding of love, compassion, tolerance and free market economics. Freedom, when understood, brings people together. When tried, freedom is popular.

The best chance for achieving peace and prosperity, for the maximum number of people world-wide, is to pursue the cause of LIBERTY...

Could You Live On Social Security?

$1,130.33 is the average monthly social security benefit. Assuming you worked 40 hours a week, every week, that's the hourly equivalent of $6.40. Where can you live? Will savings save you?

Miligate: Geishas, Courtesans And Groupies

If only the nation’s Founding Fathers could see us now!

A Supreme Court totally gone wild, de facto legislating and imposing

its will; a Congress, lair of lazy career politicians and self-serving

scoundrels; and an Executive, wearing reversible togas colored blue and

red, running the nation as an empire, and using the country’s military

as police force for multi-national predatory capitalism… subsidized by

taxpayers from America’s lower and middle classes. Are we at the embryo stage of a major military scandal… a Miligate? Petraeus and Allen are two Samson-characters who availed their modern day Delilah(s) with a razor-sharp lack of common sense. Paula Broadwell, Jill Kelley and Natalie Khawan are neither geishas, nor courtesans... perhaps more of a groupie-variety

around the military. Let’s all be concerned with pressuring the

politicians to defuse the “fiscal cliff,” and wait until appropriate

investigations are concluded to determine whether there is a Miligate.

If only the nation’s Founding Fathers could see us now!

A Supreme Court totally gone wild, de facto legislating and imposing

its will; a Congress, lair of lazy career politicians and self-serving

scoundrels; and an Executive, wearing reversible togas colored blue and

red, running the nation as an empire, and using the country’s military

as police force for multi-national predatory capitalism… subsidized by

taxpayers from America’s lower and middle classes. Are we at the embryo stage of a major military scandal… a Miligate? Petraeus and Allen are two Samson-characters who availed their modern day Delilah(s) with a razor-sharp lack of common sense. Paula Broadwell, Jill Kelley and Natalie Khawan are neither geishas, nor courtesans... perhaps more of a groupie-variety

around the military. Let’s all be concerned with pressuring the

politicians to defuse the “fiscal cliff,” and wait until appropriate

investigations are concluded to determine whether there is a Miligate.The Four Charts That Corporate Bond Managers Fear The Most

Much

is made of the 'apparent' bubble in Treasury bonds - a 30-year or so

relatively consistent trend in government bonds (through thick and

thin) and yet allocations remain minimal compared to our increasingly similar Japanese friends have experienced.

It would seem to us, thanks to Bernanke's 'visible' hand that the real

bubble is in spread product - as rates are so compressed, investors

seemingly oblivious to the word 'risk' (unintended consequence) have

flooded into ever-increasing yield/spread products - with high-yield

bonds now dominated by these technical inflows (as we noted in the close today).

If ever the combination of anchoring bias, 'dance while the music is

playing', and herding was evident, it is in corporate credit. To wit,

the total disengagement from reality (both real 'micro' earnings

and 'macro' economic uncertainty) that a flood of money has created in

this increasingly crowded (and increasingly-er illiquid) market.

Managers are well aware that the liquidity tsunami has moved the

maturity mountain (as Citi's Matt King notes) but has helped the weeds

as well as the roses.

Much

is made of the 'apparent' bubble in Treasury bonds - a 30-year or so

relatively consistent trend in government bonds (through thick and

thin) and yet allocations remain minimal compared to our increasingly similar Japanese friends have experienced.

It would seem to us, thanks to Bernanke's 'visible' hand that the real

bubble is in spread product - as rates are so compressed, investors

seemingly oblivious to the word 'risk' (unintended consequence) have

flooded into ever-increasing yield/spread products - with high-yield

bonds now dominated by these technical inflows (as we noted in the close today).

If ever the combination of anchoring bias, 'dance while the music is

playing', and herding was evident, it is in corporate credit. To wit,

the total disengagement from reality (both real 'micro' earnings

and 'macro' economic uncertainty) that a flood of money has created in

this increasingly crowded (and increasingly-er illiquid) market.

Managers are well aware that the liquidity tsunami has moved the

maturity mountain (as Citi's Matt King notes) but has helped the weeds

as well as the roses.House Republicans Find Corzine Guilty Of MF Global Collapse, Missing Funds; Democrats Refuse To Endorse Findings

It appears that these days not even the Corzining of client money can happen without it being split across furiously polarized party lines. As it turns out hours ago, the Committee on House Financial Services released an advance glimpse into a report to be released in its entirety tomorrow, which puts the blame for the collapse of not only MF Global, but also the disappearance of millions in client money, right where it belongs: the firm's then CEO Jon Corzine. Yet that Corzine corzined millions, leaving clients scrambling in bankruptcy court in an attempt to recover what should have been segregated money from the very beginning, and also just happened to blow up one of the 21 Fed-anointed Primary Dealers, is not surprising: this has been long known by everyone. Those who need a refresher are urged to recall the Honorable's testimony before the House... or maybe not: after all it is not as if Corzine himself could recall a whole lot. Where it gets interesting is that the former Democratic governor, and senator, not to mention primary bundler for president Obama, is, in the eyes of the members of the committee, innocent: All the democrats on the Investigations Subcommittee refused to sign off on the findings, meaning that to them, Corzine is completely innocent. That this is purely a political move is glaringly obvious. It is also abhorrent, because as long as political ideology gets in the way of pursuing and imposing justice, the Banana States of America will remain just that.Ron Paul's Farewell Speech on the Floor of the House of Representatives

Trader Dan at Trader Dan's Market Views - 4 hours ago

All lovers of liberty should take the time to listen to Dr. Paul's final

speech on the floor of the US House of Representatives. I sincerely doubt I

will ever see his likes again but one can always hope against hope. His

commitment to liberty is indisputable. Perhaps his son will pick up the

banner in 2016.

I cannot but feel a deep sense of loss at a principled man who served his

country and his citizens and somehow managed to keep alive his principles

in the midst of that moral cesspool on the Potomac.

You may not agree with all of this views but at least you knew exactly

where he... more »

Your support is needed...

Thank You

I'm PayPal Verified HUI Chart UPDATE

Trader Dan at Trader Dan's Market Views - 4 hours ago

This is the evening chart update of the HUI after it was further shellacked

during the afternoon hours of today's trading session when the S&P 500

broke down through its technical chart support level.

As you can see on the updated chart, the HUI has one level of chart support

left before it retraces the entirety of its move higher from the late

June/early July rally.

Israel Assassinate key figure in Hamas/ Strikes galore throughout Europe/Greek economy shrinks another 7.2%.European industrial production sinks again/UK Jobless rate increases again/

Harvey Organ at Harvey Organ's - The Daily Gold and Silver Report - 6 hours ago

Good

evening Ladies and Gentlemen:

Gold closed the comex session at $1729.50 up $5.30. Silver however was

the standout rising by 39 cents to $32.87 breaking the $32.50 resistance

level. The bankers showed up at their usual times trying to stall

advances in our two precious metals. They failed badly today. However,

the gold/silver equity shares were taken to the cleaners along with many

of the

S&P 500 Drops through Support

Trader Dan at Trader Dan's Market Views - 8 hours ago

The S&P 500 was attempting to hold near the low formed last week that came

on the heels of the post-election collapse in the US stock markets.

It just so happens that the low was in the very near vicinity to the

critical 50% Fibonacci Retracement Level of the entire rally of the late

May/early June swing low.

It bounced away from that level yesterday but today, down it went.

The index is now poised to drop all the way to the next Fibonacci

retracement level, the 61.8% level, or the 1340-1344 region.

Failing to hold there, it should retrace the entirety of the rally meaning

that we ... more »

Greenlight Capital And Third Point September 30 Holdings Summary

With the star (and legend) of John Paulson long dead and buried, and his Disadvantage Minus fund an embarrassment, wrapped in a monkeyhammering, inside a humiliation, there are few "groupied" HF managers left. One of them is Dan Loeb, who still manages to generate positive Alpha regardless of how Beta does, another one used to be William Ackman (not so much anymore, especially not with the whole JCP fiasco), some others are David Tepper, Seth Klarman, and a few others, but nobody has quite the persistent clout and following of young master, and poker maestro, David Einhorn, and his fund Greenlight. Below we breakdown his latest just released 13F, which as a reminder shows, his holdings as of September 30. Key changes: Einhorn cut his holdings in Best Buy, Carefusion, Compuware, Expedia, Hess and UnitedHealth, and started new, small, positions in Yahoo, Babcock and Wilcox, Aecon and Knight Capital. More importantly, he cut his top position, Apple, by nearly 30% from 1.45 million to 1.09 million shares, cut modestly his second biggest position Seagate, added materially to GM, making it his third position, added to Cigna at #4 and added modestly to the GDX Gold Miners ETF. Sad to say, unless he has changed his portfolio dramatically since September 30, Einhorn is likely not doing too hot, especially in the last week or two.Why The Troika's Forecasts Are A Total Joke In One Easy Chart

The

remarkable forecasting skills of the Troika and the immense decisions

being taken on the back of these 'sacrosanct' projections need to be

put into context. We are more than happy to do that (as we did here - with hilarity ensuing), but the chart below shows even more clearly, so far so bad as the Troika has pretty much nailed it on the 'most optimistic mean-reverting model' ever.

Not wanting to steal the jam from Europe's donut but the forecasts are

- quite evidently - a complete and utter joke. Going forward though,

we are sure it's different this time...

The

remarkable forecasting skills of the Troika and the immense decisions

being taken on the back of these 'sacrosanct' projections need to be

put into context. We are more than happy to do that (as we did here - with hilarity ensuing), but the chart below shows even more clearly, so far so bad as the Troika has pretty much nailed it on the 'most optimistic mean-reverting model' ever.

Not wanting to steal the jam from Europe's donut but the forecasts are

- quite evidently - a complete and utter joke. Going forward though,

we are sure it's different this time...Deer Emerges As Stocks Slump Half Way To Reality

The crowded liquidity-fueled pump-fest of the last few months is beginning to unwind. Look around at where the damage occurred. Equities and Credit were smashed; the USD is practically unchanged; Treasuries very marginally bid; commodities sideways (aside from Oil's oscillations). The close did see some of the other asset classes start to catch down to equity and credit but based on our models, we see the S&P 500 having retraced about half its short-term mispricing relative to Treasuries. All the over-pumped sectors were the biggest laggards - Financials, Industrials, Materials, and Tech - but from the 11/25/11 beginning of the global coordinated central bank pump, there is still plenty of downside for stocks. Our greatest concern now is if high-yield bond ETFs are unwound (where so much liquidity is concentrated) and forces cash bond liquidations - there is simply no depth to soak up that move and the entire secondary market will reprice (and shut the primary market - which has lived on flows for so long).

Tilson Releases September 30 13-F: Top Positions Are AIG And AAPL

Just when we thought blowing up one fund in one year is enough for Whitney Tilson (recall from July: It's Official: T1 Is Not T2; Tilson Liquidates To Buy More Of The Same), we got a glimpse of his just released 13F and are rather confident the man, the myth, the stuff of Anti-Tilson ETFs will shock and awe us all one more time. The reason? As of September 30, Tilson's inaccurately named T2 Partners - it should be T1 now that Glenn Tongue is long gone - had a total of $175 million in AUM. That's not the punchline: as part of this $175 million, Tilson had $63 million in put/call stock equivalents. In other words the much vaunted "asset manager" who for some absolutely inexplicable reason continues to get CNBC airtime, managed a grand total of $110 million in real (mostly family and friends) money. That's not the punchline either. The punchline is that Tilson's top 3 positions were AIG and AAPL, with AIG in both stock and Call format. In fact, more than 10% of the firm's virtual AUM, or $18.6 million was in stock equivalent calls for AIG and AAPL, stocks which since September 30 have gone in a literally, not virtually, straight line lower, and have as a result likely wiped out the entire intrinsic call value. The only silver lining: Tilson owned $5.5 mm in NFLX calls and a grand total of $3.6 million in NFLX stock. We hope it carries him far, because once the Icahn grand jig is up, in which the raider is exposed as having absolutely no intentions of buying the company, or even putting it in play, but merely squeezing the shorts courtesy of a costless collar and a sternly worded 13D, that will be the final straw for Tilson's second coming, and most likely, his career.Adding Insult To Rocket Attacks, Bank of Israel Now Underwater On Its Apple Position

It

was all going so well, first name terms with Obama and AAPL up 30%

from where you bought it... a mere two months later and the Bank of

Israel is now underwater on their AAPL shares and about to print

bullets. We noted in early March what a ridiculous ponzi this was

all becoming when the Bank of Israel announced its purchase of US

equity positions including AAPL. In retrospect it is so gratifying to

gloat at the self-confirming bias that enabled their reserve managers to

buy on the way up as the stock that can do no wrong lifted all boats.

Actually, it is easy to gloat in any 'spect'. We can only

assume that Bernanke's Bat-phone is ringing off the hook this afternoon

to 'get back to work' and come to the aid of his Bank of Israel mentor.

It

was all going so well, first name terms with Obama and AAPL up 30%

from where you bought it... a mere two months later and the Bank of

Israel is now underwater on their AAPL shares and about to print

bullets. We noted in early March what a ridiculous ponzi this was

all becoming when the Bank of Israel announced its purchase of US

equity positions including AAPL. In retrospect it is so gratifying to

gloat at the self-confirming bias that enabled their reserve managers to

buy on the way up as the stock that can do no wrong lifted all boats.

Actually, it is easy to gloat in any 'spect'. We can only

assume that Bernanke's Bat-phone is ringing off the hook this afternoon

to 'get back to work' and come to the aid of his Bank of Israel mentor.

by Alex Pietrowski, Activist Post:

With the defeat of California Prop 37, the fight to require labeling of genetically modified foods has passed on to other states, such as Washington and Vermont. Although California’s initiative failed on election day, the campaign brought national attention to the issue of labeling GM foods, with 30 other states now working to require GMO labels. Dave Murphy, executive director of Food Democracy Now, stated, “More than 4 million Californians are on record saying they want to know what’s in their food. This is a dynamic moment for the food movement.” (MercuryNews.com)

In Vermont, the VT Right to Know GMOs coalition has also started gathering signatures to present to elected officials about the need for GMO labeling on food products sold in retail stores. With this effort, Vermont joins the Coalition of States for Mandatory GMO Labeling comprising of the following states: Arizona, California, Connecticut, Colorado, Florida, Hawaii, Idaho, Illinois, Iowa, Maine, Massachusetts, Minnesota, Mississippi, New Hampshire, New Jersey, New York, North Carolina, South Carolina, Oregon, Pennsylvania, Vermont, Virginia, and Washington.

Read More @ Activist Post

With the defeat of California Prop 37, the fight to require labeling of genetically modified foods has passed on to other states, such as Washington and Vermont. Although California’s initiative failed on election day, the campaign brought national attention to the issue of labeling GM foods, with 30 other states now working to require GMO labels. Dave Murphy, executive director of Food Democracy Now, stated, “More than 4 million Californians are on record saying they want to know what’s in their food. This is a dynamic moment for the food movement.” (MercuryNews.com)

In Vermont, the VT Right to Know GMOs coalition has also started gathering signatures to present to elected officials about the need for GMO labeling on food products sold in retail stores. With this effort, Vermont joins the Coalition of States for Mandatory GMO Labeling comprising of the following states: Arizona, California, Connecticut, Colorado, Florida, Hawaii, Idaho, Illinois, Iowa, Maine, Massachusetts, Minnesota, Mississippi, New Hampshire, New Jersey, New York, North Carolina, South Carolina, Oregon, Pennsylvania, Vermont, Virginia, and Washington.

Read More @ Activist Post

by Reuters via CNBC:

Japan’s main opposition leader Shinzo Abe, seen as the most likely next

premier if a snap election is held next month, called on the central

bank to print “unlimited yen” to achieve a new inflation target.

Japan’s main opposition leader Shinzo Abe, seen as the most likely next

premier if a snap election is held next month, called on the central

bank to print “unlimited yen” to achieve a new inflation target.

In comments on Wednesday, he didn’t spell out what the inflation target should be. But in recent weeks he has called for the Bank of Japan [BNJAF 0.00 --- UNCH ] to achieve 3 percent inflation, three times higher than the current target, after years of deflation pressures.

Abe’s remarks keep the Bank of Japan under pressure ahead of its two-day rate review next week when its policymakers may debate the need for further economic stimulus to try to lift an economy widely seen as in recession.

Read More @ CNBC

Japan’s main opposition leader Shinzo Abe, seen as the most likely next

premier if a snap election is held next month, called on the central

bank to print “unlimited yen” to achieve a new inflation target.

Japan’s main opposition leader Shinzo Abe, seen as the most likely next

premier if a snap election is held next month, called on the central

bank to print “unlimited yen” to achieve a new inflation target.In comments on Wednesday, he didn’t spell out what the inflation target should be. But in recent weeks he has called for the Bank of Japan [BNJAF 0.00 --- UNCH ] to achieve 3 percent inflation, three times higher than the current target, after years of deflation pressures.

Abe’s remarks keep the Bank of Japan under pressure ahead of its two-day rate review next week when its policymakers may debate the need for further economic stimulus to try to lift an economy widely seen as in recession.

Read More @ CNBC

by Graham Summers, Gains Pains & Capital:

Modern financial theory dictates that sovereign bonds are the most “risk free” assets in the financial system (equity, municipal bond, corporate bonds, and the like are all below sovereign bonds in terms of risk profile). The reason for this is because it is far more likely for a company to go belly up than a country.

Because of this, the entire Western financial system has sovereign bonds (US Treasuries, German Bunds, Japanese sovereign bonds, etc) as the senior most asset pledged as collateral for hundreds of trillions of Dollars worth of trades.

Read More @ GainsPainsCapital.com

Modern financial theory dictates that sovereign bonds are the most “risk free” assets in the financial system (equity, municipal bond, corporate bonds, and the like are all below sovereign bonds in terms of risk profile). The reason for this is because it is far more likely for a company to go belly up than a country.

Because of this, the entire Western financial system has sovereign bonds (US Treasuries, German Bunds, Japanese sovereign bonds, etc) as the senior most asset pledged as collateral for hundreds of trillions of Dollars worth of trades.

Read More @ GainsPainsCapital.com

by Martin Hesse and Anne Seith, Spiegel International:

Beyond the banking world, a parallel universe of shadow banks has grown in the form of hedge funds and money market funds. They’re outside the reach of conventional financial regulation, prompting authorities to plan introducing new rules to prevent the obscure sector from triggering a new financial crisis. But in doing so they risk drying up an important source of funding to banks and firms.

In the financial world, there is a narrow divide between heaven and

hell. Frenchman Loïc Féry realized this when he was 33. He was a rising

star in the banking world, managing the trade in complex loan packages

for an investment bank. According to his business card, he was the

bank’s “global head of credit markets.” But then one of his employees

gambled away about €250 million ($317 million), and suddenly Féry was

without a job.

In the financial world, there is a narrow divide between heaven and

hell. Frenchman Loïc Féry realized this when he was 33. He was a rising

star in the banking world, managing the trade in complex loan packages

for an investment bank. According to his business card, he was the

bank’s “global head of credit markets.” But then one of his employees

gambled away about €250 million ($317 million), and suddenly Féry was

without a job.

That was in 2007. A number of investment bankers experienced a similarly precipitous fall in the turbulent years of the financial crisis.

Read More @ Spiegel.de

Beyond the banking world, a parallel universe of shadow banks has grown in the form of hedge funds and money market funds. They’re outside the reach of conventional financial regulation, prompting authorities to plan introducing new rules to prevent the obscure sector from triggering a new financial crisis. But in doing so they risk drying up an important source of funding to banks and firms.

In the financial world, there is a narrow divide between heaven and

hell. Frenchman Loïc Féry realized this when he was 33. He was a rising

star in the banking world, managing the trade in complex loan packages

for an investment bank. According to his business card, he was the

bank’s “global head of credit markets.” But then one of his employees

gambled away about €250 million ($317 million), and suddenly Féry was

without a job.

In the financial world, there is a narrow divide between heaven and

hell. Frenchman Loïc Féry realized this when he was 33. He was a rising

star in the banking world, managing the trade in complex loan packages

for an investment bank. According to his business card, he was the

bank’s “global head of credit markets.” But then one of his employees

gambled away about €250 million ($317 million), and suddenly Féry was

without a job.That was in 2007. A number of investment bankers experienced a similarly precipitous fall in the turbulent years of the financial crisis.

Read More @ Spiegel.de

by Ann Barnhardt, Barnhardt.biz:

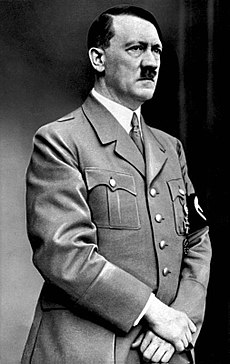

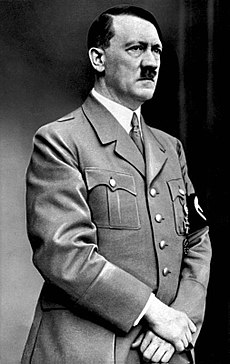

First, a history lesson:

Hitler was appointed Chancellor of Germany on January 30, 1933. Hitler

then moved quickly to marginalize and then dispense entirely with the

German Legislature, the Reichstag, and to effectively eliminate all

political parties other than the National Socialist (Nazi) Party.

First, a history lesson:

Hitler was appointed Chancellor of Germany on January 30, 1933. Hitler

then moved quickly to marginalize and then dispense entirely with the

German Legislature, the Reichstag, and to effectively eliminate all

political parties other than the National Socialist (Nazi) Party.

The last step in Hitler’s quest for total, dictatorial power was the purging of the German military of any factions that were in any way autonomous and not 100% loyal to him, specifically the SA (Sturmabteilung, which means Storm Detachment).

The SA was run by Ernst Rohm, who, like most of the founding and high-level members of the Nazi Party and eventually the Third Reich, was a homosexual ephebophile (preferring teenaged boys). In fact, Rohm was a militant and vocal homosexual in the spirit of the ancient Greeks and musloids who believed that women were sub-human and that truly masculine men only had sex with other men and boys.

Original Source @ Barnhardt.biz

First, a history lesson:

Hitler was appointed Chancellor of Germany on January 30, 1933. Hitler

then moved quickly to marginalize and then dispense entirely with the

German Legislature, the Reichstag, and to effectively eliminate all

political parties other than the National Socialist (Nazi) Party.

First, a history lesson:

Hitler was appointed Chancellor of Germany on January 30, 1933. Hitler

then moved quickly to marginalize and then dispense entirely with the

German Legislature, the Reichstag, and to effectively eliminate all

political parties other than the National Socialist (Nazi) Party.The last step in Hitler’s quest for total, dictatorial power was the purging of the German military of any factions that were in any way autonomous and not 100% loyal to him, specifically the SA (Sturmabteilung, which means Storm Detachment).

The SA was run by Ernst Rohm, who, like most of the founding and high-level members of the Nazi Party and eventually the Third Reich, was a homosexual ephebophile (preferring teenaged boys). In fact, Rohm was a militant and vocal homosexual in the spirit of the ancient Greeks and musloids who believed that women were sub-human and that truly masculine men only had sex with other men and boys.

Original Source @ Barnhardt.biz

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment