Following

the biggest drop in almost five months, Gold has bounced hard off its

100DMA as it goes vertical - rising the most in two months. Breaking

back above $1700, we can only speculate that this cross-asset class

ramp is due to rumors that Bernanke is currently in the lead in Ohio...

Spot Gold $1715 as we post...

Following

the biggest drop in almost five months, Gold has bounced hard off its

100DMA as it goes vertical - rising the most in two months. Breaking

back above $1700, we can only speculate that this cross-asset class

ramp is due to rumors that Bernanke is currently in the lead in Ohio...

Spot Gold $1715 as we post...Did You BTFD...

from Silver Doctors:

*Update: 2nd leg of vertical move in progress, silver now up over $1 to $32.28 , gold up $30 to $1717!

*Update: 2nd leg of vertical move in progress, silver now up over $1 to $32.28 , gold up $30 to $1717!

While we expected little action and a tight range in gold and silver today with all attention focused on the US Presidential Elections, gold and silver have just made a vertical move, with gold jumping to $1717, and silver from $31 to $32.28!

Perhaps this vertical move in the metals (& in the equities) is an indication the Algos have just received word that the fix is in for Emperor in Chief Obama, or are the bullion banks simply attempting to paint the tape ahead of today’s COT cutoff?

Read More @ Silver Doctors

Arguments for lower prices:

Arguments for lower prices:

Arguments for higher prices:

*Update: 2nd leg of vertical move in progress, silver now up over $1 to $32.28 , gold up $30 to $1717!

*Update: 2nd leg of vertical move in progress, silver now up over $1 to $32.28 , gold up $30 to $1717!While we expected little action and a tight range in gold and silver today with all attention focused on the US Presidential Elections, gold and silver have just made a vertical move, with gold jumping to $1717, and silver from $31 to $32.28!

Perhaps this vertical move in the metals (& in the equities) is an indication the Algos have just received word that the fix is in for Emperor in Chief Obama, or are the bullion banks simply attempting to paint the tape ahead of today’s COT cutoff?

Read More @ Silver Doctors

Gold and Silver

by Florian Grummes, SilverStrategies.com:

Arguments for lower prices:

Arguments for lower prices:- 3rd attempt (within 11 months) to take out heavy resistance around US$1,790.00-1,800.00

failed and Gold clearly broke down from bearish wedge - Gold & Silver are now in established downtrends

- COT Data still bearish for silver, but high volume sell off on Friday

is not yet included… (COT Data should be much better next friday and

commercials surely used the 4% mini crash in silver to cover shorts…) - Gold/Silver Ratio breaking out above 54

- US-Dollar completed base pattern and moved up to 200-MA, now facing strong

resistance - Recession in europe, slower demand from china

Arguments for higher prices:

- Gold & Silver now strongly oversold and hit downside targets

- High Volume washout day typically marks the end of a downtrend Read More @ SilverStrategies.com

The Market's Verdict: Buy Stocks, Buy Bonds, Buy Gold

Since

early this morning when Germany dropped its nasty econ bomb, the US

has been bid. It's not like Europe was sold, it's just that US

Treasuries, US Equities, and US-denominated Gold have been on a tear (as

the USD has been sold). Equity volumes remain dismal but apart from a

near-vertical snap up to VWAP, AAPL has been going the opposite way all

day (down!)... Or perhaps, now that Europe is closed, someone just leaked the election results given that ridonculous surge in S&P futures?

Since

early this morning when Germany dropped its nasty econ bomb, the US

has been bid. It's not like Europe was sold, it's just that US

Treasuries, US Equities, and US-denominated Gold have been on a tear (as

the USD has been sold). Equity volumes remain dismal but apart from a

near-vertical snap up to VWAP, AAPL has been going the opposite way all

day (down!)... Or perhaps, now that Europe is closed, someone just leaked the election results given that ridonculous surge in S&P futures?"State Dismissed" - The Hourly Guide To Tonight's Electoral College Closing Times

T

minus 7 hours. That is how long until both all important Florida and

Ohio polls close. As previously explained, whoever gets these two

states will almost certainly carry the election, which means that by

8pm Eastern, the marginal votes will be in, and shortly thereafter one

after another media organization and network will begin calling both

these two states, and the election, for either the Democrats or the GOP

(at which point the litigation and recount demands can begin). The

complete guide to the closing times of the polls in assorted East to

West states, together with their respective seats in the electoral

college, is shown below, although it is likely that long before

California polling is even concluded the next president will already be

known.

T

minus 7 hours. That is how long until both all important Florida and

Ohio polls close. As previously explained, whoever gets these two

states will almost certainly carry the election, which means that by

8pm Eastern, the marginal votes will be in, and shortly thereafter one

after another media organization and network will begin calling both

these two states, and the election, for either the Democrats or the GOP

(at which point the litigation and recount demands can begin). The

complete guide to the closing times of the polls in assorted East to

West states, together with their respective seats in the electoral

college, is shown below, although it is likely that long before

California polling is even concluded the next president will already be

known.A Final Selection Day Update

Predictions regarding the election outcome are all over the place. Dennis Gartman for instance thinks that 'Romney will win quite handily'.

While this opinion may be largely informed by wishful thinking in this

case, there are two interesting points made by Gartman. One concerns poll errors, and the other the Bradley (or Wilder) effect (or 'political correctness effect' - i.e., it is not motivated by racism, but by the fear of people that they might be seen as racist). Jim Cramer is taking the exact opposite view from Gartman's, expecting a 'landslide' victory for Obama. Of course Cramer wouldn't be Cramer if his forecast didn't stand out for being a bit extreme. The Princeton election consortium's latest update

of the meta-analysis of the electoral vote count on the eve of the

election continues to predict an Obama victory as well, but clearly the

race is getting tighter. However, across the pond, it is clear that the

Europeans see the election (and indeed any election it seems) very

differently, highlighting their ignorance of the difference between 'total capitalism' and 'crony capitalism'.

Predictions regarding the election outcome are all over the place. Dennis Gartman for instance thinks that 'Romney will win quite handily'.

While this opinion may be largely informed by wishful thinking in this

case, there are two interesting points made by Gartman. One concerns poll errors, and the other the Bradley (or Wilder) effect (or 'political correctness effect' - i.e., it is not motivated by racism, but by the fear of people that they might be seen as racist). Jim Cramer is taking the exact opposite view from Gartman's, expecting a 'landslide' victory for Obama. Of course Cramer wouldn't be Cramer if his forecast didn't stand out for being a bit extreme. The Princeton election consortium's latest update

of the meta-analysis of the electoral vote count on the eve of the

election continues to predict an Obama victory as well, but clearly the

race is getting tighter. However, across the pond, it is clear that the

Europeans see the election (and indeed any election it seems) very

differently, highlighting their ignorance of the difference between 'total capitalism' and 'crony capitalism'.

from Silver Underground:

The world is holding its collective breath in anticipation of [today's] highly irrelevant election outcome. Soon, Americans will learn whether the nation’s record deficit spending will be recklessly increased by 3% or 5%. We will learn whether the bailouts will be issued to Republican campaign contributors or Democratic campaign contributors (see also, in both cases: Goldman Sachs).

We will learn whether the US military will be foolishly ordered to surge in nations like Uganda for celeb-approved Democratic Party promoted reasons or in nations like Mali for reasons only known to Mitt Romney, Lindsey Graham, and John McCain. We will see whether the FBI will use the Patriot Act to target Tea Party activists or environmentalists and Occupiers. However, whether Mitt Romney or Barack Obama wins the general election tomorrow, one thing is clear: the winner will be carrying out George W Bush’s policies, and, by proxy, his fourth term.

Big-Time Deficits and Handouts for the Military Industrial Complex

George W Bush’s first two terms brought massive deficit spending on centralized, top-down programs like No Child Left Behind and Medicare Part D. Meanwhile, military industrial complex profiteers were given unprecedented access to the public treasury.

Read More @ Silver Underground

Your support is needed...

Thank You

I'm PayPal Verified

The world is holding its collective breath in anticipation of [today's] highly irrelevant election outcome. Soon, Americans will learn whether the nation’s record deficit spending will be recklessly increased by 3% or 5%. We will learn whether the bailouts will be issued to Republican campaign contributors or Democratic campaign contributors (see also, in both cases: Goldman Sachs).

We will learn whether the US military will be foolishly ordered to surge in nations like Uganda for celeb-approved Democratic Party promoted reasons or in nations like Mali for reasons only known to Mitt Romney, Lindsey Graham, and John McCain. We will see whether the FBI will use the Patriot Act to target Tea Party activists or environmentalists and Occupiers. However, whether Mitt Romney or Barack Obama wins the general election tomorrow, one thing is clear: the winner will be carrying out George W Bush’s policies, and, by proxy, his fourth term.

Big-Time Deficits and Handouts for the Military Industrial Complex

George W Bush’s first two terms brought massive deficit spending on centralized, top-down programs like No Child Left Behind and Medicare Part D. Meanwhile, military industrial complex profiteers were given unprecedented access to the public treasury.

Read More @ Silver Underground

Your support is needed...

Thank You

I'm PayPal Verified

from The Weekly Standard:

A chart from the Republican side of the Senate Budget Committee shows

that “U.S. Per Person Debt [Is] Now 35 Percent Higher than that of

Greece.”

A chart from the Republican side of the Senate Budget Committee shows

that “U.S. Per Person Debt [Is] Now 35 Percent Higher than that of

Greece.”

“According to estimates from the International Monetary Fund, America’s total government debt will be $16.8 trillion by the end of the calendar year, compared to $441 billion for Greece,” the Republican side of the Senate Budget Committee explains. “On a per person basis, that means U.S. debt is $53,400 for every man, woman, and child, compared to $39,400 for every man, woman, and child in Greece. The disparity between per capita debt in the U.S. and Greece has grown 40 percent (roughly $8,400) since 2011. Now, U.S. per person debt is 35 percent higher than that of Greece, and is also higher than per capita debt in Portugal, Italy, or Spain (which together with Greece make up the so-called PIGS countries).”

Read More @ TheWeeklyStandard.com

A chart from the Republican side of the Senate Budget Committee shows

that “U.S. Per Person Debt [Is] Now 35 Percent Higher than that of

Greece.”

A chart from the Republican side of the Senate Budget Committee shows

that “U.S. Per Person Debt [Is] Now 35 Percent Higher than that of

Greece.”“According to estimates from the International Monetary Fund, America’s total government debt will be $16.8 trillion by the end of the calendar year, compared to $441 billion for Greece,” the Republican side of the Senate Budget Committee explains. “On a per person basis, that means U.S. debt is $53,400 for every man, woman, and child, compared to $39,400 for every man, woman, and child in Greece. The disparity between per capita debt in the U.S. and Greece has grown 40 percent (roughly $8,400) since 2011. Now, U.S. per person debt is 35 percent higher than that of Greece, and is also higher than per capita debt in Portugal, Italy, or Spain (which together with Greece make up the so-called PIGS countries).”

Read More @ TheWeeklyStandard.com

by Bix Weir, Road to Roota:

Do you remember how long it took you to realize that something was not

right about the “Official Story” surrounding 911? Don’t you wish you

were clued into the conspiracy as the events were taking place so you

could see all the moves of the bad guys in real time?

Do you remember how long it took you to realize that something was not

right about the “Official Story” surrounding 911? Don’t you wish you

were clued into the conspiracy as the events were taking place so you

could see all the moves of the bad guys in real time?

As I reported yesterday, something stinks to high heaven at the DTCC as documentation damage has been officially announced yet the bottom floors are still flooded…HOW DO THEY KNOW THERE IS DAMAGE?! Hell, my safe at home is waterproof and fire proof and they are trying to tell me that there was a failure at the DTCC vault? What — did they send divers down to OPEN THE VAULT to check and see if there is damage?…Ooops!

It is a rarity when we can watch the Bad Guys in “real time” perpetrating a false flag operation with fraud cover-up and the use of a crisis to forward an agenda. What is happening at the DTCC in New York right now has given the Banksters an opportunity to “wash away their sins” and it’s part of a much larger Banking Cabal cover-up.

Read More @ RoadtoRoota.com

Do you remember how long it took you to realize that something was not

right about the “Official Story” surrounding 911? Don’t you wish you

were clued into the conspiracy as the events were taking place so you

could see all the moves of the bad guys in real time?

Do you remember how long it took you to realize that something was not

right about the “Official Story” surrounding 911? Don’t you wish you

were clued into the conspiracy as the events were taking place so you

could see all the moves of the bad guys in real time?As I reported yesterday, something stinks to high heaven at the DTCC as documentation damage has been officially announced yet the bottom floors are still flooded…HOW DO THEY KNOW THERE IS DAMAGE?! Hell, my safe at home is waterproof and fire proof and they are trying to tell me that there was a failure at the DTCC vault? What — did they send divers down to OPEN THE VAULT to check and see if there is damage?…Ooops!

It is a rarity when we can watch the Bad Guys in “real time” perpetrating a false flag operation with fraud cover-up and the use of a crisis to forward an agenda. What is happening at the DTCC in New York right now has given the Banksters an opportunity to “wash away their sins” and it’s part of a much larger Banking Cabal cover-up.

Read More @ RoadtoRoota.com

by Simon Black, Sovereign Man :

It’s really hard to ignore what’s happening today; the election phenomenon is global.

It’s really hard to ignore what’s happening today; the election phenomenon is global.

Over the last several weeks, I’ve traveled to so many countries, and EVERYWHERE it seems, the US presidential election is big news. Even when I was in Myanmar ten days ago, local pundits were engaged in the Obamney debate. Chile. Spain. Germany. Finland. Hong Kong. Thailand. Singapore. It was inescapable.

The entire world seems fixated on this belief that it actually matters who becomes the President of the United States anymore… or that one of these two guys is going to ‘fix’ things.

Fact is, it doesn’t matter. Not one bit. And I’ll show you mathematically:

1) When the US federal government spends money, expenses are officially categorized in three different ways.

Read More @ SovereignMan.com

It’s really hard to ignore what’s happening today; the election phenomenon is global.

It’s really hard to ignore what’s happening today; the election phenomenon is global.Over the last several weeks, I’ve traveled to so many countries, and EVERYWHERE it seems, the US presidential election is big news. Even when I was in Myanmar ten days ago, local pundits were engaged in the Obamney debate. Chile. Spain. Germany. Finland. Hong Kong. Thailand. Singapore. It was inescapable.

The entire world seems fixated on this belief that it actually matters who becomes the President of the United States anymore… or that one of these two guys is going to ‘fix’ things.

Fact is, it doesn’t matter. Not one bit. And I’ll show you mathematically:

1) When the US federal government spends money, expenses are officially categorized in three different ways.

Read More @ SovereignMan.com

by Jeff Nielson, Bullion Bulls Canada:

Do they replace Tweedle-Dee with Tweedle-Dum; or does Tweedle-Dee get

one more chance? This is the eternal question which confronts the binary

minds of American voters every election, in their two-party political

system which masquerades as a “democracy”.

Do they replace Tweedle-Dee with Tweedle-Dum; or does Tweedle-Dee get

one more chance? This is the eternal question which confronts the binary

minds of American voters every election, in their two-party political

system which masquerades as a “democracy”.

While we can quibble over semantics, most people would agree that a democracy must demonstrate two qualities in order to be worthy of that term:

a) A government chosen by the people;

b) Whose actions reflect the will of the people.

It is abundantly clear that the United States political system fails both of those tests. Undoubtedly, most readers will reject this assertion. They will point to the voting process, and simplistically suggest that the mere act of voting means that whatever government emerges from the process was “their choice.” I disagree.

Read More @ BullionBullsCanada.com

Do they replace Tweedle-Dee with Tweedle-Dum; or does Tweedle-Dee get

one more chance? This is the eternal question which confronts the binary

minds of American voters every election, in their two-party political

system which masquerades as a “democracy”.

Do they replace Tweedle-Dee with Tweedle-Dum; or does Tweedle-Dee get

one more chance? This is the eternal question which confronts the binary

minds of American voters every election, in their two-party political

system which masquerades as a “democracy”.While we can quibble over semantics, most people would agree that a democracy must demonstrate two qualities in order to be worthy of that term:

a) A government chosen by the people;

b) Whose actions reflect the will of the people.

It is abundantly clear that the United States political system fails both of those tests. Undoubtedly, most readers will reject this assertion. They will point to the voting process, and simplistically suggest that the mere act of voting means that whatever government emerges from the process was “their choice.” I disagree.

Read More @ BullionBullsCanada.com

by Bill Holter, MilesFranklin.com:

Spain has recently announced their employment numbers which were

horrific and paint a picture of a country in an economic depression.

The overall unemployment in Spain is now more than 25% and over 50% for

the youngest workers. Greece has similar if not worse employment

statistics than Spain. So while the US has it’s elections, all current

eyes are on Europe and their woes… for now. I might mention that

according to John Williams at Shadowstats, if the unemployment rate was “counted” as it was back in the 1970′s, our unemployment rate would be a shocking 17%!

Spain has recently announced their employment numbers which were

horrific and paint a picture of a country in an economic depression.

The overall unemployment in Spain is now more than 25% and over 50% for

the youngest workers. Greece has similar if not worse employment

statistics than Spain. So while the US has it’s elections, all current

eyes are on Europe and their woes… for now. I might mention that

according to John Williams at Shadowstats, if the unemployment rate was “counted” as it was back in the 1970′s, our unemployment rate would be a shocking 17%!

I bring this up because everything is about perception these days. The “spotlight” is again pointed back at Europe. Just as our election has become about voting because you are afraid of the other guy, finance has become about investing in the least bankrupt place. This is a pretty crappy way to go about investing but unfortunately this is the way it is, placing your trust in the least smelly cow pie! Or at least whatever happens to be the “perception of the week.”

Read more @ MilesFranklin.com

Spain has recently announced their employment numbers which were

horrific and paint a picture of a country in an economic depression.

The overall unemployment in Spain is now more than 25% and over 50% for

the youngest workers. Greece has similar if not worse employment

statistics than Spain. So while the US has it’s elections, all current

eyes are on Europe and their woes… for now. I might mention that

according to John Williams at Shadowstats, if the unemployment rate was “counted” as it was back in the 1970′s, our unemployment rate would be a shocking 17%!

Spain has recently announced their employment numbers which were

horrific and paint a picture of a country in an economic depression.

The overall unemployment in Spain is now more than 25% and over 50% for

the youngest workers. Greece has similar if not worse employment

statistics than Spain. So while the US has it’s elections, all current

eyes are on Europe and their woes… for now. I might mention that

according to John Williams at Shadowstats, if the unemployment rate was “counted” as it was back in the 1970′s, our unemployment rate would be a shocking 17%!I bring this up because everything is about perception these days. The “spotlight” is again pointed back at Europe. Just as our election has become about voting because you are afraid of the other guy, finance has become about investing in the least bankrupt place. This is a pretty crappy way to go about investing but unfortunately this is the way it is, placing your trust in the least smelly cow pie! Or at least whatever happens to be the “perception of the week.”

Read more @ MilesFranklin.com

by Kim Barker, ProPublica, and Rick Young and Emma Schwartz, Pro Publica:

The donors wrote notes on their checks like “Go get ‘em!” [2] or “Stop Obama.” [3] They scrawled in names of candidates for office in Montana [4] and Colorado [5], or simply “oil & gas.” [6]

The donors wrote notes on their checks like “Go get ‘em!” [2] or “Stop Obama.” [3] They scrawled in names of candidates for office in Montana [4] and Colorado [5], or simply “oil & gas.” [6]

But unlike donors to political committees, the names of those who gave to Western Tradition Partnership, or WTP, were never supposed to be made public.

That changed Friday after a Montana district court judge released the social welfare nonprofit’s bank records [7] at the request of Frontline and ProPublica, saying citizens had a right to know.

It was the first time that a court has ordered a modern dark money group’s donors to be made public, firing a warning shot to similar organizations engaged in politics.

Read More @ ProPublica.com

The donors wrote notes on their checks like “Go get ‘em!” [2] or “Stop Obama.” [3] They scrawled in names of candidates for office in Montana [4] and Colorado [5], or simply “oil & gas.” [6]

The donors wrote notes on their checks like “Go get ‘em!” [2] or “Stop Obama.” [3] They scrawled in names of candidates for office in Montana [4] and Colorado [5], or simply “oil & gas.” [6]

But unlike donors to political committees, the names of those who gave to Western Tradition Partnership, or WTP, were never supposed to be made public.

That changed Friday after a Montana district court judge released the social welfare nonprofit’s bank records [7] at the request of Frontline and ProPublica, saying citizens had a right to know.

It was the first time that a court has ordered a modern dark money group’s donors to be made public, firing a warning shot to similar organizations engaged in politics.

Read More @ ProPublica.com

from Gold Money News:

Jim Willie, statistical analyst and newsletter writer at GoldenJackass.com, talks to GoldMoney’s Alasdair Macleod about the economy, the impact of a zero interest rate policy, and flaws in economic statistics.

Willie states that the Federal Reserve’s ongoing efforts to debase the US dollar are contributing to a relentless deterioration of the US economy.

The Fed is committed to keeping interest rates at zero, and therefore has to continue to intervene in the bond market. As opposed to mainstream economic thought, Willie argues that the extraordinary low interest rates are not stimulating the economy, but rather destroying capital and hindering genuine growth.

When money has a negative real cost, market participants are forced to hedge — for instance, by buying commodities. At the same time the housing market is stuck in decline even though official statistics will have you believe otherwise. Bank inventory of foreclosure homes is not clearing and still sitting at 9-11 million homes. Willie emphasises that economic statistics in the US are distorted and that the US has actually been in recession for the last four years — government unemployment statistics are in his view flawed. He expects the recession to accelerate over the coming months.

Jim Willie, statistical analyst and newsletter writer at GoldenJackass.com, talks to GoldMoney’s Alasdair Macleod about the economy, the impact of a zero interest rate policy, and flaws in economic statistics.

Willie states that the Federal Reserve’s ongoing efforts to debase the US dollar are contributing to a relentless deterioration of the US economy.

The Fed is committed to keeping interest rates at zero, and therefore has to continue to intervene in the bond market. As opposed to mainstream economic thought, Willie argues that the extraordinary low interest rates are not stimulating the economy, but rather destroying capital and hindering genuine growth.

When money has a negative real cost, market participants are forced to hedge — for instance, by buying commodities. At the same time the housing market is stuck in decline even though official statistics will have you believe otherwise. Bank inventory of foreclosure homes is not clearing and still sitting at 9-11 million homes. Willie emphasises that economic statistics in the US are distorted and that the US has actually been in recession for the last four years — government unemployment statistics are in his view flawed. He expects the recession to accelerate over the coming months.

What we need is not a new president but a new presidency.

by Charles Hugh Smith, Of Two Minds:

There are few practical limits on presidential power. This is a key

dynamic in the failed presidencies of G.W. Bush and Barack Obama.

There are few practical limits on presidential power. This is a key

dynamic in the failed presidencies of G.W. Bush and Barack Obama.

If you’re not familiar with the term The Imperial Presidency, here is an introduction:

Read More @ OfTwoMinds.com

Your support is needed...

Thank You

I'm PayPal Verified

by Charles Hugh Smith, Of Two Minds:

There are few practical limits on presidential power. This is a key

dynamic in the failed presidencies of G.W. Bush and Barack Obama.

There are few practical limits on presidential power. This is a key

dynamic in the failed presidencies of G.W. Bush and Barack Obama.If you’re not familiar with the term The Imperial Presidency, here is an introduction:

Through various means, Presidents subsequently acquired powers beyond the limits of the Constitution. The daily accountability of the President to the Congress, the courts, the press and the people has been replaced by an accountability of once each four years during an election. These changes have occurred slowly over the centuries so that that which appears normal differs greatly from what was the original state of America.Historian Arthur M. Schlesinger, Jr. popularized the term with his book The Imperial Presidency (Kindle edition), originally issued in 1973 but updated in 2004 to include a discussion of the G.W. Bush presidency. Schlesinger summarized the “World War II and beyond” expansion of presidential powers thusly:

Read More @ OfTwoMinds.com

Your support is needed...

Thank You

I'm PayPal Verified

by Mac Slavo, SHTFPlan:

By all accounts, the residents of many hurricane stricken areas of the

north east are in the midst of a collapse. While FEMA, the National

Guard and private relief organizations are in place and providing some

level of assistance, the fact of the matter is that for tens of

thousands of Americans, the world as they knew it has completely

collapsed around them.

By all accounts, the residents of many hurricane stricken areas of the

north east are in the midst of a collapse. While FEMA, the National

Guard and private relief organizations are in place and providing some

level of assistance, the fact of the matter is that for tens of

thousands of Americans, the world as they knew it has completely

collapsed around them.

What we are witnessing are the immediate after-effects of what is referred to as a grid-down scenario, where utility infrastructure like water and electricity, transportation infrastructure like food and gas delivery, and commerce infrastructure like electronic banking and brick & mortar trade are no longer functioning.

In some areas there has been a total breakdown in emergency response. Without communications it has become impossible for emergency responders to be contacted. For all intents and purposes, law and order broke down within just a few hours of Hurricane Sandy passing over the east coast. Likewise, medical response was unavailable due to overwhelming demand put on the system by hundreds of people reporting simultaneous emergencies.

Read More @ SHTFPlan.com

By all accounts, the residents of many hurricane stricken areas of the

north east are in the midst of a collapse. While FEMA, the National

Guard and private relief organizations are in place and providing some

level of assistance, the fact of the matter is that for tens of

thousands of Americans, the world as they knew it has completely

collapsed around them.

By all accounts, the residents of many hurricane stricken areas of the

north east are in the midst of a collapse. While FEMA, the National

Guard and private relief organizations are in place and providing some

level of assistance, the fact of the matter is that for tens of

thousands of Americans, the world as they knew it has completely

collapsed around them.What we are witnessing are the immediate after-effects of what is referred to as a grid-down scenario, where utility infrastructure like water and electricity, transportation infrastructure like food and gas delivery, and commerce infrastructure like electronic banking and brick & mortar trade are no longer functioning.

In some areas there has been a total breakdown in emergency response. Without communications it has become impossible for emergency responders to be contacted. For all intents and purposes, law and order broke down within just a few hours of Hurricane Sandy passing over the east coast. Likewise, medical response was unavailable due to overwhelming demand put on the system by hundreds of people reporting simultaneous emergencies.

Read More @ SHTFPlan.com

by Andy Hoffman, MilesFranklin.com:

Tomorrow’s election represents an historic inflection point for America; NOT because a new Administration will effect change – Democrat or Republican – but because it will likely reside over the END GAME for “King Dollar”; and with it, the 20th century’s leading empire.

Tomorrow’s election represents an historic inflection point for America; NOT because a new Administration will effect change – Democrat or Republican – but because it will likely reside over the END GAME for “King Dollar”; and with it, the 20th century’s leading empire.

By my estimation, citizens’ apathy toward this election is like none I’ve witnessed – with most people resigned to their fates, caring little who wins. In fact, in an unprecedented campaign of bilateral negativity – at unprecedented cost – the closest thing to TRUTH I heard was Romney’s now infamous “flub”; when at a closed-door political dinner, he averred…

Read more @ MilesFranklin.com

Tomorrow’s election represents an historic inflection point for America; NOT because a new Administration will effect change – Democrat or Republican – but because it will likely reside over the END GAME for “King Dollar”; and with it, the 20th century’s leading empire.

Tomorrow’s election represents an historic inflection point for America; NOT because a new Administration will effect change – Democrat or Republican – but because it will likely reside over the END GAME for “King Dollar”; and with it, the 20th century’s leading empire.By my estimation, citizens’ apathy toward this election is like none I’ve witnessed – with most people resigned to their fates, caring little who wins. In fact, in an unprecedented campaign of bilateral negativity – at unprecedented cost – the closest thing to TRUTH I heard was Romney’s now infamous “flub”; when at a closed-door political dinner, he averred…

Read more @ MilesFranklin.com

from AnotherBoringWeek:

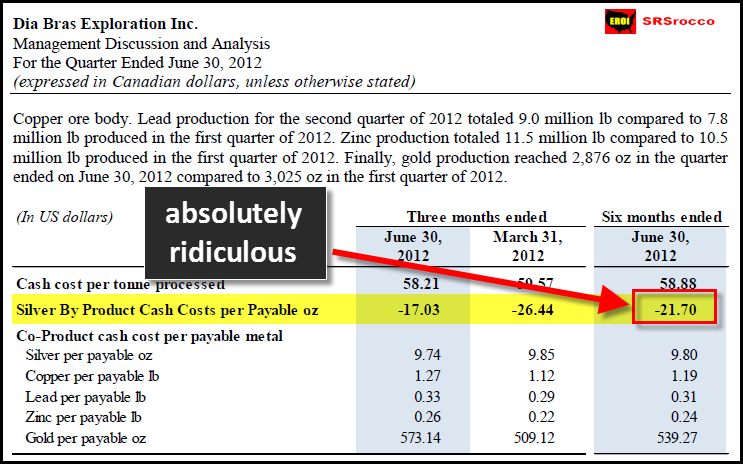

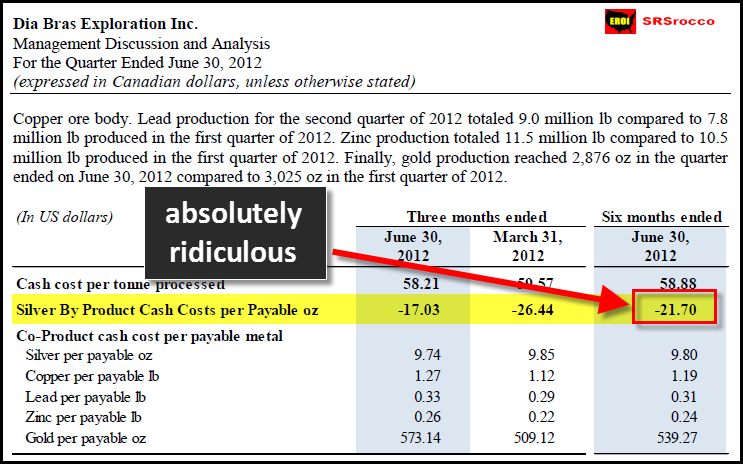

by SRSrocco, Silver Doctors:

I have been spending a great deal of time going over the balance

sheets of mining companies to get a better TRUE COST of SILVER

PRODUCTION. I have put out a request for anyone in the accounting

profession to assist me in this matter. After the initial interest, it

seems as if these folks have backed off… for whatever reason. I

don’t plan on stopping before I can figure out a BETTER WAY to cost out

gold and silver and not the pathetic industry standard of “CASH COSTS”.

I have been spending a great deal of time going over the balance

sheets of mining companies to get a better TRUE COST of SILVER

PRODUCTION. I have put out a request for anyone in the accounting

profession to assist me in this matter. After the initial interest, it

seems as if these folks have backed off… for whatever reason. I

don’t plan on stopping before I can figure out a BETTER WAY to cost out

gold and silver and not the pathetic industry standard of “CASH COSTS”.

Cash costs exclude depreciation, depletion and amortization, accretion, corporate general and administrative expenses, exploration, interest, and pre-feasibility costs. How can a mining company or the industry as a whole use CASH COST figures to show the investing public true costs of mining silver? They do it to MISLEAD the public.

I have had some SilverDoctors members reply to my previous post on Alexco Resources. One member told me about another so-called extremely LOW COST SILVER PRODUCER named Dia Bras Exploration.

Read More @ Silver Doctors

I have been spending a great deal of time going over the balance

sheets of mining companies to get a better TRUE COST of SILVER

PRODUCTION. I have put out a request for anyone in the accounting

profession to assist me in this matter. After the initial interest, it

seems as if these folks have backed off… for whatever reason. I

don’t plan on stopping before I can figure out a BETTER WAY to cost out

gold and silver and not the pathetic industry standard of “CASH COSTS”.

I have been spending a great deal of time going over the balance

sheets of mining companies to get a better TRUE COST of SILVER

PRODUCTION. I have put out a request for anyone in the accounting

profession to assist me in this matter. After the initial interest, it

seems as if these folks have backed off… for whatever reason. I

don’t plan on stopping before I can figure out a BETTER WAY to cost out

gold and silver and not the pathetic industry standard of “CASH COSTS”.Cash costs exclude depreciation, depletion and amortization, accretion, corporate general and administrative expenses, exploration, interest, and pre-feasibility costs. How can a mining company or the industry as a whole use CASH COST figures to show the investing public true costs of mining silver? They do it to MISLEAD the public.

I have had some SilverDoctors members reply to my previous post on Alexco Resources. One member told me about another so-called extremely LOW COST SILVER PRODUCER named Dia Bras Exploration.

Read More @ Silver Doctors

by Dr. Jeffrey Lewis, Silver Seek:

The silver market often seems to be like burning both ends of a candle

at the same time. Basically, somewhere in the middle the two flames are

bound to meet and cause an explosion in price.

The silver market often seems to be like burning both ends of a candle

at the same time. Basically, somewhere in the middle the two flames are

bound to meet and cause an explosion in price.

Many long term precious metal investors have wondered whether silver is just another commodity component of the CCI, or if it will eventually reassert itself as money?

In many ways, silver still behaves like any other commodity market that trades largely based on technical indicators, signals and chart patterns. In large part, this appearance is maintained by the market makers, who are the big bullion banks dominated by J.P. Morgan Chase.

At the Mercy of the CFTC, CME and the CCI

Currently holding above support noted at $31.50, the COT structure remains bearish for silver. Although Open Interest fell somewhat during the recent downside correction, a lot of speculative longs remain in the Chicago silver futures market.

Read More @ SilverSeek.com

The silver market often seems to be like burning both ends of a candle

at the same time. Basically, somewhere in the middle the two flames are

bound to meet and cause an explosion in price.

The silver market often seems to be like burning both ends of a candle

at the same time. Basically, somewhere in the middle the two flames are

bound to meet and cause an explosion in price.Many long term precious metal investors have wondered whether silver is just another commodity component of the CCI, or if it will eventually reassert itself as money?

In many ways, silver still behaves like any other commodity market that trades largely based on technical indicators, signals and chart patterns. In large part, this appearance is maintained by the market makers, who are the big bullion banks dominated by J.P. Morgan Chase.

At the Mercy of the CFTC, CME and the CCI

Currently holding above support noted at $31.50, the COT structure remains bearish for silver. Although Open Interest fell somewhat during the recent downside correction, a lot of speculative longs remain in the Chicago silver futures market.

Read More @ SilverSeek.com

Only

an alert and knowledgeable citizen can compel the proper meshing of the

huge industrial and military machinery of defense with our peaceful

methods and goals – so that security and liberty may prosper together. – Dwight D. Eisenhower in his famous speech on the dangers of the Military-Industrial Complex

by Michael Krieger, Liberty Blitzkreig

Good Op-Ed yesterday from the New York Times about how dangerous our cultural fascination with war and aggressive foreign policy is for the health of the nation – both economically and spiritually. That said, I do take one major exception with the author’s premise that we have moved beyond a time “when commercial interests influenced military action.” To think this takes a naivety of the highest order, and he clearly does not understand how the global financial system operates and what the petro-dollar is. Nonetheless, some very important points are made. From the NY Times:

In his farewell address, Eisenhower called for a better equilibrium between military and domestic affairs in our economy, politics and culture. He worried that the defense industry’s search for profits would warp foreign policy and, conversely, that too much state control of the private sector would cause economic stagnation. He warned that unending preparations for war were incongruous with the nation’s history. He cautioned that war and warmaking took up too large a proportion of national life, with grave ramifications for our spiritual health.

Read More @ LibertyBlitzkreig.com

Thank You

I'm PayPal Verified

by Michael Krieger, Liberty Blitzkreig

Good Op-Ed yesterday from the New York Times about how dangerous our cultural fascination with war and aggressive foreign policy is for the health of the nation – both economically and spiritually. That said, I do take one major exception with the author’s premise that we have moved beyond a time “when commercial interests influenced military action.” To think this takes a naivety of the highest order, and he clearly does not understand how the global financial system operates and what the petro-dollar is. Nonetheless, some very important points are made. From the NY Times:

In his farewell address, Eisenhower called for a better equilibrium between military and domestic affairs in our economy, politics and culture. He worried that the defense industry’s search for profits would warp foreign policy and, conversely, that too much state control of the private sector would cause economic stagnation. He warned that unending preparations for war were incongruous with the nation’s history. He cautioned that war and warmaking took up too large a proportion of national life, with grave ramifications for our spiritual health.

Read More @ LibertyBlitzkreig.com

from Silver Vigilante:

“We see a lot of activity…because everything reverts to pretty much a

cash economy,” said John Garbarino, chief executive of OceanFirst Bank

of Toms River, N.J regarding the squalor in the Sandy-affected region.

“It’s like the tide and the full moon. Our branches are very busy.”

Executive at banks all over the affected region have referred to the

demand for cash. Some banks are operating without power. In order to

keep track of transactions, the bank has been forced to use ledgers and

keep records of withdrawals with written checks carrying customer and

account information. Withdrawals at many branches are being capped at

$500, according to WSJ.

Of course, for depositors, the security of their personal information

should be of a concern. Had they held silver bullion and Bitcoin, they

would not even need to deal with the dominant financial system.

“We see a lot of activity…because everything reverts to pretty much a

cash economy,” said John Garbarino, chief executive of OceanFirst Bank

of Toms River, N.J regarding the squalor in the Sandy-affected region.

“It’s like the tide and the full moon. Our branches are very busy.”

Executive at banks all over the affected region have referred to the

demand for cash. Some banks are operating without power. In order to

keep track of transactions, the bank has been forced to use ledgers and

keep records of withdrawals with written checks carrying customer and

account information. Withdrawals at many branches are being capped at

$500, according to WSJ.

Of course, for depositors, the security of their personal information

should be of a concern. Had they held silver bullion and Bitcoin, they

would not even need to deal with the dominant financial system.

For banks, the scene on the ground is somewhat precarious: “If we know customers, we let them in – doing it very old school,” said one Shore Community Bank representative. With six branches and $203 million in assets, the bank saw half of its branches shutdown due to the storm. Damage at one branch cannot be assessed due to the building being inaccessible, not to mention the status of their borrowers.

Read More @ Silver Vigilante

Your support is needed... “We see a lot of activity…because everything reverts to pretty much a

cash economy,” said John Garbarino, chief executive of OceanFirst Bank

of Toms River, N.J regarding the squalor in the Sandy-affected region.

“It’s like the tide and the full moon. Our branches are very busy.”

Executive at banks all over the affected region have referred to the

demand for cash. Some banks are operating without power. In order to

keep track of transactions, the bank has been forced to use ledgers and

keep records of withdrawals with written checks carrying customer and

account information. Withdrawals at many branches are being capped at

$500, according to WSJ.

Of course, for depositors, the security of their personal information

should be of a concern. Had they held silver bullion and Bitcoin, they

would not even need to deal with the dominant financial system.

“We see a lot of activity…because everything reverts to pretty much a

cash economy,” said John Garbarino, chief executive of OceanFirst Bank

of Toms River, N.J regarding the squalor in the Sandy-affected region.

“It’s like the tide and the full moon. Our branches are very busy.”

Executive at banks all over the affected region have referred to the

demand for cash. Some banks are operating without power. In order to

keep track of transactions, the bank has been forced to use ledgers and

keep records of withdrawals with written checks carrying customer and

account information. Withdrawals at many branches are being capped at

$500, according to WSJ.

Of course, for depositors, the security of their personal information

should be of a concern. Had they held silver bullion and Bitcoin, they

would not even need to deal with the dominant financial system.For banks, the scene on the ground is somewhat precarious: “If we know customers, we let them in – doing it very old school,” said one Shore Community Bank representative. With six branches and $203 million in assets, the bank saw half of its branches shutdown due to the storm. Damage at one branch cannot be assessed due to the building being inaccessible, not to mention the status of their borrowers.

Read More @ Silver Vigilante

by Dr. Ron Paul, The Daily Bell:

Hurricane Sandy was one of the worst natural disasters the East Coast has ever seen. Cleanup and recovery will take months, if not years and estimates run in the tens of billions of dollars. Parts of New York and New Jersey will never be the same. Entire seashore communities have been wiped out, but the determination to rebuild has been lauded as courageous and admirable. Yet as with all natural disasters, Sandy raises uncomfortable questions about the extent to which taxpayers should fund the cleanup and the extent to which government programs create moral hazards.

For example, FEMA and the National Flood Insurance Program (NFIP) are expected to pick up the tab for much of the flood damage caused by the hurricane. Of course, this will mean more federal debt and inflation for the rest of us, since the program only has about $4 billion to work with and is already $18 billion in debt from hurricanes Katrina and Rita. Many think there is a need for the government to provide flood insurance of this kind. After all, the market would never provide insurance in flood prone areas at an affordable price. But shouldn’t that tell us something?

Read More @ TheDailyBell.com

Hurricane Sandy was one of the worst natural disasters the East Coast has ever seen. Cleanup and recovery will take months, if not years and estimates run in the tens of billions of dollars. Parts of New York and New Jersey will never be the same. Entire seashore communities have been wiped out, but the determination to rebuild has been lauded as courageous and admirable. Yet as with all natural disasters, Sandy raises uncomfortable questions about the extent to which taxpayers should fund the cleanup and the extent to which government programs create moral hazards.

For example, FEMA and the National Flood Insurance Program (NFIP) are expected to pick up the tab for much of the flood damage caused by the hurricane. Of course, this will mean more federal debt and inflation for the rest of us, since the program only has about $4 billion to work with and is already $18 billion in debt from hurricanes Katrina and Rita. Many think there is a need for the government to provide flood insurance of this kind. After all, the market would never provide insurance in flood prone areas at an affordable price. But shouldn’t that tell us something?

Read More @ TheDailyBell.com

Thank You

I'm PayPal Verified

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment