In The News Today

Dear CIGAs,

What happens here will determine if $3500 or $12,400 is the next most important level of the gold price.

The near miss of 2009 is not behind us. It exists in 6 to 9 months after any candidate or new Fed Chairman screws with QE to infinity.

This is the predictable result of firing Bernanke and putting an end to QE to infinity either by cessation or by walking it down. To stop QE to infinity would put in the last Pillar of gold and now that means $3500 or $12,400. Romney advisors were bonkers to even get on this subject before they had the full picture. If the candidate did what he suggests he will do, there will be a total collapse of the Western world economies in 6 to 9 month. QE cannot be reduced or stopped because the horse is already out of the barn. Once starting QE you cannot retreat. It is victory or death of the economic process.

When something like this is published by our friends at the Council on Foreign Relations you know that it is a confirmation of what I have been telling you concerning the drop off in the US dollar as the currency of settlement choice. This is the key element to an explosion in currency induced cost push inflation, which is a form of hyperinflation. The Council on Foreign Relation calls this by another name so I anticipate no credit for having discussed this with you for ten years.

"Was Triffin’s endgame—sudden reserve diversification, or the act of foreign governments abruptly shifting their funds from dollars to other currencies—about to become a reality? If so, the likeliest benefactor was the eurozone. Prominent economists opined that the euro would become the world’s reserve currency by as early as 2015.3 Through the first half of 2009 global investors seemed to agree: net inflows into eurozone debt instruments—that is, the rest of the world’s purchases of eurozone bonds less euro-area purchases of foreign bonds—surged to record levels. The related plummeting of the dollar relative to the euro added to the fear that global investors were abandoning the center country."

Jim

How Dangerous Is U.S. Government Debt?

The Risk of a Sudden Spike in U.S. Interest Rates

Author: Francis E. Warnock

Publisher Council on Foreign Relations Press

Release Date June 2010

The dollar’s status as the world’s reserve currency has become a facet of U.S. power, allowing the United States to borrow effortlessly and sustain an assertive foreign policy. But the capital inflows associated with the dollar’s reserve-currency status have created a vulnerability, too, opening the door to a foreign sell-off of U.S. securities that could drive up U.S. interest rates. In this Center for Geoeconomic Studies Capital Flows Quarterly, Francis E. Warnock argues that a sell-off came close to happening in 2009. How the United States uses this reprieve will affect the nation’s ability to borrow for years to come, with broad implications for the sustainability of an active U.S. foreign policy.

Introduction

In 1961, the Belgian economist Robert Triffin described the dilemma faced by the country at the center of the international monetary system.1 To supply the world’s risk-free asset, the center country must run a current account deficit and in doing so become ever more indebted to foreigners, until the risk-free asset that it issues ceases to be risk free. Precisely because the world is happy to have a dependable asset to hold as a store of value, it will buy so much of that asset that its issuer will become unsustainably burdened. The endgame to Triffin’s paradox is a global, wholesale dumping of the hcenter country’s securities. No one knows in advance when the tipping point will be reached, but the damage brought about by higher interest rates and slower economic growth will be readily apparent afterward.

For a long time now, the United States has seemed vulnerable to the fate that Triffin predicted. Since 1982 it has run a current account deficit every year but one, steadily piling up obligations to foreigners. Because foreigners have been eager to hold dollar assets, they have willingly enabled this pattern, pouring capital into the United States and financing the nation’s surplus of spending over savings. The dollar’s status as the world’s reserve currency has become a facet of U.S. power, allowing the United States to borrow effortlessly and sustain large debt-financed military commitments. Capital has tended to flood into the United States especially readily during moments of geopolitical stress, ensuring that the nation has had the financial wherewithal to conduct an assertive foreign policy precisely at moments when crises demanded it. But the capital inflows associated with the dollar’s reserve-currency status have created a vulnerability, too, opening the door to a foreign sell-off of U.S. securities that could drive up U.S. interest rates and render the nation’s formidable stock of debt far more expensive to service.

Late last year, this potential danger came close to becoming reality. Largely thanks to homegrown pressures, unrelated to Triffin’s dilemma, the world’s risk-free asset, the ten-year U.S. Treasury bond, was sagging. With sizeable budget deficits, the prospects of an ever-increasing amount of government debt, the end of the Federal Reserve’s crisis-driven program of accumulating Treasury bonds, and an uptick in inflation expectations, the ten-year Treasury yield increased by fifty basis points from 3.25 percent to 3.75 percent. And further increases were likely. Such increases would not only substantially raise the cost of future government borrowing, but would also threaten any recovery in housing and other interest-rate-sensitive sectors.

At the same time, moreover, foreigners seemed poised to drive U.S. borrowing costs higher. The dollar was falling sharply. Early in 2009 it fetched almost eighty euro cents in Frankfurt or Athens; by autumn it was worth sixty-seven euro cents. Foreign investors, who held more than half of the U.S. Treasury market, were getting nervous. Luo Ping, a director-general at the China Banking Regulatory Commission, summed up the angst:

"Except for U.S. Treasuries, what can you hold? Gold? You don’t hold Japanese government bonds or UK bonds. U.S. Treasuries are the safe haven. For everyone, including China, it is the only option . . . . We know the dollar is going to depreciate, so we hate you guys, but there is nothing much we can do."2

Was Triffin’s endgame—sudden reserve diversification, or the act of foreign governments abruptly shifting their funds from dollars to other currencies—about to become a reality? If so, the likeliest benefactor was the eurozone. Prominent economists opined that the euro would become the world’s reserve currency by as early as 2015.3 Through the first half of 2009 global investors seemed to agree: net inflows into eurozone debt instruments—that is, the rest of the world’s purchases of eurozone bonds less euro-area purchases of foreign bonds—surged to record levels. The related plummeting of the dollar relative to the euro added to the fear that global investors were abandoning the center country.

But then began the eurozone phase of the global financial crisis. This has provided the U.S. government with a timely respite from both domestic forces and Triffin’s endgame. U.S. policymakers need to understand that this is not a reset, not a new beginning; it is a lucky break. How the United States uses this reprieve will affect the nation’s ability to borrow for years to come, with broad implications for the sustainability of an active U.S. foreign policy.

In what follows we will walk through the domestic pressures on U.S. long-term interest rates, the role of global investors, the respite provided by the eurozone crisis, and policy implications. The story will be told primarily through pictures. For those interested in the methodology used to measure foreign official flows and a more detailed perspective on U.S. capital flows, a box and appendix are also provided.

Domestic Pressures on Long-Term Rates

In the autumn of 2009 at least three factors were weighing heavily on U.S. Treasury bond prices, driving interest rates (or "yields") upward. Significantly, none of the three factors has diminished.

The first factor is the hangover from the financial crisis. On top of tax cuts and spending increases over the past decade, the stimulus spending and the decline in tax revenues resulting from the recession worsened the U.S. fiscal situation. The budget deficit reached 10 percent of potential GDP in 2008, and even the baseline Congressional Budget Office forecast, which implausibly assumes that Congress will allow various "temporary" tax relief measures to expire, has U.S. public debt skyrocketing toward 100 percent of GDP (Figure 1, left panels).4 Various economic theories provide a link from increases in either government debt (a stock figure) or budget deficits (a flow) and increases in interest rates, be it through the crowding out of private investment or through Keynesian increases in demand. Whatever theory one prefers, Thomas Laubach showed that for each percentage point rise in the projected deficit-to-GDP ratio, longer-term interest rates increase by about twenty-five basis points (or 0.25 percent); alternatively, each percentage point rise in the public debt-to-GDP ratio increases long rates by three to four basis points.5 Combining deficit (or debt) projections with the Laubach analysis, one might expect the fiscal situation to lead to a full percentage point (or even much greater) increase in long rates.

The second domestic factor exerting upward pressure on long rates is that demand from one source—the Federal Reserve—is likely to be scaled back. In 2009, the Fed purchased $300 billion in long-dated treasuries (Figure 1, right top panel). To the extent this put downward pressure on rates, the cessation of the Fed’s credit-easing policy might be expected to lead to higher long rates.

A third factor on the radar screen is inflation expectations. An increase in inflation expectations can have a one-for-one impact on long-term nominal interest rates. Longer-term inflation expectations (Figure 1, right bottom panel) have been on a post-crisis upward march, putting yet more upward pressure on long rates.

In the autumn of 2009, the one domestic factor that was pulling rates lower was anything but comforting: concerns about a potential double-dip recession. As the U.S. recovery has strengthened, this factor has grown less significant. The result is that the balance of domestic forces in the United States now points to higher borrowing costs for the U.S. government. Adding together the pressure from large deficits, the cessation of the Fed’s crisis-response policies, and rising inflation expectations, one might expect the ten-year Treasury rate to be at least one hundred basis points higher than it was a year ago. Oddly, and perhaps ominously, the actual ten-year Treasury rate at the start of June 2010 languishes at 3.4 percent, roughly unchanged from a year ago, implying plenty of room for an upward spike.

More…

Jim Sinclair’s Commentary

John Williams tells the truth of statistics. Pay him his modest fee.

-October Jobs and Unemployment Numbers Were Not Credible, Artifacts of a Broken Reporting System and/or Direct Manipulation

-With Consistent Seasonal

Adjustments, October Jobs Gain Would Have Been About 117,000 Instead of 171,000

- October Unemployment: 7.9% (U.3), 14.6% (U.6), 22.9% (ShadowStats.com)

-M3 Annual Growth Picks Up Again"

www.ShadowStats.com

Jim Sinclair’s Commentary

Tuesday one wins and the other loses. No matter who it is, we all lose.

No dog was hurt filming this video, just embarrassed.

Dear CIGAs,

Here is a message from the finest intellect in the market, a man capable of leading, Yra Harris.

We are honored that Yra reads us, and more so that he shares his thoughts with us.

Thank you, Yra.

Respectfully,

Jim

Dear CIGAs,

I believe this is dead on – especially in his view on the impact of the HFT algo’s that are driven by keywords in headlines. When Marc Cuban is railing about this in regards to equities, the world is becoming aware as to what we have known – a giant casino with the entire board a slot machine devoid of any fundamentals, at least on a short term basis. As long as regulators fail to actually regulate the capital markets, we as all good warriors must adapt to the battlefield and take advantage of the army fighting way ahead of its supply lines, and if supply lines mean fundamentals then we will wait and move only when they are lost in our terrain.

Patience is demanded.

Yra

Gold Market Overview From An HFT Perspective November 2, 2012, at 7:46 pm

by Jim Sinclair in the category General Editorial

Jim,

Here is an overview of market action for gold longs from a HFT perspective. If you plan to trade on my information, then the trade is: Buy physical gold. Any HFT worth their salt (or silicon) already knows what I have written here.

TAKE HEART GOLD LONGS, THE PAIN IS ALMOST OVER. The next leg of our journey takes us to $1800 and over, probably in time for Christmas. The best advice I ever received in gold is: “Your emotions are always wrong.” This was from a highly skilled trader named Jim Sinclair. Thank you, Jim.

Here is what is going on:

Market releases are important, and NFP is the most important.

NFP (non-farm payrolls) is the most volatile of all data releases. Every HFT (algo and human) trade it. The high risk trade is to short bonds or long S&P prior to the release. The HFT method is to close your position pre-release and have your finger on the mouse ready to pounce. Failing that, the human method is to fade the spike and profit from mean reversion.

On a ladder, you can see 1 min before a data release that orders are pulled and volume is barren. As the data is released, algos get it first. They slam orders into the market. A second (or less) later, humans add to these orders at market and the algos sweep their profits. This drives the price as stops are crossed and slow traders enter.

For this NFP release, everyone knew the data release would be the same as October. It’s an election year. The number may be revised in a week or 2, but that won’t matter after the election.

More…

Hi Jim,

Do you have a prediction of when we might see interest rates begin to rise? Is such a prediction possible at this conjecture?

As always, thank you so much for you time.

CIGA Chris

Chris,

Sure, the second that some politician screws with QE to infinity kiss the bond market goodbye, and not a minute before.

Keep in mind that QE is non-economic bond buying. Non-economic bond buying defeats every fundamentalist on rates.

Jim

Jim Sinclair’s Commentary

A perfect rendition of the quiet but power trend that is going to deliver currency induced cost push inflation is the form of a spiral event whereby one event fires the second event that fires the third event, all the way to hyperinflation that absolutely no advisor has any idea of. It is hiding in plain view but even our crowd cannot see it.

The following is courtesy of CIGA David the Good. That is because we have plenty of CIGA David the bads.

Jim Sinclair’s Commentary

This is the change in dollar settlement function and the decline of the dollar as the Reserve currency of choice, now the reserve currency by default.

1. February 2012, China and Japan ink a deal to do bilateral trade without the US dollar. The second and third largest economies in the world now trade without the dollar.

2. Sept 7, 2012, China and Russia begin trade without the American dollar. Russia announces that it will sell China all the crude oil it needs.

3. China and Brazil begin trading without the US dollar.

4. China and Australia ink a deal to trade without the dollar.

5. India and Japan began bilateral trade without the use of the dollar, the largest currency swap of 2012.

6. India and China are buying oil from Iran but because of UN and US trade sanctions they are not allowed to use the US dollar. So to bypass the dollar they are trading in Gold.

7. Iran and Russia have begun to sell oil without the use of the dollar.

8. China and Chile to trade without the use of the US dollar.

9. China and UAEA to trade without the US dollar.

10. China and Africa (Africa Standard Bank) have said they will handle any transactions necessary between China and Africa. Right at this moment China is the #1 supplier of goods to Africa.

11. April 5th 2012, BRICS come together and decide they are going to do trade amongst themselves without the US dollar. 43% of the world’s population are in these countries, 18% of the world GDP and 53% of the global financial capitol are now not using the dollar.

12. Sept 7th 2012, China and Germany sign a deal to trade and not use the USA dollar.

13. Sept 6th 2012, China announces that any country wishing to sell crude oil can now do so using the Yuan the next day Sept 7, 2012, and it will not use the American dollar.

14. August 2012, China and Taiwan ink a deal to do trade in cross channel trade.

Jim,

Thanks for your reply. I am confused by the deflation and inflationary forces that could impact the future evolution of gold. I’ve read that gold both gains in deflationary and in inflationary environments, though some so called market pundits say that deflation is a bigger risk than inflation. Could you enlighten me on that point?

Best regards,

CIGA Julien

Dear Julien,

I have written on this at least 1000 times. I would love to answer you, but I find it too hard to write a dissertation already published so many times.

Study the Weimar Republic to get your answer. The book you want is:

"When Money Dies:" The Nightmare of Deficit Spending, Devaluation, and Hyperinflation in Weimar Germany

Respectfully yours,

Jim

Mr. Sinclair,

Thank you for your service.

In your recent post "Gold Confiscation Rumor Control," do you consider that the government might feel the need to re-monetize the precious metal(s) in which case they might feel an urgent need to top up the hoard at Ft. Knox? Certainly, the statists wouldn’t care for stackers becoming wealthy by a future re-monetization (jealousy etc).

CIGA Paul

Paul,

Gold will never be convertible again. It will enter the system another way. If you own gold solely on the basis of the German or Fort Knox demand you better sell on the next rally.

Jim

Eric,

They are both really bad for the financial future. One is faster than the other.

Jim

Market Still Building Cause For Another Rally? CIGA Eric

The what if game has many investors expecting the worst after the Presidential election. Bullish divergences of price (lower lows) and trend energy (higher lows) suggests a market building cause for another rally. The market rarely gives what the consensus expects.

Chart: NYSE Composite and Internals

More…

Your support is needed...

Thank You

I'm PayPal Verified

from KingWorldNews:

Today James Turk spoke with King World News about the Fed purposely allowing a Lehman-type blowup to occur, the stunning news about what is taking place with the Fed’s balance sheet, Friday’s gold and silver smash, as well as what to expect going forward.

Here is what Turk had to say: “When we get days like Friday with big price drops in the precious metals, Eric, two things come to mind. First, there have been a lot of similar smashes in precious metal prices over the past decade, particularly on a Friday. Why on Fridays?”

James Turk continues @ KingWorldNews.com

Today James Turk spoke with King World News about the Fed purposely allowing a Lehman-type blowup to occur, the stunning news about what is taking place with the Fed’s balance sheet, Friday’s gold and silver smash, as well as what to expect going forward.

Here is what Turk had to say: “When we get days like Friday with big price drops in the precious metals, Eric, two things come to mind. First, there have been a lot of similar smashes in precious metal prices over the past decade, particularly on a Friday. Why on Fridays?”

James Turk continues @ KingWorldNews.com

by Robert P. Murphy , Euro Pacific Capital:

Author Peter Schiff has helped reassure me that I haven’t been taking crazy pills. President and chief global strategist of broker-dealer Euro Pacific Capital, Schiff is also the man who argued face-to-face with the Occupy Wall Street protestors in Manhattan’s Zuccotti Park, telling them — in part, at least — that they had a right to be angry.

Such perspectives help inform this wide-ranging and highly readable tome. For those who dismiss Schiff as an eccentric investor who “got lucky” with his now-famous prediction of the housing collapse, The Real Crash showcases a writer and analyst with a clear hold on sanity, who nonetheless has an unsettling message to convey.

“Whenever people credit me with calling the crash,” he declares at the outset, “it pains me to tell them that what they saw in 2008 and 2009 wasn’t the crash — that was a tremor before the earthquake. The real crash is still coming.”

Read More @ EuroPacificCapital.com

Author Peter Schiff has helped reassure me that I haven’t been taking crazy pills. President and chief global strategist of broker-dealer Euro Pacific Capital, Schiff is also the man who argued face-to-face with the Occupy Wall Street protestors in Manhattan’s Zuccotti Park, telling them — in part, at least — that they had a right to be angry.

Such perspectives help inform this wide-ranging and highly readable tome. For those who dismiss Schiff as an eccentric investor who “got lucky” with his now-famous prediction of the housing collapse, The Real Crash showcases a writer and analyst with a clear hold on sanity, who nonetheless has an unsettling message to convey.

“Whenever people credit me with calling the crash,” he declares at the outset, “it pains me to tell them that what they saw in 2008 and 2009 wasn’t the crash — that was a tremor before the earthquake. The real crash is still coming.”

Read More @ EuroPacificCapital.com

The Far More Important 'Election' Part 1: China's Political Process

The imminent once-in-a-decade leadership handover in China will likely be one of the most important if not the most important leadership changes in the world this year and beyond

in Goldman Sachs' opinion. Not only because it has the potential to

mark a shift in policy direction in what has become a global economic

giant, but also, as they note, because it comes at a time of substantial

economic and social uncertainty in the country, with the economic

future of China and the legitimacy of its current power structure

potentially at stake. On the eve of this important transition, understanding

this somewhat complex power structure, the composition and policy

leanings of the likely new leadership, and the potential new policy

priorities and reforms ahead is critical.

The imminent once-in-a-decade leadership handover in China will likely be one of the most important if not the most important leadership changes in the world this year and beyond

in Goldman Sachs' opinion. Not only because it has the potential to

mark a shift in policy direction in what has become a global economic

giant, but also, as they note, because it comes at a time of substantial

economic and social uncertainty in the country, with the economic

future of China and the legitimacy of its current power structure

potentially at stake. On the eve of this important transition, understanding

this somewhat complex power structure, the composition and policy

leanings of the likely new leadership, and the potential new policy

priorities and reforms ahead is critical.The Far More Important 'Election' Part 2: China's Market Implications

Having made clear in Part 1 the various policy leanings, uncertainty, and potential reform headlines, we delve a little deeper into the specifics of what the systemic and idiosyncratic implications might be. In two simple tables, Goldman lays out the top-down asset-class perspectives as 'new' China addresses its systemic issues and then looks at how China's equities (and by implication global equity indices) can meaningfully re-rate with a background of economic sustainability concerns as reforms impact various sectors more or less. As Goldman concludes: "Cyclical adjustments can help to restore confidence, but investors will likely be unwilling to meaningfully re-rate the market until more concrete progress is made on the reform front…but reforms may not be good for all sectors."

The Chinese Credit Bubble - Full Frontal

While

Chinese government and consumer debt can be whatever China wants it to

be (and when it isn't, any discharged and non-performing debt is merely

masked over with more debt: China doesn't have $3 trillion in foreign

reserves for nothing) corporate debt, in keeping with Western-style

reporting requirements, is far more difficult to obfuscate and falsify

in recent years. It is here that we get the first glimpse of the

true sheer extent of the Chinese credit bubble, which as the chart

below shows, is already the largest in the entire world.

While

Chinese government and consumer debt can be whatever China wants it to

be (and when it isn't, any discharged and non-performing debt is merely

masked over with more debt: China doesn't have $3 trillion in foreign

reserves for nothing) corporate debt, in keeping with Western-style

reporting requirements, is far more difficult to obfuscate and falsify

in recent years. It is here that we get the first glimpse of the

true sheer extent of the Chinese credit bubble, which as the chart

below shows, is already the largest in the entire world.IceCap Asset Management: How To Lull A Banker To Sleep

When

it comes to sleepless nights, Toimi Soini of Finland originally set

the record by using the "toothpicks under the eyelids" method for 11

straight days. In hindsight, Toimi was an amateur. Toimi Soini was not a

banker and this was his downfall. As for the Canadians, Swiss

and British – yes they are all bankers, but not just any bankers. This

terrific trio have the displeasure of forever being known as the

bankers who sold their gold. The irony of course, is the

action of the World’s central bankers themselves is the reason why gold

is destined to remain golden for sometime to come. And with

gold sitting near $1700/oz, and with no end to the money printing

games, the sleepless nights are destined to continue. IceCap's

Keith Dicker opines on the wrong-ness of Alan Greenspan's economic

miracle, equity manager's misplaced rationalization of performance as

skill, China's gold-buying spree, the Nobel Peace Prize debacle, and

the inexorable growth of 'fake money'.

When

it comes to sleepless nights, Toimi Soini of Finland originally set

the record by using the "toothpicks under the eyelids" method for 11

straight days. In hindsight, Toimi was an amateur. Toimi Soini was not a

banker and this was his downfall. As for the Canadians, Swiss

and British – yes they are all bankers, but not just any bankers. This

terrific trio have the displeasure of forever being known as the

bankers who sold their gold. The irony of course, is the

action of the World’s central bankers themselves is the reason why gold

is destined to remain golden for sometime to come. And with

gold sitting near $1700/oz, and with no end to the money printing

games, the sleepless nights are destined to continue. IceCap's

Keith Dicker opines on the wrong-ness of Alan Greenspan's economic

miracle, equity manager's misplaced rationalization of performance as

skill, China's gold-buying spree, the Nobel Peace Prize debacle, and

the inexorable growth of 'fake money'.'I' For Inevitable

Just

over 400-years ago today, a group of 13 conspirators was caught trying

to assassinate King James I of England and blow up the House of Lords

in what became known as the Gunpowder Treason. If you’ve ever seen the

movie V for Vendetta, you know the story. The plot of 1605 may have been

a failure for the conspirators, but given enough time, a system so

screwed up, so unsustainable, was destined to collapse on itself.

Curiously, we’re not so different in the west today; just like the

English monarchs, we have a tiny elite that controls absolutely

everything about our economy– taxation, regulation, and the supply of

money. Needless to say, this is also unsustainable. And history shows that these types of unsustainable systems will always collapse under their own weight.

Just

over 400-years ago today, a group of 13 conspirators was caught trying

to assassinate King James I of England and blow up the House of Lords

in what became known as the Gunpowder Treason. If you’ve ever seen the

movie V for Vendetta, you know the story. The plot of 1605 may have been

a failure for the conspirators, but given enough time, a system so

screwed up, so unsustainable, was destined to collapse on itself.

Curiously, we’re not so different in the west today; just like the

English monarchs, we have a tiny elite that controls absolutely

everything about our economy– taxation, regulation, and the supply of

money. Needless to say, this is also unsustainable. And history shows that these types of unsustainable systems will always collapse under their own weight. The first thing you notice about American Silver Eagles: A Guide to the U.S. Bullion Coin Program is that it’s a big book.

The first thing you notice about American Silver Eagles: A Guide to the U.S. Bullion Coin Program is that it’s a big book. In a brief history section, the authors discuss how the federal government entered the bullion market after New Deal-era restrictions on private gold ownership were lifted. They also write about the federal government’s early efforts to compete against foreign bullion, most notably the South African Krugerrand. The Krugerrand dominated the global gold coin market in the ‘70s and early ‘80s, but Americans were prohibited from buying it due to sanctions against the Apartheid government.

At first, Congress mandated the production of non-legal tender medals to compete on the world market.

Read More @ CoinWeek.com

It’s coming down to the wire on Proposition 37. After weeks of spending a million dollars a day broadcast outright lies, the Monsant-funded “No on 37″ campaign has managed to crush the early lead of the YES campaign, making the ballot measure a very close race.

If you live in California, your YES vote on Proposition 37 is urgently needed, or the GMO labeling ballot measure may not pass at all.

The NO on 37 campaign, funded by the six largest pesticide manufacturers in the world, has relied on some of the nastiest dirty tricks ever witnessed in any campaign. For starters, they have committed a felony crime by impersonating the FDA and fabricating a quote from the FDA which was used on mailers designed to misinform voters. This criminal activity is precisely the kind of thing these chemical poisoners frequently resort to in order to maintain their “dirty little secret” of toxic GMOs hidden in your food.

Read More @ NaturalNews.com

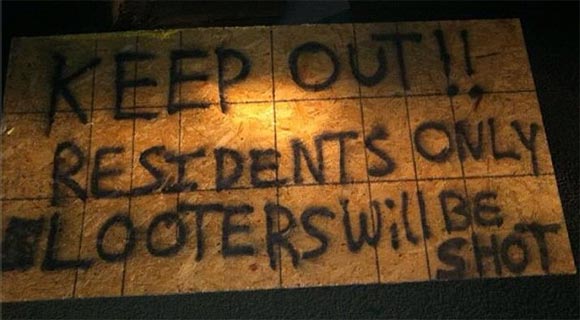

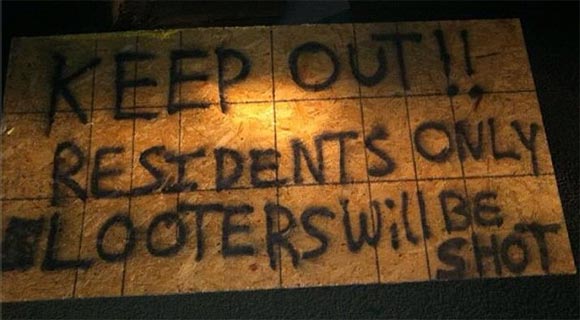

from Off Grid Survival:

Despite the federal government attempts to pretend that everything is under control; parts of New York have devolved into absolute chaos and anarchy.

From gas lines that stretch for miles to wide spread looting, robberies and violence; The Rockaways, Queens and Coney Island look more like a war zone than they do part of New York.

City Councilman James Sanders (D-Far Rockaway) is warning that his district may soon slip into complete anarchy.

Your support is needed...

Thank You

I'm PayPal Verified

Whether you’re just realizing the importance of preparing for

unforeseen disasters, or you’re a seasoned prepper, you can never have

too much information at your fingertips.

Do you know how to safely store food for the long-term, or the self defense tools you may need to protect that food if the rule of law break downs? If the global floating currency exchange mechanism breaks down, what will your ‘money’ be? When there are no doctors, how will you treat injuries and disease?

Emergency preparedness and survival planning have numerous aspects, all of which need to be considered before a crisis hits, because when the ‘S’ hits the fan, it’ll be too late. We need only look at current events to see the truth in this.

Read More @ SHTFPlan.com

Despite the federal government attempts to pretend that everything is under control; parts of New York have devolved into absolute chaos and anarchy.

From gas lines that stretch for miles to wide spread looting, robberies and violence; The Rockaways, Queens and Coney Island look more like a war zone than they do part of New York.

City Councilman James Sanders (D-Far Rockaway) is warning that his district may soon slip into complete anarchy.

He told the New York Daily News:

“We have an explosive mix here,” said Sanders. “People will take matters into their own hands.”

Read More @ OffGridSurvival.com

Your support is needed...

Thank You

I'm PayPal Verified

by Mike Adams, Natural News:

In the wake of superstorm Sandy, preppers are the new prophets. Those who failed to prepare are the new homeless.

In the wake of superstorm Sandy, preppers are the new prophets. Those who failed to prepare are the new homeless.

For as long as we can all remember, preppers and survivalists have been derided by the mainstream media, labeled “kooks” and “wing nuts” for stockpiling food, water, ammunition, medical supplies and emergency gear. Only paranoid conspiracy theorists engage in evil preparedness activities, we were told by the sellout mainstream media, and they’ve convinced many that preppers may even be terrorists.

The very word “stockpiling” has been used in a derogatory manner, as if it’s somehow bad for private citizens to stockpile food, medicine and emergency supplies that might save lives in a crisis. Never mind that the government stockpiles all these things for its own survival; citizens are routinely taught that stockpiling is bad!

Read More @ NaturalNews.com

In the wake of superstorm Sandy, preppers are the new prophets. Those who failed to prepare are the new homeless.

In the wake of superstorm Sandy, preppers are the new prophets. Those who failed to prepare are the new homeless.For as long as we can all remember, preppers and survivalists have been derided by the mainstream media, labeled “kooks” and “wing nuts” for stockpiling food, water, ammunition, medical supplies and emergency gear. Only paranoid conspiracy theorists engage in evil preparedness activities, we were told by the sellout mainstream media, and they’ve convinced many that preppers may even be terrorists.

The very word “stockpiling” has been used in a derogatory manner, as if it’s somehow bad for private citizens to stockpile food, medicine and emergency supplies that might save lives in a crisis. Never mind that the government stockpiles all these things for its own survival; citizens are routinely taught that stockpiling is bad!

Read More @ NaturalNews.com

Do you know how to safely store food for the long-term, or the self defense tools you may need to protect that food if the rule of law break downs? If the global floating currency exchange mechanism breaks down, what will your ‘money’ be? When there are no doctors, how will you treat injuries and disease?

Emergency preparedness and survival planning have numerous aspects, all of which need to be considered before a crisis hits, because when the ‘S’ hits the fan, it’ll be too late. We need only look at current events to see the truth in this.

Read More @ SHTFPlan.com

by Rebecca Rosenberg, Sally Goldenberg, Kate Kowsh and Bruce Golding, New York Post

What a run-around!

The city left more than a dozen generators desperately needed by cold and hungry New Yorkers who lost their homes to Hurricane Sandy still stranded in Central Park yesterday.

And that’s not all — stashed near the finish line of the canceled marathon were 20 heaters, tens of thousands of Mylar “space” blankets, jackets, 106 crates of apples and peanuts, at least 14 pallets of bottled water and 22 five-gallon jugs of water.

This while people who lost their homes in the Rockaways, Coney Island and Staten Island were freezing and going hungry.

Read More @ nypost.com

What a run-around!

The city left more than a dozen generators desperately needed by cold and hungry New Yorkers who lost their homes to Hurricane Sandy still stranded in Central Park yesterday.

And that’s not all — stashed near the finish line of the canceled marathon were 20 heaters, tens of thousands of Mylar “space” blankets, jackets, 106 crates of apples and peanuts, at least 14 pallets of bottled water and 22 five-gallon jugs of water.

This while people who lost their homes in the Rockaways, Coney Island and Staten Island were freezing and going hungry.

Read More @ nypost.com

by Bill Gertz, Free Beacon:

A Russian nuclear-powered attack submarine cruised within 200 miles of

the East Coast recently in the latest sign Russia is continuing to flex

its naval and aerial power against the United States, defense officials

said.

A Russian nuclear-powered attack submarine cruised within 200 miles of

the East Coast recently in the latest sign Russia is continuing to flex

its naval and aerial power against the United States, defense officials

said.

The submarine was identified by its NATO designation as a Russian Seirra-2 class submarine believed to be based with Russia’s Northern Fleet. It was the first time that class of Russian submarine had been detected near a U.S. coast, said officials who spoke on condition of anonymity because of the sensitive nature of anti-submarine warfare efforts.

One defense official said the submarine was believed to have been conducting anti-submarine warfare efforts against U.S. ballistic and cruise missile submarines based at Kings Bay, Georgia.

Read More @ FreeBeacon.com

The submarine was identified by its NATO designation as a Russian Seirra-2 class submarine believed to be based with Russia’s Northern Fleet. It was the first time that class of Russian submarine had been detected near a U.S. coast, said officials who spoke on condition of anonymity because of the sensitive nature of anti-submarine warfare efforts.

One defense official said the submarine was believed to have been conducting anti-submarine warfare efforts against U.S. ballistic and cruise missile submarines based at Kings Bay, Georgia.

Read More @ FreeBeacon.com

by Hugo Salinas Price, SilverBearCafe.com:

Why don’t humans use gold coins as Money?

The answer is quite simple: because they don’t want to, under present circumstances.

The attachment of humans to gold is remarkable; I suspect there is something metaphysical about gold that attracts human beings. Perhaps gold is part of the natural order of things, part of the Rerum Natura, and the relationship of humans to gold is “built-in” into human nature, like sexual attraction. I won’t insist upon this, but I think about it.

But getting back to the question and the answer I give. The next question is: Why don’t humans choose to use gold coins as money, under the present circumstances?

Read More @ SilverBearCafe.com

Why don’t humans use gold coins as Money?

The answer is quite simple: because they don’t want to, under present circumstances.

The attachment of humans to gold is remarkable; I suspect there is something metaphysical about gold that attracts human beings. Perhaps gold is part of the natural order of things, part of the Rerum Natura, and the relationship of humans to gold is “built-in” into human nature, like sexual attraction. I won’t insist upon this, but I think about it.

But getting back to the question and the answer I give. The next question is: Why don’t humans choose to use gold coins as money, under the present circumstances?

Read More @ SilverBearCafe.com

by Graham Summers, Gains Pains & Capital:

Yesterday we assessed the impact a second Obama term would have on the US economy and markets. Now let’s assess what impact a Romney Presidency would have on the US economy and financial markets.

For starters, Romney has already stated that he would fire Fed Chairman Ben Bernanke if he wins office. While this doesn’t represent the real shakeup that the Fed needs, it’s definitely a step in the right direction.

With that in mind, if Romney wins and makes good on this promise to fire Bernanke, then we need to consider that any market rally that occurs based on the perception that the US economy would strengthen would be short-lived.

Read More @ GainsPainsCapital.com

Your support is needed...

Thank You

I'm PayPal Verified

Yesterday we assessed the impact a second Obama term would have on the US economy and markets. Now let’s assess what impact a Romney Presidency would have on the US economy and financial markets.

For starters, Romney has already stated that he would fire Fed Chairman Ben Bernanke if he wins office. While this doesn’t represent the real shakeup that the Fed needs, it’s definitely a step in the right direction.

With that in mind, if Romney wins and makes good on this promise to fire Bernanke, then we need to consider that any market rally that occurs based on the perception that the US economy would strengthen would be short-lived.

Read More @ GainsPainsCapital.com

Your support is needed...

Thank You

I'm PayPal Verified

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment