by Eirk Rush, CFP

So… Barack Obama won re-election to the office of President of the

United States, and Republican challenger Mitt Romney has slipped into

obscurity faster than any candidate I’ve ever seen. Aside from futile,

quasi-navel gazing posturing on the part of Congress over the “fiscal

cliff” upon which the American economy is perched, news coverage since

the election has been rife with diversion and non-issues.

So… Barack Obama won re-election to the office of President of the

United States, and Republican challenger Mitt Romney has slipped into

obscurity faster than any candidate I’ve ever seen. Aside from futile,

quasi-navel gazing posturing on the part of Congress over the “fiscal

cliff” upon which the American economy is perched, news coverage since

the election has been rife with diversion and non-issues.We’re already sick of hearing autopsies of the Romney campaign. Suffice it to say that there is a host of reasons that Romney should not have been the GOP nominee, and that he could have run his campaign better. For years, conservatives have been driving home the point that when the Republican Party wants to win, it should advance conservative candidates, which Romney was most assuredly not. They have also rightly pointed out that Romney did not run on any of the party base’s core principles, thus failing to provide a distinction between him and Obama.

Read More @ CanadaFreePress.com

FOMC Minutes Show Fed Members Expect More Unsterilized Monetization After Twist Ends, As Expected

In what should be news to precisely nobody (especially our readers, for whom we laid out the next Easing steps very clearly on the day QEternity was announced, including the continuation of Twist after December 31, 2012 at

which point the Fed would merely monetize long-dated paper without

selling short-end, i.e. unsterilized), the just released FOMC minutes

indicated that "a number" of FOMC members favored more (infiniter)

QE after the end of Twist. In other words, the Fed will have to

continue monetizing the long-end of the Treasury issuance in lieu of

other willing buyers. Recall that the Fed is currently buying up all the

10 Year+ gross issuance. To assume that this can change in some way is

ludicrous. It also means that going forward, anything less than $85

billion in monthly flow from the Fed will be seen as tightening.

Apparently, this update was big news to the algos (and the BIS FX

traders) in charge of daytrading the EURUSD, which ramped by 30 pips on

the news. Stocks, however, are oddly enough, the rational instrument

today, and have barely budged on this news, once again indicating (as

shown during yesterday's Yellen comments), that the Fed has

priced itself and its future decisions out of the market, also exactly

as we predicted would happen minutes after QEternity was announced.

In what should be news to precisely nobody (especially our readers, for whom we laid out the next Easing steps very clearly on the day QEternity was announced, including the continuation of Twist after December 31, 2012 at

which point the Fed would merely monetize long-dated paper without

selling short-end, i.e. unsterilized), the just released FOMC minutes

indicated that "a number" of FOMC members favored more (infiniter)

QE after the end of Twist. In other words, the Fed will have to

continue monetizing the long-end of the Treasury issuance in lieu of

other willing buyers. Recall that the Fed is currently buying up all the

10 Year+ gross issuance. To assume that this can change in some way is

ludicrous. It also means that going forward, anything less than $85

billion in monthly flow from the Fed will be seen as tightening.

Apparently, this update was big news to the algos (and the BIS FX

traders) in charge of daytrading the EURUSD, which ramped by 30 pips on

the news. Stocks, however, are oddly enough, the rational instrument

today, and have barely budged on this news, once again indicating (as

shown during yesterday's Yellen comments), that the Fed has

priced itself and its future decisions out of the market, also exactly

as we predicted would happen minutes after QEternity was announced.Complication: US Ally Egypt Gets Involved, Says Will No Longer Tolerate Israel's Gaza Attacks

it was only a matter of time before today's Israeli offensive ran into a snag. The complication: Egypt, which has long been treading the fence being both a pro-US regional power (someone has to provide those joint guarantees on Egyptian bonds, and to supply the local tear gas canisters in exchange for a friendly Suez Canal administrator), as well as a pro-Muslim presence. Today, the government was taken to task by the ruling Islamist Muslim Brotherhood which felt the need to be true to its name and express disgust at the Israeli action in Gaza. From AFP: "Egypt’s Islamist Freedom and Justice Party, formerly headed by President Mohammed Mursi, said on Wednesday Egypt would no longer stand by as Israel attacked Palestinians after air strikes killed a Hamas leader. The FJP, the political arm of the powerful Muslim Brotherhood movement, said Israeli air strikes that killed top militant Ahmed al-Jaabari in Gaza earlier on Wednesday required “swift Arab and international action to stop the massacres.” The party, which fielded Mursi in a June election to replace toppled president Hosni Mubarak, said Israel “must take into account the changes in the Arab region and especially Egypt.” Egypt “will not allow the Palestinians to be subjected to Israeli aggression, as in the past,” the party statement said."Compromiser-In-Chief On The Economy And Fiscal Cliff - Live Webcast

After a busy morning of phone calls from Israel and chatting with his base

'influential' CEOs, we are sure the Compromiser-in-Chief will reach

across the aisle this time... right? Will the market follow the recent

trend and drop on his every word? Live webcast below...

After a busy morning of phone calls from Israel and chatting with his base

'influential' CEOs, we are sure the Compromiser-in-Chief will reach

across the aisle this time... right? Will the market follow the recent

trend and drop on his every word? Live webcast below...Meet Goldman's New Partners

It may be one of the smallest partner "classes" in recent Goldman history but for the 70 names below, today is one of the best days of their lives: it marks their induction into the real Master of the Galaxy club (sadly, not even Goldman is Master of the Universe any more). This is what Lloyd had to say: “We congratulate all those selected on this important achievement and look forward to their leadership in the years ahead." Spoiler alert: neither Greg Smith, nor Shashank Tripathi, are on the list.Gold Will Lead Most Assets to Higher Highs in 2013

Eric De Groot at Eric De Groot - 24 minutes ago

The latest leading formula and formula post are likely the best and most

up-to-date charts on Insights. I keep hoping the elves would tackle my

chart database, but apparently they're too worried about the "fiscal cliff"

and "sex scandals" that don't pass the sniff test to get out of bed right

now. Go figure! Once the drama passes, I expect gold to lead most asset

classes to higher...

[[ This is a content summary only. Visit my website for full links, other

content, and more! ]]

HUI Under Intense Selling Pressure

Trader Dan at Trader Dan's Market Views - 31 minutes ago

EVer since Newmont and Barrick reported "less than stellar" earnings, (and

that is being generous with my choice of words), the mining sector has not

been able to shrug off the selling pressure coming from both disappointed

bulls as well as opportunistic bears.

The technical posture of the market has deteriorated but if the index is

able to stay above the former downsloping trend line which it took out in

early September, the long term bulls will be okay.

It is not uncommon to see a market breach a trendline and then come back to

retest it before moving higher. If we get such a tes... more »

Secession Petitions Now Number over 610,000 Signatures

Trader Dan at Trader Dan's Market Views - 1 hour ago

I will try to keep posting an occasional tally of the number of signatures

on the ever-growing list of states from which secession petitions have been

submitted.

Based on the rate of increase (Texas is closing in on the 100,000 mark), I

suspect we will be up near one million before the week is out.

It's Getting Ugly

Dave in Denver at The Golden Truth - 1 hour ago

The declining state of the economy, as I've been explaining for a while

now, is starting to finally manifest in economic and financial reports. As

most of you know, corporate earnings for the 3rd quarter have been pretty

dismal, with lots of earnings "misses" occurring.

Second, the Government released its "income statement" for the month of

October, the first month of the Govt's Fiscal Year 2013. It showed a $120

billion deficit, substantially higher than was expected and estimated and

higher than October 2012's $98.5 billion. Here's the LINK The Government

is saying "technicali... more »

The Whole Global Financial System Will Have To Be Reset

Admin at Marc Faber Blog - 2 hours ago

I think the whole global financial system will have to be reset and it

won’t be reset by central bankers but by imploding markets — either the

currency markets, debt market or stock markets. It will happen — it will

happen one day and then we’ll be lucky if we still have 50 percent of the

asset values that we have today. - *in CNBC*

*Marc Faber is an international investor known for his uncanny predictions

of the stock market and futures markets around the world.*Israel Releases Video Of Air Strike Taking Out Hamas' Military Wing Head

No, this is not a clip from the latest Call of Duty showing what happens when one gets a 9+ killstreak. It is the IAF taking out the head of the Hamas military wing, which has set the region ablaze (even if the central bank manipulated VIX and EURUSD refuse to budge in response).

Late-Day Equity Ramp But European Bonds Ain't Buying It

Between the escalation in the Middle East and Olli Rehn pouring cold-water on the hopes and prayers of an imminent Spanish rescue-request, sovereign bond risk rose notably today. A late-day rampapalooza in EURUSD (another round of end-of-day repatriation?) signaled risk-on in the correlated monkeys and sure enough (in the US and Europe) stocks rose into the European close. The USD is remarkably unchanged on the week - despite the volatility in risk assets in general (zee stabilitee at the 1.27 peg seems the new normal) - as the Fed/ECB 'agreement' appears to have crushed the life out of yet another market-based signal - as EURUSD implied vol crashes to five-year lows.

The mainstream media never cry “wolf!” on the statistically inevitable

bankruptcy of Medicare and Social Security. Instead, they cry “wolf

cub.”

The mainstream media never cry “wolf!” on the statistically inevitable

bankruptcy of Medicare and Social Security. Instead, they cry “wolf

cub.”Robert Powell, the resident retirement economics expert at MarketWatch, has written a standard head-in-the-sand article on the #1 and #2 fiscal killers in the United States: Medicare and Social Security.

It begins with a tip-off to readers about his politics. “Congrats on your re-election! I hope you’ll forgive me for not dwelling on your victory and getting straight to the point.”

Powell knows that Obama will never read his column. So do his readers. So, the intro is for readers, not for Obama.

With all due respect, it’s time for you to tackle this nation’s retirement security issues, including Social Security, Medicare, and a host of other challenges that threaten the financial well-being and standard of living of current and future retirees.Read More @ LewRockwell.com

from Azizonomics:

UBS’s Larry Hatheway — who

once issued some fairly sane advice when he recommended the purchase of

tinned goods and small calibre firearms in the case of a Euro collapse — thinks 1000% inflation could be beneficial:

UBS’s Larry Hatheway — who

once issued some fairly sane advice when he recommended the purchase of

tinned goods and small calibre firearms in the case of a Euro collapse — thinks 1000% inflation could be beneficial:

When 1000% inflation can be desirableIn fact, the costs associated with inflation (price change) are less than commonly supposed. There is the famous “sticker price cost” – the cost of constantly changing price labels – but in a world of electronic displays and web based ordering this is not a serious economic cost (in fact, it never was). To take an extreme position, one can make the economic argument that there are only limited costs in having inflation running at 1000% per year, with one caveat. 1000% inflation is perfectly acceptable, as long as the 1000% inflation rate is stable at 1000%, and it is anticipated. Of course, one can argue that high inflation tends to be associated with high inflation volatility and uncertainty (and that is true empirically), but economically it is the volatility and uncertainty that does most of the damage.

Read More @ Azizonomics.com

from KingWorldNews:

Today a legend in the business surprised King World News when he

warned that “… global gold production is poised to fall off a cliff.”

Keith Barron, who consults with major gold companies around the world

and is responsible for one of the largest gold discoveries in the last

quarter century, also spoke about the tragic events which are taking

place in Europe.

Today a legend in the business surprised King World News when he

warned that “… global gold production is poised to fall off a cliff.”

Keith Barron, who consults with major gold companies around the world

and is responsible for one of the largest gold discoveries in the last

quarter century, also spoke about the tragic events which are taking

place in Europe.

Here is what Barron had to say: “It was just announced that the creditors for Greece had gotten together and decided they are not going to impose the severe austerity they had been talking about. The European Central Bank is aware that Greece has a shortfall between now and 2016 of 32 billion euros. They have no idea where Greece is going to find it.”

“The ECB better not try to get it from Germany because Germany is going to balk. Last week the Greek Parliament adopted new austerity measures, and we saw lots of Molotov cocktails being tossed at the Parliament buildings by students, unemployed, and others who were protesting. This took place on the evening of the announcements.

Greece is on the verge of a total breakdown….

Keith Barron continues @ KingWorldNews.com

from Fabian4Liberty:

Today a legend in the business surprised King World News when he

warned that “… global gold production is poised to fall off a cliff.”

Keith Barron, who consults with major gold companies around the world

and is responsible for one of the largest gold discoveries in the last

quarter century, also spoke about the tragic events which are taking

place in Europe.

Today a legend in the business surprised King World News when he

warned that “… global gold production is poised to fall off a cliff.”

Keith Barron, who consults with major gold companies around the world

and is responsible for one of the largest gold discoveries in the last

quarter century, also spoke about the tragic events which are taking

place in Europe.Here is what Barron had to say: “It was just announced that the creditors for Greece had gotten together and decided they are not going to impose the severe austerity they had been talking about. The European Central Bank is aware that Greece has a shortfall between now and 2016 of 32 billion euros. They have no idea where Greece is going to find it.”

“The ECB better not try to get it from Germany because Germany is going to balk. Last week the Greek Parliament adopted new austerity measures, and we saw lots of Molotov cocktails being tossed at the Parliament buildings by students, unemployed, and others who were protesting. This took place on the evening of the announcements.

Greece is on the verge of a total breakdown….

Keith Barron continues @ KingWorldNews.com

from Fabian4Liberty:

by AGXIIK, Silver Doctors:

With

the media fixated on the fiscal cliff, no one seems to be noticing the

fact that the FDIC’s expanded 100% coverage for insured deposits ends

January 1st, 2013.

With

the media fixated on the fiscal cliff, no one seems to be noticing the

fact that the FDIC’s expanded 100% coverage for insured deposits ends

January 1st, 2013.

As of January 2013 the FDIC stops offering 100% coverage for all insured deposits. That amounts to $1.6 trillion in deposits, 85-90% deposited with the TBTF mega banks. Once the insurance ramps back to $250,000 the FDIC risk amelioration offered to large depositors will cause them to flee from the insecurity of the much reduced FDIC coverage. This money will rotate immediately into short term Treasury securities. The treasury, in order to handle this flood of money, will immediately offer negative interest rates. This financing will resemble the .5% negative interest rate offered by the Swiss and Germans on the funds flooding to their banks from Spain, Greece and Italy.

This will be a bank run much larger than the Euro banks flight to safety.

Read More @ Silver Doctors

Your support is needed...

I'm PayPal Verified

With

the media fixated on the fiscal cliff, no one seems to be noticing the

fact that the FDIC’s expanded 100% coverage for insured deposits ends

January 1st, 2013.

With

the media fixated on the fiscal cliff, no one seems to be noticing the

fact that the FDIC’s expanded 100% coverage for insured deposits ends

January 1st, 2013.As of January 2013 the FDIC stops offering 100% coverage for all insured deposits. That amounts to $1.6 trillion in deposits, 85-90% deposited with the TBTF mega banks. Once the insurance ramps back to $250,000 the FDIC risk amelioration offered to large depositors will cause them to flee from the insecurity of the much reduced FDIC coverage. This money will rotate immediately into short term Treasury securities. The treasury, in order to handle this flood of money, will immediately offer negative interest rates. This financing will resemble the .5% negative interest rate offered by the Swiss and Germans on the funds flooding to their banks from Spain, Greece and Italy.

This will be a bank run much larger than the Euro banks flight to safety.

Read More @ Silver Doctors

The

sale of gold in India’s metros over Diwali touches new high, with 6,500

kilos of gold sold in one day – Dhanteras (Sunday) as demand veers from

jewellery to investment.

by Shivom Seth, MineWeb.com

It’s a case of whether you want to hear the good news first or the

not-so-good news. India is right in the middle of its festive season,

Diwali – the festival of lights, and reports coming in from all quarters

suggest that new gold sales milestones may well be set this year.

It’s a case of whether you want to hear the good news first or the

not-so-good news. India is right in the middle of its festive season,

Diwali – the festival of lights, and reports coming in from all quarters

suggest that new gold sales milestones may well be set this year.

One gold association has noted that the sale of gold jewellery this season has jumped up by over 30% as compared to the same period last year. That’s the good news. The not-so-good story emerged from India’s rural areas, normally a market with its own set of demands.

The high price of the yellow metal coupled with high inflation and a poor monsoon this year ensured that demand from rural India was unable to keep pace with its urban counterpart.

Read More @ MineWeb.com

by Shivom Seth, MineWeb.com

It’s a case of whether you want to hear the good news first or the

not-so-good news. India is right in the middle of its festive season,

Diwali – the festival of lights, and reports coming in from all quarters

suggest that new gold sales milestones may well be set this year.

It’s a case of whether you want to hear the good news first or the

not-so-good news. India is right in the middle of its festive season,

Diwali – the festival of lights, and reports coming in from all quarters

suggest that new gold sales milestones may well be set this year.One gold association has noted that the sale of gold jewellery this season has jumped up by over 30% as compared to the same period last year. That’s the good news. The not-so-good story emerged from India’s rural areas, normally a market with its own set of demands.

The high price of the yellow metal coupled with high inflation and a poor monsoon this year ensured that demand from rural India was unable to keep pace with its urban counterpart.

Read More @ MineWeb.com

from BATR:

The rapid approach of the Thelma & Louise bipartisan plunge into

the financial abyss is upon us. It is simply unbelievable, that the

prospects of rational tax salvation by the end of the year, measured by

every statement coming out of the Washington political cabal, will

materialize. Extending the current tax rates from automatic rescission

on January 1, 2013, as a stopgap method for an enactment of a lasting

political rapprochement, is the best that might occur. The net effect

will be a perspicacious downturn in economic activity, a new round of

layoffs, rising permanent unemployment and a plunge in consumer

confidence. Wall Street will make hay by shorting the market while

placing blame on the uncompromising hacks that refuse to cut a deal.

The rapid approach of the Thelma & Louise bipartisan plunge into

the financial abyss is upon us. It is simply unbelievable, that the

prospects of rational tax salvation by the end of the year, measured by

every statement coming out of the Washington political cabal, will

materialize. Extending the current tax rates from automatic rescission

on January 1, 2013, as a stopgap method for an enactment of a lasting

political rapprochement, is the best that might occur. The net effect

will be a perspicacious downturn in economic activity, a new round of

layoffs, rising permanent unemployment and a plunge in consumer

confidence. Wall Street will make hay by shorting the market while

placing blame on the uncompromising hacks that refuse to cut a deal.

As for the message from the latest election, let no one forget. With all haste during four more years, the implementation of expansive socialism from an Obama administration is inevitable.

The backbone from the establishment loyal opposition is well known for their spineless tendencies. The righteous outrage from the Tea Party representatives, silenced during much of the last campaign, is slated for confinement to a corner room in the basement.

Read More @ BATR.org

The rapid approach of the Thelma & Louise bipartisan plunge into

the financial abyss is upon us. It is simply unbelievable, that the

prospects of rational tax salvation by the end of the year, measured by

every statement coming out of the Washington political cabal, will

materialize. Extending the current tax rates from automatic rescission

on January 1, 2013, as a stopgap method for an enactment of a lasting

political rapprochement, is the best that might occur. The net effect

will be a perspicacious downturn in economic activity, a new round of

layoffs, rising permanent unemployment and a plunge in consumer

confidence. Wall Street will make hay by shorting the market while

placing blame on the uncompromising hacks that refuse to cut a deal.

The rapid approach of the Thelma & Louise bipartisan plunge into

the financial abyss is upon us. It is simply unbelievable, that the

prospects of rational tax salvation by the end of the year, measured by

every statement coming out of the Washington political cabal, will

materialize. Extending the current tax rates from automatic rescission

on January 1, 2013, as a stopgap method for an enactment of a lasting

political rapprochement, is the best that might occur. The net effect

will be a perspicacious downturn in economic activity, a new round of

layoffs, rising permanent unemployment and a plunge in consumer

confidence. Wall Street will make hay by shorting the market while

placing blame on the uncompromising hacks that refuse to cut a deal.As for the message from the latest election, let no one forget. With all haste during four more years, the implementation of expansive socialism from an Obama administration is inevitable.

The backbone from the establishment loyal opposition is well known for their spineless tendencies. The righteous outrage from the Tea Party representatives, silenced during much of the last campaign, is slated for confinement to a corner room in the basement.

Read More @ BATR.org

by Tess Pennington, SHTFPlan:

Do you think the government will be there for you in the middle of a crisis?

If they can’t handle the emergency response after a Category 1 hurricane, what will this country look like when the economic and fiscal crisis comes to a head?

What happens if the US dollar comes under attack from foreign creditors who choose to no longer accept it in trade? How will we as a nation import oil and food in such a scenario?

What if monetary easing by the Federal Reserve causes price increases so drastic that current employee wages or nutritional assistance allotments provide only a couple of days worth of food?

What if states and local municipalities are so broke that they withhold pay from government employees like police officers and emergency medical responders?

Do you think the government will be there for you in the middle of a crisis?

If they can’t handle the emergency response after a Category 1 hurricane, what will this country look like when the economic and fiscal crisis comes to a head?

What happens if the US dollar comes under attack from foreign creditors who choose to no longer accept it in trade? How will we as a nation import oil and food in such a scenario?

What if monetary easing by the Federal Reserve causes price increases so drastic that current employee wages or nutritional assistance allotments provide only a couple of days worth of food?

What if states and local municipalities are so broke that they withhold pay from government employees like police officers and emergency medical responders?

We’re talking about the potential for an absolute credit freeze that will make the situation in New York spread across this country almost overnight.

Read More @ SHTFPlan.com

Your support is needed...

Thank You

I'm PayPal Verified

by Rick Ackerman, Rick Ackerman.com:

For gold investors, first the bad news – and let us be clear up front:

it’s not really that bad. Notice in the Comex chart below that the

price of gold has been meandering within a pennant formation for more

than a year. You don’t have to be a technician to see that this could

comfortably continue for some time – well into 2014, perhaps – before

the converging lines of the pennant will narrow sufficiently to force

gold to “escape” either up or down. You can relax about which direction

is the more likely, since the pattern so far looks like a classic

consolidation, tipping the odds toward a breakout rather than a

breakdown.

For gold investors, first the bad news – and let us be clear up front:

it’s not really that bad. Notice in the Comex chart below that the

price of gold has been meandering within a pennant formation for more

than a year. You don’t have to be a technician to see that this could

comfortably continue for some time – well into 2014, perhaps – before

the converging lines of the pennant will narrow sufficiently to force

gold to “escape” either up or down. You can relax about which direction

is the more likely, since the pattern so far looks like a classic

consolidation, tipping the odds toward a breakout rather than a

breakdown.

However, our own proprietary tools (a.k.a. Hidden Pivot Analysis) suggest that it could be a while before the excitement begins. This is implied by December Gold’s failure in October to surpass an important peak at $1802 peak recorded seven months earlier, in March of 2012. Had the recent rally exceeded that peak, it would have created a bullish “impulse leg” of weekly-chart degree, clearing a path to at least $1976. Alas, the rally chickened out just five points shy of impulsiveness, casting gold into corrective purgatory for an indefinite spell.

Read More @ RickAckerman.com

For gold investors, first the bad news – and let us be clear up front:

it’s not really that bad. Notice in the Comex chart below that the

price of gold has been meandering within a pennant formation for more

than a year. You don’t have to be a technician to see that this could

comfortably continue for some time – well into 2014, perhaps – before

the converging lines of the pennant will narrow sufficiently to force

gold to “escape” either up or down. You can relax about which direction

is the more likely, since the pattern so far looks like a classic

consolidation, tipping the odds toward a breakout rather than a

breakdown.

For gold investors, first the bad news – and let us be clear up front:

it’s not really that bad. Notice in the Comex chart below that the

price of gold has been meandering within a pennant formation for more

than a year. You don’t have to be a technician to see that this could

comfortably continue for some time – well into 2014, perhaps – before

the converging lines of the pennant will narrow sufficiently to force

gold to “escape” either up or down. You can relax about which direction

is the more likely, since the pattern so far looks like a classic

consolidation, tipping the odds toward a breakout rather than a

breakdown. However, our own proprietary tools (a.k.a. Hidden Pivot Analysis) suggest that it could be a while before the excitement begins. This is implied by December Gold’s failure in October to surpass an important peak at $1802 peak recorded seven months earlier, in March of 2012. Had the recent rally exceeded that peak, it would have created a bullish “impulse leg” of weekly-chart degree, clearing a path to at least $1976. Alas, the rally chickened out just five points shy of impulsiveness, casting gold into corrective purgatory for an indefinite spell.

Read More @ RickAckerman.com

from Wealth Wire:

Your support is needed...

I'm PayPal Verified

Gold smugglers around the globe have

been smuggling gold into countries and Iranian buyers are especially

prevalent in this scheme.

In August alone, $2-billion

worth of gold was shipped to Dubai on behalf of Iranian buyers,

according to Turkish trade documents. Now, we’ve received news from

London indicating that Iranians have purchased at least $10 million

worth of silver this year as well.

In September, an additional $1.4 billion worth in gold and silver was carried in simple luggage bags from Turkey to Iran, UAE and Middle East.

Iran is

doing this to avoid strict Western sanctions in preparation for

whatever emergency situation may ensue as we inch closer to the Fiscal

Cliff with each passing day.

Read More @ WealthWire.com

by Jim McKay, Emergency Mgmt:

Americans have a false sense of security when it comes to disasters,

and should they become victims, most haven’t taken steps to help

themselves during the first few days after one strikes. Experts say

either the preparedness message isn’t getting across, or the wrong

message is being sent.

Americans have a false sense of security when it comes to disasters,

and should they become victims, most haven’t taken steps to help

themselves during the first few days after one strikes. Experts say

either the preparedness message isn’t getting across, or the wrong

message is being sent.

In a recent survey conducted by the Ad Council, 17 percent of respondents said they were very prepared for an emergency situation, which means they have a kit and a plan to sustain themselves during the first few days of a disaster. In the same survey, however, just 23 percent of respondents said they have a plan to communicate with family members if there is no cellphone service.

But this figure is considered inflated by some who say the percentage of prepared citizens is dreadful. “Oftentimes you’ll get a survey saying 6 percent of the public is prepared,” said Ana-Marie Jones, executive director of the nonprofit organization Collaborating Agencies Responding to Disasters (CARD). “That’s nothing to write home about if you consider 4 percent of the population is Mormon and they prepare without being told to do so by the U.S. government.”

Read More @ EmergencyMgmt.com

Americans have a false sense of security when it comes to disasters,

and should they become victims, most haven’t taken steps to help

themselves during the first few days after one strikes. Experts say

either the preparedness message isn’t getting across, or the wrong

message is being sent.

Americans have a false sense of security when it comes to disasters,

and should they become victims, most haven’t taken steps to help

themselves during the first few days after one strikes. Experts say

either the preparedness message isn’t getting across, or the wrong

message is being sent. In a recent survey conducted by the Ad Council, 17 percent of respondents said they were very prepared for an emergency situation, which means they have a kit and a plan to sustain themselves during the first few days of a disaster. In the same survey, however, just 23 percent of respondents said they have a plan to communicate with family members if there is no cellphone service.

But this figure is considered inflated by some who say the percentage of prepared citizens is dreadful. “Oftentimes you’ll get a survey saying 6 percent of the public is prepared,” said Ana-Marie Jones, executive director of the nonprofit organization Collaborating Agencies Responding to Disasters (CARD). “That’s nothing to write home about if you consider 4 percent of the population is Mormon and they prepare without being told to do so by the U.S. government.”

Read More @ EmergencyMgmt.com

If

the U.S. dollar is in effect a non-linear entity, any linear

correlations are likely to be wrong. As for gold–it appears to march to

an independent drummer.

by Charles Hugh Smith, Of Two Minds:

Whenever I make the case

for a stronger U.S. dollar (USD), the feedback can be sorted into three

basic reasons why the dollar will continue declining in value:

Whenever I make the case

for a stronger U.S. dollar (USD), the feedback can be sorted into three

basic reasons why the dollar will continue declining in value:

1. The USD may gain relative to other currencies, but since all fiat currencies are declining against gold, it doesn’t mean that the USD is actually gaining value; in fact, all paper money is losing value.

2. When the global financial system finally crashes, won’t that include the dollar?

3. The Federal Reserve is “printing” (creating) money, and that will continue eroding the purchasing power of the USD. Lowering interest rates to zero has dropped the yield paid on Treasury bonds, which also weakens the dollar.

The general notion here is that, given the root causes of our economic distemper – rampant financialization, over-leverage and over-indebtedness, a politically dominant parasitic banking sector, an aging population, overpromised entitlements, a financial business model based on fraud, Federal Reserve monetizing of debt, and a dysfunctional political system, to mention only the top of the list – how can the USD appreciate in real terms?

Read More @ OfTwoMinds.com

by Charles Hugh Smith, Of Two Minds:

Whenever I make the case

for a stronger U.S. dollar (USD), the feedback can be sorted into three

basic reasons why the dollar will continue declining in value:

Whenever I make the case

for a stronger U.S. dollar (USD), the feedback can be sorted into three

basic reasons why the dollar will continue declining in value:1. The USD may gain relative to other currencies, but since all fiat currencies are declining against gold, it doesn’t mean that the USD is actually gaining value; in fact, all paper money is losing value.

2. When the global financial system finally crashes, won’t that include the dollar?

3. The Federal Reserve is “printing” (creating) money, and that will continue eroding the purchasing power of the USD. Lowering interest rates to zero has dropped the yield paid on Treasury bonds, which also weakens the dollar.

The general notion here is that, given the root causes of our economic distemper – rampant financialization, over-leverage and over-indebtedness, a politically dominant parasitic banking sector, an aging population, overpromised entitlements, a financial business model based on fraud, Federal Reserve monetizing of debt, and a dysfunctional political system, to mention only the top of the list – how can the USD appreciate in real terms?

Read More @ OfTwoMinds.com

by Frank Ryan, American Thinker:

“Any time you have a really great deal, remember: for every winner, there must be a loser.”

“Any time you have a really great deal, remember: for every winner, there must be a loser.”

The expression means that when you have a lopsided transaction, one person’s good deal is likely struck at another’s expense.

With the artificially low interest rates promoted by the Federal Reserve with Quantitative Easing and Operation Twist, there are winners and losers as well. By the Fed’s own admission, the purpose of the current monetary policy is to significantly reduce long-term rates of interest to stimulate the economy.

The Federal Reserve’s monetary easing is designed to stimulate the economy while at the same time keeping inflation in check.

Read More @ AmericanThinker.com

from TF Metals Report:

Though Wednesday’s are typically down days, the charts suggest that you should keep an eye on things.

In the larger picture, nothing much has changed. The pullback, that began on 10/4 with the BLSBS report for September, concluded with the spec washout lows of 11/2, following the release of the October BLSBS. Both gold and silver retraced roughly 50% of their moves from mid-August and have rebalanced some of the spec long vs Cartel short positions.

So, where do we go from here? Both metals could simply continue to trade sideways for a while, in a tight range between 1705 and 1730 in gold and 31.60 and 32.60 in silver. Maybe they will? There is still hope, however, for a breakout. Though there are clearly well-defined caps on the charts, pressure continues to mount for the UPside breakout I’ve been expecting/hoping to see. My London contacts continue to report “robust” physical demand at each and every fix. Let’s see if this doesn’t soon bleed over into the paper markets.

Read More @ TF Metals Report.com

“Any time you have a really great deal, remember: for every winner, there must be a loser.”

“Any time you have a really great deal, remember: for every winner, there must be a loser.”The expression means that when you have a lopsided transaction, one person’s good deal is likely struck at another’s expense.

With the artificially low interest rates promoted by the Federal Reserve with Quantitative Easing and Operation Twist, there are winners and losers as well. By the Fed’s own admission, the purpose of the current monetary policy is to significantly reduce long-term rates of interest to stimulate the economy.

The Federal Reserve’s monetary easing is designed to stimulate the economy while at the same time keeping inflation in check.

Read More @ AmericanThinker.com

Though Wednesday’s are typically down days, the charts suggest that you should keep an eye on things.

In the larger picture, nothing much has changed. The pullback, that began on 10/4 with the BLSBS report for September, concluded with the spec washout lows of 11/2, following the release of the October BLSBS. Both gold and silver retraced roughly 50% of their moves from mid-August and have rebalanced some of the spec long vs Cartel short positions.

So, where do we go from here? Both metals could simply continue to trade sideways for a while, in a tight range between 1705 and 1730 in gold and 31.60 and 32.60 in silver. Maybe they will? There is still hope, however, for a breakout. Though there are clearly well-defined caps on the charts, pressure continues to mount for the UPside breakout I’ve been expecting/hoping to see. My London contacts continue to report “robust” physical demand at each and every fix. Let’s see if this doesn’t soon bleed over into the paper markets.

Read More @ TF Metals Report.com

by Patrick Barron, Mises:

Sheila Bair was chairman of the FDIC from June 2006 to July 2011. Her memoirs, Bull by the Horn: Fighting to Save Main Street from Wall Street and Wall Street from Itself,

is a fascinating and sometimes frustrating glimpse into the mind of a

career bureaucrat. She recounts myriad meetings and battles with fellow

regulators, of which there are way too many, American bankers and

foreign central bankers. Needless to say, Ms. Bair portrays herself as

the blameless, honest bureaucrat who foresaw the coming crisis and

fought, as the title implies, to save both Main Street and Wall Street.

Sheila Bair was chairman of the FDIC from June 2006 to July 2011. Her memoirs, Bull by the Horn: Fighting to Save Main Street from Wall Street and Wall Street from Itself,

is a fascinating and sometimes frustrating glimpse into the mind of a

career bureaucrat. She recounts myriad meetings and battles with fellow

regulators, of which there are way too many, American bankers and

foreign central bankers. Needless to say, Ms. Bair portrays herself as

the blameless, honest bureaucrat who foresaw the coming crisis and

fought, as the title implies, to save both Main Street and Wall Street.

People write memoirs mostly out of hubris. Do we really care what Ms. Bair thought as she entered rooms full of powerful people? Ms. Bair certainly thinks we do. The tenor of the book has a touchy-feely tone to it that may interest some, but I found it to be distracting and rather annoying. But this is a minor quibble compared to my main complaint about the book, which is that it tells me something frightening about people who have way too much power over us. And that something is that they have no insight into the nature of the system in which they operate and, therefore, they cannot accomplish their mission of making banking safe and affordable for all. Let me elaborate.

Read More @ Mises.ca

Sheila Bair was chairman of the FDIC from June 2006 to July 2011. Her memoirs, Bull by the Horn: Fighting to Save Main Street from Wall Street and Wall Street from Itself,

is a fascinating and sometimes frustrating glimpse into the mind of a

career bureaucrat. She recounts myriad meetings and battles with fellow

regulators, of which there are way too many, American bankers and

foreign central bankers. Needless to say, Ms. Bair portrays herself as

the blameless, honest bureaucrat who foresaw the coming crisis and

fought, as the title implies, to save both Main Street and Wall Street.

Sheila Bair was chairman of the FDIC from June 2006 to July 2011. Her memoirs, Bull by the Horn: Fighting to Save Main Street from Wall Street and Wall Street from Itself,

is a fascinating and sometimes frustrating glimpse into the mind of a

career bureaucrat. She recounts myriad meetings and battles with fellow

regulators, of which there are way too many, American bankers and

foreign central bankers. Needless to say, Ms. Bair portrays herself as

the blameless, honest bureaucrat who foresaw the coming crisis and

fought, as the title implies, to save both Main Street and Wall Street.People write memoirs mostly out of hubris. Do we really care what Ms. Bair thought as she entered rooms full of powerful people? Ms. Bair certainly thinks we do. The tenor of the book has a touchy-feely tone to it that may interest some, but I found it to be distracting and rather annoying. But this is a minor quibble compared to my main complaint about the book, which is that it tells me something frightening about people who have way too much power over us. And that something is that they have no insight into the nature of the system in which they operate and, therefore, they cannot accomplish their mission of making banking safe and affordable for all. Let me elaborate.

Read More @ Mises.ca

Your support is needed...

Thank You

I'm PayPal Verified

from CBS Local:

Texas Gov. Rick Perry has one message for the tens of thousands of

Texans calling for secession from the United States: The state will not

secede.

Texas Gov. Rick Perry has one message for the tens of thousands of

Texans calling for secession from the United States: The state will not

secede.

More than 76,000 people have signed a petition on the “We the People” White House website for Texas to withdraw from the Union and start a new government after President Barack Obama was re-elected.

“The US continues to suffer economic difficulties stemming from the federal government’s neglect to reform domestic and foreign spending. … Given that the state of Texas maintains a balanced budget and is the 15th largest economy in the world, it is practically feasible for Texas to withdraw from the union, and to do so would protect it’s citizens’ standard of living and re-secure their rights and liberties in accordance with the original ideas and beliefs of our founding fathers which are no longer being reflected by the federal government,” the petition states.

Read More @ Houston.CBSlocal.com

Texas Gov. Rick Perry has one message for the tens of thousands of

Texans calling for secession from the United States: The state will not

secede.

Texas Gov. Rick Perry has one message for the tens of thousands of

Texans calling for secession from the United States: The state will not

secede.More than 76,000 people have signed a petition on the “We the People” White House website for Texas to withdraw from the Union and start a new government after President Barack Obama was re-elected.

“The US continues to suffer economic difficulties stemming from the federal government’s neglect to reform domestic and foreign spending. … Given that the state of Texas maintains a balanced budget and is the 15th largest economy in the world, it is practically feasible for Texas to withdraw from the union, and to do so would protect it’s citizens’ standard of living and re-secure their rights and liberties in accordance with the original ideas and beliefs of our founding fathers which are no longer being reflected by the federal government,” the petition states.

Read More @ Houston.CBSlocal.com

by Wolf Richter, Testosterone Pit.com:

Career Education, when it reported its quarterly financial results,

shed more light on an industry that had ruthlessly taken advantage of

quirks in the American way of funding higher education, and that, even

more insidiously, had preyed on gullible prospective students who were

desperately trying to better their lives. Then it handed the tab to the

taxpayer who couldn’t say no. A perfect scam. And it contributed to a

ruinous mountain of student loans [ Next: Bankruptcy for a whole Generation].

Career Education, when it reported its quarterly financial results,

shed more light on an industry that had ruthlessly taken advantage of

quirks in the American way of funding higher education, and that, even

more insidiously, had preyed on gullible prospective students who were

desperately trying to better their lives. Then it handed the tab to the

taxpayer who couldn’t say no. A perfect scam. And it contributed to a

ruinous mountain of student loans [ Next: Bankruptcy for a whole Generation].

In the halcyon days of 2010, Career Education had $2.09 billion in annual revenues. Then a free-fall. By September 30, quarterly revenues hit $333 million. Enrollment was down 23%, in the health education category 41%. An additional 900 people will be laid off, on top of the previously announced 1,300. The company will “gradually” close 23 of its 90 campuses. Red ink is gushing, with no end in sight. The stock has plunged from $70 in June 2004 to today’s 52-week intraday low of $2.60.

Read More @ TestosteronePit.com

Career Education, when it reported its quarterly financial results,

shed more light on an industry that had ruthlessly taken advantage of

quirks in the American way of funding higher education, and that, even

more insidiously, had preyed on gullible prospective students who were

desperately trying to better their lives. Then it handed the tab to the

taxpayer who couldn’t say no. A perfect scam. And it contributed to a

ruinous mountain of student loans [ Next: Bankruptcy for a whole Generation].

Career Education, when it reported its quarterly financial results,

shed more light on an industry that had ruthlessly taken advantage of

quirks in the American way of funding higher education, and that, even

more insidiously, had preyed on gullible prospective students who were

desperately trying to better their lives. Then it handed the tab to the

taxpayer who couldn’t say no. A perfect scam. And it contributed to a

ruinous mountain of student loans [ Next: Bankruptcy for a whole Generation].In the halcyon days of 2010, Career Education had $2.09 billion in annual revenues. Then a free-fall. By September 30, quarterly revenues hit $333 million. Enrollment was down 23%, in the health education category 41%. An additional 900 people will be laid off, on top of the previously announced 1,300. The company will “gradually” close 23 of its 90 campuses. Red ink is gushing, with no end in sight. The stock has plunged from $70 in June 2004 to today’s 52-week intraday low of $2.60.

Read More @ TestosteronePit.com

by M. Frank Drover, The Daily Sheeple:

In a trend alert sent to subscribers of his quarterly Trends Journal report,

leading forecaster Gerald Celente reports that he has filed suit with

search behemoth Google for their failure to curb activities by

“impostors.”

In a trend alert sent to subscribers of his quarterly Trends Journal report,

leading forecaster Gerald Celente reports that he has filed suit with

search behemoth Google for their failure to curb activities by

“impostors.”

The lawsuit claims Google, Blogger and numerous blogs have infringed on Celente’s trademark(s). According to Celente, the blogs falsely imply that he is affiliated with them and often put forth work claiming to belong to Celente in order to solicit advertisers, sales and readers.

Google and Blogger have been named in the suit because of their refusal to assist in protecting his trademarks and intellectual property.

Read More @ TheDailySheeple.com

In a trend alert sent to subscribers of his quarterly Trends Journal report,

leading forecaster Gerald Celente reports that he has filed suit with

search behemoth Google for their failure to curb activities by

“impostors.”

In a trend alert sent to subscribers of his quarterly Trends Journal report,

leading forecaster Gerald Celente reports that he has filed suit with

search behemoth Google for their failure to curb activities by

“impostors.”The lawsuit claims Google, Blogger and numerous blogs have infringed on Celente’s trademark(s). According to Celente, the blogs falsely imply that he is affiliated with them and often put forth work claiming to belong to Celente in order to solicit advertisers, sales and readers.

Google and Blogger have been named in the suit because of their refusal to assist in protecting his trademarks and intellectual property.

Read More @ TheDailySheeple.com

from Wealth Cycles:

What is money, and why does it matter what we use as money?

What is money, and why does it matter what we use as money?

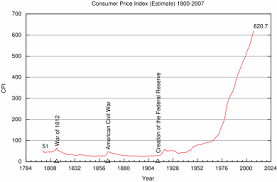

First of all, if we simply use paper rectangles as money, they can be printed. The government or, in the case of most modern nations, a bank can print as many new rectangles as it sees fit to suit its purposes. As the supply of currency increases, the price of goods and services goes up, because each new paper rectangle created means each paper rectangle already in existence is worth less. Each unit of newly printed money can purchase at present prices, but money in existence prior to the printing must buy goods and services at the new, higher price level. This permanent, ongoing and silent taxation robs everyone, but affects the poor with the most relative brutality, making the so-called “War on Poverty” a cruel joke at best.

If the poor all over the world just knew what medium, what type of money to save in, they could avoid this loss of purchasing power and save in a way that would improve their standard of living. The great thing is—the vast majority of the world’s people do already understand this concept and actively save in silver and gold coin. But are silver and gold coin really money?

Read More @ WealthCycles.com

What is money, and why does it matter what we use as money?

What is money, and why does it matter what we use as money?First of all, if we simply use paper rectangles as money, they can be printed. The government or, in the case of most modern nations, a bank can print as many new rectangles as it sees fit to suit its purposes. As the supply of currency increases, the price of goods and services goes up, because each new paper rectangle created means each paper rectangle already in existence is worth less. Each unit of newly printed money can purchase at present prices, but money in existence prior to the printing must buy goods and services at the new, higher price level. This permanent, ongoing and silent taxation robs everyone, but affects the poor with the most relative brutality, making the so-called “War on Poverty” a cruel joke at best.

If the poor all over the world just knew what medium, what type of money to save in, they could avoid this loss of purchasing power and save in a way that would improve their standard of living. The great thing is—the vast majority of the world’s people do already understand this concept and actively save in silver and gold coin. But are silver and gold coin really money?

Read More @ WealthCycles.com

from KingWorldNews:

Today acclaimed money manager Stephen Leeb told King World News, “The

first piece of data I look at, and I do it around 1AM to 2 AM every

morning, is how the Chinese yuan is performing. Recently the Chinese

yuan staged a very dramatic breakout. It is effectively at all-time

highs since China let the yuan semi-float around 20 years ago.”

Today acclaimed money manager Stephen Leeb told King World News, “The

first piece of data I look at, and I do it around 1AM to 2 AM every

morning, is how the Chinese yuan is performing. Recently the Chinese

yuan staged a very dramatic breakout. It is effectively at all-time

highs since China let the yuan semi-float around 20 years ago.”

“There has been a great deal of political pressure put on China to strengthen the yuan. The Chinese are responding to their transition to a new leadership. China’s new leader and leadership should be incredibly strong going forward. They will prepare the Chinese for the 21st century….

Stephen Leeb continues @ KingWorldNews.com

My Dear Friends,

Most commentators and participants in gold shares are under the assumption that the short interest is made of thousands of hedge funds, from the smallest to the largest. That is totally incorrect.

The short in gold shares is very concentrated in just a few large hedge funds with a few hangers on. This is why when there is no fundamental reason for selling they are manipulated against the gold price improvement, just like today. This is to play with your emotion.

The better companies from exploration to development and mining continue to increase their gold assets, knowing they are collecting mined and mineable money.

We will overcome this multi-year concentrated short on the gold shares that is totally illogical for good companies.

Respectfully yours,

Jim

My Dear Friends,

If you can do it with weed, you can secede.

Respectfully,

Jim

Shock: NYTimes notes that banking system gold may not be real or accessible Submitted by cpowell on 06:52PM ET Tuesday, November 13, 2012. Section: Daily Dispatches

How About a Fort Knox of Your Own?

By Paul Sullivan

The New York Times

Wednesday, November 14, 2012

http://www.nytimes.com/2012/11/14/your-money/some-gold-investors-want-th…

The last time the world as we knew it seemed likely to end, Dan Tapiero thought about buying gold.

He didn’t tell his wife; they didn’t talk about things like that. In fact he didn’t tell anyone for a while. He just tried to figure out how he was going to buy physical gold as the financial markets collapsed at the end of 2008.

Mining stocks were not for him, and neither was buying gold on the futures exchange. That was financial gold, meaning it existed on account statements but was not tangible. He wanted the real thing, gold in the form of bullion that he could hold in his palms, smudge with his thumbs.

But Mr. Tapiero, a portfolio manager at several hedge funds over the last two decades, realized quite quickly that it was harder to fulfill his desire than he had thought. When he called up one bank he patronized in his day job, he learned it had a minimum purchase amount of $20 million worth of physical gold. Even at that amount, he could not have access to it; it would have to stay at the bank.

He didn’t want to buy that much, but he wanted to buy more than a bag of gold coins, or a bar or two. Most of all, he wanted to know that it would be stored some place safe where he could get to it even if all of the banks suddenly closed for a while. "There was concern at that time that the system was frozen and you didn’t really know whether you were going to be able to have access to your money or to your assets," Mr. Tapiero said. "And I started thinking, OK, well, I’d like to own something that isn’t a number on a flashing screen.

Investing in physical gold has had an image problem of late. After the financial crisis, it was seen by many mainstream advisers as something that crackpots coveted. They would buy it, store in their basements, and know that their wealth was secure if the world — or at least the prevailing financial and political systems — ended.

This was easy to mock, and many people did. What, after all, would you buy with your gold if the world came to an end?

Then there was the group that saw gold as a speculative bet, as something that would rise in value as fear about the global economy sunk in. That was less of a crackpot idea: the price of gold went from around $700 an ounce when Mr. Tapiero began buying it in the fall of 2008 to more than $1,900 an ounce last summer. It is now trading around $1,700 an ounce.

Mr. Tapiero did not buy his bullion because he thought the world was ending. "And if it did end," he said, "I don’t know that gold would be that important — it might be radioactive.

He also made clear that he does not keep it at his home in Greenwich, Conn. "It might not be safe," he said, "if someone holds you at gunpoint and they say, ‘Show me your safe’ and you open it up and all your gold is there."

Instead, his gold — now about 25 percent of his net worth, he said, declining to quantify it further — is kept in various professionally managed vaults. We met at one in Midtown Manhattan.

The vault was in an unassuming, brick office building with a completely plain, even dingy lobby. The offices of the vaulting company, which asked not to be named as a condition for granting me entry, had rows of nondescript cubicles that gave no sign beyond the company logo of what might be going on there.

As for the vault itself, it looked secure from the outside. But once past the thick door, it felt completely utilitarian, even a bit grim, particularly for what it held for its undisclosed number of clients.

Mr. Tapiero eyed the rows of 100-ounce bars — each about the size of an iPhone and worth about $170,000 — and estimated there was $4 billion worth of gold at current prices stacked on metal shelves that looked as if they were built in the 1970s. That amount of gold would fit in the back of any sport utility vehicle.

The vault company did not share the identities of other customers. But suspicion that there was interest in owning this kind of physical gold led Mr. Tapiero and a friend, Steven Feldman, to form a company, Gold Bullion International, in 2009. It allows people to buy bullion but also to have access to it and, if they want, have it delivered to their home or anywhere else. Their customers range from chief executives and entrepreneurs to housewives and grandparents buying for their grandchildren.

Mr. Tapiero described their challenge as, "How do we start a company that can provide physical gold — have it delivered, but also have it stored outside the banking system — to the retail customer?

His theory was that gold had been misunderstood in the United States in a way that it had not been in the rest of the world. He attributed this to the inability of individuals to own gold for some 40 years, after President Franklin D. Roosevelt in 1933 ordered any American holding more than $100 worth of gold to exchange if for $20.67 an ounce. He did this to prevent individuals from hoarding gold during the Great Depression, and the restriction wasn’t lifted until the 1970s.

Another reason Mr. Tapiero thinks people came to misjudge gold was the bull market in stocks from 1982 to 2007, which made owning an asset that just sits there, like gold, unattractive.

Mr. Tapiero said that today gold was a legitimate investment that should be part of any diversified portfolio, because it is a hedge against a global economic slowdown and the inflation that many believe will occur when economies pick up.

But like many investments, the likelihood that gold will continue to increase in value rests on the rise of India and China. There, gold is being increasingly bought as a way to demonstrate success in addition to as an investment.

If you don’t need to be able to put your hands on your gold to sleep at night, the World Gold Council sponsors an exchange-traded fund, which trades under the ticker GLD. It allows people to buy and sell shares in a fund that owns gold, much as they would with a mutual fund that owns stocks.

Jason Toussaint, managing director of the World Gold Council, said that like Mr. Tapiero, his group wanted people to see gold as something that they should always own and not something they buy only as a safe haven.

"It implies people run to it and then when the storm has passed they go back to risky assets," he said. "We think the time is right to look for a new paradigm."

More traditional advisers see a place for gold in some portfolios, though they put it in the same group as other alternative assets. They also advise keeping the allocation relatively low, 3 to 5 percent of a total portfolio.

"Most assets like equities or bonds can be valued because they throw off some income over time," said Lisa Shalett, chief investment officer and head of investment management and guidance for Merrill Lynch Wealth Management. "We talk about gold not as an investing asset but purely as a hedging asset."

Mr. Tapiero said that the idea of making gold a permanent part of a portfolio was part of a broader argument about the future of the global economy, one epitomized in the professional investing world by two very different managers.

There is Warren Buffett, who made his fortune buying stocks in companies he understands and who does not see much use in owning gold. Then there is Ray Dalio, who runs Bridgewater Associates, the world’s largest hedge fund, who has put 10 percent of his firms money into gold.

Mr. Tapiero says he believes gold will continue to be a store of value, and he dismisses the end-of-the-world crowd — though, he said, his company is happy to sell them gold and store it for them.

"Gold will do very well, and it will be good to have physical gold if everything happens except the end of the world," Mr. Tapiero said. "If the end of the world is zero, and we get to 10, from 100, it’s going to be the thing that performs well."

Jim Sinclair’s Commentary

There is no bull market pending in the US dollar as talking heads lot to predict.

Dollar no longer primary oil currency as China begins to sell oil using Yuan SEPTEMBER 12, 2012

BY: KENNETH SCHORTGEN JR

On Sept. 11, Pastor Lindsey Williams, former minister to the global oil companies during the building of the Alaskan pipeline, announced the most significant event to affect the U.S.dollar since its inception as a currency. For the first time since the 1970′s, when Henry Kissenger forged a trade agreement with the Royal house of Saud to sell oil using only U.S. dollars, China announced its intention to bypass the dollar for global oil customers and began selling the commodity using their own currency.

Lindsey Williams: "The most significant day in the history of the American dollar, since its inception, happened on Thursday, Sept. 6. On that day, something took place that is going to affect your life, your family, your dinner table more than you can possibly imagine."

"On Thursday, Sept. 6… just a few days ago, China made the official announcement. China said on that day, our banking system is ready, all of our communication systems are ready, all of the transfer systems are ready, and as of that day, Thursday, Sept. 6, any nation in the world that wishes from this point on, to buy, sell, or trade crude oil, can do using the Chinese currency, not the American dollar. – Interview with Natty Bumpo on the Just Measures Radio network, Sept. 11

This announcement by China is one of the most significant sea changes in the global economic and monetary systems, but was barely reported on due to its announcement taking place during the Democratic convention last week. The ramifications of this new action are vast, and could very well be the catalyst that brings down the dollar as the global reserve currency, and change the entire landscape of how the world purchases energy.

Ironically, since Sept. 6, the U.S. dollar has fallen from 81.467 on the index to today’s price of 79.73. While analysts will focus on actions taking place in the Eurozone, and expected easing signals from the Federal Reserve on Thursday regarding the fall of the dollar, it is not coincidence that the dollar began to lose strength on the very day of China’s announcement.

More…

Fiscal Cliff Most Likely A Non-event CIGA Eric

As Jim suggests below, the fiscal cliff despite all the hype will likely be non-event that affords the invisible hand the opportunity to reposition for the 2013 equity market rally to new highs.

Nobody can be so irresponsible and crazy that they would walk into this one without at the least a kick of the can down the road in time, Jim Sinclair.

As I have said before, the sh*t will hit the fan, but only after the counter trend rallies in the formula and leading formula have been broken to the downside. After that, even a size 15 E policy boot won’t budge that can.

Chart 1: The Formula: S&P 500 and Federal Government Budget As A % of GDP, 12 Month Moving Average

Chart 2: The Leading Formula: Gold and Federal Taxes Withheld (TW) Less Total Government Outlays (TO) As A % of GDP, 12 Month Moving Average

Headline: Budget Deficit Widens as Fiscal Cliff Looms

The U.S. government’s budget deficit widened in October, the first month of the new fiscal year, as President Barack Obama and Congress seek an agreement to lower future gaps and avoid the so-called fiscal cliff.

The deficit expanded 22 percent to $120 billion from a $98.5 billion shortfall in October 2011, the Treasury Department said today in Washington. The gap exceeded the $113 billion median estimate in a Bloomberg survey of economists.

Source: businessweek.com

More…

The antidote to the heroin of liquidity is a controlled substance named Gold. –Yra Harris

My Dear Friends,

There is much more to this than meets the eye.

Keep your attention on the following military figures other than General David Petraeus.

Rear Admiral Charles M. Gaouette.

Brigadier General Jeffrey A. Sinclair.

US Army General Carter Ham.

US Navy Commander Joseph E. Darlak.

Bigger changes are taking place below the surface than a simple presidential election.

Respectfully,

Jim

Suddenly There’s Talk Of A New Motive For The Benghazi Attack Michael Kelley and Geoffrey Ingersoll | Nov. 12, 2012, 5:02 PM

As the spotlight shines on ex-CIA Director David Petraeus’ biographer-turned-mistress Paula Broadwell, journalists have uncovered a speech in which she may have revealed classified information about the attack on a U.S. consulate in Benghazi.

Broadwell told a Denver audience in October: "Now I don’t know if a lot of you heard this, but the CIA annex [to the consulate] had taken a couple of Libyan militia members prisoner and they think that the attack on the consulate was an effort to try to get these prisoners back."

The CIA adamantly denied her the claim, which would have been a violation of laws prohibiting CIA detention. It has also been suggested that Broadwell was confused when she made that statement.

A source of Fox News, however, corroborated Broadwell’s claim today.

If there were ever a motive to attack Americans, it would be the disappearance of friends.

But it’s important to note that the CIA operation was unknown to anyone else until it was exposed on the night of the attack and publicly acknowledged in congressional hearings on October 10. The consulate, on the other hand, was the official front for local CIA operations. If there were an original target to strike Americans, it would be the consulate, rather than the safe house.

More…

Jim Sinclair’s Commentary

A currency can become a reserve currency by default.

Yuan spot price per USD hits record high 2012-11-13 19:19:30

BEIJING, Nov. 13 (Xinhua) — The spot price of the yuan against the U.S. dollar rose to 6.2262 on Tuesday, marking a record high since China’s foreign exchange reforms seven years ago.

Tuesday was the second consecutive day that the spot price of the yuan against the U.S. dollar hit a record high since China launched its foreign exchange reforms in 2005.

Enterprises and banks have been selling off foreign currencies in anticipation of the yuan’s appreciation, pushing up the price of the currency, said Ding Zhijie, an economics professor at the University of International Business and Economics.

In China’s foreign exchange spot market, the yuan is allowed to rise or fall by 1 percent from the central parity rate each trading day.

The People’s Bank of China (PBOC), the country’s central bank, set the central parity rate of the yuan against the U.S. dollar at 6.2891 on Tuesday, the highest since May 9. The central parity rate of the yuan was 6.2865 on May 9, and even lower, at 6.2804, on May 8.

More…

Jim Sinclair’s Commentary

Judging by this picture all is not well in the halls of financial management.

Jim Sinclair’s Commentary

Here and there?

The new generals in charge of China’s guns 13 November 2012 Last updated at 19:07 ET

As China’s ruling Communist Party prepares to hand power to a new generation of leaders, the BBC Beijing Bureau explains why changes at the top of the country’s armed forces are also being closely watched.

China is ushering in a new generation of political leaders this week, as Communist Party leader Hu Jintao hands over power to successor Xi Jinping.

At the same time, a new group will take over the country’s armed forces.

Amid a wave of retirements, at least seven new members will join China’s 11-member Central Military Commission (CMC), which oversees its armed forces – including the world’s largest standing army.

The new generals will assume power at a particularly sensitive time for the Chinese military.

China’s armed forces swear allegiance to the party rather than the country, and the CMC cannot take unilateral military action.

More…

Jim Sinclair’s Commentary

Whatever is required will be provided in terms of funds or time.

This drama has one theme and that is QE by the front or rear door. A successful auction is QE.

Greece secures short-term finance 13 November 2012 Last updated at 07:00 ET

The Greek government has managed to sell 4.06bn euros ($5.15bn; £3.24bn) of treasury bills, which are very short-term bonds.

It sold the one-month bills at an interest rate of 3.95% and the three-month bonds at 4.2%.

The money is needed to cover 5bn euros of old treasury bills, which are due for payment on Friday.

Greece needs to raise the money this way because it has not yet received the next tranche of its bailout loans.

The remaining 940m euros needed will be raised over the next few days, but not through auctions.

Eurozone ministers agreed earlier in the week to give Greece two more years, until 2016, to meet its deficit-reduction targets.

More…

Jim Sinclair’s Commentary

In case you hadn’t noticed, we spent more than we earned again.

US government deficit rises sharply in October 13 November 2012 Last updated at 19:09 ET

The US government’s budget deficit rose sharply in October, highlighting the financial challenge President Barack Obama faces following his re-election.

The deficit increased 22% from a year earlier to $120bn (£75bn) as government spending outpaced tax revenues.

It comes as politicians debate how to deal with the so-called fiscal cliff of automatic tax increases and spending cuts due to take effect in January.

The White House and Congress are trying to agree a more orderly deficit cut.

The deficit is the amount by which government spending exceeds its tax revenues, with the government needing to borrow the difference.

On Tuesday the US Treasury Secretary, Timothy Geithner, warned against extending all of the tax breaks that are due to expire in January as a way of giving Washington more time to broker a deal on the deficit.

More…

Jim Sinclair’s Commentary

RIP for the pensioner and fixed income people.

![clip_image002[5] clip_image002[5]](http://www.jsmineset.com/wp-content/uploads/2012/11/clip_image0025_thumb1.jpg)

Jim Sinclair’s Commentary

What in the world makes you believe this practice and others like it (FASB false valuation of derivative paper) are not prevalent in major money center banks?

It is.

How to Help a Sick French Bank Look Healthy By Jonathan Weil Nov 9, 2012 1:05 PM ET

It’s no secret that the methods many banks use for calculating capital ratios are a farce, especially at large European lenders. Sometimes the numbers are so over- the-top, all you can really do is sit back and admire the chutzpah.

Consider France’s third-largest bank, Credit Agricole SA, which today reported a third-quarter loss of 2.85 billion euros ($3.62 billion), sending its stock down 6 percent.

The real entertainment can be found in its “core Tier 1 ratio,” which it said was 9.3 percent as of Sept. 30. The numerator in that calculation is regulatory capital. The denominator is what the regulators call “risk-weighted assets.” The smaller the denominator is, the bigger the capital ratio is.

Total assets at Credit Agricole were 1.9 trillion euros as of Sept. 30. Risk-weighted assets, however, were a mere 298.3 billion euros. In essence, we’re supposed to believe that 84 percent of Credit Agricole’s assets were riskless, even though that obviously is impossible.

Give blame where it’s due: The Basel Committee on Banking Supervision is the body that writes these rules, the objective of which is to make too-big-to-fail banks’ capital seem more robust than it really is.

More…

Jim Sinclair’s Commentary

It only takes one nuclear sub to hold the entire world ransom.

The West is no longer the economic power and better stay the military power or the curtain comes down.

China submarines to soon carry nukes, draft U.S. report says By Jim Wolf

WASHINGTON | Thu Nov 8, 2012 2:01am EST

(Reuters) – China appears to be within two years of deploying submarine-launched nuclear weapons, adding a new leg to its nuclear arsenal that should lead to arms-reduction talks, a draft report by a congressionally mandated U.S. commission says.