by Javier E. David, CNBC:

Investors should prepare for rising prices and more expansionary

monetary policy now that President Barack Obama has won re-election,

investor Jim Rogers told CNBC on Tuesday.

Investors should prepare for rising prices and more expansionary

monetary policy now that President Barack Obama has won re-election,

investor Jim Rogers told CNBC on Tuesday.

Just moments before Obama was projected to prevail in his bid for a second term against Republican challenger Mitt Romney, Rogers sharply repudiated both candidates, calling them both “evil”. (Read more: Obama Re-elected as Crucial Ohio Goes His Way.)

Investors should prepare for rising prices and more expansionary

monetary policy now that President Barack Obama has won re-election,

investor Jim Rogers told CNBC on Tuesday.

Investors should prepare for rising prices and more expansionary

monetary policy now that President Barack Obama has won re-election,

investor Jim Rogers told CNBC on Tuesday.Just moments before Obama was projected to prevail in his bid for a second term against Republican challenger Mitt Romney, Rogers sharply repudiated both candidates, calling them both “evil”. (Read more: Obama Re-elected as Crucial Ohio Goes His Way.)

The co-founder of the Quantum Fund said he expected Obama’s policies to drive up commodities and drive down the U.S. dollar As the Federal Reserve moves to stimulate a stalled economy through debt purchases, Rogers says markets should expect the status quo to remain the same.

Read More @ CNBC‘We’re Flying Blind,’ Admits Federal Reserve President

by Butler Shaffer, Lew Rockwell:

Eric S. Rosengren, the president of the Boston Federal Reserve Bank, recently gave a speech at Babson College on November 1.

That was a good place to give it. Founder Roger Babson in September,

1929, warned of a stock market crash. Wikipedia reports: “On September

5, 1929, he gave a speech saying, “Sooner or later a crash is coming,

and it may be terrific.” Later that day the stock market declined by

about 3%. This became known as the “Babson Break”. The Wall Street Crash

of 1929 and the Great Depression soon followed.”

Eric S. Rosengren, the president of the Boston Federal Reserve Bank, recently gave a speech at Babson College on November 1.

That was a good place to give it. Founder Roger Babson in September,

1929, warned of a stock market crash. Wikipedia reports: “On September

5, 1929, he gave a speech saying, “Sooner or later a crash is coming,

and it may be terrific.” Later that day the stock market declined by

about 3%. This became known as the “Babson Break”. The Wall Street Crash

of 1929 and the Great Depression soon followed.”

Dr. Rosengren began:

John

Williams, president of the San Francisco Fed, yet another noted dove,

thinks nothing can go wrong by printing gobs of money. There is no inflation, and there never will be.

They have the 'tools' to avert it. Never mind the explosion of the

money supply over the past four years – it is all good. Have no fear

though, as Williams notes: "Once it comes time to exit its super-easy

monetary policy, the Fed will target a 'soft landing,'" The hubris of these guys is jaw-dropping. We

are struck by the continued refusal by Fed officials to even think for

a second about the long range effects of their policies. In the meantime, money printing continues to undermine the economy.

Wealth cannot be generated by increasing the money supply – all that

can be achieved by this is an ephemeral improvement in the 'data' even

while scarce capital continues to be malinvested and consumed

John

Williams, president of the San Francisco Fed, yet another noted dove,

thinks nothing can go wrong by printing gobs of money. There is no inflation, and there never will be.

They have the 'tools' to avert it. Never mind the explosion of the

money supply over the past four years – it is all good. Have no fear

though, as Williams notes: "Once it comes time to exit its super-easy

monetary policy, the Fed will target a 'soft landing,'" The hubris of these guys is jaw-dropping. We

are struck by the continued refusal by Fed officials to even think for

a second about the long range effects of their policies. In the meantime, money printing continues to undermine the economy.

Wealth cannot be generated by increasing the money supply – all that

can be achieved by this is an ephemeral improvement in the 'data' even

while scarce capital continues to be malinvested and consumed

Eric S. Rosengren, the president of the Boston Federal Reserve Bank, recently gave a speech at Babson College on November 1.

That was a good place to give it. Founder Roger Babson in September,

1929, warned of a stock market crash. Wikipedia reports: “On September

5, 1929, he gave a speech saying, “Sooner or later a crash is coming,

and it may be terrific.” Later that day the stock market declined by

about 3%. This became known as the “Babson Break”. The Wall Street Crash

of 1929 and the Great Depression soon followed.”

Eric S. Rosengren, the president of the Boston Federal Reserve Bank, recently gave a speech at Babson College on November 1.

That was a good place to give it. Founder Roger Babson in September,

1929, warned of a stock market crash. Wikipedia reports: “On September

5, 1929, he gave a speech saying, “Sooner or later a crash is coming,

and it may be terrific.” Later that day the stock market declined by

about 3%. This became known as the “Babson Break”. The Wall Street Crash

of 1929 and the Great Depression soon followed.”Dr. Rosengren began:

Today I plan to highlight three main points about the economic outlook. I always like to emphasize that my remarks represent my views, not necessarily those of my colleagues on the Federal Open Market Committee or at the Board of Governors.Read More @ LewRockwell.com

No Undue Fallout From Money Printing...

John

Williams, president of the San Francisco Fed, yet another noted dove,

thinks nothing can go wrong by printing gobs of money. There is no inflation, and there never will be.

They have the 'tools' to avert it. Never mind the explosion of the

money supply over the past four years – it is all good. Have no fear

though, as Williams notes: "Once it comes time to exit its super-easy

monetary policy, the Fed will target a 'soft landing,'" The hubris of these guys is jaw-dropping. We

are struck by the continued refusal by Fed officials to even think for

a second about the long range effects of their policies. In the meantime, money printing continues to undermine the economy.

Wealth cannot be generated by increasing the money supply – all that

can be achieved by this is an ephemeral improvement in the 'data' even

while scarce capital continues to be malinvested and consumed

John

Williams, president of the San Francisco Fed, yet another noted dove,

thinks nothing can go wrong by printing gobs of money. There is no inflation, and there never will be.

They have the 'tools' to avert it. Never mind the explosion of the

money supply over the past four years – it is all good. Have no fear

though, as Williams notes: "Once it comes time to exit its super-easy

monetary policy, the Fed will target a 'soft landing,'" The hubris of these guys is jaw-dropping. We

are struck by the continued refusal by Fed officials to even think for

a second about the long range effects of their policies. In the meantime, money printing continues to undermine the economy.

Wealth cannot be generated by increasing the money supply – all that

can be achieved by this is an ephemeral improvement in the 'data' even

while scarce capital continues to be malinvested and consumed

by Jeff Cox, CNBC:

An election that was supposed to be about change actually could end up

being an intensified dose of more of the same for investors.

An election that was supposed to be about change actually could end up

being an intensified dose of more of the same for investors.

In the aftermath of President Barack Obama’s successful re-election bid Tuesday, market experts prepared for an accelerated push of easy Federal Reserve monetary policy.

An election that was supposed to be about change actually could end up

being an intensified dose of more of the same for investors.

An election that was supposed to be about change actually could end up

being an intensified dose of more of the same for investors.In the aftermath of President Barack Obama’s successful re-election bid Tuesday, market experts prepared for an accelerated push of easy Federal Reserve monetary policy.

That likely will clash

against even more uncertainty in Washington as en election that produced

little more than the status quo failed to resolve the burgeoning fiscal

issues that threaten the U.S. economy. (Read More: Next Up for Markets? The Fiscal Cliff)

But while investors know what they have and may draw some relief, the morning-after stock market was expected to open lower as traders prepared for a second four years under the Democratic incumbent.

Read More @ CNBC.comBTFD...and Keep Stacking...The Bernank will now shift to overdrive...

from Silver Doctors:

After being capped overnight during London trading at $1730 and $32.50, gold & silver have just been smacked down to pre-Obama victory levels of $31.50 and $1712.

View this morning’s weakness as a gift from the cartel, as both metals will be heading exponentially higher over the medium-long term as the Fed’s QE∞ policy has been rubber stamped by an American public re-electing Barack Obama.

Guns, ammo, and gold and silver sales have exploded throughout the country this morning in response to the election results as Americans contemplate another 4 years of an Obama Presidency with no concern for any voter approval.

As such, this morning’s weakness is a welcomed gift to PM stackers, and should be responded to professionally by STACKING THE SMACK!!!

Read More @ Silver Doctors

After being capped overnight during London trading at $1730 and $32.50, gold & silver have just been smacked down to pre-Obama victory levels of $31.50 and $1712.

View this morning’s weakness as a gift from the cartel, as both metals will be heading exponentially higher over the medium-long term as the Fed’s QE∞ policy has been rubber stamped by an American public re-electing Barack Obama.

Guns, ammo, and gold and silver sales have exploded throughout the country this morning in response to the election results as Americans contemplate another 4 years of an Obama Presidency with no concern for any voter approval.

As such, this morning’s weakness is a welcomed gift to PM stackers, and should be responded to professionally by STACKING THE SMACK!!!

Read More @ Silver Doctors

Your support is needed...

Thank You

I'm PayPal Verified

VIX Halted

CBOE's VIX Futures and Options have been halted since 1337ET.

Because in our day and age of highly "sophisticated, precise and computerized" trading, just what stock market crash can take place without a critical component of the market breaking...

And Now Come The Margin Calls: NYSE Margin Debt At 16 Month High

A

stock sell off is usually a healthy, cathartic thing: one sells,

pockets the proceeds, books a loss, and comes back to fight another day.

The big problem, however, is when speculators and traders are already massively overleveraged,

and not only don't have a positive Net Worth (defined as Free Credit

Cash Account and Credit Balances in Margin Accounts less Margin Debt)

but their Margin Debt is so high it commences a toxic loop of selling

merely to fund margin calls which usually start popping up in the last

hour of trading (and when trading desks put their phones straight to

VM), leading to more forced selling, more margin calls, and so on. And

therein lies the rub: according to the most recent NYSE margin debt

data, the market complacency recently hit such high levels, that

speculators virtually went all in, but solely in their margin accounts

without holding any cash buffer to pay for potential margin calls. As

can be seen on the table below, Margin Debt as of 9/30 hit $315 billion:

a jump of $30 billion from the prior month, and the highest since

March 2011, just before the market tanked. And confirming that there is

simply no cash on hand to pay for margin calls when they start pouring

in after today's massive sell off, is the total Net Worth, which in

September was the lowest since April. Because with record complacency,

and the Fed guaranteeing no further shocks are possible, who needs to

hold cash? Today, we will find out: just as soon as the margin calls

start coming around around 3PM Eastern...

A

stock sell off is usually a healthy, cathartic thing: one sells,

pockets the proceeds, books a loss, and comes back to fight another day.

The big problem, however, is when speculators and traders are already massively overleveraged,

and not only don't have a positive Net Worth (defined as Free Credit

Cash Account and Credit Balances in Margin Accounts less Margin Debt)

but their Margin Debt is so high it commences a toxic loop of selling

merely to fund margin calls which usually start popping up in the last

hour of trading (and when trading desks put their phones straight to

VM), leading to more forced selling, more margin calls, and so on. And

therein lies the rub: according to the most recent NYSE margin debt

data, the market complacency recently hit such high levels, that

speculators virtually went all in, but solely in their margin accounts

without holding any cash buffer to pay for potential margin calls. As

can be seen on the table below, Margin Debt as of 9/30 hit $315 billion:

a jump of $30 billion from the prior month, and the highest since

March 2011, just before the market tanked. And confirming that there is

simply no cash on hand to pay for margin calls when they start pouring

in after today's massive sell off, is the total Net Worth, which in

September was the lowest since April. Because with record complacency,

and the Fed guaranteeing no further shocks are possible, who needs to

hold cash? Today, we will find out: just as soon as the margin calls

start coming around around 3PM Eastern...Charting The Great Stagnation Of American's Real Productivity

With Federal debt growing at the rate of $40,000 a second - not all that far from what a typical family earns in a year; with a debilitating dependency on the state all too elevated; and with any number of restraints to peace and progress not only unresolved, but utterly unresolvable under present conditions, is it any wonder that our nation has become entirely stagnant. As Sean Corrigan of Diapason Commodities notes in this simple chart - real net private product per capita has been dead for more than a decade - mirroring its poor showing during the inflationary disaster of forty years ago. Given the four-more-years of Bernanke, to expect a radical turnaround under such conditions (of monetary policy largesse and experimentation) would be to display as much naivety about the prospects for 'change' as did so many bien pensants four short years ago.

Treasury Issues Fresh Batch Of 10 Year Bonds

The first day of the "next 4 years" is starting in a very auspicious fashion. First, the market crashes. Then, a major blue chip company, Boeing, just announced it would cut 30% of management jobs from 2010 levels. And finally, the US Treasury just added $24 billion in debt,

or enough to fund Greece for over one year, sending the total debt

load (the US is now at 103% debt/GDP) ever closer to the debt ceiling

breaching $16.4 trillion. But don't worry: over the next 4 years, the US

government will add another $6-8 trillion in debt, so those who didn't

get their allocation in this auction will have more than enough

opportunity. As for this one, the yield was 1.68%, the lowest since

August (but, but, what happened to the great rotation out of bonds and

into stocks?), the Bid to Cover was 2.59, the lowest since last November

and only higher compared to August' 2.49. And finally, the take down

breakdown was uneventful: 46.2% for Dealers (to be promptly flipped back

to the Fed - keep track of CUSIP 912828TY6), 39.7% for Indirects, or

below the 12 TTM average of 41.28%, and Directs got 14.1%, also below

the average, and lower than last month's 22.9%. As noted: uneventful. As

also noted: there will be many, many more such auctions in the future,

so those who wish to convert one paper into another will have ample

opportunity to do so.

The first day of the "next 4 years" is starting in a very auspicious fashion. First, the market crashes. Then, a major blue chip company, Boeing, just announced it would cut 30% of management jobs from 2010 levels. And finally, the US Treasury just added $24 billion in debt,

or enough to fund Greece for over one year, sending the total debt

load (the US is now at 103% debt/GDP) ever closer to the debt ceiling

breaching $16.4 trillion. But don't worry: over the next 4 years, the US

government will add another $6-8 trillion in debt, so those who didn't

get their allocation in this auction will have more than enough

opportunity. As for this one, the yield was 1.68%, the lowest since

August (but, but, what happened to the great rotation out of bonds and

into stocks?), the Bid to Cover was 2.59, the lowest since last November

and only higher compared to August' 2.49. And finally, the take down

breakdown was uneventful: 46.2% for Dealers (to be promptly flipped back

to the Fed - keep track of CUSIP 912828TY6), 39.7% for Indirects, or

below the 12 TTM average of 41.28%, and Directs got 14.1%, also below

the average, and lower than last month's 22.9%. As noted: uneventful. As

also noted: there will be many, many more such auctions in the future,

so those who wish to convert one paper into another will have ample

opportunity to do so.The Four Regimes (And 40 Years) Of Equity Valuation

Stocks

tend to experience very long periods (5-20 years) of either anemic or

exceptional returns, which UBS calls Investment Regimes. Somewhat

surprisingly (to some), they note that returns during these periods are

not driven by divergences in economic or earnings growth. Rather,

Investment Regimes are defined by secular multiple expansion or

contraction - and it is critical to understand this dynamic as over the

past 40 years (and four regimes) investors have tended to focus on only

one dynamic at a time. From the 'Disco' regime to the 'Hangover II', UBS explains in a few simple charts why all eyes should be focused on high-yield credit - as we have noted time and again. Inflation

signals are gone, the 'Fed model' is broken, and investment grade

credit is too repressed to matter (until it does!)...

Stocks

tend to experience very long periods (5-20 years) of either anemic or

exceptional returns, which UBS calls Investment Regimes. Somewhat

surprisingly (to some), they note that returns during these periods are

not driven by divergences in economic or earnings growth. Rather,

Investment Regimes are defined by secular multiple expansion or

contraction - and it is critical to understand this dynamic as over the

past 40 years (and four regimes) investors have tended to focus on only

one dynamic at a time. From the 'Disco' regime to the 'Hangover II', UBS explains in a few simple charts why all eyes should be focused on high-yield credit - as we have noted time and again. Inflation

signals are gone, the 'Fed model' is broken, and investment grade

credit is too repressed to matter (until it does!)...The Invisible Hand Is Not Restricted To The Gold Market

Eric De Groot at Eric De Groot - 2 hours ago

The seeds of today's global equity market decline were sown in September.

Just like gold, the next rally will begin once the invisible hand regains

control of the trend from the weak hands. Watch the equity diffusion index

move higher as stock prices fall (chart). This inverse relationship

depicts a market building cause for the next rally while the crowd panics.

Gold will...

[[ This is a content summary only. Visit my website for full links, other

content, and more! ]]Athens Riotcams Are Back - Live Webcasts

While

we await the Greek parliament vote on yet further Troika-mandated

austerity, which the government has promised to be the last such round

of cuts, or at least the last one before Germany demands even more

austerity for a country which is now, supposedly "too big"

in Merkel's words, here is how the general population is preparing for

the vote's outcome, which, if it passes, will be by a razor thin

margin. Also, as a friendly reminder the May 6, 2010 flash crash

occurred just as the video stream of the first Greek riot peaked...

While

we await the Greek parliament vote on yet further Troika-mandated

austerity, which the government has promised to be the last such round

of cuts, or at least the last one before Germany demands even more

austerity for a country which is now, supposedly "too big"

in Merkel's words, here is how the general population is preparing for

the vote's outcome, which, if it passes, will be by a razor thin

margin. Also, as a friendly reminder the May 6, 2010 flash crash

occurred just as the video stream of the first Greek riot peaked...Obama Wins A Second Term: Now What?

We

are programed to cheer and act out our sheep-like roles in partisan

politics when, like the game, unless we have money bet on the outcome

the actual winner will have absolutely no impact on our lives. The

bottom line is that voting percentages generate credibility for the

failed American political system. "There's not a dime's worth of

difference between the Democrat and Republican parties." George

Wallace, 1966 Alabama governor and presidential candidate. Romney lost for two main reasons: First, as he correctly noted during the campaign, 47 percent of American families are dependent on government handouts and they voted for what was in their own best interests; and second, the GOP leadership antagonized the 10 percent of the Republican Party electorate who supported Ron Paul for President. And so over

the next four years the people will be provoked and buy more guns they

will never have the courage to use to defend themselves against an

all-powerful government. The game will go on until the time is up for our nation. It

is time we as a generation man up for liberty to redeem ourselves in

the tear-filled eyes of future generations. The American people must

work peacefully to restore the Articles of Confederation now or else

suffer the permanent consequences of the fall of America.

We

are programed to cheer and act out our sheep-like roles in partisan

politics when, like the game, unless we have money bet on the outcome

the actual winner will have absolutely no impact on our lives. The

bottom line is that voting percentages generate credibility for the

failed American political system. "There's not a dime's worth of

difference between the Democrat and Republican parties." George

Wallace, 1966 Alabama governor and presidential candidate. Romney lost for two main reasons: First, as he correctly noted during the campaign, 47 percent of American families are dependent on government handouts and they voted for what was in their own best interests; and second, the GOP leadership antagonized the 10 percent of the Republican Party electorate who supported Ron Paul for President. And so over

the next four years the people will be provoked and buy more guns they

will never have the courage to use to defend themselves against an

all-powerful government. The game will go on until the time is up for our nation. It

is time we as a generation man up for liberty to redeem ourselves in

the tear-filled eyes of future generations. The American people must

work peacefully to restore the Articles of Confederation now or else

suffer the permanent consequences of the fall of America. Divers have found a Russian ship carrying 700 tons of gold ore that sank off the Pacific coast last month.

Divers have found a Russian ship carrying 700 tons of gold ore that sank off the Pacific coast last month.The freighter Amurskaya had been missing since Oct. 28 when it sent a distress call from the Sea of Okhotsk, an arm of the Pacific.

A statement from the Transportation Ministry said its 11 crew members remain unaccounted for.

The ship was found by divers in about 75 meters (230 feet) of water on Wednesday, the ITAR-Tass news agency reported.

Police have lodged criminal charges against the ship’s owner, who also is director of the Nikolaevsk-on-Amur port, where the ship is registered, for allegedly instructing the ship to sail despite bad weather and improper cargo procedures.

Read More @ KyivPost.com.com

[Ed. Note: The perfect video after another sham "election" in what was formerly known as 'the greatest country on earth'.]

from TheParadigmShift, via gotknowledge1:

[Ed. Note: There is an audio link for this interview; however, you must log in at OpEd News in order at access.]

By Rob Kall, Op Ed News:

I spent almost an hour talking with one of the best investigative

reporters in the world, Greg Palast, about his newest book, Billionaires

and Ballot Bandits. And we got into something very interesting– that

there’s a war between two kinds of billionaires– The vampire squids and

the Vultures. And yes, this affects the elections and the nine ways they

are going to be stolen and corrupted.

I spent almost an hour talking with one of the best investigative

reporters in the world, Greg Palast, about his newest book, Billionaires

and Ballot Bandits. And we got into something very interesting– that

there’s a war between two kinds of billionaires– The vampire squids and

the Vultures. And yes, this affects the elections and the nine ways they

are going to be stolen and corrupted.

Rob Kall: Why didn’t the Democrats, when they had control of the House, the Senate, and the White House, get rid of e-voting?

Greg Palast: Because they made a trade. Number one, the machines that were being used in places like the punch cards, the butterfly ballots, these were costing more votes than the electronic machines. The Democrats lost in Florida, one hundred- seventy eight thousand votes in 2000 to vote spoilers.

People talked about the butterfly ballot because it was one of the rare times in which rich people in Palm Beach County lost their votes. Black people are used to this.

Click Here for Part 1

Read More @ OpedNews.com

By Rob Kall, Op Ed News:

I spent almost an hour talking with one of the best investigative

reporters in the world, Greg Palast, about his newest book, Billionaires

and Ballot Bandits. And we got into something very interesting– that

there’s a war between two kinds of billionaires– The vampire squids and

the Vultures. And yes, this affects the elections and the nine ways they

are going to be stolen and corrupted.

I spent almost an hour talking with one of the best investigative

reporters in the world, Greg Palast, about his newest book, Billionaires

and Ballot Bandits. And we got into something very interesting– that

there’s a war between two kinds of billionaires– The vampire squids and

the Vultures. And yes, this affects the elections and the nine ways they

are going to be stolen and corrupted.Rob Kall: Why didn’t the Democrats, when they had control of the House, the Senate, and the White House, get rid of e-voting?

Greg Palast: Because they made a trade. Number one, the machines that were being used in places like the punch cards, the butterfly ballots, these were costing more votes than the electronic machines. The Democrats lost in Florida, one hundred- seventy eight thousand votes in 2000 to vote spoilers.

People talked about the butterfly ballot because it was one of the rare times in which rich people in Palm Beach County lost their votes. Black people are used to this.

Click Here for Part 1

Read More @ OpedNews.com

from TruthNeverTold :

We are doomed, saith the preacher, and should accommodate ourselves to

it. In times of growing governmental power, protestation at some point

becomes futile. Little is served by standing in front of a charging

Mongol army and shouting, “No! You should reconsider! Perhaps some other

course would be advisable. Let’s parley….”

We are doomed, saith the preacher, and should accommodate ourselves to

it. In times of growing governmental power, protestation at some point

becomes futile. Little is served by standing in front of a charging

Mongol army and shouting, “No! You should reconsider! Perhaps some other

course would be advisable. Let’s parley….”Complaint is useless. It is too late. It booteth not. We are done. The Mongols ride. America comes apart at the seams. The country turns into something altogether new, new for America.

In high school, I read Shirer, first Berlin Diary and then The Rise and Fall of the Third Reich. I had little idea what I was reading. A naval base in rural Virginia is not a hotbed of historical understanding, or any understanding. I knew nothing of Weimar or the Spartacists or the Treaty of Versailles.

Read More @ SilverBearCafe.com

by Ron Holland, The Daily Bell:

I’m certainly glad the election is finally over. While I have loved

politics my entire life, this presidential election has gone on for over

three years, including the GOP primaries, and I’ve had my fill of

meaningless slogans and counter-slogans, lies and counter-lies. I had to

quit watching political news the last few weeks, as I thought I would

become physically sick if I watched any more establishment political

“experts” give their required opinions and propaganda bites.

I’m certainly glad the election is finally over. While I have loved

politics my entire life, this presidential election has gone on for over

three years, including the GOP primaries, and I’ve had my fill of

meaningless slogans and counter-slogans, lies and counter-lies. I had to

quit watching political news the last few weeks, as I thought I would

become physically sick if I watched any more establishment political

“experts” give their required opinions and propaganda bites.

The 2012 presidential election has been like a ballgame hyped and built up over three years. We are programed to cheer and act out our sheep-like roles in partisan politics when, like the game, unless we have money bet on the outcome the actual winner will have absolutely no impact on our lives.

This was destined to be a close, statistically tied election, as get out the vote efforts included repetitive harping on its life-changing importance and the evils of the opposition candidates and party. The bottom line is that voting percentages generate credibility for the failed American political system.

Read More @ TheDailyBell.com

I’m certainly glad the election is finally over. While I have loved

politics my entire life, this presidential election has gone on for over

three years, including the GOP primaries, and I’ve had my fill of

meaningless slogans and counter-slogans, lies and counter-lies. I had to

quit watching political news the last few weeks, as I thought I would

become physically sick if I watched any more establishment political

“experts” give their required opinions and propaganda bites.

I’m certainly glad the election is finally over. While I have loved

politics my entire life, this presidential election has gone on for over

three years, including the GOP primaries, and I’ve had my fill of

meaningless slogans and counter-slogans, lies and counter-lies. I had to

quit watching political news the last few weeks, as I thought I would

become physically sick if I watched any more establishment political

“experts” give their required opinions and propaganda bites.The 2012 presidential election has been like a ballgame hyped and built up over three years. We are programed to cheer and act out our sheep-like roles in partisan politics when, like the game, unless we have money bet on the outcome the actual winner will have absolutely no impact on our lives.

This was destined to be a close, statistically tied election, as get out the vote efforts included repetitive harping on its life-changing importance and the evils of the opposition candidates and party. The bottom line is that voting percentages generate credibility for the failed American political system.

Read More @ TheDailyBell.com

by Wolf Richter, Testosterone Pit.com:

The European Union has been pursuing a dream, and in doing so, it has

created a ballooning superstructure of governance manned by 41,000

bureaucrats and mostly unelected politicians. In 2011, they spent €129

billion that had been obtained from member states and their taxpayers.

But now, the European Court of Auditors released its audit report

for that year—a damning document that outlines how up to 4.8% of the EU

budget had seeped through the cracks without ever reaching its target.

The European Union has been pursuing a dream, and in doing so, it has

created a ballooning superstructure of governance manned by 41,000

bureaucrats and mostly unelected politicians. In 2011, they spent €129

billion that had been obtained from member states and their taxpayers.

But now, the European Court of Auditors released its audit report

for that year—a damning document that outlines how up to 4.8% of the EU

budget had seeped through the cracks without ever reaching its target.

Already, the EU is under fire. As member governments are tightening the belts of their people to get deficits under control, and as austerity measures are tearing into healthcare benefits, wages, pensions, and safety nets, and as living standards are being hammered to smithereens, the EU government demands another budget increase.

Read More @ TestosteronePit.com

from TrimTabs:

The European Union has been pursuing a dream, and in doing so, it has

created a ballooning superstructure of governance manned by 41,000

bureaucrats and mostly unelected politicians. In 2011, they spent €129

billion that had been obtained from member states and their taxpayers.

But now, the European Court of Auditors released its audit report

for that year—a damning document that outlines how up to 4.8% of the EU

budget had seeped through the cracks without ever reaching its target.

The European Union has been pursuing a dream, and in doing so, it has

created a ballooning superstructure of governance manned by 41,000

bureaucrats and mostly unelected politicians. In 2011, they spent €129

billion that had been obtained from member states and their taxpayers.

But now, the European Court of Auditors released its audit report

for that year—a damning document that outlines how up to 4.8% of the EU

budget had seeped through the cracks without ever reaching its target.Already, the EU is under fire. As member governments are tightening the belts of their people to get deficits under control, and as austerity measures are tearing into healthcare benefits, wages, pensions, and safety nets, and as living standards are being hammered to smithereens, the EU government demands another budget increase.

Read More @ TestosteronePit.com

from TrimTabs:

from PragCap:

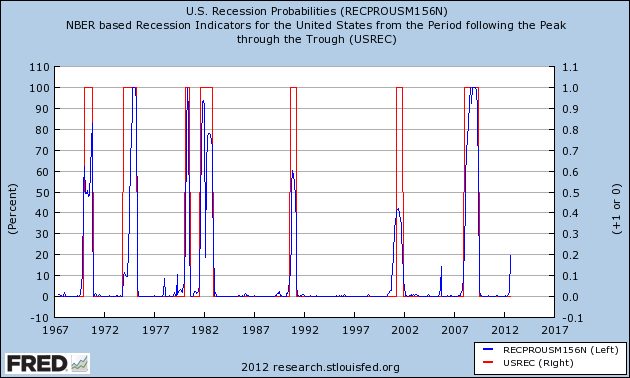

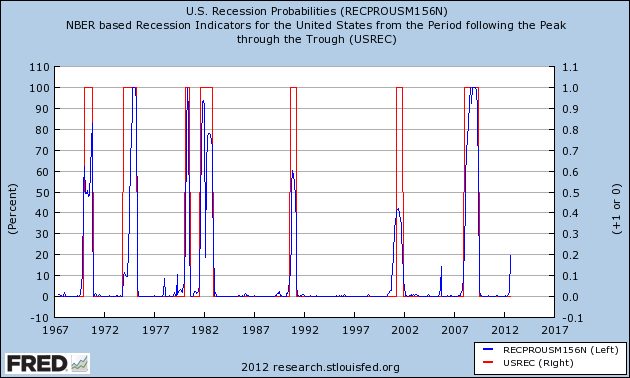

Here’s an interesting new data point that the St Louis Fed has put together to calculate recession probabilities:

Here’s an interesting new data point that the St Louis Fed has put together to calculate recession probabilities:

“Recession probabilities for the United States are obtained from a dynamic-factor markov-switching model applied to four monthly coincident variables: non-farm payroll employment, the index of industrial production, real personal income excluding transfer payments, and real manufacturing and trade sales.“

What’s interesting about this index is the current reading. At 20%, the index is at a level that has ALWAYS been followed by a recession. As you can see below, the index has never approached 20% without a subsequent recession. All 6 recessions since 1967 have coincided with 20%+ readings in the US Recession Probabilities index.

Interestingly, I still don’t see recession in my internal indicators. Those indicators have been right for a long time now (in the face of some very public recession predictions by reputable people). So I am afraid when my internal indicators point to “no recession” when an indicator like this clearly puts that opinion in the “this time is different” category….

Read More @ PragCap.com

Here’s an interesting new data point that the St Louis Fed has put together to calculate recession probabilities:

Here’s an interesting new data point that the St Louis Fed has put together to calculate recession probabilities:“Recession probabilities for the United States are obtained from a dynamic-factor markov-switching model applied to four monthly coincident variables: non-farm payroll employment, the index of industrial production, real personal income excluding transfer payments, and real manufacturing and trade sales.“

What’s interesting about this index is the current reading. At 20%, the index is at a level that has ALWAYS been followed by a recession. As you can see below, the index has never approached 20% without a subsequent recession. All 6 recessions since 1967 have coincided with 20%+ readings in the US Recession Probabilities index.

Interestingly, I still don’t see recession in my internal indicators. Those indicators have been right for a long time now (in the face of some very public recession predictions by reputable people). So I am afraid when my internal indicators point to “no recession” when an indicator like this clearly puts that opinion in the “this time is different” category….

Read More @ PragCap.com

by Fred Lucas, CNSnews:

Fifty-three House members are demanding to know whether the April 6,

2012 and June 6, 2012 bomb-attacks on the U.S. consulate in Benghazi,

Libya were immediately included in the President’s Daily Brief – those

two attacks occurred before the fatal Sept. 11 attack that killed U.S.

ambassador Chris Stevens and 3 other Americans.

Fifty-three House members are demanding to know whether the April 6,

2012 and June 6, 2012 bomb-attacks on the U.S. consulate in Benghazi,

Libya were immediately included in the President’s Daily Brief – those

two attacks occurred before the fatal Sept. 11 attack that killed U.S.

ambassador Chris Stevens and 3 other Americans.

“When was President Obama made aware of these two attacks on the Benghazi compound?” the letter asked. “Were these two attacks included in the President’s Daily Brief immediately after the attacks took place?”

The Presidential Daily Brief is a daily national security and intelligence report provided to the president each morning by the director of National Intelligence. It is the foundation of national security briefings.

Read More @ CNSnews.com

Fifty-three House members are demanding to know whether the April 6,

2012 and June 6, 2012 bomb-attacks on the U.S. consulate in Benghazi,

Libya were immediately included in the President’s Daily Brief – those

two attacks occurred before the fatal Sept. 11 attack that killed U.S.

ambassador Chris Stevens and 3 other Americans.

Fifty-three House members are demanding to know whether the April 6,

2012 and June 6, 2012 bomb-attacks on the U.S. consulate in Benghazi,

Libya were immediately included in the President’s Daily Brief – those

two attacks occurred before the fatal Sept. 11 attack that killed U.S.

ambassador Chris Stevens and 3 other Americans.“When was President Obama made aware of these two attacks on the Benghazi compound?” the letter asked. “Were these two attacks included in the President’s Daily Brief immediately after the attacks took place?”

The Presidential Daily Brief is a daily national security and intelligence report provided to the president each morning by the director of National Intelligence. It is the foundation of national security briefings.

Read More @ CNSnews.com

by Lizzie Bennett, The Daily Sheeple:

For many, many people the sh*t has already hit the fan, and the

streets, and the parks and their floors. Sewage from damaged pipes and

from backed up municipal facilities is flowing, untreated into the

streets in some areas affected by hurricane Sandy. This poses a grave

threat to health as untreated sewage is linked to many, many diseases

that can sicken and/or kill humans. Typhoid, cholera, diphtheria and a

long list of other infectious diseases are likely to be lurking in those

waters. Contact with the water is almost impossible to avoid, and

washing adequately after any contact is almost impossible when there is

no clean water supply up and running.

For many, many people the sh*t has already hit the fan, and the

streets, and the parks and their floors. Sewage from damaged pipes and

from backed up municipal facilities is flowing, untreated into the

streets in some areas affected by hurricane Sandy. This poses a grave

threat to health as untreated sewage is linked to many, many diseases

that can sicken and/or kill humans. Typhoid, cholera, diphtheria and a

long list of other infectious diseases are likely to be lurking in those

waters. Contact with the water is almost impossible to avoid, and

washing adequately after any contact is almost impossible when there is

no clean water supply up and running.

Drinking water is in very short supply and in some areas is limited to the bottles handed out by government officials. What the hell are these people to do? Sadly, the answer is that there’s not much they can do at this stage. The infrastructure is damaged, supplies are short, I would expect a great many are going to get sick in the next couple of weeks, if they don’t, I would be very surprised.

Read More @ TheDailySheeple.com

For many, many people the sh*t has already hit the fan, and the

streets, and the parks and their floors. Sewage from damaged pipes and

from backed up municipal facilities is flowing, untreated into the

streets in some areas affected by hurricane Sandy. This poses a grave

threat to health as untreated sewage is linked to many, many diseases

that can sicken and/or kill humans. Typhoid, cholera, diphtheria and a

long list of other infectious diseases are likely to be lurking in those

waters. Contact with the water is almost impossible to avoid, and

washing adequately after any contact is almost impossible when there is

no clean water supply up and running.

For many, many people the sh*t has already hit the fan, and the

streets, and the parks and their floors. Sewage from damaged pipes and

from backed up municipal facilities is flowing, untreated into the

streets in some areas affected by hurricane Sandy. This poses a grave

threat to health as untreated sewage is linked to many, many diseases

that can sicken and/or kill humans. Typhoid, cholera, diphtheria and a

long list of other infectious diseases are likely to be lurking in those

waters. Contact with the water is almost impossible to avoid, and

washing adequately after any contact is almost impossible when there is

no clean water supply up and running.Drinking water is in very short supply and in some areas is limited to the bottles handed out by government officials. What the hell are these people to do? Sadly, the answer is that there’s not much they can do at this stage. The infrastructure is damaged, supplies are short, I would expect a great many are going to get sick in the next couple of weeks, if they don’t, I would be very surprised.

Read More @ TheDailySheeple.com

from KingWorldNews:

With gold, silver, and the entire commodity complex on fire today,

Egon von Greyerz told King World News, “… the physical buyers are

continuing their aggressive purchases.” Here is what Greyerz had this

to say: “Eric, this is just the action that I’ve been predicting for a

while. I expected the pressure to last until the election. It’s clear

that November will be a strong month. This is the start of the big

move. This is the start of the move that will last until at least next

summer before a major correction.”

With gold, silver, and the entire commodity complex on fire today,

Egon von Greyerz told King World News, “… the physical buyers are

continuing their aggressive purchases.” Here is what Greyerz had this

to say: “Eric, this is just the action that I’ve been predicting for a

while. I expected the pressure to last until the election. It’s clear

that November will be a strong month. This is the start of the big

move. This is the start of the move that will last until at least next

summer before a major correction.”

“The potential exists here for a major upside move. Just look at the major charts you published today. These are charts that show gold will move up exponentially once the key levels on those charts are taken out to the upside. I am absolutely convinced there will be unlimited money printing worldwide, and the gold market is reflecting that.

The move that we have been seeing to the downside is not justified at all….

Egon von Greyerz continues @ KingWorldNews.com

Your support is needed...

I'm PayPal Verified

With gold, silver, and the entire commodity complex on fire today,

Egon von Greyerz told King World News, “… the physical buyers are

continuing their aggressive purchases.” Here is what Greyerz had this

to say: “Eric, this is just the action that I’ve been predicting for a

while. I expected the pressure to last until the election. It’s clear

that November will be a strong month. This is the start of the big

move. This is the start of the move that will last until at least next

summer before a major correction.”

With gold, silver, and the entire commodity complex on fire today,

Egon von Greyerz told King World News, “… the physical buyers are

continuing their aggressive purchases.” Here is what Greyerz had this

to say: “Eric, this is just the action that I’ve been predicting for a

while. I expected the pressure to last until the election. It’s clear

that November will be a strong month. This is the start of the big

move. This is the start of the move that will last until at least next

summer before a major correction.”“The potential exists here for a major upside move. Just look at the major charts you published today. These are charts that show gold will move up exponentially once the key levels on those charts are taken out to the upside. I am absolutely convinced there will be unlimited money printing worldwide, and the gold market is reflecting that.

The move that we have been seeing to the downside is not justified at all….

Egon von Greyerz continues @ KingWorldNews.com

Your support is needed...

Thank You

I'm PayPal Verified

You will need one of these... before this is all over...

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment