Update: the following tweet from Israel's ambassador to the US, Michael Oren, will hardly help: "ALERT: Tel Aviv area was just hit by a rocket attack from #Gaza"

Update: the following tweet from Israel's ambassador to the US, Michael Oren, will hardly help: "ALERT: Tel Aviv area was just hit by a rocket attack from #Gaza"Despite having lost its prominent headline position in the global media, the things in Gaza are going from bad to worse with news reports that Israeli ground forces are preparing to enter the Gaza Strip which will take the confrontation to an effective ground war level, even as a separate news report claims that Egypt has now closed its border with Israel, in yet another escalation. It is unclear how soon until Egypt also halts gas supplies to Israel as it did back in April - we assume not too long. So as the world awaits the next major step in a conflict that has a Katyusha rocket's chance in the Iron Dome of going away on its own, we present the latest clip provided by the handy, if oddly boastful, Israeli Defense Forces, this time showing how a rocket warehouse in Gaza just became one with the ether. Tangentially, and once again, we can't help but lament how a Plan X involving the US military would be an option here, if only the entire US military and intelligence hadn't become a gonzo reality TV show virtually overnight.

Obama's Offer to Resolve 'Cliff' Is Just a 'Sucker's Game': Ross

|

The FHA Is Blowing Up: Bad News For The Housing Market

The FHA has been the key element to the phony “housing recovery” the government has been trying to create.

In the wake of the collapse of 2008, Fannie Mae and Freddie Mac blew

up and what was left to pick up the pieces was the FHA. No private

player would issue loans with down payments of 3%, but this was no

problem for the FHA! Well - yes! "The Federal Housing

Administration is expected to report this week it could exhaust its

reserves because of rising mortgage delinquencies" This is

a big deal. The FHA is already in trouble despite a miraculous

“housing recovery” and we haven’t even hit a severe cyclical economic

slowdown yet, which is almost certain to occur in 2013. What shambles do you think the housing market will be in once that happens and the last backstop to housing is broke?

The FHA has been the key element to the phony “housing recovery” the government has been trying to create.

In the wake of the collapse of 2008, Fannie Mae and Freddie Mac blew

up and what was left to pick up the pieces was the FHA. No private

player would issue loans with down payments of 3%, but this was no

problem for the FHA! Well - yes! "The Federal Housing

Administration is expected to report this week it could exhaust its

reserves because of rising mortgage delinquencies" This is

a big deal. The FHA is already in trouble despite a miraculous

“housing recovery” and we haven’t even hit a severe cyclical economic

slowdown yet, which is almost certain to occur in 2013. What shambles do you think the housing market will be in once that happens and the last backstop to housing is broke?

A number of economists and economics writers have considered the possibility of allowing the Federal Reserve to drop interest rates below zero in order to make holding onto money costlier and encouraging individuals and firms to spend, spend, spend.

Miles Kimball details one such plan:

The US Federal Reserve’s new determination to keep buying mortgage-backed securities until the economy gets better, better known as quantitative easing, is controversial. Although a few commentators don’t think the economy needs any more stimulus, many others are unnerved because the Fed is using untested tools. (For example, see Michael Snyder’s collection of “10 Shocking Quotes About What QE3 Is Going To Do To America.”) Normally the Fed simply lowers short-term interest rates (and in particular the federal funds rate at which banks lend to each other overnight) by purchasing three-month Treasury bills. But it has basically hit the floor on the federal funds rate. If the Fed could lower the federal funds rate as far as chairman Ben Bernanke and his colleagues wanted, it would be much less controversial.Read More @ Azizonomics.com

The Bernank Laments Lack Of Housing Bubble, Demands More From Tapped Out Households

Moments ago Ben Bernanke released a speech titled "Challenges in Housing and Mortgage Markets" in which he said that while the US housing revival faces significant obstacles, the Fed will do everything it can to back the "housing recovery" (supposedly on top of the $40 billion in MBS it monetizes each month, and/or QEternity+1?). He then goes on to say that tight lenders may be thwarting the recovery, and is concerned about high unemployment, things that should be prevented as housing is a "powerful headwind to the recovery." In other words - the same canned gibberish he has been showering upon those stupid and naive enough to listen and/or believe him, because once the current downtrend in the market is confirmed to be a long-term decline, the 4th dead cat bounce in housing will end. But perhaps what is most amusing is that the Fed is now accusing none other than the US household for not doing their patriotic duty to reflate the peak bubble. To wit: "The Federal Reserve will continue to do what we can to support the housing recovery, both through our monetary policy and our regulatory and supervisory actions. But, as I have discussed, not all of the responsibility lies with the government; households, the financial services industry, and those in the nonprofit sector must play their part as well." So "get to work, Mr. Household: Benny and the Inkjets, not to mention Chuck Schumer's careers rest on your bubble-reflation skills."

Kaminsky Slams Strategists: "Do As They Do, Not As They Say"

In

a brief four minutes this morning, CNBC's Gary Kaminsky summarized

what many have suspected (and we have pointed to again and again) that

investors should as the talking-heads are doing and NOT as they are

saying (or writing). We have opined vociferously on this topic of the divergence between sentiment surveys and real money positioning,

but the outspoken 'real money manager' is gravely concerned that what

he is seeing now from the guests and newsletter writers is very similar

to what took place in 2007: "Everyone saying they would stay fully

invested, that they loved equities, that the housing boom was nothing to

worry about (recovery now); while at the same time they were

short-selling the market. People are saying one thing and doing another."

Kaminsky nails it when he points to the obvious that everybody knows

that the last four years have not been about the White House or

'recovery', but about Central Banks; and the last few weeks (post

QE-Eternity) the realization of this fact has really sunk in along with a

belief that the next four years are not positive for stocks. Not quite a Jeff Macke meltdown of truthiness but the veil has been lifted.

In

a brief four minutes this morning, CNBC's Gary Kaminsky summarized

what many have suspected (and we have pointed to again and again) that

investors should as the talking-heads are doing and NOT as they are

saying (or writing). We have opined vociferously on this topic of the divergence between sentiment surveys and real money positioning,

but the outspoken 'real money manager' is gravely concerned that what

he is seeing now from the guests and newsletter writers is very similar

to what took place in 2007: "Everyone saying they would stay fully

invested, that they loved equities, that the housing boom was nothing to

worry about (recovery now); while at the same time they were

short-selling the market. People are saying one thing and doing another."

Kaminsky nails it when he points to the obvious that everybody knows

that the last four years have not been about the White House or

'recovery', but about Central Banks; and the last few weeks (post

QE-Eternity) the realization of this fact has really sunk in along with a

belief that the next four years are not positive for stocks. Not quite a Jeff Macke meltdown of truthiness but the veil has been lifted.Remember This?

It was only a few short weeks ago when we noted

the interesting analogs between AAPL's rise and the exponential

exuberance of MSFT in the late 90s and NFLX this year. Sadly, for the

long-suffering momentum-chasers, things have gone a little pear-shaped for Apple

as it has followed, far too accurately, the same path from exuberance

to realization. Where to next? MSFT says 'a bounce to be faded'; NFLX

says 'dump it all'...either way $400 is in play for AAPL - back to the

start of the year... cue fundamental defense of what is quite clearly a

behavioral exuberance having played out.

It was only a few short weeks ago when we noted

the interesting analogs between AAPL's rise and the exponential

exuberance of MSFT in the late 90s and NFLX this year. Sadly, for the

long-suffering momentum-chasers, things have gone a little pear-shaped for Apple

as it has followed, far too accurately, the same path from exuberance

to realization. Where to next? MSFT says 'a bounce to be faded'; NFLX

says 'dump it all'...either way $400 is in play for AAPL - back to the

start of the year... cue fundamental defense of what is quite clearly a

behavioral exuberance having played out.JPM 'Benched' from Trading in the Energy Markets for Six Months

The Bernank-Obama-Keynes Toxic Triangle Dead End

In

the short run (and this is what is so insidious about the Fed’s

artificially low interest rates), all we are seeing is an illusion of

economic progress. The choice for the status quo made in last

week’s presidential election was an uninformed one—at no fault of the

voters—made in the fog of monetary distortion and Federal Reserve

Chairman Ben Bernanke’s continuous campaign of disinformation. Thus,

investment in this illusory economy is malinvestment, or investment

that always unravels with the intervention’s inevitable end,

due to either untenable credit levels (such as today’s corporate

debt-to-asset ratio, still at historic highs) or a resource crunch

(rising commodity prices) that eliminates any advantage from printing

money; and one or both of these scenarios is unavoidable. This is

our grievous position in the United States today, trapped in the status

quo by first consequences, by what we can see, due to a cause that we

cannot even see. And so we are left to learn from experience, an eventual tragic unfolding of our collective malinvestment. As Bastiat said, “Experience teaches effectually, but brutally.”

In

the short run (and this is what is so insidious about the Fed’s

artificially low interest rates), all we are seeing is an illusion of

economic progress. The choice for the status quo made in last

week’s presidential election was an uninformed one—at no fault of the

voters—made in the fog of monetary distortion and Federal Reserve

Chairman Ben Bernanke’s continuous campaign of disinformation. Thus,

investment in this illusory economy is malinvestment, or investment

that always unravels with the intervention’s inevitable end,

due to either untenable credit levels (such as today’s corporate

debt-to-asset ratio, still at historic highs) or a resource crunch

(rising commodity prices) that eliminates any advantage from printing

money; and one or both of these scenarios is unavoidable. This is

our grievous position in the United States today, trapped in the status

quo by first consequences, by what we can see, due to a cause that we

cannot even see. And so we are left to learn from experience, an eventual tragic unfolding of our collective malinvestment. As Bastiat said, “Experience teaches effectually, but brutally.”

Negative Nominal Interest Rates?

A number of economists and economics writers have considered the possibility of allowing the Federal Reserve to drop interest rates below zero

in order to make holding onto money costlier and encouraging

individuals and firms to spend, spend, spend. This unwillingness to hold

currency is supposed to stimulate the economy by encouraging

productive economic activity and investment. But is that necessarily

true? No — it will just drive people away from using the currency as a store of purchasing power. It will drive economic activity underground and banking would be turned upside down.

Japan has spent almost twenty years at the zero bound, in spite of

multiple rounds of quantitative easing and stimulus. Yet Japan remains

mired in depression. A return to growth for a depressionary post-bubble

economy requires a substantial chunk of the debt load (and thus

future debt service costs) being either liquidated, forgiven or (very

difficult and slow) paid down.

A number of economists and economics writers have considered the possibility of allowing the Federal Reserve to drop interest rates below zero

in order to make holding onto money costlier and encouraging

individuals and firms to spend, spend, spend. This unwillingness to hold

currency is supposed to stimulate the economy by encouraging

productive economic activity and investment. But is that necessarily

true? No — it will just drive people away from using the currency as a store of purchasing power. It will drive economic activity underground and banking would be turned upside down.

Japan has spent almost twenty years at the zero bound, in spite of

multiple rounds of quantitative easing and stimulus. Yet Japan remains

mired in depression. A return to growth for a depressionary post-bubble

economy requires a substantial chunk of the debt load (and thus

future debt service costs) being either liquidated, forgiven or (very

difficult and slow) paid down.

Your support is needed...

Thank You

I'm PayPal Verified

US Postal Service, Costing $250 Million Daily, Posts Record $15.9 Billion Loss, May Run Out Of Cash Soon

That

the biggest government source of employment just posted a record $15.9

billion loss (bigger than the $15 billion expected previously), is no

surprise to anyone: after all most are openly expecting the USPS to

fold, the only outstanding question is whether it will transform into a

company that is actually competitive with the private sector

(unlikely), or liquidate (also unlikely in an era where government jobs

are becoming the only form of employment available). Sadly, keeping

this zombie alive costs all other taxpayers $250 million each day:

money that could be used much more effectively in other areas of the

economy, but won't. Because there are USPS votes that have to be

purchased at cost. Perhaps the biggest surprise is that while the USPS

had a total of 607,400 employees in October, this was the lowest number

of total employees for the non-profit (but certainly loss-driven)

government run organization since the 1960s! Perhaps most shocking is

that the USPS peaked at over 900K employees in 1999 when it was still

if not profitable (as it doesn't need to be by its charter) then

certainly breakeven. Sadly those days are now gone, and the next thing

to go will be all the promised benefits for the 600K or so employees.

That

the biggest government source of employment just posted a record $15.9

billion loss (bigger than the $15 billion expected previously), is no

surprise to anyone: after all most are openly expecting the USPS to

fold, the only outstanding question is whether it will transform into a

company that is actually competitive with the private sector

(unlikely), or liquidate (also unlikely in an era where government jobs

are becoming the only form of employment available). Sadly, keeping

this zombie alive costs all other taxpayers $250 million each day:

money that could be used much more effectively in other areas of the

economy, but won't. Because there are USPS votes that have to be

purchased at cost. Perhaps the biggest surprise is that while the USPS

had a total of 607,400 employees in October, this was the lowest number

of total employees for the non-profit (but certainly loss-driven)

government run organization since the 1960s! Perhaps most shocking is

that the USPS peaked at over 900K employees in 1999 when it was still

if not profitable (as it doesn't need to be by its charter) then

certainly breakeven. Sadly those days are now gone, and the next thing

to go will be all the promised benefits for the 600K or so employees.

by Pater Tenebrarum, Acting-Man.com:

Falling Asset Prices Are Not Deflation

Falling Asset Prices Are Not Deflation

We always stress that the great financial crisis has indeed left the economy with what one might term a ‘deflationary undertow’. To the extent that households try to deleverage and are paying back debt and to the extent that banks refuse to expand credit concurrently, there is a theoretical possibility that the money supply might one day decline. It must also be stressed that this is highly hypothetical at this stage, as it has simply not happened yet.

On the contrary, the Fed has actively pumped up the money supply at a truly astonishing pace. See for yourself:

Moreover, falling prices as such are not evidence of ‘deflation’, including falling asset prices. This is however what ‘Barron’s’ asserts in a recent article, whose author muses over whether the ‘Fed is losing the fight against deflation’. Say what? According to Barron’s:

Read More @ Acting-Man.com

Falling Asset Prices Are Not Deflation

Falling Asset Prices Are Not DeflationWe always stress that the great financial crisis has indeed left the economy with what one might term a ‘deflationary undertow’. To the extent that households try to deleverage and are paying back debt and to the extent that banks refuse to expand credit concurrently, there is a theoretical possibility that the money supply might one day decline. It must also be stressed that this is highly hypothetical at this stage, as it has simply not happened yet.

On the contrary, the Fed has actively pumped up the money supply at a truly astonishing pace. See for yourself:

Moreover, falling prices as such are not evidence of ‘deflation’, including falling asset prices. This is however what ‘Barron’s’ asserts in a recent article, whose author muses over whether the ‘Fed is losing the fight against deflation’. Say what? According to Barron’s:

Read More @ Acting-Man.com

by Keith Weiner, Financial Sense:

Dear Mr. Price: I read your piece: “On the Use of Gold Coins as Money”. I think you ask the right question. This is the elephant in the room. Why do gold and silver not circulate?

Dear Mr. Price: I read your piece: “On the Use of Gold Coins as Money”. I think you ask the right question. This is the elephant in the room. Why do gold and silver not circulate?

I love your analogy of the Swiss asserting that they will “allow” gold to have a monetary role, this being like “re-hydrating water.” It is not within the power of foolish governments either to imbue water with wetness, or gold with moneyness.

Gold is already money. It is the commodity with the tightest bid-ask spread. It is the commodity with the highest ratio of inventories divided by annual mine production (stocks to flows). And it is the commodity whose marginal utility does not decline. These statements are as true for gold today as they were under the gold standard 100 years ago.

Read More @ FinancialSense.com

Dear Mr. Price: I read your piece: “On the Use of Gold Coins as Money”. I think you ask the right question. This is the elephant in the room. Why do gold and silver not circulate?

Dear Mr. Price: I read your piece: “On the Use of Gold Coins as Money”. I think you ask the right question. This is the elephant in the room. Why do gold and silver not circulate?I love your analogy of the Swiss asserting that they will “allow” gold to have a monetary role, this being like “re-hydrating water.” It is not within the power of foolish governments either to imbue water with wetness, or gold with moneyness.

Gold is already money. It is the commodity with the tightest bid-ask spread. It is the commodity with the highest ratio of inventories divided by annual mine production (stocks to flows). And it is the commodity whose marginal utility does not decline. These statements are as true for gold today as they were under the gold standard 100 years ago.

Read More @ FinancialSense.com

from Gold Silver Worlds:

The international pressure on the usage of the US dollar as a world

reserve currency is increasing. Turkish Prime Minister Erdoğan openly

asked why the International Monetary Fund is not using gold as its

reserves instead of the dollar. It’s becoming increasingly clear that

the dollar isn’t necessarily a blessing but rather an issue for some

countries. These are some highlights from what Erdoğan publicly said

(source: Sabah.com.tr)

The international pressure on the usage of the US dollar as a world

reserve currency is increasing. Turkish Prime Minister Erdoğan openly

asked why the International Monetary Fund is not using gold as its

reserves instead of the dollar. It’s becoming increasingly clear that

the dollar isn’t necessarily a blessing but rather an issue for some

countries. These are some highlights from what Erdoğan publicly said

(source: Sabah.com.tr)

The international pressure on the usage of the US dollar as a world

reserve currency is increasing. Turkish Prime Minister Erdoğan openly

asked why the International Monetary Fund is not using gold as its

reserves instead of the dollar. It’s becoming increasingly clear that

the dollar isn’t necessarily a blessing but rather an issue for some

countries. These are some highlights from what Erdoğan publicly said

(source: Sabah.com.tr)

The international pressure on the usage of the US dollar as a world

reserve currency is increasing. Turkish Prime Minister Erdoğan openly

asked why the International Monetary Fund is not using gold as its

reserves instead of the dollar. It’s becoming increasingly clear that

the dollar isn’t necessarily a blessing but rather an issue for some

countries. These are some highlights from what Erdoğan publicly said

(source: Sabah.com.tr)Expressing that he doesn’t feel it is right for the IMF to act according to one nation’s currency, Erdoğan states, “The IMF extends aid on a who, where, how and on what conditions bases. For example, if the IMF is under the influence of any single currency then what, are they going rule the world based on the exchange rates of that particular currency?Read More @ GoldSilverWorlds.com

Why do we not switch then to a monetary unit such as gold, which is at the very least an international constant and indicator which has maintained its honor throughout history. This is something to think about.”

from TF Metals Report:

You’ll be hearing a lot over the next few days about the “Iron Dome” that Israel has. Apparently, The Gold Cartel has one, too.

As reported in the morning update to the previous thread, today we witnessed an extraordinary act of blatant manipulation in the gold pit. Over the course of about 5 minutes, one single order was filled. This massive dump of about 25,000 gold contracts managed to move the price of gold down by nearly $20. To give you an appreciation of the size and scale of this deliberately criminal act, 25,000 contracts is the paper equivalent of 2.5 million ounces of gold or, roughly, 77 metric tonnes. 77 tonnes is the paper equivalent to the alleged physical holdings of Australia or Indonesia.

Now, think about that for a moment. Indonesia is the 4th largest country in the world, in terms of population. Coming in at 250,000,000 people, there exists in Indonesia about 1/10th of an ounce of gold for every person. And some prick in New York was able to dump the entire thing in a matter of seconds. Amazing. And this is what passes for free and fair markets in the 21st century!

Anyway, back to the “Iron Dome” analogy….

Read More @ TF Metals Report.com

You’ll be hearing a lot over the next few days about the “Iron Dome” that Israel has. Apparently, The Gold Cartel has one, too.

As reported in the morning update to the previous thread, today we witnessed an extraordinary act of blatant manipulation in the gold pit. Over the course of about 5 minutes, one single order was filled. This massive dump of about 25,000 gold contracts managed to move the price of gold down by nearly $20. To give you an appreciation of the size and scale of this deliberately criminal act, 25,000 contracts is the paper equivalent of 2.5 million ounces of gold or, roughly, 77 metric tonnes. 77 tonnes is the paper equivalent to the alleged physical holdings of Australia or Indonesia.

Now, think about that for a moment. Indonesia is the 4th largest country in the world, in terms of population. Coming in at 250,000,000 people, there exists in Indonesia about 1/10th of an ounce of gold for every person. And some prick in New York was able to dump the entire thing in a matter of seconds. Amazing. And this is what passes for free and fair markets in the 21st century!

Anyway, back to the “Iron Dome” analogy….

Read More @ TF Metals Report.com

by Judge, Andrew P. Napolitano, Lew Rockwell:

The evidence that Gen. David Petraeus, formerly the commander of U.S.

troops in Afghanistan, the author of the current Army field manual,

Princeton Ph.D. and, until last week, the director of the Central

Intelligence Agency, was forced to resign from the CIA to silence him is

far stronger than is the version of events that the Obama

administration has given us.

The evidence that Gen. David Petraeus, formerly the commander of U.S.

troops in Afghanistan, the author of the current Army field manual,

Princeton Ph.D. and, until last week, the director of the Central

Intelligence Agency, was forced to resign from the CIA to silence him is

far stronger than is the version of events that the Obama

administration has given us.

The government would have us believe that because the FBI confronted Petraeus with his emails showing a pattern of inappropriate personal private behavior, he voluntarily departed his job as the country’s chief spy to avoid embarrassment. The government would also have us believe that the existence of the general’s relationship with Paula Broadwell, an unknown military scholar who wrote a book about him last year, was recently and inadvertently discovered by the FBI while it was conducting an investigation into an alleged threat made by Broadwell to another woman. And the government would as well have us believe that the president learned of all this at 5 p.m. on Election Day.

We now know that the existence of a personal relationship between Broadwell and Petraeus had been suspected and whispered about by his senior-level colleagues and by his personal staff in the military, who worried that it might become publicly known, since before the time that he came to run the CIA.

Read More @ LewRockwell.com

The evidence that Gen. David Petraeus, formerly the commander of U.S.

troops in Afghanistan, the author of the current Army field manual,

Princeton Ph.D. and, until last week, the director of the Central

Intelligence Agency, was forced to resign from the CIA to silence him is

far stronger than is the version of events that the Obama

administration has given us.

The evidence that Gen. David Petraeus, formerly the commander of U.S.

troops in Afghanistan, the author of the current Army field manual,

Princeton Ph.D. and, until last week, the director of the Central

Intelligence Agency, was forced to resign from the CIA to silence him is

far stronger than is the version of events that the Obama

administration has given us.The government would have us believe that because the FBI confronted Petraeus with his emails showing a pattern of inappropriate personal private behavior, he voluntarily departed his job as the country’s chief spy to avoid embarrassment. The government would also have us believe that the existence of the general’s relationship with Paula Broadwell, an unknown military scholar who wrote a book about him last year, was recently and inadvertently discovered by the FBI while it was conducting an investigation into an alleged threat made by Broadwell to another woman. And the government would as well have us believe that the president learned of all this at 5 p.m. on Election Day.

We now know that the existence of a personal relationship between Broadwell and Petraeus had been suspected and whispered about by his senior-level colleagues and by his personal staff in the military, who worried that it might become publicly known, since before the time that he came to run the CIA.

Read More @ LewRockwell.com

by Michael Krieger, Liberty Blitzkreig

The

several States composing, the United States of America, are not united

on the principle of unlimited submission to their general government;

but that, by a compact under the style and title of a Constitution for

the United States, and of amendments thereto, they constituted a general

government for special purposes — delegated to that government certain

definite powers, reserving, each State to itself, the residuary mass of

right to their own self-government; and that whensoever the general

government assumes undelegated powers, its acts are unauthoritative,

void, and of no force.

The

several States composing, the United States of America, are not united

on the principle of unlimited submission to their general government;

but that, by a compact under the style and title of a Constitution for

the United States, and of amendments thereto, they constituted a general

government for special purposes — delegated to that government certain

definite powers, reserving, each State to itself, the residuary mass of

right to their own self-government; and that whensoever the general

government assumes undelegated powers, its acts are unauthoritative,

void, and of no force.

- Thomas Jefferson in the Kentucky Resolution of 1798 in response to the Alien and Sedition Acts

It was always inevitable. Once enough people realized that the Federal government is nothing more than a collective of corrupt, criminal thugs there was bound to be a backlash. Given the structure of these United States, it was bound to take the form of States rights versus centralized power in Washington D.C. This is not about Obama; the cancer in the capital is bipartisan.

Read More @ LibertyBlitzkreig.com

The

several States composing, the United States of America, are not united

on the principle of unlimited submission to their general government;

but that, by a compact under the style and title of a Constitution for

the United States, and of amendments thereto, they constituted a general

government for special purposes — delegated to that government certain

definite powers, reserving, each State to itself, the residuary mass of

right to their own self-government; and that whensoever the general

government assumes undelegated powers, its acts are unauthoritative,

void, and of no force.

The

several States composing, the United States of America, are not united

on the principle of unlimited submission to their general government;

but that, by a compact under the style and title of a Constitution for

the United States, and of amendments thereto, they constituted a general

government for special purposes — delegated to that government certain

definite powers, reserving, each State to itself, the residuary mass of

right to their own self-government; and that whensoever the general

government assumes undelegated powers, its acts are unauthoritative,

void, and of no force.- Thomas Jefferson in the Kentucky Resolution of 1798 in response to the Alien and Sedition Acts

It was always inevitable. Once enough people realized that the Federal government is nothing more than a collective of corrupt, criminal thugs there was bound to be a backlash. Given the structure of these United States, it was bound to take the form of States rights versus centralized power in Washington D.C. This is not about Obama; the cancer in the capital is bipartisan.

Read More @ LibertyBlitzkreig.com

The

World Gold Council says global gold demand fell 11% y-on-y in Q3,

dampened mainly by fading Chinese fervour for the metal as its economy

slowed.

by Jan Harvey, MineWeb.com

Global gold demand dropped 11 percent in the three months to September

from record levels seen in the same period last year, dampened mainly

by fading Chinese fervour as its economy slowed, with stronger Indian

demand stemming a larger fall, the World Gold Council said.

Global gold demand dropped 11 percent in the three months to September

from record levels seen in the same period last year, dampened mainly

by fading Chinese fervour as its economy slowed, with stronger Indian

demand stemming a larger fall, the World Gold Council said.

Chinese gold consumption fell 8 percent in the July to September period to 176.8 tonnes, the WGC’s quarterly demand trends report showed on Thursday, with both jewellery and investment demand hurt by a slowing economic growth.

Data last month showed China’s economy slowed for a seventh straight quarter in the July to September period. Chinese bar and coin investment dropped 12 percent to 53 tonnes, while jewellery buying fell 5 percent to 123.8 tonnes.

Read More @ MineWeb.com

by Jan Harvey, MineWeb.com

Global gold demand dropped 11 percent in the three months to September

from record levels seen in the same period last year, dampened mainly

by fading Chinese fervour as its economy slowed, with stronger Indian

demand stemming a larger fall, the World Gold Council said.

Global gold demand dropped 11 percent in the three months to September

from record levels seen in the same period last year, dampened mainly

by fading Chinese fervour as its economy slowed, with stronger Indian

demand stemming a larger fall, the World Gold Council said.Chinese gold consumption fell 8 percent in the July to September period to 176.8 tonnes, the WGC’s quarterly demand trends report showed on Thursday, with both jewellery and investment demand hurt by a slowing economic growth.

Data last month showed China’s economy slowed for a seventh straight quarter in the July to September period. Chinese bar and coin investment dropped 12 percent to 53 tonnes, while jewellery buying fell 5 percent to 123.8 tonnes.

Read More @ MineWeb.com

By John Moffett, Op Ed News:

In a conference call with key supporters Tuesday night, President Obama

urged Democratic activists to stay engaged in the coming budget

negotiations concerning the so-called “fiscal cliff” but also

telegraphed plainly his intent to give away much in his showdown with

Republican lawmakers

In a conference call with key supporters Tuesday night, President Obama

urged Democratic activists to stay engaged in the coming budget

negotiations concerning the so-called “fiscal cliff” but also

telegraphed plainly his intent to give away much in his showdown with

Republican lawmakers

As the Huffington Post, who listened in on the call, reports:

In a conference call with key supporters Tuesday night, President Obama

urged Democratic activists to stay engaged in the coming budget

negotiations concerning the so-called “fiscal cliff” but also

telegraphed plainly his intent to give away much in his showdown with

Republican lawmakers

In a conference call with key supporters Tuesday night, President Obama

urged Democratic activists to stay engaged in the coming budget

negotiations concerning the so-called “fiscal cliff” but also

telegraphed plainly his intent to give away much in his showdown with

Republican lawmakersAs the Huffington Post, who listened in on the call, reports:

The president, speaking from a White House phone, cautioned listeners to expect disappointments during his second term. As he has in the past, Obama warned that he was prepared to swallow some bitter pills during the negotiations, including some that would agitate the base.Read More @ OpedNews.com

“As we move forward there are going to be new wrinkles and new frustrations, we can’t predict them yet,” he said. “We are going to have some triumphs and some successes, but there are going to be some tough days, starting with some of these negotiations around the fiscal cliff that you probably read about.”

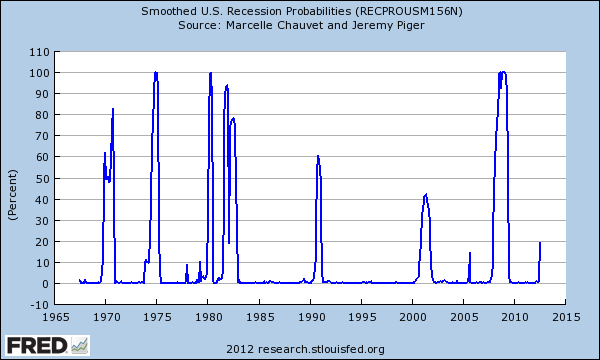

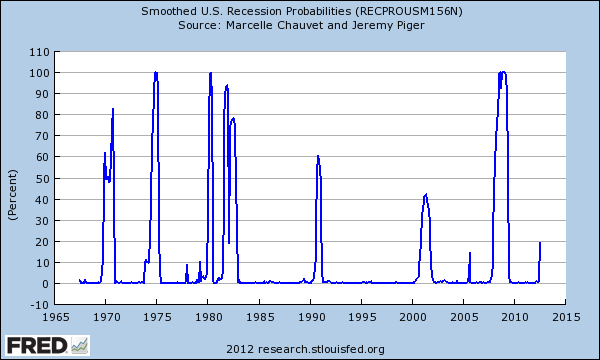

from MyBudget360.com:

For the 50 million Americans in poverty the probability of a recession is 100 percent. Growing economic divide for working class.

The probabilities of the US slipping into another official recession

are growing. Don’t tell this to the 50 million people that are

reportedly at the poverty level according to a new US Census report.

This trend isn’t something new and it certainly is not going to be

resolved overnight. We have nearly 47 million Americans receiving food stamps

so the probability of slipping into another recession should not come

as a shock. The fiscal cliff is not a surprise. We’ve known that

unsustainable debt growth would ultimately lead to a day of reckoning.

There are now rumors that a patch work for one year is going to be

applied to kick the can down deeper into the future. Look at how well

this approach is working in Europe. The core problem of this debt

crisis has yet to be resolved. Let us examine the recession probability

further.

The probabilities of the US slipping into another official recession

are growing. Don’t tell this to the 50 million people that are

reportedly at the poverty level according to a new US Census report.

This trend isn’t something new and it certainly is not going to be

resolved overnight. We have nearly 47 million Americans receiving food stamps

so the probability of slipping into another recession should not come

as a shock. The fiscal cliff is not a surprise. We’ve known that

unsustainable debt growth would ultimately lead to a day of reckoning.

There are now rumors that a patch work for one year is going to be

applied to kick the can down deeper into the future. Look at how well

this approach is working in Europe. The core problem of this debt

crisis has yet to be resolved. Let us examine the recession probability

further.

Read More @ MyBudget360.com

Your support is needed...

I'm PayPal Verified

For the 50 million Americans in poverty the probability of a recession is 100 percent. Growing economic divide for working class.

The probabilities of the US slipping into another official recession

are growing. Don’t tell this to the 50 million people that are

reportedly at the poverty level according to a new US Census report.

This trend isn’t something new and it certainly is not going to be

resolved overnight. We have nearly 47 million Americans receiving food stamps

so the probability of slipping into another recession should not come

as a shock. The fiscal cliff is not a surprise. We’ve known that

unsustainable debt growth would ultimately lead to a day of reckoning.

There are now rumors that a patch work for one year is going to be

applied to kick the can down deeper into the future. Look at how well

this approach is working in Europe. The core problem of this debt

crisis has yet to be resolved. Let us examine the recession probability

further.

The probabilities of the US slipping into another official recession

are growing. Don’t tell this to the 50 million people that are

reportedly at the poverty level according to a new US Census report.

This trend isn’t something new and it certainly is not going to be

resolved overnight. We have nearly 47 million Americans receiving food stamps

so the probability of slipping into another recession should not come

as a shock. The fiscal cliff is not a surprise. We’ve known that

unsustainable debt growth would ultimately lead to a day of reckoning.

There are now rumors that a patch work for one year is going to be

applied to kick the can down deeper into the future. Look at how well

this approach is working in Europe. The core problem of this debt

crisis has yet to be resolved. Let us examine the recession probability

further.Read More @ MyBudget360.com

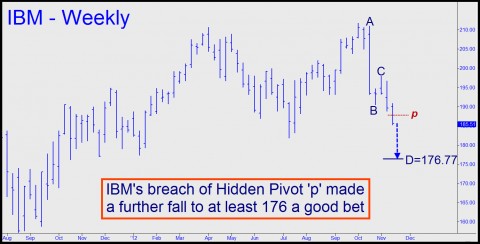

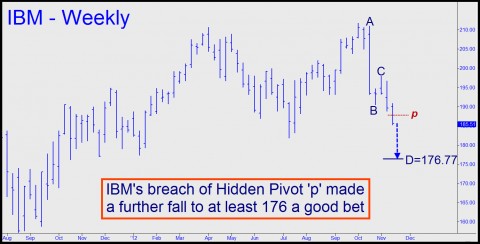

by Rick Ackerman, Rick Ackerman.com:

A stall has turned into a power dive on Wall Street, with some

bellwether stocks plummeting toward key supports flagged here just a

short while ago. One of them, IBM, actually breached a “midpoint Hidden

Pivot” support yesterday at 187.78, and that spells more trouble for

investors. The actual low at 185.25 was not far beneath the 187.38

support, but the latter number should have held very precisely if the

stock is to avoid yet more carnage. Under the circumstances, IBM looks

primed to fall a further $8, to at least 177.56, before it has another

chance to get traction.

A stall has turned into a power dive on Wall Street, with some

bellwether stocks plummeting toward key supports flagged here just a

short while ago. One of them, IBM, actually breached a “midpoint Hidden

Pivot” support yesterday at 187.78, and that spells more trouble for

investors. The actual low at 185.25 was not far beneath the 187.38

support, but the latter number should have held very precisely if the

stock is to avoid yet more carnage. Under the circumstances, IBM looks

primed to fall a further $8, to at least 177.56, before it has another

chance to get traction.

Meanwhile, Google, another stock whose year-end performance will weigh heavily on portfolio managers’ bonuses, relapsed to an important Hidden Pivot support of its own at 650.69. We’d drum-rolled a possible reversal from that number last week, and it came in the form of $20 rally from exactly 650.30. But if Google were about to recover its mojo, the rally should have lasted perhaps 8-12 days.

Read More @ RickAckerman.com

A stall has turned into a power dive on Wall Street, with some

bellwether stocks plummeting toward key supports flagged here just a

short while ago. One of them, IBM, actually breached a “midpoint Hidden

Pivot” support yesterday at 187.78, and that spells more trouble for

investors. The actual low at 185.25 was not far beneath the 187.38

support, but the latter number should have held very precisely if the

stock is to avoid yet more carnage. Under the circumstances, IBM looks

primed to fall a further $8, to at least 177.56, before it has another

chance to get traction.

A stall has turned into a power dive on Wall Street, with some

bellwether stocks plummeting toward key supports flagged here just a

short while ago. One of them, IBM, actually breached a “midpoint Hidden

Pivot” support yesterday at 187.78, and that spells more trouble for

investors. The actual low at 185.25 was not far beneath the 187.38

support, but the latter number should have held very precisely if the

stock is to avoid yet more carnage. Under the circumstances, IBM looks

primed to fall a further $8, to at least 177.56, before it has another

chance to get traction. Meanwhile, Google, another stock whose year-end performance will weigh heavily on portfolio managers’ bonuses, relapsed to an important Hidden Pivot support of its own at 650.69. We’d drum-rolled a possible reversal from that number last week, and it came in the form of $20 rally from exactly 650.30. But if Google were about to recover its mojo, the rally should have lasted perhaps 8-12 days.

Read More @ RickAckerman.com

from Russia Today:

Israel says all male members of Hamas are now targets. Warplanes are dropping leaflets over Gaza, warning Palestinians to keep away from militant positions. RT spoke to a film-maker and activist Harry Fear in the embattled enclave, who says civilians are bearing the brunt of the Israeli onslaught.

Israel says all male members of Hamas are now targets. Warplanes are dropping leaflets over Gaza, warning Palestinians to keep away from militant positions. RT spoke to a film-maker and activist Harry Fear in the embattled enclave, who says civilians are bearing the brunt of the Israeli onslaught.

from Silver Underground:

Back in the days before the War on Drugs, police officers were best represented by the iconic TV Sheriff Andy Griffith. Since officers had no reason to randomly search citizens then, their presence was universally appreciated. However, changes in the law have caused law enforcers to view harmless citizens as public threats. Certain items have been deemed contraband, and personal healthcare mistakes have been criminalized. Since anyone could in theory be engaging in those activities at any time, police now view all citizens as potential criminals.

Now, any American could be thrown into a time consuming, escalating, and invasive police encounter simply because his or her tail light bulb died during a trip home from work. People who look fatigued, dress in a counter-cultural manner, or belong to certain ethnic groups may be profiled for an intense investigation at any time, and officers often request searches using ambiguous phrasings that lead people to believe that they have no choice but to comply. The below video demonstrates how a citizen can politely assert his or her natural rights during a police encounter. Let’s talk about why it’s important to reserve your rights, even if you have nothing to hide.

Read More @ Silver Underground

Back in the days before the War on Drugs, police officers were best represented by the iconic TV Sheriff Andy Griffith. Since officers had no reason to randomly search citizens then, their presence was universally appreciated. However, changes in the law have caused law enforcers to view harmless citizens as public threats. Certain items have been deemed contraband, and personal healthcare mistakes have been criminalized. Since anyone could in theory be engaging in those activities at any time, police now view all citizens as potential criminals.

Now, any American could be thrown into a time consuming, escalating, and invasive police encounter simply because his or her tail light bulb died during a trip home from work. People who look fatigued, dress in a counter-cultural manner, or belong to certain ethnic groups may be profiled for an intense investigation at any time, and officers often request searches using ambiguous phrasings that lead people to believe that they have no choice but to comply. The below video demonstrates how a citizen can politely assert his or her natural rights during a police encounter. Let’s talk about why it’s important to reserve your rights, even if you have nothing to hide.

Read More @ Silver Underground

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment