by SRSrocco, Silver Doctors:

The physical silver scramble continues, as a MASSIVE 2.4 million ounces of silver were withdrawn from Brink’s & HSBC vaults Wednesday!

The physical silver scramble continues, as a MASSIVE 2.4 million ounces of silver were withdrawn from Brink’s & HSBC vaults Wednesday!

Got PHYZZ??

Read More @ Silver Doctors

The physical silver scramble continues, as a MASSIVE 2.4 million ounces of silver were withdrawn from Brink’s & HSBC vaults Wednesday!

The physical silver scramble continues, as a MASSIVE 2.4 million ounces of silver were withdrawn from Brink’s & HSBC vaults Wednesday!Got PHYZZ??

Read More @ Silver Doctors

Good evening Ladies and Gentlemen:

Gold closed down $16.10 to finish the comex session at $1713.30. Silver which was certainly the object of interest to our bankers today, was whacked early but recovered to show a loss of only 20 cents finishing at $32.67 As I promised you yesterday a raid was imminent, and we certainly had a dandy attack today. The gold/silver mining equity shares had a terrible day yesterday and another one today. One of the big signs of an attack will happen is when the precious metal is up on the day coupled with a big drop in the mining shares. This is a signal to the bankers that a raid is forthcoming the next day. The bankers today threw a monstrous 19,182 gold contracts in a 5 minute span or 3800 contracts per minute. These were all non backed with any gold behind them. In raids such as this, in normal times, silver would have dropped by $1.50 or so on this collusive behaviour. Today however, silver held firm and refused to follow the wishes of JPMorgan and friends. A fall of only 20 cents is surely a victory for our side.

There is no question that the bankers are intent on getting gold below the $1700 mark and silver below the 32.50 level as many calls have been written on gold and silver. The bankers do not want many of these contracts to land in the money and thus the massive onslaught we witnessed today. As long as we have no referee, the bankers will be free to do anything they like. Their only problem is real physical which according to GATA has seen supplies drop dramatically in London.

Read More @ HarveyOrgan.Blogspot.ca

Gold closed down $16.10 to finish the comex session at $1713.30. Silver which was certainly the object of interest to our bankers today, was whacked early but recovered to show a loss of only 20 cents finishing at $32.67 As I promised you yesterday a raid was imminent, and we certainly had a dandy attack today. The gold/silver mining equity shares had a terrible day yesterday and another one today. One of the big signs of an attack will happen is when the precious metal is up on the day coupled with a big drop in the mining shares. This is a signal to the bankers that a raid is forthcoming the next day. The bankers today threw a monstrous 19,182 gold contracts in a 5 minute span or 3800 contracts per minute. These were all non backed with any gold behind them. In raids such as this, in normal times, silver would have dropped by $1.50 or so on this collusive behaviour. Today however, silver held firm and refused to follow the wishes of JPMorgan and friends. A fall of only 20 cents is surely a victory for our side.

There is no question that the bankers are intent on getting gold below the $1700 mark and silver below the 32.50 level as many calls have been written on gold and silver. The bankers do not want many of these contracts to land in the money and thus the massive onslaught we witnessed today. As long as we have no referee, the bankers will be free to do anything they like. Their only problem is real physical which according to GATA has seen supplies drop dramatically in London.

Read More @ HarveyOrgan.Blogspot.ca

Guess What They Are Not Cutting In The Fiscal Cliff...

In his farewell address to Congress yesterday, Ron Paul blasted the dangers of what he called 'Economic Ignorance'.

He's dead right. Around the world, economic ignorance abounds. And

perhaps nowhere is this more obvious today than in the senseless

prattling over the US 'Fiscal Cliff'. US government spending falls into

three categories: Discretionary, Mandatory, and Interest on Debt. The

only thing Congress has a say over is Discretionary Spending. But here's

the problem - the US fiscal situation is so untenable that the

government fails to collect enough tax revenue to cover mandatory

spending and debt interest alone. This means that they could

cut the ENTIRE discretionary budget and still be in the hole by $251

billion. This is why the Fiscal Cliff is irrelevant. Increasing taxes

won't increase their total tax revenue. Politicians have tried this for

decades. It doesn't work. Bottom line-- the Fiscal Cliff doesn't matter. The US passed the point of no return a long time ago.

In his farewell address to Congress yesterday, Ron Paul blasted the dangers of what he called 'Economic Ignorance'.

He's dead right. Around the world, economic ignorance abounds. And

perhaps nowhere is this more obvious today than in the senseless

prattling over the US 'Fiscal Cliff'. US government spending falls into

three categories: Discretionary, Mandatory, and Interest on Debt. The

only thing Congress has a say over is Discretionary Spending. But here's

the problem - the US fiscal situation is so untenable that the

government fails to collect enough tax revenue to cover mandatory

spending and debt interest alone. This means that they could

cut the ENTIRE discretionary budget and still be in the hole by $251

billion. This is why the Fiscal Cliff is irrelevant. Increasing taxes

won't increase their total tax revenue. Politicians have tried this for

decades. It doesn't work. Bottom line-- the Fiscal Cliff doesn't matter. The US passed the point of no return a long time ago. Visualizing The World's Rich

We

hear a lot about billionaires, millionaires, and 250,000-aires but

just where are all these tax-dodging blood-suckers skulking and just how many trips to Space on Virgin Galactic can the Top 25 Wealthiest people take per day?... Everything you wanted to know about the uber-wealthy is one simple mega-infographic.

We

hear a lot about billionaires, millionaires, and 250,000-aires but

just where are all these tax-dodging blood-suckers skulking and just how many trips to Space on Virgin Galactic can the Top 25 Wealthiest people take per day?... Everything you wanted to know about the uber-wealthy is one simple mega-infographic.DTCC Provides Update On Status Of Flooded Securities Vault

As

has been widely reported previously, while the NY Fed's deep

underground gold vault remained dry during the Sandy flooding in

downtown NY, one institution which got badly hurt was the DTCC, aka Cede

& Co (profiled here in July of 2009 in " The Biggest Financial Company You Have Never Heard Of"), which is the entity serving as custodian of virtually every electronically traded

security in the modern marketplace (equity, debt, derivative,

synthetic, in fact anything which is not a physical asset in itself and

is not in the hands, or safe, of the rightful owner). We put the

emphasis on electronically, because DTCC is also the actual

custodian of all physical proof of stock ownership, such as

certificates, bond deeds, and the like. It is the largely irrelevant

latter (because it has been several decades since anyone actually

demanded a physical copy of the stock certificates backing their shares

of company XYZ) that the DTCC got in trouble for when its securities

vault got flooded, and in the process destroyed countless physical stock certificates. Note we did not use the word electronic

because those are there and accounted for in numerous back up data

sites, with full designation and attribution. In other words anyone who

made a mountain out of this particular mole hill sadly has no idea how

modern markets operate, since all that the DTCC needs to do to remedy

the flooding damage is to notify transfer agents of this natural

disaster, and then have duplicate stock certificates printed at a cost

of 1 cent for every thousands or so print outs. Which is more or less

what the DTCC also just said in its press release.

As

has been widely reported previously, while the NY Fed's deep

underground gold vault remained dry during the Sandy flooding in

downtown NY, one institution which got badly hurt was the DTCC, aka Cede

& Co (profiled here in July of 2009 in " The Biggest Financial Company You Have Never Heard Of"), which is the entity serving as custodian of virtually every electronically traded

security in the modern marketplace (equity, debt, derivative,

synthetic, in fact anything which is not a physical asset in itself and

is not in the hands, or safe, of the rightful owner). We put the

emphasis on electronically, because DTCC is also the actual

custodian of all physical proof of stock ownership, such as

certificates, bond deeds, and the like. It is the largely irrelevant

latter (because it has been several decades since anyone actually

demanded a physical copy of the stock certificates backing their shares

of company XYZ) that the DTCC got in trouble for when its securities

vault got flooded, and in the process destroyed countless physical stock certificates. Note we did not use the word electronic

because those are there and accounted for in numerous back up data

sites, with full designation and attribution. In other words anyone who

made a mountain out of this particular mole hill sadly has no idea how

modern markets operate, since all that the DTCC needs to do to remedy

the flooding damage is to notify transfer agents of this natural

disaster, and then have duplicate stock certificates printed at a cost

of 1 cent for every thousands or so print outs. Which is more or less

what the DTCC also just said in its press release.Gold Lower but Holding Above Support

Trader Dan at Trader Dan's Market Views - 7 minutes ago

Considering what looks more like a non-stop avalanche of selling in the

mining sector, the yellow metal is holding relatively well. It has bounced

off the first level of support shown on the price chart that comes in very

near to the $1700 level.

Failure to remain above this level will allow the market to move lower

towards the $1680 region where it can be expected to find some buying

support.

To get the least bit of excitement going, gold will have to clear $1740 and

remain above that level before it rattles anyone other than the most

short-term bears.

Today, a story out of the ... more »

Ron Paul Comments on the Secession Movement

Trader Dan at Trader Dan's Market Views - 18 minutes ago

God bless this man!

Ron Paul: The Founders Believed in Secession

“Secession is what we did when we left England, it was a wonderful thing”

*Paul Joseph Watson*

Infowars.com

November 15, 2012

Congressman Ron Paul reacted to the secessionist movement sweeping America

today by reminding people that the United States seceded from the British

empire, while slamming those who suggested their fellow Americans should be

deported merely for talking about the idea.

http://www.infowars.com/ron-paul-the-founders-believed-in-secession/

Gold Follows The ABCD Cycle

Eric De Groot at Eric De Groot - 2 hours ago

Gold follows an A(minor up), B(minor down/consolidation), C(Major UP), and

D(Major DOWN) cycle. The last major buy signal for gold came July 27th 2012

after the D-wave "hook". This buy signal is marked in the chart below.

We're in the middle of an AB transition, but today's aggressive selling in

the gold shares sector suggests that a large number of retail traders and

community members...

[[ This is a content summary only. Visit my website for full links, other

content, and more! ]]

Systemic Collapse: The Corzine Factor

Dave in Denver at The Golden Truth - 4 hours ago

*In the end, more than freedom, they wanted security. They wanted a

comfortable life, and they lost it all – security, comfort, and freedom.

When the Athenians finally wanted not to give to society but for society to

give to them, when the freedom they wished for most was freedom from

responsibility, then Athens ceased to be free and was never free again.* *-

*Edward Gibbon, English historian and acclaimed author of "The Decline and

Fall of the Roman Empire."

I hope everyone has a chance to meditate on the quote above, as it applies

to the state of our society here and now. Hist... more »

Why Politicians Hate Austerity - In One Simple Chart

Just as our political class in the US is spending its time focused on the tax-'em-til-they-bleed side of the equation as opposed to the cut-em-to-the-bone austerity side of the income statement; so the evidence is clear (thanks to the following chart) - austerity doesn't get you re-elected. When all that matters is your next government paycheck for your 'elected' position, far from being for the people, austerity is avoided as vehemently as possible. Not only does social unrest increase (as the 'people' have become used to unsustainable standards of living) but incumbent popularty sinks - rapidly.

Low Range, Medium Volume, High Anxiety

Equity indices end the day marginally red as the machines tried every trick in the book to get markets up...(levering FX carry, spiking PMs, running HYG, spiking vol)

to enable more selling - especially at the close when we saw notable

size blocks being traded into that ramp to try and get green. VWAP was the anchor all day for S&P 500 futures (and since the synthetics are where the liquidity is - everything else followed) as stocks trend-reversed as normal on the EU close.

In general volatility and high-yield credit had a significantly weak

day but into the close managed to rise a little as risk-assets broadly

recoupled with equity markets to close. Despite a lot of noise and chop

stocks lost a little, Treasuries gained a little (-2bps on the week!), Silver scrambled back from its flash crash (but gold didn't do as well), and the USD ended today up a remarkably unchanged 0.04% (with EUR up 0.5% and JPY down 2.2% on the week). VIX ended back above 18% as AAPL just keeps falling with its 300DMA now in play.

Equity indices end the day marginally red as the machines tried every trick in the book to get markets up...(levering FX carry, spiking PMs, running HYG, spiking vol)

to enable more selling - especially at the close when we saw notable

size blocks being traded into that ramp to try and get green. VWAP was the anchor all day for S&P 500 futures (and since the synthetics are where the liquidity is - everything else followed) as stocks trend-reversed as normal on the EU close.

In general volatility and high-yield credit had a significantly weak

day but into the close managed to rise a little as risk-assets broadly

recoupled with equity markets to close. Despite a lot of noise and chop

stocks lost a little, Treasuries gained a little (-2bps on the week!), Silver scrambled back from its flash crash (but gold didn't do as well), and the USD ended today up a remarkably unchanged 0.04% (with EUR up 0.5% and JPY down 2.2% on the week). VIX ended back above 18% as AAPL just keeps falling with its 300DMA now in play.Hamas Releases Video Of Downed Israeli Drone, IDF Denies

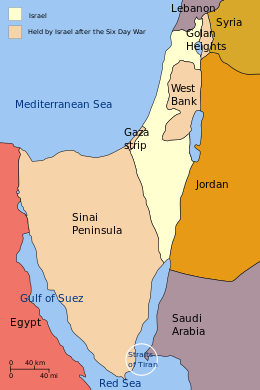

Someone is lying here: either Hamas did not down an IDF drone, dubbed "Sky Light", and the clip below is one big fraud (unclear why Hamas would go to such a length to fabricate a downed drone video), or the IDF is lying when it said it "confirmed" that one of its drones had been shot down. Either way, we have a feeling that the airborne campaign is coming to an end, and that Israel may and likely will escalate to a full blown land invasion very soon unless something dramatically changes. We fail to see what catalyzes this.

Goldman's Swirlogram Confirms Economic Slowdown

It would seem that the downswing into this economic slowdown has been considerably faster than many expected (as it always seems to be). Since we first introduced Goldman's Swirlogram indicator the business cycle (in May 2012), helped by the promise more and more liquidity, we have rotated remarkably from slowdown to contraction to recovery to expansion and now - in November - the leading indicators are pointing to a rapid shift into a slowdown phase. The Global Leading Indicator (GLI) is losing momentum fast and has made lower cycle highs each time since the 2009 'recovery' began. While Goldman caveats some of this with 'Sandy'-related impacts, the GLI seems to confirm what Global PMIs are hinting at - that global growth is slowing.

The Hypocrite Of The Day Award Goes To...

While we largely enjoy Dallas Fed's Dick Fisher hawkish, non-conformist thinking at the FOMC, and his willingness to come up with amusing cartoon names to explain the Fed's monetary policy (we are currently on Toy Story, and specifically Buzz "To Infinity and Beyond" Lighyear), we certainly do not miss when even said faux Fed bad cops telegraph hypocrisy so gruesome it shows demonstrates beyond a shadow of a doubt just how fake the facade of the Fed's "contrarians" truly is. To wit:- FISHER SAYS U.S. LAWMAKERS HAVE BECOME `PARASITIC WASTRELS'

How America's Middle Class, And Future Pensioners, Bailed Out A Generation Of Overzealous Homebuyers

In the current Bernanke-Obama-Keynes toxic triangle (defined previously here)

economy, blink too long and you will miss the latest bailout. While 4

years ago, it was America's M.A.D.-hostage taxpaying middle class that

had no choice but to fund the trillions in direct Fed cash handouts and

guarantees to bail out the banks, in the process saving and preserving

the trillions in wealth for America's uber wealthy (the "1%") class, ever since then it has been the government's turn to rescue the country's lower and lower-middle classes (the "47%"),

who, with no gun to their heads, decided to splurge during the height

of the housing bubble (insurmountable mortgage payments and $0 down

notwithstanding) and buy that aspirational McMansion that would make

them so much more appealing in the eyes of the next door neighbor (who

too could never afford their house in the first place). This has

happened courtesy of a progressively more pervasive mortgage forgiveness plan, which

has seen the total amount of debt funding a given home purchase shrink

little by little each day. However, since there is no free lunch

anywhere, certainly not when a bank's balance sheet is being impaired,

like in 2008, someone is once again on the hook for this latest

bailout. That someone, not surprisingly, is again America's

middle class that lived within its means, that saved money while others

splurged, and even put cash away for retirement, handing it over to

various Pension investment vehicles.

In the current Bernanke-Obama-Keynes toxic triangle (defined previously here)

economy, blink too long and you will miss the latest bailout. While 4

years ago, it was America's M.A.D.-hostage taxpaying middle class that

had no choice but to fund the trillions in direct Fed cash handouts and

guarantees to bail out the banks, in the process saving and preserving

the trillions in wealth for America's uber wealthy (the "1%") class, ever since then it has been the government's turn to rescue the country's lower and lower-middle classes (the "47%"),

who, with no gun to their heads, decided to splurge during the height

of the housing bubble (insurmountable mortgage payments and $0 down

notwithstanding) and buy that aspirational McMansion that would make

them so much more appealing in the eyes of the next door neighbor (who

too could never afford their house in the first place). This has

happened courtesy of a progressively more pervasive mortgage forgiveness plan, which

has seen the total amount of debt funding a given home purchase shrink

little by little each day. However, since there is no free lunch

anywhere, certainly not when a bank's balance sheet is being impaired,

like in 2008, someone is once again on the hook for this latest

bailout. That someone, not surprisingly, is again America's

middle class that lived within its means, that saved money while others

splurged, and even put cash away for retirement, handing it over to

various Pension investment vehicles.  On the near 100% probability that Germany will not voluntarily give

money to Spain, nor will Germany voluntarily modify its trade policies,

the choices facing Spain are quite bleak.

On the near 100% probability that Germany will not voluntarily give

money to Spain, nor will Germany voluntarily modify its trade policies,

the choices facing Spain are quite bleak.Michael Pettis, writing for Carnegie Europe describes Spain’s unpleasant choices in Spain Will be Forced to Choose.

In the great debate over the economy we sometimes forget the simple arithmetic of economic rebalancing. This arithmetic, like it or not, severely limits the options open to Spain.

Read More @ GlobalEconomicAnalysis.blogspot.com

Israel attacked and killed the top Hamas leader yesterday. The attacks

back and forth commenced AFTER our elections; are you surprised? The

“leadership scandal” within our military has only gone public, again,

AFTER the elections. If you were watching closely for the last several

months you would know that there has been a handful of other Generals

and Admirals that have been replaced. There are several theories on

this. My theory is that these were longtime and “conservative” leaders

that were swept out of power in a clean sweep. Is this a surprise? I

could also ask the same question about the recent deluge of negative

economic reports and the suddenly declining stock market but I’ll let

you think this through.

Israel attacked and killed the top Hamas leader yesterday. The attacks

back and forth commenced AFTER our elections; are you surprised? The

“leadership scandal” within our military has only gone public, again,

AFTER the elections. If you were watching closely for the last several

months you would know that there has been a handful of other Generals

and Admirals that have been replaced. There are several theories on

this. My theory is that these were longtime and “conservative” leaders

that were swept out of power in a clean sweep. Is this a surprise? I

could also ask the same question about the recent deluge of negative

economic reports and the suddenly declining stock market but I’ll let

you think this through.In the past, were any of our ambassadors killed and dragged through the streets, you could bet your bottom Dollar that swift and very forceful retribution would have been our response. Not so today. In the past, were Egypt (another “sort of” ally) to publicly back Hamas and oppose Israel, there would have been an immediate retraction from them and or a statement from The White House. Again, not so this time to the point where the only thing being heard are crickets, lots and lots of crickets.

Read more @ MilesFranklin.com

Your support is needed...

Thank You

I'm PayPal Verified

The stable price of silver has Indians investing in the white metal, with investors looking for good returns.

by Shivom Seth, MineWeb.com

It is not just gold that caught the eye of Indian consumers

celebrating Diwali. Brisk business in silver was also seen in select

parts of the country.

It is not just gold that caught the eye of Indian consumers

celebrating Diwali. Brisk business in silver was also seen in select

parts of the country.

Given the high price of gold and the Indian government’s new regulation on buying gold and tax deductions at source, the sale of silver items at jewellery shops soared to a new high.

“Silver has proved to be the preferred substitute with most retail buyers this Diwali,” said Manish Mehta of bullion retailer, D P Zaveri and Sons

Read More @ MineWeb.com

from facebook:

by Shivom Seth, MineWeb.com

Given the high price of gold and the Indian government’s new regulation on buying gold and tax deductions at source, the sale of silver items at jewellery shops soared to a new high.

“Silver has proved to be the preferred substitute with most retail buyers this Diwali,” said Manish Mehta of bullion retailer, D P Zaveri and Sons

Read More @ MineWeb.com

from facebook:

by Brandon Turbeville, Activist Post:

While the attention of most Americans was focused on whatever trivia

dished out from the mainstream media such as the current hot celebrity

or the David Petraeus incident, it appears that the Bilderberg Group has

arranged what some have described as an impromptu meeting in Rome,

Italy.

While the attention of most Americans was focused on whatever trivia

dished out from the mainstream media such as the current hot celebrity

or the David Petraeus incident, it appears that the Bilderberg Group has

arranged what some have described as an impromptu meeting in Rome,

Italy.

Yet, although much of the European press is dark on the issue, which is unfortunately characteristic of the mainstream media in any nation, some Italian newspapers are reporting the information regarding the meeting.

According to 21stCenturyWire, the agenda apparently centered around the fate of EU countries such as Italy, Spain, and Greece, three nations that have been hit hard with the worldwide derivatives crisis and the subsequent imposition of austerity.

Read More @ Activist Post

While the attention of most Americans was focused on whatever trivia

dished out from the mainstream media such as the current hot celebrity

or the David Petraeus incident, it appears that the Bilderberg Group has

arranged what some have described as an impromptu meeting in Rome,

Italy.

While the attention of most Americans was focused on whatever trivia

dished out from the mainstream media such as the current hot celebrity

or the David Petraeus incident, it appears that the Bilderberg Group has

arranged what some have described as an impromptu meeting in Rome,

Italy. Yet, although much of the European press is dark on the issue, which is unfortunately characteristic of the mainstream media in any nation, some Italian newspapers are reporting the information regarding the meeting.

According to 21stCenturyWire, the agenda apparently centered around the fate of EU countries such as Italy, Spain, and Greece, three nations that have been hit hard with the worldwide derivatives crisis and the subsequent imposition of austerity.

Read More @ Activist Post

by Jeff Nielson, Bullion Bulls Canada:

When a reader (and fellow silver-mining investor) recently expressed

his frustrations on our Forum regarding the absurd valuations which most

of these miners currently exhibit, I decided it was once again time to

try to shed some light (and sanity?) on this subject.

When a reader (and fellow silver-mining investor) recently expressed

his frustrations on our Forum regarding the absurd valuations which most

of these miners currently exhibit, I decided it was once again time to

try to shed some light (and sanity?) on this subject.

When I began investing in these silver miners many years ago; one of the first anomalies to which I was introduced was that the vast majority of silver produced in the world (more than 75% at that time) was produced as a “byproduct” of other mining. While I immediately recognized that this was an extremely important factoid, at that time I lacked the level of understanding necessary to glean its true significance.

Since that time, the ramifications of these incredible parameters in silver mining are now apparent to me. Sadly, however, this important analytical point does not seem to be as apparent to others. While I’ve covered this subject matter once already in a prior commentary, the lack of general awareness in this area clearly merits repetition of this analysis.

Read More @ BullionBullsCanada.com

When a reader (and fellow silver-mining investor) recently expressed

his frustrations on our Forum regarding the absurd valuations which most

of these miners currently exhibit, I decided it was once again time to

try to shed some light (and sanity?) on this subject.

When a reader (and fellow silver-mining investor) recently expressed

his frustrations on our Forum regarding the absurd valuations which most

of these miners currently exhibit, I decided it was once again time to

try to shed some light (and sanity?) on this subject.When I began investing in these silver miners many years ago; one of the first anomalies to which I was introduced was that the vast majority of silver produced in the world (more than 75% at that time) was produced as a “byproduct” of other mining. While I immediately recognized that this was an extremely important factoid, at that time I lacked the level of understanding necessary to glean its true significance.

Since that time, the ramifications of these incredible parameters in silver mining are now apparent to me. Sadly, however, this important analytical point does not seem to be as apparent to others. While I’ve covered this subject matter once already in a prior commentary, the lack of general awareness in this area clearly merits repetition of this analysis.

Read More @ BullionBullsCanada.com

from Gold Money:

Call it wishful thinking, but a small part of me thinks that the real reason why German officials are starting to ask tough questions about their gold reserves

is because it is losing confidence in our monetary system. (And could

you blame them? The Europe Union has a majority of countries in deep

economic and political decline, and the United States government only

knows how to borrow and spend trillions of dollars a year. It’s only a

matter of time before everything falls apart.)

Call it wishful thinking, but a small part of me thinks that the real reason why German officials are starting to ask tough questions about their gold reserves

is because it is losing confidence in our monetary system. (And could

you blame them? The Europe Union has a majority of countries in deep

economic and political decline, and the United States government only

knows how to borrow and spend trillions of dollars a year. It’s only a

matter of time before everything falls apart.)

Incidentally, “confidence” is a word central bankers love to use. They are always talking about “renewing,” “rebuilding” or even “restoring” confidence. If they could only “boost confidence,” the economy would be much, much better.

Read More @ GoldMoney.com

from trendsjournal:

Your support is needed...

I'm PayPal Verified

Call it wishful thinking, but a small part of me thinks that the real reason why German officials are starting to ask tough questions about their gold reserves

is because it is losing confidence in our monetary system. (And could

you blame them? The Europe Union has a majority of countries in deep

economic and political decline, and the United States government only

knows how to borrow and spend trillions of dollars a year. It’s only a

matter of time before everything falls apart.)

Call it wishful thinking, but a small part of me thinks that the real reason why German officials are starting to ask tough questions about their gold reserves

is because it is losing confidence in our monetary system. (And could

you blame them? The Europe Union has a majority of countries in deep

economic and political decline, and the United States government only

knows how to borrow and spend trillions of dollars a year. It’s only a

matter of time before everything falls apart.)Incidentally, “confidence” is a word central bankers love to use. They are always talking about “renewing,” “rebuilding” or even “restoring” confidence. If they could only “boost confidence,” the economy would be much, much better.

Read More @ GoldMoney.com

from trendsjournal:

by Mike Adams, Natural News:

Citizens from all 50 U.S. states have now filed petitions with the White House asking for “peaceful secession” from the union. According to Daily Caller, more than 675,000 petition signatures have now been collected.

Citizens from all 50 U.S. states have now filed petitions with the White House asking for “peaceful secession” from the union. According to Daily Caller, more than 675,000 petition signatures have now been collected.

The Texas petition now has over 100,000 signatures, and more signatures are appearing by the hour.

It raises the practical question: Could Texas survive as a nation state if it secedes from the union?

The short answer is YES.

No state is better positioned than Texas to fend for itself

As you’ll see here, Texas is unquestionably the state best positioned to function as its own nation. Here’s why:

Read More @ NaturalNews.com

Citizens from all 50 U.S. states have now filed petitions with the White House asking for “peaceful secession” from the union. According to Daily Caller, more than 675,000 petition signatures have now been collected.

Citizens from all 50 U.S. states have now filed petitions with the White House asking for “peaceful secession” from the union. According to Daily Caller, more than 675,000 petition signatures have now been collected.The Texas petition now has over 100,000 signatures, and more signatures are appearing by the hour.

It raises the practical question: Could Texas survive as a nation state if it secedes from the union?

The short answer is YES.

No state is better positioned than Texas to fend for itself

As you’ll see here, Texas is unquestionably the state best positioned to function as its own nation. Here’s why:

Read More @ NaturalNews.com

by Michael Krieger, Liberty Blitzkreig

A very important article came out from the Wall Street Journal

yesterday titled “FHA Nears Need for Taxpayer Funds,” and it outlines

the serious financial problems facing the Federal Housing

Administration. For those that are unaware or need a refresher, the FHA

has been the key element to the phony “housing recovery” the government

has been trying to create. In the wake of the collapse of 2008, Fannie

Mae and Freddie Mac blew up and what was left to pick up the pieces was

the FHA. No private player would issue loans with down payments of 3%,

but this was no problem for the FHA!

A very important article came out from the Wall Street Journal

yesterday titled “FHA Nears Need for Taxpayer Funds,” and it outlines

the serious financial problems facing the Federal Housing

Administration. For those that are unaware or need a refresher, the FHA

has been the key element to the phony “housing recovery” the government

has been trying to create. In the wake of the collapse of 2008, Fannie

Mae and Freddie Mac blew up and what was left to pick up the pieces was

the FHA. No private player would issue loans with down payments of 3%,

but this was no problem for the FHA!

Interestingly enough, a lot of the subprime borrowers that blew up the housing market the last time became the primary customers of the FHA. Let’s see, 3% down and subprime borrowers…what could possibly go wrong?! From the WSJ:

A very important article came out from the Wall Street Journal

yesterday titled “FHA Nears Need for Taxpayer Funds,” and it outlines

the serious financial problems facing the Federal Housing

Administration. For those that are unaware or need a refresher, the FHA

has been the key element to the phony “housing recovery” the government

has been trying to create. In the wake of the collapse of 2008, Fannie

Mae and Freddie Mac blew up and what was left to pick up the pieces was

the FHA. No private player would issue loans with down payments of 3%,

but this was no problem for the FHA!

A very important article came out from the Wall Street Journal

yesterday titled “FHA Nears Need for Taxpayer Funds,” and it outlines

the serious financial problems facing the Federal Housing

Administration. For those that are unaware or need a refresher, the FHA

has been the key element to the phony “housing recovery” the government

has been trying to create. In the wake of the collapse of 2008, Fannie

Mae and Freddie Mac blew up and what was left to pick up the pieces was

the FHA. No private player would issue loans with down payments of 3%,

but this was no problem for the FHA!Interestingly enough, a lot of the subprime borrowers that blew up the housing market the last time became the primary customers of the FHA. Let’s see, 3% down and subprime borrowers…what could possibly go wrong?! From the WSJ:

The Federal Housing Administration is expected to report this week it could exhaust its reserves because of rising mortgage delinquencies, according to people familiar with the agency’s finances, a development that could result in the agency needing to draw on taxpayer funding for the first time in its 78-year history.Read More @ LibertyBlitzkreig.com

by Joel Bowman, SilverBearCafe.com:

“If I had a world of my own,” declared Alice, Lewis Carroll’s red

pill-popping protagonist while wandering around her author’s Wonderland,

“everything would be nonsense. Nothing would be what it is, because

everything would be what it isn’t. And contrary wise, what is, it

wouldn’t be. And what it wouldn’t be, it would. You see?”

“If I had a world of my own,” declared Alice, Lewis Carroll’s red

pill-popping protagonist while wandering around her author’s Wonderland,

“everything would be nonsense. Nothing would be what it is, because

everything would be what it isn’t. And contrary wise, what is, it

wouldn’t be. And what it wouldn’t be, it would. You see?”

What’s going on, Fellow Reckoner? What’s happening…now that we’re through the looking glass? Stocks dawdle. Gold drags its chain. And the whole economy — to the extent that such a thing even exists — marches headlong off a cliff. That’s what we’re told. Welcome to post-election 2012…where nothing is quite as it seems.

Read More @ SilverBearCafe.com

“If I had a world of my own,” declared Alice, Lewis Carroll’s red

pill-popping protagonist while wandering around her author’s Wonderland,

“everything would be nonsense. Nothing would be what it is, because

everything would be what it isn’t. And contrary wise, what is, it

wouldn’t be. And what it wouldn’t be, it would. You see?”

“If I had a world of my own,” declared Alice, Lewis Carroll’s red

pill-popping protagonist while wandering around her author’s Wonderland,

“everything would be nonsense. Nothing would be what it is, because

everything would be what it isn’t. And contrary wise, what is, it

wouldn’t be. And what it wouldn’t be, it would. You see?”What’s going on, Fellow Reckoner? What’s happening…now that we’re through the looking glass? Stocks dawdle. Gold drags its chain. And the whole economy — to the extent that such a thing even exists — marches headlong off a cliff. That’s what we’re told. Welcome to post-election 2012…where nothing is quite as it seems.

Read More @ SilverBearCafe.com

from misesmedia:

Archived from the live Mises.tv broadcast, this lecture by Danny Sanchez was presented at “What Has Government Done to Our Money? A Seminar for High School Students,” hosted by the Ludwig von Mises Institute in Auburn, Alabama, on 9 November 2012. Includes an introduction by Mark Thornton. Music by Kevin MacLeod.

Archived from the live Mises.tv broadcast, this lecture by Danny Sanchez was presented at “What Has Government Done to Our Money? A Seminar for High School Students,” hosted by the Ludwig von Mises Institute in Auburn, Alabama, on 9 November 2012. Includes an introduction by Mark Thornton. Music by Kevin MacLeod.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment