Submitted by Tyler Durden on 05/21/2016 - 12:08

Submitted by Tyler Durden on 05/21/2016 - 12:08

407,000 private sector workers are about to lose most of their pensions. When private pension plans go broke, they go broke. Public pension expect a bailout.

A Retired White House Correspondent Explains "How Obama Gets Away With It"

Submitted by Tyler Durden on 05/21/2016 - 12:59 At a time when large numbers of Americans say they are fed up with politics and politicians, why is it that the nation’s chief politician, President Obama, seems to skate above it unscathed? Reporters who criticize or dig too deep are cast by the administration as spoilsports or, worse, cut off from sources. With Donald Trump now the media obsession—and most in the media don’t like him—it is easy to see why Mr. Obama’s performance over the past seven-plus years is still not a major issue in the 2016 campaign. And that’s the way he likes it.

from TheInfoWarrior:

Alex Jones talks with Peter Schiff about the coming economic collapse and how America could easily become the next Venezuela.

Alex Jones talks with Peter Schiff about the coming economic collapse and how America could easily become the next Venezuela.

from X22Report:

Canada’s March retail numbers decline. Existing homes sales pushed up by speculators purchasing condos. Business loan delinquencies are on the rise signalling a freeze in the credit market. The death cross formation has appeared in the market, the last time this happened back in 2001 and 2008 the market and economy crashed 1 – 2 months later. Japan is preparing for huge loses on its debt holdings.

Canada’s March retail numbers decline. Existing homes sales pushed up by speculators purchasing condos. Business loan delinquencies are on the rise signalling a freeze in the credit market. The death cross formation has appeared in the market, the last time this happened back in 2001 and 2008 the market and economy crashed 1 – 2 months later. Japan is preparing for huge loses on its debt holdings.

by Mark O’Byrne, GoldCore:

Bank bail-ins pose risks to retail investors and especially savers

throughout the western world. The new bail-in rules have been made

operational since the beginning of this year in the EU and in many other

countries yet the risks and ramifications of bail ins have been largely

ignored in most of the media.

Bank bail-ins pose risks to retail investors and especially savers

throughout the western world. The new bail-in rules have been made

operational since the beginning of this year in the EU and in many other

countries yet the risks and ramifications of bail ins have been largely

ignored in most of the media.

The Financial Times covers bail-ins today with a focus on the risk to investors while continuing to ignore that posed to savers and depositors including small and medium size enterprises.

Read More

Bank bail-ins pose risks to retail investors and especially savers

throughout the western world. The new bail-in rules have been made

operational since the beginning of this year in the EU and in many other

countries yet the risks and ramifications of bail ins have been largely

ignored in most of the media.

Bank bail-ins pose risks to retail investors and especially savers

throughout the western world. The new bail-in rules have been made

operational since the beginning of this year in the EU and in many other

countries yet the risks and ramifications of bail ins have been largely

ignored in most of the media.The Financial Times covers bail-ins today with a focus on the risk to investors while continuing to ignore that posed to savers and depositors including small and medium size enterprises.

Read More

Trump Lashes Out At Clinton's Hypocrisy: "No More Guns To Protect Hillary!"

Submitted by Tyler Durden on 05/21/2016 - 12:31 As the Clinton campaign continues to stumble along trying to figure out just how to attack Trump, The Donald is wasting no time showing Hillary how that's done...“Let’s see how they feel walking around without their guns and their bodyguards...”"The Sendai Dischord" - Japan Humiliated At G-7 Meeting In Sharp Rift Over Yen Intervention

Submitted by Tyler Durden on 05/21/2016 - 11:31

CIA 'Accidentally' Destroyed 6,700 Page Torture Report? Snowden Calls Bullshit

Submitted by Tyler Durden on 05/21/2016 - 10:58 "I worked at The CIA. I wrote the Emergency Destruction Plan for Geneva. When CIA destroys something, it's never a mistake..."

from Henry Makow:

The great Kahal of New York relentlessly develops its strategy and executes its policies in conjunction with Tel Aviv. The other great Kahal in the Americas operates in Argentina, which outside Israel, harbors the second largest Jewish population in the world, estimated at two million (rather than the official version of 300,000.)

In a groundbreaking 10-page article in the current issue of Culture Wars, Thomas Brennan explains why Argentina is so important to the Jews, and how its was inevitable that the Catholic Archbishop, now installed in Rome, should become their chore goy. [pictured: Archbishop Bergoglio with his handler Rabbi Abraham Skorka]

Read More

The great Kahal of New York relentlessly develops its strategy and executes its policies in conjunction with Tel Aviv. The other great Kahal in the Americas operates in Argentina, which outside Israel, harbors the second largest Jewish population in the world, estimated at two million (rather than the official version of 300,000.)

In a groundbreaking 10-page article in the current issue of Culture Wars, Thomas Brennan explains why Argentina is so important to the Jews, and how its was inevitable that the Catholic Archbishop, now installed in Rome, should become their chore goy. [pictured: Archbishop Bergoglio with his handler Rabbi Abraham Skorka]

Read More

Trump's Grass Roots: Small Donors Flood Trump Super PAC In April

Submitted by Tyler Durden on 05/21/2016 - 10:35 That the Great America PAC raised $514k in April in support of Donald Trump isn't very surprising, what is surprising however, is the fact that 81% of those funds came from donors giving less than $200. The PAC was established in early February, and during that month it raised $74k with just 22% from small donors. In March the PAC gained some momentum, collecting $479k in total donations, but the percentage of small donors was similar to January, coming in at 24%

Portland School Board Bans Literature Denying Climate Change

Submitted by Tyler Durden on 05/21/2016 - 09:50 There will be no more discussion as to whether or not humans are contributing to climate change in the Portland, Oregan public school system, as the school board plans to ban all material that denies the existence of man-made climate change. Although the topic is still being heavily debated within the scientific community, young and impressionable students will now only receive the politically correct side of the issue. ‘Man is causing climate change, no questions asked.’

Egypt Officials Release First Footage Of EgyptAir Debris; Find Airplane Black Boxes

Submitted by Tyler Durden on 05/21/2016 - 08:46 Following two days of searching, Egyptian crews have located the data recorders for EgyptAir Flight 804 close to an area where human remains and debris from the crashed flight have been found, CBS News reports citing government sources. Also on Saturday morning, the Egyptian military posted new photos of debris on its spokesman's Facebook page. They included what appeared to be parts of a seat, a lifejacket and what looks to be a pink and purple children's blanket.Something Stunning Is Taking Place Off The Coast Of Singapore

Submitted by Tyler Durden on 05/20/2016 - 23:58

Silent Majority: 55% Of Americans Want Independent To Run Against Trump, Clinton

Submitted by Tyler Durden on 05/20/2016 - 21:30

It’s happening! According to a new poll, Americans have finally maxed out their tolerance for “lesser evils” in presidential politics. The survey, published by independent research firm, Data Targeting, found a majority of Americans now want an independent candidate to take on Hillary Clinton and Donald Trump — two of the most disliked candidates in recent history.

The Mother Of All Head & Shoulder Patterns Just Completed The Right Shoulder

Submitted by Tyler Durden on 05/20/2016 - 20:30 China was, in essence, the right shoulder to the greatest head and shoulder pattern in the history of mankind. Central banks and federal governments will do everything in their power to maintain the present system. They will attempt anything and likely everything to maintain what ultimately cannot be maintained. Unfortunately, no one knows how much is too much and the economic, financial, and societal ramifications. Invest accordingly?!?

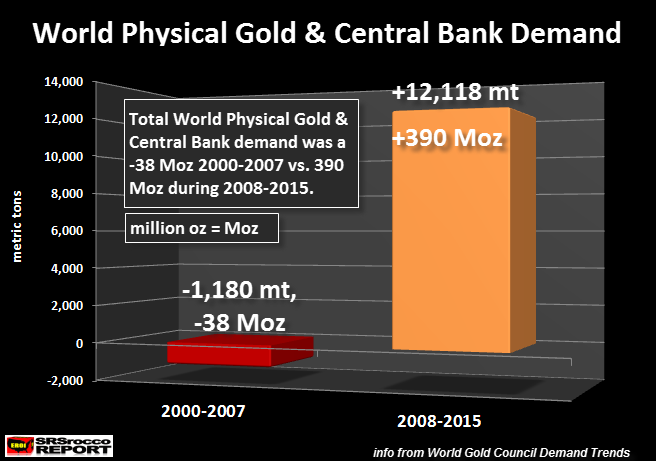

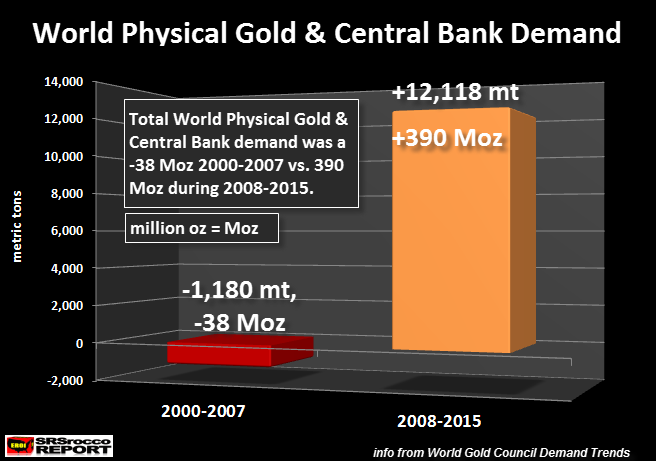

by Steve St. Angelo, SRSRocco Report:

This gold chart should have Central Banks extremely worried. Why?

Because the change in physical gold and Central Bank demand since the

first crash of the U.S. and global markets in 2008 is literally off the

charts.

This gold chart should have Central Banks extremely worried. Why?

Because the change in physical gold and Central Bank demand since the

first crash of the U.S. and global markets in 2008 is literally off the

charts.

I advise precious metals investors not to focus on the short-term gold price movement, rather they should concentrate on the long-term trend changes. This is where the ultimate payoff will be by investing in gold. Now, I say “INVESTING”, in gold because that is what we are doing.

Many analysts such as Jim Rickards don’t believe that gold is an investment. Mr. Rickards looks at gold as money or insurance on the collapse of the U.S. Dollar and fiat monetary system. However, I look at gold as an investment due to the collapse of U.S. and World energy production.

Read More

This gold chart should have Central Banks extremely worried. Why?

Because the change in physical gold and Central Bank demand since the

first crash of the U.S. and global markets in 2008 is literally off the

charts.

This gold chart should have Central Banks extremely worried. Why?

Because the change in physical gold and Central Bank demand since the

first crash of the U.S. and global markets in 2008 is literally off the

charts.I advise precious metals investors not to focus on the short-term gold price movement, rather they should concentrate on the long-term trend changes. This is where the ultimate payoff will be by investing in gold. Now, I say “INVESTING”, in gold because that is what we are doing.

Many analysts such as Jim Rickards don’t believe that gold is an investment. Mr. Rickards looks at gold as money or insurance on the collapse of the U.S. Dollar and fiat monetary system. However, I look at gold as an investment due to the collapse of U.S. and World energy production.

Read More

Barack Obama has played a direct role in covering up the truth behind the 9/11 event since the day he took office. In fact, 9/11 victims’ families just released a statement charging that Obama has stood in the way of justice by trying to block legislation that would allow them to sue Saudi Arabia for its role in 9/11. But the Senate unanimously passed JASTA any way, so Obama says he will veto it. It’s just another example of Obama putting foreign governments in front of truth and the American people. But with the House of Saud ripe for a fall, the classified 28 pages of the 9/11 report which implicate Saudi Arabia in the financing of the 9/11 false flag event – along with the green light to sue the Saudis from the US Senate, we may finally see the hardcore, horrible truth about 9/11 revealed. Can Obama put the genie back in the bottle? Harley Schlanger, a national spokesman for LaRouchePAC joins me to discuss this and much, much more.

‘Clinton as president is danger to world peace’ – far-right French leader Marine Le Pen

by Jeff Nielson, Bullion Bulls:

It is hard not to become a fan of France’s “radical” Front-National leader, Marine Le Pen. On this side of the Atlantic, her name first surfaced during the Greek crisis, when “Grexit” (i.e. talk of Greece leaving the EU) was being frequently bandied about. Le Pen’s response? “Moi aussi.” (Me too.) She dubbed herself“Madame Frexit.”

Equally, she earned the eternal hatred of the One Bank, since the Big Bank crime syndicate uses the EU as a political/monetary straitjacket, by which it bludgeons Europe’s once-sovereign nations into serving this crime syndicate.

Despite this, Front-National continues to lead France’s polling, making Le Pen the current favorite as France’s next president. As a result, we can likely expect that “something will happen” to Ms. Le Pen, between now and France’s next election.

Read More

by Jeff Nielson, Bullion Bulls:

It is hard not to become a fan of France’s “radical” Front-National leader, Marine Le Pen. On this side of the Atlantic, her name first surfaced during the Greek crisis, when “Grexit” (i.e. talk of Greece leaving the EU) was being frequently bandied about. Le Pen’s response? “Moi aussi.” (Me too.) She dubbed herself“Madame Frexit.”

Equally, she earned the eternal hatred of the One Bank, since the Big Bank crime syndicate uses the EU as a political/monetary straitjacket, by which it bludgeons Europe’s once-sovereign nations into serving this crime syndicate.

Despite this, Front-National continues to lead France’s polling, making Le Pen the current favorite as France’s next president. As a result, we can likely expect that “something will happen” to Ms. Le Pen, between now and France’s next election.

Read More

by Dave Kranzler, Investment Research Dynamics:

What

are these Fed officials doing? They’re putting into question the

credibility of the institution because they sound like idiots. – a good

friend/colleague of Investment Research Dynamics

What

are these Fed officials doing? They’re putting into question the

credibility of the institution because they sound like idiots. – a good

friend/colleague of Investment Research Dynamics

It’s becoming a farce of epic proportions, especially when there’s an entire month between FOMC meetings. Starting this past Tuesday the typical Fed officials began their monthly cyclical cant of rate hike threats. For some reason the stock and paper derivative precious metals markets always take a beating when the “threat” of a rate hike at the next meeting is floated.

On Tuesday one official stated that June was a meeting at which action could be taken but that it was too early based on Q2 data “to draw a conclusion.” Another official, SF Fed Prez, John Williams, threatened that “June was a live meeting.” Both officials gave themselves an “out” by saying that a rate hike depends on the data.

Read More

What

are these Fed officials doing? They’re putting into question the

credibility of the institution because they sound like idiots. – a good

friend/colleague of Investment Research Dynamics

What

are these Fed officials doing? They’re putting into question the

credibility of the institution because they sound like idiots. – a good

friend/colleague of Investment Research DynamicsIt’s becoming a farce of epic proportions, especially when there’s an entire month between FOMC meetings. Starting this past Tuesday the typical Fed officials began their monthly cyclical cant of rate hike threats. For some reason the stock and paper derivative precious metals markets always take a beating when the “threat” of a rate hike at the next meeting is floated.

On Tuesday one official stated that June was a meeting at which action could be taken but that it was too early based on Q2 data “to draw a conclusion.” Another official, SF Fed Prez, John Williams, threatened that “June was a live meeting.” Both officials gave themselves an “out” by saying that a rate hike depends on the data.

Read More

from Rogue Money:

This week brought ominous news on multiple fronts for the tottering House of Saud…

This week brought ominous news on multiple fronts for the tottering House of Saud…

First, the United States Senate unanimously passed a voice vote to legalize civil lawsuits against foreign governments seeking damages for terrorist attacks carried out on U.S. soil. Although Senators like Lindsey Graham (R-SC) denied that the resolution was aimed at Saudi Arabia, Tuesday’s ‘coincidence’ of The New York Times publishing 47 pages of declassified FBI memos related to the Bureau’s informant who lived with the Saudi-sponsored 9/11 hijackers could leave the House of Saud no doubts as to their being thrown under the bus by both the executive and legislative branches in Washington.

The Drone Strike Silencing of the al-Awlakis: Did the Obama White House Not Want Them to Live to Be Granted Reduced Sentences to Testify Against the Saudis in 9/11?

Read More

This week brought ominous news on multiple fronts for the tottering House of Saud…

This week brought ominous news on multiple fronts for the tottering House of Saud…First, the United States Senate unanimously passed a voice vote to legalize civil lawsuits against foreign governments seeking damages for terrorist attacks carried out on U.S. soil. Although Senators like Lindsey Graham (R-SC) denied that the resolution was aimed at Saudi Arabia, Tuesday’s ‘coincidence’ of The New York Times publishing 47 pages of declassified FBI memos related to the Bureau’s informant who lived with the Saudi-sponsored 9/11 hijackers could leave the House of Saud no doubts as to their being thrown under the bus by both the executive and legislative branches in Washington.

The Drone Strike Silencing of the al-Awlakis: Did the Obama White House Not Want Them to Live to Be Granted Reduced Sentences to Testify Against the Saudis in 9/11?

Read More

by Bill Holter, via Silver Doctors:

For many years we have warned of the dangers of derivatives.

We were laughed at leading up to the 2008 financial debacle when Lehman

broke and nearly took the entire system down. That turned out to be no

laughing matter and here we are again at exactly the same situation

where derivatives threaten to melt the financial system again. The

difference now of course is the “saving ammunition” has already been

spent where sovereign treasuries and central banks have destroyed their

own balance sheets.

For many years we have warned of the dangers of derivatives.

We were laughed at leading up to the 2008 financial debacle when Lehman

broke and nearly took the entire system down. That turned out to be no

laughing matter and here we are again at exactly the same situation

where derivatives threaten to melt the financial system again. The

difference now of course is the “saving ammunition” has already been

spent where sovereign treasuries and central banks have destroyed their

own balance sheets.

Two weeks ago, the Fed announced a “48 hour stay in place” provision for for collateral of any derivative contracts where the big banks are involved. The idea here is to prevent collateral being pulled by the survivor for 48 hours should the bank counterparty become insolvent.

This will give the Fed a window of time to get the fire hose of liquidity out and reliquify a large bank’s balance sheet before they can break the derivatives chain. But what does this really do? Does it make derivatives any more sound or does it really just add more risk to central bank balance sheets and thus the currencies themselves?

Read More

For many years we have warned of the dangers of derivatives.

We were laughed at leading up to the 2008 financial debacle when Lehman

broke and nearly took the entire system down. That turned out to be no

laughing matter and here we are again at exactly the same situation

where derivatives threaten to melt the financial system again. The

difference now of course is the “saving ammunition” has already been

spent where sovereign treasuries and central banks have destroyed their

own balance sheets.

For many years we have warned of the dangers of derivatives.

We were laughed at leading up to the 2008 financial debacle when Lehman

broke and nearly took the entire system down. That turned out to be no

laughing matter and here we are again at exactly the same situation

where derivatives threaten to melt the financial system again. The

difference now of course is the “saving ammunition” has already been

spent where sovereign treasuries and central banks have destroyed their

own balance sheets.Two weeks ago, the Fed announced a “48 hour stay in place” provision for for collateral of any derivative contracts where the big banks are involved. The idea here is to prevent collateral being pulled by the survivor for 48 hours should the bank counterparty become insolvent.

This will give the Fed a window of time to get the fire hose of liquidity out and reliquify a large bank’s balance sheet before they can break the derivatives chain. But what does this really do? Does it make derivatives any more sound or does it really just add more risk to central bank balance sheets and thus the currencies themselves?

Read More

by Samuel Bryan, Schiff Gold:

These are not normal economic times.

These are not normal economic times.

Interest rates have remained artificially low, plunging into negative territory in many places. Central banks continue to inflate the money supply with quantitative easing. Some policy-makers have even floated the idea of helicopter money. Worldwide money printing is reportedly approaching $100 trillion.

There is no end to this crazy monetary policy in sight. This led billionaire investor Stanley Druckenmiller to recommend selling US stocks to buy gold. Well-known hedge fund manager Paul Singer said the recent surge in gold is just the beginning. And Bank of America said gold is entering a new and long bull market.

Read More

These are not normal economic times.

These are not normal economic times.Interest rates have remained artificially low, plunging into negative territory in many places. Central banks continue to inflate the money supply with quantitative easing. Some policy-makers have even floated the idea of helicopter money. Worldwide money printing is reportedly approaching $100 trillion.

There is no end to this crazy monetary policy in sight. This led billionaire investor Stanley Druckenmiller to recommend selling US stocks to buy gold. Well-known hedge fund manager Paul Singer said the recent surge in gold is just the beginning. And Bank of America said gold is entering a new and long bull market.

Read More

The Eurozone Is The Greatest Danger

Submitted by Tyler Durden on 05/21/2016 - 13:30 Financial and economic prospects for the Eurozone have many similarities to the 1972-75 period in the UK, which this writer remembers vividly. This time, the prospects facing the Eurozone potentially could be worse. The obvious difference is the far higher levels of debt, which will never allow the ECB to run interest rates up sufficiently to kill price inflation. More likely, positive rates of only one or two per cent would be enough to destabilise the Eurozone’s financial system. Let us hope that these dangers are exaggerated, and the final outcome will not be systemically destabilising, not just for Europe, but globally as well. A wise man, faced with the unknown, believes nothing, expects the worst, and takes precautions./

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment