[Ed. Note: Willie’s statement that the US Navy

is paying silver bullion for fuel in the Persian Gulf can be found at

the 17:55 mark. However, he provides precious little additional

information to back up this sensational claim.]

by Jim Willie, via Silver Doctors:

“The dollar devaluation is right around the corner!…The US Navy in the Persian Gulf is already being forced by the Saudis to use SILVER BULLION to purchase fuel!“

Hat Trick Letter Editor Jim Willie joins the Power Hour for one of his most shocking interviews EVER on this Absolute Game Changing Development for the Dollar:

Topics include the corruption angle in financial analysis with forecasts, saving the big banks while allowing the economy to die during colossal bank bailouts by the USGovt, the future demise of the USDollar in its global rejection, a description of a New Scheiss Dollar with continued fraud, the true relationship for the USGovt with Saudi Arabia, the theft of Saudi wealth and the Washington planned scuttle of the kingdom, the primary risks for bank failures, the role of Deutsche Bank in the bank failure contagion, the re-industrialization of the United States with possible Chinese investment & more.

Click HERE to Listen

by Jim Willie, via Silver Doctors:

“The dollar devaluation is right around the corner!…The US Navy in the Persian Gulf is already being forced by the Saudis to use SILVER BULLION to purchase fuel!“

Hat Trick Letter Editor Jim Willie joins the Power Hour for one of his most shocking interviews EVER on this Absolute Game Changing Development for the Dollar:

Topics include the corruption angle in financial analysis with forecasts, saving the big banks while allowing the economy to die during colossal bank bailouts by the USGovt, the future demise of the USDollar in its global rejection, a description of a New Scheiss Dollar with continued fraud, the true relationship for the USGovt with Saudi Arabia, the theft of Saudi wealth and the Washington planned scuttle of the kingdom, the primary risks for bank failures, the role of Deutsche Bank in the bank failure contagion, the re-industrialization of the United States with possible Chinese investment & more.

Click HERE to Listen

The "Longest Uninterrupted Smart Money Selling Streak In History" Extends To 16 Weeks

Submitted by Tyler Durden on 05/17/2016 - 10:32 Last night, following 15 consecutive weeks of client selling, we asked - rhetorically - if today the selling by BofA's smart money clients would stretch to a new record 16 consecutive weeks. Earlier today we received the BofA update, as well as the answer: a resounding yes.

Soros’s U.S. listed stock holdings drop to $3.5 billion. Firm adds $264 million stake in bullion producer Barrick Gold

from Bloomberg:

Billionaire George Soros cut his firm’s investments in U.S. stocks by

more than a third in the first quarter and bought a $264 million stake

in the world’s biggest bullion producer Barrick Gold Corp.

Billionaire George Soros cut his firm’s investments in U.S. stocks by

more than a third in the first quarter and bought a $264 million stake

in the world’s biggest bullion producer Barrick Gold Corp.

The value of Soros Fund Management’s publicly disclosed holdings dropped by 37 percent to $3.5 billion as of the end of the last quarter, according to a government filing Monday. Soros acquired 1.7 percent of Barrick, making it the firm’s biggest U.S.-listed holding. Soros also disclosed owning call options on 1.05 million shares in the SPDR Gold Trust, an exchange-traded fund that tracks the price of gold.

Read More

from Bloomberg:

Billionaire George Soros cut his firm’s investments in U.S. stocks by

more than a third in the first quarter and bought a $264 million stake

in the world’s biggest bullion producer Barrick Gold Corp.

Billionaire George Soros cut his firm’s investments in U.S. stocks by

more than a third in the first quarter and bought a $264 million stake

in the world’s biggest bullion producer Barrick Gold Corp.The value of Soros Fund Management’s publicly disclosed holdings dropped by 37 percent to $3.5 billion as of the end of the last quarter, according to a government filing Monday. Soros acquired 1.7 percent of Barrick, making it the firm’s biggest U.S.-listed holding. Soros also disclosed owning call options on 1.05 million shares in the SPDR Gold Trust, an exchange-traded fund that tracks the price of gold.

Read More

by Egon Von Greyerz, Gold Switzerland:

Charles Ponzi must be turning in his grave! His pyramid scheme in 1920

guaranteed returns of 50% in 50 days and 100% in 100 days. And initial

investors clearly achieved these returns but most of them were too

greedy to cash in. His total scheme “only” lost $20 million ($225

million in today’s money) for the investors. In comparison, Madoff cost

his investors $18 billion. At least Ponzi became famous for his

achievement. So far Madoff has not achieved fame.

Charles Ponzi must be turning in his grave! His pyramid scheme in 1920

guaranteed returns of 50% in 50 days and 100% in 100 days. And initial

investors clearly achieved these returns but most of them were too

greedy to cash in. His total scheme “only” lost $20 million ($225

million in today’s money) for the investors. In comparison, Madoff cost

his investors $18 billion. At least Ponzi became famous for his

achievement. So far Madoff has not achieved fame.

But both Ponzi and Madoff were small time crooks compared to governments and central banks today. Because whether we take, Japan, China, the EU or the USA, they have all created Ponzi schemes which are exponentially bigger than what Ponzi did. Admittedly no government is promising the 50% return that Ponzi did or Madoff’s 10-12%. Instead they are giving investors of their “Ponzi” bonds the illusion that they will receive the capital back. To paraphrase Mark Twain, investors are neither going to get the return ON their money nor the return OF their money, at least not in real terms.

Read More

Charles Ponzi must be turning in his grave! His pyramid scheme in 1920

guaranteed returns of 50% in 50 days and 100% in 100 days. And initial

investors clearly achieved these returns but most of them were too

greedy to cash in. His total scheme “only” lost $20 million ($225

million in today’s money) for the investors. In comparison, Madoff cost

his investors $18 billion. At least Ponzi became famous for his

achievement. So far Madoff has not achieved fame.

Charles Ponzi must be turning in his grave! His pyramid scheme in 1920

guaranteed returns of 50% in 50 days and 100% in 100 days. And initial

investors clearly achieved these returns but most of them were too

greedy to cash in. His total scheme “only” lost $20 million ($225

million in today’s money) for the investors. In comparison, Madoff cost

his investors $18 billion. At least Ponzi became famous for his

achievement. So far Madoff has not achieved fame.But both Ponzi and Madoff were small time crooks compared to governments and central banks today. Because whether we take, Japan, China, the EU or the USA, they have all created Ponzi schemes which are exponentially bigger than what Ponzi did. Admittedly no government is promising the 50% return that Ponzi did or Madoff’s 10-12%. Instead they are giving investors of their “Ponzi” bonds the illusion that they will receive the capital back. To paraphrase Mark Twain, investors are neither going to get the return ON their money nor the return OF their money, at least not in real terms.

Read More

"Was Ist Sex" - These Are The Disturbing Cartoons Germany Uses To Teach Sex To Refugees

Submitted by Tyler Durden on 05/17/2016 - 11:59

Is Mitt Romney On A Suicide Mission?

Submitted by Tyler Durden on 05/17/2016 - 13:02 “It’s a suicide mission,” said the Republican Party Chairman. The Romney-Kristol cabal is Hillary Clinton’s fifth column inside the Republican Party.

Stocks Slide After Lockhart/Williams Say Rate-Hike In June On The Table

Submitted by Tyler Durden on 05/17/2016 - 12:42 Once again the narrative spewing forth from today's Fed speakers is that "the market is too pessimistic" presumably meaning the bond market because stocks are near record highs; and crucially, that despite collapsing industrial production, plunging GDP expectations, near-record inventories, and weakness in employment data that the US economy is "doing well" and that "June is a live meeting" for a rate hike... the equity market is not amused...

Weapons Headed To Libya: Hillary's Interventionist Disaster Continues To Spiral Out Of Control

Submitted by Tyler Durden on 05/17/2016 - 12:17 Earlier today, The Guardian published an article detailing how foreign leaders were gathering in Vienna to discuss how to address the humanitarian disaster/ISIS haven they themselves created in Libya. As usual, the key agenda item revolved around whether the U.S. and its allies should ship weapons into the arena to inspire, you know, freedom and democracy.

Why 2,900 Is The Most Important Number In The World For US Equity Bulls

Submitted by Tyler Durden on 05/17/2016 - 11:46 What happens if - just as it did in Aug 2015 and Jan 2016 - the S&P 500 starts caring about Chinese stocks? The answer, as BofAML's Stephen Suttmeier explains, is "nothing good."

from The Daily Bell:

This is one weak nominee: Hillary Clinton’s problem isn’t Bernie Sanders. It’s Hillary Clinton … -Salon

This is one weak nominee: Hillary Clinton’s problem isn’t Bernie Sanders. It’s Hillary Clinton … -Salon

Like machine-gun fire, rat-tat-tat, three major mainstream publications in a row have recently posted stories featuring a “weak” Hillary Clinton.

This further strengthens our hypothesis that the Hillary may not ever make it to the presidential race.

We first wrote about this late last week in an article entitled, Signs from Mainstream Media that Clinton’s Campaign Might be Over.

Read More

This is one weak nominee: Hillary Clinton’s problem isn’t Bernie Sanders. It’s Hillary Clinton … -Salon

This is one weak nominee: Hillary Clinton’s problem isn’t Bernie Sanders. It’s Hillary Clinton … -SalonLike machine-gun fire, rat-tat-tat, three major mainstream publications in a row have recently posted stories featuring a “weak” Hillary Clinton.

This further strengthens our hypothesis that the Hillary may not ever make it to the presidential race.

We first wrote about this late last week in an article entitled, Signs from Mainstream Media that Clinton’s Campaign Might be Over.

Read More

If Killery is installed by TPTB... can we get a restraining order to keep the idiots husband out of the White House so he doesn't do any further damage?...

Bill Clinton Confirms "Wants Economic Role" In Hillary's Administration

Submitted by Tyler Durden on 05/17/2016 - 11:32 Is this why stocks are slipping? Following Hillary's hint last night that she would like to put her husband in "charge of revitalising the economy, because you know he knows how to do it," Bill confirmed the farce this morning, admitting he has asked for an "economic role" in his wife's adminstration. As Yves Smith so eloquently noted, after having institutionalized the neoliberal economic policies that have enriched the 1% and particularly the 0.1% at the expense of everyone else, Hillary Clinton wants to give the long-suffereing citizenry an even bigger dose. Good luck America.America's Age Of Impunity

Submitted by Tyler Durden on 05/17/2016 - 11:30

This Is Goldman's Primer On The Most Critical Crude Oil Prices

Submitted by Tyler Durden on 05/17/2016 - 11:12 While we are not sure if the market has finally had time to actually read Goldman's oil note from Sunday night (posted here at the same time) and understand that far from bullish Goldman actually warned that the market rebalancing is taking far longer and as a result is lowering its 2017 price targets, there was one additional curious highlight in the report: Goldman's breakdown of critical prices bands for oil which actually is a useful guide for how the broader market (if devoid of momentum-chasing algo traders) would respond with oil trading in any given price interval

A Nation Of Housing 'Haves' & 'Have-Nots'

Submitted by Tyler Durden on 05/17/2016 - 11:04 Everyone who follows the statistics of rising income and wealth inequality knows we're becoming a nation of haves and have-nots. What's not being discussed is the role of housing.

Live Feed: Paris Protesters, Riot Police Clash Over Labor Law

Submitted by Tyler Durden on 05/17/2016 - 10:45 French protesters have once again taken to the streets of Paris once again over the recent passage of the unpopular labor reform, and are being met by tear gas.

One Of These Things Is Not Like The Others

Submitted by Tyler Durden on 05/17/2016 - 10:41 Trannies up 2% - best day in a month - because, well why not...As Insurance Losses Mount So Do Refusals: "Sorry, We Don't Take Obamacare"

Submitted by Tyler Durden on 05/17/2016 - 10:15 A McKinsey study shows Obamacare insurers lost money in 2014 and the losses doubled in 2015. Amazingly, the study concludes there’s nothing to worry about because “30 percent of insurers nationwide were profitable.” Meanwhile, outright refusals to accept Obamacare mount. “Sorry, We Don’t Take Obamacare” is now a frequent response.

Gartman: "We Were Fully, Completely And Totally Wrong", Sees Bear Market In "Catholic Global Terms"

Submitted by Tyler Durden on 05/17/2016 - 09:53 "We were fully, completely and totally wrong. There is no reason to mince words; there are no excuses to be made, nor should there be. We were wrong… obviously and utterly and we shall do well and our best to simply acknowledge that fact... Does this mean then that we shall turn bullish of equities? Shall we cast aside our beliefs that the highs made one year ago in broad, catholic terms are suddenly to be thought of as within reach and likely to be taken out? Of course not."

from RT:

Hacktivist collective Anonymous has launched cyber-attacks on major

financial institutions across the world, including the Bank of England,

in order to “start an online revolution.”

Hacktivist collective Anonymous has launched cyber-attacks on major

financial institutions across the world, including the Bank of England,

in order to “start an online revolution.”

Hackers claimed to have taken down the Bank of England’s internal email server as part of an operation dubbed ‘OpIcarus.’

Mail.bankofengland.co.uk was down for part of Friday.

Read More

Hacktivist collective Anonymous has launched cyber-attacks on major

financial institutions across the world, including the Bank of England,

in order to “start an online revolution.”

Hacktivist collective Anonymous has launched cyber-attacks on major

financial institutions across the world, including the Bank of England,

in order to “start an online revolution.”Hackers claimed to have taken down the Bank of England’s internal email server as part of an operation dubbed ‘OpIcarus.’

Mail.bankofengland.co.uk was down for part of Friday.

Read More

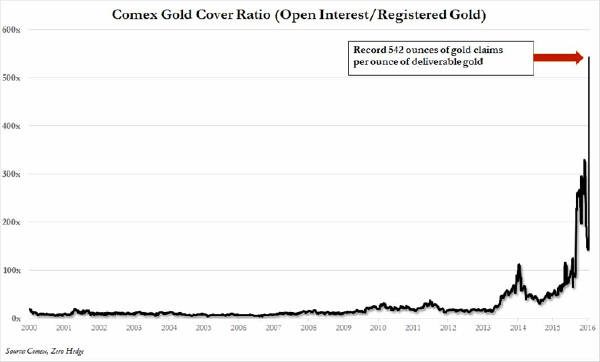

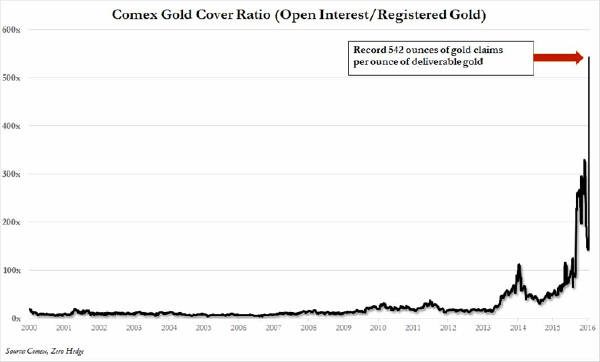

by Clint Siegner, Money Metals Exchange:

A respectable number of Americans hold investments in gold and silver in one form or another. Some hold physical bullion, while others opt for indirect ownership via ETFs or other instruments. A very small minority speculate via the futures markets. But we frequently report on the futures markets – why exactly is that?

Because that is where prices are set. The mint certificates, the ETFs, and the coins in an investor’s safe – all of them – are valued, at least in large part, based on the most recent trade in the nearest delivery month on a futures exchange such as the COMEX. These “spot” prices are the ones scrolling across the bottom of your CNBC screen.

That makes the futures markets a tiny tail wagging a much larger dog.

Read More

A respectable number of Americans hold investments in gold and silver in one form or another. Some hold physical bullion, while others opt for indirect ownership via ETFs or other instruments. A very small minority speculate via the futures markets. But we frequently report on the futures markets – why exactly is that?

Because that is where prices are set. The mint certificates, the ETFs, and the coins in an investor’s safe – all of them – are valued, at least in large part, based on the most recent trade in the nearest delivery month on a futures exchange such as the COMEX. These “spot” prices are the ones scrolling across the bottom of your CNBC screen.

That makes the futures markets a tiny tail wagging a much larger dog.

Read More

by Andy Hoffman, Miles Franklin:

On Wednesday, just before yet another blatant Cartel attack – not to

mention, before we learned on Friday, that the COMEX “commercial” short

position hit another all-time high, I taunted “hey Cartel, is that the best you got?”

Well, here we are just three trading days later, and gold is back in

earshot of the very, very key round number of $1,308/oz (listen to this

interview with Andrew Maguire);

whilst silver is back up to $17.35/oz, having recouped all of the

“losses” from Mondays’ and Thursdays’ paper raids. To that end, take a

look at how pathetic last night’s 143rd “Sunday Night Sentiment” raid of

the past 149 weeks was; followed by an even more pitiful “2:15 AM” EST

attack. Which is why, yet again, I emphatically retort to

fear-mongerers that don’t realize we’re back in a Precious Metals bull

market, “it’s the ‘commercials’ that should be scared!” I mean geez, even JP Morgan says so – and as they say, what won’t go down, must go up!

On Wednesday, just before yet another blatant Cartel attack – not to

mention, before we learned on Friday, that the COMEX “commercial” short

position hit another all-time high, I taunted “hey Cartel, is that the best you got?”

Well, here we are just three trading days later, and gold is back in

earshot of the very, very key round number of $1,308/oz (listen to this

interview with Andrew Maguire);

whilst silver is back up to $17.35/oz, having recouped all of the

“losses” from Mondays’ and Thursdays’ paper raids. To that end, take a

look at how pathetic last night’s 143rd “Sunday Night Sentiment” raid of

the past 149 weeks was; followed by an even more pitiful “2:15 AM” EST

attack. Which is why, yet again, I emphatically retort to

fear-mongerers that don’t realize we’re back in a Precious Metals bull

market, “it’s the ‘commercials’ that should be scared!” I mean geez, even JP Morgan says so – and as they say, what won’t go down, must go up!

Read More

On Wednesday, just before yet another blatant Cartel attack – not to

mention, before we learned on Friday, that the COMEX “commercial” short

position hit another all-time high, I taunted “hey Cartel, is that the best you got?”

Well, here we are just three trading days later, and gold is back in

earshot of the very, very key round number of $1,308/oz (listen to this

interview with Andrew Maguire);

whilst silver is back up to $17.35/oz, having recouped all of the

“losses” from Mondays’ and Thursdays’ paper raids. To that end, take a

look at how pathetic last night’s 143rd “Sunday Night Sentiment” raid of

the past 149 weeks was; followed by an even more pitiful “2:15 AM” EST

attack. Which is why, yet again, I emphatically retort to

fear-mongerers that don’t realize we’re back in a Precious Metals bull

market, “it’s the ‘commercials’ that should be scared!” I mean geez, even JP Morgan says so – and as they say, what won’t go down, must go up!

On Wednesday, just before yet another blatant Cartel attack – not to

mention, before we learned on Friday, that the COMEX “commercial” short

position hit another all-time high, I taunted “hey Cartel, is that the best you got?”

Well, here we are just three trading days later, and gold is back in

earshot of the very, very key round number of $1,308/oz (listen to this

interview with Andrew Maguire);

whilst silver is back up to $17.35/oz, having recouped all of the

“losses” from Mondays’ and Thursdays’ paper raids. To that end, take a

look at how pathetic last night’s 143rd “Sunday Night Sentiment” raid of

the past 149 weeks was; followed by an even more pitiful “2:15 AM” EST

attack. Which is why, yet again, I emphatically retort to

fear-mongerers that don’t realize we’re back in a Precious Metals bull

market, “it’s the ‘commercials’ that should be scared!” I mean geez, even JP Morgan says so – and as they say, what won’t go down, must go up!Read More

New Sheep Ranch for california...

by James White, Northwest Liberty News:

On April 19, 2016 the first of three meetings were held to introduce discussions about Quay Valley; a futuristic community that has been proposed for King County, CA. The troubling part of the proposed community is that it appears to be some kind of creation right out of the Agenda 21 playbook, up to, and including, the globalist buzz-word “sustainability” used to describe it; as yet one more “conspiracy” gets proven to be fact.

The issues I see with the program such as this are many, but for sake of brevity I will touch just one. After this program is implemented, the media coverage will be off the charts. We will be repeatedly hammered with the many benefits of living in these close-quartered, compact cities and how those who live on the “outside” must not care about our planet, or our environment. If the scenario gets Played out until it’s end, those of us who decide not to take up residence in one of the “sustainable” cities will be likened to eco-terrorists and arrested for cries against earth.

We are in a battle for our lives and the lives of our children. The people who are running things mean business, and we need to raise a standard against them. If we allow ourselves to be herded into compact cities under the guise of “saving the planet,” we will truly be signing on to slavery.

Read More @ Northwestlibertynews.com

On April 19, 2016 the first of three meetings were held to introduce discussions about Quay Valley; a futuristic community that has been proposed for King County, CA. The troubling part of the proposed community is that it appears to be some kind of creation right out of the Agenda 21 playbook, up to, and including, the globalist buzz-word “sustainability” used to describe it; as yet one more “conspiracy” gets proven to be fact.

The issues I see with the program such as this are many, but for sake of brevity I will touch just one. After this program is implemented, the media coverage will be off the charts. We will be repeatedly hammered with the many benefits of living in these close-quartered, compact cities and how those who live on the “outside” must not care about our planet, or our environment. If the scenario gets Played out until it’s end, those of us who decide not to take up residence in one of the “sustainable” cities will be likened to eco-terrorists and arrested for cries against earth.

We are in a battle for our lives and the lives of our children. The people who are running things mean business, and we need to raise a standard against them. If we allow ourselves to be herded into compact cities under the guise of “saving the planet,” we will truly be signing on to slavery.

Read More @ Northwestlibertynews.com

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment