Submitted by Tyler Durden on 05/03/2016 - 11:36

Submitted by Tyler Durden on 05/03/2016 - 11:36

Cynics, skeptics, and fiction-peddlers are frowned upon by the Obama administration (and the mainstream media) when it comes to our glorious leader's economic miracle. So we thought a simple litmus test might be useful to judge just how 'doomed' the nation really is...

Ken Rogoff's Shockingly Simple Advice To Emerging Markets: Hoard Gold

Submitted by Tyler Durden on 05/03/2016 - 12:15 For some time, the rich countries have argued that it is in everyone’s collective interest to demonetize gold. But there is a good case to be made that a shift in emerging markets toward accumulating gold would help the international financial system function more smoothly and benefit everyone.

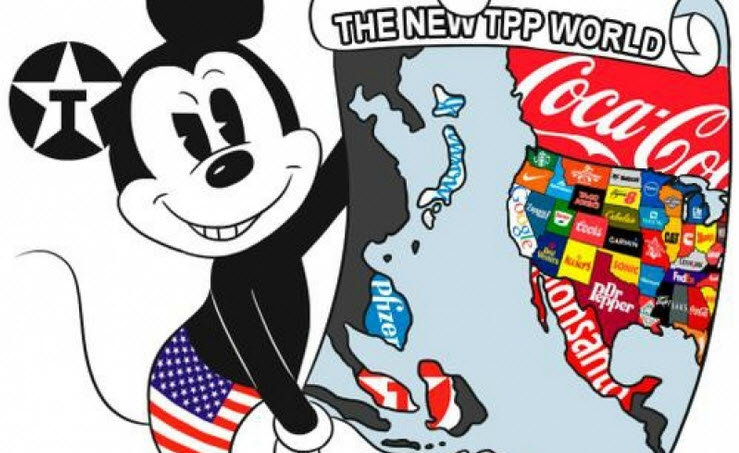

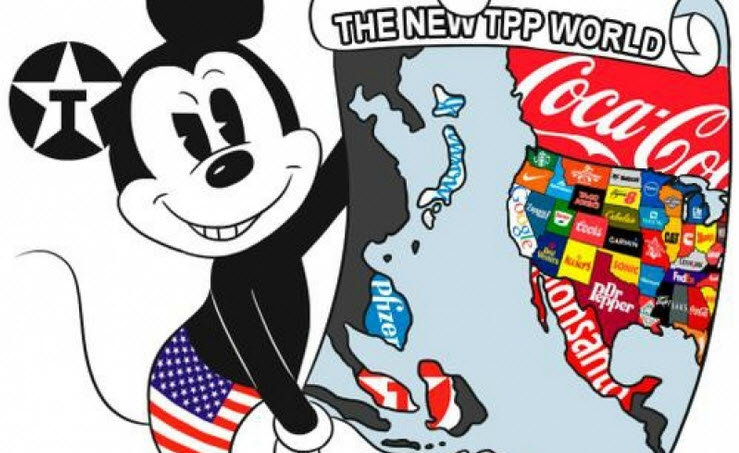

"The TTIP Is Doomed" - France Threatens To Reject Obama's Huge Transatlantic Trade Deal

Submitted by Tyler Durden on 05/03/2016 - 11:52 Following this weekend's leak by Greenpeace demonstrating not only that the TTIP is driven entirely by narrow corporate interests, but that Obama is openly willing to reneg on his pro-environment agenda just to pass the Transatlantic Treaty at any cost, the blowback arrived earlier today when France became the first major European nation which threatened to reject the huge free trade deal between the U.S. and the European Union, because according to AP "it's too friendly to U.S. business and probably doomed."

by Michael Snyder, The Economic Collapse Blog:

Last month, a “secret meeting” that involved more than 100 executives from some of the biggest financial institutions in the United States was held in New York City. During this “secret meeting“, a company known as “Chain” unveiled a technology that transforms U.S. dollars into “pure digital assets”. Reportedly, there were representatives from Nasdaq, Citigroup, Visa, Fidelity, Fiserv and Pfizer in the room, and Chain also claims to be partnering with Capital One, State Street, and First Data. This “revolutionary” technology is intended to completely change the way that we use money, and it would represent a major step toward a cashless society. But if this new digital cash system is going to be so good for society, why was it unveiled during a secret meeting for Wall Street bankers? Is there something more going on here than we are being told?

Read More

Last month, a “secret meeting” that involved more than 100 executives from some of the biggest financial institutions in the United States was held in New York City. During this “secret meeting“, a company known as “Chain” unveiled a technology that transforms U.S. dollars into “pure digital assets”. Reportedly, there were representatives from Nasdaq, Citigroup, Visa, Fidelity, Fiserv and Pfizer in the room, and Chain also claims to be partnering with Capital One, State Street, and First Data. This “revolutionary” technology is intended to completely change the way that we use money, and it would represent a major step toward a cashless society. But if this new digital cash system is going to be so good for society, why was it unveiled during a secret meeting for Wall Street bankers? Is there something more going on here than we are being told?

Read More

Meanwhile, Traders Are Getting Angrier With Every Passing Day

Submitted by Tyler Durden on 05/03/2016 - 10:34 "We’re condemned to serial bouts of severe volatility having been trained to dismiss real and knowable risks as just improbable black swans.... Central banks can’t keep giving markets everything they want, or the volatility in the end will be catastrophic"

A Surprise From JPM: "Pundits Are Urging Investors To Chase Performance; We Believe This Would Be A Mistake"

Submitted by Tyler Durden on 05/03/2016 - 11:14 "Equities had a meaningful rebound from the February lows, and we now find many who didn’t want to add at the time, are looking to enter the market at these levels. Indeed, pundits are urging investors to “chase performance”. We believe that this would be a mistake; complacency has crept into the market again, technicals appear overbought and the upturn in activity appears to be stalling."

U.S. Gasoline Prices Hit 6 Month High, Keep Rising

Submitted by Tyler Durden on 05/03/2016 - 10:55 The average price of gas in the United States is now at $2.22, up 8 cents over last week, hitting a 6-month high. This, in stark contrast to February’s ultra-low gas prices of $1.68 per gallon - a level that had not been since the end of 2008. The 30% surge off the lows is the largest seasonal spike since 2007...

Treasury Yields Tumble Most In 3 Months Despite Fed's Williams Warning

Submitted by Tyler Durden on 05/03/2016 - 10:24 Having pushed higher yesterday, it appears 'investors' have had a sudden change of heart and are panic-buying bonds today, despite Fed's Williams warning that: WILLIAMS SAYS U.S. TREASURIES ARE PRICED EXTRAORDINARILY HIGH. Treasury yields are down 5bps (2Y) to 9bps (10Y) with non-stop buying since Europe opened. 30Y yield's 7.5bps drop is the biggest since Feb 18th, pushing the yield back to its 20-day moving average.

Three Years After Going Public, Fairway Files Chapter 11

Submitted by Tyler Durden on 05/03/2016 - 10:05 Back in April 2013, during the height of the IPO scramble, the NYT gushed about Fairway's just concluded IPO: "Until recently, Fairway was not much more than a popular market on Manhattan’s Upper West Side, where residents went for goods like smoked salmon, medjool dates and cheeses. Today, it is a fast-growing 12-store grocery chain with ambitions of opening 300 outlets across the country." Just over three years later, the once successful IPO is now a distant memory and soon enough, so will the company behind it because overnight Fairway Group Holdings filed for Chapter 11 bankruptcy protection,

WTI Crude Crumbles To $43 Handle As Demand Fears Grow

Submitted by Tyler Durden on 05/03/2016 - 10:00 Remember when the low oil price was an "over-supply" issue and nothing at all to do with the other side of the same coin - dwindling demand? Well it appears that reality is dawning that a record glut combined with tumbling global growth (confirmed by weakness in China PMI, US PMI, and now EU growth expectations) is sending crude prices lower, back to a $43 handle for the June contract...

What Goes Up (Slowly On No Volume) Plunges Quickly

Submitted by Tyler Durden on 05/03/2016 - 09:56 Yesterday's 'odd' gains in stocks amid dismal data and weakness across every asset class have been entirely erased this morning... in a hurry...

Either Reverse All The Perverse Incentives Or The System Will Implode

Submitted by Tyler Durden on 05/03/2016 - 09:45 As you no doubt noticed, every perverse incentive is the cash cow for a vested interest or cartel. That's why the perverse incentives will endure until the system implodes under their pathological weight.

In Latest Blow To Hedge Funds, AIG Redeems $4 Billion; CALSTRS Says "2 And 20" Model Is "Off The Table"

Submitted by Tyler Durden on 05/03/2016 - 09:26 The pain for hedge funds is only just starting: Chris Ailman, who runs investments at CALSTRS, said in a Bloomberg Television interview from the Milken conference that the hedge fund industry’s two-and-twenty fee model is “broken” and “off the table” for large institutional investors. And then the latest blow to the suddenly struggling industry came overnight from none other than the firm which started the bailout regime, AIG, which following its earnings report announced that the insurer - burned by losses on hedge funds - has submitted notices of redemption for $4.1 billion of those holdings. “As of today, we have received $1.2 billion of proceeds from those redemptions."

European Stocks Tumble After EU Slashes Growth, Inflation Guesses

Submitted by Tyler Durden on 05/03/2016 - 09:09 Despite unleashing his bazooka, Mario Draghi - like his colleagues at The BoJ - appears to have hit the limit of his impotence as the European Commission cut its outlook for growth and inflation across the Union for 2016 and 2017. Citing the economic slowdown in China and other emerging markets, geopolitical tensions and uncertainty ahead of the U.K. referendum on EU membership, WSJ reports EU’s economists also cautioned that the strength of factors that have been supporting growth in the region, such as low oil prices and a weaker euro, could start to fade. This sparked modest Euro weakness (after a non-stop surge in the last week) dragging down European stocks and darkening the outlook for the banking system further.

German Coverup Scandal: Ministry Urged Erasing "Rape" From "Monstrous" Cologne Migrant Attack Report

Submitted by Tyler Durden on 05/03/2016 - 08:47 A high-ranking police officer has alleged that his seniors tried to strike the word rape from an internal police report after the mass sexual assaults in Cologne over New Year. A chief superintendent in the Cologne police told the investigative committee established in the wake of the attacks that the interior ministry in North Rhine-Westphalia had sought to influence the investigations.

Aussie Dollar Crashes Through Key Support After "Surprise" Rate Cut

Submitted by Tyler Durden on 05/03/2016 - 08:34 As a major leg of many carry trades, the collapse of the Aussie Dollar in the last week has sent ripples through many risk-on positions. Following last week's plunge in inflation to record lows, one would have assumed that expectations for a 'stimulating' rate-cut were baked in to some extent (as AUD plunged then), but this morning's surprise RBA move has sparked another leg down in the commodity currency, breaking below a crucial uptrend off the January lows as the commodity currency decouples from exuberance in Chinese metals...

Two Wrongs Don't Make A Right - Is Fiorina The Fall Gal?

Submitted by Tyler Durden on 05/03/2016 - 08:24 What does this absurd gimmick tell us about him, given that he cannot possibly win the required number of delegates any longer? A sign of mental illness perhaps? Probably not. We think it is telling us that he is desperately trying to ingratiate himself with the Republican establishment – which is firmly anti-Trump for the simple reason that Trump is a genuine threat to its cozy cronyism. The only purpose of Mr. Cruz’ continued participation in the primaries is an attempt to deny The Donald the majority of delegates in order to bring about a brokered convention."This Has Been The Longest Selling Streak In History" - 'Smart Money' Sells For Record 14 Consecutive Weeks

Submitted by Tyler Durden on 05/03/2016 - 08:04 "Last week, during which the S&P 500 fell 1.3% in its biggest weekly decline since early Feb., BofAML clients were net sellers of US equities for the 14th consecutive week, in the amount of $2.8bn. As we noted last week, this has been the longest uninterrupted selling streak in our data history (since ‘08)—previously the longest streak was 12 weeks (in late ‘10)."

First US Soldier In Iraq Killed By Islamic State During "Enemy Fire"

Submitted by Tyler Durden on 05/03/2016 - 07:14 US "boots on the ground" on Iraq have just suffered their first casualty. Moments ago US Defense Secretary Ash Carter announced that the Islamic State killed the first U.S. serviceman in Iraq who was aiding Kurdish fighters near the northern Iraqi city of Mosul. A statement from the US-led forces in Iraq added the fatality was "a result of enemy fire." "It is a combat death, of course. And a very sad loss," Carter told reporters at a press conference in Germany.

"Unexpected" Australian Rate Cut To Record Low Unleashes FX Havoc, Global "Risk Off"

Submitted by Tyler Durden on 05/03/2016 - 06:39 Overnight Australia finally admitted it has succumbed to the global economic weakness plaguing the rest of the world when in a "surprise" move, Australia’s central bank cut its benchmark interest rate for the first time in a year to a record low and left the door open for further easing to counter a wave of disinflation that’s swept over the developed world. The move sent the local currency tumbling and local stocks climbing. Reserve Bank of Australia Governor Glenn Stevens and his board lowered the cash rate by 25 basis points to 1.75 percent Tuesday, a move predicted by just 12 of 27 economists surveyed by Bloomberg. The announcement has, not surprisingly unleashed havoc across FX markets and broadly pushed global mood into its latest "risk off" phase.Obamacare To Unveil "Price Shock" One Week Before The Elections

Submitted by Tyler Durden on 05/02/2016 - 23:18 The last thing Democrats want to contend with just a week before the 2016 presidential election is an outcry over double-digit insurance hikes as millions of Americans begin signing up for Obamacare. But that looks increasingly likely as health plans socked by Obamacare losseDon't Sleep Through The Revolution: A Graduation Message For A Dark Age

Submitted by Tyler Durden on 05/02/2016 - 22:55 Unfortunately, we who should have known better failed to guard against such a future. The world is disintegrating on every front - politically, environmentally, morally - and for the next generation, the future does not look promising. The following bits of wisdom, gleaned from a lifetime of standing up to injustice and speaking truth to power, will hopefully help them survive the perils of the journey that awaits...

China Manufacturing PMI Disappoints - In Contraction For 14th Straight Month

Submitted by Tyler Durden on 05/02/2016 - 22:20 Despite a trillion dollars of credit spewed into the Chinese 'economy' speculative finance channels, Manufacturing remains in a slump as April's China PMI tumbled to 49.4 after a brief bounce back up to 49.8 (from the 48.0 low in Feb). This is the 14th month in a row of contraction. As Caixin reports, relatively weak market conditions and muted client demand contributed to a further solid decline in staff numbers, which seems to put a nail in the coffin of anyone who believes recent price action in industrial commodities is anything but speculative fervor.

I don’t often delve into politics. We promised you financial information, and I aim to provide just that. Unfortunately, they intersect, often with disastrous results.

There is something pressing that absolutely needs to be addressed right now in this election, both by voters and politicians alike, and it isn’t coming up at all.

The Social Security Disability Insurance program will be depleted within a few years. Social Security will be tapped out in the mid-2030s.

That means one thing: The government will soon raise taxes — and is definitely going to hand you a hefty income cut.

Read More

Hey

brothers, I’ll be mostly away this week on a much-needed vacation with

family. My friend Solution, has graciously offered a piece for us this

week. I hope you enjoy it. See y’all soon! -WW

Hey

brothers, I’ll be mostly away this week on a much-needed vacation with

family. My friend Solution, has graciously offered a piece for us this

week. I hope you enjoy it. See y’all soon! -WWThe tireless research and study by the Wealth Watchman, and (undoubtedly) the attention of family, has given me the opportunity to present once again. And it is always a great privilege to opine on behalf of the Wealth Watchman and his shield-brethren; I am humbled by this opportunity! Until recently I really have been mostly uninspired but if I am reading the smoke signals correctly the winds of change are a comin’! (Special Thanks to my #1 son for the graphics work on the title…he has skillz that his dad lacks!)

Read More

from Washington’s Blog:

Presently, three supposed ‘trade’ deals are being proposed by U.S. President Barack Obama, to be signed by major trading nations (except Russia, China, and the other BRICS nations): TPP with Asia, TTIP with Europe, and also (but only for financial and other services) TISA with Europe. The promised benefits in all three cases are said to be economic.

Three independent economic studies have been done, two of Obama’s TTIP treaty with Europe, and one of his TPP treaty with Asia, and all three independent economic analyses find that the publics in each participating country will suffer, and that the owners of international corporations (especially in the U.S.) will benefit, if the proposed ‘trade’ deal goes into effect.

Read More

Presently, three supposed ‘trade’ deals are being proposed by U.S. President Barack Obama, to be signed by major trading nations (except Russia, China, and the other BRICS nations): TPP with Asia, TTIP with Europe, and also (but only for financial and other services) TISA with Europe. The promised benefits in all three cases are said to be economic.

Three independent economic studies have been done, two of Obama’s TTIP treaty with Europe, and one of his TPP treaty with Asia, and all three independent economic analyses find that the publics in each participating country will suffer, and that the owners of international corporations (especially in the U.S.) will benefit, if the proposed ‘trade’ deal goes into effect.

Read More

by J. D. Heyes, Natural News:

A so-called “weed” growing right in your front and back yards could hold the key to being the most effective cancer-fighting compound in the world.

A so-called “weed” growing right in your front and back yards could hold the key to being the most effective cancer-fighting compound in the world.

Previous research, as well as recent research from the University of Windsor in Canada, has found that dandelion root may be especially effective in treating and defeating cancer, and much more so than immune system-destroying chemotherapy.

As noted by the university in a press release, researchers are so sure that they have finally developed the correct dosage of the extract, that they are preparing clinical trials using a specially formulated dandelion tea.

Read More

A so-called “weed” growing right in your front and back yards could hold the key to being the most effective cancer-fighting compound in the world.

A so-called “weed” growing right in your front and back yards could hold the key to being the most effective cancer-fighting compound in the world.Previous research, as well as recent research from the University of Windsor in Canada, has found that dandelion root may be especially effective in treating and defeating cancer, and much more so than immune system-destroying chemotherapy.

As noted by the university in a press release, researchers are so sure that they have finally developed the correct dosage of the extract, that they are preparing clinical trials using a specially formulated dandelion tea.

Read More

from GoldSeek:

The price of gold shot up over $60 this week. The price of silver moved up proportionally, gaining over $0.85. The mood is now palpable. The feeling in the air is that of long suffering suddenly turned to optimism. Big gains, if not the collapse of the price-suppression cartel, are now inevitable.

The headlines and articles, screaming for gold to hit $10,000 to $50,000, are pervasive. Today we won’t dwell on our favorite point that if the price of gold hits $50,000 then that means the price of the dollar has collapsed. If you own an ounce of gold, then you may have a lot more dollars. But unfortunately, each of those dollars is worth a lot less.

Today, we want to look at this new alleged precious metals bull market. Does it have legs? Are we likely to see silver hit $20, much less $1,000? We will support our analysis with a new graph to show the big picture.

Read More

The price of gold shot up over $60 this week. The price of silver moved up proportionally, gaining over $0.85. The mood is now palpable. The feeling in the air is that of long suffering suddenly turned to optimism. Big gains, if not the collapse of the price-suppression cartel, are now inevitable.

The headlines and articles, screaming for gold to hit $10,000 to $50,000, are pervasive. Today we won’t dwell on our favorite point that if the price of gold hits $50,000 then that means the price of the dollar has collapsed. If you own an ounce of gold, then you may have a lot more dollars. But unfortunately, each of those dollars is worth a lot less.

Today, we want to look at this new alleged precious metals bull market. Does it have legs? Are we likely to see silver hit $20, much less $1,000? We will support our analysis with a new graph to show the big picture.

Read More

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment