Submitted by Tyler Durden on 05/09/2016 - 20:58

Submitted by Tyler Durden on 05/09/2016 - 20:58

"We’re much more concerned about the market going down 20% than we are it going up 20%. And so the significant weighting to the short side reflects that."

Trump On Debt Renegotiation: "You Never Have To Default Because You Print The Money"

Submitted by Tyler Durden on 05/09/2016 - 08:56 "If interest rates go up, we can buyback debt at a discount if we are liquid enough as a country. People say I want to default on debt - these people are crazy. First of all you never have to default because you print the money I hate to tell you, so there is never a default. It was reported in the NYT that I want to default on debt - you know I am the king of debt, I love debt, but debt is tricky and its dangerous. But let me just tell you: if interest rates go up and bonds go down, you can buy debt - that's what I'm talking about."

Paul Craig Roberts Warns 'Killary' Will Be "The Last American President"

Submitted by Tyler Durden on 05/09/2016 - 22:30 "The question is: will enough insouciant Americans align with the One Percent, the neocons, the men-hating feminists, homosexuals, the transgendered, and other “preferred minorities” to put the US presidency in the hands of an aggressive, corrupt person with a conscience deficit? That is the goal toward which the presstitutes are driving the brainwashed. If we end up with Killary, neither the US nor the world will survive the mistake. She will be the last American president..."

State Department "Unable To Find" Hillary Emails To IT Aide, Apologizes For Incompetence

Submitted by Tyler Durden on 05/09/2016 - 20:57 "The department has searched for Mr. Pagliano's e-mail PST file, and has not located one that covers the time period of Secretary Clinton's tenure... The department does acknowledge, we must work to improve our systems for record management and retention as part of the ongoing effort, the department is not automatically archiving Secretary Kerry's e-mails as well as the e-mails of numerous senior staff."Remembering The Lessons Of WWII: Putin Calls For A "Non-Aligned System Of International Security"

Submitted by Tyler Durden on 05/09/2016 - 22:05 The evil the world faces today is akin to that of the Nazi threat during WWII, warned Vladimir OPutin today at the V-Day celebrations, and called upon everyone to remember the lessons of history, unify, and defeat the terrorists. "The lessons of history show that peace on our planet doesn't establish itself, that you need to be on high alert. We must defeat this evil, and Russia is open to join forces with all countries and is ready to work on the creation of a modern, non-aligned system of international security."

Cell Phone Addiction: 15 Numbers That Show The Ridiculous Obsession Americans Have With Their Phones

Submitted by Tyler Durden on 05/09/2016 - 21:25 No matter who is around and no matter how important what they are supposed to be doing may be, many Americans feel a deep, dark compulsion to constantly check their smartphones. As you will see below, the average user checks his or her phone 35 times a day, but of course there are some people that are well into the triple digits. Cell phone addiction is very real, and that is why there are actually rehab programs for this sort of thing. Unfortunately, we simply can’t put the entire country into rehab, and this problem just keeps getting worse with each passing year.

M. King Hubbert: The Limits To Oil

Submitted by Tyler Durden on 05/09/2016 - 20:35 M. King Hubbert did more to raise awareness of the finite nature of global oil reserves than any other person, living or dead. He was a larger-than-life figure, who fought tirelessly to insert the limits of nature into the national dialog regarding the strategic use of resources. Yet surprisingly little has been publicly documented about the man, even though we are hurtling ever faster into a future shaped by the very limits he warned about.

Options Traders Confidence Collapses Most Since August Crash

Submitted by Tyler Durden on 05/09/2016 - 20:10 The realized (actual) volatility of the US equity market has plunged in recent weeks to its lowest since April 2015 as an odd complacency washed across risk assets emboldened by "whatever it takes" synonyms spewing from every and any central banker in the world. However, options traders appear to be losing faith in the market turmoil cease-fire as implied volatility (the market's best guess at future uncertainty) trades at its largest premium to historical volatility in over a year.

China Trade And The Inevitability Of Systemic Reset

Submitted by Tyler Durden on 05/09/2016 - 19:45 The reset is the answer, not the problem. Delaying the answer only elongates the pain of the problem. Under the direction of orthodox economics (the fusion of Keynes and monetarism) the world’s “stimulus” apparatus is making a bad situation worse by (at best) dragging it out far longer than maybe it would have under more traditional business cycle conditions. Belief in the power of “stimulus” to make it happen prevents awareness of what is, again, really a paradigm shift that will not be altered. What we are analyzing, then, is not what awaits but how long it takes to get there and the huge, growing costs to delay what looks only inevitable.

Record Number Of Parents Tell Kids They're On Their Own When It Comes To College Bill

Submitted by Tyler Durden on 05/09/2016 - 19:26 The current outstanding student loan debt in the United States is roughly $1.3 trillion, and getting bigger by the second. The good news (for those not concerned about economic realities), Obama has just set the precedent that loans will be forgiven, the bad news, parents are now telling their kids to take out more student loans if they intend on going to college.

The Twilight Of The Gods (aka Central Bankers)

Submitted by Tyler Durden on 05/09/2016 - 18:55 The current financial market volatility increasingly reflects loss of faith in policy makers. Celebrity central bankers are learning that they must constantly produce new miracles for their followers. For the moment, the volatility is confined to financial markets and the effect on the real economy is limited. The ever present risk is of a doom loop where financial market problems lead to banking system weakness which, in turn, feeds a credit crunch and a contraction in economic activity. That familiar movie does not have a happy ending.

Hard LendingClub: Fallout From P2P Scandal Results In Another Resignation; John Mack Is Dragged In

Submitted by Tyler Durden on 05/09/2016 - 17:46 As we reported earlier today, following the surprising "resignation" of the company's CEO and Chairman, Renaud Laplanche as a result of an "internal board review of sales of $22 million in near-prime loans to a single investor", which resulted in the stock losing a quarter of its market cap in minutes, subsequent revelations have seen the spotlight shining brightly on none other than former Morgan Stanley CEO and current Lending Club board member, John Mack, who according to Bloomberg invested in the same venture that led to the termination resignation of the CEO.

Citi: "Wage Growth Only For The Wealthy"

Submitted by Tyler Durden on 05/09/2016 - 16:47 As Citi shows, job creation since 2009 has been largely bimodal, benefiting the two income extremes, or as he puts it "Chefs and CEOs, with not much in between." But even more notable is the chart on the right which King summarizes very simply: there has been wage growth but "only for the wealthy."Biotech-Buying Spree Helps Stocks Shrug Off China Crash, Commodity Collapse, & Credit Crunch

Submitted by Tyler Durden on 05/09/2016 - 16:02

The Problem Of Excessive Optimism

Submitted by Tyler Durden on 05/09/2016 - 15:55 "If we have borrowed more from our future than any time in history and markets value the future, we should be selling at a discount, not a premium to historic valuations... Overconfidence and over valuation always extract a terrible payback."

Morgan Stanley: "Creative Destruction, Once The Backbone Of Capitalism, Is No Longer Considered"

Submitted by Tyler Durden on 05/09/2016 - 15:41 "Austrian School-like destruction, increasing exports and finally providing debt-funded domestic demand. Creative destruction, once the backbone of a functioning capitalist system, is no longer seriously considered as the social costs of this approach appear unacceptably high."

St. Louis Fed Slams Draghi, Kuroda - "Negative Rates Are Taxes In Sheep's Clothing"

Submitted by Tyler Durden on 05/09/2016 - 15:15 "At the end of the day, negative interest rates are taxes in sheep’s clothing. Few economists would ever claim that raising taxes on households will stimulate spending. So why would they think negative interest rates will?"The Best Arbitrage Trade In The World Today

Submitted by Tyler Durden on 05/09/2016 - 15:00

Cameron's 'Project Fear' Goes Full M.A.D. - Vote No To Brexit Or Face World War 3

Submitted by Tyler Durden on 05/09/2016 - 14:45 Just as the government did in the lead up to The Scottish Referendum in 2014, it appears David Cameron is already escalating the so-called Project Fear. In a stunning statement of sheer fearmongery, clearly reflecting the establishment's panic at the rise of Brexit votes in the polls, The Telegraph reports UK PM David Cameron warned that Britain will pay a high cost if "we turn our back" on the EU, invoking Sir Winston Churchill and highlighting the battles of Trafalgar, Blenheim, Waterloo and the two World Wars as evidence that Britain cannot pretend to be "immune from the consequences."Facebook Workers Admit They "Routinely" Suppressed Conservative News

Submitted by Tyler Durden on 05/09/2016 - 14:36 "We as a company are neutral - we have not and will not use our products in a way that attempts to influence how people vote." That is a quote from a Facebook spokesperson given in response to a leaked internal poll which asked what responsiblity Facebook had in preventing Donald Trump from becoming the next president. In light of the fact that a former employee is now admitting Facebook routinely suppresses conservative news stories from its trending news section, we're curious if that same response will be used.

Trumptopia Vs. Deep-State Democracy

Submitted by Tyler Durden on 05/09/2016 - 14:30 For decades, this country has see-sawed between the long tenures of two Deep State errand boys from each major party, putting both parties in such a bad odor that Trump now rises on their mephitic fumes. Hillary Clinton, of course, is the Deep State incarnate, which is the real reason so few citizens trust her. Every poor schnook getting shaken down for a $90,000 appendectomy bill looks at Hillary and knows exactly what she represents. Voters seem attracted to Trump because he’s so eager to give the finger to the Deep State. It deserves the finger, but it also needs to be carefully disassembled without blowing up what remains of this country.

Full List Of 214,000 Offshore Shell Companies Linked To "Panama Papers" Released Online

Submitted by Tyler Durden on 05/09/2016 - 14:17 Whether it was funded by Soros, the CIA, the Rothschilds or even Putin is unclear, but moments ago the International Consortium of Investigative Journalists - the group responsible for preparing and organizing the Panama Papers leak - published a searchable database laying out 214,000 offshore entities created in 21 jurisdictions, from Nevada to Hong Kong and the British Virgin Islands.

The Bank Of Japan Begins Selling ¥1.3 Trillion In Stocks Acquired Over The Years

Submitted by Tyler Durden on 05/09/2016 - 13:37 In a stark reminder, that what central banks buy they eventually have to sell, Japan's Nikkei writes that the Bank of Japan has begun selling equities it bought from commercial banks in the previous decade to ease anxiety over the financial sector. But before some interpret the move as a risk to Japan's stock "market" as the biggest equity backstopper now becomes a seller, concurrent with the BOJ's liquidations Kuroda will offset these divestments with extra purchases of exchange-traded funds, in effect netting out selling with even more stock buying.

Poland Refuses To Accept Any Refugees "As They Pose A Threat To Security", Will Not Comply With European "Blackmail"

Submitted by Tyler Durden on 05/09/2016 - 13:17 Seemingly unfazed by the recent European Commission proposal to punish countries which refuse to comply with "fair" refugee allocation quotas with fines as high as €250,000 per asylum seeker, the head of Poland’s ruling Law and Justice party and former PM Jaroslaw Kaczynski said that no refugees will be accepted in Poland "as they pose a threat to security" adding that Poland will oppose any law forcing EU members to pay €250,000 per refused refugee. The U.S. is now in its eighth year since the Wall Street bank collapse

of 2008 and most members of the general public believe the bailouts are

long finished. That’s a fallacy. Last Friday, the Government

Accountability Office (GAO) released a report

showing that there are 16 banks still involved in the original bailout

program – one of which, First Bancorp, owes the government $124.97

million or 49 percent of the funds owed by the other 15 banks combined.

First Bancorp continues to trade on the New York Stock Exchange under

the stock symbol, FBP. The common stock of First Bancorp has declined

from over $150 a share in 2009 to close last Friday at $3.72. According

to the company’s 10K filed with the Securities and Exchange Commission

for year-end December 31, 2015, the U.S. government still owned 4.8

percent of the company’s common stock at that time.

The U.S. is now in its eighth year since the Wall Street bank collapse

of 2008 and most members of the general public believe the bailouts are

long finished. That’s a fallacy. Last Friday, the Government

Accountability Office (GAO) released a report

showing that there are 16 banks still involved in the original bailout

program – one of which, First Bancorp, owes the government $124.97

million or 49 percent of the funds owed by the other 15 banks combined.

First Bancorp continues to trade on the New York Stock Exchange under

the stock symbol, FBP. The common stock of First Bancorp has declined

from over $150 a share in 2009 to close last Friday at $3.72. According

to the company’s 10K filed with the Securities and Exchange Commission

for year-end December 31, 2015, the U.S. government still owned 4.8

percent of the company’s common stock at that time.In addition, as Wall Street On Parade reported last month, the U.S. Treasury agreed to pump in an additional $258.1 billion going forward if Freddie Mac or Fannie Mae run into trouble, on top of the $187.5 billion they have already received from the U.S. taxpayer. In their first quarter earnings reports, both companies reported significant losses in their derivatives books but did not tap their Treasury lifelines further – at least for now. Freddie Mac and Fannie Mae were put into conservatorship by the U.S. government during the 2008 crisis. Wall Street banks are entangled with Freddie Mac and Fannie Mae because they serve as counterparties to each other’s trillions of dollars in derivatives.

Read More

from China Rising:

The Sino-Russian alliance continues to prosper and expand, even though

the two countries’ governments don’t want to call it that. Since the

last installment of the Moscow-Beijing Express, I could write another article about all the visits, communications, deals signed, plans made, exports and imports: http://chinarising.puntopress.com/2016/04/02/the-china-russia-alliance-is-in-full-bloom-if-you-know-where-to-look/

Suffice it to say that Russia and China continue to be tightly wound

together strategically, commercially, economically and diplomatically.

The Sino-Russian alliance continues to prosper and expand, even though

the two countries’ governments don’t want to call it that. Since the

last installment of the Moscow-Beijing Express, I could write another article about all the visits, communications, deals signed, plans made, exports and imports: http://chinarising.puntopress.com/2016/04/02/the-china-russia-alliance-is-in-full-bloom-if-you-know-where-to-look/

Suffice it to say that Russia and China continue to be tightly wound

together strategically, commercially, economically and diplomatically.

But for this dynamic duo on the world stage – the only force on Planet Earth which prevents all of humanity from kneeling down to the boot heel of Western tyranny, their surrounding skies continue to darken, and they are having to respond in kind. You have to be brainwashed by imperial propaganda to not see and admit that Eurangloland and its military phalanx, NATO, are preparing for an eventual hot war, of some shape or form, with China and Russia.

Read More

The Sino-Russian alliance continues to prosper and expand, even though

the two countries’ governments don’t want to call it that. Since the

last installment of the Moscow-Beijing Express, I could write another article about all the visits, communications, deals signed, plans made, exports and imports: http://chinarising.puntopress.com/2016/04/02/the-china-russia-alliance-is-in-full-bloom-if-you-know-where-to-look/

Suffice it to say that Russia and China continue to be tightly wound

together strategically, commercially, economically and diplomatically.

The Sino-Russian alliance continues to prosper and expand, even though

the two countries’ governments don’t want to call it that. Since the

last installment of the Moscow-Beijing Express, I could write another article about all the visits, communications, deals signed, plans made, exports and imports: http://chinarising.puntopress.com/2016/04/02/the-china-russia-alliance-is-in-full-bloom-if-you-know-where-to-look/

Suffice it to say that Russia and China continue to be tightly wound

together strategically, commercially, economically and diplomatically.

But for this dynamic duo on the world stage – the only force on Planet Earth which prevents all of humanity from kneeling down to the boot heel of Western tyranny, their surrounding skies continue to darken, and they are having to respond in kind. You have to be brainwashed by imperial propaganda to not see and admit that Eurangloland and its military phalanx, NATO, are preparing for an eventual hot war, of some shape or form, with China and Russia.

Read More

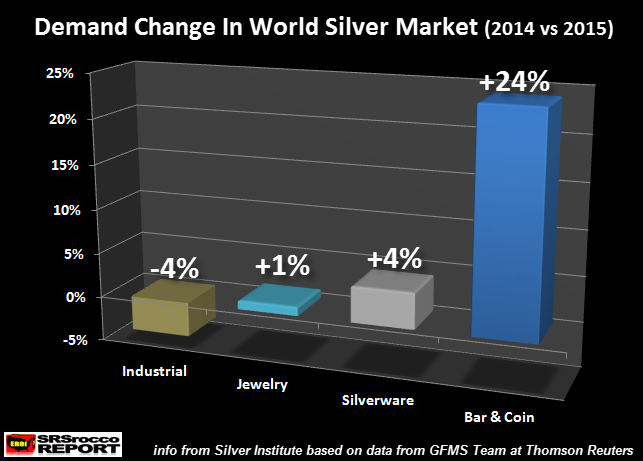

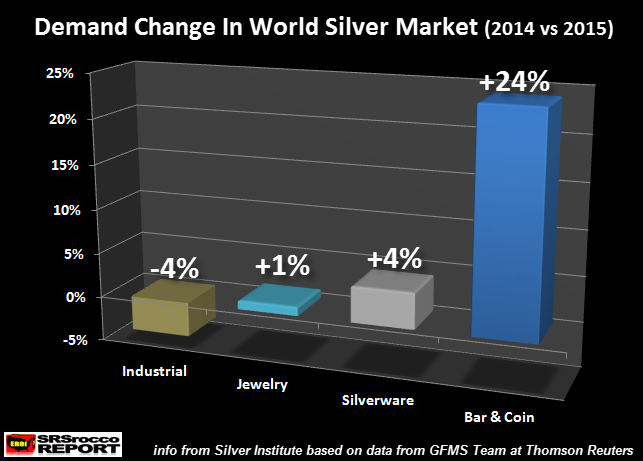

by Steven St. Angelo, SRS Rocco:

While precious metals investors are concerned about the short-term price movements in silver, the real focus should be on this amazing silver market trend. When the silver market data finally came out in the new 2016 World Silver Survey (released May 5th), it really surprised me. And, it takes a lot to surprise me.

Not only did physical Silver Bar & Coin demand hit a new record in 2015, it did so in a huge way. Physical Silver Bar & Coin demand jumped 24% in 2015 versus the prior year reaching a record 292.3 million oz (Moz). Part of the reason for the higher record was the addition of “Private Bars & Rounds” to the statistics.

I had mentioned in prior articles that I had an email exchange with the GFMS Team at Thomson Reuters about the Private Bars & Rounds figure. The GFMS Team stated that they were working on including this amount, but I thought it would be in the next few years. However, they updated all their past Silver Bar & Coin demand to include Private Bars & Rounds in the 2016 World Silver Survey.

Read More…

While precious metals investors are concerned about the short-term price movements in silver, the real focus should be on this amazing silver market trend. When the silver market data finally came out in the new 2016 World Silver Survey (released May 5th), it really surprised me. And, it takes a lot to surprise me.

Not only did physical Silver Bar & Coin demand hit a new record in 2015, it did so in a huge way. Physical Silver Bar & Coin demand jumped 24% in 2015 versus the prior year reaching a record 292.3 million oz (Moz). Part of the reason for the higher record was the addition of “Private Bars & Rounds” to the statistics.

I had mentioned in prior articles that I had an email exchange with the GFMS Team at Thomson Reuters about the Private Bars & Rounds figure. The GFMS Team stated that they were working on including this amount, but I thought it would be in the next few years. However, they updated all their past Silver Bar & Coin demand to include Private Bars & Rounds in the 2016 World Silver Survey.

Read More…

by Ethan A. Huff, Natural News:

The California Environmental Protection Agency’s Office of

Environmental Health Hazard Assessment (OEHHA) recently released a

document called Evidence on the Carcinogenicity of Fluoride and Its Salts

that highlights the many health hazards caused by the consumption of

fluoride. And the Fluoride Action Network (FAN) recently submitted a

compilation of its own to OEHHA, which is soon to make a final decision

concerning fluoride’s toxicity, providing additional evidence that

fluoride causes cancer.

The California Environmental Protection Agency’s Office of

Environmental Health Hazard Assessment (OEHHA) recently released a

document called Evidence on the Carcinogenicity of Fluoride and Its Salts

that highlights the many health hazards caused by the consumption of

fluoride. And the Fluoride Action Network (FAN) recently submitted a

compilation of its own to OEHHA, which is soon to make a final decision

concerning fluoride’s toxicity, providing additional evidence that

fluoride causes cancer.

FAN has been working for many years to raise awareness about the toxicity of fluoride, with the eventual goal of getting it removed from public water supplies. And its most recent efforts involving OEHHA could be the straw that breaks the camel’s back, so to speak, as it has the potential to unleash the truth about fluoride on a massive scale, and spark a revolt against its use.

According to a recent FAN press release, OEHHA’s report was birthed out of an inquiry into the science of fluoride’s toxicity. It is also a prelude to the group’s scientific advisory board Carcinogen Identification Committee (CIC) meeting to be held on October 12 – 13, 2011, which will make a decision on the status of fluoride as a carcinogen.

Read More

The California Environmental Protection Agency’s Office of

Environmental Health Hazard Assessment (OEHHA) recently released a

document called Evidence on the Carcinogenicity of Fluoride and Its Salts

that highlights the many health hazards caused by the consumption of

fluoride. And the Fluoride Action Network (FAN) recently submitted a

compilation of its own to OEHHA, which is soon to make a final decision

concerning fluoride’s toxicity, providing additional evidence that

fluoride causes cancer.

The California Environmental Protection Agency’s Office of

Environmental Health Hazard Assessment (OEHHA) recently released a

document called Evidence on the Carcinogenicity of Fluoride and Its Salts

that highlights the many health hazards caused by the consumption of

fluoride. And the Fluoride Action Network (FAN) recently submitted a

compilation of its own to OEHHA, which is soon to make a final decision

concerning fluoride’s toxicity, providing additional evidence that

fluoride causes cancer.FAN has been working for many years to raise awareness about the toxicity of fluoride, with the eventual goal of getting it removed from public water supplies. And its most recent efforts involving OEHHA could be the straw that breaks the camel’s back, so to speak, as it has the potential to unleash the truth about fluoride on a massive scale, and spark a revolt against its use.

According to a recent FAN press release, OEHHA’s report was birthed out of an inquiry into the science of fluoride’s toxicity. It is also a prelude to the group’s scientific advisory board Carcinogen Identification Committee (CIC) meeting to be held on October 12 – 13, 2011, which will make a decision on the status of fluoride as a carcinogen.

Read More

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment