Submitted by Tyler Durden on 05/27/2016 - 15:54 "The failure of American consumption to pick up over the past year and more in the manner expected can be explained not just by increased consumer caution but also by the increasing costs of two essentially nondiscretionary items for most Americans. That is the soaring cost of medical care and the rising cost of rents." That will be all.

ISIS Commander Killed In Falluja Airstrikes As A Familiar Face Emerges

Submitted by Tyler Durden on 05/27/2016 - 15:33 US-led coalition air and artillery strikes have killed 70 ISIS fighters in Fallujah, including the militants’ leader in the Iraqi city, a military spokesman said Friday. Baghdad-based Colonel Steve Warren said that over the last four days, 20 strikes in the besieged city had destroyed ISIS fighting positions and gun emplacements. “We’ve killed more than 70 enemy fighters, including Maher Al-Bilawi, who is the commander of ISIL forces in Fallujah."

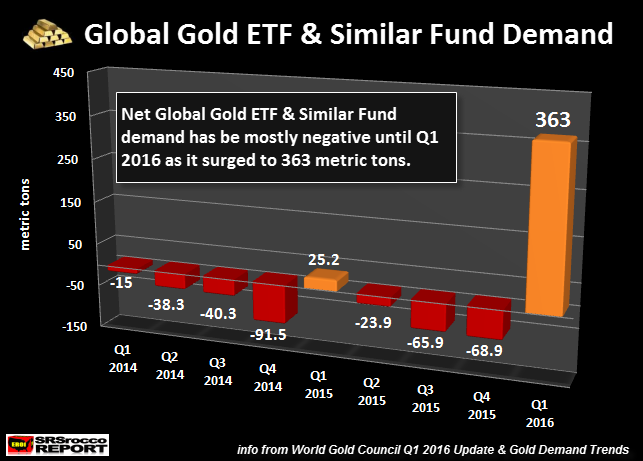

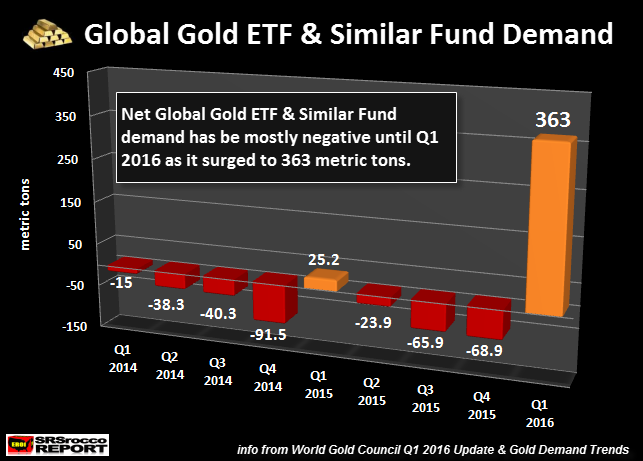

by Steve St. Angelo, SRSRocco Report:

Investors better be prepared as the next crash of the U.S. economy is

coming. This is not based on hype or speculation, rather due to the

disintegration of the underlying fundamentals. Matter-a-fact, the

fundamentals are so completely AWFUL, that the next market crash will

make 2008 look quite tame indeed.

Investors better be prepared as the next crash of the U.S. economy is

coming. This is not based on hype or speculation, rather due to the

disintegration of the underlying fundamentals. Matter-a-fact, the

fundamentals are so completely AWFUL, that the next market crash will

make 2008 look quite tame indeed.

To get the skinny on the lousy fundamental data, let’s first look at the Auto Industry. The next series of charts come from the article, More Warnings–Unsustainable Auto Sales & Stock PE Ratios:

Read More

Investors better be prepared as the next crash of the U.S. economy is

coming. This is not based on hype or speculation, rather due to the

disintegration of the underlying fundamentals. Matter-a-fact, the

fundamentals are so completely AWFUL, that the next market crash will

make 2008 look quite tame indeed.

Investors better be prepared as the next crash of the U.S. economy is

coming. This is not based on hype or speculation, rather due to the

disintegration of the underlying fundamentals. Matter-a-fact, the

fundamentals are so completely AWFUL, that the next market crash will

make 2008 look quite tame indeed.To get the skinny on the lousy fundamental data, let’s first look at the Auto Industry. The next series of charts come from the article, More Warnings–Unsustainable Auto Sales & Stock PE Ratios:

Read More

G-7 Refuses To Warn Of "Global Economic Crisis" Over Fear "Sentiment Can Become Self-Fulfilling"

Submitted by Tyler Durden on 05/27/2016 - 11:46 In order to press his individual agenda of preserving optionality to intervene in the FX market and push the Yen lower (using increasingly more desperate measures), Japan's Prime Minister had just one task in the latest G-7 meeting: to have the Group of Seven leaders warn of the risk of a global economic crisis in the final communique issued as the summit wrapped earlier today in Japan. He failed. The reason why: "the G-7 is obviously aware of the ‘announcement effect’ the official communique has. In such a situation, warning of negative risks and sentiment can become self-fulfilling.""

Here's Why All Pension Funds Are Doomed, Doomed, Doomed

Submitted by Tyler Durden on 05/27/2016 - 13:50 It's looking increasingly likely that third time's the charm: this set of bubbles is the last one central banks can blow. And when markets free-fall and don't reflate into new bubbles, pension funds will expire, as they were fated to do the day central banks chose zero interest rates forever as their cure for a broken economic model.

by Paul Craig Roberts, Paul Craig Roberts:

Having successfully used the EU to conquer the Greek people by turning

the Greek “leftwing” government into a pawn of Germany’s banks, Germany

now finds the IMF in the way of its plan to loot Greece into oblivion .

Having successfully used the EU to conquer the Greek people by turning

the Greek “leftwing” government into a pawn of Germany’s banks, Germany

now finds the IMF in the way of its plan to loot Greece into oblivion .

The IMF’s rules prevent the organization from lending to countries that cannot repay the loan. The IMF has concluded on the basis of facts and analysis that Greece cannot repay. Therefore, the IMF is unwilling to lend Greece the money with which to repay the private banks.

The IMF says that Greece’s creditors, many of whom are not creditors but simply bought up Greek debt at a cheap price in hopes of profiting, must write off some of the Greek debt in order to lower the debt to an amount that the Greek economy can service.

Read More

Having successfully used the EU to conquer the Greek people by turning

the Greek “leftwing” government into a pawn of Germany’s banks, Germany

now finds the IMF in the way of its plan to loot Greece into oblivion .

Having successfully used the EU to conquer the Greek people by turning

the Greek “leftwing” government into a pawn of Germany’s banks, Germany

now finds the IMF in the way of its plan to loot Greece into oblivion .The IMF’s rules prevent the organization from lending to countries that cannot repay the loan. The IMF has concluded on the basis of facts and analysis that Greece cannot repay. Therefore, the IMF is unwilling to lend Greece the money with which to repay the private banks.

The IMF says that Greece’s creditors, many of whom are not creditors but simply bought up Greek debt at a cheap price in hopes of profiting, must write off some of the Greek debt in order to lower the debt to an amount that the Greek economy can service.

Read More

What Would Ludwig von Mises Do In Venezuela?

Submitted by Tyler Durden on 05/27/2016 - 15:20 The crisis in Venezuela is the most modern illustration of the horrific consequences of socialism and the devastating reality of hyperinflation. What makes this disaster all the more infuriating is that it could have been avoided with a basic understanding of history. We’ve seen the disaster of socialism and interventionism in various forms play out across the world time and time again with similar results, and yet new generations of central planners — backed by ideologically aligned intellectuals — are consistently able to fool people into believing that “this time will be different.”

Yellen Says Rate Hikes Soon As Need More Ammo "In Case Of Shock" - Live Feed

Submitted by Tyler Durden on 05/27/2016 - 13:11 *YELLEN: ECONOMY IS CONTINUING TO IMPROVE*YELLEN: WITH GAINS, HIKE IN COMING MONTHS MAY BE APPROPRIATE

*YELLEN: DON'T HAVE TYPICAL SCOPE TO CUT RATES IN CASE OF SHOCK

Explaining Bernie-Conomics Using Two Beers

Submitted by Tyler Durden on 05/27/2016 - 15:05 It's simple really...

BTFVIX?

Submitted by Tyler Durden on 05/27/2016 - 14:50 With Goldman suggesting VIX should be in the upper teens based on 'fundamentals' and event risks galore on the horizon (FOMC, Brexit, Spain elections, US elections, etc.) Geneva Swiss Bank suggests it is time to BTFVIX...

Hedge Fund Billionaire Slams Democracy, Says The "Tyranny Of The Majority Is An Unhealthy Development"

Submitted by Tyler Durden on 05/27/2016 - 14:38 In his latest letter to investors, OakTree Capital's Howard Marks goes political (slamming Trump's tariffs and Bernie's minimum wage machinations), shedding some blinding light on the economic reality of America, the dismal failure (and increasing impotence) of central bankers, and the ongoing "tryanny of the majority" warning that if everyone wants to tax-the-rich, soon there will be no rich to tax. As he concludes, short-term fixes simply cannot create wealth out of thin air (see Venezuela), as Churchill once said "for a nation to try to tax [or stimulate or devalue] itself into prosperity is like a man standing in a bucket and trying to lift himself up by the handle."

Alibaba’s SEC Probe: What’s Missing From This Disclosure?

Submitted by Tyler Durden on 05/27/2016 - 14:35 On 24-May-2016, Alibaba Group disclosed what appears to be an informal SEC investigation. This is the first time this matter has been disclosed. Details are scant, leaving the investor unable to adequately assess the risk it poses. Using the template of who/what/where/when/why, we will examine what is missing. Our conclusion is you are left with a risk that management views as material but you cannot analyze. We generally recommend avoiding such scenarios.

This Week's Main News From The Oil Sector

Submitted by Tyler Durden on 05/27/2016 - 14:10 For those who need a quick and easy recap of all the main events that took place in the oil and gas services sector, here it is courtesy of Credit Suisse's James Wicklung who present the various "things we've learned this week."

Stocks, Bonds Slide As Hawkish Yellen Sends July Rate-Hike Odds To Record Highs

Submitted by Tyler Durden on 05/27/2016 - 14:09 Following Yellen's uncharacteristicaly hawkish tone, the odds of a July rate-hike have shot higher - now higher than June or September have ever been - to record highs. This has sent short-term bond yields higher, the yield curve dramatically flatter, stocks lower, and gold down...

Death By A Theta Cuts

Submitted by Tyler Durden on 05/27/2016 - 13:30 Implied volatility should remain structurally elevated into and through an eventual recession (and likely bear market) before subsiding once the next sustained recovery has begun. That is precisely why we have struggled with the idea that the high-volatility regime intact since last August may truncate at less than a year. If our reasoning is correct and volatility remains structurally elevated, it follows that the recent three-month cyclical trough, as the longest such period on record, is statistically unlikely to last much longer.

Why Stocks Keep Rising Despite Another Rate Hike On The Horizon: One Explanation

Submitted by Tyler Durden on 05/27/2016 - 13:08 "It would seem to us that the equity outcome in the weighted average view is a lot less positive. There are few S&P 2500 optimists even at 2.5% growth but plenty of S&P 1600 or less pessimists on the negative scenario. Bottom line – one more and pretty much done is unlikely to be as risk positive as recent asset market prices action suggests."

Crude Traders Shrug As Oil Rig Count Resumes Decline

Submitted by Tyler Durden on 05/27/2016 - 13:05 Following last week's unchanged oil rig count - breaking a 21-week streak of declines - as the rig count inflected perfectly with lagged oil prices. However, despite a rise in lagged oil prices, the oil rig count declined 2 to 316 this week - new lows since Oct 2009. Total rig count dropped to 404 - a new record low. Crude traders appear to have left for the day as there was no visible reaction to this data."I'm Going To Stick With This Right To The End" - French President Hollande Threatens Union Protesters

Submitted by Tyler Durden on 05/27/2016 - 12:23 "We can't accept that there are unions that dictate the law. This is not a moment to endanger the French recovery. As head of state, I want us to go right to the end."

Exposing Detroit's "No School Administrator Left Behind" Program

Submitted by Tyler Durden on 05/27/2016 - 12:04 Federal investigators revealed another blow to Detroit Public Schools this week. Meet Carolyn StarkeyDarden - the system’s former grant-development director - who has just been charged on suspicion of obtaining nearly $1.3 million by lying about children’s tutoring services. As The Burning Platform's Jim Quinn rages, this is called the “No School Administrator Left Behind” Program.

"The Great White Hope"

Submitted by Tyler Durden on 05/27/2016 - 11:19 “Angry white male” is now an acceptable slur in culture and politics. So it is that people of that derided ethnicity, race, and gender see in Donald Trump someone who unapologetically berates and mocks the elites who have dispossessed them, and who despise them. Is it any surprise that militant anti-government groups attract white males? Is it so surprising that the Donald today, like Jess Willard a century ago, is seen by millions as “The Great White Hope”?

In Stunning Reversal, IMF Blames Globalization For Spreading Inequality, Causing Market Crashes

Submitted by Tyler Durden on 05/27/2016 - 10:51 In a stunning reversal for an organization that rests at the bedrock of the modern "neoliberal" (a term the IMF itself uses generously), aka capitalist system, overnight IMF authors Jonathan D. Ostry, Prakash Loungani, and Davide Furceri issued a research paper titled "Neoliberalism: Oversold?" whose theme is a stunning one: it accuses neoliberalism, and its immediate offshoot, globalization and "financial openness", for causing not only inequality, but also making capital markets unstable. WikiLeaks releases latest documents from TISA negotiations … The

classified annex to the draft “core text” of the Trade in Services

Agreement is part of what is being secretly negotiated by the U.S., EU

and 22 countries. The website WikiLeaks released on Wednesday

classified documents from the Trade in Services Agreement, or TISA,

which is a huge trade agreement being negotiated in secret by the United

States, the European Union and 22 other countries. -Telesur

WikiLeaks releases latest documents from TISA negotiations … The

classified annex to the draft “core text” of the Trade in Services

Agreement is part of what is being secretly negotiated by the U.S., EU

and 22 countries. The website WikiLeaks released on Wednesday

classified documents from the Trade in Services Agreement, or TISA,

which is a huge trade agreement being negotiated in secret by the United

States, the European Union and 22 other countries. -TelesurThis release seems to make it clear that global elites are using trade treaties to write a new global constitution.

What is the new structure being imposed?

Over the past millennium, societies have been organized around feudalism and democracy. Now we are headed toward corporatism.

Read More

As regular readers know, we have long warned that the End Game for the

banksters manipulation of the bond markets & interest rates via gold

and silver manipulation will occur when industrial users of physical

silver, namely the colossal electronics industry- sniff the first signs

of a wholesale shortage of physical silver, and begin panic hoarding of

silver to ensure continued production of their tech gadgets.

As regular readers know, we have long warned that the End Game for the

banksters manipulation of the bond markets & interest rates via gold

and silver manipulation will occur when industrial users of physical

silver, namely the colossal electronics industry- sniff the first signs

of a wholesale shortage of physical silver, and begin panic hoarding of

silver to ensure continued production of their tech gadgets. As First Majestic CEO Keith Neumeyer reveals in this stunning Bloomberg interview, that End Game industrial supply panic may have just begun…

Read More

by Jeff Berwick, The Dollar Vigilante:

Throw every “norm” out the window. This Keynesian, central banking

world has everything so distorted that nothing makes sense anymore.

Throw every “norm” out the window. This Keynesian, central banking

world has everything so distorted that nothing makes sense anymore.

There are currently more than $7 trillion in bonds, worldwide, offering a negative interest rate. Wrap your head around that! People are actually paying trillions of dollars to give their money to mostly bankrupt governments with the promise they will receive less at a later date.

Treasury Bonds used to be described as having a “risk-free return.” Now they are “return-free risk”.

This system is so backwards, inside-out, manipulated and bankrupt that what once used to be seen as “prudent and sound” is very obviously risky.

For example, Moody’s reported last Friday that Apple, Microsoft, Alphabet (Google), Cisco Systems and Oracle are sitting on $504 billion in cash and “cash equivalents.”

Read More

Throw every “norm” out the window. This Keynesian, central banking

world has everything so distorted that nothing makes sense anymore.

Throw every “norm” out the window. This Keynesian, central banking

world has everything so distorted that nothing makes sense anymore.There are currently more than $7 trillion in bonds, worldwide, offering a negative interest rate. Wrap your head around that! People are actually paying trillions of dollars to give their money to mostly bankrupt governments with the promise they will receive less at a later date.

Treasury Bonds used to be described as having a “risk-free return.” Now they are “return-free risk”.

This system is so backwards, inside-out, manipulated and bankrupt that what once used to be seen as “prudent and sound” is very obviously risky.

For example, Moody’s reported last Friday that Apple, Microsoft, Alphabet (Google), Cisco Systems and Oracle are sitting on $504 billion in cash and “cash equivalents.”

Read More

by J. D. Heyes, Natural News:

Talk radio giant Rush Limbaugh and others refer to the world’s biggest social media site as “Fakebook,” and there’s a reason for that: Much of what users see is manufactured to fit certain narratives, while keeping the truth about certain other subjects and issues out of the picture.

Talk radio giant Rush Limbaugh and others refer to the world’s biggest social media site as “Fakebook,” and there’s a reason for that: Much of what users see is manufactured to fit certain narratives, while keeping the truth about certain other subjects and issues out of the picture.

In recent days there has been much buzz over the allegation that Facebook censors its “trending” news stories to drown out conservative and right-leaning news and websites, even if those stories are in fact trending across the Web. Former Facebook “news curators” – the editors responsible for identifying those trending stories, writing up short descriptions and adding a link to the stories in the trending section – said there was a concerted effort to push Left-wing and liberal news sites, even if their stories weren’t trending.

But now, as Breitbart News is reporting, advocates for trimming immigration into the U.S. say those claims are just the beginning.

Read More

Talk radio giant Rush Limbaugh and others refer to the world’s biggest social media site as “Fakebook,” and there’s a reason for that: Much of what users see is manufactured to fit certain narratives, while keeping the truth about certain other subjects and issues out of the picture.

Talk radio giant Rush Limbaugh and others refer to the world’s biggest social media site as “Fakebook,” and there’s a reason for that: Much of what users see is manufactured to fit certain narratives, while keeping the truth about certain other subjects and issues out of the picture.In recent days there has been much buzz over the allegation that Facebook censors its “trending” news stories to drown out conservative and right-leaning news and websites, even if those stories are in fact trending across the Web. Former Facebook “news curators” – the editors responsible for identifying those trending stories, writing up short descriptions and adding a link to the stories in the trending section – said there was a concerted effort to push Left-wing and liberal news sites, even if their stories weren’t trending.

But now, as Breitbart News is reporting, advocates for trimming immigration into the U.S. say those claims are just the beginning.

Read More

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment