The Forgotten Depression tells of the slump of 1920-21: high unemployment, collapse in commodity prices, upsurge in bankruptcies and sharp break in stock prices. However, unlike the Great Depression, the 1920 affair was over in 18 months. What explains its brevity? James Grant, publisher of the prestigious Grant's Interest Rate Observer, tells the story of America's last governmentally-untreated depression; relatively brief and self-correcting which gave way to the Roaring Twenties...

Why Deutsche Bank Thinks A Fed Rate Hike Would Unleash A Stock MarketCrash

"If you think you’ve seen this movie before it’s because you have. Like during 2015, the Fed appears bent on pushing rate expectations higher, and the operative question is whether markets are sufficiently calm for the Fed to use the June 2016 meeting to pave the way for a July hike. We think the answer is no.... and the outlier appears to be the S&P500, where valuations appear excessive given the breakeven/real yield framework."

by David Stockman, David Stockman’s Contra Corner:

The

estimable Martin Feldstein put the wood to the Fed in a recent op ed

and in so doing hit the nail directly on the head. He essentially called

foul ball on the whole inflation targeting regime and its magic 2.00%

goalposts in part due to the measuring stick challenge.

The

estimable Martin Feldstein put the wood to the Fed in a recent op ed

and in so doing hit the nail directly on the head. He essentially called

foul ball on the whole inflation targeting regime and its magic 2.00%

goalposts in part due to the measuring stick challenge.

A fundamental problem with an explicit inflation target is the difficulty of knowing if it has been hit.

That problem is plainly evident in the chart below. You could very easily make the argument that goods prices are beyond the Fed’s reach because they are set in the world markets and by the marginal cost of labor in China and the EM.

Therefore the more domestically driven CPI index for services such as housing, medical care, education, transportation, recreation etc. is the more relevant yard stick. Alas, if there is something magic about 2.00%, why then, mission accomplished!

Read More

The

estimable Martin Feldstein put the wood to the Fed in a recent op ed

and in so doing hit the nail directly on the head. He essentially called

foul ball on the whole inflation targeting regime and its magic 2.00%

goalposts in part due to the measuring stick challenge.

The

estimable Martin Feldstein put the wood to the Fed in a recent op ed

and in so doing hit the nail directly on the head. He essentially called

foul ball on the whole inflation targeting regime and its magic 2.00%

goalposts in part due to the measuring stick challenge.A fundamental problem with an explicit inflation target is the difficulty of knowing if it has been hit.

That problem is plainly evident in the chart below. You could very easily make the argument that goods prices are beyond the Fed’s reach because they are set in the world markets and by the marginal cost of labor in China and the EM.

Therefore the more domestically driven CPI index for services such as housing, medical care, education, transportation, recreation etc. is the more relevant yard stick. Alas, if there is something magic about 2.00%, why then, mission accomplished!

Read More

Dear Comrades in Golden Arms,

I was there and considered by some to have been the largest gold trader from 1968 to March 1980. I recall every day of it like it was yesterday.

NOW:

I do not believe that gold has registered its all-time high by a long shot.

I do not accept the recent decline from above $1900 as a gold bear market.

I believe all accepted tools for market timing will fail in the long term super bull market.

I believe the recent long decline to be but a reaction in the giant bull gold market.

Into a new New Normal, all previous relationships between gold and anything will not apply.

The basic motivator of new gold prices to come finds it basis in the physical gold market, not in the paper gold market.

Read More

407,000 Workers Stunned As Pension Fund Proposes 60% Cuts, Treasury Says "Not Enough"

407,000 private sector workers are about to lose most of their pensions. When private pension plans go broke, they go broke. Public pension expect a bailout.How The Deep State's Cronies Steal From You

Much of The Deep State's growth is recorded in the pages of the Code of Federal Regulations (CFR). This tracks all the laws laid down by successive governments. A privilege, a special tax break, a rule, a prohibition, a piece of meat here, a piece of meat there… and soon the foxes are eating high on the hog. But what’s meat for the foxes is poison for the economy.

What Bubble? Triple-Wide Mobile Home Sells For $5.3 Million In Malibu

The most stunning part of the deal is that the same property sold for $4 million only a year ago. What could possibly go wrong flipping mobile homes for millions in a softening economy? In light of of all of this, we expect to see a pilot for "Flip This Malibu Mobile" coming to a network very soon.

Ron Paul: "I Feel A Kinship With Bernie Sanders"

Submitted by Tyler Durden on 05/21/2016 - 16:28 "We’re both against corporatism. We’re both against the special benefits to big business. His answer to that wouldn’t always be the same. Mine would always drift to the free markets. His would drift to ‘well we need more government to redistribute wealth,’ but we could both attack subsidies to business or the military industrial complex. In that sense, there is a kinship."

America's "Advanced Stupid" In 2 Stunning Charts

This isn't your average everyday stupid... this is 'advanced' stupid!

What Student Loans Are Used For: Vacations, iPads, Kegs, Entertainment

"Checks were celebrated across the campus as almost like a bonus for being a college kid. [Students] would go directly to the bank to cash it. I bought electronics for my dorm room and drinks were on me for a month or two. In an abstract way, I knew I would have to pay it back. But you don't have a timeline in your mind about what that was going to look like. I just knew it would happen later."

Trump Lashes Out At Clinton's Hypocrisy: "No More Guns To Protect Hillary!"

As the Clinton campaign continues to stumble along trying to figure out just how to attack Trump, The Donald is wasting no time showing Hillary how that's done...“Let’s see how they feel walking around without their guns and their bodyguards...”

Contra-Krugman: 'Austrian' Economists Dismiss The Myths Of The 2016 Election - Live Feed

As economist William Anderson explains, "presidential elections in the United States spawn Really Bad Economic Policies, and 2016 is a vintage year." Candidates promise everything from living wages to free health care and college. Proposals about how to run whole segments of the economy are made with a straight face. The most tired and hackneyed ideas about income equality, corporate greed, creating jobs, and paying one's fair share of taxes are trotted out. And millions of voters apparently believe it all, falling for the same promises of free stuff and prosperity from Washington. How do political candidates get away with this nonsense, year after year and election after election? More importantly, what can we do as individuals to fight the entrenched economic illiteracy that keeps politicians in business?

"We Are Becoming Convinced That The System Won't Stabilize" - Citi Explains How Central Banks Broke The Market

"Central bank distortions have exacerbated these movements, making investor interest more one-sided and leading one market after another to exhibit more bubble-like tendencies, rising exponentially and then falling back abruptly. As such, managers are struggling to justify their fees, while the sellside wonders whether it is really worth the continuing commitment to market-making in the face of increased capital requirements and legal and back-office overheads."

The Eurozone Is The Greatest Danger

Financial and economic prospects for the Eurozone have many similarities to the 1972-75 period in the UK, which this writer remembers vividly. This time, the prospects facing the Eurozone potentially could be worse. The obvious difference is the far higher levels of debt, which will never allow the ECB to run interest rates up sufficiently to kill price inflation. More likely, positive rates of only one or two per cent would be enough to destabilise the Eurozone’s financial system. Let us hope that these dangers are exaggerated, and the final outcome will not be systemically destabilising, not just for Europe, but globally as well. A wise man, faced with the unknown, believes nothing, expects the worst, and takes precautions.

A Retired White House Correspondent Explains "How Obama Gets Away With It"

At a time when large numbers of Americans say they are fed up with politics and politicians, why is it that the nation’s chief politician, President Obama, seems to skate above it unscathed? Reporters who criticize or dig too deep are cast by the administration as spoilsports or, worse, cut off from sources. With Donald Trump now the media obsession—and most in the media don’t like him—it is easy to see why Mr. Obama’s performance over the past seven-plus years is still not a major issue in the 2016 campaign. And that’s the way he likes it."The Sendai Dischord" - Japan Humiliated At G-7 Meeting In Sharp Rift Over Yen Intervention

CIA 'Accidentally' Destroyed 6,700 Page Torture Report? Snowden Calls Bullshit

Submitted by Tyler Durden on 05/21/2016 - 10:58 "I worked at The CIA. I wrote the Emergency Destruction Plan for Geneva. When CIA destroys something, it's never a mistake..."

‘Clinton as president is danger to world peace’ – far-right French leader Marine Le Pen

by Jeff Nielson, Bullion Bulls:

It is hard not to become a fan of France’s “radical” Front-National leader, Marine Le Pen. On this side of the Atlantic, her name first surfaced during the Greek crisis, when “Grexit” (i.e. talk of Greece leaving the EU) was being frequently bandied about. Le Pen’s response? “Moi aussi.” (Me too.) She dubbed herself“Madame Frexit.”

Equally, she earned the eternal hatred of the One Bank, since the Big Bank crime syndicate uses the EU as a political/monetary straitjacket, by which it bludgeons Europe’s once-sovereign nations into serving this crime syndicate.

Despite this, Front-National continues to lead France’s polling, making Le Pen the current favorite as France’s next president. As a result, we can likely expect that “something will happen” to Ms. Le Pen, between now and France’s next election.

Read More

by Jeff Nielson, Bullion Bulls:

It is hard not to become a fan of France’s “radical” Front-National leader, Marine Le Pen. On this side of the Atlantic, her name first surfaced during the Greek crisis, when “Grexit” (i.e. talk of Greece leaving the EU) was being frequently bandied about. Le Pen’s response? “Moi aussi.” (Me too.) She dubbed herself“Madame Frexit.”

Equally, she earned the eternal hatred of the One Bank, since the Big Bank crime syndicate uses the EU as a political/monetary straitjacket, by which it bludgeons Europe’s once-sovereign nations into serving this crime syndicate.

Despite this, Front-National continues to lead France’s polling, making Le Pen the current favorite as France’s next president. As a result, we can likely expect that “something will happen” to Ms. Le Pen, between now and France’s next election.

Read More

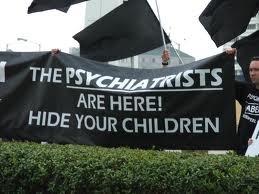

by Dave Hodges, The Common Sense Show:

Recently I have written about how DSM V, the manual for diagnosing

mental illnesses has been politicized in the area of gender identity

disorder. Well, we are seeing the same thing with regard to a new

disorder we call Oppositional Defiant Disorder, which marginalizes all

protesters, those who hang out on the Internet and criticize the

government. These developments are not new as this article will trace

the attempts for the government to label dissent as mental illness and

they desperately want to get a hold of your kids and jam psychotropic

drug into their system.

Recently I have written about how DSM V, the manual for diagnosing

mental illnesses has been politicized in the area of gender identity

disorder. Well, we are seeing the same thing with regard to a new

disorder we call Oppositional Defiant Disorder, which marginalizes all

protesters, those who hang out on the Internet and criticize the

government. These developments are not new as this article will trace

the attempts for the government to label dissent as mental illness and

they desperately want to get a hold of your kids and jam psychotropic

drug into their system.

A Brief History

There is an ongoing battle for the psychological health and welfare of America’s children and eventually all Americans. Since 2002, the government has been intent on testing millions for mental illness. This obsession even extends to our veterans as they return from combat and leave the service. The veterans are increasingly being diagnosed as having PTSD and they are subsequently being adjudicated to not being eligible to own a firearm.

Read More

Recently I have written about how DSM V, the manual for diagnosing

mental illnesses has been politicized in the area of gender identity

disorder. Well, we are seeing the same thing with regard to a new

disorder we call Oppositional Defiant Disorder, which marginalizes all

protesters, those who hang out on the Internet and criticize the

government. These developments are not new as this article will trace

the attempts for the government to label dissent as mental illness and

they desperately want to get a hold of your kids and jam psychotropic

drug into their system.

Recently I have written about how DSM V, the manual for diagnosing

mental illnesses has been politicized in the area of gender identity

disorder. Well, we are seeing the same thing with regard to a new

disorder we call Oppositional Defiant Disorder, which marginalizes all

protesters, those who hang out on the Internet and criticize the

government. These developments are not new as this article will trace

the attempts for the government to label dissent as mental illness and

they desperately want to get a hold of your kids and jam psychotropic

drug into their system.A Brief History

There is an ongoing battle for the psychological health and welfare of America’s children and eventually all Americans. Since 2002, the government has been intent on testing millions for mental illness. This obsession even extends to our veterans as they return from combat and leave the service. The veterans are increasingly being diagnosed as having PTSD and they are subsequently being adjudicated to not being eligible to own a firearm.

Read More

by Alasdair Macleod, GoldMoney:

World-wide,

markets are horribly distorted, which spells danger not only to

investors, but to businesses and their employees as well, because it is

impossible to allocate capital efficiently in this financial

environment.

World-wide,

markets are horribly distorted, which spells danger not only to

investors, but to businesses and their employees as well, because it is

impossible to allocate capital efficiently in this financial

environment.

With markets everywhere disrupted by interventions from central banks, governments, and their sovereign wealth funds, economic progress is being badly hampered, and therefore so is the ability of anyone to earn the profits required to pay down the highs levels of debt we see today. Money that is invested in bonds and deposited in banks may already be on the way to money-heaven, without complacent investors and depositors realising it.

It should become clear in the coming weeks that price inflation in the dollar, and therefore the currencies that align with it, will exceed the Fed’s 2% target by a significant amount by the end of this year. This is because falling commodity prices last year, which subdued price inflation to under one per cent, will be replaced by rising commodity prices this year. That being the case, CPI inflation should pick up significantly in the coming months, already reflected in the most recent estimate of core price inflation in the US, which exceeded two per cent. Therefore, interest rates should rise far more than the small amount the market has already factored into current price levels.

Read More

World-wide,

markets are horribly distorted, which spells danger not only to

investors, but to businesses and their employees as well, because it is

impossible to allocate capital efficiently in this financial

environment.

World-wide,

markets are horribly distorted, which spells danger not only to

investors, but to businesses and their employees as well, because it is

impossible to allocate capital efficiently in this financial

environment.With markets everywhere disrupted by interventions from central banks, governments, and their sovereign wealth funds, economic progress is being badly hampered, and therefore so is the ability of anyone to earn the profits required to pay down the highs levels of debt we see today. Money that is invested in bonds and deposited in banks may already be on the way to money-heaven, without complacent investors and depositors realising it.

It should become clear in the coming weeks that price inflation in the dollar, and therefore the currencies that align with it, will exceed the Fed’s 2% target by a significant amount by the end of this year. This is because falling commodity prices last year, which subdued price inflation to under one per cent, will be replaced by rising commodity prices this year. That being the case, CPI inflation should pick up significantly in the coming months, already reflected in the most recent estimate of core price inflation in the US, which exceeded two per cent. Therefore, interest rates should rise far more than the small amount the market has already factored into current price levels.

Read More

by Bill Holter, via Silver Doctors:

For many years we have warned of the dangers of derivatives.

We were laughed at leading up to the 2008 financial debacle when Lehman

broke and nearly took the entire system down. That turned out to be no

laughing matter and here we are again at exactly the same situation

where derivatives threaten to melt the financial system again. The

difference now of course is the “saving ammunition” has already been

spent where sovereign treasuries and central banks have destroyed their

own balance sheets.

For many years we have warned of the dangers of derivatives.

We were laughed at leading up to the 2008 financial debacle when Lehman

broke and nearly took the entire system down. That turned out to be no

laughing matter and here we are again at exactly the same situation

where derivatives threaten to melt the financial system again. The

difference now of course is the “saving ammunition” has already been

spent where sovereign treasuries and central banks have destroyed their

own balance sheets.

Two weeks ago, the Fed announced a “48 hour stay in place” provision for for collateral of any derivative contracts where the big banks are involved. The idea here is to prevent collateral being pulled by the survivor for 48 hours should the bank counterparty become insolvent.

This will give the Fed a window of time to get the fire hose of liquidity out and reliquify a large bank’s balance sheet before they can break the derivatives chain. But what does this really do? Does it make derivatives any more sound or does it really just add more risk to central bank balance sheets and thus the currencies themselves?

Read More

For many years we have warned of the dangers of derivatives.

We were laughed at leading up to the 2008 financial debacle when Lehman

broke and nearly took the entire system down. That turned out to be no

laughing matter and here we are again at exactly the same situation

where derivatives threaten to melt the financial system again. The

difference now of course is the “saving ammunition” has already been

spent where sovereign treasuries and central banks have destroyed their

own balance sheets.

For many years we have warned of the dangers of derivatives.

We were laughed at leading up to the 2008 financial debacle when Lehman

broke and nearly took the entire system down. That turned out to be no

laughing matter and here we are again at exactly the same situation

where derivatives threaten to melt the financial system again. The

difference now of course is the “saving ammunition” has already been

spent where sovereign treasuries and central banks have destroyed their

own balance sheets.Two weeks ago, the Fed announced a “48 hour stay in place” provision for for collateral of any derivative contracts where the big banks are involved. The idea here is to prevent collateral being pulled by the survivor for 48 hours should the bank counterparty become insolvent.

This will give the Fed a window of time to get the fire hose of liquidity out and reliquify a large bank’s balance sheet before they can break the derivatives chain. But what does this really do? Does it make derivatives any more sound or does it really just add more risk to central bank balance sheets and thus the currencies themselves?

Read More

by Samuel Bryan, Schiff Gold:

These are not normal economic times.

These are not normal economic times.

Interest rates have remained artificially low, plunging into negative territory in many places. Central banks continue to inflate the money supply with quantitative easing. Some policy-makers have even floated the idea of helicopter money. Worldwide money printing is reportedly approaching $100 trillion.

There is no end to this crazy monetary policy in sight. This led billionaire investor Stanley Druckenmiller to recommend selling US stocks to buy gold. Well-known hedge fund manager Paul Singer said the recent surge in gold is just the beginning. And Bank of America said gold is entering a new and long bull market.

Read More

These are not normal economic times.

These are not normal economic times.Interest rates have remained artificially low, plunging into negative territory in many places. Central banks continue to inflate the money supply with quantitative easing. Some policy-makers have even floated the idea of helicopter money. Worldwide money printing is reportedly approaching $100 trillion.

There is no end to this crazy monetary policy in sight. This led billionaire investor Stanley Druckenmiller to recommend selling US stocks to buy gold. Well-known hedge fund manager Paul Singer said the recent surge in gold is just the beginning. And Bank of America said gold is entering a new and long bull market.

Read More

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment