Submitted by Tyler Durden on 05/02/2016 - 16:02

Caught On Tape: Raw Footage Shows The Moment A Missile Hits Aleppo Hospital

Submitted by Tyler Durden on 05/02/2016 - 17:15 Sadly, a typical consequence of war is that innocent "collateral damage" lives are lost. The civil war in Syria is no different, as over the past week four medical facilities were hit with missiles from fighter jets taking out their targets from the skies, pushing the civilian death toll even higher. One of the targets that got hit last week (during a truce nonetheless) was a pediatric hospital in Aleppo that was supported by both Doctors Without Borders and the International Red Cross. Recovered cctv footage captures the moments before, during, and after the hospital took a direct hit.

"Debt Is The Cause, Not The Cure"- Why $19 Trillion In Debt 'Is' A Problem

Submitted by Tyler Durden on 05/02/2016 - 15:50 Debt, if used for productive investments, can be a solution to stimulating economic growth in the short-term. However, in the U.S., debt has been squandered on increases in social welfare programs and debt service which has an effective negative return on investment. Therefore, the larger the balance of debt becomes, the more economically destructive it is by diverting an ever growing amount of dollars away from productive investments to service payments. The relevance of debt growth versus economic growth is all too evident as shown below...

6 Charts That Show the Global Demographic Crisis Is Unfolding

Submitted by Tyler Durden on 05/02/2016 - 16:50 The world is undergoing a profound demographic shift that will cause sweeping changes over the next few decades. Those changes will broaden the scope of our study of economics and investing; they will alter our understanding of sociology; and they will radically affect politics and governments.Sparks Fly In German Press As Treatment Of Muslims Hits "Gunpoint"

Submitted by Tyler Durden on 05/02/2016 - 14:59

The Energy Junk Bond Default Rate Just Hit An All Time High

Submitted by Tyler Durden on 05/02/2016 - 16:22 Following this weekend's bankruptcies of Ultra Petroleum and Midstate Petroleum which added $3.1 billion to the mushrooming high-yield energy bond default volume tally, in addition to the $1.5 billion of credit facility defaults, the energy high-yield default has soared to a record 13% rate, surpassing the 9.7% mark set in 1999, according to Fitch Ratings.

The Last Time This Happened, Stocks Tumbled 20%

Submitted by Tyler Durden on 05/02/2016 - 15:35 For the last 11 weeks - off The Dimon Bottom - the S&P 500 has made higher lows week after week without break. Last week, however, saw the streak end (with a lower low set). This length of incessant "uptrend" streak has not been since February 2011, at which time it was broken leading to an immediate decline followed by a considerably plunge soon after...

Why The Obamacare Gold Rush Is Bankrupting America

Submitted by Tyler Durden on 05/02/2016 - 15:20 Our health care system is going to implode under its own weight. National Health Expenditures are approaching 20 percent of gross domestic product — a figure that is expected to about double over the next half century. Obamacare didn’t start the process, but it’s expediting the end. Obamacare did not reform health care system; it merely transformed it to subsidize favored constituents. To pay for all this price gouging, employers are being forced to offer benefits that many workers themselves cannot afford or absorb in lower take home pay.

Here Is Mario Draghi's Advice To Europe's Crushed Savers

Submitted by Tyler Durden on 05/02/2016 - 15:05 "For a start, savers can still earn satisfactory rates of return from diversifying their assets, even when interest rates on deposit and savings accounts are very low. For example, US households allocate about a third of their financial assets to equities..."

“Nightmare” Mistake: Visa Free Travel For 80 Million Turks Coming Up

Submitted by Tyler Durden on 05/02/2016 - 14:43 Of all the inane, self-serving, deals German Chancellor Angela Merkel made with Turkey, visa-free travel for 80 million Islamic Turks tops the list. “This is all a nightmare,” said one diplomat charged with making the deal work. Nightmares aside, Brussels Prepares Legal Groundwork on Visa-Free Travel for Turks.

2008 Deja Vu? Treasury Warns Congress - Bailout Puerto Rico Or Risk "Chaotic Unwinds... Cascading Defaults"

Submitted by Tyler Durden on 05/02/2016 - 14:39 In a disappointingly similar tone to the warnings, threats, and promises sent to Congress in 2008 when demanding the banks get their bailout (or else), Treasury Secretary Jack lew has released a letter he sent to Congress warning that if Puerto Rico's situation is not "fixed" in an "orderly" manner "quickly" then the nation will face "cascading defaults."

"Sell In May" ... And June

Submitted by Tyler Durden on 05/02/2016 - 14:35 "Sell in May and go away" -- the old equity-market adage still holds water, but, as Bloomberg's Mark Cudmore explains, it's important to note how the seasonals have evolved since the great financial crisis.Just Two Headlines: For Oil 2016 Is Setting Up To Be A Rerun Of Last Year

Submitted by Tyler Durden on 05/02/2016 - 14:21

9/11 Damage Control Begins: CIA Director Warns "28 Pages" Contains Inaccurate Information

Submitted by Tyler Durden on 05/02/2016 - 14:00 It appears the reality of the so-called "28 pages" - removed from the 9/11 Commission report - being unclassified may be getting closer and many suspect. Why do we say that? Because none other than CIA Director John Brennan did the Sunday talk-show circuit to start the propaganda, playing-down the report's significance, warning that information in the 28 pages hasn't been vetted or corroborated, adding that releasing the information would give ammunition to those who want to tie the terror attacks to Saudi Arabia - "I think there's a combination of things that are accurate and inaccurate [in the report]."

Is Charlie Munger Becoming Austrian: "It Was Massively Stupid For Our Government To Print So Much Money "

Submitted by Tyler Durden on 05/02/2016 - 13:19 Any moment now we expect Paul Krugman to come out with an op-ed suggesting that not just Time magazine, but Charlie Munger is the latest to join ZH payroll following what were some surprising comments by Warren Buffett's right hand man earlier today on CNBC when he said that "the U.S. is looking more like Japan given the prolonged low-interest-rate environment." The one phrase which Krugman will surely have something to say about was the following: "I strongly suspect it was massively stupid for our government to rely so heavily on printing money and so lightly on fiscal stimulus and infrastructure," Munger told CNBC's "Squawk Box."A Decade Of Maximum Peril

Submitted by Tyler Durden on 05/02/2016 - 12:55 The sad truth may be that rackets of this kind are unreformable, and that we can’t begin to do things differently until they collapse. Likewise in virtually all other areas of American life, the real trend as yet un-discussed in this election campaign, will be unwinding and downscaling of the onerous, toxic hyper-complexity of the age now passing and finding our way to a workable re-set of what used to be known as political-economy. In the meantime: a clown show.

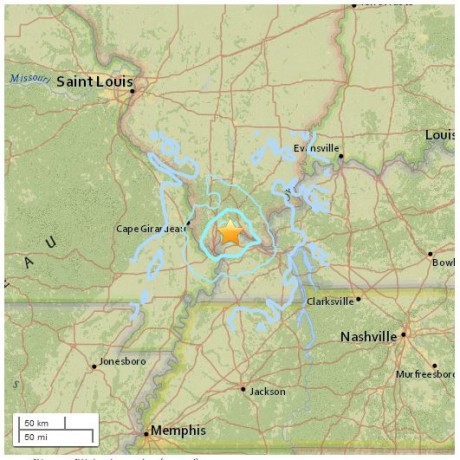

Could the earthquake that just struck the New Madrid fault seismic zone near the town of La Center, Kentucky be a “foreshock” for a much bigger quake yet to come? Very early on Sunday morning, a magnitude 3.5 earthquake hit western Kentucky, and it was felt in parts of three other states as well. In fact, it is being reported that the quake could be felt all the way over in Miller, Missouri, which is 267 miles away. The New Madrid fault seismic zone is six times larger than the more famous San Andreas fault zone in California, and it covers portions of Illinois, Indiana, Ohio, Missouri, Arkansas, Kentucky, Tennessee and Mississippi. Scientists tell us that the New Madrid fault is about 30 years overdue for a major event, and because of the nature of the Earth’s crust in that part of the country, a major earthquake would do significant damage all the way to the east coast.

Read More

First things first: the U.S. already has a border wall with Mexico. This is a widely-documented fact, illustrated in detail by National Geographic. If Trump supporters had bothered to do so much as a Google search, they would realize that — whatever one might think of undocumented migration — it isn’t going to be stopped by a border wall. A border wall already exists, and undocumented migration continues.

But what about replacing the current border wall with a bigger one? Surely that will stop migrants from coming across the border? Well, not really.

Read More

by Dave Kranzler, Investment Research Dynamics:

Currently skepticism toward the ongoing rally in the precious metals sector is rampant. A lot of it based on shamelessly presented analysis of the COT data. But the COT data analysts have been wrong since March on their doom and gloom outlook based on the attributes of the long/short data in the weekly COT report.

Let me preface this with the proviso that the veracity of the COT data is predicated on the reliability of reports generated by the likes of JP Morgan, HSBC and Scotia. If these banks are providing bona fide, non-fraudulent Comex data reports, it would be the only area of their entire business for which they are not publishing corrupted financial information.

Read More

Currently skepticism toward the ongoing rally in the precious metals sector is rampant. A lot of it based on shamelessly presented analysis of the COT data. But the COT data analysts have been wrong since March on their doom and gloom outlook based on the attributes of the long/short data in the weekly COT report.

Let me preface this with the proviso that the veracity of the COT data is predicated on the reliability of reports generated by the likes of JP Morgan, HSBC and Scotia. If these banks are providing bona fide, non-fraudulent Comex data reports, it would be the only area of their entire business for which they are not publishing corrupted financial information.

Read More

from MyBudget360.com:

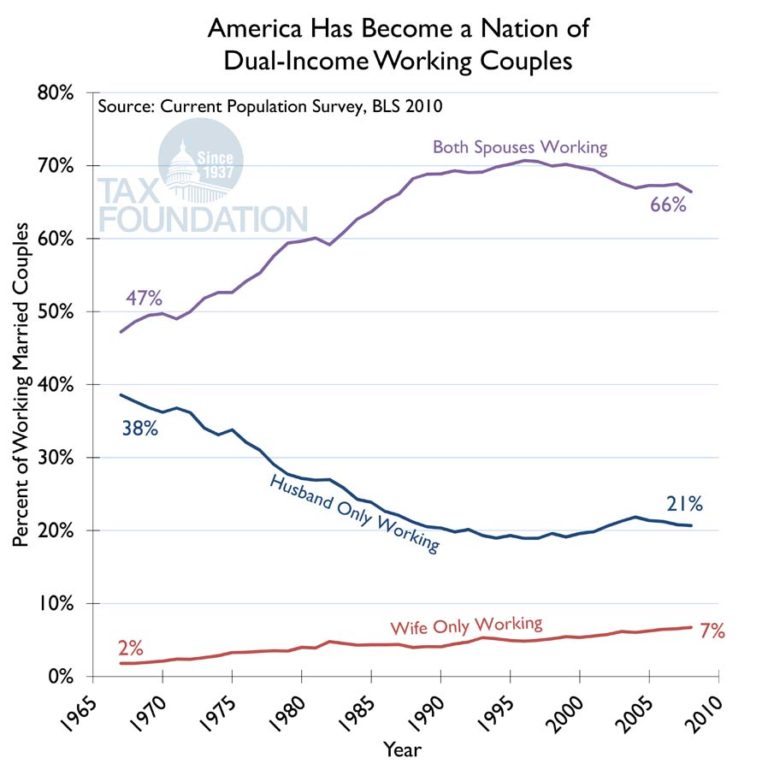

America has become a nation where households depend on multiple streams of income just to get by. Many people think that having two incomes is a luxury when in most cases, you need two incomes just to get by and keep up with the rising cost of living. This is reflected in the two income trap. Take for example a couple that works and makes the median household income of $52,000. In many cases if the couple has a child, daycare costs are needed and these can run exceptionally high. Healthcare costs are also incredibly high and have grown unbelievably fast over the last two decades. This recent recession could have been called a Mancession since most of the jobs lost went to men. America is a nation of dual-income households because people are too broke to get by on one income. The current state of the economy hasn’t helped much in supporting economic growth for working families.

Read More

America has become a nation where households depend on multiple streams of income just to get by. Many people think that having two incomes is a luxury when in most cases, you need two incomes just to get by and keep up with the rising cost of living. This is reflected in the two income trap. Take for example a couple that works and makes the median household income of $52,000. In many cases if the couple has a child, daycare costs are needed and these can run exceptionally high. Healthcare costs are also incredibly high and have grown unbelievably fast over the last two decades. This recent recession could have been called a Mancession since most of the jobs lost went to men. America is a nation of dual-income households because people are too broke to get by on one income. The current state of the economy hasn’t helped much in supporting economic growth for working families.

Read More

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment