World-wide, markets are horribly distorted, which spells danger not

only to investors, but to businesses and their employees as well,

because it is impossible to allocate capital efficiently in this

financial environment.

World-wide, markets are horribly distorted, which spells danger not

only to investors, but to businesses and their employees as well,

because it is impossible to allocate capital efficiently in this

financial environment.With markets everywhere disrupted by interventions from central banks, governments, and their sovereign wealth funds, economic progress is being badly hampered, and therefore so is the ability of anyone to earn the profits required to pay down the highs levels of debt we see today. Money that is invested in bonds and deposited in banks may already be on the way to money-heaven, without complacent investors and depositors realising it.

It should become clear in the coming weeks that price inflation in the dollar, and therefore the currencies that align with it, will exceed the Fed’s 2% target by a significant amount by the end of this year.

Read More

05/19/2016 - 16:43

USA has a FOREX Nuclear Option that can obliterate investment markets in one click.Your Future...

by Agence France-Presse , Global Post:

It was around noon when a food truck rolled up to a Venezuelan

state-subsidized supermarket in the town of Guarenas just east of the

capital.

It was around noon when a food truck rolled up to a Venezuelan

state-subsidized supermarket in the town of Guarenas just east of the

capital.

But, to the fury of the long line of people waiting out front, the cargo wasn’t unloaded. Instead soldiers took it away.

“We want food!” the crowd roared in protest, to no avail. Some tried to run after the truck.

Under the state of emergency imposed by President Nicolas Maduro, the military, along with government-organized civilian committees, ensures that food packets are delivered door-to-door in order to — as officials say — cut out black market operators.

Read More

It was around noon when a food truck rolled up to a Venezuelan

state-subsidized supermarket in the town of Guarenas just east of the

capital.

It was around noon when a food truck rolled up to a Venezuelan

state-subsidized supermarket in the town of Guarenas just east of the

capital.But, to the fury of the long line of people waiting out front, the cargo wasn’t unloaded. Instead soldiers took it away.

“We want food!” the crowd roared in protest, to no avail. Some tried to run after the truck.

Under the state of emergency imposed by President Nicolas Maduro, the military, along with government-organized civilian committees, ensures that food packets are delivered door-to-door in order to — as officials say — cut out black market operators.

Read More

Republicans, Democrats Agree On A Bill To Bailout Puerto Rico

Submitted by Tyler Durden on 05/19/2016 - 13:27 It turns out that Puerto Rico's plan to default on its debt and beg congress for help is working out as planned. After a slight delay, House Republicans have reached an agreement with the Obama administration to provide a path to restructure Puerto Rico's $70 billion debt load. The bill would offer the island a legal out similar to bankruptcy and wouldn't commit any federal money according to the WSJ.

by Bill Bonner, Daily Reckoning:

And another clever billionaire says he is looking elsewhere for profits. Reuters:

And another clever billionaire says he is looking elsewhere for profits. Reuters:

Activist investor Carl Icahn on Monday said there was a chance the stock market could suffer a big decline, saying valuations are rich and earnings at many companies are fueled more by low borrowing costs than management’s efforts to boost results.

“I am very cautious on equities today. This market could easily have a big drop,” Icahn said.

Yes, dear reader, the smart money is getting out of U.S. stocks. And here’s our old friend Rob Marstrand explaining why:

Right now, every measure that analyzes the S&P 500 says it’s expensive. Prices are high relative to earnings, net assets, sales, and cash flow.

What’s more, there’s plenty of evidence that the main thing propping up the stock prices is heavy buying by the companies themselves [via share repurchases].

Read More

And another clever billionaire says he is looking elsewhere for profits. Reuters:

And another clever billionaire says he is looking elsewhere for profits. Reuters:Activist investor Carl Icahn on Monday said there was a chance the stock market could suffer a big decline, saying valuations are rich and earnings at many companies are fueled more by low borrowing costs than management’s efforts to boost results.

“I am very cautious on equities today. This market could easily have a big drop,” Icahn said.

Yes, dear reader, the smart money is getting out of U.S. stocks. And here’s our old friend Rob Marstrand explaining why:

Right now, every measure that analyzes the S&P 500 says it’s expensive. Prices are high relative to earnings, net assets, sales, and cash flow.

What’s more, there’s plenty of evidence that the main thing propping up the stock prices is heavy buying by the companies themselves [via share repurchases].

Read More

by Pepe Escobar, The News Doctors:

Let’s start by examining what the Dragon himself – President Xi Jinping

– has to say about China being largely derided in influential Beltway

circles as a House of Cards.

Let’s start by examining what the Dragon himself – President Xi Jinping

– has to say about China being largely derided in influential Beltway

circles as a House of Cards.

Xi has forcefully dismissed the notion that a House of Cards power struggle has been raging at the rarified heights of the Chinese Communist Party (CCP). Yet at the same time he’s adamant; “conspirators”, “careerists”, “cabals” and “cliques” are attempting to undermine the CCP from within.

Thus, with ironic/poetic justice, a 42-part series on corruption in China – titled In the Name of the People and financed by the Middle Kingdom’s top law enforcement agency – is bound to go live before the end of 2016, featuring a CCP stalwart as the bad guy (that’s a first). Call him the Chinese Frank Underwood.

Read More

Let’s start by examining what the Dragon himself – President Xi Jinping

– has to say about China being largely derided in influential Beltway

circles as a House of Cards.

Let’s start by examining what the Dragon himself – President Xi Jinping

– has to say about China being largely derided in influential Beltway

circles as a House of Cards.Xi has forcefully dismissed the notion that a House of Cards power struggle has been raging at the rarified heights of the Chinese Communist Party (CCP). Yet at the same time he’s adamant; “conspirators”, “careerists”, “cabals” and “cliques” are attempting to undermine the CCP from within.

Thus, with ironic/poetic justice, a 42-part series on corruption in China – titled In the Name of the People and financed by the Middle Kingdom’s top law enforcement agency – is bound to go live before the end of 2016, featuring a CCP stalwart as the bad guy (that’s a first). Call him the Chinese Frank Underwood.

Read More

China Furious After US Launches Trade War "Nuke" With 522% Duty

Submitted by Tyler Durden on 05/19/2016 - 15:42 China is livid: as a result of record Chinese steel dumping, the US unleashed what is nothing short of a nuclear bomb in its rapidly escalating trade war with China, by imposing duties of 522% on cold-rolled steel used in automobiles and other manufacturing. In doing so it has effectively rendered Chinese exports to the US unsustainable and will force even more excess Chinese production to remain landlocked within China's borders, making the domestic glut that much worse. NSA whistleblower Edward Snowden pushed back against CIA claims

Wednesday that the recent destruction of the Senate’s torture report was

done so by accident.

NSA whistleblower Edward Snowden pushed back against CIA claims

Wednesday that the recent destruction of the Senate’s torture report was

done so by accident.As reported Monday, an intelligence source speaking with Yahoo News revealed that the CIA inspector general’s office deleted both an “uploaded computer file with the report” as well as “a disk that also contained the document.”

Snowden, who worked as a cybersecurity expert for the CIA prior to his time as an NSA contractor, insinuated that the document’s destruction was anything but accidental.

Read More

The Shift To A Cashless Society Is Snowballing

Submitted by Tyler Durden on 05/19/2016 - 22:00 Love it or hate it, cash is playing an increasingly less important role in society. In some ways this is great news for consumers. The rise of mobile and electronic payments means faster, convenient, and more efficient purchases in most instances. However, there is also a darker side in the shift to a cashless society. Governments and central banks have a different rationale behind the elimination of cash transactions, and as a result, the so-called “war on cash” is on.

Former Hedgeye And Business Insider Employee Arrested For Robbing Three Banks

Submitted by Tyler Durden on 05/19/2016 - 21:45 The last time we heard the name Vincent Veneziani was several years ago, when he was at Business Insider, a close friend with all of Henry Blodget's editors and writers, writing stories about Wall Street criminals and frauds. The inherent irony here will become evident in a few moments...

The Clinton Campaign Has No Idea How To Attack Donald Trump

Submitted by Tyler Durden on 05/19/2016 - 21:25 As the Clinton campaign turns its attention to Donald Trump (or tries to at least), it is encountering one of the many things that makes running against 'The Teflon Don' difficult: With everything he has said and done, how is it possible to focus on only a few key things to attack him on.

Who Answers For Government Lies?

Submitted by Tyler Durden on 05/19/2016 - 20:20 Here is a quick pop quiz. What happens if we lie to the government? What happens if the government lies to us? Does it matter who does the lying? Does anyone care any longer that the government lies to the American people with impunity and prosecutes people when it thinks they have lied to it? Does the government work for us, or do we work for the government?

Which US States Have The Highest And Lowest Gasoline Taxes

Submitted by Tyler Durden on 05/19/2016 - 20:02 Here are the gas tax rates, effective as of April 1, in every US state from the highest (Pennsylvania, Washington, and New York), to the lowest (South Carolina, New Jersey - yes NJ has a low tax for something - and Alaska).'Dilbert' Creator Evaluates The Political Chess Board: Women, Women, Women Vs America, America, America

Submitted by Tyler Durden on 05/19/2016 - 19:30

Former London Mayor Wins Most Offensive Erdogan Poem Contest

Submitted by Tyler Durden on 05/19/2016 - 19:00 There was a young fellow from Ankara... Who was a terrific wankerer...

Monetary Policy For Dummies

Submitted by Tyler Durden on 05/19/2016 - 18:30 Global turmoil, global turmoil, global turmoil. Since we are in the midst of a pause, rate hikes are predictably back on. Given this framework, we can judge FOMC leanings from China. Here is a handy guide for US Monetary Policy As Derived From Chinese Liquidity Policy Due to London and Tokyo Bank PolicyCaption Contest: Obama Unveils New Anti-Trump Weapon

Submitted by Tyler Durden on 05/19/2016 - 18:05 Taking a page from Mario Draghi's economic savior play-book, it appears President Obama's meeting with Janet Yellen was not wasted as he seems to have found the blueprints of his own 'bazooka' and bubble-blowing machine. Perhaps the realization that Trump's success is based on Obama's fiction-peddling, the president has been forced to do "whatever it takes" ...FBI Director Contradicts US Intelligence - "No Evidence" Of Terrorism In EgyptAir Crash

Submitted by Tyler Durden on 05/19/2016 - 17:20

by Alexander Rogozhin, New Eastern Outlook:

Recently, President Erdogan’s inner circles have intensified attacks on

Isbank, the biggest private Turkish bank, and the pressure has only

been increasing. Established in 1924 by Mustafa Kemal Ataturk, the

founder of the Republic of Turkey, Isbank has been heavily criticized by

pro-government mass media since 2012. Yigit Bulut, a senior advisor to

Prime Minister Erdogan was the last to bash the bank last January. Bulut

openly stated that the government should be managing the bank’s

operations.

Recently, President Erdogan’s inner circles have intensified attacks on

Isbank, the biggest private Turkish bank, and the pressure has only

been increasing. Established in 1924 by Mustafa Kemal Ataturk, the

founder of the Republic of Turkey, Isbank has been heavily criticized by

pro-government mass media since 2012. Yigit Bulut, a senior advisor to

Prime Minister Erdogan was the last to bash the bank last January. Bulut

openly stated that the government should be managing the bank’s

operations.

Isbank often falls victim of heated political debates because of its structure. According to Ataturk’s will, the Republican People’s Party (the main opposition party) is supposed to hold 28% of the bank’s shares. In his speech Bulut contested this provision, denying the Republican People’s Party’s right to be the bank’s major shareholder. He also said that the bank should be promptly expropriated and turned into a state-controlled institution.

Read More

Recently, President Erdogan’s inner circles have intensified attacks on

Isbank, the biggest private Turkish bank, and the pressure has only

been increasing. Established in 1924 by Mustafa Kemal Ataturk, the

founder of the Republic of Turkey, Isbank has been heavily criticized by

pro-government mass media since 2012. Yigit Bulut, a senior advisor to

Prime Minister Erdogan was the last to bash the bank last January. Bulut

openly stated that the government should be managing the bank’s

operations.

Recently, President Erdogan’s inner circles have intensified attacks on

Isbank, the biggest private Turkish bank, and the pressure has only

been increasing. Established in 1924 by Mustafa Kemal Ataturk, the

founder of the Republic of Turkey, Isbank has been heavily criticized by

pro-government mass media since 2012. Yigit Bulut, a senior advisor to

Prime Minister Erdogan was the last to bash the bank last January. Bulut

openly stated that the government should be managing the bank’s

operations.Isbank often falls victim of heated political debates because of its structure. According to Ataturk’s will, the Republican People’s Party (the main opposition party) is supposed to hold 28% of the bank’s shares. In his speech Bulut contested this provision, denying the Republican People’s Party’s right to be the bank’s major shareholder. He also said that the bank should be promptly expropriated and turned into a state-controlled institution.

Read More

by Daniel Barker, Natural News:

According to the website of the Food and Drug Administration (FDA), the

agency is “responsible for protecting the public health,” but it’s

becoming increasingly obvious that its real agenda – at least in recent

years – has been precisely the opposite.

According to the website of the Food and Drug Administration (FDA), the

agency is “responsible for protecting the public health,” but it’s

becoming increasingly obvious that its real agenda – at least in recent

years – has been precisely the opposite.

Margaret Hamburg, the departing FDA commissioner, has just been implicated in a federal racketeering lawsuit, alleging that she, her hedge-fund manager husband, and Johnson & Johnson conspired to profit from the suppression of information regarding a “dangerous and in fact, deadly” antibiotic that is likely to have caused more than 5,000 deaths.

Read More

According to the website of the Food and Drug Administration (FDA), the

agency is “responsible for protecting the public health,” but it’s

becoming increasingly obvious that its real agenda – at least in recent

years – has been precisely the opposite.

According to the website of the Food and Drug Administration (FDA), the

agency is “responsible for protecting the public health,” but it’s

becoming increasingly obvious that its real agenda – at least in recent

years – has been precisely the opposite.Margaret Hamburg, the departing FDA commissioner, has just been implicated in a federal racketeering lawsuit, alleging that she, her hedge-fund manager husband, and Johnson & Johnson conspired to profit from the suppression of information regarding a “dangerous and in fact, deadly” antibiotic that is likely to have caused more than 5,000 deaths.

Read More

by Michael Collins, Washingtons Blog:

Some rough housing at a Democratic Party convention in Nevada over the

weekend shocked party leaders and the mainstream media. The official

custodians of propriety demand that Sanders control his followers and

denounce their actions. The double standard on this issue is simply

appalling since the Clinton campaign represents failed policies that got

350,000 killed and future plans (the “no fly zone” for Syria) that will

cost even more lives.

Some rough housing at a Democratic Party convention in Nevada over the

weekend shocked party leaders and the mainstream media. The official

custodians of propriety demand that Sanders control his followers and

denounce their actions. The double standard on this issue is simply

appalling since the Clinton campaign represents failed policies that got

350,000 killed and future plans (the “no fly zone” for Syria) that will

cost even more lives.

To be specific, Hillary Clinton’s policies, as secretary of state, helped launch the Libyan regime change operation. To date, 100,000 Libyans are dead due to that foreign policy fiasco. Clinton was the tip of the spear for the “Assad must go” movement resulting in major support for extremist jihadist fighters attacking the sovereign state of Syria. Why? Because Assad didn’t just amble off when then Secretary of State Clinton commanded him to he leave his office and nation. The death toll in Syria is 250,000.

Read More

Some rough housing at a Democratic Party convention in Nevada over the

weekend shocked party leaders and the mainstream media. The official

custodians of propriety demand that Sanders control his followers and

denounce their actions. The double standard on this issue is simply

appalling since the Clinton campaign represents failed policies that got

350,000 killed and future plans (the “no fly zone” for Syria) that will

cost even more lives.

Some rough housing at a Democratic Party convention in Nevada over the

weekend shocked party leaders and the mainstream media. The official

custodians of propriety demand that Sanders control his followers and

denounce their actions. The double standard on this issue is simply

appalling since the Clinton campaign represents failed policies that got

350,000 killed and future plans (the “no fly zone” for Syria) that will

cost even more lives.To be specific, Hillary Clinton’s policies, as secretary of state, helped launch the Libyan regime change operation. To date, 100,000 Libyans are dead due to that foreign policy fiasco. Clinton was the tip of the spear for the “Assad must go” movement resulting in major support for extremist jihadist fighters attacking the sovereign state of Syria. Why? Because Assad didn’t just amble off when then Secretary of State Clinton commanded him to he leave his office and nation. The death toll in Syria is 250,000.

Read More

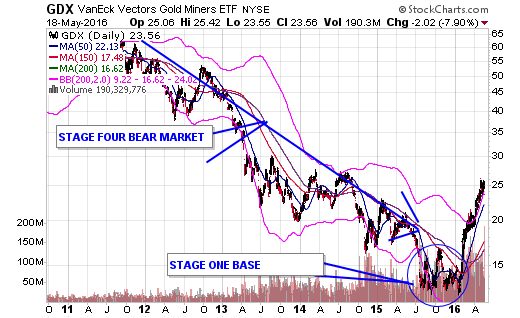

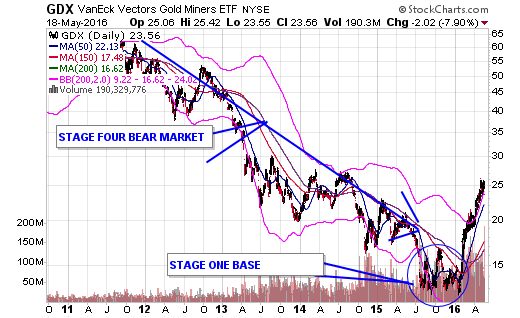

by Mike Swanson, Wall Street Window, SGT Report:

Yesterday the stock market and gold prices fell into their closing

bells after the release of minutes of the Federal Reserve’s April

meeting.

Yesterday the stock market and gold prices fell into their closing

bells after the release of minutes of the Federal Reserve’s April

meeting.

The Federal Reserve did not raise interest rates at that meeting, but the minutes showed that some Federal Reserve Board members hope to raise interest rates in June.

Back in December the Federal Reserve raised interest rates and predicted that it would raise rates four times in 2016. Then the stock market dumped in January and banks in Europe showed signs of stress so the Federal Reserve got scared and was unable to raise rates at any of its meetings so far this year.

Read More

Yesterday the stock market and gold prices fell into their closing

bells after the release of minutes of the Federal Reserve’s April

meeting.

Yesterday the stock market and gold prices fell into their closing

bells after the release of minutes of the Federal Reserve’s April

meeting.The Federal Reserve did not raise interest rates at that meeting, but the minutes showed that some Federal Reserve Board members hope to raise interest rates in June.

Back in December the Federal Reserve raised interest rates and predicted that it would raise rates four times in 2016. Then the stock market dumped in January and banks in Europe showed signs of stress so the Federal Reserve got scared and was unable to raise rates at any of its meetings so far this year.

Read More

I was there and considered by some to have been the largest gold trader from 1968 to March 1980. I recall every day of it like it was yesterday.

NOW:

- I do not believe that gold has registered its all-time high by a long shot.

- I do not accept the recent decline from above $1900 as a gold bear market.

- I believe all accepted tools for market timing will fail in the long term super bull market.

- I believe the recent long decline to be but a reaction in the giant bull gold market.

- Into a new New Normal, all previous relationships between gold and anything will not apply.

- The basic motivator of new gold prices to come finds it basis in the physical gold market, not in the paper gold market.

- The 1% are not stupid or in the main would not have the positions that they have if market jerks.

- Knowing without any doubt what is about to occur, they have been for 8 years cleaning out the physical market.

- China and Russia are not gold speculators, but know exactly what is about to occur, having made it a policy to accumulate gold on a continuing basis.

- Like China and Russia, the right time to buy gold and therefore silver is when you have spare cash to do it.

- The demand for physical gold will eventually overcome the physical market, forcing deliveries to be taken on all the world’s paper markets and demanded in the forgotten large OTC derivatives of gold, written naked.

- The sign that this is taking place will be the ever increasing margin requirement of paper gold until it hits 100%.

- At that point the paper exchange is no longer a paper exchange but rather a physical exchange because physical gold supply will trade at a large premium to paper gold.

- This is the point in time when the question will be asked what is the value of a metals contract that cannot perform, the paper gold contracts.

- The answer to a non-performing contract is that its value is zero.

- Paper gold will trade down to the value of the paper it is written on, zero.

- At that time the value of physical gold will be whatever the major owners of physical wish it to be.

- The value of gold producing companies still functioning will be determined by their over the ground stored physical at full gold value and its underground gold at a modest discount to the stockpiled gold.

- Very few gold miners can grasp that concept. Investors do not have a clue.

- Talking heads seem to be getting a hint that something has changed in gold but have no clue as to why.

- This transmutation of what gold is, is happening right now, not some time in the future.

- The gold market is reflecting this in this minor recovery, making all fishing line market movements a great buy while gambleholic traders still can sell modestly into Rhino horn moves up.

- I do not think trading is correct because the final change will come overnight. You will go to sleep in one financial market and wake up the next day in the new New Normal financial world where gold, not paper, is King.

- The 1% makes this one of the first choices of assets to own on their decision tree.

- This explains the strange action of gold with the manipulators to the dirty work of their masters.

- As the paper price of gold is capped, the 1% are the major buyers on the physical metals, mostly direct from refiners and producers.

- This means that trillions of paper dollars need to be covered.

- The USDX may well be the most useless indicators of the value of the dollar.

- The value is not to be registered against other fiat currency, but rather in buying gold versus gold.

- As such, the USDX falls out of its traditional relationship to gold. This also reduces the SDR to a joke.

- Therefore the 1% is on the bull side of gold in the physical market while the Banksters have been on the short side of the gold price via paper.

- Time is running out for the short of paper gold to be a riskless trade with the Federal Reserve at its back. The intrinsic value of the silver and gold contract is zero and zero cannot fulfill the contract obligation of the paper gold contract. That is how the paper metals exchanges go boom. Therefore zero value for a delivery month on paper gold or silver is zero profit to the short of gold and silver paper contracts.

- All those long gold anything will have the wind at their back for a long and deserved change.

what may well be the most important subjects you need to understand. Some of these conversations have over an hour of in-depth material.

Best Regards,

Jim

There has been a new addition to the debt clock. Take a look at the four letter word in the bottom lower right. Compliments of CIGA JB Slear

http://www.usdebtclock.org

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment