Submitted by Tyler Durden on 05/24/2016 - 21:30

Submitted by Tyler Durden on 05/24/2016 - 21:30

Today’s presidential hopefuls must jump through a series of hoops aimed at selecting the candidates best suited to serve the interests of the American police state. Candidates who are anti-war, anti-militarization, anti-Big Money, pro-Constitution, pro-individual freedom and unabashed advocates for the citizenry need not apply. The carefully crafted spectacle of the presidential election with its nail-biting primaries, mud-slinging debates, caucuses, super-delegates, popular votes and electoral colleges has become a fool-proof exercise in how to persuade a gullible citizenry into believing that their votes matter. Yet no matter how many Americans go to the polls on November 8, “we the people” will not be selecting the nation’s next president.

Paul Craig Roberts: "Americans Are A Conquered People"

Submitted by Tyler Durden on 05/24/2016 - 22:30 The optimism that we see is that the public’s support of outsiders is an indication that the insouciant public is waking up. But Americans will have to do more than wake up, as they cannot rescue themselves via the voting booth. In our opinion, the American people will remain serfs until they wake up to Revolution. Today Americans exist as a conquered people.

Trump Escalates Clinton Attack, Calls Vince Foster Suicide "Very Fishy"

Submitted by Tyler Durden on 05/24/2016 - 15:12 Just hours after Donald Trump released a clip in which the presumptive Republican presidential candidate hinted at Bill Clinton's sexual transgressions which featured audio of two women - Kathleen Willey and Juanita Broaddrick - who have made rape accusations against Bill Clinton, Trump escalated his attack on Hillary and Bill Clinton in an interview with WaPo in which Trump called the circumstances of Vincent Foster’s death "very fishy."

Currency War Resumes - China Devalues Yuan To 5-Year Lows

Submitted by Tyler Durden on 05/24/2016 - 22:25 After a brief haitus from the ongoing currency wars, China fired another salvo at The Fed tonight by devaluing the Yuan fix to 6.5693 - its weakest against the USD since March 2011. After eight days higher in a row for The USD Index, it seems PBOC has turned its currency liberalization plan off, stabilizing the broad Renminbi basket (which has been steadly devalued) and turning its attention to devaluing against the USD. Having unleashed turmoil in August (pre-Sept FOMC) and January (post Dec rate-hike), it appears the rising rate-hike probabilities jawboned by The Fed are decidedly disagreeable to "authoritative persons" in China.

Here's The Full List Of Organizations That Paid Hillary Clinton From 2013-2015

It’s enough to make you sick.

All You Need To Know About The China Boom-Bust Cycle In One Chart

Submitted by Tyler Durden on 05/24/2016 - 21:57 If anyone is still confused about the not so subtle dynamics between markets and monetary policy in China, or the country's bipolar, and ever more frequent boom and bust cycles, you won't be after seeing this chart from Socgen.

Eurogroup Agrees To Disburse €7.5BN To Greece Which Will Be Used To Repay Creditors

Submitted by Tyler Durden on 05/24/2016 - 20:50 The short summary: Greece has promised to implement even more Draconian measures (which may or may not happen) in order to get money that was already promised to it, while the Eurogroup disburses just enough cash to cover the immediate funding needs of the creditors with a little left over to pay for government arrears while demanding even more austerity; future tranches may or may not be paid out if Greece complies with its promises (which will not happen) and meanwhile the Eurogroup says it may someday provide debt relief, once Greece ends its bailout program... which will never happen.

Political Polarity Shift - "Trigger Happy Hillary" Making Dems The War Party

Submitted by Tyler Durden on 05/24/2016 - 20:30 The two parties are undergoing a process of “role reversal,” as these students put it, right before our eyes. Americans are rejecting imperialism – on both sides of the political spectrum.CNN Lashes Out At Trump Over Vince Foster "Conspiracy", Rushes To Hillary's Defense

Submitted by Tyler Durden on 05/24/2016 - 20:23

Shootings In Chicago Are Up An Astonishing 50% From This Time Last Year

Submitted by Tyler Durden on 05/24/2016 - 20:00 This past weekend in Chicago saw another five killed and 40 wounded in shootings, slightly down from Mother's day weekend when eight people were killed and 42 wounded. The two weekends are indicative of what's taking place in the homicide riddled city, in which the number of people shot so far this year is running an astonishing 50% above this time last year - what's worse, summer is not even here yet, which is traditionally the city's most violent period.

Japan's Broken Economy - 25 Years Of Failed "Stimulus" & "Temporary Illusions"

Submitted by Tyler Durden on 05/24/2016 - 19:30 Given the history of intervention and “stimulus”, and more so when it occurs and really re-occurs, any impartial observer would be forgiven if they believed that QEs were actually constant impediments to growth. The proliferation of “stimulus” after the Great Recession correlates only with this downshift in the Japanese economy that cannot be due to demographics. At best, QEs have accomplished nothing at all positive, leaving no trace of something actually being stimulated for all the sustained “stimulus”; at worst, QE is the cause of Japan’s further nightmarish descent.With The Lowest Volume Since Q1 2014, The Global M&A Boom May Be Over

Submitted by Tyler Durden on 05/24/2016 - 19:00

Northwest Territorial Mint Scandal: Investors Had Fair Warning On This Blowup As Well

Submitted by Tyler Durden on 05/24/2016 - 18:28 The news unfortunately just keeps getting worse for customers and creditors of Northwest Territorial Mint. The prominent bullion dealer located near Seattle, Washington filed for bankruptcy court protection at the end of March. The losses of customers who never received delivery of orders plus the losses of other creditors could be as high as $50 million, according to news reports.

Clinton Adviser, Nobel Prize Winning Economist Endorsed Venezuelan Socialism

Submitted by Tyler Durden on 05/24/2016 - 17:30 Ludwig von Mises once wrote, "No one can escape the influence of a prevailing ideology.” The images coming from Venezuela should serve as a potent reminder of how dangerous the ideas of men like Joseph Stiglitz are. Statism and economic interventionism must be rejected, in order for humanity to thrive.

by SGT, SGT Report.com:

Bill Holter from JS Mineset.com is back to help us document the collapse for the fourth week of May, 2016. And as physical gold and silver moves East and into the strong hands of more than a billion Chinese, and as foreign banks publicly settle global trade in the Yuan, Bill reminds us that “Every step forward by China, is one or two steps backward for the US and the Dollar, that’s what’s happening. For instance, if the Yuan is backed by gold, then why would someone accept the Dollar in lieu of the Yuan if the Dollar’s not backed by anything?”

The build out of the infrastructure for the world to move completely away from the Dollar is almost complete. You have been warned.

Bill Holter from JS Mineset.com is back to help us document the collapse for the fourth week of May, 2016. And as physical gold and silver moves East and into the strong hands of more than a billion Chinese, and as foreign banks publicly settle global trade in the Yuan, Bill reminds us that “Every step forward by China, is one or two steps backward for the US and the Dollar, that’s what’s happening. For instance, if the Yuan is backed by gold, then why would someone accept the Dollar in lieu of the Yuan if the Dollar’s not backed by anything?”

The build out of the infrastructure for the world to move completely away from the Dollar is almost complete. You have been warned.

In the beginning of June the Swiss will be called upon to make a

historic decision. Switzerland is the first country worldwide to put the

idea of an Unconditional Basic Income to a vote and the outcome of this

referendum will set a strong precedent and establish a landmark in the

evolution of this debate.

In the beginning of June the Swiss will be called upon to make a

historic decision. Switzerland is the first country worldwide to put the

idea of an Unconditional Basic Income to a vote and the outcome of this

referendum will set a strong precedent and establish a landmark in the

evolution of this debate.The Swiss public will have to approve or reject a change in the constitution that would allow for an Unconditional Basic Income (UBI), or a preset, monthly minimum income to be paid out by the government to every adult and child in the country if their income falls below a specific threshold. Even though details of this proposal have been few and far between, the most commonly cited amount of this guaranteed income would be 2,500 Swiss Francs for adults and 625 francs for children. The architects of the proposal stress that this government-guaranteed payment, unlike the current benefit programs, will be entirely “no questions asked”, i.e. it will not be means-tested and it will apply for every person legally living in Switzerland.

Read More

In 2007, more than a dozen of the world’s largest banks colluded to deliberately depress the rate at which they paid out on investments. This rate is known as the London Interbank Offered Rate (LIBOR),

which is the average of interest rates estimated by each of the leading

banks in London that it would be charged were it to borrow from other

banks.

In 2007, more than a dozen of the world’s largest banks colluded to deliberately depress the rate at which they paid out on investments. This rate is known as the London Interbank Offered Rate (LIBOR),

which is the average of interest rates estimated by each of the leading

banks in London that it would be charged were it to borrow from other

banks.Financial institutions, mortgage lenders, and credit card agencies around the world, set their own rates relative to it, and at least $350 trillion in derivatives and other financial products are tied to the LIBOR. These mega banks suppressed LIBOR, during the beginning of the collapse, to boost earnings and make their bottom lines appear healthier.

This banking conspiracy to rig LIBOR was one of the key factors in bringing about the financial collapse of 2008. The scandal was so large, in fact, that it nearly bankrupt the planet.

Read More

by Simon Black, Sovereign Man:

Out here in Eastern Washington’s Yakima Valley are beautiful, seemingly endless fields of abundance and wealth.

Out here in Eastern Washington’s Yakima Valley are beautiful, seemingly endless fields of abundance and wealth.

But not ‘wealth’ in the conventional sense. I’m not talking about paper money that’s conjured out of thin air by central bankers.

I’m talking about real wealth. Real assets.

Growing up in a lower middle class household where my parents had to work three jobs each just to pay the rent, I never understood what any of that meant.

Like most people, I used to think that ‘wealth’ was how much money you had in your bank account. And for us there was never enough.

Read More

Out here in Eastern Washington’s Yakima Valley are beautiful, seemingly endless fields of abundance and wealth.

Out here in Eastern Washington’s Yakima Valley are beautiful, seemingly endless fields of abundance and wealth.But not ‘wealth’ in the conventional sense. I’m not talking about paper money that’s conjured out of thin air by central bankers.

I’m talking about real wealth. Real assets.

Growing up in a lower middle class household where my parents had to work three jobs each just to pay the rent, I never understood what any of that meant.

Like most people, I used to think that ‘wealth’ was how much money you had in your bank account. And for us there was never enough.

Read More

by Jeff Thomas, International Man:

In 2014, we published an article entitled “Watch the Movie Before It Is Filmed.”

In that article, I described the situation in Venezuela at that time.

The effects of fifteen years of collectivism were threatening to

collapse the economy. The government was reacting by printing bolivares

(Venezuelan currency) on a large scale—a knee-jerk solution that has

been utilized by over twenty other countries in the last century—always

with the same outcome: hyperinflation, resulting in economic collapse.

In 2014, we published an article entitled “Watch the Movie Before It Is Filmed.”

In that article, I described the situation in Venezuela at that time.

The effects of fifteen years of collectivism were threatening to

collapse the economy. The government was reacting by printing bolivares

(Venezuelan currency) on a large scale—a knee-jerk solution that has

been utilized by over twenty other countries in the last century—always

with the same outcome: hyperinflation, resulting in economic collapse.

At the time, I recommended to readers that they “watch the movie” as it was being played out in Venezuela, as it would offer them insight into what was on the way in their own country, should they reside in Europe or North America.

The pattern followed by Venezuela is roughly the same as for the other jurisdictions; Venezuela is just a bit more advanced in the progression. Therefore, what we are observing in Venezuela is likely to be played out in other countries that have made the same mistake of taking on more debt than they can ever pay back.

Read More

In 2014, we published an article entitled “Watch the Movie Before It Is Filmed.”

In that article, I described the situation in Venezuela at that time.

The effects of fifteen years of collectivism were threatening to

collapse the economy. The government was reacting by printing bolivares

(Venezuelan currency) on a large scale—a knee-jerk solution that has

been utilized by over twenty other countries in the last century—always

with the same outcome: hyperinflation, resulting in economic collapse.

In 2014, we published an article entitled “Watch the Movie Before It Is Filmed.”

In that article, I described the situation in Venezuela at that time.

The effects of fifteen years of collectivism were threatening to

collapse the economy. The government was reacting by printing bolivares

(Venezuelan currency) on a large scale—a knee-jerk solution that has

been utilized by over twenty other countries in the last century—always

with the same outcome: hyperinflation, resulting in economic collapse.At the time, I recommended to readers that they “watch the movie” as it was being played out in Venezuela, as it would offer them insight into what was on the way in their own country, should they reside in Europe or North America.

The pattern followed by Venezuela is roughly the same as for the other jurisdictions; Venezuela is just a bit more advanced in the progression. Therefore, what we are observing in Venezuela is likely to be played out in other countries that have made the same mistake of taking on more debt than they can ever pay back.

Read More

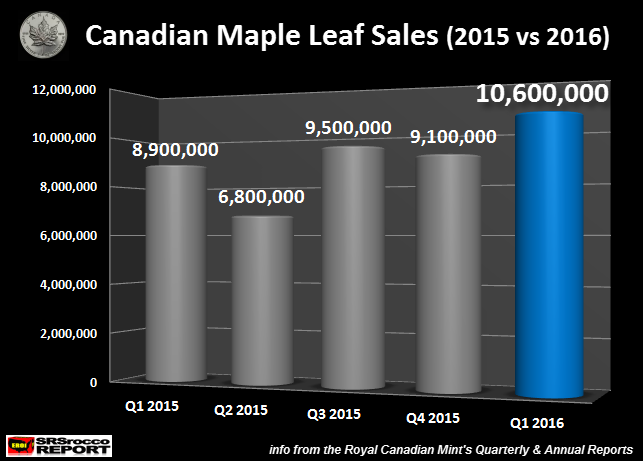

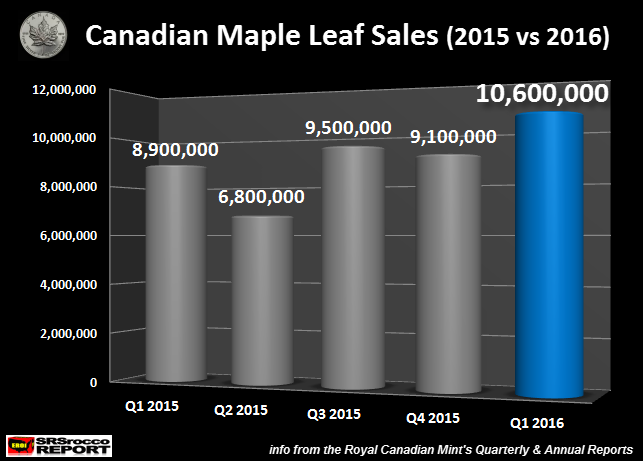

by Steve St. Angelo, SRS Rocco Report:

The Royal Canadian Mint just published its Q1 2016 Report, and the bullion coin sales figures were stunning to say the least. Not only did sales of Canadian Silver Maple Leafs surpass its previous record during the third quarter last year, it did so by a wide margin.

Why is this such a big deal? Because Q1 2016 sales of Silver Maples topped the Q3 2015 record, without surging demand and product shortages. Last year, there was a huge spike in silver retail investment demand due to the supposed “Shemitah” or the collapse of the broader stock markets. Investors piled into silver in a big way as they perceived a year-end market crash was inevitable.

Read More

The Royal Canadian Mint just published its Q1 2016 Report, and the bullion coin sales figures were stunning to say the least. Not only did sales of Canadian Silver Maple Leafs surpass its previous record during the third quarter last year, it did so by a wide margin.

Why is this such a big deal? Because Q1 2016 sales of Silver Maples topped the Q3 2015 record, without surging demand and product shortages. Last year, there was a huge spike in silver retail investment demand due to the supposed “Shemitah” or the collapse of the broader stock markets. Investors piled into silver in a big way as they perceived a year-end market crash was inevitable.

Read More

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment