Bonds Bid As Fed Minutes Spark Little Reaction Across Markets

FOMC Minutes Reveal Fed Wanted More Info Before Hiking

"Sex Sale" - How Brazil's Prostitutes Prepare For The Olympics

Trump Says Clinton Is Trying To Bribe Loretta Lynch

Is Russia Winning The Oil Export War Against The Saudis?

EU Banks Crash To Crisis Lows As Funding Panic Accelerates

Spot The "Outlier" Who Bought Stocks In Q2

Italy Bans Short-Selling In Monte Paschi For Three Months, Forgets To Ban Buying Of CDS

And The Biggest Loser From The UK's "Falling Dominoes" Is...

Broken Stoxx 50, 600 Feeds "Resolved" Moments After Europe Close

Domino #6: Canada Life Halts UK Property Fund Redemptions "For Up To Six Months"

Five Bricks In The 'Wall Of Worry'

Domino #4: Henderson Suspends $5 Billion UK Property Fund Over "Exceptional Liquidity Pressures"

Ex-ECB Banker Stokes Europe's Banking Panic: "People Are Starting To Withdraw From The Market"

President Obama Explains His 'Strategy' In Afghanistan - Live Feed

European Market Breaks: Stoxx 50, Stoxx 600 Have Not Calculated Prices For Nearly An Hour

"Rebound? What Rebound?" - Services Sector Business Confidence Hits Record Lows As ISM Surges To 7-Month Highs

World's Biggest Asset Manager Downgrades European Banks To Sell, Expects Global Slowdown

"It Feels Like 2008" Government Bond Yields Signal "Something Very Nasty Is Coming"

The future is what they filter. Silicon Valley has taken over, though ultimate control remains in the hands of bankers.

The future is what they filter. Silicon Valley has taken over, though ultimate control remains in the hands of bankers.We have reached the point where Facebook is so powerful, experts admit it could rig an election just by geofiltering where voting reminders appear. Google search results can have a similar diminishing effect on democracy. These new elite have control of the information that our society is made up of.

You will vote for those whom they have selected, and you will read views which have been promoted. As the London Telegraph reports:

Read More

by Pamela Senzee, No Lies Radio:

It’s Independence Day, but what does this mean? Can we “celebrate

independence” with our Constitution laying in coma, in ICU? Dr. Paul

Craig Roberts, a Reagan appointee serving as Assistant Secretary to the

Treasury has become a polestar of truth for millions around the world as

one of the world’s preeminent truth tellers. He speaks with QMR host

Pamela Senzee about BREXIT, false flags (including an assessment on the

recent Orlando shooting rage and of others) and the varied aspects of

American coup. He speaks, as well, about what might be done as we look

toward solutions to this the most unprecedented and challenging time of

our nation’s history as well as that of the world — a coup by financial

forces entirely opposed to Constitutional Liberty, Roberts stands as a

voice for truth in America and for True America.

It’s Independence Day, but what does this mean? Can we “celebrate

independence” with our Constitution laying in coma, in ICU? Dr. Paul

Craig Roberts, a Reagan appointee serving as Assistant Secretary to the

Treasury has become a polestar of truth for millions around the world as

one of the world’s preeminent truth tellers. He speaks with QMR host

Pamela Senzee about BREXIT, false flags (including an assessment on the

recent Orlando shooting rage and of others) and the varied aspects of

American coup. He speaks, as well, about what might be done as we look

toward solutions to this the most unprecedented and challenging time of

our nation’s history as well as that of the world — a coup by financial

forces entirely opposed to Constitutional Liberty, Roberts stands as a

voice for truth in America and for True America.

Click HERE to Listen

It’s Independence Day, but what does this mean? Can we “celebrate

independence” with our Constitution laying in coma, in ICU? Dr. Paul

Craig Roberts, a Reagan appointee serving as Assistant Secretary to the

Treasury has become a polestar of truth for millions around the world as

one of the world’s preeminent truth tellers. He speaks with QMR host

Pamela Senzee about BREXIT, false flags (including an assessment on the

recent Orlando shooting rage and of others) and the varied aspects of

American coup. He speaks, as well, about what might be done as we look

toward solutions to this the most unprecedented and challenging time of

our nation’s history as well as that of the world — a coup by financial

forces entirely opposed to Constitutional Liberty, Roberts stands as a

voice for truth in America and for True America.

It’s Independence Day, but what does this mean? Can we “celebrate

independence” with our Constitution laying in coma, in ICU? Dr. Paul

Craig Roberts, a Reagan appointee serving as Assistant Secretary to the

Treasury has become a polestar of truth for millions around the world as

one of the world’s preeminent truth tellers. He speaks with QMR host

Pamela Senzee about BREXIT, false flags (including an assessment on the

recent Orlando shooting rage and of others) and the varied aspects of

American coup. He speaks, as well, about what might be done as we look

toward solutions to this the most unprecedented and challenging time of

our nation’s history as well as that of the world — a coup by financial

forces entirely opposed to Constitutional Liberty, Roberts stands as a

voice for truth in America and for True America.Click HERE to Listen

from TruthNeverTold:

by F. William Engdahl, New Eastern Outlook:

According to a report in the Washington Post, precisely 107 of the

living Nobel Science Prize awardees have done just that. They foolishly

signed a letter urging Greenpeace to stop opposing genetically modified

organisms (GMOs). The letter specifically asks Greenpeace to cease its

efforts to block introduction of so-called “Golden Rice,” a genetically

manipulated rice variety that allegedly “could reduce” vitamin A

deficiencies in infants in the developing world. This demonstrates

either that those 107 Nobel laureates are not truly intelligent or that

they are yet another group of scientist prostitutes willing to whore

their reputation for a few shekels from Monsanto & Co. Or both…

According to a report in the Washington Post, precisely 107 of the

living Nobel Science Prize awardees have done just that. They foolishly

signed a letter urging Greenpeace to stop opposing genetically modified

organisms (GMOs). The letter specifically asks Greenpeace to cease its

efforts to block introduction of so-called “Golden Rice,” a genetically

manipulated rice variety that allegedly “could reduce” vitamin A

deficiencies in infants in the developing world. This demonstrates

either that those 107 Nobel laureates are not truly intelligent or that

they are yet another group of scientist prostitutes willing to whore

their reputation for a few shekels from Monsanto & Co. Or both…

The not-so-noble Nobel scientists’ letter states, “We urge Greenpeace and its supporters to re-examine the experience of farmers and consumers worldwide with crops and foods improved through biotechnology, recognize the findings of authoritative scientific bodies and regulatory agencies, and abandon their campaign against ‘GMOs’ in general and Golden Rice in particular.” The letter is addressed, “To the Leaders of Greenpeace, the United Nations and Governments around the world.” Their letter closes with a gut-wrenching appeal, “How many poor people in the world must die before we consider this a ‘crime against humanity‘? ” That’s heavy. It’s also bullshit.

Read More

According to a report in the Washington Post, precisely 107 of the

living Nobel Science Prize awardees have done just that. They foolishly

signed a letter urging Greenpeace to stop opposing genetically modified

organisms (GMOs). The letter specifically asks Greenpeace to cease its

efforts to block introduction of so-called “Golden Rice,” a genetically

manipulated rice variety that allegedly “could reduce” vitamin A

deficiencies in infants in the developing world. This demonstrates

either that those 107 Nobel laureates are not truly intelligent or that

they are yet another group of scientist prostitutes willing to whore

their reputation for a few shekels from Monsanto & Co. Or both…

According to a report in the Washington Post, precisely 107 of the

living Nobel Science Prize awardees have done just that. They foolishly

signed a letter urging Greenpeace to stop opposing genetically modified

organisms (GMOs). The letter specifically asks Greenpeace to cease its

efforts to block introduction of so-called “Golden Rice,” a genetically

manipulated rice variety that allegedly “could reduce” vitamin A

deficiencies in infants in the developing world. This demonstrates

either that those 107 Nobel laureates are not truly intelligent or that

they are yet another group of scientist prostitutes willing to whore

their reputation for a few shekels from Monsanto & Co. Or both…The not-so-noble Nobel scientists’ letter states, “We urge Greenpeace and its supporters to re-examine the experience of farmers and consumers worldwide with crops and foods improved through biotechnology, recognize the findings of authoritative scientific bodies and regulatory agencies, and abandon their campaign against ‘GMOs’ in general and Golden Rice in particular.” The letter is addressed, “To the Leaders of Greenpeace, the United Nations and Governments around the world.” Their letter closes with a gut-wrenching appeal, “How many poor people in the world must die before we consider this a ‘crime against humanity‘? ” That’s heavy. It’s also bullshit.

Read More

from The Anti Media:

Indianapolis, IN — War games and nuclear policy perpetuated by the

Obama administration are “fueling growing tensions” with Russia and

putting the world at risk of a nuclear war, according to an official

nonpartisan organization consisting of 1,407 mayors and other leaders of

cities with 30,000 or more inhabitants.

Indianapolis, IN — War games and nuclear policy perpetuated by the

Obama administration are “fueling growing tensions” with Russia and

putting the world at risk of a nuclear war, according to an official

nonpartisan organization consisting of 1,407 mayors and other leaders of

cities with 30,000 or more inhabitants.

In a unanimous decision at their 84th annual conference, the United States Conference of Mayors (USCM) passed a resolution condemning President Barack Obama’s decision to set the U.S. on track to spend $1 trillion over the next 30 years to “maintain and modernize its nuclear bombs and warheads, production facilities, delivery systems, and command and control.”

“The Obama administration has […] reduced the US nuclear stockpile less than any post-Cold War presidency,” the resolution, passed in Indianapolis on June 27, reads.

The resolution is supportive of the 1970 international nuclear agreement known as the Non-Proliferation Treaty (NPT), but the USCM chastised the Obama administration’s drift from NPT principles by contrasting it with another international agreement to which the administration has held steadfast.

Read More

Indianapolis, IN — War games and nuclear policy perpetuated by the

Obama administration are “fueling growing tensions” with Russia and

putting the world at risk of a nuclear war, according to an official

nonpartisan organization consisting of 1,407 mayors and other leaders of

cities with 30,000 or more inhabitants.

Indianapolis, IN — War games and nuclear policy perpetuated by the

Obama administration are “fueling growing tensions” with Russia and

putting the world at risk of a nuclear war, according to an official

nonpartisan organization consisting of 1,407 mayors and other leaders of

cities with 30,000 or more inhabitants.In a unanimous decision at their 84th annual conference, the United States Conference of Mayors (USCM) passed a resolution condemning President Barack Obama’s decision to set the U.S. on track to spend $1 trillion over the next 30 years to “maintain and modernize its nuclear bombs and warheads, production facilities, delivery systems, and command and control.”

“The Obama administration has […] reduced the US nuclear stockpile less than any post-Cold War presidency,” the resolution, passed in Indianapolis on June 27, reads.

The resolution is supportive of the 1970 international nuclear agreement known as the Non-Proliferation Treaty (NPT), but the USCM chastised the Obama administration’s drift from NPT principles by contrasting it with another international agreement to which the administration has held steadfast.

Read More

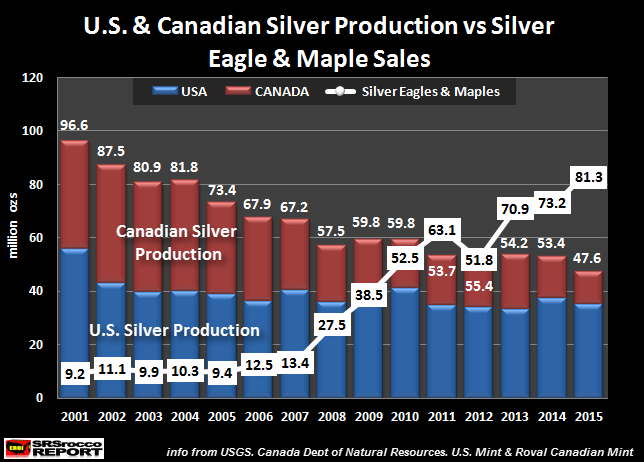

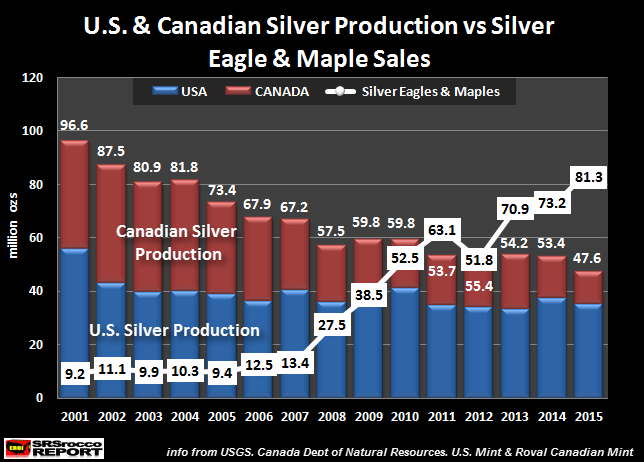

by Steve St. Angelo, SRSRocco Report:

Americans and Canadians will likely face silver shortages in the future

as investment demand continues to surge higher. This will come at time

as the silver price skyrockets, thus making it even harder for

investors to acquire physical metal.

Americans and Canadians will likely face silver shortages in the future

as investment demand continues to surge higher. This will come at time

as the silver price skyrockets, thus making it even harder for

investors to acquire physical metal.

The U.S. and Royal Canadian Mints produce most of the Official Silver coins in the world. In 2015, the combined total of Silver Eagles and Maples sales equaled 81.3 million ounces (Moz). This is a stunning amount as their total sales in 2001 were only 9.2 Moz:

Read More

Americans and Canadians will likely face silver shortages in the future

as investment demand continues to surge higher. This will come at time

as the silver price skyrockets, thus making it even harder for

investors to acquire physical metal.

Americans and Canadians will likely face silver shortages in the future

as investment demand continues to surge higher. This will come at time

as the silver price skyrockets, thus making it even harder for

investors to acquire physical metal.The U.S. and Royal Canadian Mints produce most of the Official Silver coins in the world. In 2015, the combined total of Silver Eagles and Maples sales equaled 81.3 million ounces (Moz). This is a stunning amount as their total sales in 2001 were only 9.2 Moz:

Read More

by Dave Hodges, The Common Sense Show:

In

light of the FBI’s recent decision to not file criminal charges against

Hillary Clinton over the email scandal has Clinton jumping for joy as

she is undoubtedly proclaiming that “I got away with extreme criminal

behavior, again. I am untouchable!”

In

light of the FBI’s recent decision to not file criminal charges against

Hillary Clinton over the email scandal has Clinton jumping for joy as

she is undoubtedly proclaiming that “I got away with extreme criminal

behavior, again. I am untouchable!”

The FBI Director announced that his agency will not be recommending that criminal charges be filed against Hillary Clinton.

The FBI Director was clearly motivated by job preservation as opposed to doing his job as a sworn federal official. He is no better than the criminal Attorney General, Loretta Lynch(mob), who will be retained by Clinton is she becomes the next president. The American government is a total criminal enterprise system.

Read More

In

light of the FBI’s recent decision to not file criminal charges against

Hillary Clinton over the email scandal has Clinton jumping for joy as

she is undoubtedly proclaiming that “I got away with extreme criminal

behavior, again. I am untouchable!”

In

light of the FBI’s recent decision to not file criminal charges against

Hillary Clinton over the email scandal has Clinton jumping for joy as

she is undoubtedly proclaiming that “I got away with extreme criminal

behavior, again. I am untouchable!”The FBI Director announced that his agency will not be recommending that criminal charges be filed against Hillary Clinton.

The FBI Director was clearly motivated by job preservation as opposed to doing his job as a sworn federal official. He is no better than the criminal Attorney General, Loretta Lynch(mob), who will be retained by Clinton is she becomes the next president. The American government is a total criminal enterprise system.

Read More

by Ken Jorgustin Modern Survival Blog:

At the highest level, silver is used in industry, in jewelry, and as an

investment (and/or wealth preservation). Together, these three

categories represent more than 95 % of annual silver demand.

At the highest level, silver is used in industry, in jewelry, and as an

investment (and/or wealth preservation). Together, these three

categories represent more than 95 % of annual silver demand.

Silver has been used as a medium of exchange dating back to the earliest of records. It has always been considered to be a form of ‘money’. Even up until the late 19th century, most nations were on a silver standard as to their ‘money’, with silver coins making up the main circulating currency.

The thing is, even though today’s silver coins are not used as national currency (replaced by Fiat ‘paper’), silver is still collected, stacked, and invested by many people as a hedge against today’s modern currency and a collapse thereof. People who know history may also know that EVERY ‘paper’ currency ever created has ALWAYS collapsed. And most critical-thinking people today know that our current system and foundation is no longer on solid ground…

Read More

At the highest level, silver is used in industry, in jewelry, and as an

investment (and/or wealth preservation). Together, these three

categories represent more than 95 % of annual silver demand.

At the highest level, silver is used in industry, in jewelry, and as an

investment (and/or wealth preservation). Together, these three

categories represent more than 95 % of annual silver demand.Silver has been used as a medium of exchange dating back to the earliest of records. It has always been considered to be a form of ‘money’. Even up until the late 19th century, most nations were on a silver standard as to their ‘money’, with silver coins making up the main circulating currency.

The thing is, even though today’s silver coins are not used as national currency (replaced by Fiat ‘paper’), silver is still collected, stacked, and invested by many people as a hedge against today’s modern currency and a collapse thereof. People who know history may also know that EVERY ‘paper’ currency ever created has ALWAYS collapsed. And most critical-thinking people today know that our current system and foundation is no longer on solid ground…

Read More

/

When I was in high school studying history and government, my friends

and I used to laugh at the Latin American Banana Republics. A “Banana

Republic” is one in which the ruling class of elites exploit

Governmental power for their own benefit at the expense of Untitledthe

rest of the population. Rule of Law is replaced by Rule of Those in

Charge. The leaders rake in massive amounts of illegal wealth and

stand completely immune from prosecution. (click to enlarge)

When I was in high school studying history and government, my friends

and I used to laugh at the Latin American Banana Republics. A “Banana

Republic” is one in which the ruling class of elites exploit

Governmental power for their own benefit at the expense of Untitledthe

rest of the population. Rule of Law is replaced by Rule of Those in

Charge. The leaders rake in massive amounts of illegal wealth and

stand completely immune from prosecution. (click to enlarge)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment