The Cruz Fallout: "An Extraordinary Scene The Like Of Which Has Not Been Seen In A Generation"

On a side-note, it’s important to know that late July/early August is

seasonally the most quiet part of the year for the biggest eastern

hemisphere gold accumulators. And we’re going into the “roll” period,

when the bulk of the massive blob of August paper gold “rolls” into

December, the next “front month” for Comex Paper gold. Having said that,

China has actually slightly increased its gold imports this month.

India has been in hibernation since March 1 but it’s biggest seasonal

buying period starts in about four weeks. Unless smuggled gold into

India is significantly greater in volume than anyone understands,

India’s demand will be somewhat price inelastic and its elephantine

appetite for gold will have a big impact on the price of gold.

On a side-note, it’s important to know that late July/early August is

seasonally the most quiet part of the year for the biggest eastern

hemisphere gold accumulators. And we’re going into the “roll” period,

when the bulk of the massive blob of August paper gold “rolls” into

December, the next “front month” for Comex Paper gold. Having said that,

China has actually slightly increased its gold imports this month.

India has been in hibernation since March 1 but it’s biggest seasonal

buying period starts in about four weeks. Unless smuggled gold into

India is significantly greater in volume than anyone understands,

India’s demand will be somewhat price inelastic and its elephantine

appetite for gold will have a big impact on the price of gold.This leads us to Japan. Curiously, Japan announced announced last week that its TOCOM Untitledcommodity exchange (Japan’s less corrupted CME-equivalent) would begin trading physical gold – like the Shanghai Gold Exchange – on July 25th – TOCOM Physical Gold. It also announced that it would be introducing a delivery-at-settlement option for its current-month gold futures contract. That is, TOCOM gold futures buyers will now have the ability to take delivery of physical gold via TOCOM’s paper gold.

Read More

Could This Rally Be A Head-Fake?

10Y Bund Yield Falls Back Under 0% After Draghi Leave QE Program Unchanged In Less Dovish Announcement

Philly Fed Slumps To 6-Month Lows As National Activity Index Jumps To 6-Month Highs

Mario Draghi's "Whatever-er It Takes"-Promising ECB Press Conference - Live Feed

ECB Keeps Rates Unchanged

What To Expect In Today's ECB Announcement: "Time To Send Another Dovish Signal"

Yen Soars, Stocks Slide After Kuroda Says "No Need Or Possibility For Helicopter Money"

Ted Cruz Booed For Refusing To Endorse Trump; Heidi Cruz Escorted Out To Shouts Of "Goldman Sachs"

Beware of Junkyard Dogs: “This Isn’t A Really Normal Environment”

234 Billion-Dollar-Managing Fund Unclear Why Market Ignoring The Biggest Risk

Sharia In Denmark

George Soros Doubles Down: Accept 300k Refugees Costing $30Bn, Or Risk EU Collapse

by Dr. Jeffrey Lewis, Silver-coin-investor.com:

A long time reader and forum member posted the following with a question regarding silver industrial demand:

“The question that begs an answer, is how will this ultimately effect the monetary value of Silver and does that foretell a change in investment strategies?” (Full comment below).

In a market like silver, where price has not reflected true supply and demand for decades, an interesting syndrome evolves.

Read More

A long time reader and forum member posted the following with a question regarding silver industrial demand:

“The question that begs an answer, is how will this ultimately effect the monetary value of Silver and does that foretell a change in investment strategies?” (Full comment below).

In a market like silver, where price has not reflected true supply and demand for decades, an interesting syndrome evolves.

Read More

from The Alex Jones Channel:

by Mike Adams, Natural News:

According to shocking new science, 90% of pregnant women in the USA

carry “detectable levels” of 62 chemicals that damage developing brains.

As documented by Project TENDR

(“Targeting Environmental NeuroDevelopmental Risks”), there is now “now

substantial scientific evidence linking toxic environmental chemicals to

neurodevelopmental disorders such as autism spectrum disorder,

attention deficits, hyperactivity, intellectual disability and learning

disorders.”

According to shocking new science, 90% of pregnant women in the USA

carry “detectable levels” of 62 chemicals that damage developing brains.

As documented by Project TENDR

(“Targeting Environmental NeuroDevelopmental Risks”), there is now “now

substantial scientific evidence linking toxic environmental chemicals to

neurodevelopmental disorders such as autism spectrum disorder,

attention deficits, hyperactivity, intellectual disability and learning

disorders.”

From the Daily Mail:

Common chemicals found in plastic bottles, pollution and even makeup are harming the brains of foetuses and growing children, according to new research.

Scientists said the chemicals can lower children’s IQs and are being introduced into people’s lives with little review of the associated dangers.

Chemicals that are of most concern include lead and mercury, organophosphate pesticides used in agriculture and gardens, polybrominated diphenyl ethers (PBDEs) found in flame retardants, and phthalates, found in plastic bottles, food containers and beauty products.

Flame retardants, and traffic pollution and from wood smoke can also affect brain development in both the womb and in childhood, according to the new report.

Read More

According to shocking new science, 90% of pregnant women in the USA

carry “detectable levels” of 62 chemicals that damage developing brains.

As documented by Project TENDR

(“Targeting Environmental NeuroDevelopmental Risks”), there is now “now

substantial scientific evidence linking toxic environmental chemicals to

neurodevelopmental disorders such as autism spectrum disorder,

attention deficits, hyperactivity, intellectual disability and learning

disorders.”

According to shocking new science, 90% of pregnant women in the USA

carry “detectable levels” of 62 chemicals that damage developing brains.

As documented by Project TENDR

(“Targeting Environmental NeuroDevelopmental Risks”), there is now “now

substantial scientific evidence linking toxic environmental chemicals to

neurodevelopmental disorders such as autism spectrum disorder,

attention deficits, hyperactivity, intellectual disability and learning

disorders.”From the Daily Mail:

Common chemicals found in plastic bottles, pollution and even makeup are harming the brains of foetuses and growing children, according to new research.

Scientists said the chemicals can lower children’s IQs and are being introduced into people’s lives with little review of the associated dangers.

Chemicals that are of most concern include lead and mercury, organophosphate pesticides used in agriculture and gardens, polybrominated diphenyl ethers (PBDEs) found in flame retardants, and phthalates, found in plastic bottles, food containers and beauty products.

Flame retardants, and traffic pollution and from wood smoke can also affect brain development in both the womb and in childhood, according to the new report.

Read More

from The Daily Bell:

Chris Christie Made a Case Against Hillary Clinton. We

Fact-Checked. … … Gov. Chris Christie of New Jersey, whom Donald J.

Trump passed over to be his running mate, was one of the stars of the

Republican convention’s second night on Tuesday, delivering a detailed

case against Hillary Clinton with a prosecutorial zeal … Like many

indictments, the facts presented to the Republican jury were sometimes

selective: not necessarily false, but often ignoring exculpatory

evidence. Below is a closer look at Mr. Christie’s case. – New York

Times

Chris Christie Made a Case Against Hillary Clinton. We

Fact-Checked. … … Gov. Chris Christie of New Jersey, whom Donald J.

Trump passed over to be his running mate, was one of the stars of the

Republican convention’s second night on Tuesday, delivering a detailed

case against Hillary Clinton with a prosecutorial zeal … Like many

indictments, the facts presented to the Republican jury were sometimes

selective: not necessarily false, but often ignoring exculpatory

evidence. Below is a closer look at Mr. Christie’s case. – New York

Times

The pro-Hillary mainstream media has been shocked by the GOP convention and often cited suggestions that Hillary Clinton ought to be in jail rather than running for president.

The New York Times even “fact-checked” Christie’s allegations and made a fool of itself doing so. But the GOP didn’t do much better.

Read More

Chris Christie Made a Case Against Hillary Clinton. We

Fact-Checked. … … Gov. Chris Christie of New Jersey, whom Donald J.

Trump passed over to be his running mate, was one of the stars of the

Republican convention’s second night on Tuesday, delivering a detailed

case against Hillary Clinton with a prosecutorial zeal … Like many

indictments, the facts presented to the Republican jury were sometimes

selective: not necessarily false, but often ignoring exculpatory

evidence. Below is a closer look at Mr. Christie’s case. – New York

Times

Chris Christie Made a Case Against Hillary Clinton. We

Fact-Checked. … … Gov. Chris Christie of New Jersey, whom Donald J.

Trump passed over to be his running mate, was one of the stars of the

Republican convention’s second night on Tuesday, delivering a detailed

case against Hillary Clinton with a prosecutorial zeal … Like many

indictments, the facts presented to the Republican jury were sometimes

selective: not necessarily false, but often ignoring exculpatory

evidence. Below is a closer look at Mr. Christie’s case. – New York

TimesThe pro-Hillary mainstream media has been shocked by the GOP convention and often cited suggestions that Hillary Clinton ought to be in jail rather than running for president.

The New York Times even “fact-checked” Christie’s allegations and made a fool of itself doing so. But the GOP didn’t do much better.

Read More

by Mark O’Byrne, GoldCore:

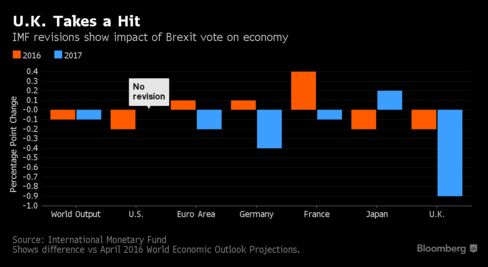

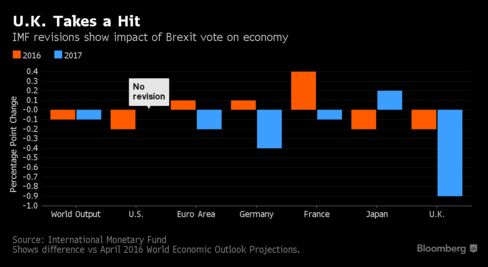

Following on from the Brexit vote last month the IMF have decided to re-evaluate their forecast for global growth.

Following on from the Brexit vote last month the IMF have decided to re-evaluate their forecast for global growth.

Bloomberg reports that they have revised their original 3.2% forecast down to 3.1% for 2016 and from 3.5% to 3.4% for 2017. While these feel like very modest revisions ,the IMF would not be known for radical changes of direction preferring slow and steady revisions.

Read More

Following on from the Brexit vote last month the IMF have decided to re-evaluate their forecast for global growth.

Following on from the Brexit vote last month the IMF have decided to re-evaluate their forecast for global growth.Bloomberg reports that they have revised their original 3.2% forecast down to 3.1% for 2016 and from 3.5% to 3.4% for 2017. While these feel like very modest revisions ,the IMF would not be known for radical changes of direction preferring slow and steady revisions.

Read More

from Sovereign Man:

I’m excited.

I’m excited.

Tomorrow starts our summer Liberty & Entrepreneurship camp, an annual event that our foundation sponsors in which some of my most accomplished friends and I mentor young students from all over the world.

This year we have students from dozens of countries, places like Indonesia, Ecuador, Nigeria, Brazil, New Zealand, Ukraine, Canada, Estonia, China, Venezuela, Singapore, India, and the United States.

We’ll spend five days together at a beautiful lakeside resort here in Lithuania helping them build real skills in value creation, business development, investing, and more.

Read More

I’m excited.

I’m excited.Tomorrow starts our summer Liberty & Entrepreneurship camp, an annual event that our foundation sponsors in which some of my most accomplished friends and I mentor young students from all over the world.

This year we have students from dozens of countries, places like Indonesia, Ecuador, Nigeria, Brazil, New Zealand, Ukraine, Canada, Estonia, China, Venezuela, Singapore, India, and the United States.

We’ll spend five days together at a beautiful lakeside resort here in Lithuania helping them build real skills in value creation, business development, investing, and more.

Read More

from RT:

/

While the Justice Department has given Hillary a pass on the handling

of classified emails, the new Republican party is preparing to convict

her in the court of public opinion, as Trump goes to war with Hillary

Clinton.

While the Justice Department has given Hillary a pass on the handling

of classified emails, the new Republican party is preparing to convict

her in the court of public opinion, as Trump goes to war with Hillary

Clinton.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment