Hillary for Prison 2016...

What A Trump Victory Really Means For The Market

BTFTD! - US Equity Markets Explode Into Green After Being Limit-Down Overnight

"Wrong Way Gartman"

Gartman Says Sell Everything: "Bear Markets Are Now Fully Engaged"

Healthcare Stocks Are Crashing As The End Of Obamacare Looms

President Obama Invites "Uniquely Unqualified" President-Elect Trump To The White House

Gold Surges Post-Trump, Nears Heaviest Volume Day Ever

Putin Congratulates Trump, Says Russia Is Ready To Restore Relations With The US

Stunned Global Markets Wake Up To President Trump

I hope she is packing for PRISON...

Clinton Concedes: Donald Trump Becomes 45th U.S. President

Election Fatigue? We Have Bad News For You

Nassim Taleb Explains Who Just Got Buried

Brexit Vs US Election - Deja Vu All Over Again

Obamacare Is Over: Republicans Retain Senate

Huffington Post Ends Editor's Note Calling Trump "Serial Liar, Rampant Xenophobe, Racist, Misogynist"

Yale Professor Makes Exam Optional Due To Student Shock Over Presidential Election

Meanwhile, At Hillary Clinton's Headquarters: Tragedy

by Gordon T. Long, Gold Seek:

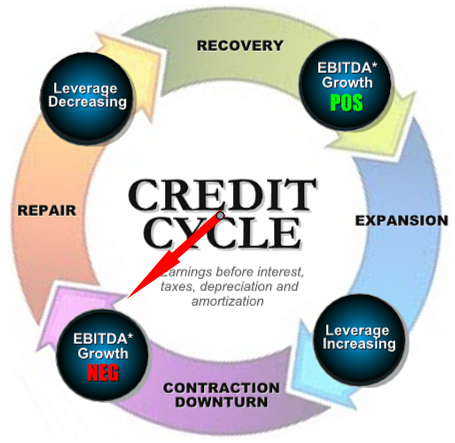

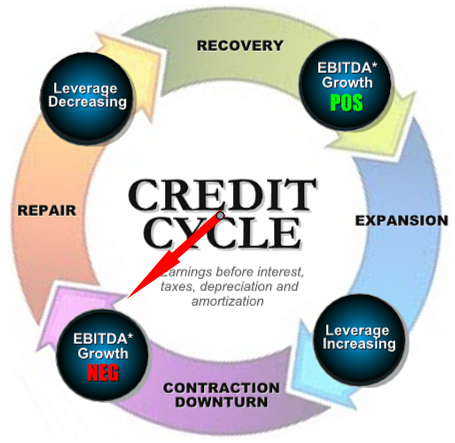

We may not know for a fact who will win the US election, but what we do

know is that the Credit Cycle has turned. This will turn out to be more

important in the near term, once the expected US Election market

gyrations have subsided!

We may not know for a fact who will win the US election, but what we do

know is that the Credit Cycle has turned. This will turn out to be more

important in the near term, once the expected US Election market

gyrations have subsided!

CREDIT CYCLE HAS TURNED

It’s time for investors to refocus on the banks who live via the credit cycle, and specifically the troubled EU Banking sector.

When the Credit Cycle turns, those banks most over-extended always “pay the piper”!

Read More

We may not know for a fact who will win the US election, but what we do

know is that the Credit Cycle has turned. This will turn out to be more

important in the near term, once the expected US Election market

gyrations have subsided!

We may not know for a fact who will win the US election, but what we do

know is that the Credit Cycle has turned. This will turn out to be more

important in the near term, once the expected US Election market

gyrations have subsided!CREDIT CYCLE HAS TURNED

It’s time for investors to refocus on the banks who live via the credit cycle, and specifically the troubled EU Banking sector.

When the Credit Cycle turns, those banks most over-extended always “pay the piper”!

Read More

by Wolf Richter, Wolf Street:

The Fed likes the word “credit.” Sounds less onerous than “debt.”

The Fed likes the word “credit.” Sounds less onerous than “debt.”

Consumer debt rose by $19.3 billion in September to $3.71 trillion, another record in a five-year series of records, the Federal Reserve’s Board of Governors reported on Monday. Consumer debt is up 6% from a year ago, at a time when wages are barely creeping up and when consumer spending rose only 2.4% over the same period.

This follows the elegant principle of borrowing ever more to produce smaller and smaller gains in spending and economic growth. Which is a highly sustainable economic model with enormous future potential, according to the Fed.

Read More

The Fed likes the word “credit.” Sounds less onerous than “debt.”

The Fed likes the word “credit.” Sounds less onerous than “debt.”Consumer debt rose by $19.3 billion in September to $3.71 trillion, another record in a five-year series of records, the Federal Reserve’s Board of Governors reported on Monday. Consumer debt is up 6% from a year ago, at a time when wages are barely creeping up and when consumer spending rose only 2.4% over the same period.

This follows the elegant principle of borrowing ever more to produce smaller and smaller gains in spending and economic growth. Which is a highly sustainable economic model with enormous future potential, according to the Fed.

Read More

by Michael Snyder, The Economic Collapse Blog:

Most Americans assume that their votes decide who the next president

will be, but that is actually not the case. It is the Electoral College

that will elect the next president, and they don’t meet until December

19th. And the truth is that all of the members of the Electoral College

never meet in one place. Rather, electors gather together in all 50

state capitals on the second Wednesday in December, and it is at that

time that the next president and vice president are officially elected.

Of course members of the Electoral College have voted according to the

will of the people about 99 percent of the time throughout our history,

but with how crazy this election has turned out to be you never know

what might happen. For example, later on in this article you will see

that one elector in Washington state has already publicly stated that he

will not cast his vote for Hillary Clinton. If other “faithless

electors” emerge, that could potentially change the entire outcome of

the election.

Most Americans assume that their votes decide who the next president

will be, but that is actually not the case. It is the Electoral College

that will elect the next president, and they don’t meet until December

19th. And the truth is that all of the members of the Electoral College

never meet in one place. Rather, electors gather together in all 50

state capitals on the second Wednesday in December, and it is at that

time that the next president and vice president are officially elected.

Of course members of the Electoral College have voted according to the

will of the people about 99 percent of the time throughout our history,

but with how crazy this election has turned out to be you never know

what might happen. For example, later on in this article you will see

that one elector in Washington state has already publicly stated that he

will not cast his vote for Hillary Clinton. If other “faithless

electors” emerge, that could potentially change the entire outcome of

the election.

Read More

Most Americans assume that their votes decide who the next president

will be, but that is actually not the case. It is the Electoral College

that will elect the next president, and they don’t meet until December

19th. And the truth is that all of the members of the Electoral College

never meet in one place. Rather, electors gather together in all 50

state capitals on the second Wednesday in December, and it is at that

time that the next president and vice president are officially elected.

Of course members of the Electoral College have voted according to the

will of the people about 99 percent of the time throughout our history,

but with how crazy this election has turned out to be you never know

what might happen. For example, later on in this article you will see

that one elector in Washington state has already publicly stated that he

will not cast his vote for Hillary Clinton. If other “faithless

electors” emerge, that could potentially change the entire outcome of

the election.

Most Americans assume that their votes decide who the next president

will be, but that is actually not the case. It is the Electoral College

that will elect the next president, and they don’t meet until December

19th. And the truth is that all of the members of the Electoral College

never meet in one place. Rather, electors gather together in all 50

state capitals on the second Wednesday in December, and it is at that

time that the next president and vice president are officially elected.

Of course members of the Electoral College have voted according to the

will of the people about 99 percent of the time throughout our history,

but with how crazy this election has turned out to be you never know

what might happen. For example, later on in this article you will see

that one elector in Washington state has already publicly stated that he

will not cast his vote for Hillary Clinton. If other “faithless

electors” emerge, that could potentially change the entire outcome of

the election.Read More

A

MASSIVE 46 BILLION USA LEAVES CHINESE SHORES AS THE YUAN WEAKENS:

PROBABLY IT WILL BE HIGHER AS MANY DOLLARS ALSO LEAVE VIA THE POBC FX

MOVES/EGYPT TURNS HER BACK AGAINST SAUDI ARABIA AND THE USA AND TURNS TO

RUSSIA,CHINA AND IRAN

from Harvey Organ:

It seems that Shanghai pricing is higher than the other two , (NY and

London). The spread has been occurring on a regular basis and thus I

expect to see arbitrage happening as investors buy the lower priced NY

gold and sell to China at the higher price. This should drain the comex.

It seems that Shanghai pricing is higher than the other two , (NY and

London). The spread has been occurring on a regular basis and thus I

expect to see arbitrage happening as investors buy the lower priced NY

gold and sell to China at the higher price. This should drain the comex.

Also why would mining companies hand in their gold to the comex and receive constantly lower prices. They would be open to lawsuits if they knowingly continue to supply the comex despite the fact that they could be receiving higher prices in Shanghai.

Read More @ Harveyorganblog.com

from Harvey Organ:

It seems that Shanghai pricing is higher than the other two , (NY and

London). The spread has been occurring on a regular basis and thus I

expect to see arbitrage happening as investors buy the lower priced NY

gold and sell to China at the higher price. This should drain the comex.

It seems that Shanghai pricing is higher than the other two , (NY and

London). The spread has been occurring on a regular basis and thus I

expect to see arbitrage happening as investors buy the lower priced NY

gold and sell to China at the higher price. This should drain the comex.Also why would mining companies hand in their gold to the comex and receive constantly lower prices. They would be open to lawsuits if they knowingly continue to supply the comex despite the fact that they could be receiving higher prices in Shanghai.

Read More @ Harveyorganblog.com

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment