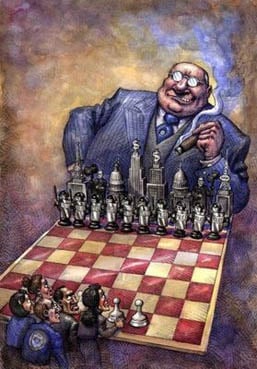

Submitted by Tyler Durden on 07/26/2015 - 15:00 Less than a decade after a housing/derivatives bubble nearly wiped out the global financial system, a new and much bigger commodities/derivatives bubble is threatening to finish the job. So... the central banks will panic. Again. Countries that retain some control over their monetary systems will see their interest rates fall to zero and beyond, while those that don’t will be thrown into some kind of new age hyperinflationary depression. Not 2008 all over again; this is something much stranger.

When

investing becomes gambling, bad endings follow. The next credit crunch

could make 2008-09 look mild by comparison. Bank of International

Settlements(BIS) data show around $700 trillion in global derivatives.

When

investing becomes gambling, bad endings follow. The next credit crunch

could make 2008-09 look mild by comparison. Bank of International

Settlements(BIS) data show around $700 trillion in global derivatives. Along with credit default swaps and other exotic instruments, the total notional derivatives value is about $1.5 quadrillion – about 20% more than in 2008, beyond what anyone can conceive, let alone control if unexpected turmoil strikes.

The late Bob Chapman predicted it. So does Paul Craig Roberts. It could “destroy Western civilization,” he believes. Financial deregulation turned Wall Street into a casino with no rules except unrestrained making money. Catastrophic failure awaits. It’s just a matter of time.

Read More @ Globalresearch.ca

It's Not Just Margin Debt: Presenting The Complete Chinese Stock Market Ponzi Schematic

Submitted by Tyler Durden on 07/26/2015 - 17:45 Late last month, we suggested that the pressure on Chinese equities - which at that point had only begun to build - was at least partially attributable to an unwind in the country’s CNY1 trillion backdoor margin lending edifice. Precisely measuring the amount of shadow financing that helped drive Chinese stocks to nosebleed levels is virtually impossible, as is determining how much of that leverage has been unwound and how much remains or has been restored, but BofAML is out with a valiant attempt to not only identify each shadow lending channel, but to quantify just how much leverage may be built into the Chinese market. The figures will shock you.

From Trump Tower To Clinton's Compound - The Homes Of The 2016 Presidential Candidates

Submitted by Tyler Durden on 07/26/2015 - 18:15 As dozens now vie for residence in the big white one of Pennsylvania Avenue, MarketWatch, courtesy of LoanDepot.com and CoreLogic, unveil the homes (since most own more than one) and mortgages of the 2016 presidential candidates. With homeownership rates at multi-decade lows, and the American Dream disappearing for most, it appears it pays to be in government - from Trump Tower and Clinton's Compounds to Bernie Sanders' underwater mortgages and Carly Fiorina's five fireplaces...

Gold and Gibson's Paradox

Submitted by Tyler Durden on 07/26/2015 - 17:15 There is a myth prevalent today that the gold price always falls when interest rates rise. The logic is that when interest rates rise it is more expensive to hold gold, which just sits there not earning anything. And since markets discount future expectations, gold will even fall when a rise in interest rates is expected. With the Fed's Open Market Committee debating the timing of an interest rate rise to take place possibly in September, it is therefore no surprise to market commentators that the gold price continues its bear market. Only the myth is just that: a myth denied by empirical evidence.July 24, 2015

On the heels of another chaotic trading week in major markets, today one of the top economists in the world sent King World News an incredibly powerful piece warning about the most dangerous bubble in history and why the central banks are now in a panic. Below is the fantastic piece from Michael Pento.

KWN will be releasing interviews all day today with Eric Sprott and many others, but first…

By Michael Pento of Pento Portfolio Strategies

July 24 – (King World News) – One of the most ironic and fascinating characteristics about an asset bubble is that central banks claim they can’t recognize one until after it bursts. And Wall Street apologists tend to ignore the manifestation of bubbles because the profit stream is just too difficult to surrender.

The excuses for piling money into a particular asset class and sending prices several standard deviations above normal are made to seem rational at the time: Housing prices have never gone down on a national basis and people have to live somewhere, the internet will replace all brick and mortar stores, and perhaps the classic example is that variegated tulips are so rare they should be treated like gold….

Continue reading the Michael Pento piece below…

I am willing to let the Dutch off the hook; back in the seventeenth century asset bubbles were virtually nonexistent because money was still in specie. But central banks have created the perfect petri dish for asset bubbles over the past three decades. Therefore, it’s imperative for investors to understand the classic warning signs of a bubble so you can avoid the inevitable carnage in the wake of its collapse.

As I identified in my book “The Coming Bond Market Collapse”, there are three classic metrics to determine when an asset has grown into a bubble: it becomes extremely over supplied, over owned and overpriced compared to historical norms.

The real estate market circa 2005 was a great example of a classic bubble. The supply of new homes boomed as new home construction rates peaked around 2 million units per annum in the middle of the last decade. That’s about 400k units higher than what would be considered the historical average.

Just prior to the start of the Great Recession the level of home ownership in the U.S. soared. This rate hit a high of 69% during 2005, after bouncing around 64-66% for decades. Today’s home ownership rate has fallen back to just 63.7%, which is the lowest in 25 years.

And finally, during the real estate bubble homes were massively overpriced. According to Trulia, at its 2006 peak home prices were 39% overvalued based on consumer incomes and cost to rent. On a national level the median home price to income ratio shot to 4.7 in 2006, compared to the 2.6 historical average. The current home price to income ratio has climbed back to 4.4 on a national basis. However, even though home prices are currently vastly overvalued, the housing market is not in a classic bubble because the real estate market is not currently in the conditions of being over owned or over supplied.

But the bond bubble is a classic bubble thanks to Wall Street and the Federal Reserve. The bond market qualifies as being in a state of over supply because there has been an additional $60 trillion in total global debt that has accrued since 2007.

During the first half of this year, $891 billion in bonds were issued in the U.S. alone. That’s up 7.5% from the same period in 2014, which was itself a record year, according to the Securities Industry and Financial Markets Association.

More…

Two Week Shanghai Gold Exchange Withdrawals Exceed All 2014 Comex Deliveries

The numbers below are simply SHOCKING:

Submitted by PM Fund Manager Dave Kranzler, Investment Research Dynamics:

The Shanghai Gold Exchange is the only major official physical gold trading market in the world. All trades on the exchange are settled with the exchange of ownership on physical gold bullion. Paper future contracts do not trade on the SGE. In contrast, trading occurs on the LBMA and Comex in paper gold. The Comex is de facto a 99.999% paper gold exchange for which the percentage metal backing the paper traded is minuscule. The LBMA has been rapidly “catching up” to the Comex in this regard, although on a percentage basis the LBMA experiences a higher amount physical gold exchanged than the Comex.

Because of the way in which the SGE functions, gold withdrawn from the SGE measures the true demand for gold in China in a given time period. All gold – except for the gold purchased by the Peoples Bank of China – purchased by any form of end user must pass through the SGE by law. It is for this reason that “withdrawals” represent the most accurate measurement of demand for gold in China – except the Central Bank’s demand.

In the past two weeks, 106.1 tonnes of gold were withdrawn from the SGE. As Smaulgld.com has observed:

Gold withdrawals on the Shanghai Gold Exchange the past two weeks were larger than the amount of gold delivered on COMEX during 2014 and greater than the amount of gold Germany has repatriated from the New York Fed since 2013.

I’ll point out one minor correction to the fact above: it’s more gold than the U.S. Government has been able to repatriate back to Germany.

Year to date SGE withdrawals are 1,260 tonnes. This translates into an approximate annualized run-rate of 2400 tonnes – with one of heaviest seasonal periods of Chinese gold demand still to come.

I find it fascinating how the entire world, including and especially the U.S. media, has summarily dismissed the unwillingness of the U.S. Government to return Germany’s gold. Recall, Germany originally asked for over 600 tonnes of gold to be returned. This was after the Fed refused a request by a German delegation to inspect its gold (the Fed allowed the delegation into one of the nine vaults where the gold is supposedly being “safekept”).

If the gold is there and it belongs to Germany, why is the U.S. Government dragging it’s feet on this matter? The question, of course, is highly rhetorical. With China moving more gold into the country and delivering to the entities who pay for this gold, transportation and delivery is not the issue.

At some point in the future, I have no idea when and neither does anyone else, there will be a massive upward explosion in the price of gold which is ignited by investors and Governments holding paper gold and who make move to take delivery of physical gold that no longer exists in the custodial vaults listed on their paper claims.

More…

Tyler Durden on 07/24/2015 20:49 -0400

Three weeks ago, we reported that the US Mint had run out of physical silver on the same day silver plunged to its lowest price in 2015. This happened just days after the UK Royal mint announced that “during June, we experienced twice the expected demand for Sovereign bullion coins from our customers based in Greece.”

While the surge in physical demand clearly did not explain the liquidation in the price of “paper” silver, we are still hoping that the OCC writes us back with an explanation why this happened, and maybe it can clarify also just how much more silver the mint will sell before it runs out of silver in inventory again as it did 20 days ago.

We bring all of this up because just like 20 days ago when unstoppable demand for physical silver met an immovable paper silver selling object (with the “object” for now winning), so earlier today the price of gold tumbled to the lowest level in 5 years, some $1,072 per ounce, before it staged a dramatic comeback closing just under $1,100…

… thanks in no small part to the illegal spoofing we noted earlier.

More…

from Secular Investor:

We wrote on July 5th that markets are increasingly looking scary. Now, only 3 weeks later, the situation seems to be escalating.

We wrote on July 5th that markets are increasingly looking scary. Now, only 3 weeks later, the situation seems to be escalating.

Let’s get it straight: this is a serious deflationary bust in the making. The most worrisome fact is Dr. Copper’s technical breakdown, as seen on the first chart.

The price of copper, being a leading indicator for the health of the global economy, has broken through a multi-decade trend channel. This is really bad news for the global economy, and for markets in particular. This setup carries a message you simply cannot ignore if you are a serious investor.

Read More @ SecularInvestor.com

We wrote on July 5th that markets are increasingly looking scary. Now, only 3 weeks later, the situation seems to be escalating.

We wrote on July 5th that markets are increasingly looking scary. Now, only 3 weeks later, the situation seems to be escalating.Let’s get it straight: this is a serious deflationary bust in the making. The most worrisome fact is Dr. Copper’s technical breakdown, as seen on the first chart.

The price of copper, being a leading indicator for the health of the global economy, has broken through a multi-decade trend channel. This is really bad news for the global economy, and for markets in particular. This setup carries a message you simply cannot ignore if you are a serious investor.

Read More @ SecularInvestor.com

Europe's New Colonialism: ECB Rejects Greek Request To Reopen Stock Market

Submitted by Tyler Durden on 07/26/2015 - 16:44 To understand what really happened earlier today, one should read the Bloomberg explanation, according to which it was the ECB which rejected proposals by Greek authorities to reopen country’s financial markets with no restrictions in place for both Greek and foreign traders, citing an Athens Exchange spokeswoman. And just like that, we wave goodbye to the Hellenic Republic, and greet the Mediterranean Vassal Province of Mario and Merkel. Because as of this moment, no Greek decision can be taken without the direct or indirect express prior approval of either the ECB and/or Berlin.

Reports Of Secret Drachma Plots Leave Tsipras Facing Fresh Crisis

Submitted by Tyler Durden on 07/26/2015 - 11:20 Now that Tsipras has succeeded in compelling Greek lawmakers to cede the country’s sovereignty to Brussels in exchange for the right to use the euro, tales of unrealized redenomination plots have come out of the woodwork. Just two days after FT reported that former Energy Minister Panayotis Lafazanis planned to seize the country's mint and currency reserves, Kathimerini reports that Yanis Varoufakis, on orders from Tsipras, developed a top-secret parallel banking system. Now, the opposition lawmakers who helped Tsipras pass the new bailout measures through parliament are demanding answers.

Forget Banks - GMOs Are The New "Too Big To Fail' System

Submitted by Tyler Durden on 07/26/2015 - 16:10 Before the crisis that started in 2007, both of us believed that the financial system was fragile and unsustainable, contrary to the near ubiquitous analyses at the time. Now, there is something vastly riskier facing us, with risks that entail the survival of the global ecosystem - not the financial system. The G.M.O. experiment, carried out in real time and with our entire food and ecological system as its laboratory, is perhaps the greatest case of human hubris ever. It creates yet another systemic, “too big too fail” enterprise - but one for which no bailouts will be possible when it fails.Revenue Recession: Investors Are Paying Too Much For Growth, Barclays Says

Submitted by Tyler Durden on 07/26/2015 - 15:35 In the U.S., the economy has failed to accelerate, with GDP growth stubbornly below 2.5%. It is worse in Europe and even China has slowed. Stagnant global economic growth, a strong USD, and lower oil prices have combined to cause revenue growth for the S&P 500 to fall. The first quarter of 2015 was the first quarter of negative sales growth for the S&P 500 since the financial crisis. 2Q15 is expected to be worse

How We Got Here - The 2008 Financial Crisis For Dummies

Submitted by Tyler Durden on 07/26/2015 - 14:15 It could never happen again, right?

Deflation Is Winning - Beware!

Submitted by Tyler Durden on 07/26/2015 - 13:30 Deflation is back on the front burner and it's going to destroy all of the careful central planning and related market manipulation of the past 6 years. Clear signs from the periphery indicate that a destructive deflationary pulse has been unleashed. After years of suppression, the forces of reality are threatening to overwhelm our managed global ""markets"'. And it's about damn time.

Donald Trump's Top 30 Insults

Submitted by Tyler Durden on 07/26/2015 - 12:45 Amid the 16 (yes sixteen!) candidates for Republican Presidential nominee, there is one, and only one, that stands above the rest in terms of sheer un-filtered, un-political, and some would say un-presidential outspoken-ness. In an oustanding aggregation of abuse, The Hill has documented Donald Trump's Top 30 insults (so far in the 2016 campaign alone)... The Greek crisis is no accident, says Jim Rickards, but is part of a long-running plan to bring Europe under central control.

The Greek crisis is no accident, says Jim Rickards, but is part of a long-running plan to bring Europe under central control.Jim was general council at Long-Term Capital Management, a hedge fund that made massively levered bets in the late 90’s and eventually went south, exposing banks to over $1 trillion in potential losses. He was involved in negotiating a bailout in the aftermath.

The CIA has called on Jim to help investigate how stock markets might indicate impending threats.

He’s the author of Currency Wars and The Death of Money, and will be attending the Sprott-Stansberry Vancouver Natural Resource Symposium – which begins next week.

Jim Rickards Audio Interview @ DailyReckoning.com

from Survival Blog:

I am fairly new to this blog but have found it immensely interesting

and useful, and it prompted me to write down some thoughts I have been

having for years. As a physician, I am particularly interested in how

healthcare and basic needs will survive in a post-apocalyptic world. If

this article is redundant for long-time users of the site, I apologize.

I am fairly new to this blog but have found it immensely interesting

and useful, and it prompted me to write down some thoughts I have been

having for years. As a physician, I am particularly interested in how

healthcare and basic needs will survive in a post-apocalyptic world. If

this article is redundant for long-time users of the site, I apologize.On June 5, 1976, at around 12:00 p.m., a catastrophic failure of an earth-built dam in southeastern Idaho occurred, resulting in the release of 250,000 acre-feet of water on an unsuspecting Snake River Plain. I was seven going on eight years old, living in the path of the water and subsequently living through a disaster scenario. Luckily, I had a father who was smart enough to listen to the warnings and evacuate us to higher ground and eventually to relatives out of state while the clean-up occurred. While my family was somewhat prepared, our food reserves and family mementos were stored in our basement, which ended up being filled with four feet of muddy, dead animal-infested water. In addition, our well was contaminated and remained so for many months after the event.

Read More @ SurvivalBlog.com

from Seeking Alpha:

Gold prices have declined below $1,100 and the share price of SPDR Gold

Trust ETF (NYSEARCA:GLD) has declined below $105. GLD made two

unsuccessful attempts to break the $110 level over the past 9 months.

The third one was successful. The main catalyst that helped it price to

break the important support level was China’s announcement that the

country holds 1,658 tonnes of gold.

Gold prices have declined below $1,100 and the share price of SPDR Gold

Trust ETF (NYSEARCA:GLD) has declined below $105. GLD made two

unsuccessful attempts to break the $110 level over the past 9 months.

The third one was successful. The main catalyst that helped it price to

break the important support level was China’s announcement that the

country holds 1,658 tonnes of gold.

The problem is that although China announced that its official gold reserves increased by 604 tonnes, or approximately by 60%, compared to the last public data released back in 2009, it is significantly less than expected. For example, Bloomberg Intelligence expected that the People’s Bank of China holds gold reserves of 3,510 tonnes, and the World Gold chief economist at Australia & New Zealand Banking Group Ltd. predicted that China holds official gold reserves of at least 3,000 tonnes.

Read More @ SeekingAlpha.com

Gold prices have declined below $1,100 and the share price of SPDR Gold

Trust ETF (NYSEARCA:GLD) has declined below $105. GLD made two

unsuccessful attempts to break the $110 level over the past 9 months.

The third one was successful. The main catalyst that helped it price to

break the important support level was China’s announcement that the

country holds 1,658 tonnes of gold.

Gold prices have declined below $1,100 and the share price of SPDR Gold

Trust ETF (NYSEARCA:GLD) has declined below $105. GLD made two

unsuccessful attempts to break the $110 level over the past 9 months.

The third one was successful. The main catalyst that helped it price to

break the important support level was China’s announcement that the

country holds 1,658 tonnes of gold.The problem is that although China announced that its official gold reserves increased by 604 tonnes, or approximately by 60%, compared to the last public data released back in 2009, it is significantly less than expected. For example, Bloomberg Intelligence expected that the People’s Bank of China holds gold reserves of 3,510 tonnes, and the World Gold chief economist at Australia & New Zealand Banking Group Ltd. predicted that China holds official gold reserves of at least 3,000 tonnes.

Read More @ SeekingAlpha.com

from Gold Silver Worlds:

Gold is universally recognized as a safe-haven investment, a go-to

asset class when others look uncertain. Following the 2008 financial

crisis, for instance, the metal’s price surged, eventually topping out

at $1,900 per ounce in August 2011.

Gold is universally recognized as a safe-haven investment, a go-to

asset class when others look uncertain. Following the 2008 financial

crisis, for instance, the metal’s price surged, eventually topping out

at $1,900 per ounce in August 2011.

Gold has traded down for 10 straight sessions to end the week at $1,099 per ounce, its lowest point in more than five years. Commodities in general have dropped to a 13-year low.

Gold stocks, as expressed by the XAU, have also tumbled.

The selloff was given a huge push last Friday when China, for the first time in six years, revealed the amount of gold its central bank holds. Although the number jumped nearly 60 percent since 2009 to 1,658 tonnes, markets were underwhelmed, as they had expected to see double the amount.

Read More @ GoldSilverWorlds.com

Gold is universally recognized as a safe-haven investment, a go-to

asset class when others look uncertain. Following the 2008 financial

crisis, for instance, the metal’s price surged, eventually topping out

at $1,900 per ounce in August 2011.

Gold is universally recognized as a safe-haven investment, a go-to

asset class when others look uncertain. Following the 2008 financial

crisis, for instance, the metal’s price surged, eventually topping out

at $1,900 per ounce in August 2011.Gold has traded down for 10 straight sessions to end the week at $1,099 per ounce, its lowest point in more than five years. Commodities in general have dropped to a 13-year low.

Gold stocks, as expressed by the XAU, have also tumbled.

The selloff was given a huge push last Friday when China, for the first time in six years, revealed the amount of gold its central bank holds. Although the number jumped nearly 60 percent since 2009 to 1,658 tonnes, markets were underwhelmed, as they had expected to see double the amount.

Read More @ GoldSilverWorlds.com

from Fox News:

Kentucky Sen. Rand Paul, a Republican presidential candidate, said

Sunday that he’ll try this afternoon on Capitol Hill to force a vote to

block federal funding for Planned Parenthood, following the release of

videos showing group officials discussing how they provide aborted fetal

organs for research. “I really think the time has come in our country

to have the debate on whether taxpayer money should still be spent on

this,” Paul told “Fox News Sunday.”

Kentucky Sen. Rand Paul, a Republican presidential candidate, said

Sunday that he’ll try this afternoon on Capitol Hill to force a vote to

block federal funding for Planned Parenthood, following the release of

videos showing group officials discussing how they provide aborted fetal

organs for research. “I really think the time has come in our country

to have the debate on whether taxpayer money should still be spent on

this,” Paul told “Fox News Sunday.”

Paul is one of several Republican lawmakers or presidential candidates who have said they want to eliminate Planned Parenthood’s federal funding, which they so far have failed to do.

Paul said he will try a long-shot legislative maneuver — submitting a “discharge position” — to force the vote when senators return Sunday to Washington to vote on a transportation and transit funding bill set to expire in a few days.

Read More @ FoxNews.com

Kentucky Sen. Rand Paul, a Republican presidential candidate, said

Sunday that he’ll try this afternoon on Capitol Hill to force a vote to

block federal funding for Planned Parenthood, following the release of

videos showing group officials discussing how they provide aborted fetal

organs for research. “I really think the time has come in our country

to have the debate on whether taxpayer money should still be spent on

this,” Paul told “Fox News Sunday.”

Kentucky Sen. Rand Paul, a Republican presidential candidate, said

Sunday that he’ll try this afternoon on Capitol Hill to force a vote to

block federal funding for Planned Parenthood, following the release of

videos showing group officials discussing how they provide aborted fetal

organs for research. “I really think the time has come in our country

to have the debate on whether taxpayer money should still be spent on

this,” Paul told “Fox News Sunday.”Paul is one of several Republican lawmakers or presidential candidates who have said they want to eliminate Planned Parenthood’s federal funding, which they so far have failed to do.

Paul said he will try a long-shot legislative maneuver — submitting a “discharge position” — to force the vote when senators return Sunday to Washington to vote on a transportation and transit funding bill set to expire in a few days.

Read More @ FoxNews.com

from NorthWestLibertyNews:

Daves Hodges (The Common Sense Show) joins James White (The Liberty Brothers Radio Show) to discuss former assassinations of men who challenged the establishment.

Daves Hodges (The Common Sense Show) joins James White (The Liberty Brothers Radio Show) to discuss former assassinations of men who challenged the establishment.

from The Extinction Protocol:

Panic has erupted throughout social media, as earlier reports stated

that San Francisco will experience a major earthquake “any day now.” The

story came out after a 4.0 magnitude earthquake on the Hayward Fault

rocked the Bay Area on Tuesday. A U.S. Geological Survey scientist said

that the fault is expected to result in a major earthquake “any day now”

and advised Bay Area residents to be prepared, according to CBS San

Francisco. The story quickly picked up on Facebook and became viral,

spreading panic on social media and fear among the Bay Area residents.

The story was apparently sourced from the local news wire Bay City News,

which reported that “while a 2008 report put the probability of a

6.7-magnitude or larger earthquake on the Hayward-Rodgers Creek Fault

system over the next 30 years at 31 percent, Brocher said the reality is

a major quake is expected on the fault ‘any day now,’” SF Gate

reported.

Panic has erupted throughout social media, as earlier reports stated

that San Francisco will experience a major earthquake “any day now.” The

story came out after a 4.0 magnitude earthquake on the Hayward Fault

rocked the Bay Area on Tuesday. A U.S. Geological Survey scientist said

that the fault is expected to result in a major earthquake “any day now”

and advised Bay Area residents to be prepared, according to CBS San

Francisco. The story quickly picked up on Facebook and became viral,

spreading panic on social media and fear among the Bay Area residents.

The story was apparently sourced from the local news wire Bay City News,

which reported that “while a 2008 report put the probability of a

6.7-magnitude or larger earthquake on the Hayward-Rodgers Creek Fault

system over the next 30 years at 31 percent, Brocher said the reality is

a major quake is expected on the fault ‘any day now,’” SF Gate

reported.

Read More @ Theextinctionprotocol.wordpress.com

Panic has erupted throughout social media, as earlier reports stated

that San Francisco will experience a major earthquake “any day now.” The

story came out after a 4.0 magnitude earthquake on the Hayward Fault

rocked the Bay Area on Tuesday. A U.S. Geological Survey scientist said

that the fault is expected to result in a major earthquake “any day now”

and advised Bay Area residents to be prepared, according to CBS San

Francisco. The story quickly picked up on Facebook and became viral,

spreading panic on social media and fear among the Bay Area residents.

The story was apparently sourced from the local news wire Bay City News,

which reported that “while a 2008 report put the probability of a

6.7-magnitude or larger earthquake on the Hayward-Rodgers Creek Fault

system over the next 30 years at 31 percent, Brocher said the reality is

a major quake is expected on the fault ‘any day now,’” SF Gate

reported.

Panic has erupted throughout social media, as earlier reports stated

that San Francisco will experience a major earthquake “any day now.” The

story came out after a 4.0 magnitude earthquake on the Hayward Fault

rocked the Bay Area on Tuesday. A U.S. Geological Survey scientist said

that the fault is expected to result in a major earthquake “any day now”

and advised Bay Area residents to be prepared, according to CBS San

Francisco. The story quickly picked up on Facebook and became viral,

spreading panic on social media and fear among the Bay Area residents.

The story was apparently sourced from the local news wire Bay City News,

which reported that “while a 2008 report put the probability of a

6.7-magnitude or larger earthquake on the Hayward-Rodgers Creek Fault

system over the next 30 years at 31 percent, Brocher said the reality is

a major quake is expected on the fault ‘any day now,’” SF Gate

reported.Read More @ Theextinctionprotocol.wordpress.com

from TruthNeverTold:

Natural News contributor Jonathan Landsman has just publicly published a “lost” interview with Dr. Nicholas Gonzalez, the holistic cancer treatment doctor who passed away earlier this week.

This video interview, never before released to the public, reveals truly mind-blowing information about the failure of chemotherapy and why holistic approaches to cancer treatment work far better than chemo.

The complete interview is revealed below. To access a massive library of other private interviews with pioneering doctors and healers, join the NaturalHealth365 Inner Circle, featuring an astonishing 300 exclusive interviews with the industry’s greatest pioneers.

Read More @ NaturalNews.com

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment