from KingWorldNews:

Richard Russell:

“The economist Richard Koo calls this the balance sheet recession. The

problem here and in the whole world is a four letter word — debt.

Despite the fact that the Fed has been spewing forth trillions of

dollars of fiat money, the retail public, chocked up with debt, is

saving and paying off debt rather than spending more. The balance sheets

of the retail public, the US, and the world, are loaded with debt.

Richard Russell:

“The economist Richard Koo calls this the balance sheet recession. The

problem here and in the whole world is a four letter word — debt.

Despite the fact that the Fed has been spewing forth trillions of

dollars of fiat money, the retail public, chocked up with debt, is

saving and paying off debt rather than spending more. The balance sheets

of the retail public, the US, and the world, are loaded with debt.

The Fed is gung-ho to normalize this situation and is convinced that the economy is expanding and will be able to function with higher short rates. The big question is whether the US economy is actually improving. John Williams of Shadow Statistics claims that the expanding US economy is just wishes, lies and propaganda. Williams claims that the US is stumbling and sinking into recession.

Richard Russell continues @ KingWorldNews.com

Richard Russell:

“The economist Richard Koo calls this the balance sheet recession. The

problem here and in the whole world is a four letter word — debt.

Despite the fact that the Fed has been spewing forth trillions of

dollars of fiat money, the retail public, chocked up with debt, is

saving and paying off debt rather than spending more. The balance sheets

of the retail public, the US, and the world, are loaded with debt.

Richard Russell:

“The economist Richard Koo calls this the balance sheet recession. The

problem here and in the whole world is a four letter word — debt.

Despite the fact that the Fed has been spewing forth trillions of

dollars of fiat money, the retail public, chocked up with debt, is

saving and paying off debt rather than spending more. The balance sheets

of the retail public, the US, and the world, are loaded with debt.The Fed is gung-ho to normalize this situation and is convinced that the economy is expanding and will be able to function with higher short rates. The big question is whether the US economy is actually improving. John Williams of Shadow Statistics claims that the expanding US economy is just wishes, lies and propaganda. Williams claims that the US is stumbling and sinking into recession.

Richard Russell continues @ KingWorldNews.com

by Dave Kranzler, Investment Research Dynamics:

“Printed money” is electronic money that is created BOTH by the Fed’s electronic printing press AND the electronic printing press that creates debt certificates. Why the latter? Because debt behaves like money until that debt is repaid. Simply printing money to repay existing debt while printing enough to issue more debt is not the definition of “repayment.” This process in fact forces even more “printed” electronic money into the system.

Read More @ InvestmentResearchDynamics.com

The Fed no longer has

credibility, and you can see that. The divergence between the futures

markets and the Fed’s own projections about what they’re going to do

about interest rates—this is a huge problem,” he told CNBC’s “Squawk Box.” – Senator Pat Toomey on CNBC

Sorry Pat, the entire U.S. financial system has lost all credibilty.

While the economic condition of the United States continues to

deteriorate rather quickly, the S&P 500 and Nasdaq continue to push

insanely higher on a historically unprecedented tidal wave of printed

money.“Printed money” is electronic money that is created BOTH by the Fed’s electronic printing press AND the electronic printing press that creates debt certificates. Why the latter? Because debt behaves like money until that debt is repaid. Simply printing money to repay existing debt while printing enough to issue more debt is not the definition of “repayment.” This process in fact forces even more “printed” electronic money into the system.

Read More @ InvestmentResearchDynamics.com

The GOP's Biggest Nightmare: Trump Dominates Fox News Poll

Submitted by Tyler Durden on 07/17/2015 - 15:04 Demagogue

or not, The Donald continues to gain support among Republicans for the

GOP Presidential nomination, according to the latest FOX News poll, and

among Republican primary voters, Trump now captures 18 percent: more than his closest competitor, Walker.

Demagogue

or not, The Donald continues to gain support among Republicans for the

GOP Presidential nomination, according to the latest FOX News poll, and

among Republican primary voters, Trump now captures 18 percent: more than his closest competitor, Walker.

California Water Wars Escalate: State Changes Law, Orders Farmers To Stop Pumping

Submitted by Tyler Durden on 07/17/2015 - 17:10 "In the water world, the pre-1914 rights were considered to be gold," exclaimed one water attorney, but as AP reports, it appears that 'gold' is being tested as California water regulators flexed their muscles by ordering a group of farmers to stop pumping from a branch of the San Joaquin River amid an escalating battle over how much power the state has to protect waterways that are drying up in the drought. As usual, governments do what they want with one almond farmer raging "I've made investments as a farmer based on the rule of law...Now, somebody's changing the law that we depend on." This is not abiout toi get any better as NBCNews reports, this drought is of historic proportions - the worst in over 100 years.

The Wall Of Worry

Submitted by Tyler Durden on 07/17/2015 - 16:55 Greece... just another brick in the wall...

5 Things To Ponder: Beach Reading

Submitted by Tyler Durden on 07/17/2015 - 16:35 While the markets have improved since the "resolution" of the Greek crisis, in my opinion we would have expected substantially more given the overall "angst" that the situation was generating. Yet, the market remains in a bearish consolidation pattern. Furthermore, relative strength, momentum and volume remain a detraction from the "bullishness" of this week's "crisis resolution rally.""Irrelevant" Greece 'Deal' Sparks Week-Long Stock And Bond Buying Frenzy

Submitted by Tyler Durden on 07/17/2015 - 16:02

"Trust, But Vilify" - What A Difference 28 Years Makes

Submitted by Tyler Durden on 07/17/2015 - 15:45 Don't ask. Period.

Attention Greek Bankers: Bridge In Brooklyn For Sale On The Cheap

Submitted by Tyler Durden on 07/17/2015 - 15:20 If you were a shareholder of a Greek bank, you wouldn’t lose sleep over your relationship with your regulator. In that context, the statement of the 12 July Euro Summit may have come as a shock—particularly the bit about the new program for Greece having to include "the establishment of a buffer of EUR 10 to 25bn for the banking sector in order to address potential bank recapitalisation needs and resolution costs." You could be forgiven for thinking—where did that come from?China Increases Gold Holdings By 57% "In One Month" In First Official Update Since 2009

Submitted by Tyler Durden on 07/17/2015 - 14:36

Friday Humor: The "Risk Profile" Of The Russell 1000 ETF

Submitted by Tyler Durden on 07/17/2015 - 14:30 Searching for a refuge in today's uncertain markets? BlackRock has a solution...

Thank Goodness Everything's Fixed

Submitted by Tyler Durden on 07/17/2015 - 14:05 The trick is to borrow as much as you can and leverage it to the hilt, and buy, buy, buy.

Furious China Lashes Out At Critics Of Its Rigged GDP Data

Submitted by Tyler Durden on 07/17/2015 - 13:46 "Working out the statistics for the Chinese economy is immensely challenging and it is hard to be absolutely accurate. No wonder the West has questions about the methodology. But different methods will not affect the authority of the NBS figures.... Despite the lowest GDP growth rate, the Chinese economy is not in its hardest times because the slowdown has greatly declined and the public has adapted to the current growth and even a lower rate. As faking a 7 percent figure takes more risk than releasing a lower but real one, China has no motives to forge the data... It is hence groundless to suspect the NBS faked its statistics."

Global Equity Markets Explained (In 1 Cartoon)

Submitted by Tyler Durden on 07/17/2015 - 13:25 "Free" markets for all, but the real joke is that this comes from the Beijing Review

Nigel Farage Blasts Obama's "Everything Is Awesome" Narrative, Explains Why Euro Was A Delusional Dream

Submitted by Tyler Durden on 07/17/2015 - 13:11 "As you will know, because Obama keeps telling you this, and The State Department keeps telling you this, and the American press keeps telling you this, 'everything is going wonderfully well in Europe... there is absolutely nothing to worry about at all... the eurozone is a fantastic success... and there are lots of American businesses like Goldman Sachs'... well that opinion is not right!" The Euro project was a delusional dream for it was never designed to succeed but to cut corners all in hope of creating the United States of Europe to challenge the USA and dethrone the dollar, That dream has turned into a nightmare and will never raise Europe to that lofty goal of the financial capitol of the world.

China continues to open up its gold market, with plans to launch a renminbi-denominated gold fix and talking with the CME to “list its products and prices on CME, whose members and clients will be allowed to trade the Chinese exchange’s products”. Such news reports are usually accompanied by references to China wanting to “increase its influence in global gold markets” in line with its size in the physical market.

Such developments are generally seen by goldbugs as positive, the narrative being that China is a physical gold market and they love gold and only buy it (never sell), which will mean that will we have a market “that is not distorted by the banks, their proprietary trading, or control of the gold distribution system globally”, according to Julian Phillips, for example.

Read More @ PerthMint.com.au

from Gold Silver Worlds:

Examine the 20 year log scale chart of monthly gold. I have drawn lines

connecting highs and lows. The result is an expanding channel or

megaphone pattern. The increasing prices are exponential (log scale

chart) because of exponential increases in debt, money supply, and

Keynesian craziness, although I have no graph to prove the latter.

Examine the 20 year log scale chart of monthly gold. I have drawn lines

connecting highs and lows. The result is an expanding channel or

megaphone pattern. The increasing prices are exponential (log scale

chart) because of exponential increases in debt, money supply, and

Keynesian craziness, although I have no graph to prove the latter.

Examine log scale charts for silver, crude oil, the Dow Transports, and the S&P 500 Index. You can see similar exponential increases and megaphone patterns of much higher highs and deeper lows.

Read More @ GoldSilverWorlds.com

Examine the 20 year log scale chart of monthly gold. I have drawn lines

connecting highs and lows. The result is an expanding channel or

megaphone pattern. The increasing prices are exponential (log scale

chart) because of exponential increases in debt, money supply, and

Keynesian craziness, although I have no graph to prove the latter.

Examine the 20 year log scale chart of monthly gold. I have drawn lines

connecting highs and lows. The result is an expanding channel or

megaphone pattern. The increasing prices are exponential (log scale

chart) because of exponential increases in debt, money supply, and

Keynesian craziness, although I have no graph to prove the latter.Examine log scale charts for silver, crude oil, the Dow Transports, and the S&P 500 Index. You can see similar exponential increases and megaphone patterns of much higher highs and deeper lows.

Read More @ GoldSilverWorlds.com

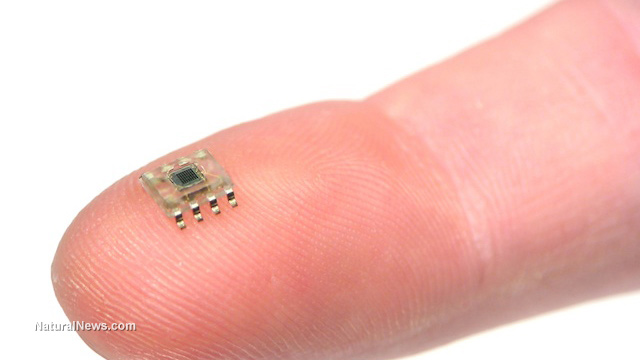

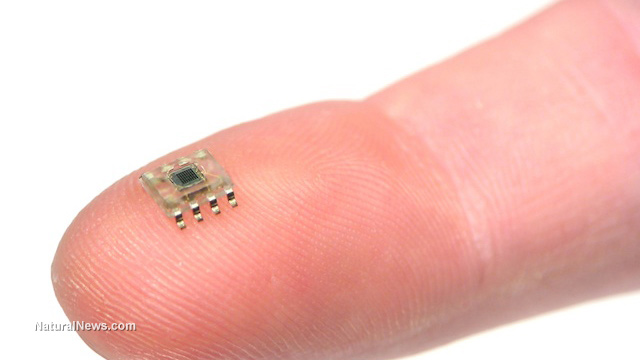

by Mike Adams, Natural News:

The cult of “science” has a fetish for trying to amalgamate humanity

with machine. And its latest endeavor in this pursuit has taken the form

of an emerging brain implant technology that would render humans part

flesh, part computer.

The cult of “science” has a fetish for trying to amalgamate humanity

with machine. And its latest endeavor in this pursuit has taken the form

of an emerging brain implant technology that would render humans part

flesh, part computer.

Researchers from the University of California, Berkeley (UCB), have come up with a concept they’ve dubbed “neural dust” that they say can be implanted into people’s brains for data collection purposes. And the technology is reportedly so small that humans wouldn’t even know it was inside their heads.

Using a special wire apparatus, the neural dust can be “dipped” into a person’s cerebral cortex, report scientists, where it would remain embedded indefinitely. And since it’s powered by special piezoelectric materials, this dust wouldn’t require a recharge, which means once it’s there, it’s there for good.

Read More @ NaturalNews.com

The cult of “science” has a fetish for trying to amalgamate humanity

with machine. And its latest endeavor in this pursuit has taken the form

of an emerging brain implant technology that would render humans part

flesh, part computer.

The cult of “science” has a fetish for trying to amalgamate humanity

with machine. And its latest endeavor in this pursuit has taken the form

of an emerging brain implant technology that would render humans part

flesh, part computer.Researchers from the University of California, Berkeley (UCB), have come up with a concept they’ve dubbed “neural dust” that they say can be implanted into people’s brains for data collection purposes. And the technology is reportedly so small that humans wouldn’t even know it was inside their heads.

Using a special wire apparatus, the neural dust can be “dipped” into a person’s cerebral cortex, report scientists, where it would remain embedded indefinitely. And since it’s powered by special piezoelectric materials, this dust wouldn’t require a recharge, which means once it’s there, it’s there for good.

Read More @ NaturalNews.com

from Ready Nutrition:

Back when I was a kid, my mom used to carry a “Saturday night special”

in her purse. I always thought it was a special surprise we kids were

not supposed to see. I knew it was important though because she would

always say things like, “Don’t worry, I’ve got my Saturday night

special.” When I was older, I finally realized she was carrying a

handgun and was thankful that she had enough forethought to plan for

when things go awry. The Saturday night special is a great backup weapon

and Jeremiah Johnson lists some great points about it. So, when you go

out for dinner this weekend, don’t forget your Derringer .38.]

Back when I was a kid, my mom used to carry a “Saturday night special”

in her purse. I always thought it was a special surprise we kids were

not supposed to see. I knew it was important though because she would

always say things like, “Don’t worry, I’ve got my Saturday night

special.” When I was older, I finally realized she was carrying a

handgun and was thankful that she had enough forethought to plan for

when things go awry. The Saturday night special is a great backup weapon

and Jeremiah Johnson lists some great points about it. So, when you go

out for dinner this weekend, don’t forget your Derringer .38.]

Good Day to all of you Readers out there! Welcome to Ready Nutrition for a segment that you ladies can’t afford to miss: JJ’s review of a Derringer. Yes, the Derringer is a miniature pistol that presents an opportunity for a “stealthy backup friend/backup piece” that you can turn to when it hits the fan. A backup piece can be used when the primary firearm is either out of commission/ammo or when stealth requirements do not enable you to employ your primary effectively.

Read More @ ReadyNutrition.com

Back when I was a kid, my mom used to carry a “Saturday night special”

in her purse. I always thought it was a special surprise we kids were

not supposed to see. I knew it was important though because she would

always say things like, “Don’t worry, I’ve got my Saturday night

special.” When I was older, I finally realized she was carrying a

handgun and was thankful that she had enough forethought to plan for

when things go awry. The Saturday night special is a great backup weapon

and Jeremiah Johnson lists some great points about it. So, when you go

out for dinner this weekend, don’t forget your Derringer .38.]

Back when I was a kid, my mom used to carry a “Saturday night special”

in her purse. I always thought it was a special surprise we kids were

not supposed to see. I knew it was important though because she would

always say things like, “Don’t worry, I’ve got my Saturday night

special.” When I was older, I finally realized she was carrying a

handgun and was thankful that she had enough forethought to plan for

when things go awry. The Saturday night special is a great backup weapon

and Jeremiah Johnson lists some great points about it. So, when you go

out for dinner this weekend, don’t forget your Derringer .38.]Good Day to all of you Readers out there! Welcome to Ready Nutrition for a segment that you ladies can’t afford to miss: JJ’s review of a Derringer. Yes, the Derringer is a miniature pistol that presents an opportunity for a “stealthy backup friend/backup piece” that you can turn to when it hits the fan. A backup piece can be used when the primary firearm is either out of commission/ammo or when stealth requirements do not enable you to employ your primary effectively.

Read More @ ReadyNutrition.com

from from DAHBOO777:

by Alex Thomas, SHTFPlan:

It appears that ISIS operatives on American soil are coordinating with

an extended network and are preparing direct attacks on soft targets.

With school starting for millions of kids across the nation next month

and anti-gun proponents working to dismantle any ability for Americans

to defend themselves in high-value terrorist target zones, parents

should be concerned about what next year will bring.

It appears that ISIS operatives on American soil are coordinating with

an extended network and are preparing direct attacks on soft targets.

With school starting for millions of kids across the nation next month

and anti-gun proponents working to dismantle any ability for Americans

to defend themselves in high-value terrorist target zones, parents

should be concerned about what next year will bring.

This morning an extremist made good on Islamic State threats to attack military personnel within the borders of the United States by killing four people at two separate installations. Though the government has yet to confirm Muhammad Youssef Abdulazeez’s ties with the middle east terror group, Infowars reports that just minutes after reports of the shooting began to surface and before law enforcement officials confirmed the identity of the shooter, a Twitter account created within the last 48 hours took credit for the shooting, specifically noting Chattanooga as the target.

Read More @ SHTFPlan.com

It appears that ISIS operatives on American soil are coordinating with

an extended network and are preparing direct attacks on soft targets.

With school starting for millions of kids across the nation next month

and anti-gun proponents working to dismantle any ability for Americans

to defend themselves in high-value terrorist target zones, parents

should be concerned about what next year will bring.

It appears that ISIS operatives on American soil are coordinating with

an extended network and are preparing direct attacks on soft targets.

With school starting for millions of kids across the nation next month

and anti-gun proponents working to dismantle any ability for Americans

to defend themselves in high-value terrorist target zones, parents

should be concerned about what next year will bring.This morning an extremist made good on Islamic State threats to attack military personnel within the borders of the United States by killing four people at two separate installations. Though the government has yet to confirm Muhammad Youssef Abdulazeez’s ties with the middle east terror group, Infowars reports that just minutes after reports of the shooting began to surface and before law enforcement officials confirmed the identity of the shooter, a Twitter account created within the last 48 hours took credit for the shooting, specifically noting Chattanooga as the target.

Read More @ SHTFPlan.com

from The Daily Coin:

The only difference between Greece and the United States is that the United States can unilaterally print its own money – money that enables unlimited Government funding and allows the big banks to remain solvent. The actual process of money printing and debt creation is implemented by the Federal Reserve and the Too Big To Fail Banks that operate as agents of the Fed.

Read More @ TheDailyCoin.org

The more I learn, the more I realize that the Fed is nothing but a criminal enterprise, that the guys at the top know it.

Everyone within breathing distance of top slots at

the NY Fed is a criminal. Remember, the NY Fed shares space with the

Exchange Stabilization Fund/Working Group on Financial Markets even

though the latter is formally part of the Treasury. – John Titus, one conclusion from reading the 2009 FOMC transcriptsThe only difference between Greece and the United States is that the United States can unilaterally print its own money – money that enables unlimited Government funding and allows the big banks to remain solvent. The actual process of money printing and debt creation is implemented by the Federal Reserve and the Too Big To Fail Banks that operate as agents of the Fed.

Read More @ TheDailyCoin.org

by Dr. Jeffrey Lewis, Silver-coin-investor:

Despite the continued technical, paper induced bias to the downside,

recent news that the US Mint has stopped silver eagle production is once

again is being singled as the likely cause for the premium surges now

being observed across all physical silver retail products.

Despite the continued technical, paper induced bias to the downside,

recent news that the US Mint has stopped silver eagle production is once

again is being singled as the likely cause for the premium surges now

being observed across all physical silver retail products.

Is this true physical demand bleeding through the paper charade?

The bullion retail trade is a thin margin business to begin with.

While difficult to verify, it is possible that some of this surge in premium is coming from dealers protecting thin margins. It would be somewhat of a natural business strategy.

Read More @ Silver-coin-investor.com

/ Despite the continued technical, paper induced bias to the downside,

recent news that the US Mint has stopped silver eagle production is once

again is being singled as the likely cause for the premium surges now

being observed across all physical silver retail products.

Despite the continued technical, paper induced bias to the downside,

recent news that the US Mint has stopped silver eagle production is once

again is being singled as the likely cause for the premium surges now

being observed across all physical silver retail products. Is this true physical demand bleeding through the paper charade?

The bullion retail trade is a thin margin business to begin with.

While difficult to verify, it is possible that some of this surge in premium is coming from dealers protecting thin margins. It would be somewhat of a natural business strategy.

Read More @ Silver-coin-investor.com

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment