from BPearthwatch:

The Latest Out Of Europe: "Pretty Steady Level Of Shittiness"

Submitted by Tyler Durden on 07/12/2015 - 20:30 Me: How are the talks going?EU source: "Shitty."

Me: "Getting more shitty or less?"

Source: "Pretty steady level of shittiness

How Fascist Capitalism Functions: The Case Of Greece

Submitted by Tyler Durden on 07/12/2015 - 20:15

There

is democratic capitalism, and there is fascist capitalism. What we have

today is fascist capitalism; and the following will explain how it

works, using as an example the case of Greece. Simply out - The whole

system is a money-funnel, from the public, to the aristocracy.

Submitted by Tyler Durden on 07/12/2015 - 20:15

There

is democratic capitalism, and there is fascist capitalism. What we have

today is fascist capitalism; and the following will explain how it

works, using as an example the case of Greece. Simply out - The whole

system is a money-funnel, from the public, to the aristocracy.

Russia Readies Fuel Deliveries To Athens, Will Support Greek "Economic Revival"

Submitted by Tyler Durden on 07/12/2015 - 19:40 "Russia intends to support the revival of Greece's economy by broadening cooperation in the energy sector. Accordingly we are studying the possibility of organising direct deliveries of energy resources to Greece, starting shortly."

The Crony Capitalist Pretense Behind Warren Buffett's Banking Buys

Submitted by Tyler Durden on 07/12/2015 - 19:05 When Warren Buffet put $5 billion in Berkshire Hathaway funds into Goldman Sachs the week after Lehman failed, amidst total turmoil and panic, it appeared from the outside a high risk bet. Buffet had long tried to portray himself as a folksy engine of traditional stability, investing only in things he could understand, so jumping into a wholesale run of chained liabilities may have seemed more than slightly out of character. We have no particular issue with Buffet making those investments, only the pretense of intentional mysticism that surrounds them. The reason the criticism of crony-capitalism sticks is because this was not Buffet's first intervention to "save" a famed institution on Wall Street. If Buffet's convention is to stick with "things you know" then he has been right there through the whole of the full-scale wholesale/eurodollar revolution.

This Better Be A Mistake...

Submitted by Tyler Durden on 07/12/2015 - 18:43 ...or else a rather blatant Fox News error may be about to start a revolution. The announcement

on Tuesday by the US Mint that it had sold out of silver Eagle bullion

coins due to a “significant” increase in demand with no orders being

taken until August and possible rationing thereafter has resulted in a

surge in coin premiums.

The announcement

on Tuesday by the US Mint that it had sold out of silver Eagle bullion

coins due to a “significant” increase in demand with no orders being

taken until August and possible rationing thereafter has resulted in a

surge in coin premiums.Kitco reported that premiums “have already posted a 50% increase and pressure for further premium adjustments is expected” as “physical demand for all silver products has soared over the past two days.” USAGOLD had already been experiencing strong demand over the past two weeks but “today’s [Tuesday’s] price drop has encouraged another wave of interest.” Gainesville Coins said they were “BUYING American Silver Eagles for more today than we were SELLING them for yesterday!”

Silver Doctors has the best summary of the current state of supply and premiums in this post, with 90% junk bags at up to $3.00, Silver Eagles as high as $3.25 (wholesale), a doubling of premiums on silver rounds and bars, and expectations that the Royal Canadian Mint will soon announce a premium hike.

Read More @ PerthMint.com.au

from KWN:

Amid an intense global economic slowdown that began in 2008, China’s

economy amazingly appeared to be unaffected. Defying the worldwide real

estate collapse, China’s GDP grew by an impressive 8.7 percent in 2009.

Fueled initially by a $586 billion stimulus package, China would end up

plowing an additional $20 trillion into a fixed-asset bubble that was

designed to produce the government’s desired GDP print….

Amid an intense global economic slowdown that began in 2008, China’s

economy amazingly appeared to be unaffected. Defying the worldwide real

estate collapse, China’s GDP grew by an impressive 8.7 percent in 2009.

Fueled initially by a $586 billion stimulus package, China would end up

plowing an additional $20 trillion into a fixed-asset bubble that was

designed to produce the government’s desired GDP print….China’s Massive Ghost Cities: Perhaps inspired by the movie “Field of Dreams,” the Chinese government believed in the adage “If you build it, they will come.” For the next six years China built empty cities in spades. But sadly the Chinese peasants never came to occupy these edifices in the predetermined numbers because prices grew out of reach. New construction remains mostly unoccupied to this day; estimates are that 52 million homes are vacant and 90 percent of those empty units were purchased strictly for investment purposes.

Read More @ Kingworldnews.com

from TNT:

Why the actions of banning short selling and punishing the market taken by the Chinese government will backfire.

from MyBudget360.com:

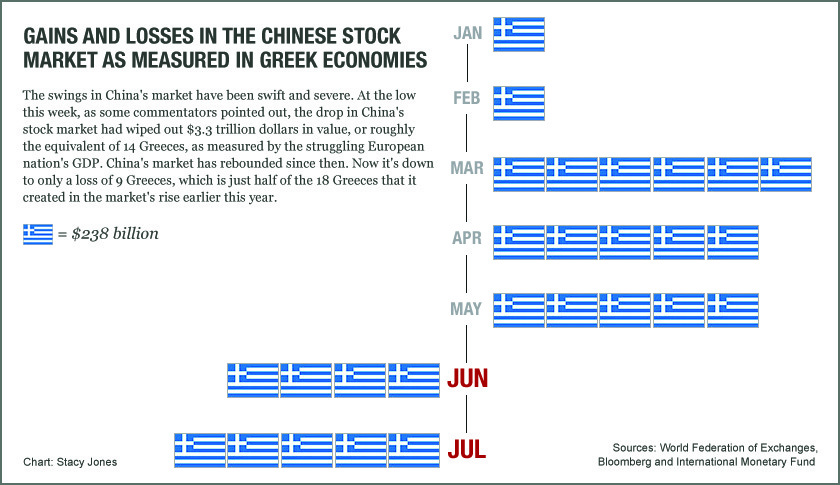

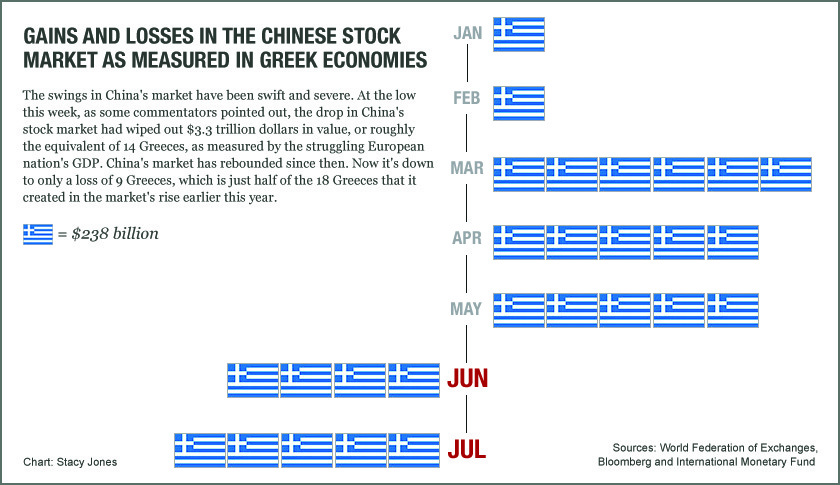

The market has been fixated on the actions of Greece, a country with 11 million people or the equivalent of Los Angeles County. However, the bigger action is taking place in the gambling obsessed Chinese economy. For those of you not following global news the Chinese stock markets, primarily the Shanghai Composite, Shenzhen, and Hang Seng have been on a ridiculous tear. The ChiNext which tracks China’s small-cap board had a trailing PE ratio of 90, twice that of the NASDAQ back in America’s dotcom bubble in 2000. In other words China is in one massive bubble. They are following the path of Japan in the sense that they had (still have) an absurd real estate bubble that has now popped and people then flooded their money into the stock market. The recent actions in China carry an underlying feeling of fear. They loved capitalism when the stock market was soaring and farm workers and hairdressers suddenly became mini Warren Buffets. But with the bust, all of a sudden it is communist central and people are being punished for selling. This doesn’t bode well especially considering at the latest trough, $3.3 trillion in wealth evaporated. This is the equivalent of losing 14 Greeces.

Read More @ MyBudget360.com

from MyBudget360.com:

The market has been fixated on the actions of Greece, a country with 11 million people or the equivalent of Los Angeles County. However, the bigger action is taking place in the gambling obsessed Chinese economy. For those of you not following global news the Chinese stock markets, primarily the Shanghai Composite, Shenzhen, and Hang Seng have been on a ridiculous tear. The ChiNext which tracks China’s small-cap board had a trailing PE ratio of 90, twice that of the NASDAQ back in America’s dotcom bubble in 2000. In other words China is in one massive bubble. They are following the path of Japan in the sense that they had (still have) an absurd real estate bubble that has now popped and people then flooded their money into the stock market. The recent actions in China carry an underlying feeling of fear. They loved capitalism when the stock market was soaring and farm workers and hairdressers suddenly became mini Warren Buffets. But with the bust, all of a sudden it is communist central and people are being punished for selling. This doesn’t bode well especially considering at the latest trough, $3.3 trillion in wealth evaporated. This is the equivalent of losing 14 Greeces.

Read More @ MyBudget360.com

from Ready Nutrition:

Collectively speaking, most Americans take for granted the system in

place to deliver essential supplies to their area. “The system,” an

underlying infrastructure that keeps goods, services and commerce in

America flowing creates a sense of normalcy and order. Food, water,

gasoline and medications are just a few of the items restocked weekly in

order for our dependent society to maintain a steady flow. What many

fail to grasp is just how fragile the system is and just how quickly it

can collapse.

Collectively speaking, most Americans take for granted the system in

place to deliver essential supplies to their area. “The system,” an

underlying infrastructure that keeps goods, services and commerce in

America flowing creates a sense of normalcy and order. Food, water,

gasoline and medications are just a few of the items restocked weekly in

order for our dependent society to maintain a steady flow. What many

fail to grasp is just how fragile the system is and just how quickly it

can collapse.

Our transportation systems are one of the weakest links in the system. Mac Slavo explains:

Read More @ ReadyNutrition.com

Collectively speaking, most Americans take for granted the system in

place to deliver essential supplies to their area. “The system,” an

underlying infrastructure that keeps goods, services and commerce in

America flowing creates a sense of normalcy and order. Food, water,

gasoline and medications are just a few of the items restocked weekly in

order for our dependent society to maintain a steady flow. What many

fail to grasp is just how fragile the system is and just how quickly it

can collapse.

Collectively speaking, most Americans take for granted the system in

place to deliver essential supplies to their area. “The system,” an

underlying infrastructure that keeps goods, services and commerce in

America flowing creates a sense of normalcy and order. Food, water,

gasoline and medications are just a few of the items restocked weekly in

order for our dependent society to maintain a steady flow. What many

fail to grasp is just how fragile the system is and just how quickly it

can collapse.Our transportation systems are one of the weakest links in the system. Mac Slavo explains:

Read More @ ReadyNutrition.com

from DAHBOO777:

by Erica, Natural News:

Research has found that the intense taste of spices is associated with

high concentrations of antioxidants and other powerful substances that

have been proven to stop cancer in its tracks. Here are seven common

kitchen spices that are among the top natural cancer-fighting compounds

available. Most of them are probably already in your home and ready to

use.

Research has found that the intense taste of spices is associated with

high concentrations of antioxidants and other powerful substances that

have been proven to stop cancer in its tracks. Here are seven common

kitchen spices that are among the top natural cancer-fighting compounds

available. Most of them are probably already in your home and ready to

use.

Oregano

oregano confirms its worth as a potential agent against prostate cancer. Consisting of anti-microbial compounds, just one teaspoon of oregano has the power of two cups of red grapes! Phyto-chemical ‘Quercetin’ present in oregano restricts growth of malignant cells in the body and acts like a drug against cancer-centric diseases.

Read More @ NaturalNews.com

Research has found that the intense taste of spices is associated with

high concentrations of antioxidants and other powerful substances that

have been proven to stop cancer in its tracks. Here are seven common

kitchen spices that are among the top natural cancer-fighting compounds

available. Most of them are probably already in your home and ready to

use.

Research has found that the intense taste of spices is associated with

high concentrations of antioxidants and other powerful substances that

have been proven to stop cancer in its tracks. Here are seven common

kitchen spices that are among the top natural cancer-fighting compounds

available. Most of them are probably already in your home and ready to

use.Oregano

oregano confirms its worth as a potential agent against prostate cancer. Consisting of anti-microbial compounds, just one teaspoon of oregano has the power of two cups of red grapes! Phyto-chemical ‘Quercetin’ present in oregano restricts growth of malignant cells in the body and acts like a drug against cancer-centric diseases.

Read More @ NaturalNews.com

from KingWorldNews:

EvG forecasted the current present problems in the world economy over

12 years ago. In 2002 when gold was $300 per ounce, MAM recommended to

its investors to put 50% of their investment assets into physical gold

stored outside the banking system.

EvG forecasted the current present problems in the world economy over

12 years ago. In 2002 when gold was $300 per ounce, MAM recommended to

its investors to put 50% of their investment assets into physical gold

stored outside the banking system.

Egon von Greyerz started his working life in Geneva as a banker and thereafter spent 17 years as Finance Director and Executive Vice-Chairman of a FTSE 100 company in the UK.

Since the 1990s EvG has been actively involved with financial investment activities including Mergers and Acquisitions and Asset allocation consultancy for private family funds. This led to the creation of Matterhorn Asset Management an asset management company based on wealth preservation principles. The GoldSwitzerland Division was created to facilitate the buying and storage of physical gold and silver for private investors, companies, trusts and pension funds.

Egon von Greyerz Audio Interview @ KingWorldNews.com

EvG forecasted the current present problems in the world economy over

12 years ago. In 2002 when gold was $300 per ounce, MAM recommended to

its investors to put 50% of their investment assets into physical gold

stored outside the banking system.

EvG forecasted the current present problems in the world economy over

12 years ago. In 2002 when gold was $300 per ounce, MAM recommended to

its investors to put 50% of their investment assets into physical gold

stored outside the banking system.Egon von Greyerz started his working life in Geneva as a banker and thereafter spent 17 years as Finance Director and Executive Vice-Chairman of a FTSE 100 company in the UK.

Since the 1990s EvG has been actively involved with financial investment activities including Mergers and Acquisitions and Asset allocation consultancy for private family funds. This led to the creation of Matterhorn Asset Management an asset management company based on wealth preservation principles. The GoldSwitzerland Division was created to facilitate the buying and storage of physical gold and silver for private investors, companies, trusts and pension funds.

Egon von Greyerz Audio Interview @ KingWorldNews.com

by Dave Hodges, The Common Sense Show:

Our worst fears about Jade Helm are beginning to be realized. Back in

March of 2015, many of us in the alternative media saw the inherent

danger in the unconstitutional military drill called “Jade Helm 15″. Now

we see that our concerns were well-founded as the more draconian parts

of this drill are beginning to take shape. This article explores one

aspect of Jade Helm, namely, the use of covert death squads connected to

this drill.

Our worst fears about Jade Helm are beginning to be realized. Back in

March of 2015, many of us in the alternative media saw the inherent

danger in the unconstitutional military drill called “Jade Helm 15″. Now

we see that our concerns were well-founded as the more draconian parts

of this drill are beginning to take shape. This article explores one

aspect of Jade Helm, namely, the use of covert death squads connected to

this drill.

Lord Monckton Speaks Out About Global Governance

Lord Christopher Monckton is not a stranger to the establishment of a tyrannical global government. It is Monckton’s belief that world government will be formally rolled out under the guise of saving the environment.

Read More

Our worst fears about Jade Helm are beginning to be realized. Back in

March of 2015, many of us in the alternative media saw the inherent

danger in the unconstitutional military drill called “Jade Helm 15″. Now

we see that our concerns were well-founded as the more draconian parts

of this drill are beginning to take shape. This article explores one

aspect of Jade Helm, namely, the use of covert death squads connected to

this drill.

Our worst fears about Jade Helm are beginning to be realized. Back in

March of 2015, many of us in the alternative media saw the inherent

danger in the unconstitutional military drill called “Jade Helm 15″. Now

we see that our concerns were well-founded as the more draconian parts

of this drill are beginning to take shape. This article explores one

aspect of Jade Helm, namely, the use of covert death squads connected to

this drill.Lord Monckton Speaks Out About Global Governance

Lord Christopher Monckton is not a stranger to the establishment of a tyrannical global government. It is Monckton’s belief that world government will be formally rolled out under the guise of saving the environment.

Read More

from Dark5, via The Victory Report:

As the situation in Puerto Rico has recently revealed, Greece is not alone. The world is filled with debt laden nations, many of which may never be able to pay down their liabilities. All told, the world is $200 trillion in debt, of which $57 trillion was accumulated in the past 8 years. And for the record, all the wealth in the world, including assets, amounts to $241 trillion (as of 2013). It’s safe to say that the human race is on one massive debt bender, and there won’t be any easy way out.

As for which countries are worse off than others, a recent article from The Guardian happens to reveal which of the world’s nations are on the fast track to a debt crisis. As I read it however, there was a country that was suspiciously missing from the list. Can you spot this missing debt junky? (hint: it’s America. The answer is always America.)

Read More @ TheDailySheeple.com

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment