Submitted by Tyler Durden on 07/31/2015 - 09:15

Submitted by Tyler Durden on 07/31/2015 - 09:15

"Please remember, these people are our neighbors and friends. You have a skill that will be very much in need when this goes down. You are experts in the job market and you know what it takes to get hired. This is a time for us to step up and do what we can to help."

The World's Second Biggest Stock Is Crushing A 28-Year Trendline

Submitted by Tyler Durden on 07/31/2015 - 12:34 Since the lows after the October 1987 crash, XOM has 'trended' positively for 28 years... finding support at a critical trendline four times over that period... until now. While internals of the market are weak, the fact that the world's second largest stock has broken an historic trendline is notably concerning and confirmed by what will be the 3rd monthly close below the level today...This Is What A Total Breakdown In Market Internals Looks Like

Submitted by Tyler Durden on 07/31/2015 - 11:12 Below-the-surface breakdowns strengthen BCA Research's conviction that investors should stay defensive. Technically, the S&P 500 looks weak. Breadth has thinned considerably this year. Less than 50% of S&P 500 industry groups are trading above their 40-week moving average and/or have a positive 52-week rate of change.

Head Trader Of World's 4th Largest Hedge Fund Caught In HFT Frontrunning Scandal

Submitted by Tyler Durden on 07/31/2015 - 10:25 Shortly after we reported the latest market-rigging scandal, in which ITG was busted for frontrunning sellside clients in its dark pool in what has been since dubbed a "trading experiment" (because it sounds better than criminal conspiracy to defraud clients), and which will cost the company a record for a private Wall Street firm $22 million settlement, we had one question for AQR's Cliff Asness yesterday morning: "Hi @Cimmerian999, is Hitesh Mittal the AQR employee who was formerly at ITG and is part of the SEC settlement?" We got no answer from the AQR head, but luckily Bloomberg noticed, and as it turns out the answer to our question was a resounding yes.

The Fed's Bathtub Economics Brigade Blathers On, Part 1

Submitted by Tyler Durden on 07/31/2015 - 12:15 Our monetary politburo is driving the US economy in the wrong direction. That is, toward dis-employment of its true, wealth-creating economic resources - human labor, entrepreneurial talent and market driven gains in economic factor efficiency. Contrary to this week’s self-congratulatory statement, all is not well and its not getting weller.

The Swiss National Bank Is Long $94 Billion In Stocks, Reports Record Loss Equal To 7% Of Swiss GDP

Submitted by Tyler Durden on 07/31/2015 - 11:56 Earlier today, the SNB which is perhaps the most transparent hedge fund of all central banks and actually lays out its financial statements in a respectable manner every quarter, released its results for the second quarter (and first half) of 2015. The result: another absolutely epic loss, amounting to €50.1 billion ($51.8 billion) of which €47.2 billion on currency positions - a whopping 7% of Swiss GDP - meaning that in Q2 the SNB lost another €20 billion. This happened despite the SNB having invested 17%, or $94 billion, in foreign - mostly US -stocks.

by Mac Slavo, SHTFPlan:

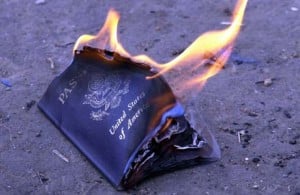

Another small step for authoritarian bureaucracy, another massive leap

forward in the destruction of Americans rights to due process and full

protection under the law.

Another small step for authoritarian bureaucracy, another massive leap

forward in the destruction of Americans rights to due process and full

protection under the law.

Increasingly, designations on watchlists, but official and unofficial, are replacing due process of suspicion, investigation, arrest, charge and trial, and skipping ahead to simply blacklist individuals and deny them equal rights.

This time, the legislation centers around passports, which would now be revoked upon any suspicion, whatsoever and despite a lack of evidence of wrongdoing, of links to foreign terrorists groups. But these links to ‘terrorism’ are not legally defined or limited, nor do they result as a penalty for criminal convictions, but from being added to a list. Gestapo, anyone?

Read More @ SHTFPlan.com

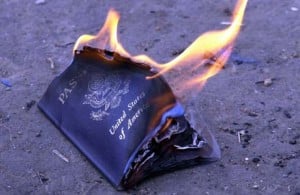

Another small step for authoritarian bureaucracy, another massive leap

forward in the destruction of Americans rights to due process and full

protection under the law.

Another small step for authoritarian bureaucracy, another massive leap

forward in the destruction of Americans rights to due process and full

protection under the law.Increasingly, designations on watchlists, but official and unofficial, are replacing due process of suspicion, investigation, arrest, charge and trial, and skipping ahead to simply blacklist individuals and deny them equal rights.

This time, the legislation centers around passports, which would now be revoked upon any suspicion, whatsoever and despite a lack of evidence of wrongdoing, of links to foreign terrorists groups. But these links to ‘terrorism’ are not legally defined or limited, nor do they result as a penalty for criminal convictions, but from being added to a list. Gestapo, anyone?

Read More @ SHTFPlan.com

Bad Data... Buy It All

Submitted by Tyler Durden on 07/31/2015 - 11:41 FOMC inflation fears... Weak GDP... Piss-poor wage growth... buy it all

The Cost of Stagnation: We're Living In Limbo

Submitted by Tyler Durden on 07/31/2015 - 11:30 This erosion of opportunities to complete life's stages and core dramas is rarely recognized, much less addressed. The End of Secure Work and the diminishing returns of financialization are disrupting these core human challenges and frustrating those who are unable to proceed to the next stage of life...

LinkedOut - Social Media Superstar Enters Bear Market Overnight

Submitted by Tyler Durden on 07/31/2015 - 11:04 Well that escalated quickly...

VIX Crushed Back To 11 Handle As "Investors" Seek Safety Of Biotechs

Submitted by Tyler Durden on 07/31/2015 - 10:53 Because nothing says "sell vol with both hands and feet" and buy Biotechs like a collapse in the wage growth meme and consumer sentiment...

The 2015 Untrustworthies Report - Why Social Security Could Be Bankrupt In 12 Years

Submitted by Tyler Durden on 07/31/2015 - 10:50 The so-called “trustees” of the social security system issued their annual report last week and the stenographers of the financial press dutifully reported that the day of reckoning when the trust funds run dry has been put off another year - until 2034. So take a breath and kick the can. That’s five Presidential elections away!...Except that is not what the report really says.

Gold Surges Back Above $1100 As Dollar Dumps After Wage Data

Submitted by Tyler Durden on 07/31/2015 - 10:18 Paper gold prices continue their extreme volatility ride, spiking $20 as the dismal ECI data hit this morning (as we pre-suppose weak data means moar money printing inevitably coming down the pike)... I have maintained since the so-called Greek Debt “crisis” began back in 2010, I believe it was,

I have maintained since the so-called Greek Debt “crisis” began back in 2010, I believe it was,that the imposition of austerity on Greece could not possibly work and that the only solution was to write down the debt to a level that Greece could service and introduce reforms that loosen the hold the oligarchs have on the Greek economy. The current Greek government has taken the same position, and now the IMF has joined us.

The IMF has said that debt relief measures, that is, write-downs, are necessary and that this necessary measure goes far beyond what the eurozone has offered so far. Asked if the plan could succeed without debt relief, the director of the IMF said, “categorically, no.”

Read More @ PaulCraigRoberts.org

FinanceAndLiberty.com:

from Gold Core:

Depressed prices have led to the usual market response, a surge in physical demand for coins and bars globally.

Depressed prices have led to the usual market response, a surge in physical demand for coins and bars globally.

This is confirmed in conversations we have had with our refiner and mint partners in recent days. There are growing shortages of supply of small coins and bars. This is resulting in delays in receiving bullion and indeed to rising premiums.

Asian gold demand picked up this week keeping premiums robust and slightly higher in the world’s top gold buying regions.

Read More @ GoldCore.com

Depressed prices have led to the usual market response, a surge in physical demand for coins and bars globally.

Depressed prices have led to the usual market response, a surge in physical demand for coins and bars globally.This is confirmed in conversations we have had with our refiner and mint partners in recent days. There are growing shortages of supply of small coins and bars. This is resulting in delays in receiving bullion and indeed to rising premiums.

Asian gold demand picked up this week keeping premiums robust and slightly higher in the world’s top gold buying regions.

Read More @ GoldCore.com

from Ellen Brown:

In the modern global banking system, all banks need a credit line with the central bank in order to be part of the payments system. Choking off that credit line was a form of blackmail the Greek government couldn’t refuse.

Former Greek finance minister Yanis Varoufakis is now being charged with treason for exploring the possibility of an alternative payment system in the event of a Greek exit from the euro. The irony of it all was underscored by Raúl Ilargi Meijer, who opined in a July 27th blog:

The fact that these things were taken into consideration doesn’t mean Syriza was planning a coup . . . . If you want a coup, look instead at the Troika having wrestled control over Greek domestic finances. That’s a coup if you ever saw one.

Read More @ EllenBrown.com

In the modern global banking system, all banks need a credit line with the central bank in order to be part of the payments system. Choking off that credit line was a form of blackmail the Greek government couldn’t refuse.

Former Greek finance minister Yanis Varoufakis is now being charged with treason for exploring the possibility of an alternative payment system in the event of a Greek exit from the euro. The irony of it all was underscored by Raúl Ilargi Meijer, who opined in a July 27th blog:

The fact that these things were taken into consideration doesn’t mean Syriza was planning a coup . . . . If you want a coup, look instead at the Troika having wrestled control over Greek domestic finances. That’s a coup if you ever saw one.

Read More @ EllenBrown.com

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment