Submitted by Tyler Durden on 07/27/2015 - 06:32 This was not supposed to happen.

When Authorities "Own" The Market, The System Breaks Down: Here's Why

Submitted by Tyler Durden on 07/27/2015 - 09:30 What authorities have created is a facsimile of a market. It looks like a market on the surface, but only gamblers and fools risk capital in markets based on false information.

Global Stocks, US Equity Futures Slide Following China Crash

Submitted by Tyler Durden on 07/27/2015 - 07:06 It all started in China, where as we noted previously, the Shanghai Composite plunged by 8.5% in closing hour, suffering its biggest one day drop since February 2007 and the second biggest in history. The Hang Seng, while spared the worst of the drubbing, was also down 3.1%. There were numerous theories about the risk off catalyst, including fears the PPT was gradually being withdrawn, a decline in industrial profits, as well as an influx in IPOs which drained liquidity from the market. At the same time, Nikkei 225 (-0.95%) and ASX 200 (-0.16%) traded in negative territory underpinned by softness in commodity prices.

Concerned About "Treason" Charges, Varoufakis Issues Public Statement On "Cloak And Dagger" Drachma "Plan B"

Submitted by Tyler Durden on 07/27/2015 - 09:06 Overnight, the Telegraph's Ambrose-Pritchard reported that "Mr Varoufakis told the Telegraph that the quotes were accurate but some reports in the Greek press had been twisted, making it look as if he had been plotting a return to the drachma from the start. "The context of all this is that they want to present me as a rogue finance minister, and have me indicted for treason. It is all part of an attempt to annul the first five months of this government and put it in the dustbin of history," he said. It remains to be seen if treason charges are forthcoming but Varoufakis isn't wasting time, and after giving unofficial on the record comments to the Telegraph, moments ago he issued the following public statement on his blog.

US Recession Imminent - Durable Goods Drop For 5th Month, Core CapEx Collapses

Submitted by Tyler Durden on 07/27/2015 - 08:40 Durable Goods new orders has now fallen 5 months in a row (after revisions) flashing a orangey/red recession warning. After 2 weak months, Durable Goods bounced more than expected in June (+3.4% vs +3.2% exp) - though non-seasonally-adjusted dropped 3.1% MoM. There was an unexpected drop in Capital Goods Shipments non-defense Ex-Air which fell 0.1% (against expectations of a 0.6% rise), but mosty worrying is that Core CapEx collapsed 6.6% YoY - the second biggest decline since Lehman.The Full Audio Recording Of Varoufakis' Drachma Plan B

Submitted by Tyler Durden on 07/27/2015 - 08:18

The Complete Guide To China's CNY 4 Trillion Margin Doomsday Machine

Submitted by Tyler Durden on 07/27/2015 - 07:57 On the heels of a veritable bloodbath in Chinese equities overnight which saw the SHCOMP slide a harrowing 8.5%, the entire world is now beginning to take a hard look at the notion that dramatic bouts of selling pressure are aggravated and perhaps triggered by an unwind in the multiple backdoor margin lending channels that allowed investors to skirt official restrictions on leverage and helped to drive the market’s world-beating rally. Here is the complete guide to China's CNY4 trillion shadow margin edifice.TRUMP SCHOOLS COOPER: ‘PEOPLE DON’T TRUST YOU’

Donald Trump got a little snippy with Anderson Cooper tonight for citing not-so-good polls about him, and told him, “The people don’t trust you.”

Frontrunning: July 27

Submitted by Tyler Durden on 07/27/2015 - 07:41- Chinese shares tumble 8.5 percent in biggest one-day drop since 2007 (Reuters)

- Japan’s Economy Shrank Last Quarter, Top Forecaster Says (BBG)

- Creditor teams in Athens to work on third bailout (AFP)

- Tsipras’s Paradox Is Six Months of Pain and Enduring Popularity (BBG)

- Goldman-Backed Instant Messaging Company Seeks New Investment (WSJ)

- Best Buy will sell the Apple Watch on August 7th (Engadget) - when is it coming to Dollar General?

- Senate votes to revive Ex-Im (Hill)

- U.S.-Turkey Deal Paves Way to Set Up Buffer Zone in Northern Syria (WSJ)

by Michael Snyder, The Economic Collapse Blog:

Was last week a preview of things to come? There are quite a few

people out there that believe that the stock market would begin to

decline in July, and that appears to be precisely what is happening.

Last week, the Dow Jones Industrial Average fell by more than 530

points. It was the biggest one week decline that we have seen so far in

2015, and some are suggesting that this could only be just the beginning. By just about any measurement that you might want to use, the stock market is overvalued.

But we have been in this bubble for so long that many people have come

to believe that this is “the new normal”. In fact, earlier today someone

that I know dropped me a line and suggested that our financial

overlords may be able to use the tools at their disposal to get this

current bubble to persist indefinitely. Unfortunately, the truth is that

no financial bubble ever lasts forever, and right now some very

alarming things are starting to happen behind the scenes. Over the past

couple of weeks, the smart money has been dumping stocks like crazy,

and the lack of liquidity in the bond markets is beginning to become

acute. Could it be possible that another great financial crisis is just

around the corner?

Was last week a preview of things to come? There are quite a few

people out there that believe that the stock market would begin to

decline in July, and that appears to be precisely what is happening.

Last week, the Dow Jones Industrial Average fell by more than 530

points. It was the biggest one week decline that we have seen so far in

2015, and some are suggesting that this could only be just the beginning. By just about any measurement that you might want to use, the stock market is overvalued.

But we have been in this bubble for so long that many people have come

to believe that this is “the new normal”. In fact, earlier today someone

that I know dropped me a line and suggested that our financial

overlords may be able to use the tools at their disposal to get this

current bubble to persist indefinitely. Unfortunately, the truth is that

no financial bubble ever lasts forever, and right now some very

alarming things are starting to happen behind the scenes. Over the past

couple of weeks, the smart money has been dumping stocks like crazy,

and the lack of liquidity in the bond markets is beginning to become

acute. Could it be possible that another great financial crisis is just

around the corner?

Read More…

Was last week a preview of things to come? There are quite a few

people out there that believe that the stock market would begin to

decline in July, and that appears to be precisely what is happening.

Last week, the Dow Jones Industrial Average fell by more than 530

points. It was the biggest one week decline that we have seen so far in

2015, and some are suggesting that this could only be just the beginning. By just about any measurement that you might want to use, the stock market is overvalued.

But we have been in this bubble for so long that many people have come

to believe that this is “the new normal”. In fact, earlier today someone

that I know dropped me a line and suggested that our financial

overlords may be able to use the tools at their disposal to get this

current bubble to persist indefinitely. Unfortunately, the truth is that

no financial bubble ever lasts forever, and right now some very

alarming things are starting to happen behind the scenes. Over the past

couple of weeks, the smart money has been dumping stocks like crazy,

and the lack of liquidity in the bond markets is beginning to become

acute. Could it be possible that another great financial crisis is just

around the corner?

Was last week a preview of things to come? There are quite a few

people out there that believe that the stock market would begin to

decline in July, and that appears to be precisely what is happening.

Last week, the Dow Jones Industrial Average fell by more than 530

points. It was the biggest one week decline that we have seen so far in

2015, and some are suggesting that this could only be just the beginning. By just about any measurement that you might want to use, the stock market is overvalued.

But we have been in this bubble for so long that many people have come

to believe that this is “the new normal”. In fact, earlier today someone

that I know dropped me a line and suggested that our financial

overlords may be able to use the tools at their disposal to get this

current bubble to persist indefinitely. Unfortunately, the truth is that

no financial bubble ever lasts forever, and right now some very

alarming things are starting to happen behind the scenes. Over the past

couple of weeks, the smart money has been dumping stocks like crazy,

and the lack of liquidity in the bond markets is beginning to become

acute. Could it be possible that another great financial crisis is just

around the corner?Read More…

Friends, as I have long lamented, the fascist overreach of the US

Federal Government and our “Representatives” is moving faster than any

one of us can possibly document. “It takes a village” as Hillary once

famously quipped, to keep an eye on the Orwellian tyranny.

Friends, as I have long lamented, the fascist overreach of the US

Federal Government and our “Representatives” is moving faster than any

one of us can possibly document. “It takes a village” as Hillary once

famously quipped, to keep an eye on the Orwellian tyranny.My friend Waldemar from Intercept Media e-mailed me with yet another troubling development about which I was unaware. The criminals in Washington have introduced a new Bill which WHEN passed will allow the US government to round up “radicalized” Americans – or those who are becoming radicalized – and put them in FEMA camps. The Bill is H.R. 2899 The Countering Violent Extremism Act Of 2015, and hardcore red-white-and-blue, Boogey man is under your bed, Pentagon Kool-Aid drinking “Representatives” like Congressman Michael McCaul can’t wait to pass it in order to “protect” the “homeland” in this “generation long fight against terror,” as he puts it.

And guess which agencies will do the dirty work of rounding up these “pre-crime” extremists? The DHS and FEMA.

As Waldemar writes, “I feel like taking the first plane ticket out of here. Don’t know how much longer we are going to have free speech and blogs like yours. Unfortunately I don’t see a clear plan to counter this, but I do what we can to help even if does not make much difference. Heart breaking.”

Read More…

‘Don’t want to get hurt by police? Don’t break the law.’

Tis a common phrase among those who unquestioningly support law

enforcement regardless of their proven track record of corruption and

misconduct.

‘Don’t want to get hurt by police? Don’t break the law.’

Tis a common phrase among those who unquestioningly support law

enforcement regardless of their proven track record of corruption and

misconduct.Sadly the apologists are nearly as dangerous as the corrupt and abusive officers as they advocate for blind support of the badge. Many times, apologists will support censorship, become brutal, and even hold fundraisers for cops who shoot unarmed people in the back!

The badge and uniform are infallible in the blind eyes of those who are too afraid to question authority. Police kill, we are told, because they have to make it home to their families at night. Police only harm those guilty of a crime….if you don’t want to get shot by police, don’t break the law they say.

Read More See Infographic @ TheFreeThoughtProject.com

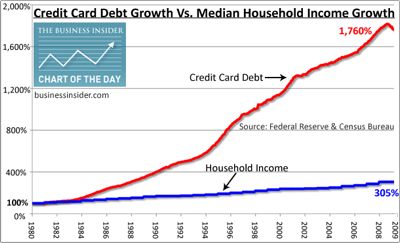

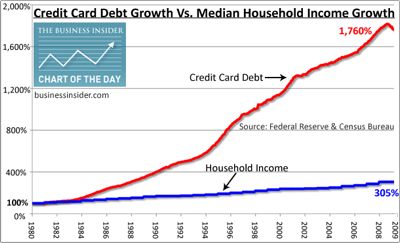

Credit card debt outstanding back up to $900 billion. Since 1980 household income up 300% while credit card debt up 1,760%.

from MyBudget360.com:

The middle class started disappearing in earnest in the late 1970s. Massive inflation started eating away at the standard of living for most Americans. Yet much of this was covered up by access to debt. Credit cards, creative mortgages, student loans, and auto debt all allowed Americans to continue acting as if prosperity was only an American Express card away. Credit card debt outstanding is now back up to $900 billion, a number last seen during the Great Recession before the great deleveraging. Americans have used debt as a means to cover up the reality that the middle class is disappearing. Credit cards are probably the clearest example of spending money you don’t have. Credit cards allow you to literally spend future earned money today. We always hear that many pay their balance off each month. Well the data shows something else. There is $900 billion in credit card debt floating out in the system.

Read More @ MyBudget360.com

from MyBudget360.com:

The middle class started disappearing in earnest in the late 1970s. Massive inflation started eating away at the standard of living for most Americans. Yet much of this was covered up by access to debt. Credit cards, creative mortgages, student loans, and auto debt all allowed Americans to continue acting as if prosperity was only an American Express card away. Credit card debt outstanding is now back up to $900 billion, a number last seen during the Great Recession before the great deleveraging. Americans have used debt as a means to cover up the reality that the middle class is disappearing. Credit cards are probably the clearest example of spending money you don’t have. Credit cards allow you to literally spend future earned money today. We always hear that many pay their balance off each month. Well the data shows something else. There is $900 billion in credit card debt floating out in the system.

Read More @ MyBudget360.com

from Wolf Street:

Commodities had once again an ugly week. Copper hit the lowest level

since June 2009. Gold dropped below $1,100 an ounce. Other metals

dropped too. Agricultural commodities fell; corn plunged nearly 7% for

the week. Crude oil swooned, with West Texas Intermediate dropping

nearly 7% to $47.97 a barrel, a true debacle for energy junk-bond

investors.

Commodities had once again an ugly week. Copper hit the lowest level

since June 2009. Gold dropped below $1,100 an ounce. Other metals

dropped too. Agricultural commodities fell; corn plunged nearly 7% for

the week. Crude oil swooned, with West Texas Intermediate dropping

nearly 7% to $47.97 a barrel, a true debacle for energy junk-bond

investors.

It was the kind of rout that bottom fishers a few months ago apparently didn’t think was possible.

For example, in March, coal miner Peabody Energy had issued 10% second-lien notes due 2022 at 97.5 cents on the dollar. Now, these junk bonds are trading at around 49 cents on the dollar, having lost half their value in four months, and 17% in July alone, according to S&P Capital IQ’s LCD HY Weekly. Yield-hungry fund managers that bought them at issuance and stuffed them into their bond funds that people hold in their retirement accounts should be sued for malpractice.

Read More @ Wolfstreet.com

Commodities had once again an ugly week. Copper hit the lowest level

since June 2009. Gold dropped below $1,100 an ounce. Other metals

dropped too. Agricultural commodities fell; corn plunged nearly 7% for

the week. Crude oil swooned, with West Texas Intermediate dropping

nearly 7% to $47.97 a barrel, a true debacle for energy junk-bond

investors.

Commodities had once again an ugly week. Copper hit the lowest level

since June 2009. Gold dropped below $1,100 an ounce. Other metals

dropped too. Agricultural commodities fell; corn plunged nearly 7% for

the week. Crude oil swooned, with West Texas Intermediate dropping

nearly 7% to $47.97 a barrel, a true debacle for energy junk-bond

investors.It was the kind of rout that bottom fishers a few months ago apparently didn’t think was possible.

For example, in March, coal miner Peabody Energy had issued 10% second-lien notes due 2022 at 97.5 cents on the dollar. Now, these junk bonds are trading at around 49 cents on the dollar, having lost half their value in four months, and 17% in July alone, according to S&P Capital IQ’s LCD HY Weekly. Yield-hungry fund managers that bought them at issuance and stuffed them into their bond funds that people hold in their retirement accounts should be sued for malpractice.

Read More @ Wolfstreet.com

by Roger Charles, Who What Why:

As readers of WhoWhatWhy know, our site has been one of the very few continuing to explore

the fiery death two years ago of investigative journalist Michael

Hastings, whose car left a straight segment of a Los Angeles street at a

high speed, jumped the median, hit a tree, and blew up.

As readers of WhoWhatWhy know, our site has been one of the very few continuing to explore

the fiery death two years ago of investigative journalist Michael

Hastings, whose car left a straight segment of a Los Angeles street at a

high speed, jumped the median, hit a tree, and blew up.

Our original report described anomalies of the crash and surrounding events that suggest cutting-edge foul play—that an external hacker could have taken control of Hastings’s car in order to kill him. If this sounds too futuristic, a series of recent technical revelations has proven that “car hacking” is entirely possible. The latest just appeared this week.

Read More @ WhoWhatWhy.org

As readers of WhoWhatWhy know, our site has been one of the very few continuing to explore

the fiery death two years ago of investigative journalist Michael

Hastings, whose car left a straight segment of a Los Angeles street at a

high speed, jumped the median, hit a tree, and blew up.

As readers of WhoWhatWhy know, our site has been one of the very few continuing to explore

the fiery death two years ago of investigative journalist Michael

Hastings, whose car left a straight segment of a Los Angeles street at a

high speed, jumped the median, hit a tree, and blew up.Our original report described anomalies of the crash and surrounding events that suggest cutting-edge foul play—that an external hacker could have taken control of Hastings’s car in order to kill him. If this sounds too futuristic, a series of recent technical revelations has proven that “car hacking” is entirely possible. The latest just appeared this week.

Read More @ WhoWhatWhy.org

by Joshua Krause, Daily Sheeple:

A little over two weeks ago, a source within the US Mint announced that

sales of their silver eagles had grown to the point that the Mint was

running out, and would have to suspend all orders for several weeks. This claim was later officially confirmed by the US Mint, and ZeroHedge

noted how strange it was that demand for physical silver was peaking at

a time when the price was falling to record levels. They also added

that other precious metal sellers like the GoldCore, BullionVault, and

the UK Royal Mint were experiencing an unprecedented demand for physical

gold, but at the time this was easily attributable to the economic

crisis in Greece.

A little over two weeks ago, a source within the US Mint announced that

sales of their silver eagles had grown to the point that the Mint was

running out, and would have to suspend all orders for several weeks. This claim was later officially confirmed by the US Mint, and ZeroHedge

noted how strange it was that demand for physical silver was peaking at

a time when the price was falling to record levels. They also added

that other precious metal sellers like the GoldCore, BullionVault, and

the UK Royal Mint were experiencing an unprecedented demand for physical

gold, but at the time this was easily attributable to the economic

crisis in Greece.

But now it’s not so easy to make that claim. The US Mint announced this week that their gold has been flying off the shelves lately, and they haven’t sold this much since April of 2013, which totaled 210,000 ounces. When Reuters mentioned this fact on Wednesday, the mint had sold 110,000 ounces. Just two days later ZeroHedge mentioned that their sales had grown to 143,000 ounces for July. At this rate, their gold sales may match their previous record by the end of the month.

Read More @ thedailysheeple.com

A little over two weeks ago, a source within the US Mint announced that

sales of their silver eagles had grown to the point that the Mint was

running out, and would have to suspend all orders for several weeks. This claim was later officially confirmed by the US Mint, and ZeroHedge

noted how strange it was that demand for physical silver was peaking at

a time when the price was falling to record levels. They also added

that other precious metal sellers like the GoldCore, BullionVault, and

the UK Royal Mint were experiencing an unprecedented demand for physical

gold, but at the time this was easily attributable to the economic

crisis in Greece.

A little over two weeks ago, a source within the US Mint announced that

sales of their silver eagles had grown to the point that the Mint was

running out, and would have to suspend all orders for several weeks. This claim was later officially confirmed by the US Mint, and ZeroHedge

noted how strange it was that demand for physical silver was peaking at

a time when the price was falling to record levels. They also added

that other precious metal sellers like the GoldCore, BullionVault, and

the UK Royal Mint were experiencing an unprecedented demand for physical

gold, but at the time this was easily attributable to the economic

crisis in Greece.But now it’s not so easy to make that claim. The US Mint announced this week that their gold has been flying off the shelves lately, and they haven’t sold this much since April of 2013, which totaled 210,000 ounces. When Reuters mentioned this fact on Wednesday, the mint had sold 110,000 ounces. Just two days later ZeroHedge mentioned that their sales had grown to 143,000 ounces for July. At this rate, their gold sales may match their previous record by the end of the month.

Read More @ thedailysheeple.com

by Reid J. Epstein, Market Watch:

Donald Trump isn’t just the leading Republican candidate in the

national polls—a barometer of name recognition—he’s now looking strong

in the early presidential nominating states where voters are paying

attention.

Donald Trump isn’t just the leading Republican candidate in the

national polls—a barometer of name recognition—he’s now looking strong

in the early presidential nominating states where voters are paying

attention.

An NBC News/Marist poll released Sunday found the New York developer in first place among New Hampshire GOP primary voters and just two percentage points behind Wisconsin Gov. Scott Walker in Iowa.

Trump carries 21% of the New Hampshire GOP primary electorate, a decisive lead over second-place Jeb Bush, who had 14%, the poll found. In Iowa, Trump is at 17%, with Walker at 19%. Until now, Trump had been in the lead of national polling but Walker and Bush led opinion surveys in Iowa and New Hampshire, home to the nation’s first two presidential nominating contests.

Read More @ marketwatch.com

Donald Trump isn’t just the leading Republican candidate in the

national polls—a barometer of name recognition—he’s now looking strong

in the early presidential nominating states where voters are paying

attention.

Donald Trump isn’t just the leading Republican candidate in the

national polls—a barometer of name recognition—he’s now looking strong

in the early presidential nominating states where voters are paying

attention.An NBC News/Marist poll released Sunday found the New York developer in first place among New Hampshire GOP primary voters and just two percentage points behind Wisconsin Gov. Scott Walker in Iowa.

Trump carries 21% of the New Hampshire GOP primary electorate, a decisive lead over second-place Jeb Bush, who had 14%, the poll found. In Iowa, Trump is at 17%, with Walker at 19%. Until now, Trump had been in the lead of national polling but Walker and Bush led opinion surveys in Iowa and New Hampshire, home to the nation’s first two presidential nominating contests.

Read More @ marketwatch.com

from X22Report:

by Claire Bernish, Activist Post:

A bill with bipartisan support introduced in Congress this week is

finally tolling the death knell for cannabis prohibition. By removing a

notorious legal contradiction, the legislation would give precedence to

state marijuana laws—making federal enforcement a thing of the past in

states where medical and recreational weed are legal.

A bill with bipartisan support introduced in Congress this week is

finally tolling the death knell for cannabis prohibition. By removing a

notorious legal contradiction, the legislation would give precedence to

state marijuana laws—making federal enforcement a thing of the past in

states where medical and recreational weed are legal.

While its brevity is astonishing—without the obligatory title pomp, it would struggle to take up a single page—the legislation is capable of ending perhaps the most contentious provision in the ubiquitous War on Drugs. Simply titled the “Respect State Marijuana Laws Act of 2015,” the bill introduced by Rep. Dana Rohrabacher has incredible potential for substantial reform that makes its passage of paramount importance.

Read More @ ActivistPost.com

A bill with bipartisan support introduced in Congress this week is

finally tolling the death knell for cannabis prohibition. By removing a

notorious legal contradiction, the legislation would give precedence to

state marijuana laws—making federal enforcement a thing of the past in

states where medical and recreational weed are legal.

A bill with bipartisan support introduced in Congress this week is

finally tolling the death knell for cannabis prohibition. By removing a

notorious legal contradiction, the legislation would give precedence to

state marijuana laws—making federal enforcement a thing of the past in

states where medical and recreational weed are legal.While its brevity is astonishing—without the obligatory title pomp, it would struggle to take up a single page—the legislation is capable of ending perhaps the most contentious provision in the ubiquitous War on Drugs. Simply titled the “Respect State Marijuana Laws Act of 2015,” the bill introduced by Rep. Dana Rohrabacher has incredible potential for substantial reform that makes its passage of paramount importance.

Read More @ ActivistPost.com

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment