Submitted by Tyler Durden on 07/13/2015 - 16:30 One of the preconditions imposed on Greece for a deal is that it signs into law European rules that would put euro zone authorities at the ECB and in Brussels, rather than Athens, in charge of identifying and closing or breaking up sick banks. This in turn could lead to a shake-up of the sector that could see some banks close, with losses pushed onto bondholders and possibly even large depositors. In such circumstances, there would be little that Athens could do to prevent this.

by Dr. Ron Paul, Ron Paul Institute For Peace:

The drama over Greece’s financial crisis continues to dominate the

headlines. As this column is being written, a deal may have been reached

providing Greece with yet another bailout if the Greek government

adopts new “austerity” measures. The deal will allow all sides to brag

about how they came together to save the Greek economy and the European

Monetary Union. However, this deal is merely a Band-Aid, not a permanent

fix to Greece’s problems. So another crisis is inevitable.

The drama over Greece’s financial crisis continues to dominate the

headlines. As this column is being written, a deal may have been reached

providing Greece with yet another bailout if the Greek government

adopts new “austerity” measures. The deal will allow all sides to brag

about how they came together to save the Greek economy and the European

Monetary Union. However, this deal is merely a Band-Aid, not a permanent

fix to Greece’s problems. So another crisis is inevitable.

The Greek crisis provides a look into what awaits us unless we stop overspending on warfare and welfare and restore a sound monetary system. While most commentators have focused on Greece’s welfare state, much of Greece’s deficit was caused by excessive military spending. Even as its economy collapses and the government makes (minor) cuts in welfare spending, Greece’s military budget remains among the largest in the European Union.

Read More @ RonPaulInstitute.org

The drama over Greece’s financial crisis continues to dominate the

headlines. As this column is being written, a deal may have been reached

providing Greece with yet another bailout if the Greek government

adopts new “austerity” measures. The deal will allow all sides to brag

about how they came together to save the Greek economy and the European

Monetary Union. However, this deal is merely a Band-Aid, not a permanent

fix to Greece’s problems. So another crisis is inevitable.

The drama over Greece’s financial crisis continues to dominate the

headlines. As this column is being written, a deal may have been reached

providing Greece with yet another bailout if the Greek government

adopts new “austerity” measures. The deal will allow all sides to brag

about how they came together to save the Greek economy and the European

Monetary Union. However, this deal is merely a Band-Aid, not a permanent

fix to Greece’s problems. So another crisis is inevitable.The Greek crisis provides a look into what awaits us unless we stop overspending on warfare and welfare and restore a sound monetary system. While most commentators have focused on Greece’s welfare state, much of Greece’s deficit was caused by excessive military spending. Even as its economy collapses and the government makes (minor) cuts in welfare spending, Greece’s military budget remains among the largest in the European Union.

Read More @ RonPaulInstitute.org

This Weekend's Greece Negotiations Explained In 60 Seconds (By Darth Vader)

Submitted by Tyler Durden on 07/13/2015 - 17:50 "Sources" say this is how it all went down...

Cashtration: As Goes Greece, So Goes The World

Submitted by Tyler Durden on 07/13/2015 - 17:30 The tedious drama that we’ve been observing in Greece in recent years is far from over. What we’re witnessing is the greatest credit bubble/debt bubble that mankind has ever seen. What we’re seeing in Greece is not merely a country of socialistically inclined people behaving very foolishly. We’re seeing a small pin pricking a very large balloon. Greek debt is tied to EU debt. EU debt is tied to world debt. The coming debacle may unfold in this manner...The (Amended) Founding Principles Of The European Union

Submitted by Tyler Durden on 07/13/2015 - 17:00

David Einhorn Says Varoufakis "Must Not Be Familiar With The Tyler Durden School Of Negotiation"

Submitted by Tyler Durden on 07/13/2015 - 16:28 "Mr. Varoufakis, who kept reminding everyone that he is a professor of game theory, believed that the European leaders would prefer to make concessions now rather than manage the disruption of a Greek default. He must not be familiar with the Tyler Durden school of negotiation: the first rule of using game theory is you do not talk about using game theory. What’s more obvious is that Syriza didn’t understand what the game is."US Equities Soar On Greek "Deal"; Greek Stocks, Euro Plunge

Submitted by Tyler Durden on 07/13/2015 - 16:06

The One Lesson To Learn Before A Market Crash

Submitted by Tyler Durden on 07/13/2015 - 15:58 Greece is saved!!! I mean BANKERS are saved!!! The market will celebrate the total capitulation of Greece to the EU bankers. Nothing has been resolved. The debt won’t be repaid. The can has been kicked again. Portugal, Spain, Italy, Ireland and even France are essentially insolvent. It’s all a ponzi scheme. The bankers win and the people lose. Hope is not a strategy. Hussman’s weekly tome shows how a crisis plays out. Bad shit happens and the powers that be react with bad solutions that keep their wealth and power protected. Their bad solutions lead to a worse crisis. More bad solutions. And so on, until complete collapse.

German Production Is A Facade Built On Bad Loans...

Submitted by Tyler Durden on 07/13/2015 - 15:14 Similar to the US banks who funded home owners that shouldn’t have received mortgages and made a fortune doing so – at least initially, the Germans funded the periphery nations in an effort to drive output growth domestically. However, financing a large portion of ones’ customer purchases is a high risk endeavour. And the Germans are in the midst of this hard lesson.

Why Did Schauble Almost Use The "Nuclear Option" - Tim Geithner Explains

Submitted by Tyler Durden on 07/13/2015 - 14:57 "The idea was that with Greece out, Germany would be more likely to provide the financial support the eurozone needed because the German people would no longer perceive aid to Europe as a bailout for the Greeks. At the same time, a Grexit would be traumatic enough that it would help scare the rest of Europe into giving up more sovereignty to a stronger banking and fiscal union."

Argentina As A Model For Greece

Submitted by Tyler Durden on 07/13/2015 - 14:33 "I think that if Greece were to leave the Euro things would get very complicated for them... and this would create the same very unhealthy situation as we have in Argentina. Why? If people start storing value in a foreign currency, in this case Greeks using Euros, this will create a huge lack of transparency and affect normal trade flows and transactions. And we know that the parallel economy in Greece is already quite large the way it is. So imagine an exponential version of that. It would be a very difficult period for Greece."

Even The Players Are Losing Faith In Their Own Shenanigans

Submitted by Tyler Durden on 07/13/2015 - 13:54 What is on display more brightly and clearly than ever, though, is the utter fakery of international banking. The players have lost faith in their own shenanigans. They simply go through the motions now awaiting the political fallout, which is to say the revolt of the people who can still do arithmetic. The old refrain, “your check is in the mail” may not be so reassuring to folks who haven’t eaten for three days. Personally, I would expect the gasoline bombs to be flying around Syntagma Square before the middle of the week.

What Assets Did Greece Just Hand Over To Europe: "Airports, Airplanes, Infrastructure And Most Certainly Banks"

Submitted by Tyler Durden on 07/13/2015 - 13:54 The Simpsons was right all along... Recently, we’ve witnessed the bank holiday in Greece, the limitation as

to how much the Greek people can withdraw from their accounts each day.

Recently, we’ve witnessed the bank holiday in Greece, the limitation as

to how much the Greek people can withdraw from their accounts each day.Not surprisingly, the mainstream press have focused on images such as the one above – a queue at an ATM – and discussed the difficulty of the Greek people in trying to run their lives on the €50-€60 that they’re allowed to withdraw each day.

The press then comment poignantly that “Something needs to be done.” The implication is that “someone”, either the banks or the government, need to find a way to deliver these people more money, so that they can continue to function economically.

Read More @ InternationalMan.com

from KingWorldNews:

John Embry:

“Obviously the big news today is the Greek capitulation to the German

pressure and yet another kick-of-the-can down the road. Thus there are

relief rallies in world stock markets, the U.S. dollar is somewhat

firmer, and naturally gold and silver have been driven down again….

John Embry:

“Obviously the big news today is the Greek capitulation to the German

pressure and yet another kick-of-the-can down the road. Thus there are

relief rallies in world stock markets, the U.S. dollar is somewhat

firmer, and naturally gold and silver have been driven down again….

“The takedown in gold and silver occurred at the exact time of day as always — 3 AM EST. This is when the London traders go into action. It also took place once again at the Comex opening, when huge paper sell orders programmed through algorithms hit the market overwhelming any buying support. This is so repetitive that it’s irritating but it is what it is.

John Embry Continues @ KingWorldNews.com

John Embry:

“Obviously the big news today is the Greek capitulation to the German

pressure and yet another kick-of-the-can down the road. Thus there are

relief rallies in world stock markets, the U.S. dollar is somewhat

firmer, and naturally gold and silver have been driven down again….

John Embry:

“Obviously the big news today is the Greek capitulation to the German

pressure and yet another kick-of-the-can down the road. Thus there are

relief rallies in world stock markets, the U.S. dollar is somewhat

firmer, and naturally gold and silver have been driven down again….“The takedown in gold and silver occurred at the exact time of day as always — 3 AM EST. This is when the London traders go into action. It also took place once again at the Comex opening, when huge paper sell orders programmed through algorithms hit the market overwhelming any buying support. This is so repetitive that it’s irritating but it is what it is.

John Embry Continues @ KingWorldNews.com

from Ready Nutrition:

It’s easy to look at the impoverished peoples of any developed nation

and think to yourself “boy, they sure have it easy.” When you compare

our poor to the poor people living in the rest of the world, it’s seems

obvious that our people are better off.

It’s easy to look at the impoverished peoples of any developed nation

and think to yourself “boy, they sure have it easy.” When you compare

our poor to the poor people living in the rest of the world, it’s seems

obvious that our people are better off.

Oftentimes they can be seen with cell phones, cars, running water, a reliable source of electricity, heating and cooling, etc. It takes up a much higher percentage of their budget, but many of those people living below the poverty line in the United States still have a higher standard of living than those living in the rest of the world. And when you compare our poor to those who lived in previous eras, the divide is even wider. However, you shouldn’t be fooled by these comparisons.

Read More @ ReadyNutrition.com

It’s easy to look at the impoverished peoples of any developed nation

and think to yourself “boy, they sure have it easy.” When you compare

our poor to the poor people living in the rest of the world, it’s seems

obvious that our people are better off.

It’s easy to look at the impoverished peoples of any developed nation

and think to yourself “boy, they sure have it easy.” When you compare

our poor to the poor people living in the rest of the world, it’s seems

obvious that our people are better off.Oftentimes they can be seen with cell phones, cars, running water, a reliable source of electricity, heating and cooling, etc. It takes up a much higher percentage of their budget, but many of those people living below the poverty line in the United States still have a higher standard of living than those living in the rest of the world. And when you compare our poor to those who lived in previous eras, the divide is even wider. However, you shouldn’t be fooled by these comparisons.

Read More @ ReadyNutrition.com

by Sandeep Godiyal, Natural News:

One of the worst things about the low-fat craze – which gripped America

and other parts of the West for decades and is only now slowly eroding

as people realize that fat can be healthy after all – was the fact that

so many people avoided nuts in their diet. While it is true that nuts

are what is considered to be a calorie-dense food – high in fat as well

as protein – this does not necessarily mean that, when eaten in

moderation, they are unhealthy. As a matter of fact, research is

increasingly coming to light which shows nuts to be one of the great

health foods. They are a great part of a balanced diet and are

appropriate for people with a number of health conditions, including

diabetes, heart disease and other chronic diseases that can cause so

much damage. Let’s take a look at the past and future research on the

benefits of adding nuts to the diet.

One of the worst things about the low-fat craze – which gripped America

and other parts of the West for decades and is only now slowly eroding

as people realize that fat can be healthy after all – was the fact that

so many people avoided nuts in their diet. While it is true that nuts

are what is considered to be a calorie-dense food – high in fat as well

as protein – this does not necessarily mean that, when eaten in

moderation, they are unhealthy. As a matter of fact, research is

increasingly coming to light which shows nuts to be one of the great

health foods. They are a great part of a balanced diet and are

appropriate for people with a number of health conditions, including

diabetes, heart disease and other chronic diseases that can cause so

much damage. Let’s take a look at the past and future research on the

benefits of adding nuts to the diet.

Read More @ NaturalNews.com

One of the worst things about the low-fat craze – which gripped America

and other parts of the West for decades and is only now slowly eroding

as people realize that fat can be healthy after all – was the fact that

so many people avoided nuts in their diet. While it is true that nuts

are what is considered to be a calorie-dense food – high in fat as well

as protein – this does not necessarily mean that, when eaten in

moderation, they are unhealthy. As a matter of fact, research is

increasingly coming to light which shows nuts to be one of the great

health foods. They are a great part of a balanced diet and are

appropriate for people with a number of health conditions, including

diabetes, heart disease and other chronic diseases that can cause so

much damage. Let’s take a look at the past and future research on the

benefits of adding nuts to the diet.

One of the worst things about the low-fat craze – which gripped America

and other parts of the West for decades and is only now slowly eroding

as people realize that fat can be healthy after all – was the fact that

so many people avoided nuts in their diet. While it is true that nuts

are what is considered to be a calorie-dense food – high in fat as well

as protein – this does not necessarily mean that, when eaten in

moderation, they are unhealthy. As a matter of fact, research is

increasingly coming to light which shows nuts to be one of the great

health foods. They are a great part of a balanced diet and are

appropriate for people with a number of health conditions, including

diabetes, heart disease and other chronic diseases that can cause so

much damage. Let’s take a look at the past and future research on the

benefits of adding nuts to the diet.Read More @ NaturalNews.com

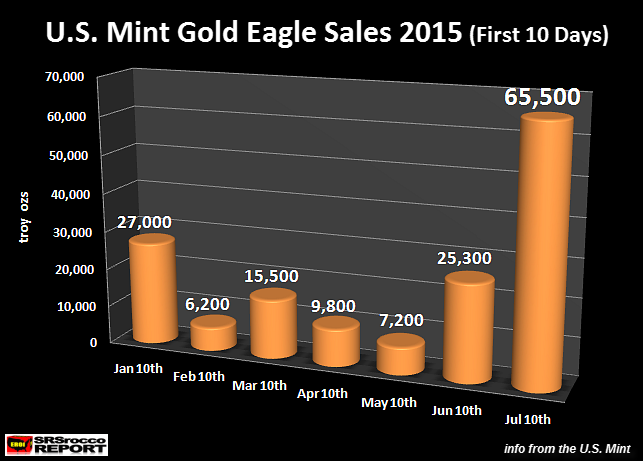

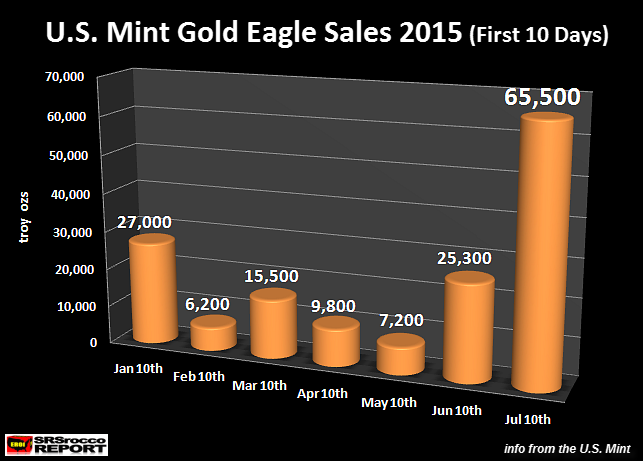

by Steve St. Angelo, SRS Rocco Report:

Something quite interesting took place on Friday last week. The U.S.

Mint updated its figures showing sales of its Gold Eagles surged to a

level not seen for more than a year. Sales of Gold Eagles have been

strong ever since the financial turmoil in Europe increased

significantly with the threat of a Greek Exit.

Something quite interesting took place on Friday last week. The U.S.

Mint updated its figures showing sales of its Gold Eagles surged to a

level not seen for more than a year. Sales of Gold Eagles have been

strong ever since the financial turmoil in Europe increased

significantly with the threat of a Greek Exit.

Sales of Gold Eagles increased from 21,500 oz in May to 76,000 oz in June due to investor’s concern on the financial fallout of a Greek Exit. However, this was nothing compared to Gold Eagle buying during the remaining days of last week.

Read More…

Something quite interesting took place on Friday last week. The U.S.

Mint updated its figures showing sales of its Gold Eagles surged to a

level not seen for more than a year. Sales of Gold Eagles have been

strong ever since the financial turmoil in Europe increased

significantly with the threat of a Greek Exit.

Something quite interesting took place on Friday last week. The U.S.

Mint updated its figures showing sales of its Gold Eagles surged to a

level not seen for more than a year. Sales of Gold Eagles have been

strong ever since the financial turmoil in Europe increased

significantly with the threat of a Greek Exit.Sales of Gold Eagles increased from 21,500 oz in May to 76,000 oz in June due to investor’s concern on the financial fallout of a Greek Exit. However, this was nothing compared to Gold Eagle buying during the remaining days of last week.

Read More…

from The Burning Platform:

The proof of the pudding is in the eating, the old saw goes. This one,

alas, is a mélange of several old shit sandwiches bound in liaison of

subterfuge and seasoned with political absurdities. Having been fooled

in this bistro before, citizen-patrons leave the table resigned to yet

another bout of food poisoning as the music of universal upchuck rings

across the European Union from Helsinki to Lisbon

The proof of the pudding is in the eating, the old saw goes. This one,

alas, is a mélange of several old shit sandwiches bound in liaison of

subterfuge and seasoned with political absurdities. Having been fooled

in this bistro before, citizen-patrons leave the table resigned to yet

another bout of food poisoning as the music of universal upchuck rings

across the European Union from Helsinki to Lisbon

What is on display more brightly and clearly than ever, though, is the utter fakery of international banking. The players have lost faith in their own shenanigans. They simply go through the motions now awaiting the political fallout, which is to say the revolt of the people who can still do arithmetic. So, now Greece can supposedly expect another $90-equivalent in new loans on top of the $350-equivalent already racked up. That’s rich. The loan repayment schedule must look like a map of Middle Earth.

Read More @ TheBurningPlatform.com

The proof of the pudding is in the eating, the old saw goes. This one,

alas, is a mélange of several old shit sandwiches bound in liaison of

subterfuge and seasoned with political absurdities. Having been fooled

in this bistro before, citizen-patrons leave the table resigned to yet

another bout of food poisoning as the music of universal upchuck rings

across the European Union from Helsinki to Lisbon

The proof of the pudding is in the eating, the old saw goes. This one,

alas, is a mélange of several old shit sandwiches bound in liaison of

subterfuge and seasoned with political absurdities. Having been fooled

in this bistro before, citizen-patrons leave the table resigned to yet

another bout of food poisoning as the music of universal upchuck rings

across the European Union from Helsinki to LisbonWhat is on display more brightly and clearly than ever, though, is the utter fakery of international banking. The players have lost faith in their own shenanigans. They simply go through the motions now awaiting the political fallout, which is to say the revolt of the people who can still do arithmetic. So, now Greece can supposedly expect another $90-equivalent in new loans on top of the $350-equivalent already racked up. That’s rich. The loan repayment schedule must look like a map of Middle Earth.

Read More @ TheBurningPlatform.com

from ppsimmons:

[Ed. Note: What could YOUR community do with $4 Million an hour? ~MRH]

from RT:

from Global Research:

Tectonic geopolitical shifts are taking place in Eurasia. The Venetian

merchant Marco Polo and the Moroccan scholar Ibn Battuta, both great

travelers of their days, would be thoroughly impressed with the trade

networks that are developing. The Eurasia of today is developing into a

vast network of superhighways, railroad connections, mammoth ports, and

sophisticated airports.

Tectonic geopolitical shifts are taking place in Eurasia. The Venetian

merchant Marco Polo and the Moroccan scholar Ibn Battuta, both great

travelers of their days, would be thoroughly impressed with the trade

networks that are developing. The Eurasia of today is developing into a

vast network of superhighways, railroad connections, mammoth ports, and

sophisticated airports.

Interconnectedness is the name of the game and Beijing has been leading the way forward. Despite China’s massive project to bring the economies of Eurasia together, the Chinese still face resentment by those that want to tarnish the image and leadership role of the People’s Republic. Here is just the latest example: although it is annually reported around Ramadan that there are restrictions on China’s Muslims, this year there has been a large international media barrage of reports claiming that China has banned fasting in the Muslim-majority Xinjiang Uyghur Autonomous Region. This type of media campaign evokes memories about the 3.14 protests that were orchestrated in the Tibet Autonomous Region and internationally to disrupt the 2008 Summer Olympics in Beijing.

Read More @ Globalresearch.ca

Tectonic geopolitical shifts are taking place in Eurasia. The Venetian

merchant Marco Polo and the Moroccan scholar Ibn Battuta, both great

travelers of their days, would be thoroughly impressed with the trade

networks that are developing. The Eurasia of today is developing into a

vast network of superhighways, railroad connections, mammoth ports, and

sophisticated airports.

Tectonic geopolitical shifts are taking place in Eurasia. The Venetian

merchant Marco Polo and the Moroccan scholar Ibn Battuta, both great

travelers of their days, would be thoroughly impressed with the trade

networks that are developing. The Eurasia of today is developing into a

vast network of superhighways, railroad connections, mammoth ports, and

sophisticated airports.Interconnectedness is the name of the game and Beijing has been leading the way forward. Despite China’s massive project to bring the economies of Eurasia together, the Chinese still face resentment by those that want to tarnish the image and leadership role of the People’s Republic. Here is just the latest example: although it is annually reported around Ramadan that there are restrictions on China’s Muslims, this year there has been a large international media barrage of reports claiming that China has banned fasting in the Muslim-majority Xinjiang Uyghur Autonomous Region. This type of media campaign evokes memories about the 3.14 protests that were orchestrated in the Tibet Autonomous Region and internationally to disrupt the 2008 Summer Olympics in Beijing.

Read More @ Globalresearch.ca

from The Sleuth Journal:

As our economy trembles in shambles the United States military is not only igniting the Jade Helm 15 drills but has also begun Operation Talisman Sabre in which 33,000 troops will be deployed to the Pacific to train for war.

Considering a global economic collapse is on the horizon and tensions with Russia and China are rising, our mainstream media has conveniently remained quite on the issue leading me to believe this operation has a much more sinister goal in mind.

Many of us are already aware that the governments way out of impending economic crisis is to ignite a War. Could it be that these drills are in preparation for World War III and maybe even civil uprising as a result of the coming economic crash?

Read More @ Thesleuthjournal.com

As our economy trembles in shambles the United States military is not only igniting the Jade Helm 15 drills but has also begun Operation Talisman Sabre in which 33,000 troops will be deployed to the Pacific to train for war.

Considering a global economic collapse is on the horizon and tensions with Russia and China are rising, our mainstream media has conveniently remained quite on the issue leading me to believe this operation has a much more sinister goal in mind.

Many of us are already aware that the governments way out of impending economic crisis is to ignite a War. Could it be that these drills are in preparation for World War III and maybe even civil uprising as a result of the coming economic crash?

Read More @ Thesleuthjournal.com

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment