Submitted by Tyler Durden on 07/30/2015 - 20:30

Submitted by Tyler Durden on 07/30/2015 - 20:30

Donald Trump’s ascendance as the early GOP front-runner is symbolic of a greater global trend: growing pushback against institutional political and economic power.

Gold is the money of Kings...

Silver is the money of Gentlemen...

Barter is the money of Peasants...

And Debt...Dept is the money of SLAVES...

This proves that 7 out of 10 Americans are IDIOTS...

Debt Slaves: 7 Out Of 10 Americans Believe That Debt "Is A Necessity In Their Lives"

Submitted by Tyler Durden on 07/30/2015 - 23:00 Could you live without debt? Most Americans say that they cannot. According to a brand new Pew survey, approximately 7 out of every 10 Americans believe that “debt is a necessity in their lives”, and approximately 8 out of every 10 Americans actually have debt right now. Most of us like to think that “someday” we will get out of the hole and quit being debt slaves, but very few of us ever actually accomplish this. That is because the entire system is designed to trap us in debt before we even get out into the “real world” and keep us in debt until we die. Sadly, most Americans don’t even realize what is being done to them.

from KingWorldNews:

China lost 2% to 3% last night, though Europe was slightly positive.

Our stock market fell a bit less than 0.5% in the early going, for no

particular reason that I could see. Last night’s crop of earnings

reports saw plenty of disappointments, from high-flyer Facebook to Whole

Foods to BorgWarner, but I don’t think that had much to do with this

morning’s weakness. Today’s macro data, in the form of the GDP report,

is a perfect snapshot of where the economy actually is. According to the

government, GDP growth for the second quarter was 2.3%, while prices

rose 2%, so if you accept those numbers at face value they essentially

equal stagflation.

China lost 2% to 3% last night, though Europe was slightly positive.

Our stock market fell a bit less than 0.5% in the early going, for no

particular reason that I could see. Last night’s crop of earnings

reports saw plenty of disappointments, from high-flyer Facebook to Whole

Foods to BorgWarner, but I don’t think that had much to do with this

morning’s weakness. Today’s macro data, in the form of the GDP report,

is a perfect snapshot of where the economy actually is. According to the

government, GDP growth for the second quarter was 2.3%, while prices

rose 2%, so if you accept those numbers at face value they essentially

equal stagflation.

But Who’s Counting?

I would suggest the reality is worse, because the actual inflation rate is undoubtedly higher than 2% (especially if you are a renter), and we have basically been in a stagflationary environment for at least several years, though it continues to be viewed as a deflationary one. When that psychology changes and the environment is recognized for what it really is, I think equity valuations, and bonds, for that matter, will be drastically different, but that change still lies ahead of us.

Bill Fleckenstein continues @ KingWorldNews.com

China lost 2% to 3% last night, though Europe was slightly positive.

Our stock market fell a bit less than 0.5% in the early going, for no

particular reason that I could see. Last night’s crop of earnings

reports saw plenty of disappointments, from high-flyer Facebook to Whole

Foods to BorgWarner, but I don’t think that had much to do with this

morning’s weakness. Today’s macro data, in the form of the GDP report,

is a perfect snapshot of where the economy actually is. According to the

government, GDP growth for the second quarter was 2.3%, while prices

rose 2%, so if you accept those numbers at face value they essentially

equal stagflation.

China lost 2% to 3% last night, though Europe was slightly positive.

Our stock market fell a bit less than 0.5% in the early going, for no

particular reason that I could see. Last night’s crop of earnings

reports saw plenty of disappointments, from high-flyer Facebook to Whole

Foods to BorgWarner, but I don’t think that had much to do with this

morning’s weakness. Today’s macro data, in the form of the GDP report,

is a perfect snapshot of where the economy actually is. According to the

government, GDP growth for the second quarter was 2.3%, while prices

rose 2%, so if you accept those numbers at face value they essentially

equal stagflation.But Who’s Counting?

I would suggest the reality is worse, because the actual inflation rate is undoubtedly higher than 2% (especially if you are a renter), and we have basically been in a stagflationary environment for at least several years, though it continues to be viewed as a deflationary one. When that psychology changes and the environment is recognized for what it really is, I think equity valuations, and bonds, for that matter, will be drastically different, but that change still lies ahead of us.

Bill Fleckenstein continues @ KingWorldNews.com

Let’s look at two different topics where we are seeing contradictory "evidence". First up is what’s happening in the gold and silver markets. Never before have I seen sentiment as poor as it is today. Nor have I seen so many negative articles about gold in the various mainstream publications. It has gotten so bad, gold has even been compared to "pet rocks"! While we have seen food fights before, the name calling as of late has become deafening led recently by Martin Armstrong and Cliff Droke. I wonder how or what their response is to the physical side of the argument?

As you know, there have been "air pockets" in the price of gold over the last three years. Nearly always, these takedowns occur at night and in particular Sunday nights. The last one a couple of weeks back, saw $2.7 billion worth of gold sold over a two minute span. I have asked the question many times, "who" controls this much gold and if we could identify someone or some entity, "who" would ever sell in a manner to destroy pricing if a profit motive truly exists? Can anyone conjure up an answer to this while including the phrase "profit motive"? I dare any of the gold bashers to answer these two very simple questions! Front running just a bit, any real answer I would imagine must have "desired lower gold price" as part of the explanation.

A very real problem or flaw in logic exists in the current gold and silver markets. If there is in fact so much selling (panic selling), how is it possible the U.S. Mint had to stop selling Silver Eagles nearly a month ago? It can only be for one of two reasons. Either they had enough silver but could not produce coins fast enough to satisfy demand, or, they could not source enough silver to make the coins. But this does not make any sense. How could there be "too much demand" if everyone is selling? Also, how could there not be enough silver available if everyone is selling and has sold? Where did all of this "sold" silver go to? Again, I dare anyone to come up with a logical answer to this.

We are also seeing the same thing in gold. It is trading in backwardation ($7 plus) in London and with substantial premiums in India and throughout Asia. If the masses are dumping gold then supply should be plentiful, how can physical tightness exist or premiums over the paper price exist if recently sold gold is falling out of dump trucks on their way to refineries? Any logical answers for this? The gold bashers say "see, the price is down, there is your proof". Do Armstrong and crew deny that the only thing necessary to sell a COMEX gold or silver contract short is the ability to post margin? Do they deny that "money" (margin) can be and is created for free ? And then used to "water down" the futures in the same manner as a company over issues stock or a country over issues money supply?

There is a very real distinction between paper gold and physical gold, this will soon become apparent. The difference is physical in your own control is no one else’s liability. Paper gold on the other hand is the liability of the issuer of the contract. Currently, COMEX has a whopping 11.7 tons left of deliverable gold left. JP Morgan claims to have less than four tons, these are the lowest numbers I can ever remember. To put it in perspective, 11.7 tons of gold is worth less than $400 million dollars. The COMEX can now be broken and exposed with petty cash! As sure as the Sun will rise tomorrow, there will eventually be a "call" on real gold. Not only on COMEX gold but ALL paper gold …any call will not be met because the gold does not exist to meet the call. There are now more than 100 paper ounces of gold sold for every one ounce of real gold that exists to deliver. If there were 100 fake shares of IBM trading and watering down every one real share in existence, the price of IBM stock would be trading in the low single digits! The fake shares would alter perception but not the reality of what the company is worth as an ongoing concern.

Another area to touch on is the "threat" of the Fed raising interest rates. I view a rate hike as ONLY a threat at this point and will get into that shortly. Looking back, the Fed has floated the idea of rate normalization ever since early 2010. It was always six months out …and continually extended. But this time they really mean it? The consensus is now for a rate hike in September. I can only say one thing to Janet Yellen and the gang, I DARE YOU! In my opinion, if the Fed were to raise rates we might only have a functioning financial system for about 48 hours, I cannot see more than a week or two at the most.

Why is this you ask? Let’s count the ways … First, global trade is already imploding. China is entering a margin call scenario on many fronts. An already strong dollar is pressuring an over indebted world that owes in dollars. Internally, the U.S. is missing on many cylinders, retail sales and housing turnover already weak will become disastrous. Reported economic numbers are barely treading water even with bogus assumptions and accounting. Tightening credit will also have a negative effect on the banking system with razor thin margins and even more so in the derivatives complex. Higher rates on their own will create margin calls, not to mention investors scrambling for the door in fear of even more rate hikes. Panic begets panic in other words.

The way I see it, there is a very real probability the Fed not only does not raise rates in September, a very real chance exists for QE4 to be announced and implemented in a panic. It should be added that the possibility of forced U.S. Treasury sales by China is a distinct possibility. They may be forced to do this to shore up their panicky markets. Who will be the buyer? Yes of course, the Fed and ONLY the Fed! It is my belief the Fed is about to be tested beyond breaking not only as lender of last resort but also "buyer of only resort" when it comes to the Treasury market. Liquidity is already quite tight world wide, can the Fed really exacerbate the situation by raising rates? Is any economy anywhere in the world strong enough to bare higher rates? Any financial system solid enough? I DARE THEM to raise rates …I bet they will instead be forced to do the opposite and pump unprecedented new liquidity!

Standing watch,

Bill Holter

Holter-Sinclair collaboration

Comments welcome! bholter@hotmail.com

filed under (unt

According to the Wall Street Journal,

total donations by UBS to the Clinton Foundation grew from less than

$60,000 at the end of 2008 to approximately $600,000 by the end of 2014.

The Wall Street Journal reports that the bank also lent $32 million

through entrepreneurship and inner city loan programs that it launched

in association with the Clinton Foundation. At the very same time, they

were paying former President Bill Clinton $1.5 million to participate in

a series of corporate Q&A sessions with UBS Chief Executive Bob

McCann. You really cannot make up this stuff.

According to the Wall Street Journal,

total donations by UBS to the Clinton Foundation grew from less than

$60,000 at the end of 2008 to approximately $600,000 by the end of 2014.

The Wall Street Journal reports that the bank also lent $32 million

through entrepreneurship and inner city loan programs that it launched

in association with the Clinton Foundation. At the very same time, they

were paying former President Bill Clinton $1.5 million to participate in

a series of corporate Q&A sessions with UBS Chief Executive Bob

McCann. You really cannot make up this stuff.On top of that, the Inspector General recommended that the Justice Department investigate Hillary’s erasing of emails for that would have clearly been criminal. Of course, the Justice Department would NEVER investigate Hillary while in the hands of the Obama Administration. This is why the whole executive structure of government is broken.

Read More @ ArmstrongEconomics.org

It's really sad that America is filled with so many pussies...If I could go on Safari...I would in a second...

Secret Memo Reveals US Was Aware Of Americans Killing Zimbabwe Lions; Only Concern Was Getting Caught

Submitted by Tyler Durden on 07/30/2015 - 22:24 "One safari operator accused an American, by name, of killing a lion illegally and then smuggling its hide out through South Africa. Given the rampant smuggling of other animal products across Zimbabwe's southern border (reftel), this is not unlikely. As reported in reftel, American hunting dollars are vital to Zimbabwe's conservation efforts, but there are also serious risks that Americans could be implicated in smuggling and poaching operations."

Chinese Stocks Extend Yesterday's Plunge Despite Regulators "Asking" Insurers To Stop "Net Sales"

Submitted by Tyler Durden on 07/30/2015 - 21:20 Following last night's afternoon session plungefest (with ChiNext's biggest drop in a month), as it appeared the government experimented with 'free' markets briefly, regulators have "asked" insurance companies to be "net sellers" of stocks going forward. With margin debt dropping for the 4th day in a row (to fresh 4-month lows), Markit noted that accusations of foreigners short selling shares is “overblown” by Chinese market regulators and not the cause of a recent rout in the stock market, according to the SCMP. The requests and threats appear to not be working as CSI-300 futures open down 0.7%.

"Greed Is King" - What We Learned Talking To Chinese Stock Investors

Submitted by Tyler Durden on 07/30/2015 - 21:00 During a short stay in Shanghai a few weeks ago on unrelated business, we had an opportunity to witness the ground zero of the China market frenzy at its peak and its nascent plunge. Chinese retail investors make up 85% of the market, a far cry from the U.S. where retail investors own less than 30% of equities and make up less than 2% of NYSE trading volume for listed firms in 2009. Combined with the highest trading frequencies in the world and one of the lowest educational levels, describing China’s market as immature is an understatement.

China Says US "Militarization" Of South China Sea Shows Washington "Wants Nothing Better Than Chaos"

Submitted by Tyler Durden on 07/30/2015 - 20:00 "China is extremely concerned at the United States' pushing of the militarization of the South China Sea region. "What they are doing can't help but make people wonder whether they want nothing better than chaos."

Why Do So Many Working Age Americans Choose Not To Enter The Workforce?

Submitted by Tyler Durden on 07/30/2015 - 19:30 You could call it the "Mystery of the Missing Worker" – why do so many people of working age chose not to enter the workforce? Here are the numbers, as of the most recent Employment Situation report: 250 million: the total number of people of working age in the United States; 149 million: the total number of people in that population that have a job; 8 million: the number of people who want a job but do not have one; leaving 93 million: the number of people who don’t work, and don’t want work. To put some context around that last number, it is 30% of the entire U.S. population. Why?Least Transparent Ever: IRS Used "Wholly Separate" Message System To Hide Communications

Submitted by Tyler Durden on 07/30/2015 - 19:30

Lerner then asks whether OCS is automatically archived. When informed it was not, Lerner responded “Perfect.”

This Is The 714 Sq. Foot Hovel In LA That Can Be Yours For Just $1.1 Million

Submitted by Tyler Durden on 07/30/2015 - 19:01 This is full on mania and with inventory building up, people are starting to crunch the numbers more carefully. I’m curious, how does someone justify a 144% increase on this place? As we all know, real estate is essentially a game of musical chairs, especially in boom and bust California. Someone is trying to cash in on a lottery ticket here for Venice.

Does This Look Like An Accidental Relationship To You?

Submitted by Tyler Durden on 07/30/2015 - 18:30 Monetary policy divergence manifests itself first in currencies, because currencies aren’t an asset class at all, but a political construction that represents and symbolizes monetary policy. Then the divergence manifests itself in those asset classes, like commodities, that have no internal dynamics or cash flows and are thus only slightly removed in their construction and meaning from however they’re priced in this currency or that. From there the divergence spreads like a cancer (or like a cure for cancer, depending on your perspective) into commodity-sensitive real-world companies and national economies. Eventually – and this is the Big Point – the divergence spreads into everything, everywhere."Why Commodities Defaults Could Spread", UBS Explains

Submitted by Tyler Durden on 07/30/2015 - 18:00 "In the wake of the commodity price swoon one of the recurring questions is will the stress in commodity markets spillover to other sectors?," UBS asks. Spoiler alert: the answer is "yes."

"Moscow Must Burn": Ukraine's "Christian Taliban" Pledges Anti-Russian "Crusade"

Submitted by Tyler Durden on 07/30/2015 - 17:05 "I would like Ukraine to lead the crusades. Our mission is not only to kick out the occupiers, but also revenge. Moscow must burn."The deals are moving hot and heavy in the Middle East. This may represent some sort of secret major realignment among middle eastern nations of which President Obama’s nuclear deal with Iran may only be a small part. A Russian news agency yesterday announced that the Russian government has signed major deals in Saudi Arabia, Egypt and Jordan for the construction of much needed nuclear power plants

from Gregory Mannarino :

by Mises Institute, The Daily Bell:

Due to Obamacare, my health plan has become something other than insurance. It is now, for the most part, nothing other than a wealth transfer scheme to benefit the politically connected over others.

In order to identify the difference between health insurance and government-mandated health care coverage, we can look to Human Action, in which Ludwig von Mises splits probability into class probability and case probability:

Due to Obamacare, my health plan has become something other than insurance. It is now, for the most part, nothing other than a wealth transfer scheme to benefit the politically connected over others.

In order to identify the difference between health insurance and government-mandated health care coverage, we can look to Human Action, in which Ludwig von Mises splits probability into class probability and case probability:

Class probability means: We know or

assume to know, with regard to the problem concerned, everything about

the behavior of a whole class of events or phenomena; but about the

actual singular events or phenomena we know nothing but that they are

elements of this class.

Read More @ TheDailyBell.com

Silver will be appreciably higher by 2020 relative to where we now reside in 2015.

by Avi Gilburt, Market Watch:

I don’t know of many charts out there that a bullish investor since 2011 would look at with more disgust than the silver chart. It has been an exceptionally painful experience for those bullishly inclined since 2011. In fact, silver has dropped 70% from its 2011 heights to its recent lows, and it is still not done. But this story certainly has a “silver lining” for those who are willing to be a bit more patient.

On Aug. 30, 2011, I wrote my first public column about silver, which called for a market top in silver with a shorting target of 42.90, and that it must remain below 44.30 for the downside to ensue. Within the same column, I provided a downside target of 26.80 in the futures.

On Sept. 2, 2011, silver futures reached a high of 43.72, and then began a waterfall decline which spiked as low as 26.36 24 days later before a larger countertrend rally took hold. In fact, in my comments to this column, I noted on Sept. 3, 2011, that “we are probably within a trading day or two of a big move,” and my perspective was clearly to the downside, as I was shorting silver at the time. As we now know, silver declined 38% within three weeks

Read More @ MarketWatch.com

by Avi Gilburt, Market Watch:

I don’t know of many charts out there that a bullish investor since 2011 would look at with more disgust than the silver chart. It has been an exceptionally painful experience for those bullishly inclined since 2011. In fact, silver has dropped 70% from its 2011 heights to its recent lows, and it is still not done. But this story certainly has a “silver lining” for those who are willing to be a bit more patient.

On Aug. 30, 2011, I wrote my first public column about silver, which called for a market top in silver with a shorting target of 42.90, and that it must remain below 44.30 for the downside to ensue. Within the same column, I provided a downside target of 26.80 in the futures.

On Sept. 2, 2011, silver futures reached a high of 43.72, and then began a waterfall decline which spiked as low as 26.36 24 days later before a larger countertrend rally took hold. In fact, in my comments to this column, I noted on Sept. 3, 2011, that “we are probably within a trading day or two of a big move,” and my perspective was clearly to the downside, as I was shorting silver at the time. As we now know, silver declined 38% within three weeks

Read More @ MarketWatch.com

from Peter Schiff:

by Andrew Hoffman, Miles Franklin:

As usual, I have extremely timely, eminently actionable topics to

discuss. And while I’d love to simply talk “big picture,” the collapse

of history’s largest, most destructive fiat Ponzi scheme is moving too

rapidly to be complacent. Trust me, I’d love to take a well-deserved

rest – and man, is it well-deserved. However, the so-called “race to the

finish” is on; and as I not only love my job, but feel compelled to do

it as well as possible, there’s no way I’m going to slow down any time

soon. In return, I ask for nothing but your goodwill, and help in

spreading such “gospel” as rapidly as possible. That said, Miles

Franklin would clearly appreciate the opportunity to earn your business, if you happen to be considering the purchase, sale, or storage of Precious Metals.

As usual, I have extremely timely, eminently actionable topics to

discuss. And while I’d love to simply talk “big picture,” the collapse

of history’s largest, most destructive fiat Ponzi scheme is moving too

rapidly to be complacent. Trust me, I’d love to take a well-deserved

rest – and man, is it well-deserved. However, the so-called “race to the

finish” is on; and as I not only love my job, but feel compelled to do

it as well as possible, there’s no way I’m going to slow down any time

soon. In return, I ask for nothing but your goodwill, and help in

spreading such “gospel” as rapidly as possible. That said, Miles

Franklin would clearly appreciate the opportunity to earn your business, if you happen to be considering the purchase, sale, or storage of Precious Metals.

This week, it’s been a pleasure spending time with Miles Franklin’s first class team here in Vancouver – led by my “twin brother” Andy Schectman, who provided the Yin to my Yang at today’s presentations; with me answering investors’ questions about the markets and economy – and he, the “State of the Bullion Industry.” To that end, Andy and I have hosted numerous private meetings for investor groups throughout the country – and would be thrilled to do so for you, if you can put one together in your home town.

Read More @ MilesFranklin.com

As usual, I have extremely timely, eminently actionable topics to

discuss. And while I’d love to simply talk “big picture,” the collapse

of history’s largest, most destructive fiat Ponzi scheme is moving too

rapidly to be complacent. Trust me, I’d love to take a well-deserved

rest – and man, is it well-deserved. However, the so-called “race to the

finish” is on; and as I not only love my job, but feel compelled to do

it as well as possible, there’s no way I’m going to slow down any time

soon. In return, I ask for nothing but your goodwill, and help in

spreading such “gospel” as rapidly as possible. That said, Miles

Franklin would clearly appreciate the opportunity to earn your business, if you happen to be considering the purchase, sale, or storage of Precious Metals.

As usual, I have extremely timely, eminently actionable topics to

discuss. And while I’d love to simply talk “big picture,” the collapse

of history’s largest, most destructive fiat Ponzi scheme is moving too

rapidly to be complacent. Trust me, I’d love to take a well-deserved

rest – and man, is it well-deserved. However, the so-called “race to the

finish” is on; and as I not only love my job, but feel compelled to do

it as well as possible, there’s no way I’m going to slow down any time

soon. In return, I ask for nothing but your goodwill, and help in

spreading such “gospel” as rapidly as possible. That said, Miles

Franklin would clearly appreciate the opportunity to earn your business, if you happen to be considering the purchase, sale, or storage of Precious Metals.This week, it’s been a pleasure spending time with Miles Franklin’s first class team here in Vancouver – led by my “twin brother” Andy Schectman, who provided the Yin to my Yang at today’s presentations; with me answering investors’ questions about the markets and economy – and he, the “State of the Bullion Industry.” To that end, Andy and I have hosted numerous private meetings for investor groups throughout the country – and would be thrilled to do so for you, if you can put one together in your home town.

Read More @ MilesFranklin.com

by Penny Starr, CNS News:

In 2012, President Barack Obama in a video message to supporters of

Planned Parenthood Federation of America’s Political Action Committee

pledged to fight efforts in Congress to defund the nation’s largest

abortion provider.

In 2012, President Barack Obama in a video message to supporters of

Planned Parenthood Federation of America’s Political Action Committee

pledged to fight efforts in Congress to defund the nation’s largest

abortion provider.

“That’s why last year when Republicans in Congress threatened to shut down the government unless we stopped funding Planned Parenthood, I had a simple answer: ‘No,’” Obama says in the 2-minute video posted on YouTube by PPVotes on March 28, 2012.

“For you and for most Americans protecting women’s health is a mission that stands above politics,” Obama says. “Yet over the past year you’ve had to stand up to politicians who want to deny millions of women the care they rely on and inject themselves into decisions that are best made between a woman and her doctor.”

Read More @ CNS News.com:

In 2012, President Barack Obama in a video message to supporters of

Planned Parenthood Federation of America’s Political Action Committee

pledged to fight efforts in Congress to defund the nation’s largest

abortion provider.

In 2012, President Barack Obama in a video message to supporters of

Planned Parenthood Federation of America’s Political Action Committee

pledged to fight efforts in Congress to defund the nation’s largest

abortion provider.“That’s why last year when Republicans in Congress threatened to shut down the government unless we stopped funding Planned Parenthood, I had a simple answer: ‘No,’” Obama says in the 2-minute video posted on YouTube by PPVotes on March 28, 2012.

“For you and for most Americans protecting women’s health is a mission that stands above politics,” Obama says. “Yet over the past year you’ve had to stand up to politicians who want to deny millions of women the care they rely on and inject themselves into decisions that are best made between a woman and her doctor.”

Read More @ CNS News.com:

from TheAlexJonesChannel:

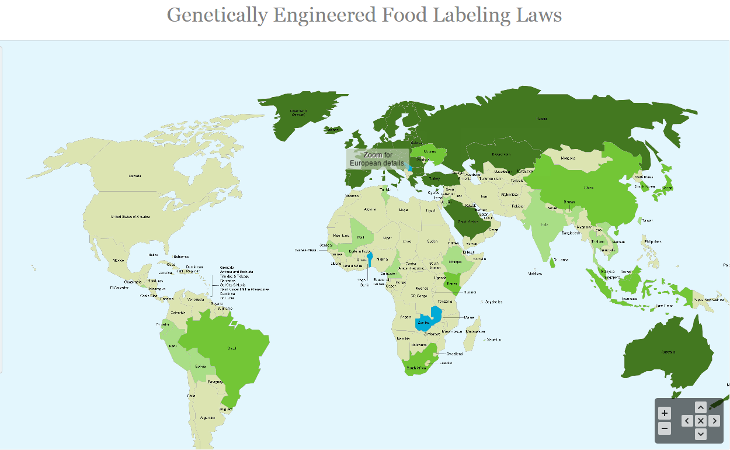

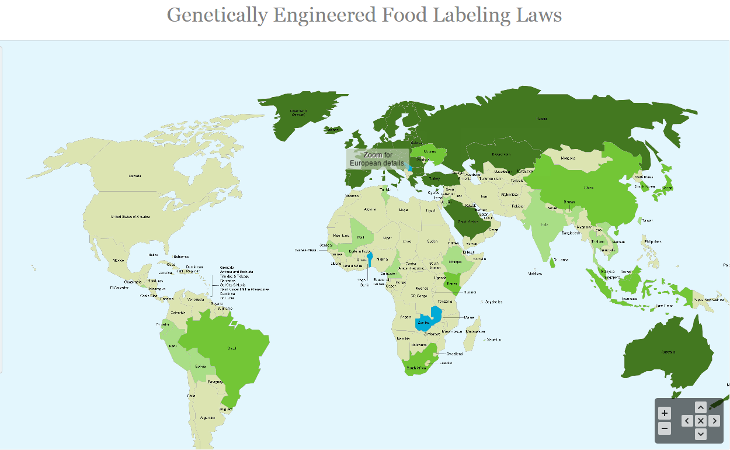

by Christina Sarich, Natural Society:

The WHO has already declared that five of the major chemical herbicides

used to grow GMO crops are either likely or definitely cancerous, yet

the USA still makes secret trade deals that would allow biotech to push

their genetically modified ‘food’ on Americans who don’t want to eat it.

The WHO has already declared that five of the major chemical herbicides

used to grow GMO crops are either likely or definitely cancerous, yet

the USA still makes secret trade deals that would allow biotech to push

their genetically modified ‘food’ on Americans who don’t want to eat it.

Our right to know if we are even eating GMO crops is being taken away via legislation known as the Deny Americans the Right to Know Act (DARK) act. (This is officially known as the ‘Safe and Accurate Food Labeling Act.)

More than 60 countries have already passed mandatory GMO labeling laws, and many will ban GMO crops altogether this year if they haven’t already. You can see a great map of these GM labeling bans here.

Read More @ NaturalSociety.com

The WHO has already declared that five of the major chemical herbicides

used to grow GMO crops are either likely or definitely cancerous, yet

the USA still makes secret trade deals that would allow biotech to push

their genetically modified ‘food’ on Americans who don’t want to eat it.

The WHO has already declared that five of the major chemical herbicides

used to grow GMO crops are either likely or definitely cancerous, yet

the USA still makes secret trade deals that would allow biotech to push

their genetically modified ‘food’ on Americans who don’t want to eat it.Our right to know if we are even eating GMO crops is being taken away via legislation known as the Deny Americans the Right to Know Act (DARK) act. (This is officially known as the ‘Safe and Accurate Food Labeling Act.)

More than 60 countries have already passed mandatory GMO labeling laws, and many will ban GMO crops altogether this year if they haven’t already. You can see a great map of these GM labeling bans here.

Read More @ NaturalSociety.com

by Dave Kranzler, Investment Research Dynamics:

I guess the new policy regarding the presentation of economic data

that has been implemented by the Obama Government is, “if you don’t the

results the first time around, make shit up to make it look better the

second time.” After all the media will zero in on the newly fabricated

statistics and that will become the Orwellian Truth. Besides, the

public doesn’t care.”

I guess the new policy regarding the presentation of economic data

that has been implemented by the Obama Government is, “if you don’t the

results the first time around, make shit up to make it look better the

second time.” After all the media will zero in on the newly fabricated

statistics and that will become the Orwellian Truth. Besides, the

public doesn’t care.”

Immediately after the release of the headline GDP report, Reuters released a news report headlined: “U.S. believes no structural issues in GDP data construction” – LINK. It’s like symphonic orchestration. Release a fraudulent economic report and follow it right up with a news report from Reuters which affirms the “validity” of the report, using Government statisticians as the source of information. And Americans accuse the Chinese and Russians of issuing propaganda based on fraud?

Read More @ InvestmentResearchDynamics.com

I guess the new policy regarding the presentation of economic data

that has been implemented by the Obama Government is, “if you don’t the

results the first time around, make shit up to make it look better the

second time.” After all the media will zero in on the newly fabricated

statistics and that will become the Orwellian Truth. Besides, the

public doesn’t care.”

I guess the new policy regarding the presentation of economic data

that has been implemented by the Obama Government is, “if you don’t the

results the first time around, make shit up to make it look better the

second time.” After all the media will zero in on the newly fabricated

statistics and that will become the Orwellian Truth. Besides, the

public doesn’t care.”Immediately after the release of the headline GDP report, Reuters released a news report headlined: “U.S. believes no structural issues in GDP data construction” – LINK. It’s like symphonic orchestration. Release a fraudulent economic report and follow it right up with a news report from Reuters which affirms the “validity” of the report, using Government statisticians as the source of information. And Americans accuse the Chinese and Russians of issuing propaganda based on fraud?

Read More @ InvestmentResearchDynamics.com

by Alasdair Macleod, GoldMoney:

Anyone with a nose for markets will tell you that the Chinese

government’s attempt to rescue the country’s stock markets from collapse

is far from succeeding.

Anyone with a nose for markets will tell you that the Chinese

government’s attempt to rescue the country’s stock markets from collapse

is far from succeeding.

Bubbles collapse, period; and government interventions don’t stop them. Furthermore, we are beginning to see a crack widen in the foundations of China’s capital markets that could end up undermining the whole economy.

Since the government owns the banking system, some of the knock-on effects will doubtless be concealed. A consequence for China is that domestic financial instability could threaten her current plans for the international development of her currency. Here the timing couldn’t be worse, because in a few months the IMF is due to announce its decision about the inclusion of the renminbi in the SDR*. The odds were in favour of China succeeding in this quest, on the basis that China was deemed to have fulfilled the necessary conditions, and the IMF itself has been supportive.

Read More @ GoldMoney.com

Anyone with a nose for markets will tell you that the Chinese

government’s attempt to rescue the country’s stock markets from collapse

is far from succeeding.

Anyone with a nose for markets will tell you that the Chinese

government’s attempt to rescue the country’s stock markets from collapse

is far from succeeding.Bubbles collapse, period; and government interventions don’t stop them. Furthermore, we are beginning to see a crack widen in the foundations of China’s capital markets that could end up undermining the whole economy.

Since the government owns the banking system, some of the knock-on effects will doubtless be concealed. A consequence for China is that domestic financial instability could threaten her current plans for the international development of her currency. Here the timing couldn’t be worse, because in a few months the IMF is due to announce its decision about the inclusion of the renminbi in the SDR*. The odds were in favour of China succeeding in this quest, on the basis that China was deemed to have fulfilled the necessary conditions, and the IMF itself has been supportive.

Read More @ GoldMoney.com

from Gold Silver Worlds:

In the world of basic commodities nearly every market participant,

whether a producer or consumer, is a price taker, accepting the general

price level prevailing at the time. For example, the individual consumer

of gasoline has little choice but to take the price at the pump or go

elsewhere. Same with corporate consumers like airlines and other

transportation entities. They can hedge and fix their costs, but that

hedging must be based upon current prevailing prices. Even large

producers like the oil companies must take what prices the market

provides, although the largest oil producers, like Saudi Arabia, could

set (make) oil prices if it wanted to (at least temporarily).

In the world of basic commodities nearly every market participant,

whether a producer or consumer, is a price taker, accepting the general

price level prevailing at the time. For example, the individual consumer

of gasoline has little choice but to take the price at the pump or go

elsewhere. Same with corporate consumers like airlines and other

transportation entities. They can hedge and fix their costs, but that

hedging must be based upon current prevailing prices. Even large

producers like the oil companies must take what prices the market

provides, although the largest oil producers, like Saudi Arabia, could

set (make) oil prices if it wanted to (at least temporarily).

That’s the way it is and should be with world commodities – 99.9% of all consumers and producers are price takers, that is, accepting whatever the prevailing price happens to be.

Read More @ GoldSilverWorlds.com

In the world of basic commodities nearly every market participant,

whether a producer or consumer, is a price taker, accepting the general

price level prevailing at the time. For example, the individual consumer

of gasoline has little choice but to take the price at the pump or go

elsewhere. Same with corporate consumers like airlines and other

transportation entities. They can hedge and fix their costs, but that

hedging must be based upon current prevailing prices. Even large

producers like the oil companies must take what prices the market

provides, although the largest oil producers, like Saudi Arabia, could

set (make) oil prices if it wanted to (at least temporarily).

In the world of basic commodities nearly every market participant,

whether a producer or consumer, is a price taker, accepting the general

price level prevailing at the time. For example, the individual consumer

of gasoline has little choice but to take the price at the pump or go

elsewhere. Same with corporate consumers like airlines and other

transportation entities. They can hedge and fix their costs, but that

hedging must be based upon current prevailing prices. Even large

producers like the oil companies must take what prices the market

provides, although the largest oil producers, like Saudi Arabia, could

set (make) oil prices if it wanted to (at least temporarily).That’s the way it is and should be with world commodities – 99.9% of all consumers and producers are price takers, that is, accepting whatever the prevailing price happens to be.

Read More @ GoldSilverWorlds.com

from Bill Still:

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment