Submitted by Tyler Durden on 07/19/2015 - 15:15 "If this plan is implemented, the streets of Athens will sound the tracks of tanks"...

Chinese Stocks Drop Despite Officials Confirming "Stock Market Rout Stopped By Timely Measures"

Submitted by Tyler Durden on 07/19/2015 - 21:22 After two days of deleveraging and a squeeze into the expiration of CSI-300 Futures pushing Chinese stocks higher, the grandmas and farmers have decided now is an opportune moment to once again start adding margin debt. Who is to blame? Simple - Chinese officials have confirmed that "the stock market rout is over thanks to their timely measures." Futures opened modestly higher but are fading as the cash open looms...

Is Australia The Next Greece?

Submitted by Tyler Durden on 07/19/2015 - 21:45 Australian consumers are more worried about the medium term outlook than at the peak of the financial crisis, and rightfully so. As The Telegraph reports, by the end of the first quarter this year, Australia’s net foreign debt had climbed to a record $955bn, equal to an already unsustainable 60pc of gross domestic product, and is set to rise as RBA's bet that depreciation in the value of the country’s currency would help to offset the decline in its overbearing mining industry hasn’t happened to the extent they would have wished. Furthermore, as UBS explains, China's real GDP growth cycles have become an increasingly important driver of Australia's nominal GDP growth this last decade. With iron ore and coal prices plumbing new record lows, a Chinese (real) economy firing on perhaps 1 cyclinder, and equity investors reeling from China's collapse; perhaps the situation facing Australia is more like Greece than many want to admit, as Gina Rinehart, Australia’s richest woman and matriarch of Perth’s Hancock mining dynasty stunned her workers this week: accept a 10% pay cut or face redundancies.

How The Fed And Wall Street Are Eating Their Seed Corn

Submitted by Tyler Durden on 07/19/2015 - 20:10 What both Wall Street in general as well as the Federal Reserve has wrought is a market so adulterated, so anemic, and so mistrusted the euphemistic “money on the sidelines” has more in common with nursery rhymes than it does with anything reality based. There is no money on the sidelines. Nobody wants “in” to this market. Anyone with half a brain and a modicum of common sense wants out – and the outflow numbers show it still to be true.

Janet Yellen Was Half Right

Submitted by Tyler Durden on 07/19/2015 - 20:35 Just over a year ago, Janet Yellen did the unthinkable. In a moment of clarity, The Fed called out two darlings of the momentum-chasing euphoria-driven stock buying frenzy for 'special' treatment when Yellen uttered the Cramer-mind-blowing fact that "small cap social media and biotech stock valuations were substantially stretched." It appears, judging by today's market, that she was half right...

French President Calls For The Creation Of United States Of Europe

Submitted by Tyler Durden on 07/19/2015 - 19:35 French President Francois Hollande said that the 19 countries using the euro need their own government complete with a budget and parliament to cooperate better and overcome the Greek crisis. “Circumstances are leading us to accelerate,” Hollande said in an opinion piece published by the Journal du Dimanche on Sunday. “What threatens us is not too much Europe, but a lack of it.”... Countries in favor of more integration should move ahead, forming an “avant-garde,” Hollande said.

China Destroyed Its Stock Market In Order To Save It

Submitted by Tyler Durden on 07/19/2015 - 19:00 During the Vietnam War, surveying the shelled wreckage of Ben Tre, an American officer famously remarked, “It became necessary to destroy the town to save it.” His comment came to epitomize the sort of self-defeating “victory” that undoes what it aims to achieve. Last week, China destroyed its stock market in order to save it. Faced with a crash in share prices from a bubble of its own making, the Chinese government intervened ruthlessly, and recklessly, to turn those prices around. Its heavy-handed approach seemed to work, for the moment, but only by severely damaging far more important goals and ambitions.

Russia Unveils "Terminator T-1" Inspired Killer Robots

Submitted by Tyler Durden on 07/19/2015 - 18:15 Many had believed that Russia was years behind the envelope when it comes to putting advanced robotic technology on the battlefield. Until today, when a video showcased Russia's latest military equipment in Sevastopol, ranging from the "Bastion" air defense and anti-ship complexes missile system to sniper rifles and special ops naval guns, also showed none other than the Platform-M combat robot mingling among the population of this most important Crimean city.

Creator Of Internet Privacy Device Silenced: "Effective Immediately We Are Halting Further Development"

Submitted by Tyler Durden on 07/19/2015 - 17:30 Despite the literal hundreds of thousands of pages of information about government snooping and the Congressional “investigations” that followed, nothing has been done to curb the unabated violations of Americans’ Constitutional rights to be secure in their homes and personal effects. Thus, as always, the free market began developing its own solutions. Earlier this year an inventor by the name of Benjamin Caudill announced a device he dubbed the ProxyHam which was going to literally change everything about how those concerned with privacy could connect to the internet. However, just hours before Caudill was to reveal a fully-functioning ProxyHam at the DefCon hacking conference his presentation was abruptly cancelled - No reason was given and Caudill posted several cryptic Tweets that left many baffled; the device had been disappeared, the company was cancelling production on retail units, and the source code and blueprints would no longer be released to the public.

The Complete Guide To ETF Phantom Liquidity

Submitted by Tyler Durden on 07/19/2015 - 16:45 How the intersection of Fed policy, the post-crisis regulatory regime, and illiquid markets turned ETFs into the new financial weapons of mass destruction.

What's Scarce Geopolitically: Stability, Ways To Get Ahead, & Innovation

Submitted by Tyler Durden on 07/19/2015 - 16:00 Conserving what is failing is not a path to stability.

Inside Look At US Government Cyber Security

Submitted by Tyler Durden on 07/19/2015 - 14:45 Do you feel safe? Healthful food choices are becoming increasingly abundant in the United States – this can be exemplified by the fact that organics are booming like crazy. But

as many as 23.5 million people in this country don’t have access to

this overflow of nutrition because they live in “food deserts” –

areas of the country where there are no grocery stores but plenty of

mini-marts offering sugar-filled snacks and artery clogging prepared

foods. [1]

Healthful food choices are becoming increasingly abundant in the United States – this can be exemplified by the fact that organics are booming like crazy. But

as many as 23.5 million people in this country don’t have access to

this overflow of nutrition because they live in “food deserts” –

areas of the country where there are no grocery stores but plenty of

mini-marts offering sugar-filled snacks and artery clogging prepared

foods. [1]Low-income citizens also lack the funds to purchase healthful foods, as fast and processed foods are much cheaper than fresh produce, whole grain breads and pastas, and lean and organic meats. Not surprisingly, food deserts have been linked to obesity and other chronic diseases.

Read More @ NaturalSociety.com

from Henry Makow:

I was surprised to read that

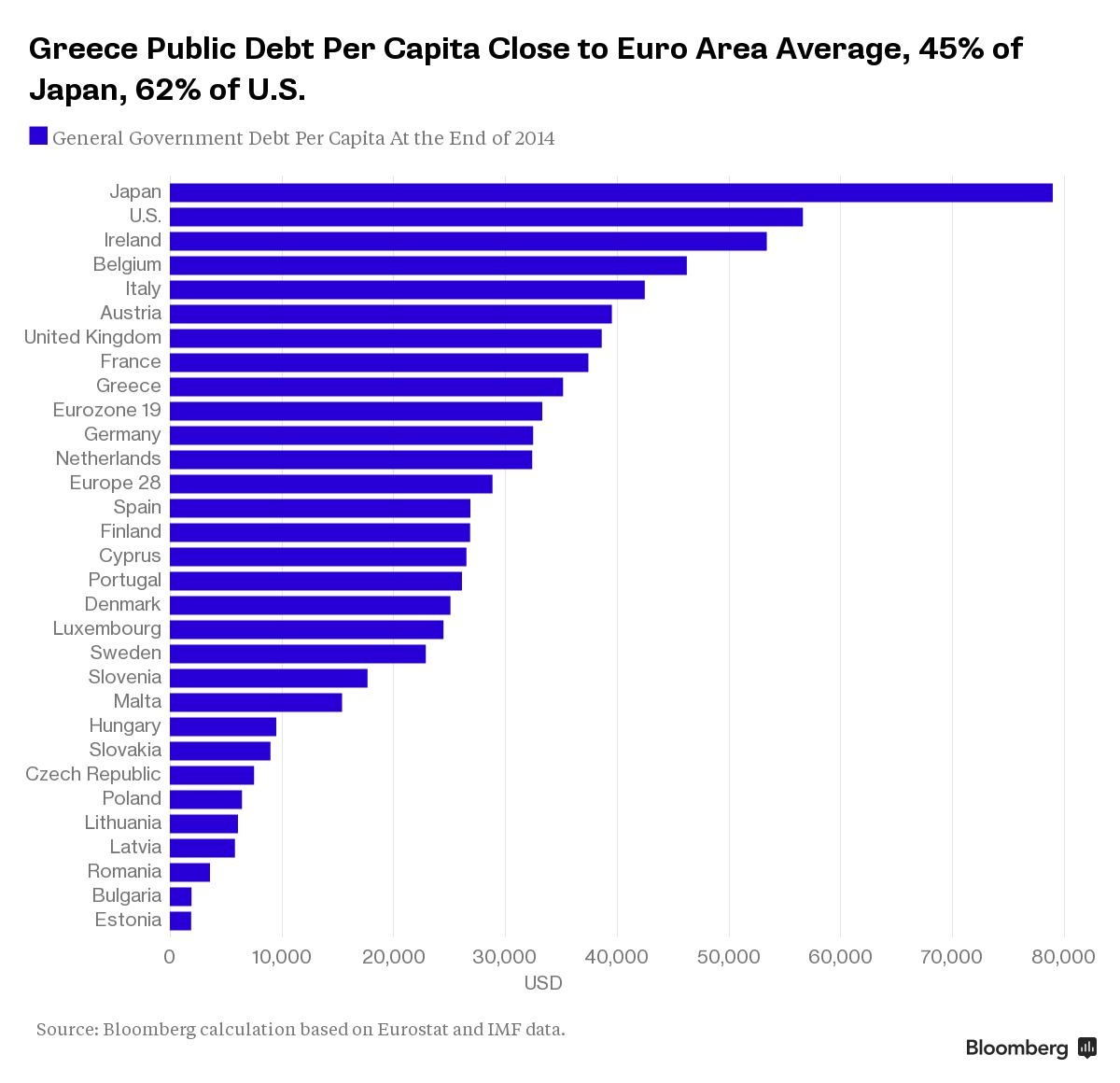

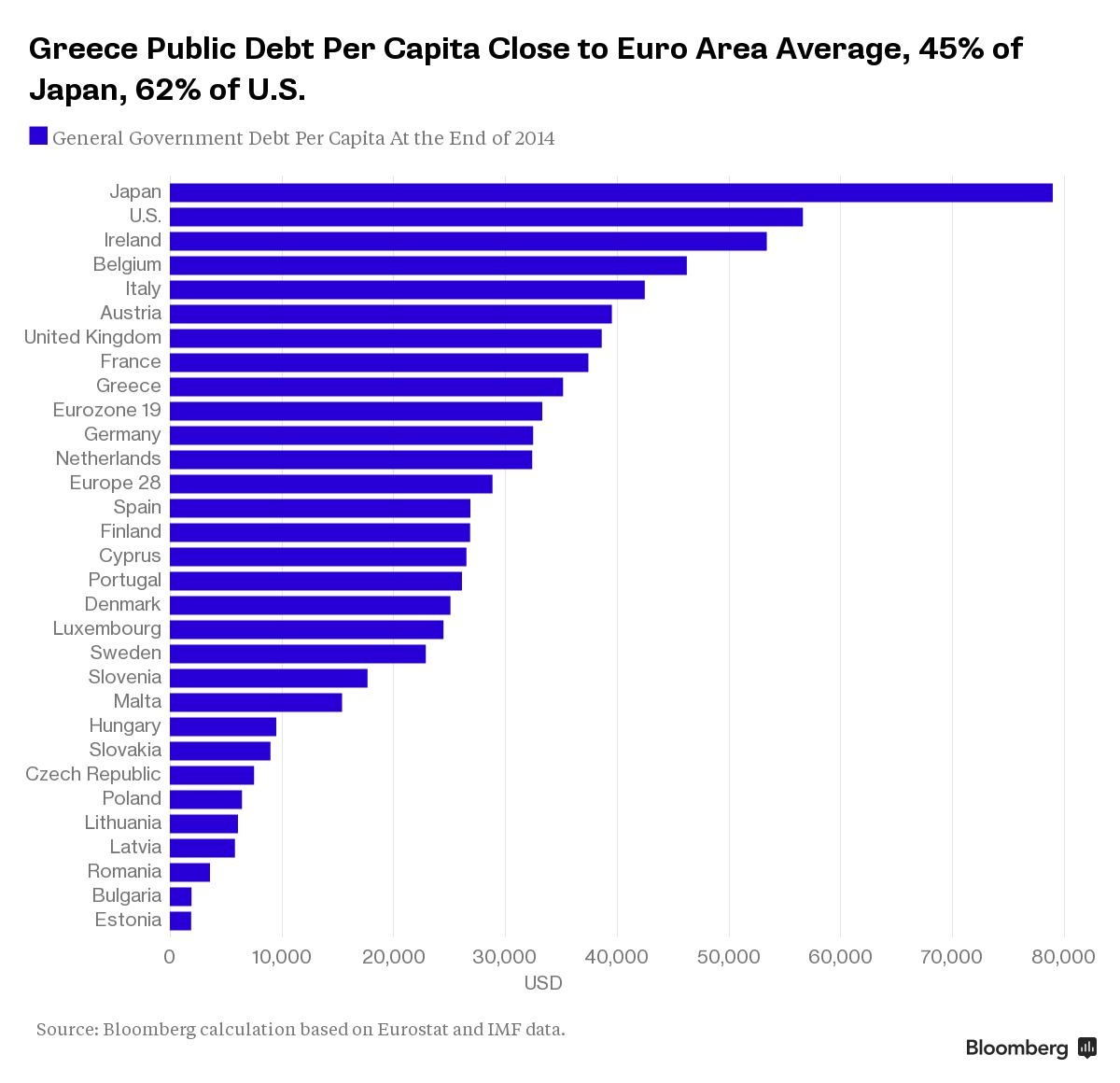

America’s per capita debt is 50% higher than Greece’s. Greeks owe about

$35,000 per person while Americans owe $57,000. In fact, as the chart

below indicates, the Greek per capita debt is close to the Eurozone

average, and almost the same as Germany at $34,000.

I was surprised to read that

America’s per capita debt is 50% higher than Greece’s. Greeks owe about

$35,000 per person while Americans owe $57,000. In fact, as the chart

below indicates, the Greek per capita debt is close to the Eurozone

average, and almost the same as Germany at $34,000.

The difference of course is their capacity to carry this debt. The Greek debt is 200% of the Gross Domestic Product. In 2013, United States public debt-to-GDP ratio was 71.8%, or 104.5% including external debt. The level of public debt was 76.9% of GDP in Germany, 22.4% in China, 66.7% in India, 86% in Canada, 87.2% in the UK, 92.2% in France, 94% in Spain, 124% in Ireland and 127.9% in Italy.

Obviously all nations are vulnerable to the Greek treatment if there were an economic crisis that affected the GDP.

Read More @ HenryMakow.com

I was surprised to read that

America’s per capita debt is 50% higher than Greece’s. Greeks owe about

$35,000 per person while Americans owe $57,000. In fact, as the chart

below indicates, the Greek per capita debt is close to the Eurozone

average, and almost the same as Germany at $34,000.

I was surprised to read that

America’s per capita debt is 50% higher than Greece’s. Greeks owe about

$35,000 per person while Americans owe $57,000. In fact, as the chart

below indicates, the Greek per capita debt is close to the Eurozone

average, and almost the same as Germany at $34,000.The difference of course is their capacity to carry this debt. The Greek debt is 200% of the Gross Domestic Product. In 2013, United States public debt-to-GDP ratio was 71.8%, or 104.5% including external debt. The level of public debt was 76.9% of GDP in Germany, 22.4% in China, 66.7% in India, 86% in Canada, 87.2% in the UK, 92.2% in France, 94% in Spain, 124% in Ireland and 127.9% in Italy.

Obviously all nations are vulnerable to the Greek treatment if there were an economic crisis that affected the GDP.

Read More @ HenryMakow.com

China

has obviously been adding to its gold at a furious pace. By my own

calculations; China could have acquired total reserves of at least 4,000

tonnes

by Jeff Nielson, Bullion Bulls:

China’s increased gold reserves are “clue” on GDP:

There was a long-awaited (but rather token) announcement this week by

China’s government, reporting an increase in its official gold reserves

by 57%. Some commentators still try to imply that China is being

sly or even dishonest by not reporting ALL of its gold-holdings

(official and unofficial). This clearly indicates they still don’t understand the rules with respect to reporting gold reserves.

China’s increased gold reserves are “clue” on GDP:

There was a long-awaited (but rather token) announcement this week by

China’s government, reporting an increase in its official gold reserves

by 57%. Some commentators still try to imply that China is being

sly or even dishonest by not reporting ALL of its gold-holdings

(official and unofficial). This clearly indicates they still don’t understand the rules with respect to reporting gold reserves.

As regular readers here know; gold is bound by the rules of MONEY. International law requires nations to disclose their gold reserves EXACTLY the same way as it requires them to report their currency reserves. This is because despite the lies/rhetoric of the bankers; they have ALWAYS considered gold as “money” — and international banking regulations have always reflected this fact.

The rule itself is very simple. If a government adds to (or subtracts from) its currency reserves (gold or paper) via INTERNATIONAL TRANSACTIONS, then it is always obligated to report those transactions in a timely manner. This is because one of the purposes of these financial laws is to track money (gold or paper) as it moves out of one economy and into another. Conversely, whenever a nation adds to its currency reserves (gold or paper) through domestic transactions; it is NEVER required to report such transactions — ever. This reflects the fact that no money/currency is changing jurisdictions.

Read More @ BullionBullsCanada.com

by Jeff Nielson, Bullion Bulls:

China’s increased gold reserves are “clue” on GDP:

There was a long-awaited (but rather token) announcement this week by

China’s government, reporting an increase in its official gold reserves

by 57%. Some commentators still try to imply that China is being

sly or even dishonest by not reporting ALL of its gold-holdings

(official and unofficial). This clearly indicates they still don’t understand the rules with respect to reporting gold reserves.

China’s increased gold reserves are “clue” on GDP:

There was a long-awaited (but rather token) announcement this week by

China’s government, reporting an increase in its official gold reserves

by 57%. Some commentators still try to imply that China is being

sly or even dishonest by not reporting ALL of its gold-holdings

(official and unofficial). This clearly indicates they still don’t understand the rules with respect to reporting gold reserves.As regular readers here know; gold is bound by the rules of MONEY. International law requires nations to disclose their gold reserves EXACTLY the same way as it requires them to report their currency reserves. This is because despite the lies/rhetoric of the bankers; they have ALWAYS considered gold as “money” — and international banking regulations have always reflected this fact.

The rule itself is very simple. If a government adds to (or subtracts from) its currency reserves (gold or paper) via INTERNATIONAL TRANSACTIONS, then it is always obligated to report those transactions in a timely manner. This is because one of the purposes of these financial laws is to track money (gold or paper) as it moves out of one economy and into another. Conversely, whenever a nation adds to its currency reserves (gold or paper) through domestic transactions; it is NEVER required to report such transactions — ever. This reflects the fact that no money/currency is changing jurisdictions.

Read More @ BullionBullsCanada.com

by Chris Powell, GATA:

Dear Friend of GATA and Gold:

Our friend R.B. writes:

“Once China or any country comes out with an official statement saying it has X tonnes of gold when it really as a lot more (as China certainly does), how does it turn around later and say it has (and had, in fact, at the time of the previous statement) much more?

“Also, the recent acknowledgment by the Tocqueville Gold Fund manager, John Hathaway, of gold price suppression by central banks raises the question of why he didn’t ‘come out’ a long time ago. If people in the gold business had come out earlier about gold price suppression in appreciable numbers, maybe gold’s position would be quite different today. It seems fair to exclaim: ‘Only now are you aboard.'”

Read More @ Gata.com

Dear Friend of GATA and Gold:

Our friend R.B. writes:

“Once China or any country comes out with an official statement saying it has X tonnes of gold when it really as a lot more (as China certainly does), how does it turn around later and say it has (and had, in fact, at the time of the previous statement) much more?

“Also, the recent acknowledgment by the Tocqueville Gold Fund manager, John Hathaway, of gold price suppression by central banks raises the question of why he didn’t ‘come out’ a long time ago. If people in the gold business had come out earlier about gold price suppression in appreciable numbers, maybe gold’s position would be quite different today. It seems fair to exclaim: ‘Only now are you aboard.'”

Read More @ Gata.com

from The Burning Platform:

The government released their monthly CPI report this week. Even though

it came in at an annualized rate of 3.6%, they and their mouthpieces in

the corporate mainstream media dutifully downplayed the uptrend. They

can’t let the plebs know the truth. That might upend their economic

recovery storyline and put a crimp into their artificial free money,

zero interest rate, stock market rally. If they were to admit inflation

is rising, the Fed would be forced to raise rates. That is unacceptable

in our rigged .01% economy. There are banker bonuses, CEO stock options,

corporate stock buyback earnings per share goals and captured

politician elections at stake.

The government released their monthly CPI report this week. Even though

it came in at an annualized rate of 3.6%, they and their mouthpieces in

the corporate mainstream media dutifully downplayed the uptrend. They

can’t let the plebs know the truth. That might upend their economic

recovery storyline and put a crimp into their artificial free money,

zero interest rate, stock market rally. If they were to admit inflation

is rising, the Fed would be forced to raise rates. That is unacceptable

in our rigged .01% economy. There are banker bonuses, CEO stock options,

corporate stock buyback earnings per share goals and captured

politician elections at stake.

The corporate MSM immediately shifted the focus to the annual CPI figure of 0.1%. That’s right. Your government keepers expect you to believe the prices you pay to live your everyday life have been essentially flat in the last year. Anyone who lives in the real world, not the BLS Bizarro world of models, seasonal adjustments, hedonic adjustments, and substitution adjustments, knows this is a lie. The original concept of CPI was to measure the true cost of maintaining a constant standard of living. It should reflect your true inflation of out of pocket costs to live a daily existence in this country.

Read More @ TheBurningPlatform.com

The government released their monthly CPI report this week. Even though

it came in at an annualized rate of 3.6%, they and their mouthpieces in

the corporate mainstream media dutifully downplayed the uptrend. They

can’t let the plebs know the truth. That might upend their economic

recovery storyline and put a crimp into their artificial free money,

zero interest rate, stock market rally. If they were to admit inflation

is rising, the Fed would be forced to raise rates. That is unacceptable

in our rigged .01% economy. There are banker bonuses, CEO stock options,

corporate stock buyback earnings per share goals and captured

politician elections at stake.

The government released their monthly CPI report this week. Even though

it came in at an annualized rate of 3.6%, they and their mouthpieces in

the corporate mainstream media dutifully downplayed the uptrend. They

can’t let the plebs know the truth. That might upend their economic

recovery storyline and put a crimp into their artificial free money,

zero interest rate, stock market rally. If they were to admit inflation

is rising, the Fed would be forced to raise rates. That is unacceptable

in our rigged .01% economy. There are banker bonuses, CEO stock options,

corporate stock buyback earnings per share goals and captured

politician elections at stake.The corporate MSM immediately shifted the focus to the annual CPI figure of 0.1%. That’s right. Your government keepers expect you to believe the prices you pay to live your everyday life have been essentially flat in the last year. Anyone who lives in the real world, not the BLS Bizarro world of models, seasonal adjustments, hedonic adjustments, and substitution adjustments, knows this is a lie. The original concept of CPI was to measure the true cost of maintaining a constant standard of living. It should reflect your true inflation of out of pocket costs to live a daily existence in this country.

Read More @ TheBurningPlatform.com

by Phyllis, Natural News:

There many disease that we can cure them naturally and we don’t need any drugs and pills.

There many disease that we can cure them naturally and we don’t need any drugs and pills.

As we know medical model which relies on pharmaceutical intervention for every known illness, there are well over one hundred common diseases that can be reversed naturally. In particular, research indicates that arthritis , type 2 diabetes, hypertension and cancer can all be treated with proper herbal strategies, nutrition and exercise.

6 Diseases Few Are Aware Can Be Reversed Naturally Without Drugs

Heart Disease

Making significant dietary and lifestyle changes allow many people who suffer with coronary heart disease, high cholesterol, obesity and/or high blood pressure to reduce or even eliminate their dependence on medications and avoid invasive surgical procedures.

Read More @ NaturalNews.com

There many disease that we can cure them naturally and we don’t need any drugs and pills.

There many disease that we can cure them naturally and we don’t need any drugs and pills.As we know medical model which relies on pharmaceutical intervention for every known illness, there are well over one hundred common diseases that can be reversed naturally. In particular, research indicates that arthritis , type 2 diabetes, hypertension and cancer can all be treated with proper herbal strategies, nutrition and exercise.

6 Diseases Few Are Aware Can Be Reversed Naturally Without Drugs

Heart Disease

Making significant dietary and lifestyle changes allow many people who suffer with coronary heart disease, high cholesterol, obesity and/or high blood pressure to reduce or even eliminate their dependence on medications and avoid invasive surgical procedures.

Read More @ NaturalNews.com

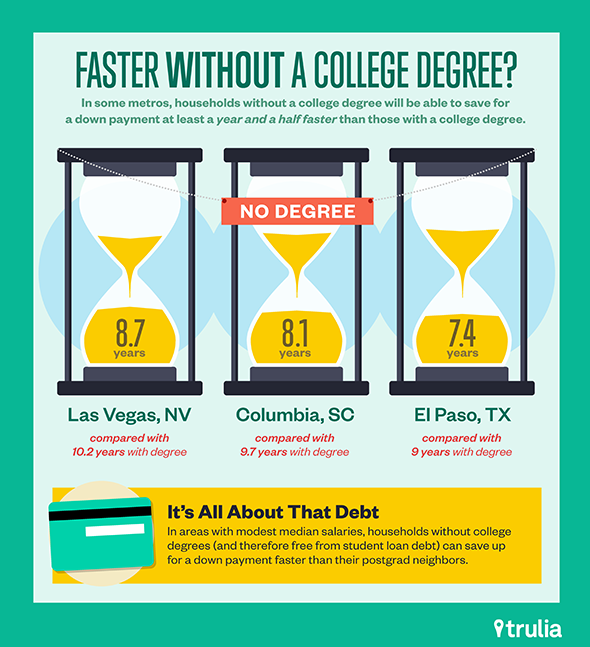

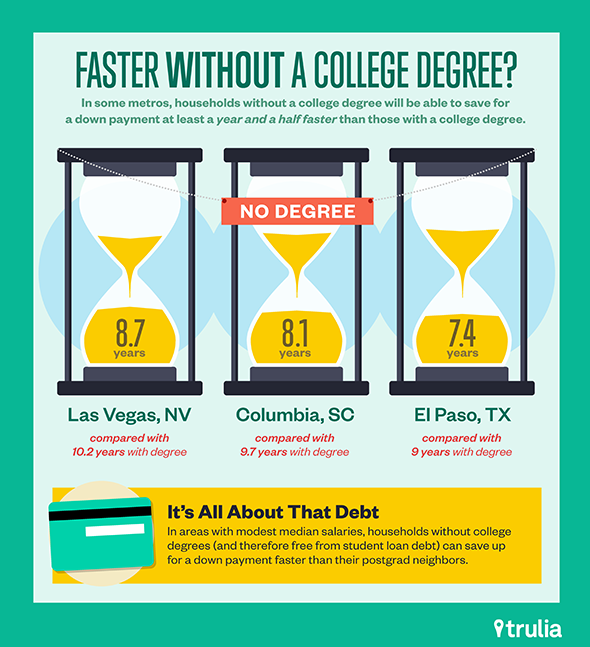

The vast majority of other Millennials are mired in debt and unable to purchase homes.

from MyBudget360.com:

Most young Americans are still living in an economy that feels like it is in a recession. Yet there are Millennials that are doing well and are thriving in this economy. How are they escaping mountains of student debt? How are they gaining access to down payments to purchase more expensive homes? The short answer is that they have rich parents. This isn’t some Trumpism. This is merely facts that are coming out of research from the Fed, Census, and Zillow. For the vast majority of young Americans the last decade has been one of low wage labor and a market mired with very expensive colleges. Despite the disappearing middle class many of those Millennials that are thriving are doing so thanks to familial wealth transfers. We tend to romanticize the “self-made” person in the United States but it is increasingly becoming more difficult. More wealth is accumulated in fewer hands and it is staying there.

Read More @ MyBudget360.com

from MyBudget360.com:

Most young Americans are still living in an economy that feels like it is in a recession. Yet there are Millennials that are doing well and are thriving in this economy. How are they escaping mountains of student debt? How are they gaining access to down payments to purchase more expensive homes? The short answer is that they have rich parents. This isn’t some Trumpism. This is merely facts that are coming out of research from the Fed, Census, and Zillow. For the vast majority of young Americans the last decade has been one of low wage labor and a market mired with very expensive colleges. Despite the disappearing middle class many of those Millennials that are thriving are doing so thanks to familial wealth transfers. We tend to romanticize the “self-made” person in the United States but it is increasingly becoming more difficult. More wealth is accumulated in fewer hands and it is staying there.

Read More @ MyBudget360.com

WeAreChange:

In this video Luke Rudkowski gives you a behind the scenes look at life in Tokyo, he shows you the best and worst parts of this very unique society. From suicide rates to robot wars with chicks, we go through it all.

In this video Luke Rudkowski gives you a behind the scenes look at life in Tokyo, he shows you the best and worst parts of this very unique society. From suicide rates to robot wars with chicks, we go through it all.

from Paul Craig Roberts:

Obama is being praised as a man of peace for the nuclear agreement with

Iran. Some are asking if Obama will take the next step and repair

US-Russian relations and bring the Ukrainian imbroglio to an end?

Obama is being praised as a man of peace for the nuclear agreement with

Iran. Some are asking if Obama will take the next step and repair

US-Russian relations and bring the Ukrainian imbroglio to an end?

If so he hasn’t told Assistant Secretary of State Victoria Nuland or his nominee as Vice Chairman of the Joint Chiefs of Staff, Air Force General Paul Selva, or his nominee as Chairman of the Joint Chiefs of Staff, Marine General Joseph Dunford, or his Secretary of the Air Force, Deborah Lee James.

The other day on Ukrainian TV Victoria Nuland declared that if Russia does not “fulfill its obligations,” by which she means to turn all of Ukraine over to Washington including Crimea, a historical Russian province, “we’re prepared to put more pressure on Russia.” During the past week both of Obama’s nominees to the top military positions told the US Senate that Russia was the main threat to the US, an “existential threat” even. With this level of war rhetoric in play, clearly Obama has no interest in reducing the tensions that Washington has created with Russia.

Read More @ PaulCraigRoberts.org

Obama is being praised as a man of peace for the nuclear agreement with

Iran. Some are asking if Obama will take the next step and repair

US-Russian relations and bring the Ukrainian imbroglio to an end?

Obama is being praised as a man of peace for the nuclear agreement with

Iran. Some are asking if Obama will take the next step and repair

US-Russian relations and bring the Ukrainian imbroglio to an end?If so he hasn’t told Assistant Secretary of State Victoria Nuland or his nominee as Vice Chairman of the Joint Chiefs of Staff, Air Force General Paul Selva, or his nominee as Chairman of the Joint Chiefs of Staff, Marine General Joseph Dunford, or his Secretary of the Air Force, Deborah Lee James.

The other day on Ukrainian TV Victoria Nuland declared that if Russia does not “fulfill its obligations,” by which she means to turn all of Ukraine over to Washington including Crimea, a historical Russian province, “we’re prepared to put more pressure on Russia.” During the past week both of Obama’s nominees to the top military positions told the US Senate that Russia was the main threat to the US, an “existential threat” even. With this level of war rhetoric in play, clearly Obama has no interest in reducing the tensions that Washington has created with Russia.

Read More @ PaulCraigRoberts.org

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment