Submitted by Tyler Durden on 07/03/2015 - 15:56 "Greek banks are preparing contingency plans for a possible “bail-in” of depositors amid fears. The plans, which call for a “haircut” of at least 30 per cent on deposits above €8,000, sketch out an increasingly likely scenario for at least one bank, the sources said."

Gold Bullion Dealer Unexpectedly "Suspends Operations" Due To "Significant Transactional Delays"

Submitted by Tyler Durden on 07/03/2015 - 17:40

Massive "No" Demonstration Floods Athens' Syntagma Square As Tsipras Speaks - Live Webcast

Submitted by Tyler Durden on 07/03/2015 - 14:25 Athens floods to Syntagma square to demonstrate their support for a "No" vote in what may be one of the biggest demonstrations in history.Greece Has Spent A Half-Century In Default Or Restructuring

Liar of the United States...

Barack Obama Tells Another Whopper - He Did Not Create 12.8 Million Jobs

Submitted by Tyler Durden on 07/03/2015 - 15:50 America is better off when President Obama is out on the stump bloviating and boasting rather than in Washington actively doing harm. But the whoppers he just told the students at the University of Wisconsin are beyond the pale. Said our spinmeister-in-chief: "And the unemployment rate is now down to 5.3 percent. (Applause.) Keep in mind, when I came into office it was hovering around 10 percent. All told, we’ve now seen 64 straight months of private sector job growth, which is a new record — (applause) — new record — 12.8 million new jobs all told." That’s a pack of context-free factoids. It has already begun. The total mismanagement of Euroland and the utter

failure to understand what the German Hyperinflation was all about, has

led to this misconception that austerity is good and inflation is bad.

Imposing austerity creates deflation and the Troika is just complete

wrong. The fallout from Cyprus was nothing. Now the Troika is punishing

Greece and destroying that economy crushing it into the dust. Many other

countries are now starting to experience discontent from the voting

population. In Austria, 261,159 people signed a petition to exit the

Euro/EU.

It has already begun. The total mismanagement of Euroland and the utter

failure to understand what the German Hyperinflation was all about, has

led to this misconception that austerity is good and inflation is bad.

Imposing austerity creates deflation and the Troika is just complete

wrong. The fallout from Cyprus was nothing. Now the Troika is punishing

Greece and destroying that economy crushing it into the dust. Many other

countries are now starting to experience discontent from the voting

population. In Austria, 261,159 people signed a petition to exit the

Euro/EU.Read More @ ArmstrongEconomics.org

Egypt Is On The Edge Of Full Blown Civil War

Submitted by Tyler Durden on 07/03/2015 - 17:00 In the last few days there were dozens of separate attacks in Egypt from the Sinai up to Cairo. More than 60 people died while the Egyptian army used F16 attack plains to protect itself against it disgruntled population. It is clear that the Egyptian rulers will not be able to contain the current situation, today could be marked as the start of Egypt’s civil war.

Greeks Split On Greferendum As Credit Suisse Says "No" Vote Defies "Rationality"

Submitted by Tyler Durden on 07/03/2015 - 14:15 "Introducing a new currency is a pipe dream and the likely result is a broken financial system reliant on a neighbor’s currency (the euro) and banking system. The choice is not 'do you accept the core’s terms your government has rejected?' Rather, it is 'do you want Greek banks to function independently?' and, de facto, do you want to be able to use the cash machine tomorrow?"

What It All Comes Down To On Sunday

Submitted by Tyler Durden on 07/03/2015 - 10:55 "Do you think Europe should forgive your debt, check box 'Yes' or 'No'." "No" means a lot of pain now and recovery later. "Yes" means less pain now but no hope of recovery ever. Choose wisely...

Fearing Spillover, ECB Moves To Shield Neighboring Banks From Greek Meltdown

Submitted by Tyler Durden on 07/03/2015 - 15:15 The ECB is moving to backstop Bulgaria's banking sector in an effort to get ahead of a Greek contagion."The ECB would provide access to its refinancing operations, offering euros to the banking system against eligible collateral," Bloomberg reports, citing unnamed sources. Monsanto spun off its chemical business to a company called Solutia,

but that may not provide protection in a recent lawsuit. Monsanto, along

with Pfizer and Pharmacia, will have to defend themselves in

court for allegations made by plaintiffs that the corporations’

manufacture of PCBs, or polychlorinated biphenyls, caused

lymphohematopoietic cancer.

Monsanto spun off its chemical business to a company called Solutia,

but that may not provide protection in a recent lawsuit. Monsanto, along

with Pfizer and Pharmacia, will have to defend themselves in

court for allegations made by plaintiffs that the corporations’

manufacture of PCBs, or polychlorinated biphenyls, caused

lymphohematopoietic cancer.The lawsuit was filed in a St. Louis County Circuit Court, and Monsanto is a lead defendant. One of the most hated companies in the world for good reason, Monsanto manufactured PCBs from the 1920’s until 1977, when they were finally limited by government agencies and Congress. Today, PCBs have been in almost everything Americans are exposed to, from food packaging to paint.

Read More @ NaturalSociety.com

![clip_image002[5] clip_image002[5]](http://www.jsmineset.com/wp-content/uploads/2015/07/clip_image0025_thumb.gif)

Bill Holter Warns- Greece is Going to Happen HERE in the US!

1. Greek problem is not $3 billion, its $3 TRILLION IN DERIVATIVES- Will ISDA Allow Default?

2. Greek default WAS NOT PRICED IN- Why a MASSIVE LIQUIDITY EVENT has been triggered!

3. End Game for Greek Depositors- Are the Depositor Haircuts and Bail-ins Imminent?

4. Bill Warns: Greece Is Going to Happen Here- The Credit System is Going to Collapse!

5. Gold Will Get Your Wealth into the Next System After a Reset Occurs

6. JPM Corners the Commodities Derivatives Market Adding $3 TRILLION

7. COMEX Will Go Force Majeure Allowing JPM to Unwind Massive Short Position

1. Financial Institutions should not be allowed to cheat people through

confusing and complex products, or just plain lying about credit cards

and mortgages.

1. Financial Institutions should not be allowed to cheat people through

confusing and complex products, or just plain lying about credit cards

and mortgages.2. Financial Institutions should not be allowed to use taxpayers to pick up their risks through deposits or bailouts.

We know what needs to be done. Big financial institutions are flexing their political power to keep us from doing it, and to undermine what has already been attempted. Auto loans now look like the pre-crisis mortgage market because they were exempted by Congress from Consumer Financial Protection Bureau oversight. Department of Justice relies on deferred prosecutions and does not take repeat offending institutions to trial, and the SEC is even worse. They are abusing a system that was designed for low level non-violent offenders. It is time to end the slap on the wrist culture at DOJ and SEC. Fines should be equal, at a minimum, to every dime of profits gained, and there should be an independent judicial review of these deals.

Read More @ Jessescrossroadscafe.blogspot.ca

FDIC Sounds Alarm On Insolvent, "Zero Hedged" Oil & Gas Producers

Submitted by Tyler Durden on 07/03/2015 - 13:05 "U.S. regulators are sounding the alarm about banks’ exposure to oil-and-gas producers, a move that could limit their ability to lend to companies battered by a yearlong slump in prices," WSJ reports, reinforcing the notion that North America's "zero hedged" O&G sector is in for a rough ride.

US Pushed For IMF Greek Haircut Study Release After Euro 'Allies' Tried To Block

Submitted by Tyler Durden on 07/03/2015 - 14:40 The timing of the release of The IMF's 'Greece needs a debt haircut no matter what' report this week was odd to say the least. Being as it confirmed everything the Greek government has been saying and provided the perfect ammunition for Tsipras to spin Sunday's Greferendum as a Yes/No to debt haircuts - something everyone can understand (and get behind). It is understandable then that, as Reuters reports, Greece's eurozone allies tried to block the release of the damning report this week but the Europeans were heavily outnumbered and the United States, the strongest voice in the IMF, was in favor of publication, sources said. While The IMF concluded, "Facts are stubborn. You can't hide the facts because they may be exploited," one wonders if this move merely reinforces Goldman's concpiracy theory.

Do Share Buybacks Create Value? (Spoiler Alert: No)

Submitted by Tyler Durden on 07/03/2015 - 14:40 Stock buybacks have been in the news lately, as their growing size has lead to criticism, especially from politicians who believe they contribute to economic inequality. But the simplest critique of the practice of buybacks can be made on economic grounds, in terms of value created or destroyed.

What Choice Do We Have?

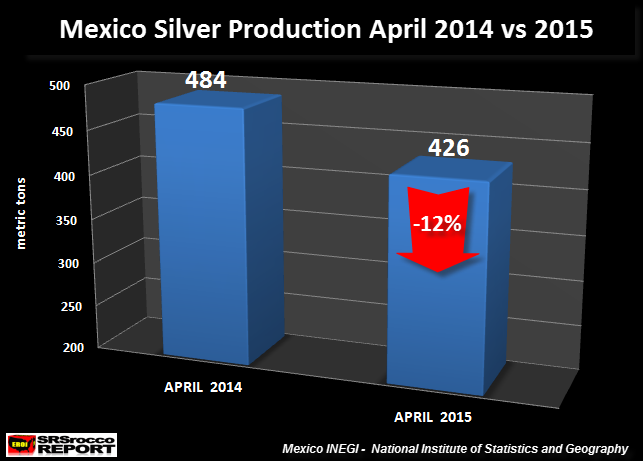

Submitted by Tyler Durden on 07/03/2015 - 13:40 The idea that our large-scale problems could be fixed with systemic reforms is enticing: replace the thousands of pages of tax code with a simple flat tax without deductions, for example, or the replacement of too big to jail/fail banks with community-owned banks that served the public, not shareholders. But the attraction of reforms is a siren song, because our system is run by vested interests for vested interests, period. Any real reform is Dead On Arrival (DOA) because any real reform threatens the swag and security of vested interests. The World’s largest silver producer saw its production decline

significantly in April. According to Mexico’s INEGI – National

Institute of Statistics and Geography, Mexico’s silver production

dropped a stunning 12% in April compared to the same month last year.

The World’s largest silver producer saw its production decline

significantly in April. According to Mexico’s INEGI – National

Institute of Statistics and Geography, Mexico’s silver production

dropped a stunning 12% in April compared to the same month last year.Looking at the chart below, we can see Mexico’s silver production declined 58 metric tons (mt), from 484 in April last year down to 426 metric tons in 2015:

That’s a large decline in just one month.

Mexico’s total silver production for the first four months of 2015 is

down 5% (92 mt) compared to last year. Here is the data:

Jan-Apr 2014 = 1,893 mt

Jan-Apr 2015 = 1,801 mt.

This is the actually data released by Mexico’s INEGI:

Read More @ SRSroccoreport.com

by Lauretta Brown, CNSnews:

Beginning in seventh grade, public school students in the Virginia

suburbs outside Washington, D.C., will be taught about “sexual

orientation terms,” including heterosexuality, homosexuality,

bisexuality – “and the gender identity term transgender,” according to a

newly adopted sex education curriculum. The Fairfax County School Board

voted last week to adopt the controversial new “Family Life Education Curriculum.”

Beginning in seventh grade, public school students in the Virginia

suburbs outside Washington, D.C., will be taught about “sexual

orientation terms,” including heterosexuality, homosexuality,

bisexuality – “and the gender identity term transgender,” according to a

newly adopted sex education curriculum. The Fairfax County School Board

voted last week to adopt the controversial new “Family Life Education Curriculum.”

The meeting was crowded with angry parents, many of whom spoke out against the sudden changes.

Andrea Lafferty, a Fairfax County parent and president of the Traditional Values Coalition, spoke at the board meeting, asking parents: “Do you want gender identity to be introduced to seventh grade?” Parents in the audience shouted, “No!”

Read More @ CNSnews.com

Beginning in seventh grade, public school students in the Virginia

suburbs outside Washington, D.C., will be taught about “sexual

orientation terms,” including heterosexuality, homosexuality,

bisexuality – “and the gender identity term transgender,” according to a

newly adopted sex education curriculum. The Fairfax County School Board

voted last week to adopt the controversial new “Family Life Education Curriculum.”

Beginning in seventh grade, public school students in the Virginia

suburbs outside Washington, D.C., will be taught about “sexual

orientation terms,” including heterosexuality, homosexuality,

bisexuality – “and the gender identity term transgender,” according to a

newly adopted sex education curriculum. The Fairfax County School Board

voted last week to adopt the controversial new “Family Life Education Curriculum.”The meeting was crowded with angry parents, many of whom spoke out against the sudden changes.

Andrea Lafferty, a Fairfax County parent and president of the Traditional Values Coalition, spoke at the board meeting, asking parents: “Do you want gender identity to be introduced to seventh grade?” Parents in the audience shouted, “No!”

Read More @ CNSnews.com

by Michael Snyder, Economic Collapse Blog:

The second largest stock market in the entire world is collapsing right

in front of our eyes. Since hitting a peak in June, the most important

Chinese stock market index has plummeted by well over 20 percent, and

more than 3 trillion dollars of “paper wealth” has been wiped out. Of

course the Shanghai Composite Index is still way above the level it was

sitting at exactly one year ago, but what is so disturbing about this

current crash is that it is so similar to what we witnessed just prior

to the great financial crisis of 2008 in the United States. From

October 2006 to October 2007, the Shanghai Composite Index more than

tripled in value. It was the greatest stock market surge in Chinese

history. But after hitting a peak, it began to fall dramatically. From

October 2007 to October 2008, the Shanghai Composite Index absolutely

crashed. In the end, more than two-thirds of all wealth in the market

was completely wiped out. You can see all of this on a chart that you

can find right here.

What makes this so important to U.S. investors is the fact that Chinese

stocks started crashing well before U.S. stocks started crashing during

the last financial crisis, and now it is happening again. Is this yet

another sign that a U.S. stock market crash is imminent?

The second largest stock market in the entire world is collapsing right

in front of our eyes. Since hitting a peak in June, the most important

Chinese stock market index has plummeted by well over 20 percent, and

more than 3 trillion dollars of “paper wealth” has been wiped out. Of

course the Shanghai Composite Index is still way above the level it was

sitting at exactly one year ago, but what is so disturbing about this

current crash is that it is so similar to what we witnessed just prior

to the great financial crisis of 2008 in the United States. From

October 2006 to October 2007, the Shanghai Composite Index more than

tripled in value. It was the greatest stock market surge in Chinese

history. But after hitting a peak, it began to fall dramatically. From

October 2007 to October 2008, the Shanghai Composite Index absolutely

crashed. In the end, more than two-thirds of all wealth in the market

was completely wiped out. You can see all of this on a chart that you

can find right here.

What makes this so important to U.S. investors is the fact that Chinese

stocks started crashing well before U.S. stocks started crashing during

the last financial crisis, and now it is happening again. Is this yet

another sign that a U.S. stock market crash is imminent?

Read More…

The second largest stock market in the entire world is collapsing right

in front of our eyes. Since hitting a peak in June, the most important

Chinese stock market index has plummeted by well over 20 percent, and

more than 3 trillion dollars of “paper wealth” has been wiped out. Of

course the Shanghai Composite Index is still way above the level it was

sitting at exactly one year ago, but what is so disturbing about this

current crash is that it is so similar to what we witnessed just prior

to the great financial crisis of 2008 in the United States. From

October 2006 to October 2007, the Shanghai Composite Index more than

tripled in value. It was the greatest stock market surge in Chinese

history. But after hitting a peak, it began to fall dramatically. From

October 2007 to October 2008, the Shanghai Composite Index absolutely

crashed. In the end, more than two-thirds of all wealth in the market

was completely wiped out. You can see all of this on a chart that you

can find right here.

What makes this so important to U.S. investors is the fact that Chinese

stocks started crashing well before U.S. stocks started crashing during

the last financial crisis, and now it is happening again. Is this yet

another sign that a U.S. stock market crash is imminent?

The second largest stock market in the entire world is collapsing right

in front of our eyes. Since hitting a peak in June, the most important

Chinese stock market index has plummeted by well over 20 percent, and

more than 3 trillion dollars of “paper wealth” has been wiped out. Of

course the Shanghai Composite Index is still way above the level it was

sitting at exactly one year ago, but what is so disturbing about this

current crash is that it is so similar to what we witnessed just prior

to the great financial crisis of 2008 in the United States. From

October 2006 to October 2007, the Shanghai Composite Index more than

tripled in value. It was the greatest stock market surge in Chinese

history. But after hitting a peak, it began to fall dramatically. From

October 2007 to October 2008, the Shanghai Composite Index absolutely

crashed. In the end, more than two-thirds of all wealth in the market

was completely wiped out. You can see all of this on a chart that you

can find right here.

What makes this so important to U.S. investors is the fact that Chinese

stocks started crashing well before U.S. stocks started crashing during

the last financial crisis, and now it is happening again. Is this yet

another sign that a U.S. stock market crash is imminent?Read More…

by Joshua Krause, Activist Post:

It’s been found that year after year, more Americans are leaving the

United States and renouncing their citizenship. It’s a trend that,

while small, has been seeing explosive growth. Just a few years ago

only a couple of hundred Americans took that course of action. But last

year, a record 3,415 Americans said goodbye to their citizenship.

It’s been found that year after year, more Americans are leaving the

United States and renouncing their citizenship. It’s a trend that,

while small, has been seeing explosive growth. Just a few years ago

only a couple of hundred Americans took that course of action. But last

year, a record 3,415 Americans said goodbye to their citizenship.

Of course, that number is just a drop in the bucket compared to the rest of the population. However, moving to a new country is often a tedious an expensive process. If it were easier, how many people do you think would be willing to leave this country? A new survey conducted by the peer-to-peer money transfer service known as TransferWise, asked that question to 2000 American residents and citizens. They found that 35% of them would consider leaving the good old US of A.

Read More @ ActivistPost.com

It’s been found that year after year, more Americans are leaving the

United States and renouncing their citizenship. It’s a trend that,

while small, has been seeing explosive growth. Just a few years ago

only a couple of hundred Americans took that course of action. But last

year, a record 3,415 Americans said goodbye to their citizenship.

It’s been found that year after year, more Americans are leaving the

United States and renouncing their citizenship. It’s a trend that,

while small, has been seeing explosive growth. Just a few years ago

only a couple of hundred Americans took that course of action. But last

year, a record 3,415 Americans said goodbye to their citizenship.Of course, that number is just a drop in the bucket compared to the rest of the population. However, moving to a new country is often a tedious an expensive process. If it were easier, how many people do you think would be willing to leave this country? A new survey conducted by the peer-to-peer money transfer service known as TransferWise, asked that question to 2000 American residents and citizens. They found that 35% of them would consider leaving the good old US of A.

Read More @ ActivistPost.com

Just because Walmart figured out a way to sell consumer products for

cheaper than your local mom and pop shop, effectively putting it out of

business, doesn’t mean that this multinational corporation is evil — or

so goes the claim by many a radical capitalist in defense of one of the

world’s most hated businesses. Too bad this isn’t actually the case,

though, as it has now come to light that part of Walmart’s takeover

strategy involves hiding its billions of dollars in profits in offshore

tax havens to avoid paying the exorbitant taxes otherwise incurred by

small businesses.

Just because Walmart figured out a way to sell consumer products for

cheaper than your local mom and pop shop, effectively putting it out of

business, doesn’t mean that this multinational corporation is evil — or

so goes the claim by many a radical capitalist in defense of one of the

world’s most hated businesses. Too bad this isn’t actually the case,

though, as it has now come to light that part of Walmart’s takeover

strategy involves hiding its billions of dollars in profits in offshore

tax havens to avoid paying the exorbitant taxes otherwise incurred by

small businesses.More than $76 billion worth of Walmart’s assets, according to a new report, are held overseas in trusts and other crafty financial instruments, shielding the company from its U.S. tax burden. A shocking 90% of Walmart’s overseas assets are currently being held in either Luxembourg or the Netherlands, the former of which doesn’t even have a single Walmart store within its borders.

Read More @ NaturalNews.com

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment