Submitted by Tyler Durden on 07/20/2015 - 14:15

Submitted by Tyler Durden on 07/20/2015 - 14:15

"While the hardcore of Podemos voters will read the outcome as an even stronger need to change the economic and political order in Europe, the more undecided voters will probably look twice at the Greek economy — held in stasis by bank holidays and capital controls — before risking voting for Podemos," Bloomberg says.

115 Years Of Context For The Current Equity Exuberance

Submitted by Tyler Durden on 07/20/2015 - 15:00

Value-Added-Tax-nado: Greeks Face Soaring Food & Tourism Costs

Submitted by Tyler Durden on 07/20/2015 - 11:07 More than 40,000 food items are being sold with a "poisonous" 10% Value Added Tax hike as of today, burdening the average Greek household with at least 55 euro extra costs per month.

More than 40,000 food items are being sold with a "poisonous" 10% Value Added Tax hike as of today, burdening the average Greek household with at least 55 euro extra costs per month.Greeks Get First Look At Their Future: Long Bank Lines And Punishing Taxes

Submitted by Tyler Durden on 07/20/2015 - 10:39

Greek "Hell" Remains After Athens Uses Creditor Money To Repay Creditors

Submitted by Tyler Durden on 07/20/2015 - 10:25 As we showed before when we showed the various Greek circle of debt hell, unless Greece finds a way to access the market once again following its "triumphal return" in mid-2014 when it issued bonds that cost investors (with other people's money) their 2015 bonus, it is only then that the Greek debt repayment hell begins.

Mexican Peso Plunges To 16/USD - Record Lows

Submitted by Tyler Durden on 07/20/2015 - 10:11 The Mexican Peso has devalued 23.5% in the last 12 months, breaking 16.00/USD for the first time in history today...

Last Night's Gold Slam So Furious It Halted The Market Not Once But Twice, And The Funniest "Explanation" Yet

Submitted by Tyler Durden on 07/20/2015 - 12:35 Yesterday, just before the Chinese market opened, precious metals but mostly gold, flash crashed in milliseconds with a violent urgency never before seen. We documented the unprecedented event last night, but for those who missed it, the following chart from Nanex clearly lays out just how sudden the "out of nowhere" selling was, which led to not one but two 20-second halts in the gold futures market spaced out precisely 30 seconds apart as a result of a Velocity Logic (or lack thereof) event.

from Gold Core:

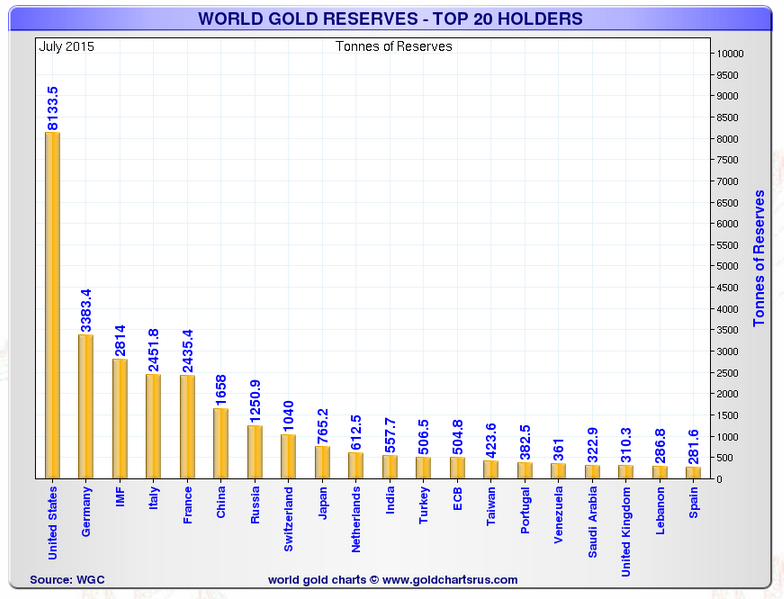

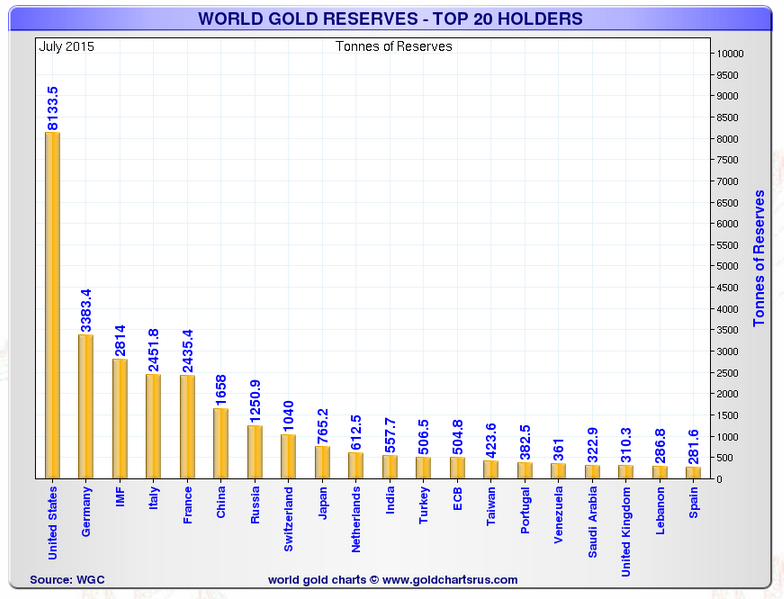

China officially revised its gold reserves upward for the first time

since 2009 on Friday. The People’s Bank of China (PBOC) stated on Friday

that it had added 604 tonnes of gold to its official reserves last

month.

China officially revised its gold reserves upward for the first time

since 2009 on Friday. The People’s Bank of China (PBOC) stated on Friday

that it had added 604 tonnes of gold to its official reserves last

month.

Gold is no longer used to back paper and digital money of today, however it remains an important part of monetary reserves internationally. This can be seen in the People’s Bank of China’s (PBOC) announcement of an increase in their gold reserves.

China’s official reserves are now almost 1660 tonnes of gold. Analysts, including Bloomberg and ourselves, had been expecting a sharp jump to at least 2,000 tonnes and possibly as high as 3,000 or 4,000 tonnes.

Read More @ GoldCore.com

China officially revised its gold reserves upward for the first time

since 2009 on Friday. The People’s Bank of China (PBOC) stated on Friday

that it had added 604 tonnes of gold to its official reserves last

month.

China officially revised its gold reserves upward for the first time

since 2009 on Friday. The People’s Bank of China (PBOC) stated on Friday

that it had added 604 tonnes of gold to its official reserves last

month.Gold is no longer used to back paper and digital money of today, however it remains an important part of monetary reserves internationally. This can be seen in the People’s Bank of China’s (PBOC) announcement of an increase in their gold reserves.

China’s official reserves are now almost 1660 tonnes of gold. Analysts, including Bloomberg and ourselves, had been expecting a sharp jump to at least 2,000 tonnes and possibly as high as 3,000 or 4,000 tonnes.

Read More @ GoldCore.com

Can U.S. Nuclear Plants Operate For 80 Years?

Submitted by Tyler Durden on 07/20/2015 - 14:40 The nuclear industry in the United States has been at a standstill for several decades. After an extraordinary wave of construction in the 1960s and 1970s, the nuclear industry ground to a halt. Operating nuclear reactors for 80 years may be feasible, but wear and tear cannot only raise safety questions, but constant maintenance can make them economically unviable. Cracks can form in plants as they age, forcing the plant offline. The cost of repairs have already forced some power plants offline for good. The San Onofre plant in California, for example, was shut down by Southern California Edison after the bill to repair leaks ballooned. Duke Energy closed a reactor at its Crystal River power plant in Florida as repair costs got out of hand. Such incidents could be more frequent in the years ahead. But if the industry gets its way, some plants could operate well beyond their current 60-year licenses.

from The Burning Platform:

Spent my entire Sunday moving big bales for the cattle this winter.

Spent all of last week putting a new steel roof on a 100′ long barn.

Gardened, read books, kept date night with my wife on Saturday night in

our kitchen, shelled enough peas to last through till next year, sold

some piglets, helped some local millennials with their new farm stand

venture, cleaned totes, scraped and repainted the front of the milk

house, cut hay with scythe for the chickens for winter, slaughtered and

processed 100 meat birds for the freezer, made coffee from the beans our

family sent from Hawaii, repaired a piece of equipment, york raked a

neighbor’s driveway, weeded, planted second crop of greens, slept. My

total work hours last week (if you include shelling peas on the bed

@10pm work) was just over 75. My body is stiff when I wake up, my arms

are sore most of the time I’m not moving but I can say the following-

Spent my entire Sunday moving big bales for the cattle this winter.

Spent all of last week putting a new steel roof on a 100′ long barn.

Gardened, read books, kept date night with my wife on Saturday night in

our kitchen, shelled enough peas to last through till next year, sold

some piglets, helped some local millennials with their new farm stand

venture, cleaned totes, scraped and repainted the front of the milk

house, cut hay with scythe for the chickens for winter, slaughtered and

processed 100 meat birds for the freezer, made coffee from the beans our

family sent from Hawaii, repaired a piece of equipment, york raked a

neighbor’s driveway, weeded, planted second crop of greens, slept. My

total work hours last week (if you include shelling peas on the bed

@10pm work) was just over 75. My body is stiff when I wake up, my arms

are sore most of the time I’m not moving but I can say the following-

Read More @ TheBurningPlatform.com

image/www.goodreads.com

Read More @ TheBurningPlatform.com

image/www.goodreads.com

Trump Hits A Bump

Submitted by Tyler Durden on 07/20/2015 - 13:50 Unfortunately, Trump’s antics will make it only more difficult to hold a sane debate about taking that time-out from immigration. So, one alternative is an insane debate about it, one based on sheer grievance and gall rather than the responsibilities of governance. We've feared for many years that we are all set up to welcome a red-white-and-blue, corn-pone Nazi political savior type. We don’t think Donald Trump is it. But he will be a stalking horse for a far more skillful demagogue when the time comes. There’s a fair chance that the wheels will come off the banking and monetary system well before the 2016 election. Who knows who or what will come out of the woodwork before then.

WTI Crude Tumbles Below $50 - 3 Month Lows

Submitted by Tyler Durden on 07/20/2015 - 13:42 But the recovery... demand... growth... front-month WTI Crude just broke beloe $50 for the first time since April...

Deflationary Boom 2.0 - Commodity Index Crashes To 13 Year Lows

Submitted by Tyler Durden on 07/20/2015 - 13:27 The Bloomberg Commodity Index tumbled once again today, hitting its lowest level since 2002. Stocks did not. We have seen this kind of 'deflationary' boom before... and it did not end well...

Wall Street's Incessant Rose-Colored Glasses

Submitted by Tyler Durden on 07/20/2015 - 12:59 The power, if not necessarily the Truth, resides primarily with the bulls right now or at least it does in certain parts of the market. The NASDAQ broke out last week to new highs but the S&P 500 and even the more speculative Russell 2000 did not. The market’s advance continues to narrow, to concentrate among fewer and fewer names. Bulls will tell you that this is just a pause and the advance will broaden out. And if enough people believe that and there isn’t any convincing reason to sell, they might be right for a while. But at some point the rose colored glasses will come off and someone might wonder aloud why Celgene paid $7 billion for a company with trailing 12 month revenue of $4.5 million. Someone might wonder why Netflix is worth $48 billion and CBS is only worth $27 billion with more than twice the revenue, better margins, a higher ROE and the ability to produce positive cash flow. Until then it’s just a dream within a dream and somebody keeps hitting snooze on the alarm clock.

Ashley Madison Hacked: America's 37 Million 'Cheaters' About To Be Exposed

Submitted by Tyler Durden on 07/20/2015 - 12:42 Large caches of data stolen from online cheating site AshleyMadison.com have been posted online by an individual or group that claims to have completely compromised the company’s user databases, financial records and other proprietary information (including profiles with all the customers’ secret sexual fantasies). The hacker group "The Impact Team" manifesto concludes, "too bad for those [37 million] men, they’re cheating dirtbags and deserve no such discretion."

Obama's Goals For Middle East Hinge On Putin

Submitted by Tyler Durden on 07/20/2015 - 11:57 Even after a few weeks have passed, the unexpected visit of the Saudi Deputy Crown Prince to the St. Petersburg Economic Forum still has a lot of people scratching their heads. The news is full of widespread and contradictory theories, while questions abound. Why had the Saudis accepted an invitation from a country sanctioned by the U.S., its oldest and strongest ally? It is still a bit early for all the pieces to neatly fit together but now, after the dust has settled somewhat, a pattern seems to be emerging that may explain the situation.

Q1 GAAP EPS Lowest Since 2012: The S&P500 Is Now Trading Over 20x PE Using Unadjusted Earnings

Submitted by Tyler Durden on 07/20/2015 - 11:35 Putting it all together, here is the LTM GAAP and non-GAAP EPS, and the resultant P/E ratios for the S&P on a 2015 forward basis (using Deutsche Bank's optimistic growth forecasts for the rest of 2015 which have Q4 2015 GAAP EPS projected to grow 23% from lastt Q4). As of this moment, with the S&P500 at 2130, the S&P 500 is trading at 18.1x forward (non-GAAP) PE based on 2015P EPS of 118, and an unprecedented 20.3x GAAP PE if one uses the far more realistic 105 GAAP EPS.Where Next For Precious Metals: This Is What The Charts Say

Submitted by Tyler Durden on 07/20/2015 - 10:49 Following last night's flash-crash dump across the precious metals complex, with gold tumbling to briefly test the multi-decade channel at $1080 levels, SocGen's technical analysis team digs in to understand key levels for gold, silver, platinum, and palladium, concerned about further weakness ahead.

by Dave Kranzler, Investment Research Dynamics:

As everyone knows, the primary stock indices are being aggressively

supported and pushed higher by the Fed using the liquidity with which it

as flooded the banking system. However, most of the non-marquee indices

have been selling off. As an example, the SOX semiconductor index is

down 10.5% since June 1st. I’ll bet a lot of you are surprised by that

fact, given that the tech-heavy NASDAQ hit an all-time high last week.

As everyone knows, the primary stock indices are being aggressively

supported and pushed higher by the Fed using the liquidity with which it

as flooded the banking system. However, most of the non-marquee indices

have been selling off. As an example, the SOX semiconductor index is

down 10.5% since June 1st. I’ll bet a lot of you are surprised by that

fact, given that the tech-heavy NASDAQ hit an all-time high last week.

When I was a junk bond trader, one of the sectors I traded was semiconductors/electronics. Because semiconductors are used in many everyday-use consumer goods, including automobiles, semiconductor sales is considered to be bellwether economic barometer. Thus, if the SOX is tanking despite a torrid rally in the Dow, SPX and Nasdaq, it likely indicates that the economy is slowing down – significantly.

Read More @ InvestmentResearchDynamics.com

As everyone knows, the primary stock indices are being aggressively

supported and pushed higher by the Fed using the liquidity with which it

as flooded the banking system. However, most of the non-marquee indices

have been selling off. As an example, the SOX semiconductor index is

down 10.5% since June 1st. I’ll bet a lot of you are surprised by that

fact, given that the tech-heavy NASDAQ hit an all-time high last week.

As everyone knows, the primary stock indices are being aggressively

supported and pushed higher by the Fed using the liquidity with which it

as flooded the banking system. However, most of the non-marquee indices

have been selling off. As an example, the SOX semiconductor index is

down 10.5% since June 1st. I’ll bet a lot of you are surprised by that

fact, given that the tech-heavy NASDAQ hit an all-time high last week.When I was a junk bond trader, one of the sectors I traded was semiconductors/electronics. Because semiconductors are used in many everyday-use consumer goods, including automobiles, semiconductor sales is considered to be bellwether economic barometer. Thus, if the SOX is tanking despite a torrid rally in the Dow, SPX and Nasdaq, it likely indicates that the economy is slowing down – significantly.

Read More @ InvestmentResearchDynamics.com

from TheAlexJonesChannel:

by Michael Snyder, The Economic Collapse Blog:

The President of France has come up with a very creative way of

solving the European debt crisis. On Sunday, a piece authored by French

President Francois Hollande suggested that the ultimate solution to the

problems currently plaguing Europe would be for every member of the

eurozone to transfer all of their sovereignty to a newly created federal

government. In other words, it would essentially be a “United States

of Europe”. This federal government would have a prime minister, a

parliament, a federal budget and a federal treasury. Presumably, the

current national governments in Europe would continue to function much

like state governments in the U.S. do. In the end, there may be some

benefits to such a union – particularly for the weaker members of the

eurozone. But at what cost would those benefits come?

The President of France has come up with a very creative way of

solving the European debt crisis. On Sunday, a piece authored by French

President Francois Hollande suggested that the ultimate solution to the

problems currently plaguing Europe would be for every member of the

eurozone to transfer all of their sovereignty to a newly created federal

government. In other words, it would essentially be a “United States

of Europe”. This federal government would have a prime minister, a

parliament, a federal budget and a federal treasury. Presumably, the

current national governments in Europe would continue to function much

like state governments in the U.S. do. In the end, there may be some

benefits to such a union – particularly for the weaker members of the

eurozone. But at what cost would those benefits come?

Read More…

The President of France has come up with a very creative way of

solving the European debt crisis. On Sunday, a piece authored by French

President Francois Hollande suggested that the ultimate solution to the

problems currently plaguing Europe would be for every member of the

eurozone to transfer all of their sovereignty to a newly created federal

government. In other words, it would essentially be a “United States

of Europe”. This federal government would have a prime minister, a

parliament, a federal budget and a federal treasury. Presumably, the

current national governments in Europe would continue to function much

like state governments in the U.S. do. In the end, there may be some

benefits to such a union – particularly for the weaker members of the

eurozone. But at what cost would those benefits come?

The President of France has come up with a very creative way of

solving the European debt crisis. On Sunday, a piece authored by French

President Francois Hollande suggested that the ultimate solution to the

problems currently plaguing Europe would be for every member of the

eurozone to transfer all of their sovereignty to a newly created federal

government. In other words, it would essentially be a “United States

of Europe”. This federal government would have a prime minister, a

parliament, a federal budget and a federal treasury. Presumably, the

current national governments in Europe would continue to function much

like state governments in the U.S. do. In the end, there may be some

benefits to such a union – particularly for the weaker members of the

eurozone. But at what cost would those benefits come?Read More…

by Louis Cammarosano, SMAULGLD:

The People’s Bank of China Updates Its Gold Reserve Holdings

The People’s Bank of China Updates Its Gold Reserve Holdings

Chinese Gold reserves jump 604 tons from 1,054 tons last reported in 2009 to 1,658 tons.

Many gold observers ask – ‘Is that it’?

Since 2009 China has mined over 2,000 tons of gold and imported over 3,300 tons of gold through Hong Kong*.

Where did it all go?

On July 17, 2015, the People’s Bank of China (PBOC) updated its gold reserves holdings for the first time since 2009. The PBOC reported adding 604 tons of gold to their reserves bringing the total from 1,054 tons to 1,658 tons.

Read More @ SMAULGLD.com

The People’s Bank of China Updates Its Gold Reserve Holdings

The People’s Bank of China Updates Its Gold Reserve HoldingsChinese Gold reserves jump 604 tons from 1,054 tons last reported in 2009 to 1,658 tons.

Many gold observers ask – ‘Is that it’?

Since 2009 China has mined over 2,000 tons of gold and imported over 3,300 tons of gold through Hong Kong*.

Where did it all go?

On July 17, 2015, the People’s Bank of China (PBOC) updated its gold reserves holdings for the first time since 2009. The PBOC reported adding 604 tons of gold to their reserves bringing the total from 1,054 tons to 1,658 tons.

Read More @ SMAULGLD.com

from The News Doctors:

The recent Mother of All Corrections in Chinese stocks – which wiped

out a $3.8 trillion on paper – inevitably led the usual US “experts” to

forecast, once again, China’s imminent collapse. Hong Kong even

resuscitated the “regime change” meme.

The recent Mother of All Corrections in Chinese stocks – which wiped

out a $3.8 trillion on paper – inevitably led the usual US “experts” to

forecast, once again, China’s imminent collapse. Hong Kong even

resuscitated the “regime change” meme.

Nonsense.

The roller coaster lasted a few days. And then it was gone. Significantly, major US funds – including Fidelity and Goldman Sachs – were among the first to declare the turbulence over, and move on. Goldman Sachs, by the way, soon reverted to bullish. Its chief China economist, Kinger Lau, predicted that Shanghai will rally 27 percent over the next 12 months.

So this is not a bubble. At least not yet. Beijing has a lot of tools to – as newspeak goes – “support the market.” According to Little Helmsman Deng Xiaoping’s maxim, “Socialism with Chinese characteristics,” which will stop at nothing to control the “irrational exuberance” of the markets.

Read More @ TheNewsDoctors.com

The recent Mother of All Corrections in Chinese stocks – which wiped

out a $3.8 trillion on paper – inevitably led the usual US “experts” to

forecast, once again, China’s imminent collapse. Hong Kong even

resuscitated the “regime change” meme.

The recent Mother of All Corrections in Chinese stocks – which wiped

out a $3.8 trillion on paper – inevitably led the usual US “experts” to

forecast, once again, China’s imminent collapse. Hong Kong even

resuscitated the “regime change” meme.Nonsense.

The roller coaster lasted a few days. And then it was gone. Significantly, major US funds – including Fidelity and Goldman Sachs – were among the first to declare the turbulence over, and move on. Goldman Sachs, by the way, soon reverted to bullish. Its chief China economist, Kinger Lau, predicted that Shanghai will rally 27 percent over the next 12 months.

So this is not a bubble. At least not yet. Beijing has a lot of tools to – as newspeak goes – “support the market.” According to Little Helmsman Deng Xiaoping’s maxim, “Socialism with Chinese characteristics,” which will stop at nothing to control the “irrational exuberance” of the markets.

Read More @ TheNewsDoctors.com

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment